Altus Group Limited (TSX: AIF) (the “Company” or “Altus”), a

leading provider of software, data solutions and independent

advisory services to the global commercial real estate (“CRE”)

industry, announced today plans for the transition of its

leadership team, including the promotion of Jim Hannon as the

Company’s next Chief Executive Officer (“CEO”), succeeding Mike

Gordon who will remain on the Board. Concurrent with the leadership

transition plans, Jorge Blanco has been promoted to the role of

President of the Company’s Altus Analytics business and to the

newly created role of Chief Commercial Officer of Altus. The

Company also announced its preliminary unaudited financial results

for the fourth quarter and year ended December 31, 2021, which are

at the top end of the Company’s financial guidance range provided

in its press release dated November 11, 2021, and that the Toronto

Stock Exchange (“TSX”) has approved its notice of intention to

enter into a normal course issuer bid (“NCIB”) for its common

shares.

Leadership Transition Plans

The Company’s Board of Directors is pleased to

share it has promoted Jim Hannon, currently President of Altus

Analytics, to succeed Mike Gordon as CEO, effective April

1, 2022. Mr. Gordon will leave his executive role

at Altus to pursue a new opportunity as CEO of ArisGlobal, a

privately-held life science software company, on which he has

served as the Chair of the Board for over two years. Mr. Gordon

will remain CEO of Altus until March 31, 2022 to

ensure a smooth transition and will remain a Director on Altus’

Board.

Mr. Hannon is appointed following a robust

succession planning process supported by an external search firm.

In his current role, he has led rapid transformation of Altus’

operations, including integration of recent key acquisitions, and

has a career track record of driving successful strategic change

and growth. He has worked closely with Mr. Gordon in developing and

implementing the Company’s growth strategy to date and is ideally

skilled to lead it forward.

Since joining Altus as President of Altus

Analytics in December 2020, Mr. Hannon has successfully enhanced

go-to-market plans and optimized Altus Analytics’ operating model

which has led to record 85% Bookings growth and strong 30% revenue

growth in 2021, both in constant currency. He has brought emphasis

on customer success and operational efficiencies that will enable

Altus to profitably scale, grow and expand globally. With over 30

years of global operating experience, prior to joining Altus he

held senior management roles at Callcredit Information Group, FICO

and Avaya.

The Company is also pleased to announce that

Jorge Blanco, current Chief Product Officer, will be promoted to

the role of President of Altus Analytics and to the newly created

role of Chief Commercial Officer of Altus, also effective April 1,

2022. In his new role, Mr. Blanco will retain

leadership of product strategy and roadmap, and expand his

oversight to Altus Analytics operations, and commercial

strategy.

As demonstrated by the strong 2021 financial

results released today, Mr. Gordon leaves the CEO role at Altus

with a very effective senior executive team who have worked

together to create and deliver rapid progress on the Company’s

refocused product roadmap and growth strategy. Altus and its senior

executive team remain passionately committed to delivering on the

Company’s long-term financial and strategic priorities.

Raymond Mikulich, Chair of

Altus said:

“On behalf of the Board I would like to thank

Mike for the many achievements and contributions under his watch,

and we are pleased that he will remain on Altus’ Board of

Directors. As CEO he has assembled an exceptionally strong senior

executive team and led significant progress against our long-term

strategy that has us well-positioned financially and strategically

to become one of the world’s foremost experts and providers of CRE

intelligence and solutions. The Board and I are

delighted that Jim is to be Altus’ next CEO. He has a deep

understanding of the business and has been closely involved in

every aspect of Altus’ operations. The Board is very confident that

his leadership, together with the support of the senior executive

team, will build on our strong track record of growth and

performance to deliver stakeholder value.”

Mike Gordon, CEO of Altus

said:

“I joined Altus to help position the Company for

its next chapter in a rapidly growing and evolving end-market. I’m

incredibly proud that we achieved this goal on an accelerated

timeline, as demonstrated by the strong 2021 results. Departing

from the CEO role at this point was personally a very difficult

decision to make, but I know that due to the exceptional quality of

Jim and the wider senior team they will execute on Altus’ strategy

brilliantly, as they have successfully done so this past year. I

look forward to supporting the team in reaching Altus’ full

potential through our next phases of growth as a member of the

Board of Directors.”

Jim Hannon, newly appointed CEO of

Altus said:

“I am excited and honoured to take on the CEO

role and I am confident that this will be a seamless transition.

