Altus Group Limited (ʺAltus” or “the Company”) (TSX: AIF), a market

leading intelligence-as-a-service provider to the global commercial

real estate (“CRE”) industry, announced today its financial and

operating results for the fourth quarter and year ended December

31, 2021.

Unless otherwise indicated, all amounts are in

Canadian dollars and percentages are in comparison to the same

period in 2020.

2021 Summary:

- Consolidated revenues were $625.4 million, up 11.4% (14.7% on a

constant currency basis).

- Consolidated profit from continuing operations, in accordance

with IFRS, was $25.6 million, down 5.3% from $27.0 million.

- Consolidated earnings per share from continuing operations, in

accordance with IFRS, was $0.62 per share basic and $0.60 per share

diluted, compared to $0.67 and $0.66, respectively.

- Consolidated Adjusted EBITDA* was $109.8 million, up 10.9%

(15.1% on a constant currency basis).

- Adjusted EPS* was $1.90, up 13.8% from $1.67.

- Altus Analytics revenues were $251.1 million, up 23.3% (29.9%

on a constant currency basis), of which Over Time revenues* were

$207.8 million, up 23.9% (29.4% on a constant currency basis), and

Adjusted EBITDA was $41.6 million, up 16.0% (25.2% on a constant

currency basis).

- Altus Analytics Bookings* totaled $95.1 million, up 76.1%

(84.9% on a constant currency basis), of which organic growth in

Bookings was 65.3% (74.1% on a constant currency basis).

- At the end of 2021, 42%* of the Company’s total ARGUS

Enterprise (“AE”) user base had been contracted on ARGUS Cloud,

compared to 14% at the end of 2020.

- CRE Consulting revenues were $374.6 million, up 4.7% (6.0% on a

constant currency basis) and Adjusted EBITDA was $104.1 million, up

13.0% (14.0% on a constant currency basis).

- As at December 31, 2021, bank debt was $287.6 million and cash

and cash equivalents was $51.3 million (representing a funded debt

to Adjusted EBITDA leverage ratio of 2.47 times, as such ratio is

defined in our credit facility agreement, or a net debt to Adjusted

EBITDA leverage ratio* of 2.17 times).

- During the year three highly strategic acquisitions were

completed:

- Finance Active, a debt management SaaS solution that provides

Altus with a platform for CRE debt valuation and risk

management and an international footprint;

- StratoDem Analytics, a data-science-as-a-service for the real

estate sector that, together with Altus’ data and technology,

provides predictive analytics to maximize asset and portfolio

performance; and

- Reonomy, an AI-powered data platform for the CRE industry that

provides comprehensive data and technology for the delivery of

Altus’ intelligence-as-a-service offering.

Fourth Quarter 2021

Summary:

- Consolidated revenues were $162.9 million, up 16.8% (19.9% on a

constant currency basis).

- Consolidated profit from continuing operations, in accordance

with IFRS, was $6.9 million, up 49.1% from $4.6 million.

- Consolidated earnings per share from continuing operations, in

accordance with IFRS, was $0.16 per share basic and $0.15 per share

diluted, compared to $0.11 per share basic and diluted.

- Consolidated Adjusted EBITDA was $25.9 million, down 3.3% (up

1.3% on a constant currency basis).

- Adjusted EPS was $0.42 down from $0.44.

- Altus Analytics revenues were $72.4 million, up 40.6% (46.6% on

a constant currency basis), of which Over Time revenues were $59.8

million, up 37.6% (41.0% on a constant currency basis), and

Adjusted EBITDA was $10.7 million, up 9.0% (19.1% on a constant

currency basis).

- Altus Analytics Bookings totaled $31.1 million, up 109.5%

(113.3% on a constant currency basis), of which organic growth in

Bookings was 86.9% (90.7% on a constant currency basis).

- CRE Consulting revenues were $90.6 million, up 2.9% (4.2% on a

constant currency basis) and Adjusted EBITDA was $24.2 million, in

line with 2021.

- Completed a $172.5 million equity financing, including the

issuance of approximately 2.8 million shares priced at $62.00 per

common share in October 2021, and further amended our bank credit

facilities in November 2021 to increase borrowing capacity to $400

million, with certain provisions to further increase the limit to

$450 million.

*Altus uses certain non-GAAP financial measures

such as Adjusted EBITDA, Adjusted EPS, constant currency, and net

debt to Adjusted EBITDA leverage ratio, as well as supplementary

financial measures such as Bookings, and Over Time revenues. Since

these measures are not standard measures under GAAP, they may not

be comparable to similar measures reported by other entities. Refer

to the “Non-GAAP and Other Measures” section for more information

on each measure and a reconciliation of Adjusted EBITDA to Profit

(Loss) and Adjusted Earnings (Loss) per Share to Profit (Loss).

Jim Hannon, incoming Chief Executive

Officer of Altus said:

“Our fourth quarter results reflect growing

momentum in our business and underscore strong operating execution

during 2021. Our 11% topline and earnings growth marked a solid

finish to a very productive year for Altus. We made tremendous

strategic progress to put the Company on a path to accelerate

growth and deliver competitive differentiation to our customers. We

enter 2022 with strong demand for our solutions, with an improved

operating posture and strong momentum to deliver sustained robust

revenue growth at expanded margins. I couldn’t be more excited to

lead Altus during this pivotal time of growth and

transformation.”

