HAVERTYS (NYSE: HVT and HVT.A), today reported its operating

results for the fourth quarter and year ended December 31, 2021.

Fourth quarter 2021 versus fourth quarter

2020:

- Diluted earnings per common share (“EPS”) of $1.35 versus

$1.37.

- Consolidated sales increased 10.2% to $265.9 million.

Comparable store sales increased 9.2%.

- Pre-tax income of $32.1 million versus $31.3 million.

FY 2021 versus FY 2020:

- EPS of $4.90 versus $3.12 and Adjusted EPS for 2020 of

$1.88.

- Adjusted EPS for 2020 excludes $1.24 for gain on a

sale-leaseback transaction.

- Consolidated sales increased 35.4% to a record $1,012.8

million. Comparable store sales for the year rose 17.9%.

- Pre-tax income of $118.5 million versus $76.7 million and

Adjusted Pre-tax income for 2020 of $42.5 million.

Clarence H. Smith, chairman and CEO, said, “We are proud to

report another record-breaking quarter in sales and building on the

previous quarters’ outstanding results which drove our annual sales

over a billion dollars. Our merchandising team carefully managed

our product line-up and despite the impact from a $5.6 million LIFO

charge, our gross profit margins in the fourth quarter were 56.4%.

We experienced inflation pressure in our operating costs and

residual demurrage fees. Our pre-tax income of $32.1 million was

very strong and a record quarter of operating income at 12.1% of

sales.

“The impact of COVID has been challenging but our agility,

systems, and financial strength provided tools to work around and

through many obstacles. However, it was primarily our people, the

dedicated Havertys team members, that generated these outstanding

results. Our sales for the year of $1.0 billion is a record that we

acknowledge and celebrate. This was profitable sales growth as we

improved our gross profit and operating margins amidst

extraordinary cost increases. My sincere thanks to each member of

the team for their contributions during these so called “uncertain

times.”

“As a result of our strong performance and consistent with our

commitment to returning capital to our shareholders, during 2021 we

purchased $41.8 million in common shares, paid quarterly dividends

of $17.4 million, and in December paid a special cash dividend of

$35.0 million. During the first half of 2022, we plan to repurchase

$25.0 million in shares under an existing authorization. We have

paid an annual cash dividend since 1935 and increased our quarterly

cash dividend payouts each year since 2008.

“We have a strong position in the fastest growing markets in the

country and plan to open four stores in 2022. Our online presence

is also being improved to drive engagement and sales. Our balance

sheet is strong and funds from our expected results of operations

should be sufficient to cover our strategic plans, while also

allowing us to return amounts to our shareholders. We are confident

that our strategy for expanding our profitable growth will enable

us to surpass the high bar set in 2021.”

Key Results(amounts in millions, except per

share amounts)

|

Results of Operations |

|

Q4 2021 |

|

Q4 2020 |

|

FY 2021 |

|

FY 2020 |

|

| Sales |

|

$ |

265.9 |

|

$ |

241.3 |

|

$ |

1,012.8 |

|

$ |

748.3 |

|

| Gross Profit |

|

|

150.0 |

|

|

137.6 |

|

|

574.6 |

|

|

419.0 |

|

| Gross profit as a

% of sales |

|

|

56.4 |

% |

|

57.0 |

% |

|

56.7 |

% |

|

56.0 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| SGA |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Variable |