Altus is exceptionally positioned for growth. We will continue

executing our declared strategy and remain focused on operational

excellence with the best talent in our industry. I’m pleased to

have Jorge step into the expanded role of President of Altus

Analytics and Chief Commercial Officer of the Company. Based on our

20-year history together, I’m confident Jorge will drive strong

operational results and transformative innovation. I

look forward to building on the success that Mike and our senior

executive team have achieved in such a remarkably short time.”

Jorge Blanco, newly appointed President

of Altus Analytics and Chief Commercial Officer of Altus

said:

“I’m thrilled to lead Altus Analytics at this

exciting inflection point in the business, and to work side-by-side

with my colleagues across all of Altus to leave our mark on the

industry as the first in industry CRE intelligence-as-a-service

provider.”

Fourth Quarter & Year Ended December

31, 2021 Preliminary Financial

Results and Other Measures

Altus is providing the following preliminary

unaudited financial results for the fourth quarter and year ended

December 31, 2021:

Unless otherwise indicated, all amounts are in

Canadian dollars and percentages are in comparison to the same

period in 2020.

|

Consolidated |

Quarter ended December 31, |

Year ended December 31, |

|

In thousands of dollars, except for per share amounts |

|

2021 |

|

2020 |

% Change |

Constant Currency% Change |

|

2021 |

|

2020 |

% Change |

Constant Currency% Change |

|

Revenues |

$ |

162,909 |

$ |

139,480 |

16.8% |

19.9% |

$ |

625,387 |

$ |

561,156 |

11.4% |

14.7% |

| Adjusted EBITDA* |

$ |

25,861 |

$ |

26,734 |

-3.3% |

1.3% |

$ |

109,755 |

$ |

98,928 |

10.9% |

15.1% |

| Adjusted EBITDA Margin* |

|

15.9% |

|

19.2% |

|

|

|

17.5% |

|

17.6% |

|

|

| Profit (loss) from continuing

operations |

$ |

6,890 |

$ |

4,622 |

|

|

$ |

25,573 |

$ |

27,009 |

|

|

| Earnings (loss) per share from

continuing operations: |

|

|

|

|

|

|

|

|

|

Basic |

$0.16 |

$0.11 |

|

|

$0.62 |

$0.67 |

|

|

|

Diluted |

$0.15 |

$0.11 |

|

|

$0.60 |

$0.66 |

|

|

|

Adjusted* |

$0.42 |

$0.44 |

|

|

$1.90 |

$1.67 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Dividends declared per share |

$0.15 |

$0.15 |

|

|

$0.60 |

$0.60 |

|

|

*Refers to Non-GAAP Financial Measures. See

below under “Non-GAAP Measures” for cautionary statement relating

to these measures, discussion of their composition, usefulness and

where applicable, reconciliation to the most comparable financial

measure disclosed in financial statements.

|

Altus Analytics |

Quarter ended December 31, |

Year ended December 31, |

|

In thousands of dollars |

|

2021 |

|

2020 |

% Change |

Constant Currency % Change |

|

2021 |

|

2020 |

% Change |

Constant Currency % Change |

|

Revenues |

$ |

72,407 |

$ |

51,515 |

40.6% |

46.6% |

$ |

251,084 |

$ |

203,707 |

23.3% |

29.9% |

| Adjusted EBITDA |

$ |

10,698 |

$ |

9,815 |

9.0% |

19.1% |

$ |

41,567 |

$ |

35,845 |

16.0% |

25.2% |

|

Adjusted EBITDA Margin |

|

14.8% |

|

19.1% |

|

|

|

16.6% |

|

17.6% |

|

|

|

Other Measures* |

|

|

|

|

|

|

|

Bookings |

$ |

31,120 |

$ |

14,851 |

109.5% |

113.3% |

$ |

95,066 |

$ |

53,973 |

76.1% |

84.9% |

| Over Time revenues |

$ |

59,801 |

$ |

43,468 |

37.6% |

41.0% |

$ |

207,805 |

$ |

167,678 |

23.9% |

29.4% |

| AE software maintenance

retention rate |

|

94% |

|

94% |

|

|

|

94% |

|

96% |

|

|

| Geographical revenue

split |

|

|

|

|

|

|

|

|

|

North America |

|

75% |

|

81% |

|

|

|

75% |

|

81% |

|

|

|

International |

|

25% |

|

19% |

|

|

|

25% |

|

19% |

|

|

| Cloud

adoption rate (as at end of period) |

|

|

|

|

|

42% |

|

14% |

|

|

*Refers to Supplementary Financial Measures. See

below under “Other Measures” for cautionary statement relating to

these measures and a discussion of their composition and

usefulness.