Summary of Operating and Financial

Performance by Business Segment:

Comparative figures have been restated to

reflect accrued variable compensation costs within the respective

business units.

|

Consolidated |

Year ended December 31, |

Quarter ended December 31, |

|

In thousands of dollars, except for per share amounts |

|

2021 |

|

2020 |

% Change |

Constant Currency % Change |

|

2021 |

|

2020 |

% Change |

Constant Currency % Change |

|

Revenues |

$ |

625,387 |

$ |

561,156 |

11.4% |

14.7% |

$ |

162,909 |

$ |

139,480 |

16.8% |

19.9% |

| Adjusted

EBITDA* |

$ |

109,755 |

$ |

98,928 |

10.9% |

15.1% |

$ |

25,861 |

$ |

26,734 |

-3.3% |

1.3% |

| Adjusted

EBITDA Margin* |

|

17.5% |

|

17.6% |

|

|

|

15.9% |

|

19.2% |

|

|

| Profit

(loss) from continuing operations |

$ |

25,573 |

$ |

27,009 |

|

|

$ |

6,890 |

$ |

4,622 |

|

|

| Earnings

(loss) per share from continuing operations: |

|

|

|

|

|

|

|

|

|

Basic |

$ |

0.62 |

$ |

0.67 |

|

|

$ |

0.16 |

$ |

0.11 |

|

|

|

Diluted |

$ |

0.60 |

$ |

0.66 |

|

|

$ |

0.15 |

$ |

0.11 |

|

|

|

Adjusted* |

$ |

1.90 |

$ |

1.67 |

|

|

$ |

0.42 |

$ |

0.44 |

|

|

|

Dividends declared per share |

$ |

0.60 |

$ |

0.60 |

|

|

$ |

0.15 |

$ |

0.15 |

|

|

*Altus uses certain non-GAAP financial measures

such as Adjusted EBITDA, Adjusted EBITDA Margin and Adjusted EPS.

Since these measures are not standard measures under GAAP, they may

not be comparable to similar measures reported by other entities.

Refer to the “Non-GAAP and Other Measures” section for more

information on each measure and a reconciliation of Adjusted EBITDA

to Profit (Loss) and Adjusted Earnings (Loss) per Share to Profit

(Loss).

|

Altus Analytics |

Year ended December 31, |

Quarter ended December 31, |

|

In thousands of dollars |

|

2021 |

|

2020 |

% Change |

Constant Currency % Change |

|

2021 |

|

2020 |

% Change |

Constant Currency % Change |

|

Revenues |

$ |

251,084 |

$ |

203,707 |

23.3% |

29.9% |

$ |

72,407 |

$ |

51,515 |

40.6% |

46.6% |

| Adjusted

EBITDA* |

$ |

41,567 |

$ |

35,845 |

16.0% |

25.2% |

$ |

10,698 |

$ |

9,815 |

9.0% |

19.1% |

|

Adjusted EBITDA Margin* |

|

16.6% |

|

17.6% |

|

|

|

14.8% |

|

19.1% |

|

|

|

Other Measures* |

|

|

|

|

|

|

|

Bookings |

$ |

95,066 |

$ |

53,973 |

76.1% |

84.9% |

$ |

31,120 |

$ |

14,851 |

109.5% |

113.3% |

| Over Time

revenues |

$ |

207,805 |

$ |

167,678 |

23.9% |

29.4% |

$ |

59,801 |

$ |

43,468 |

37.6% |

41.0% |

| AE software

maintenance retention rate |

|

94% |

|

96% |

|

|

|

94% |

|

94% |

|

|

| Geographical

revenue split |

|

|

|

|

|

|

|

|

|

North America |

|

75% |

|

81% |

|

|

|

75% |

|

81% |

|

|

|

International |

|

25% |

|

19% |

|

|

|

25% |

|

19% |

|

|

|

Cloud adoption rate (as at end of period) |

|

42% |

|

14% |

|

|

|

|

|

|

*Altus uses certain non-GAAP financial measures

such as Adjusted EBITDA and Adjusted EBITDA Margin as well as

supplementary financial measures such as Bookings, Over Time

revenues, AE software maintenance retention rate, and cloud

adoption rate. Since these measures are not standard measures under

GAAP, they may not be comparable to similar measures reported by

other entities. Refer to the “Non-GAAP and Other Measures” section

for more information on each measure and a reconciliation of

Adjusted EBITDA to Profit (Loss).

|

CRE Consulting |

Year ended December 31, |

Quarter ended December 31, |

|

In thousands of dollars |

|

2021 |

|

2020 |

% Change |

Constant Currency % Change |

|

2021 |

|

2020 |

% Change |

Constant Currency % Change |

|

Revenues |

|

|

|

|

|

|

|

|

| Property

Tax |

$ |

259,911 |

$ |

245,162 |

6.0% |

8.0% |

$ |

60,060 |

$ |

57,477 |

4.5% |

6.2% |

|

Valuation and Cost Advisory |

|

114,693 |

|

112,592 |

1.9% |

1.7% |

|

30,517 |

|

30,564 |

(0.2%) |

0.6% |

|

Revenues |

$ |

374,604 |

$ |

357,754 |

4.7% |

6.0% |

$ |

90,577 |

$ |

88,041 |

2.9% |

4.2% |

|

Adjusted EBITDA* |

|

|

|

|

|

|

|

|

| Property

Tax |

$ |

87,616 |

$ |

76,961 |

13.8% |

15.1% |

$ |

18,222 |

$ |

18,121 |

0.6% |

2.0% |

|

Valuation and Cost Advisory |

|

16,440 |

|

15,127 |

8.7% |

8.5% |

|

5,948 |

|

6,086 |

(2.3%) |

(1.9%) |

|

Adjusted EBITDA |

$ |

104,056 |

$ |

92,088 |

13.0% |

14.0% |

$ |

24,170 |

$ |

24,207 |

(0.2%) |

1.0% |

|

Adjusted EBITDA Margin* |

|

27.8% |

|

25.7% |

|

|

|

26.7% |

|

27.5% |

|

|

*Altus uses certain non-GAAP financial measures

such as Adjusted EBITDA and Adjusted EBITDA Margin. Since these

measures are not standard measures under GAAP, they may not be

comparable to similar measures reported by other entities. Refer to

the “Non-GAAP and Other Measures” section for more information on

each measure and a reconciliation of Adjusted EBITDA to Profit

(Loss).