|

|

47.5 |

|

|

41.6 |

|

|

173.8 |

|

|

135.3 |

|

| |

Fixed |

|

|

70.5 |

|

|

65.4 |

|

|

282.5 |

|

|

242.0 |

|

| Total |

|

|

118.0 |

|

|

107.0 |

|

|

456.3 |

|

|

377.3 |

|

| SGA as a % of

sales |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Variable |

|

|

17.9 |

% |

|

17.2 |

% |

|

17.2 |

% |

|

18.1 |

% |

| |

Fixed |

|

|

26.5 |

% |

|

27.1 |

% |

|

27.9 |

% |

|

32.3 |

% |

| Total |

|

|

44.4 |

% |

|

44.3 |

% |

|

45.1 |

% |

|

50.4 |

% |

| Pre-tax

income |

|

|

32.1 |

|

|

31.3 |

|

|

118.5 |

|

|

76.7 |

|

| Pre-tax income as

a % of sales |

|

|

12.1 |

% |

|

13.0 |

% |

|

11.7 |

% |

|

10.3 |

% |

| Adjusted pre-tax

income(1)(2) |

|

|

32.1 |

|

|

31.3 |

|

|

118.5 |

|

|

42.5 |

|

| Adjusted pre-tax

income as a % of sales |

|

|

12.1 |

% |

|

13.0 |

% |

|

11.7 |

% |

|

5.7 |

% |

| Net income |

|

|

24.3 |

|

|

25.4 |

|

|

90.8 |

|

|

59.1 |

|

| Net income as a %

of sales |

|

|

9.1 |

% |

|

10.5 |

% |

|

9.0 |

% |

|

7.9 |

% |

| Diluted earnings

per share (“EPS”) |

|

$ |

1.35 |

|

$ |

1.37 |

|

$ |

4.90 |

|

$ |

3.12 |

|

| Adjusted

EPS(1)(2) |

|

$ |

1.35 |

|

$ |

1.37 |

|

$ |

4.90 |

|

$ |

1.88 |

|

|

Other Financial and Operations Data |

|

|

FY 2021 |

|

|

FY 2020 |

|

|

EBITDA (in millions)(2) |

|

$ |

134.6 |

|

$ |

94.8 |

|

| Adjusted EBITDA(1)(2) |

|

$ |

134.6 |

|

$ |

60.6 |

|

| Sales per square foot |

|

$ |

232 |

|

$ |

173 |

|

| Average ticket |

|

$ |

2,865 |

|

$ |

2,482 |

|

|

Liquidity Measures |

|

|

|

|

|

|

|

|

|

|

|

Free Cash Flow |

|

FY 2021 |

|

FY 2020 |

|

Cash Returns toShareholders |

|

FY 2021 |

|

FY 2020 |

|

Operating cash flow |

|

$ |

97.2 |

|

$ |

130.2 |

|

Share repurchases |

|

$ |

41.8 |

|

$ |

19.7 |

|

|

|

|

|

|

|

|

|

Dividends |

|

|

17.4 |

|

|

14.2 |

|

Capital expenditures |

|

|

34.1 |

|

|

10.9 |

|

Special dividends |

|

|

35.0 |

|

|

36.3 |

|

Free cash flow |

|

$ |

63.1 |

|

$ |

119.3 |

|

Cash returns to shareholders |

|

$ |

94.2 |

|

$ |

70.2 |

|

|

(1) Adjusted for $34.3 million gain from sale

of facilities including $31.6 million sale leaseback

transaction.

(2) See the reconciliation of the non-GAAP

metrics at the end of the release.

Fourth Quarter ended December 31, 2021 Compared to Same Period

of 2020

- EPS of $1.35 versus $1.37.

- Sales increased 10.2% and comparable store sales rose

9.2%.

- Total written sales were down 3.5% and written comparable store

sales were down 4.7%. Comparing the fourth quarter of 2021 to the

same period of 2019, total written sales were up 13.1%.

- Gross profit margins decreased 60.0 basis points to 56.4% in

2021 from 57.0% for the same period of 2020 due primarily from a

193 basis points increase from charges for our LIFO reserve.

- SG&A expenses were 44.4% of sales versus 44.3% and

increased $10.9 million. The primary drivers of this change are:

- increase of $3.1 million in sales commissions and related

benefits and costs due to higher sales.

- increase in occupancy costs of $2.0 million in 2021, due to

rent abatements received in 2020.

- increase in warehouse expense of $2.4 million primarily from

$1.8 million in demurrage fees and higher salaries and

benefits.

Balance Sheet and YTD Cash Flow

- Cash and cash equivalents at December 31, 2021 are $172.9

million.