|

CRE Consulting |

Quarter ended December 31, |

Year ended December 31, |

|

In thousands of dollars |

|

2021 |

|

2020 |

% Change |

Constant Currency % Change |

|

2021 |

|

2020 |

% Change |

Constant Currency % Change |

|

Revenues |

|

|

|

|

|

|

|

|

|

Property Tax |

$ |

60,060 |

$ |

57,477 |

4.5% |

6.2% |

$ |

259,911 |

$ |

245,162 |

6.0% |

8.0% |

|

Valuation and Cost Advisory |

$ |

30,517 |

$ |

30,564 |

(0.2%) |

0.6% |

$ |

114,693 |

$ |

112,592 |

1.9% |

1.7% |

|

Revenues |

$ |

90,577 |

$ |

88,041 |

2.9% |

4.2% |

$ |

374,604 |

$ |

357,754 |

4.7% |

6.0% |

|

Adjusted EBITDA |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Property Tax |

$ |

18,222 |

$ |

18,121 |

0.6% |

2.0% |

$ |

87,616 |

$ |

76,961 |

13.8% |

15.1% |

|

Valuation and Cost Advisory |

$ |

5,948 |

$ |

6,086 |

(2.3%) |

(1.9%) |

$ |

16,440 |

$ |

15,127 |

8.7% |

8.5% |

|

Adjusted EBITDA |

$ |

24,170 |

$ |

24,207 |

(0.2%) |

1.0% |

$ |

104,056 |

$ |

92,088 |

13.0% |

14.0% |

|

Adjusted EBITDA Margin |

|

26.7% |

|

27.5% |

|

|

|

27.8% |

|

25.7% |

|

|

As at December 31, 2021, bank debt was $287.6

million and cash and cash equivalents was $51.3 million

(representing a funded debt to Adjusted EBITDA leverage ratio of

2.47 times, or a net debt to Adjusted EBITDA ratio of 2.17

times).

The preliminary financial results and other

measures for the fourth quarter and year ended December 31, 2021

are unaudited, reflect information available to the Company as of

the date of this press release, and are subject to revision. Actual

results may differ from these preliminary results due to the

completion of year end accounting procedures and adjustments, and

the completion of the preparation and audit of the Company’s

financial statements for the fourth quarter and year ended December

31, 2021, which are anticipated to be finalized and released on

February 24, 2022.

Angelo Bartolini, CFO of Altus

said:

“As we enter 2022, Altus is on a strong

trajectory to deliver robust revenue growth at expanded margins.

The operational enhancements, investments and acquisitions from the

past year have enabled us to rapidly advance on our strategic

initiatives. The strong quarterly Bookings growth combined with

rising Over Time revenues point to continued revenue growth at

Altus Analytics with improved margins. Additionally, CRE Consulting

remains on a clear path to deliver another record revenue year

given the strength in our global Property Tax business.”

Normal Course Issuer

Bid

The Company also announced today that the TSX

has approved its notice of intention to enter into a NCIB for its

common shares as appropriate opportunities arise from time to time.

Altus’ NCIB will be made in accordance with the policies of the

TSX. Altus may purchase its common shares during the period from

February 8, 2022 to February 7, 2023.

Under the NCIB and subject to the market price

of its common shares and other considerations, over the next 12

months Altus may purchase for cancellation up to 1,345,142 common

shares, representing approximately 3% of its issued and outstanding

common shares as at January 31, 2022. There were 44,838,073 common

shares outstanding as at January 31, 2022. Daily purchases will be

limited to 20,336 common shares, other than block purchase

exemptions. Purchases may be made on the open market through the

facilities of the TSX and/or alternative Canadian trading systems

at the market price at the time of acquisition, as well as by other

means as may be permitted by TSX rules and applicable securities

laws. Altus has not made any purchases in the 12 months preceding

the date of this notice pursuant to an NCIB. Any tendered shares

taken up and paid for by Altus will be cancelled. The Company plans

to fund the NCIB purchases from its existing cash

balance.