Q4 2021 Review

On a consolidated basis, revenues were $162.9

million, up 16.8% (19.9% on a constant currency basis).and Adjusted

EBITDA was $25.9 million, down 3.3% (up 1.3% on a constant currency

basis). Organic revenue growth was 6.9% (9.3% on a constant

currency basis) and organic Adjusted EBITDA growth was 0.3% (4.4%

on a constant currency basis). Adjusted EPS was $0.42, compared to

$0.44 in the fourth quarter of 2020.

Consolidated profit from continuing operations,

in accordance with IFRS, was $6.9 million, up 49.1% from $4.6

million in the same period in 2020. In addition to the higher

Adjusted EBITDA performance, profit from continuing operations was

impacted by additional acquisition and related transition costs,

costs related to the June 13, 2021 cybersecurity incident net of

insurance proceeds received and receivable, share-based

compensation costs, amortization of acquisition-related intangibles

and right-of-use assets, and incremental finance costs on our bank

debt. This was offset by lower restructuring costs related to the

Company’s 2020 global restructuring program, additional gains on

its partnership investments, gains on equity derivatives, and our

share of profit from our GeoVerra joint venture. Consolidated

earnings per share from continuing operations, in accordance with

IFRS, was $0.16 per share basic and $0.15 per share diluted,

compared to $0.11 per share basic and diluted in the same period in

2020.

Altus Analytics revenues increased to $72.4

million, up 40.6% (46.6% on a constant currency basis). Organic

revenues were up 17.3% (21.9% on a constant currency basis). The

acquisitions of Finance Active, StratoDem Analytics and Reonomy

represented 23.2% of the 40.6% revenue growth. Over Time revenues

were $59.8 million, up 37.6% (41.0% on a constant currency basis).

Adjusted EBITDA was $10.7 million, up 9.0% (19.1% on a constant

currency basis).

- The healthy growth in Over Time revenues benefitted from higher

sales across all the key solutions, both organic and from

acquisitions, including customer expansion and new customer

additions. Sequentially, Over Time revenues grew 8.5% (8.8% on a

constant currency basis) from $55.1 million in the third quarter of

2021.

- Bookings in the fourth quarter increased by 109.5%

year-over-year to $31.1 million (113.3% on a constant currency

basis). Organic growth in Bookings was 86.9% (90.7% on a constant

currency basis).

- The transition of AE to cloud subscriptions progressed at a

healthy pace throughout the fourth quarter with continued momentum

in migrating existing customers from the on-premise product and

selling cloud-enabled AE to new customers. As at the end of the

fourth quarter, 42% of Company’s total AE user base had been

contracted on ARGUS Cloud, compared to 14% at the start of the

year.

- Adjusted EBITDA improved on higher revenues however was

impacted by the purchase price accounting adjustment of $1.7

million to Finance Active and Reonomy’s deferred revenues as well

as higher investment related to accelerating the Company’s data

strategy. The purchase price accounting adjustment had a 3.3%

impact to revenue growth and a 1.9% impact to Adjusted EBITDA

margin.

CRE Consulting revenues increased to $90.6

million, up 2.9% (4.2% on a constant currency basis) and Adjusted

EBITDA was $24.2 million, in line with the past year.

- Property Tax revenues were $60.1 million, up 4.5% (6.2% on a

constant currency basis) and Adjusted EBITDA was $18.2 million, up

0.6% (2.0% on a constant currency basis). The growth in Canada and

the U.S. was offset by a decline in the U.K. which was impacted by

a decrease in settlement activity.

- Valuation and Cost Advisory revenues were $30.5 million, down

0.2% (up 0.6% on a constant currency basis) and Adjusted EBITDA was

$5.9 million, down 2.3% (down 1.9% on a constant currency

basis).

Corporate Costs were $9.0 million, compared to

$7.3 million (restated to reflect accrued variable compensation

costs within the respective business units) in the same period in

2020. Corporate costs increased primarily due to higher IT,

compensation, travel and IR program costs.

As at December 31, 2021, bank debt was $287.6

million and cash and cash equivalents was $51.3 million

(representing a funded debt to Adjusted EBITDA leverage ratio of

2.47 times, as such ratio is defined in our credit facility

agreement, or a net debt to Adjusted EBITDA leverage ratio of 2.17

times).

2022 Outlook Summary

Altus remains strongly positioned to sustain and

grow its market leadership position in CRE

intelligence-as-a-service solutions. The Company’s mission critical

solutions are in non-discretionary demand, supported by a highly

repeatable and economically insulated revenue base.

At Altus Analytics, reflecting the strength of

the business in 2021 and the contributions from the acquisitions

made, Altus is well positioned for another strong year to drive

sustained double-digit year-over-year revenue growth in 2022,

including double-digit Organic and Over Time revenue growth, both

on a constant currency basis. Management also expects a

double-digit year-over-year improvement in Adjusted EBITDA, on a

constant currency basis, which should translate to a year-over-year

improvement in Adjusted EBITDA margins for fiscal year 2022. As

supported by the acceleration of growth rates and strong Bookings

performance, the Company is on track to meet its aspirational

long-term goal of achieving revenues of $400 million by the end of

2023.

At CRE Consulting, growth is expected to be

driven primarily by the Property Tax business, which is poised for

another record revenue year, supported by a significant pipeline of

cases to be settled in all three geographical markets, as well as a

healthy backlog of new sales bookings achieved by business

development activities, and record annuity billings in the U.K. The

Valuation and Cost Advisory practices enjoy significant market

share and, as a result, are expected to continue growing modestly

with a focus on unlocking operating efficiencies supported by

technology.