- Generated $97.2 million in cash from operating activities

driven by a solid performance, a $12.7 million increase in customer

deposits from written orders, offset by funding of a $22.1 million

increase in inventories.

- Capital expenditures of $34.1 million which included purchase

of a leased Virginia home delivery center which was part of the May

2020 sale leaseback.

- Paid $52.4 million in dividends including $35.0 million in a

special cash dividend.

- Repurchased $41.8 million of common stock.

- No funded debt.

Expectations and Other

- We expect gross profit margins for 2022 will be between 56.7%

to 57.0%. Gross profit margins fluctuate quarter to quarter in

relation to our promotional cadence. Our estimated gross profit

margins are based on changes in product and freight costs and its

impact on our LIFO reserve.

- Fixed and discretionary expenses within SG&A are expected

to be in the $295.0 to $298.0 million range in 2022, an approximate

5.0% increase over the 2021 level of $282.5 million. Variable

SG&A expenses were 17.2% as a percent of sales in 2021 and are

anticipated to be in the 17.2% to 17.4% range in 2022 based on

potential increases in selling and delivery costs.

- Our effective tax rate for 2022 is expected to be 25% excluding

the impact from the vesting of stock-based awards, potential tax

credits, and any new tax legislation.

- Planned capital expenditures are approximately $37.0 million in

2022. We expect to increase retail square footage by 1%, opening

four stores and closing two. Capital expenditures are also planned

for the conversion of our home delivery center in Virginia to a

regional distribution facility, and as part of our enhanced online

presence, additional spend on information technology.

- We expect to repurchase $25.0 million of common stock during

the first half of 2022 under a current share repurchase program

authorization.

| HAVERTY FURNITURE

COMPANIES, INC. |

| CONDENSED CONSOLIDATED

STATEMENTS OF INCOME |

| (In thousands, except per

share data – Unaudited) |

|

|

|

Three Months EndedDecember

31, |

|

Year Ended December 31, |

|

|

|

|

2021 |

|

2020 |

|

2021 |

|

2020 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net sales |

|

$ |

265,940 |

|

$ |

241,339 |

|

$ |

1,012,799 |

|

$ |

748,252 |

|

| Cost of goods

sold |

|

|

115,853 |

|

|

103,720 |

|

|

438,174 |

|

|

329,258 |

|

|

|

Gross profit |

|

|

150,087 |

|

|

137,619 |

|

|

574,625 |

|

|

418,994 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Selling, general and