The Company may enter into an automatic share

purchase plan in relation to the NCIB that would allow for the

purchase of its common shares, subject to certain trading

parameters, at times when Altus ordinarily would not be active in

the market due to its own internal trading black-out period,

insider trading rules or otherwise. Any such plan entered into with

a broker will be adopted in accordance with applicable Canadian

securities law and will be announced in a press release. Outside of

these periods, common shares will be repurchased in accordance with

management’s discretion and in compliance with applicable law.

The Company is commencing the NCIB because it

believes that it provides flexibility around its capital allocation

investments, particularly during periods when its common shares may

trade in a price range that does not adequately reflect their

underlying value based on the Company’s business and strong

financial position. As a result, to maximize shareholder value,

Altus believes that an investment in its outstanding common shares

may represent an attractive use of available funds while continuing

to balance other growth investments, including investing in

operations and in potential M&A. This is consistent with the

Company’s contemplated capital allocation priorities as presented

at its recent investor day in December 2021. Decisions regarding

the amount and timing of future purchases of common shares will be

based on market conditions, share price and other factors and will

be at management’s discretion. The Company's Board of Directors

will regularly review the NCIB in connection with a balanced

capital allocation strategy focused primarily on funding

growth.

Conference Call Details

The Company is inviting its shareholders and its

financial analysts to join its conference call and webcast today,

February 3, 2022, at 5:30 pm ET, to further discuss the leadership

transition announcement. A conference call and webcast to discuss

the Company’s fourth quarter and year-end results is expected to be

scheduled for February 24, 2022, following the release of its

management’s discussion and analysis and consolidated financial

statements for the year ended December 31, 2021.

|

Date: |

Thursday, February 3, 2022 |

|

Time: |

5:30 p.m. (ET) |

|

Webcast: |

altusgroup.com (under Investor Relations) |

|

Live Call: |

1-800-319-4610 (toll-free North America) or +1-416-915-3239

(Toronto area) |

|

Replay: |

available via webcast at

www.altusgroup.com/company/investor-relations |

About Altus Group Limited

Altus Group Limited is a leading provider of

software, data solutions and independent advisory services to the

global commercial real estate industry. Our businesses, Altus

Analytics and Altus Commercial Real Estate Consulting, reflect

decades of experience, a range of expertise, and technology-enabled

capabilities. Our solutions empower clients to analyze, gain

insight and recognize value on their real estate investments.

Headquartered in Canada, we have approximately 2600 employees

around the world, with operations in North America, Europe, and

Asia Pacific. Our clients include many of the world’s largest

commercial real estate industry participants. Altus Group pays a

quarterly dividend of $0.15 per share and our shares are traded on

the Toronto Stock Exchange under the symbol AIF. For more

information on Altus Group, please visit: www.altusgroup.com.

Forward-Looking Information

This press release contains certain statements

that constitute forward-looking information within the meaning of

applicable securities laws (“forward-looking statements”).

Statements concerning Altus Group’s objectives, goals, strategies,

priorities, intentions, plans, beliefs, expectations and estimates,

and the business, operations, financial performance and condition

of the Company are forward-looking statements. The words “believe”,

“expect”, “anticipate”, “estimate”, “intend”, “may”, “will”,

“would”, “could”, “should”, “continue”, “plan”, “goal”,

“objective”, and similar expressions and the negative of such

expressions are intended to identify forward-looking statements,

although not all forward-looking statements contain these

identifying words.

Certain material factors and assumptions were

applied in providing these forward-looking statements.

Forward-looking information involves numerous assumptions including

the following specific assumptions: settlement volumes in the

Property Tax business will occur on a timely basis and that

assessment authorities will process appeals in a manner consistent

with expectations; the successful execution of our business

strategies; consistent and stable economic conditions or conditions

in the financial markets; consistent and stable legislation in the

various countries in which we operate; no disruptive changes in the

technology environment; the opportunity to acquire accretive

businesses and the absence of negative financial and other impacts

resulting from strategic investments or acquisitions on short term

results; the successful integration of acquired businesses; and the

continued availability of qualified

professionals. Projections may also be impacted by

macroeconomic factors, in addition to other factors not

controllable by the Company. Altus Group has also made certain

macroeconomic and general industry assumptions in the preparation

of such forward-looking statements. Management believes that the

expectations reflected in forward-looking statements are based upon

reasonable assumptions; however, Management can give no assurance

that actual results will be consistent with these forward-looking

statements. Not all factors which affect the forward-looking

information are known, and actual results may vary from the

projected results in a material respect, and may be above or below

the forward-looking information presented in a material

respect.