Q4 & Fiscal Year 2021 Results

Conference Call & Webcast

Date: Thursday, February 24, 2022

Time: 5:00 p.m. (ET)

Webcast: altusgroup.com (under Investor

Relations)

Live Call: 1-800-319-4610 (toll-free North

America) or 416-915-3239 (Toronto area)

Replay: available via webcast at

altusgroup.com

About Altus

Altus provides the global commercial real estate

industry with vital actionable intelligence solutions driven by our

de facto standard ARGUS technology, unparalleled asset level data,

and market leading expertise. A market leader in providing

intelligence-as-a-service, Altus empowers CRE professionals to make

well-informed decisions with greater speed and scale to maximize

returns and reduce risk. Trusted by most of the world’s largest CRE

leaders, our solutions for the valuation, performance, and risk

management of CRE assets are integrated into workflows critical to

success across the CRE value chain. Founded in 2005, Altus is a

global company with over 2,600 employees across North America, EMEA

and Asia Pacific. For more information about Altus (TSX: AIF)

please visit altusgroup.com.

Non-GAAP and Other Measures

Non-GAAP Financial Measures

We use certain non-GAAP measures as indicators

of financial performance. Readers are cautioned that they are not

defined performance measures, are not generally accepted financial

measures nor do not have any standardized meaning under IFRS and

may differ from similar computations as reported by other similar

entities and, accordingly, may not be comparable to financial

measures as reported by those entities. We believe that these

measures which include non-GAAP financial measures and non-GAAP

ratios as defined in National Instrument 52-112 "Non-GAAP and Other

Financial Measures Disclosure" (“NI 52-112”), may

assist investors in assessing an investment in our shares as they

provide additional insight into our performance. These non-GAAP

measures should not be considered in isolation or as a substitute

for financial measures prepared in accordance with IFRS.

Adjusted Earnings before Interest,

Taxes, Depreciation and Amortization (“Adjusted EBITDA”)

is a non-GAAP financial measure which represents profit (loss) from

continuing operations before income taxes, adjusted for the effects

of: occupancy costs calculated on a similar basis prior to the

adoption of IFRS 16, finance costs (income), net - other,

depreciation of property, plant and equipment and amortization of

intangibles, depreciation of right-of-use assets, finance costs

(income), net - leases, acquisition and related transition costs

(income), unrealized foreign exchange (gains) losses, (gains)

losses on disposal of right-of-use assets, property, plant and

equipment and intangibles, share of (profit) loss of joint venture,

impairment charges, non-cash share-based compensation costs,

(gains) losses on equity derivatives net of mark-to-market

adjustments on related restricted share units (“RSUs”) and deferred

share units (“DSUs”) being hedged, (gains) losses on derivatives,

restructuring costs (recovery), (gains) losses on investments,

(gains) losses on hedging transactions, and other costs or income

of a non-operating and/or non-recurring nature. Refer to the below

for a reconciliation of Adjusted EBITDA to profit (loss).

Organic Adjusted EBITDA is a

non-GAAP financial measure which represents Adjusted EBITDA (as

defined above) excluding Adjusted EBITDA from business acquisitions

that are not fully integrated, up to the first anniversary of the

acquisition.

Adjusted EBITDA Margin is a

non-GAAP financial ratio which represents the percentage factor of

Adjusted EBITDA to revenues. We use Adjusted EBITDA, Organic

Adjusted EBITDA and Adjusted EBITDA Margin to evaluate the

performance of our business, as well as when making decisions about

the ongoing operations of the business and our ability to generate

cash flows.

Adjusted Earnings (Loss) is a

non-GAAP financial measure which represents profit (loss) from

continuing operations adjusted for the effects of: occupancy costs

calculated on a similar basis prior to the adoption of IFRS 16,

depreciation of right-of-use assets, finance costs (income), net -

leases, amortization of intangibles of acquired businesses,

unrealized foreign exchange losses (gains), (gains) losses on

disposal of right-of-use assets, property, plant and equipment and

intangibles, non-cash share-based compensation costs, losses

(gains) on equity derivatives net of mark-to-market adjustments on

related RSUs and DSUs being hedged, interest accretion on

contingent consideration payables, restructuring costs (recovery),

losses (gains) on hedging transactions and interest expense

(income) on swaps, acquisition and related transition costs

(income), losses (gains) on investments, share of (profit) loss of

joint venture, impairment charges, (gains) losses on derivatives,

other costs or income of a non-operating and/or non-recurring

nature, and the tax impact on these items. We use Adjusted Earnings

(Loss) to facilitate the calculation of Adjusted Earnings (Loss)

per Share (“Adjusted EPS”).

Adjusted EPS is a non-GAAP

financial ratio calculated by dividing Adjusted Earnings (Loss) by

the basic weighted average number of shares adjusted for the

effects of the weighted average number of restricted shares. We use

Adjusted EPS to assess the performance of our business before the

effects of the noted items, because they affect the comparability

of our financial results and could potentially distort the analysis

of trends in business performance. Refer to the below for a

reconciliation of Adjusted EPS to profit (loss).

Constant currency is a non-GAAP

financial measure that presents the financial results and non-GAAP

measures within this press release by translating monthly results

denominated in local currency (US dollars, British pound, Euro,

Australian dollars, and other foreign currencies) at the foreign

exchange rates of the comparable month. We adjust for currency so

that our financial and operational performance can be viewed

without the impact of fluctuations in foreign currency exchange

rates against the Canadian dollar, thereby facilitating

period-to-period comparisons of the Company's business

performance.

Other Measures

We also apply certain other measures to allow us

to measure our performance against our operating strategy and

against the results of our peers and competitors. Readers are

cautioned that they are not standardized financial measurements in

accordance with IFRS and may differ from similar computations as

reported by other similar entities and, accordingly, may not be

comparable to financial measures as reported by those entities.

These other measures, which include supplementary financial

measures as defined in NI 52-112 should not be considered in

isolation or as a substitute for any other measure of performance

under IFRS.

Bookings is a

supplementary financial measure we introduced in the first quarter

of 2021 for the Altus Analytics business segment. We define

Bookings as the annual contract value (“ACV”) for new sales of our

recurring offerings (software, Appraisal Management solutions and

data subscriptions) and the total contract value (“TCV”) for

one-time engagements (consulting, training and due diligence). The

contract value of renewals is excluded from this metric, with the

exception of additional capacity or products purchased at the time

of renewal. We use Bookings as a measure to track the performance

and success of our sales initiatives, and as an indicator of future

revenue growth.