administrative |

|

|

117,952 |

|

|

107,007 |

|

|

456,267 |

|

|

377,288 |

|

| |

Other expense (income),

net |

|

|

94 |

|

|

(601 |

) |

|

54 |

|

|

(34,899 |

) |

|

Total expenses |

|

|

118,046 |

|

|

106,406 |

|

|

456,321 |

|

|

342,389 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income before

interest and income taxes |

|

|

32,041 |

|

|

31,213 |

|

|

118,304 |

|

|

76,605 |

|

| Interest income,

net |

|

|

58 |

|

|

61 |

|

|

231 |

|

|

126 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income before

income taxes |

|

|

32,099 |

|

|

31,274 |

|

|

118,535 |

|

|

76,731 |

|

| Income tax

expense |

|

|

7,793 |

|

|

5,846 |

|

|

27,732 |

|

|

17,583 |

|

| |

Net income |

|

$ |

24,306 |

|

$ |

25,428 |

|

$ |

90,803 |

|

$ |

59,148 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted earnings

per share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Common Stock |

|

$ |

1.35 |

|

$ |

1.37 |

|

$ |

4.90 |

|

$ |

3.12 |

|

| |

Class A Common Stock |

|

$ |

1.33 |

|

$ |

1.35 |

|

$ |

4.69 |

|

$ |

3.04 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted weighted

average shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Common Stock |

|

|

18,042 |

|

|

18,618 |

|

|

18,543 |

|

|

18,932 |

|

| |

Class A Common Stock |

|

|

1,287 |

|

|

1,499 |

|

|

1,330 |

|

|

1,522 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash dividends per

share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Common Stock |

|

$ |

2.25 |

|

$ |

2.22 |

|

$ |

2.97 |

|

$ |

2.77 |

|

| |

Class A Common Stock |

|

$ |

2.13 |

|

$ |

2.10 |

|

$ |

2.79 |

|

$ |

2.62 |

|

| HAVERTY FURNITURE

COMPANIES, INC. |

| CONDENSED CONSOLIDATED

BALANCE SHEETS |

| (In thousands–

Unaudited) |

|

|

|

December 31,2021 |

|

December 31,2020 |

|

|

|

|

|

|

|

|

|

ASSETS |

|

|

|

|

|

|

| Current

assets |

|

|

|

|

|

|

|

| |

Cash and cash

equivalents |

|

$ |

166,146 |

|

$ |

200,058 |

|

| |

Restricted cash

and cash equivalents |

|

|

6,716 |

|

|

6,713 |

|

| |

Inventories |

|

|

112,031 |

|

|

89,908 |

|

| |

Prepaid

expenses |

|

|

12,418 |

|

|

9,580 |

|

| |

Other current

assets |

|

|

11,746 |

|

|

9,985 |

|

|

|

|

Total current assets |

|

|

309,057 |

|

|

316,244 |

|

| |

|

|

|

|

|

|

|

| Property and

equipment, net |

|

|

126,099 |

|

|

108,366 |

|

| Right of-use lease

assets |

|

|

222,356 |

|

|

228,749 |

|

| Deferred income

taxes |

|

|

16,375 |

|

|

15,814 |

|

| Other assets |

|

|

12,403 |

|

|

11,199 |

|

| |

|

Total assets |

|

$ |

686,290 |

|

$ |

680,372 |

|

| |

|

|

|

|

|

|

|

| LIABILITIES AND

STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

|

| Current

liabilities |

|

|

|

|

|

|

|

| |

Accounts

payable |

|

$ |

31,235 |

|

$ |

31,429 |

|

| |

Customer

deposits |

|

|

98,897 |

|

|

86,183 |

|

| |

Accrued

liabilities |

|

|

46,664 |

|

|

52,963 |

|

| |

Current lease

liabilities |

|

|

33,581 |

|

|

33,466 |

|

| |

|

Total current liabilities |

|

|

210,377 |

|

|

204,041 |

|

| |

|

|

|

|

|

|

|

| Noncurrent lease

liabilities |

|

|

196,771 |

|

|

200,200 |

|

| Other

liabilities |

|

|

23,172 |

|

|

23,164 |

|

| |

|

Total liabilities |

|

|

430,320 |

|

|

427,405 |

|

|

|

|

|

|

|

|

|

|

| Stockholders’