The COVID-19 pandemic has cast additional

uncertainty on each of these factors and assumptions. There can be

no assurance that they will continue to be valid. Given the rapid

pace of change with respect to the COVID-19 pandemic, it is

difficult to make further assumptions about these matters. The

duration, extent and severity of the impact the COVID-19 pandemic,

including measures to prevent its spread, will have on our business

is uncertain and difficult to predict at this time. As of the date

of this press release, many of our offices and clients remain

subject to limitations and restrictions set to reduce the spread of

COVID-19, and a significant portion of our employees continue to

work remotely.

Inherent in the forward-looking information are

known and unknown risks, uncertainties and other factors that could

cause our actual results, performance or achievements, or industry

results, to differ materially from any results, performance or

achievements expressed or implied by such forward-looking

information. Those risks, uncertainties and other factors that

could cause actual results to differ materially from the

forward-looking information include, but are not limited to: the

general state of the economy; the COVID‐19

pandemic; currency; our financial performance; our financial

targets; the commercial real estate market; industry competition;

our acquisitions; our cloud subscriptions transition; software

renewals; professional talent; third party information; enterprise

transactions; new product introductions; technological change;

intellectual property; technology strategy; information technology

governance and security; our product pipeline; property tax

appeals; legislative and regulatory changes; fixed-price and

contingency engagements; appraisal and appraisal management

mandates; the Canadian multi-residential market; customer

concentration and the loss of material clients; interest rates;

credit; income tax matters; health and safety hazards; our

contractual obligations; legal proceedings; our insurance limits;

our ability to meet the solvency requirements necessary to make

dividend payments; leverage and financial covenants; our share

price; our capital investments; and the issuance of additional

common shares, as well as those described in our annual publicly

filed documents, including the Annual Information Form for the year

ended December 31, 2020 (which are available on SEDAR at

www.sedar.com).

Given these risks, uncertainties and other

factors, investors should not place undue reliance on

forward-looking information as a prediction of actual results. The

forward-looking information reflects management’s current

expectations and beliefs regarding future events and operating

performance and is based on information currently available to

management. Although we have attempted to identify important

factors that could cause actual results to differ materially from

the forward-looking information contained herein, there are other

factors that could cause results not to be as anticipated,

estimated or intended. The forward-looking information contained

herein is current as of the date of this press release and, except

as required under applicable law, we do not undertake to update or

revise it to reflect new events or circumstances. Additionally, we

undertake no obligation to comment on analyses, expectations or

statements made by third parties in respect of Altus Group, our

financial or operating results, or our securities.

Non-GAAP Measures

We use certain non-GAAP measures as indicators

of financial performance. Readers are cautioned that they are not

defined performance measures, and do not have any standardized

meaning under IFRS and may differ from similar computations as

reported by other similar entities and, accordingly, may not be

comparable to financial measures as reported by those entities. We

believe that these measures which include non-GAAP financial

measures and non-GAAP ratios as defined in National Instrument

52-112 "Non-GAAP and Other Financial Measures Disclosure"

(“NI 52-112”), may assist investors in assessing

an investment in our shares and that they provide more insight into

our performance. These non-GAAP measures should not be considered

in isolation or as a substitute for financial measures prepared in

accordance with IFRS.

Adjusted Earnings before Interest,

Taxes, Depreciation and Amortization (“Adjusted EBITDA”)

is a non-GAAP financial measure which represents profit (loss) from

continuing operations before income taxes, adjusted for the effects

of: occupancy costs calculated on a similar basis prior to the

adoption of IFRS 16, finance costs (income), net - other,

depreciation of property, plant and equipment and amortization of

intangibles, depreciation of right-of-use assets, finance costs

(income), net - leases, acquisition and related transition costs

(income), unrealized foreign exchange (gains) losses, (gains)

losses on disposal of right-of-use assets, property, plant and

equipment and intangibles, share of (profit) loss of joint venture,

impairment charges, non-cash share-based compensation costs,

(gains) losses on equity derivatives net of mark-to-market

adjustments on related restricted share units (“RSUs”) and deferred

share units (“DSUs”) being hedged, (gains) losses on derivatives,

restructuring costs (recovery), (gains) losses on investments,

(gains) losses on hedging transactions, and other costs or income

of a non-operating and/or non-recurring nature.