Over Time revenues is a

supplementary financial measure consistent with IFRS 15, Revenue

from Contracts with Customers, for the Altus Analytics business

segment. Our Over Time revenues are comprised of software

subscription revenues recognized on an over time basis in

accordance with IFRS 15, software maintenance revenues associated

with our legacy licenses sold on perpetual terms, Appraisal

Management revenues, and data subscription revenues. For greater

clarity, this measure does not include revenue from distinct

on-premise licenses which is recognized upfront at the point in

time when the software is delivered to the customer. We use Over

Time revenues as a measure to assess revenue trends in our

business, and as an indicator of future revenue growth.

Organic Revenue is a

supplementary financial measure which represents revenue,

consistent with IFRS 15, Revenue from Contracts with Customers,

excluding the revenues from business acquisitions that are not

fully integrated, prior to the first anniversary of the

acquisition. We use Organic Revenue to evaluate to assess revenue

trends in our business on a comparable basis versus the prior year,

and as an indicator of future revenue growth.

AE software maintenance retention

rate is a supplementary financial measure calculated as a

percentage of AE software maintenance revenue retained upon

renewal; it represents the percentage of the available renewal

opportunity in a fiscal period that renews, calculated on a dollar

basis, excluding any growth in user count or product expansion. We

use AE software maintenance retention rate as a measure to evaluate

our success in retaining our AE software customers.

Cloud adoption

rate is another measure that represents the

percentage of the total AE user base contracted on the ARGUS Cloud

platform. It includes both new AE cloud users as well as those who

have migrated from our AE on-premise software. We use Cloud

adoption rate as a measure of our progress in transitioning the AE

user base to our cloud-based platform, a key component of our

overall product strategy.

Forward-Looking Information

Certain information in this press release may

constitute “forward-looking information” within the meaning of

applicable securities legislation. All information contained in

this press release, other than statements of current and historical

fact, is forward-looking information. Forward-looking information

includes, but is not limited to, the discussion of our business and

operating initiatives, focuses and strategies, our expectations of

future performance for our various business units and our

consolidated financial results, including the guidance on financial

expectations, and our expectations with respect to cash flows and

liquidity. Generally, forward-looking information can be identified

by use of words such as “may”, “will”, “expect”, “believe”, “plan”,

“would”, “could”, “remain” and other similar terminology. All of

the forward-looking information in this press release is qualified

by this cautionary statement.

Forward-looking information is not, and cannot

be, a guarantee of future results or events. Forward-looking

information is based on, among other things, opinions, assumptions,

estimates and analyses that, while considered reasonable by us at

the date the forward-looking information is provided, inherently

are subject to significant risks, uncertainties, contingencies and

other factors that may cause actual results, performance or

achievements, industry results or events to be materially different

from those expressed or implied by the forward-looking information.

The material factors or assumptions that we identified and applied

in drawing conclusions or making forecasts or projections set out

in the forward-looking information include, but are not limited to:

engagement and product pipeline opportunities in Altus Analytics

will result in associated definitive agreements; settlement volumes

in the Property Tax business will occur on a timely basis and that

assessment authorities will process appeals in a manner consistent

with expectations; the successful execution of our business

strategies; consistent and stable economic conditions or conditions

in the financial markets; consistent and stable legislation in the

various countries in which we operate; no disruptive changes in the

technology environment; the opportunity to acquire accretive

businesses and the absence of negative financial and other impacts

resulting from strategic investments or acquisitions on short term

results; the successful integration of acquired businesses; and the

continued availability of qualified

professionals. Projections may also be impacted by

macroeconomic factors, in addition to other factors not

controllable by the Company. Altus has also made certain

macroeconomic and general industry assumptions in the preparation

of such forward-looking statements. Not all factors which affect

the forward-looking information are known, and actual results may

vary from the projected results in a material respect, and may be

above or below the forward-looking information presented in a

material respect.

The COVID-19 pandemic has cast additional

uncertainty on each of these factors and assumptions. There can be

no assurance that they will continue to be valid. Given the rapid

pace of change with respect to the COVID-19 pandemic, it is

difficult to make further assumptions about these matters. The

duration, extent and severity of the impact the COVID-19 pandemic,

including measures to prevent its spread, will have on our business

is uncertain and difficult to predict at this time. As of the date

of this press release, many of our offices and clients remain

subject to limitations and restrictions set to reduce the spread of

COVID-19, and a significant portion of our employees continue to

work remotely.

Inherent in the forward-looking information are

known and unknown risks, uncertainties and other factors that could

cause our actual results, performance or achievements, or industry

results, to differ materially from any results, performance or

achievements expressed or implied by such forward-looking

information. Those risks, uncertainties and other factors that

could cause actual results to differ materially from the

forward-looking information include, but are not limited to: the

general state of the economy; the COVID‐19 pandemic; our

financial performance; our financial targets; the commercial real

estate market; acquisitions; industry competition; business

interruption events; third party information; cybersecurity;

professional talent; our cloud subscriptions transition; software

renewals; our sales pipeline; enterprise transactions; customer

concentration and loss of material clients; product enhancements

and new product introductions; technological strategy; intellectual

property; property tax appeals and seasonality; legislative and

regulatory changes; privacy and data protection; our brand and

reputation; fixed-price and contingency engagements; the Canadian

multi-residential market; currency fluctuations; interest rates;

credit; income tax matters; health and safety hazards; our

contractual obligations; legal proceedings; our insurance limits;

our ability to meet the solvency requirements necessary to make

dividend payments; our leverage and financial covenants; our share

price; our capital investments; and the issuance of additional

common shares and debt, as well as those described in our annual

publicly filed documents, including the Annual Information Form for

the year ended December 31, 2020 and Management’s Discussion and

Analysis for the year ended December 31, 2021 (which are available

on SEDAR at www.sedar.com).