equity |

|

|

255,970 |

|

|

252,967 |

|

| |

|

Total liabilities and

stockholders’ equity |

|

$ |

686,290 |

|

$ |

680,372 |

|

| HAVERTY FURNITURE

COMPANIES, INC. |

| CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS |

| (In thousands–

Unaudited) |

|

|

|

Year Ended December 31, |

|

|

|

|

2021 |

|

2020 |

|

| CASH FLOWS FROM

OPERATING ACTIVITIES: |

|

|

|

|

|

|

|

| |

Net income |

|

$ |

90,803 |

|

$ |

59,148 |

|

| |

Adjustments to

reconcile net income to net cash provided by operating

activities: |

|

|

|

|

|

|

|

| |

|

Depreciation and

amortization |

|

|

16,304 |

|

|

18,207 |

|

| |

|

Stock-based

compensation |

|

|

8,213 |

|

|

4,375 |

|

| |

|

Deferred income

taxes |

|

|

234 |

|

|

(2,458 |

) |

| |

|

Net gain on sale

of land, property, and equipment |

|

|

(77 |

) |

|

(34,746 |

) |

| |

|

Other |

|

|

869 |

|

|

595 |

|

| |

Changes in

operating assets and liabilities: |

|

|

|

|

|

|

|

| |

|

Inventories |

|

|

(22,123 |

) |

|

14,909 |

|

| |

|

Customer

deposits |

|

|

12,714 |

|

|

56,062 |

|

| |

|

Other assets and

liabilities |

|

|

(3,244 |

) |

|

(3,250 |

) |

| |

|

Accounts payable

and accrued liabilities |

|

|

(6,451 |

) |

|

17,349 |

|

|

|

|

|

Net cash provided by operating activities |

|

|

97,242 |

|

|

130,191 |

|

| |

|

|

|

|

|

|

|

| CASH FLOWS FROM

INVESTING ACTIVITIES: |

|

|

|

|

|

|

|

| |

Capital

expenditures |

|

|

(34,090 |

) |

|

(10,927 |

) |

| |

Proceeds from sale

of property and equipment |

|

|

88 |

|

|

76,285 |

|

| |

|

|

Net cash (used in) provided by

investing activities |

|

|

(34,002 |

) |

|

65,358 |

|

| |

|

|

|

|

|

|

|

| CASH FLOWS FROM

FINANCING ACTIVITIES: |

|

|

|

|

|

|

|

| |

Proceeds from

borrowing under revolving credit facility |

|

|

— |

|

|

43,800 |

|

| |

Payments of

borrowings under revolving credit facility |

|

|

— |

|

|

(43,800 |

) |

| |

|

|

Net change in borrowings under

revolving credit facility |

|

|

— |

|

|

— |

|

| |

|

|

|

|

|

|

|

|

| |

Dividends

paid |

|

|

(52,446 |

) |

|

(50,521 |

) |

| |

Common stock

repurchased |

|

|

(41,809 |

) |

|

(19,708 |

) |

| |

Taxes on vested

restricted shares |

|

|

(2,894 |

) |

|

(951 |

) |

| |

|

|

Net cash used in financing

activities |

|

|

(97,149 |

) |

|

(71,180 |

) |

| (Decrease)

increase in cash, cash equivalents and restricted

cash equivalents |

|

|

(33,909 |

) |

|

124,369 |

|

| Cash, cash

equivalents and restricted cash equivalents at beginning of

year |

|

|

206,771 |

|

|

82,402 |

|

| Cash, cash

equivalents and restricted cash equivalents at end of year |

|

$ |

172,862 |

|

$ |

206,771 |

|

GAAP to Non-GAAP ReconciliationWe report our

financial results in accordance with accounting principles

generally accepted in the United States ("GAAP"). We supplement the

reporting of our financial information under GAAP with certain

non-GAAP financial information. The non-GAAP information presented

provides additional useful information but should not be considered

in isolation or as substitutes for the related GAAP measures. We

believe that Adjusted Pre-Tax income, Adjusted EPS, EBITDA, and

Adjusted EBITDA are meaningful measures to share with investors

because it best allows comparison of the performance for the

comparable period. In addition, the “Adjusted” metrics afford

investors a view of what we consider Havertys’ earnings performance

and the ability to make a more informed assessment of such earnings

performance.

Adjusted Pre-Tax Income and Adjusted

EPS Adjusted pre-tax income (“Adjusted Pre-Tax

Income”) and adjusted diluted earnings per share (“Adjusted EPS”)

are considered non-GAAP financial measures under the rules

because they exclude certain amounts which are included when

pre-tax income and diluted earnings per share (“EPS”) are

calculated in accordance with U.S. GAAP.