Adjusted EBITDA Margin is a

non-GAAP financial ratio which represents the percentage factor of

Adjusted EBITDA to revenues.

We use Adjusted EBITDA and Adjusted EBITDA

Margin to evaluate the performance of our business, as well as when

making decisions about the ongoing operations of the business and

our ability to generate cash flows. Refer to the below for a

reconciliation of Adjusted EBITDA to profit (loss).

Adjusted Earnings (Loss) is a

non-GAAP financial measure which represents profit (loss) from

continuing operations adjusted for the effects of: occupancy costs

calculated on a similar basis prior to the adoption of IFRS 16,

depreciation of right-of-use assets, finance costs (income), net -

leases, amortization of intangibles of acquired businesses,

unrealized foreign exchange losses (gains), (gains) losses on

disposal of right-of-use assets, property, plant and equipment and

intangibles, non-cash share-based compensation costs, losses

(gains) on equity derivatives net of mark-to-market adjustments on

related RSUs and DSUs being hedged, interest accretion on

contingent consideration payables, restructuring costs (recovery),

losses (gains) on hedging transactions and interest expense

(income) on swaps, acquisition and related transition costs

(income), losses (gains) on investments, share of (profit) loss of

joint venture, impairment charges, (gains) losses on derivatives,

other costs or income of a non-operating and/or non-recurring

nature, and the tax impact on these items.

We use Adjusted Earnings (Loss) to facilitate

the calculation of Adjusted Earnings (Loss) per Share (“Adjusted

EPS”).

Adjusted EPS is a non-GAAP

financial ratio calculated by dividing Adjusted Earnings (Loss) by

the basic weighted average number of shares adjusted for the

effects of the weighted average number of restricted shares.

We use Adjusted EPS to assess the performance of

our business before the effects of the noted items, because they

affect the comparability of our financial results and could

potentially distort the analysis of trends in business performance.

Refer to the below for a reconciliation of Adjusted EPS to profit

(loss).

Constant currency is a non-GAAP

financial measure that presents the financial results and non-GAAP

measures within this press release by translating monthly results

denominated in local currency (US dollars, British pound, Euro,

Australian dollars, and other foreign currencies) at the foreign

exchange rates of the comparable month.

We adjust for currency so that our financial and

operational performance can be viewed without the impact of

fluctuations in foreign currency exchange rates against the

Canadian dollar, thereby facilitating period-to-period comparisons

of the Company's business performance.

Other Measures

We also apply certain other measures to allow us

to measure our performance against our operating strategy and

against the results of our peers and competitors. Readers are

cautioned that they are not measurements in accordance with IFRS

and may differ from similar computations as reported by other

similar entities and, accordingly, may not be comparable to

financial measures as reported by those entities. These other

measures, which include supplementary financial measures as defined

in NI 52-112 should not be considered in isolation or as a

substitute for any other measure of performance under IFRS.

Bookings is a

supplementary financial measure we introduced in the first quarter

of 2021 for the Altus Analytics business segment. We define

Bookings as the annual contract value ("ACV") for new sales of our

recurring offerings (software, Appraisal Management solutions and

data subscriptions) and the total contract value ("TCV") for

one-time engagements (consulting, training and due diligence). The

contract value of renewals is excluded from this metric, with the

exception of additional capacity or products purchased at the time

of renewal. We use Bookings as a measure to track the performance

and success of our sales initiatives, and as an indicator of future

revenue growth.

Over Time revenues is another

measure consistent with IFRS 15, Revenue from Contracts with

Customers, for the Altus Analytics business segment. Our Over Time

revenues are comprised of software subscription revenues recognized

on an over time basis in accordance with IFRS 15, software

maintenance revenues associated with our legacy licenses sold on

perpetual terms, Appraisal Management revenues, and data

subscription revenues.

ARGUS Enterprise (“AE”) software

maintenance retention rate is a supplementary financial

measure calculated as a percentage of AE software maintenance

revenue retained upon renewal; it represents the percentage of the

available renewal opportunity in a fiscal period that renews,

calculated on a dollar basis, excluding any growth in user count or

product expansion.

Cloud adoption

rate is another measure that represents the

percentage of the total AE user base contracted on the ARGUS Cloud

platform. It includes both new AE cloud users as well as those who

have migrated from our AE on-premise software. We use

Cloud adoption rate as a measure of our progress in transitioning

the AE user base to our cloud-based platform, a key component of

our overall product strategy.

