Altus Group Limited (TSX: AIF) (the “Company” or “Altus”), a

leading provider of software, data solutions and independent

advisory services to the global commercial real estate (“CRE”)

industry, announced today that it has signed a definitive agreement

to acquire Scryer, Inc. (dba Reonomy) (“Reonomy”), a fast growing,

AI-powered data platform for the CRE industry, for US$201.5 million

(approximately C$249.5 million), (on a cash-free/debt-free basis)

subject to adjustments. The transaction is expected to close on

November 12, 2021.

Mike Gordon, Chief Executive Officer of

Altus Group said:

“The combination of Reonomy’s AI-powered data platform with

Altus’ suite of software, data and analytics capabilities creates a

very compelling client offering that will enable our clients to

better manage performance and risk within their CRE portfolios with

data-driven insights, predictive analytics and alert capabilities.

It significantly accelerates our transformative innovation in AI

predictive data analytics by better positioning us technologically,

with data science and analytics expertise, and with a robust

dataset to add analytics into workflows that not only look back at

what happened and why, but look forward to machine learning

informing us on what might happen next.”

Acquisition Highlights

- Accelerates, Altus’ innovation and data strategy to solve key

CRE challenges with real-time data-driven insights, predictive

analytics and alert capabilities.

- Expands Altus’ CRE data and analytics capabilities with

complementary and synergistic offerings which can be scaled

globally while having the potential to substantially increase the

Company’s total addressable market.

- Enhances Altus’ growth profile with strengthened cross-sell

opportunities and prospects to serve new and expanded customer use

cases.

- Strengthens data science and analytics expertise with Reonomy’s

highly talented team that has a strong cultural fit with Altus,

providing Altus and Reonomy employees with expanded opportunities

for career development and growth.

- Immediately improves the Company’s recurring revenue profile

with fast-growing subscription revenues. (Reonomy’s annual

recurring revenue forecast for 2021 is expected to be US$21 million

by year end.)

- Presents attractive revenue, cost and cost avoidance synergies

related to the Company’s ongoing data strategy initiatives and

significantly accelerates time to market on numerous product

roadmap initiatives underway.

Founded in 2013, Reonomy is a leading U.S. CRE

data and analytics provider leveraging artificial intelligence and

machine learning technologies to empower real estate industry

professionals with data-driven insights and solutions to gain

comprehensive market knowledge, discover opportunities, and

automate workflows.

Reonomy's AI-powered data platform connects

disparate property information by leveraging vast data sources,

including multiple public and proprietary data feeds, together with

AI machine learning to aggregate market intelligence on commercial

properties across the U.S., including assessor, census,

transaction, geospatial, ownership and occupant data. Using AI

machine learning and proprietary entity resolution capabilities,

Reonomy then links all the data sources for every commercial asset

with a single unique identifier (Reonomy ID). The resulting

dataset is an industry-leading collection of insights across more

than 52 million tax parcels and over 38 million commercial

properties, accounting for nearly all of the commercial inventory

in the U.S. Reonomy’s team of approximately 115 professionals will

be integrated with the Company’s Altus Analytics business.

Richard Sarkis, Executive Chairman and

Co-Founder of Reonomy said:

“I co-founded Reonomy with a very direct mission to solve a

pressing pain-point in the CRE industry - to connect data and bring

greater transparency to the CRE market at a time when credible

information on this significant asset class was still scarce. Altus

Group shares in our mission and has played a pivotal role in

advancing the transformation of the CRE industry. We are very

excited about the opportunities that joining Altus Group will bring

and how it paves the way for continued innovation. Leveraging

Altus’ unique position in the CRE value chain with our data and

analytics capabilities is exceptionally powerful and I’m confident

that together we will create considerable value for our industry

and combined stakeholders.”

Jorge Blanco, Chief Product Officer of

Altus Group, added:

“Together, we will be able to provide leading-edge insights and

analytics in a new and innovative manner. The Reonomy team has done

an exceptional job leveraging AI machine learning to solve key data

management challenges in the CRE industry and unveil hidden data

relationships. Integrating Reonomy’s data and technical

capabilities with our recently acquired StratoDem Analytics

platform for predictive analytics will enable us to deliver

analytics at scale, and when integrated together with our

foundational ARGUS software solutions, will be transformative for

the CRE industry. Our clients will be able to gain deep insights on

their CRE assets in a way that’s never been done before.”

Reonomy’s trailing twelve-month to September 30,

2021 revenues were US$18.3 million and Reonomy had an Adjusted

EBITDA loss of US$16.9 million reflecting its investment focus on

user growth, platform development and revenue acceleration.

Substantially all of Reonomy’s revenues are recurring, consistent

with Altus Group’s Over Time revenue definition. Management

anticipates that with the anticipated synergies, the impact of

Reonomy on Altus’ Adjusted EBITDA for 2022 will be nominal. The

acquisition is expected to be accretive to Altus’ Adjusted EBITDA

in 2023. In addition, as required by IFRS, Altus Group expects to

have an accounting adjustment on Reonomy’s deferred revenues.