Given these risks, uncertainties and other

factors, investors should not place undue reliance on

forward-looking information as a prediction of actual results. The

forward-looking information reflects management’s current

expectations and beliefs regarding future events and operating

performance and is based on information currently available to

management. Although we have attempted to identify important

factors that could cause actual results to differ materially from

the forward-looking information contained herein, there are other

factors that could cause results not to be as anticipated,

estimated or intended. The forward-looking information contained

herein is current as of the date of this press release and, except

as required under applicable law, we do not undertake to update or

revise it to reflect new events or circumstances. Additionally, we

undertake no obligation to comment on analyses, expectations or

statements made by third parties in respect of Altus, our financial

or operating results, or our securities.

Certain information in this press release may be

considered as “financial outlook” within the meaning of applicable

securities legislation. The purpose of this financial outlook is to

provide readers with disclosure regarding Altus’ reasonable

expectations as to the anticipated results of its proposed business

activities for the periods indicated. Readers are cautioned that

the financial outlook may not be appropriate for other

purposes.

FOR FURTHER INFORMATION PLEASE

CONTACT:

Camilla Bartosiewicz Vice President, Investor

Relations, Altus (416) 641-9773

camilla.bartosiewicz@altusgroup.com

Consolidated Statements of Comprehensive

Income (Loss) For the Years Ended December 31,

2021 and 2020 (Expressed in Thousands of Canadian

Dollars, Except for Per Share Amounts)

|

|

For the year ended December 31, 2021 |

|

For the year ended December 31, 2020 |

|

|

Revenues |

$ |

625,387 |

|

$ |

561,156 |

|

|

Expenses |

|

|

|

Employee compensation |

|

401,455 |

|

|

354,951 |

|

|

Occupancy |

|

7,743 |

|

|

7,591 |

|

|

Office and other operating |

|

123,023 |

|

|

102,193 |

|

|

Depreciation of right-of-use assets |

|

12,119 |

|

|

11,210 |

|

|

Depreciation of property, plant and equipment |

|

5,446 |

|

|

5,620 |

|

|

Amortization of intangibles |

|

29,017 |

|

|

24,784 |

|

|

Acquisition and related transition costs (income) |

|

10,137 |

|

|

(887) |

|

|

Share of (profit) loss of joint venture |

|

(1,187) |

|

|

(459) |

|

|

Restructuring costs (recovery) |

|

15 |

|

|

11,984 |

|

|

(Gain) loss on investments |

|

(2,930) |

|

|

(21) |

|

|

Finance costs (income), net - leases |

|

2,219 |

|

|

2,494 |

|

|

Finance costs (income), net - other |

|

4,130 |

|

|

4,138 |

|

|

Profit (loss) from continuing operations before income

taxes |

|

34,200 |

|

|

37,558 |

|

|

Income tax expense (recovery) |

|

8,627 |

|

|

10,549 |

|

|

Profit (loss) for the year from continuing

operations |

$ |

25,573 |

|

$ |

27,009 |

|

|

Profit (loss) for the year from discontinued operations |

|

- |

|

|

(5,576) |

|

|

Profit (loss) for the year attributable to: |

|

|

|

Non-controlling interest |

|

(115) |

|

|

- |

|

|

Shareholders of the Company |

|

25,688 |

|

|

21,433 |

|

|

Profit (loss) for the year |

$ |

25,573 |

|

$ |

21,433 |

|

|

Other comprehensive income (loss): |

|

|

|

Items that may be reclassified to profit or loss in subsequent

periods: |

|

|

|

Currency translation differences |

|

(4,828) |

|

|

1,533 |

|

|

Items that are not reclassified to profit or loss in subsequent

periods: |

|

|

|

Change in fair value of FVOCI investments, net of tax |

|

2,476 |

|

|

(987) |

|

|

Other comprehensive income (loss), net of tax |

|

(2,352) |

|

|

546 |

|

|

Comprehensive income (loss) for the year, net of tax,

attributable to: |

|

|

|

Non-controlling interest |

|

(115) |

|

|

- |

|

|

Shareholders of the Company |

|

23,336 |

|

|

21,979 |

|

|

Total comprehensive income (loss) for the year, net of

tax |

$ |

23,221 |

|

$ |

21,979 |

|

|

|

|

|

|

|

Earnings (loss) per share attributable to the shareholders

of the Company during the year |

|

|

|

Basic earnings (loss) per share: |

|

|

|

Continuing operations |

$ |

0.62 |

|

$ |

0.67 |

|

|

Discontinued operations |

$ |

0.00 |

|

$ |

(0.14) |

|

|

Diluted earnings (loss) per share: |

|

|

|

Continuing operations |

$ |

0.60 |

|

$ |

0.66 |

|

|

Discontinued operations |

$ |

0.00 |

|

$ |

(0.14) |

|

Consolidated Balance Sheets

As at December 31, 2021 and 2020

(Expressed in Thousands of Canadian Dollars)