We have calculated Adjusted Pre-Tax Income and Adjusted EPS for

the year ended December 31, 2021 and 2020 by adjusting Pre-Tax

Income and EPS for a sale-leaseback transaction in 2020.

|

(in thousands) |

|

FY 2021 |

|

FY 2020(1) |

|

|

Income before income taxes, as reported |

|

$ |

118,535 |

|

$ |

76,731 |

|

|

| Adjustments: |

|

|

|

|

|

|

Gain from sale-leaseback transaction and related property

sales(2) |

|

|

— |

|

|

(34,254 |

) |

|

|

|

|

|

|

|

|

|

Pre-tax income, as adjusted |

|

$ |

118,535 |

|

$ |

42,477 |

|

|

|

(1 |

) |

These amounts are included in our Form 10-K for the year ended

December 31, 2020. |

|

(2 |

) |

The gain from the sale-leaseback

transaction of three distribution facilities was $31.6 million as

reported in our Form 10-K for the year ended December 31, 2020. We

also sold properties adjacent to these facilities and those gains

are included in this amount. |

| |

|

FY 2021 |

|

FY 2020 |

|

| Diluted

earnings per share: |

|

|

|

|

|

|

|

| |

Reported EPS |

|

$ |

4.90 |

|

$ |

3.12 |

|

|

| |

|

|

|

|

|

|

|

|

| |

Adjustments: |

|

|

|

|

|

|

|

| |

|

Gain from

sale-leaseback transaction: pre-tax |

|

|

— |

|

|

(1.66 |

) |

|

| |

|

Tax impact

(1) |

|

|

— |

|

|

0.42 |

|

|

|

|

|

|

Net adjustment |

|

|

— |

|

|

(1.24 |

) |

|

| |

|

|

|

|

|

|

|

|

|

| |

Adjusted EPS |

|

$ |

4.90 |

|

$ |

1.88 |

|

|

(1) Calculated based on nature of

item and rates applied.Reconciliation of GAAP measures to

EBITDA and EBITDA to Adjusted EBITDA

|

(in thousands) |

|

FY 2021 |

|

FY 2020(1) |

|

Income before income taxes, as reported |

|

$ |

118,535 |

|

|

$ |

76,731 |

|

| Interest (income), net |

|

|

(231 |

) |

|

|

(126 |

) |

| Depreciation |

|

|

16,304 |

|

|

|

18,207 |

|

|

EBITDA |

|

|

134,608 |

|

|

|

94,812 |

|

|

Adjustments: |

|

|

|

|

|

Gain from sale-leaseback transaction and related property

sales(2) |

|

|

— |

|

|

|

(34,254 |

) |

|

|

|

|

|

|

|

Adjusted EBITDA |

|

$ |

134,608 |

|

|

$ |

60,558 |

|

|

(1 |

) |

These amounts are included in our Form 10-K for the year ended

December 31, 2020. |

|

(2 |

) |

The gain from the sale-leaseback

transaction of three distribution facilities was $31.6 million as

reported in our Form 10-K for the year ended December 31, 2020. We

also sold properties adjacent to these facilities and those gains

are included in this amount. |

Comparable Store

Sales Comparable-store or

“comp-store” sales is a measure which indicates the performance of

our existing stores and website by comparing the sales growth for

stores and online for a particular month over the corresponding

month in the prior year. Stores are considered non-comparable if

they were not open during the corresponding month or if the selling

square footage has been changed significantly. Stores closed due to

COVID-19 were excluded from comp-store sales.

Cost of Goods Sold

and SG&A Expense We include

substantially all our occupancy and home delivery costs

in SG&A expense as well as a portion of our

warehousing expenses. Accordingly, our gross profit may not be

comparable to those entities that include these costs in cost of

goods sold. We classify

our SG&A expenses as either variable or fixed and

discretionary. Our variable expenses are comprised of selling and

delivery costs. Selling expenses are primarily compensation and

related benefits for our commission-based sales

associates, the discount we pay for third party financing of

customer sales and transaction fees for credit card usage. We do

not outsource delivery, so these costs include personnel,

fuel, and other expenses related to this function. Fixed and

discretionary expenses are comprised of rent, depreciation and

amortization and other occupancy costs for stores, warehouses and

offices, and all advertising and administrative costs.

Conference Call InformationThe company invites

interested parties to listen to the live audiocast of the

conference call on February 16, 2022 at 10:00 a.m. ET at its

website, havertys.com under the investor relations section. If you

cannot listen live, a replay will be available on the day of the

conference call at the website or via telephone at approximately

1:00 p.m. ET through February 26, 2022. The number to access the

telephone playback is 1-888-203-1112 (access code: 1060509).