Notwithstanding Reonomy’s impact to the Altus Analytics’ Adjusted

EBITDA in 2022, Management continues to expect a year-over-year

improvement in Altus Analytics Adjusted EBITDA margins for full

year 2022.

On closing, Altus will pay US$198.5 million

(approximately C$245.8 million) in cash, funded by cash on hand and

borrowings under the Company’s credit facilities. In

addition, Altus will issue common shares from treasury to Reonomy

employees valued at US$3.0 million (approximately C$3.7 million).

These common shares will be subject to restrictions and will vest

in equal installments on the first and second anniversaries of the

issuance date. With this transaction, the Company’s funded

debt to Adjusted EBITDA leverage ratio is expected to increase to

approximately 3.0x. Given the expected synergies and existing

strong cash flows, Altus expects to de-lever to a funded debt to

EBITDA leverage ratio in the low 2.0x range by the end of 2022.

Conference Call Details

The Company will hold a conference call today,

November 11, 2021, at 5:00 pm ET to discuss its third quarter 2021

results and the details of this transaction. A replay of the

webcast will be made available on Altus Group’s Investor Relations

section of its website.

|

|

|

|

Date: |

Thursday, November 11, 2021 |

|

|

|

|

Time: |

5:00 p.m. (ET) |

|

|

|

|

Webcast: |

altusgroup.com (under Investor Relations) |

|

|

|

|

Live Call: |

1-800-319-4610 (toll-free North America) or 416-915-3239 (Toronto

area) |

|

|

|

|

Replay: |

available via webcast at

www.altusgroup.com/company/investor-relations |

|

|

|

About Altus Group Limited

Altus Group Limited is a leading provider of

software, data solutions and independent advisory services to the

global commercial real estate industry. Our businesses, Altus

Analytics and Altus Commercial Real Estate Consulting, reflect

decades of experience, a range of expertise, and technology-enabled

capabilities. Our solutions empower clients to analyze, gain

insight and recognize value on their real estate investments.

Headquartered in Canada, we have approximately 2,600 employees

around the world, with operations in North America, Europe and Asia

Pacific. Our clients include many of the world’s largest commercial

real estate industry participants. Altus Group pays a quarterly

dividend of $0.15 per share and our shares are traded on the

Toronto Stock Exchange under the symbol AIF. For more information

on Altus Group, please visit: www.altusgroup.com.

Forward-Looking Information

Certain information in this press release may

constitute “forward-looking information” within the meaning of

applicable securities legislation. All information contained in

this press release, other than statements of current and historical

fact, is forward-looking information. Forward-looking information

includes, but is not limited to, the discussion of our business and

our objectives, goals, strategies, priorities, intentions, plans,

beliefs, expectations and estimates, and our expectations of the

business, our operations, financial performance and condition.

Generally, forward-looking information can be identified by use of

words such as “believe”, “expect”, “anticipate”, “estimate”,

“intend”, “may”, “will”, “would”, “could”, “should”, “continue”,

“plan”, “goal”, “objective”, “remain” and other similar expressions

and the negative of such expressions, although not all

forward-looking information contain these identifying words. All of

the forward-looking information in this press release is qualified

by this cautionary statement.

Forward-looking information is not, and cannot

be, a guarantee of future results or events. Forward-looking

information is based on, among other things, opinions, assumptions,

estimates and analyses that, while considered reasonable by us at

the date the forward-looking information is provided, inherently

are subject to significant risks, uncertainties, contingencies and

other factors that may cause actual results, performance or

achievements, industry results or events to be materially different

from those expressed or implied by the forward-looking information.

The material factors or assumptions that we identified and applied

in drawing conclusions or making forecasts or projections set out

in the forward-looking information include, but are not limited to:

our ability to meet its “Revenue” and “Adjusted EBITDA” targets,

including assumptions on Altus Analytics Bookings growth,

subscription and maintenance renewal rates, client retention rates,

growth in our Data Solutions and Appraisal Management businesses,

assumptions on the Argus Software revenue model, license sales,

cloud conversion (including timing and rate), the 2021

post-acquisition financial results of Scryer, Inc. being in line

with historical results, expected revenue, cost, and cost avoidance

synergies will be realized, assumptions on other Altus Analytics

contributors, expenses, operating leverage, and foreign exchange;

having available cash on hand to repay debt on our expected

timelines; engagement and product pipeline opportunities in

Altus Analytics will result in associated definitive agreements;

settlement volumes in the Property Tax business will occur on a

timely basis and that assessment authorities will process appeals

in a manner consistent with expectations; the successful execution

of our business strategies; consistent and stable economic

conditions or conditions in the financial markets; consistent and

stable legislation in the various countries in which we operate; no

disruptive changes in the technology environment; the opportunity

to acquire accretive businesses and the absence of negative

financial and other impacts resulting from strategic investments or

acquisitions on short term results; the successful integration of

acquired businesses; and the continued availability of qualified

professionals. Projections may also be impacted by macroeconomic

factors, in addition to other factors not controllable by the

Company. We have also made certain macroeconomic and general

industry assumptions in the preparation of such forward-looking

information. We believe that the expectations reflected in

forward-looking information are based upon reasonable assumptions;

however, we can give no assurance that actual results will be

consistent with the forward-looking information. Not all factors

which affect the forward-looking information are known, and actual

results may vary from the projected results in a material respect,

and may be above or below the forward-looking information presented

in a material respect.