|

|

December 31, 2021 |

|

December 31, 2020 |

|

|

Assets |

|

|

|

|

Current assets |

|

|

|

|

Cash and cash equivalents |

|

$ |

51,271 |

|

$ |

69,637 |

|

|

Trade receivables and other |

|

|

223,315 |

|

|

193,072 |

|

|

Income taxes recoverable |

|

|

3,280 |

|

|

3,385 |

|

|

Derivative financial instruments |

|

|

5,868 |

|

|

2,477 |

|

|

|

|

|

283,734 |

|

|

268,571 |

|

|

Non-current assets |

|

|

|

|

Trade receivables and other |

|

|

2,818 |

|

|

1,370 |

|

|

Derivative financial instruments |

|

|

15,661 |

|

|

8,800 |

|

|

Investments |

|

|

20,806 |

|

|

10,356 |

|

|

Investment in joint venture |

|

|

16,496 |

|

|

15,309 |

|

|

Deferred tax assets |

|

|

24,089 |

|

|

19,930 |

|

|

Right-of-use assets |

|

|

59,992 |

|

|

51,690 |

|

|

Property, plant and equipment |

|

|

21,624 |

|

|

20,376 |

|

|

Intangibles |

|

|

286,670 |

|

|

77,928 |

|

|

Goodwill |

|

|

467,310 |

|

|

261,070 |

|

|

|

|

|

915,466 |

|

|

466,829 |

|

|

Total Assets |

|

$ |

1,199,200 |

|

$ |

735,400 |

|

|

Liabilities |

|

|

|

|

Current liabilities |

|

|

|

|

Trade payables and other |

|

$ |

193,388 |

|

$ |

140,294 |

|

|

Income taxes payable |

|

|

2,629 |

|

|

1,190 |

|

|

Lease liabilities |

|

|

13,914 |

|

|

11,700 |

|

|

|

|

|

209,931 |

|

|

153,184 |

|

|

Non-current liabilities |

|

|

|

|

Trade payables and other |

|

|

24,913 |

|

|

17,206 |

|

|

Lease liabilities |

|

|

57,225 |

|

|

51,883 |

|

|

Borrowings |

|

|

286,924 |

|

|

122,432 |

|

|

Deferred tax liabilities |

|

|

27,864 |

|

|

7,246 |

|

|

Non-controlling interest |

|

|

2,980 |

|

|

- |

|

|

|

|

|

399,906 |

|

|

198,767 |

|

|

Total Liabilities |

|

|

609,837 |

|

|

351,951 |

|

|

Shareholders’ Equity |

|

|

|

|

Share capital |

|

|

726,325 |

|

|

529,866 |

|

|

Contributed surplus |

|

|

42,364 |

|

|

30,428 |

|

|

Accumulated other comprehensive income (loss) |

|

|

38,439 |

|

|

40,791 |

|

|

Other equity |

|

|

(244) |

|

|

- |

|

|

Retained earnings (deficit) |

|

|

(217,406) |

|

|

(217,636) |

|

|

Equity attributable to the shareholders of the

Company |

|

|

589,478 |

|

|

383,449 |

|

|

Non-controlling interest |

|

|

(115) |

|

|

- |

|

|

Total Shareholders’ Equity |

|

|

589,363 |

|

|

383,449 |

|

|

Total Liabilities and Shareholders’ Equity |

|

$ |

1,199,200 |

|

$ |

735,400 |

|

Consolidated Statements of Cash

Flows For the Years Ended December 31, 2021 and

2020 (Expressed in Thousands of Canadian

Dollars)