FOR FURTHER INFORMATION PLEASE

CONTACT:

Camilla BartosiewiczVice President, Investor

Relations, Altus Group +1

416.641.9773camilla.bartosiewicz@altusgroup.com

FOR MEDIA INQUIRIES PLEASE CONTACT:

Elizabeth LambeSenior Manager, Global Communications, Altus

Group

+1 416.641.9787Elizabeth.lambe@altusgroup.com

Tim LinacreInstinctif Partners00 44 (0)7849

939237Tim.linacre@instinctif.com

Laura O’ConnellInstinctif Partners00 44 (0)7887 737463

Reconciliation of Adjusted EBITDA to

Profit (Loss)

The following table provides a reconciliation

between Adjusted EBITDA and profit (loss):

|

|

Quarter endedDecember 31, |

Year ended

December 31, |

|

In thousands of dollars |

|

2021 |

|

2020 |

|

2021 |

|

2020 |

|

Adjusted EBITDA |

$ |

25,861 |

$ |

26,734 |

$ |

109,755 |

$ |

98,928 |

| Occupancy costs calculated on

a similar basis prior to the adoption of IFRS 16 (1) |

|

3,477 |

|

3,053 |

|

13,199 |

|

12,312 |

| Depreciation of right-of-use

assets |

|

(3,209) |

|

(2,706) |

|

(12,119) |

|

(11,210) |

| Depreciation of property,

plant and equipment and amortization of intangibles |

|

(9,815) |

|

(7,511) |

|

(34,463) |

|

(30,404) |

| Acquisition and related

transition (costs) income |

|

(2,025) |

|

(217) |

|

(10,137) |

|

887 |

| Unrealized foreign exchange

gain (loss) |

|

145 |

|

(382) |

|

(1,104) |

|

(165) |

| Gain (loss) on disposal of

property, plant and equipment and intangibles |

|

- |

|

(454) |

|

248 |

|

(457) |

| Share of profit (loss) of

joint venture |

|

745 |

|

9 |

|

1,187 |

|

459 |

| Non-cash share-based

compensation costs |

|

(6,178) |

|

(2,133) |

|

(19,455) |

|

(10,261) |

| Gain (loss) on equity

derivatives net of mark-to-market adjustments on related RSUs and

DSUs being hedged |

|

1,035 |

|

(2,237) |

|

2,040 |

|

(471) |

| Restructuring (costs)

recovery |

|

238 |

|

(3,374) |

|

(15) |

|

(11,984) |

| Gain (loss) on

investments |

|

1,091 |

|

(1) |

|

2,930 |

|

21 |

| Impairment charge -

leases |

|

- |

|

- |

|

- |

|

(36) |

| Other non-operating and/or

non-recurring income (costs) (2) |

|

(2,944) |

|

(1,631) |

|

(11,517) |

|

(3,429) |

|

Earnings (loss) from continuing operations before finance

costs and income taxes |

|

8,421 |

|

9,150 |

|

40,549 |

|

44,190 |

|

Finance (costs) income, net - leases |

|

(515) |

|

(584) |

|

(2,219) |

|

(2,494) |

| Finance

(costs) income, net - other |

|

(1,322) |

|

(716) |

|

(4,130) |

|

(4,138) |

|

Profit (loss) from continuing operations before income

taxes |

|

6,584 |

|

7,850 |

|

34,200 |

|

37,558 |

|

Income tax (expense) recovery |

|

306 |

|

(3,228) |

|

(8,627) |

|

(10,549) |

|

Profit (loss) for the period from continuing

operations |

$ |

6,890 |

$ |

4,622 |

$ |

25,573 |

$ |

27,009 |

|

Profit (loss) for the period from discontinued operations |

|

- |

|

(276) |

|

- |

|

(5,576) |

|

Profit (loss) for the period |

$ |

6,890 |

$ |

4,346 |

$ |

25,573 |

$ |

21,433 |

(1) Management uses the non‐GAAP occupancy costs calculated on a

similar basis prior to the adoption of IFRS 16 when analyzing

financial and operating performance.(2) Other non‐operating and/or

non‐recurring income (costs) for the year ended December 31, 2021

relate to (i) costs relating to the June 13, 2021 cybersecurity

incident net of insurance proceeds received or receivable, and (ii)

transaction and other related costs. For the year ended December

31, 2020, other non‐operating and/or non‐recurring income (costs)

relate to (i) transitional costs related to the departure of senior

executives, (ii) legal, advisory, and other consulting costs

related to a Board strategic initiative, and (iii) transaction and

other related costs.