The COVID-19 pandemic has cast additional

uncertainty on each of these factors and assumptions. There can be

no assurance that they will continue to be valid. Given the rapid

pace of change with respect to the COVID-19 pandemic, it is

difficult to make further assumptions about these matters. The

duration, extent and severity of the impact the COVID-19 pandemic,

including measures to prevent its spread, will have on our business

is uncertain and difficult to predict at this time. As of the date

of this press release many of our offices and clients remain

subject to limitations and restrictions set to reduce the spread of

COVID-19, and a significant portion of our employees continue to

work remotely.

Inherent in the forward-looking information are

known and unknown risks, uncertainties and other factors that could

cause our actual results, performance or achievements, or industry

results, to differ materially from any results, performance or

achievements expressed or implied by such forward-looking

information. Those risks, uncertainties and other factors that

could cause actual results to differ materially from the

forward-looking information include, but are not limited to: the

general state of the economy; the COVID‐19 pandemic; currency; our

financial performance; our financial targets; the commercial real

estate market; industry competition; our acquisitions; our cloud

subscriptions transition; software renewals; professional talent;

third party information; enterprise transactions; new product

introductions; technological change; intellectual property;

technology strategy; information technology governance and

security; our product pipeline; property tax appeals; legislative

and regulatory changes; fixed-price and contingency engagements;

appraisal and appraisal management mandates; the Canadian

multi-residential market; customer concentration and the loss of

material clients; interest rates; credit; income tax matters;

health and safety hazards; our contractual obligations; legal

proceedings; our insurance limits; our ability to meet the solvency

requirements necessary to make dividend payments; leverage and

financial covenants; our share price; our capital investments; and

the issuance of additional common shares, as well as those

described in our annual publicly filed documents, including the

Annual Information Form for the year ended December 31, 2020 (which

are available on SEDAR at www.sedar.com). In addition, in respect

of the June 13, 2021 cybersecurity incident, while we have

implemented our cybersecurity and business continuity protocols and

adopted additional measures to enhance the security of our IT

systems to help detect and prevent future attempts or incidents of

malicious activity, we are subject to a number of risks and

uncertainties in connection with the incident. Such risks and

uncertainties include, but are not limited to: the outcome of the

ongoing investigation into the incident; costs related to the

investigation and any potential liabilities, regulatory

investigation or lawsuit resulting from the incident; costs related

to and the effectiveness of our mitigation and remediation efforts;

our ability to recover proceeds under our insurance policies; and

the potential loss of customer and other stakeholder confidence in

our ability to protect their information, and the potential adverse

financial impact such loss of confidence may have on our

business.

Given these risks, uncertainties and other

factors, investors should not place undue reliance on

forward-looking information as a prediction of actual results. The

forward-looking information reflects management’s current

expectations and beliefs regarding future events and operating

performance and is based on information currently available to

management. Although we have attempted to identify important

factors that could cause actual results to differ materially from

the forward-looking information contained herein, there are other

factors that could cause results not to be as anticipated,

estimated or intended. The forward-looking information contained

herein is current as of the date of this press release and, except

as required under applicable law, we do not undertake to update or

revise it to reflect new events or circumstances. Additionally, we

undertake no obligation to comment on analyses, expectations or

statements made by third parties in respect of Altus Group, our

financial or operating results, or our securities.

Certain information in this press release may be

considered as “financial outlook” within the meaning of applicable

securities legislation. The purpose of this financial outlook is to

provide readers with disclosure regarding Altus Group’s reasonable

expectations as to the anticipated results of its proposed business

activities for the periods indicated. Readers are cautioned that

the financial outlook may not be appropriate for other

purposes.

FOR FURTHER INFORMATION PLEASE

CONTACT:

| Camilla

Bartosiewicz Vice President, Investor Relations, Altus Group

416.641.9773 Camilla.Bartosiewicz@altusgroup.com |

Ernest

ClarkChief Marketing Officer, Altus Group+44 (0) 20 7636

7347Ernest.Clark@altusgroup.com |

FOR MEDIA INQUIRIES PLEASE

CONTACT:

Altus

Group

Elizabeth

Lambe

Senior Manager Global

Communications

416.641.9787

Elizabeth.Lambe@altusgroup.com

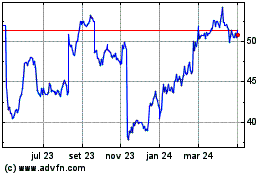

Altus (TSX:AIF)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

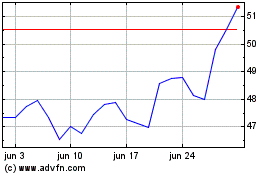

Altus (TSX:AIF)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025