About Havertys Havertys (NYSE: HVT

and HVT.A), established in 1885, is a full-service home furnishings

retailer with 121 showrooms in 16 states in the Southern and

Midwestern regions providing its customers with a wide selection of

quality merchandise in middle to upper-middle price ranges.

Additional information is available on the Company’s website

havertys.com.

Safe

Harbor This press release contains,

and the conference call may contain forward-looking

statements subject to the safe harbor provisions of

Section 27A of the Securities Act of 1933 and

Section 21E of the Securities Act of 1934. These

forward-looking statements are subject to risks and uncertainties

and change based on various important factors, many of which are

beyond our control.

All statements in the future tense and all statements

accompanied by words such as “expect,” “likely,” “outlook,”

“forecast,” “preliminary,” “would,” “could,” “should,” “position,”

“will,” “project,” “intend,” “plan,” “on track,” “anticipate,” “to

come,” “may,” “possible,” “assume,” and variations of such words

and similar expressions are intended to identify such

forward-looking statements. These forward-looking statements

include, without limitation, our expected ability to operate and

protect our team members and customers during the COVID-19

pandemic, the execution and effect of our cost savings initiatives,

our expectations for selling square footage and capital

expenditures for 2022, our liquidity position to continue to fund

our growth plans, and our efforts and initiatives to help us emerge

from the pandemic well-positioned. We caution that our

forward-looking statements involve risks and uncertainties, and

while we believe that our expectations for the future are

reasonable in view of currently available information you are

cautioned not to place undue reliance on our forward-looking

statements, and they should not be relied upon as a prediction

of actual results. Factors that could cause actual results to

differ materially from those expressed or implied in any

forward-looking statements include, but are not limited to: the

extent and duration of the disruption to our business operations

caused by the health crisis associated with the COVID-19 pandemic,

including the effects on the financial health of our business

partners and customers, on supply chains and our suppliers, and on

access to capital and liquidity provided by the financial and

capital markets; our ability to maintain compliance with debt

covenants and amend such credit facilities as necessary;

disruptions in our suppliers' operations, including from the impact

of COVID-19, including potential problems with inventory

availability and the potential result of the volatility or higher

cost of product and international freight due to the high demand of

products and low supply for an unpredictable period of time;

disruptions in our third-party producers’ operations in foreign

countries; changes in national and international legislation or

government regulations or policies, including changes to import

tariffs and the unpredictability of such changes; failure of

vendors to meet our quality control standards or to react to

changes in legislative or regulatory frameworks; disruptions in our

distribution centers; changes in general economic conditions,

including unemployment, inflation (including the impact of

tariffs); labor shortages and the Company's ability to successfully

attract and retain employees in the current labor market; uncertain

credit markets and other macroeconomic conditions; competitive

product, service and pricing pressures; failure or weakness in our

disclosure controls and procedures and internal controls over

financial reporting; disruptions caused by a failure or breach of

the Company's information systems and information technology

infrastructure, as well as other risks and uncertainties discussed

in the Company's Annual Report on Form 10-K for 2020 (all of which

risks may be amplified by the COVID-19 pandemic) and from time

to time in the Company's subsequent filings with the SEC.

Forward-looking statements describe our

expectations only as of the date they are made, and the

Company undertakes no duty to update its forward-looking statements

except as required by law. You are advised, however, to review any

further disclosures we make on related subjects in our subsequent

Forms 10-K, 10-Q, 8-K, and other reports filed with the

SEC.

SOURCE: Havertys

Contact:

Havertys 404-443-2900

Jenny Hill Parker

SVP, Finance, and Corporate Secretary

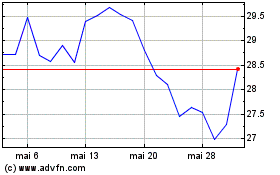

Haverty Furniture Compan... (NYSE:HVT)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Haverty Furniture Compan... (NYSE:HVT)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025