Reconciliation of Adjusted Earnings

(Loss) Per Share to Profit (Loss)

The following table provides a reconciliation

between Adjusted EPS and profit (loss):

|

|

Quarter endedDecember 31, |

Year ended

December 31, |

|

In thousands of dollars, except for per share amounts |

|

2021 |

|

2020 |

|

2021 |

|

2020 |

|

Profit (loss) for the period |

$ |

6,890 |

$ |

4,346 |

$ |

25,573 |

$ |

21,433 |

|

(Profit) loss for the period from discontinued operations |

|

- |

|

276 |

|

- |

|

5,576 |

|

Occupancy costs calculated on a similar basis prior to the adoption

of IFRS 16 (1) |

|

(3,477) |

|

(3,053) |

|

(13,199) |

|

(12,312) |

|

Depreciation of right-of-use assets |

|

3,209 |

|

2,706 |

|

12,119 |

|

11,210 |

|

Finance costs (income), net - leases |

|

515 |

|

584 |

|

2,219 |

|

2,494 |

|

Amortization of intangibles of acquired businesses |

|

7,654 |

|

5,724 |

|

28,435 |

|

23,533 |

|

Unrealized foreign exchange loss (gain) |

|

(145) |

|

382 |

|

1,104 |

|

165 |

|

Loss (gain) on disposal of property, plant and equipment and

intangibles |

|

- |

|

454 |

|

(248) |

|

457 |

|

Non-cash share-based compensation costs |

|

6,178 |

|

2,133 |

|

19,455 |

|

10,261 |

|

Loss (gain) on equity derivatives net of mark-to-market adjustments

on related RSUs and DSUs being hedged |

|

(1,035) |

|

2,237 |

|

(2,040) |

|

471 |

|

Interest accretion on contingent consideration payables |

|

- |

|

- |

|

- |

|

102 |

|

Restructuring costs (recovery) |

|

(238) |

|

3,374 |

|

15 |

|

11,984 |

|

Loss (gain) on hedging transactions, including currency forward

contracts and interest expense (income) on swaps |

|

- |

|

- |

|

- |

|

138 |

|

Acquisition and related transition costs (income) |

|

2,025 |

|

217 |

|

10,137 |

|

(887) |

|

Loss (gain) on investments |

|

(1,091) |

|

1 |

|

(2,930) |

|

(21) |

|

Share of loss (profit) of joint venture |

|

(745) |

|

(9) |

|

(1,187) |

|

(459) |

|

Impairment charge - leases |

|

- |

|

- |

|

- |

|

36 |

|

Other non-operating and/or non-recurring costs (income) |

|

2,944 |

|

1,631 |

|

11,517 |

|

3,429 |

|

Tax impact on above |

|

(3,840) |

|

(2,933) |

|

(10,656) |

|

(9,836) |

|

Adjusted earnings (loss) for the period |

$ |

18,844 |

$ |

18,070 |

$ |

80,314 |

$ |

67,774 |

| Weighted average number of

shares - basic |

|

43,945,167 |

|

40,379,692 |

|

41,684,077 |

|

40,158,543 |

|

Weighted average number of restricted shares |

|

680,150 |

|

345,089 |

|

580,280 |

|

351,452 |

|

Weighted average number of shares - adjusted |

|

44,625,317 |

|

40,724,781 |

|

42,264,357 |

|

40,509,995 |

|

Adjusted earnings (loss) per share |

$0.42 |

$0.44 |

$1.90 |

$1.67 |

(1) Management uses the non-GAAP occupancy

costs calculated on a similar basis prior to the adoption of IFRS

16 when analyzing operating performance, which may provide useful

information to both management and investors in measuring our

financial performance.

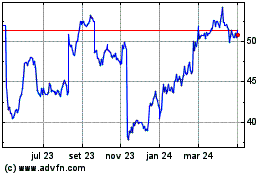

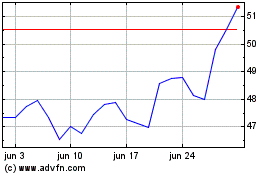

Altus (TSX:AIF)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

Altus (TSX:AIF)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025