|

|

For the year ended December 31, 2021 |

For the year ended December 31, 2020 |

|

Cash flows from operating activities |

|

|

|

|

Profit (loss) from continuing operations before income taxes |

|

$ |

34,200 |

|

$ |

37,558 |

|

|

Profit (loss) from discontinued operations before income taxes |

|

|

- |

|

|

(5,576 |

) |

|

Profit (loss) before income taxes |

|

$ |

34,200 |

|

$ |

31,982 |

|

|

Adjustments for: |

|

|

|

|

Depreciation of right-of-use assets |

|

|

12,119 |

|

|

11,262 |

|

|

Depreciation of property, plant and equipment |

|

|

5,446 |

|

|

5,731 |

|

|

Amortization of intangibles |

|

|

29,017 |

|

|

24,785 |

|

|

Finance costs (income), net - leases |

|

|

2,219 |

|

|

2,559 |

|

|

Finance costs (income), net - other |

|

|

4,130 |

|

|

4,123 |

|

|

Share-based compensation |

|

|

23,938 |

|

|

15,398 |

|

|

Unrealized foreign exchange (gain) loss |

|

|

1,104 |

|

|

165 |

|

|

(Gain) loss on investments |

|

|

(2,930) |

|

|

(21) |

|

|

(Gain) loss on disposal of right-of-use assets, property, plant and

equipment and intangibles |

|

|

(248) |

|

|

518 |

|

|

(Gain) loss on derivatives |

|

|

(10,252) |

|

|

(3,991) |

|

|

Share of (profit) loss of joint venture |

|

|

(1,187) |

|

|

(459) |

|

|

Impairment charge - leases |

|

|

- |

|

|

36 |

|

|

Fair value loss (gain) on net assets directly associated with

discontinued operations |

|

|

- |

|

|

5,163 |

|

|

(Gain) loss on sale of the discontinued operations |

|

|

- |

|

|

(483) |

|

|

Net changes in operating working capital |

|

|

(18,832) |

|

|

(1,910) |

|

|

Net cash generated by (used in) operations |

|

|

78,724 |

|

|

94,858 |

|

|

Less: interest paid on borrowings |

|

|

(3,606) |

|

|

(3,547) |

|

|

Less: interest paid on leases |

|

|

(2,219) |

|

|

(2,559) |

|

|

Less: income taxes paid |

|

|

(19,547) |

|

|

(19,051) |

|

|

Add: income taxes refunded |

|

|

2,956 |

|

|

2,599 |

|

|

Net cash provided by (used in) operating

activities |

|

|

56,308 |

|

|

72,300 |

|

|

Cash flows from financing activities |

|

|

|

|

Proceeds from exercise of options |

|

|

13,814 |

|

|

11,988 |

|

|

Proceeds from share issuance, net of transaction costs |

|

|

164,771 |

|

|

- |

|

|

Financing fees paid |

|

|

(414) |

|

|

(723) |

|

|

Proceeds from borrowings |

|

|

341,024 |

|

|

38,135 |

|

|

Repayment of borrowings |

|

|

(178,819) |

|

|

(53,265) |

|

|

Payments of principal on lease liabilities |

|

|

(12,070) |

|

|

(11,960) |

|

|

Dividends paid |

|

|

(21,564) |

|

|

(21,859) |

|

|

Treasury shares purchased for share-based compensation |

|

|

(6,312) |

|

|

(3,614) |

|

|

Net cash provided by (used in) financing

activities |

|

|

300,430 |

|

|

(41,298) |

|

|

Cash flows from investing activities |

|

|

|

|

Purchase of investments |

|

|

(4,157) |

|

|

(365) |

|

|

Cash contribution to investment in joint venture |

|

|

- |

|

|

(3,794) |

|

|

Purchase of intangibles |

|

|

(4,664) |

|

|

(770) |

|

|

Purchase of property, plant and equipment |

|

|

(5,965) |

|

|

(3,580) |

|

|

Proceeds from disposal of property, plant and equipment and

intangibles |

|

|

- |

|

|

96 |

|

|

Proceeds from investment |

|

|

326 |

|

|

- |

|

|

Acquisitions, net of cash acquired |

|

|

(358,855) |

|

|

(12,490) |

|

|

Net cash provided by (used in) investing

activities |

|

|

(373,315) |

|

|

(20,903) |

|

|

Effect of foreign currency translation |

|

|

(1,789) |

|

|

(724) |

|

|

Net increase (decrease) in cash and cash

equivalents |

|

|

(18,366) |

|

|

9,375 |

|

|

Cash and cash equivalents, beginning of year |

|

|

69,637 |

|

|

60,262 |

|

|

Cash and cash equivalents, end of year |

|

$ |

51,271 |

|

$ |

69,637 |

|

Reconciliation of Adjusted EBITDA to

Profit (Loss)

The following table provides a reconciliation

between Adjusted EBITDA and profit (loss):

|

|

Year ended December 31, |

Quarter ended December 31, |

|

In thousands of dollars |

|

2021 |

|

|

2020 |

|

|

2021 |

|

|

2020 |

|

|

Adjusted EBITDA |

$ |

109,755 |

|

$ |

98,928 |

|

$ |

25,861 |

|

$ |

26,734 |

|

| Occupancy

costs calculated on a similar basis prior to the adoption of IFRS

16 (1) |

|

13,199 |

|

|

12,312 |

|

|

3,477 |

|

|

3,053 |

|

| Depreciation

of right-of-use assets |

|

(12,119) |

|

|

(11,210) |

|

|

(3,209) |

|

|

(2,706) |

|

| Depreciation

of property, plant and equipment and amortization of

intangibles |

|

(34,463) |

|

|

(30,404) |

|

|

(9,815) |

|

|

(7,511) |

|

| Acquisition

and related transition (costs) income |

|

(10,137) |

|

|

887 |

|

|

(2,025) |

|

|

(217) |

|

| Unrealized

foreign exchange gain (loss) (2) |

|

(1,104) |

|

|

(165) |

|

|

145 |

|

|

(382) |

|

| Gain (loss)

on disposal of right-of-use assets, property, plant and equipment

and intangibles (2) |

|

248 |

|

|

(457) |

|

|

- |

|

|

(454) |

|

| Share of

profit (loss) of joint venture |

|

1,187 |

|

|

459 |

|

|

745 |

|

|

9 |

|

| Non-cash

share-based compensation costs (3) |

|

(19,455) |

|

|

(10,261) |

|

|

(6,178) |

|

|

(2,133) |

|

| Gain (loss)

on equity derivatives net of mark-to-market adjustments on related

RSUs and DSUs being hedged (3) |

|

2,040 |

|

|

(471) |

|

|

1,035 |

|

|

(2,237) |

|

|

Restructuring (costs) recovery |

|

(15) |

|

|

(11,984) |

|

|

238 |

|

|

(3,374) |

|

| Gain (loss)

on investments (4) |

|

2,930 |

|

|

21 |

|

|

1,091 |

|

|

(1) |

|

| Impairment

charge - leases |

|

- |

|

|

(36) |

|

|

- |

|

|

- |

|

| Other

non-operating and/or non-recurring income (costs) (5) |

|

(11,517) |

|

|

(3,429) |

|

|

(2,944) |

|

|

(1,631) |

|

|

Earnings (loss) from continuing operations before finance

costs and income taxes |

|

40,549 |

|

|

44,190 |

|

|

8,421 |

|

|

9,150 |

|

|

Finance (costs) income, net - leases |

|

(2,219) |

|

|

(2,494) |

|

|

(515) |

|

|

(584) |

|

|

Finance (costs) income, net - other |

|

(4,130) |

|

|

(4,138) |

|

|

(1,322) |

|

|

(716) |

|

|

Profit (loss) from continuing operations before income

taxes |

|

34,200 |

|

|

37,558 |

|

|

6,584 |

|

|

7,850 |

|

|

Income tax (expense) recovery |

|

(8,627) |

|

|

(10,549) |

|

|

306 |

|

|

(3,228) |

|

|

Profit (loss) for the period from continuing

operations |

$ |

25,573 |

|

$ |

27,009 |

|

$ |

6,890 |

|

$ |

4,622 |

|

|

Profit (loss) for the period from discontinued operations |

|

- |

|

|

(5,576) |

|

|

- |

|

|

(276) |

|

|

Profit (loss) for the period |

$ |

25,573 |

|

$ |

21,433 |

|

$ |

6,890 |

|

$ |

4,346 |

|

(1) Management uses the non-GAAP occupancy costs calculated on a

similar basis prior to the adoption of IFRS 16 when analyzing

financial and operating performance.(2) Included in office and

other operating expenses in the consolidated statements of

comprehensive income (loss).(3) Included in employee compensation

expenses in the consolidated statements of comprehensive income

(loss).(4) Gain (loss) on investments relates to changes in the

fair value of investments in partnerships.(5) Other non-operating

and/or non-recurring income (costs) for the year and quarter ended

December 31, 2021 relate to (i) costs relating to the June 13, 2021

cybersecurity incident net of insurance proceeds received and

receivable, and (ii) transaction and other related costs. For the

year and quarter ended December 31, 2020, other non-operating

and/or non-recurring income (costs) relate to (i) transitional

costs related to the departure of senior executives, (ii) legal,

advisory, and other consulting costs related to a Board strategic

initiative, and (iii) transaction and other related costs. These

are included in office and other operating expenses in the

consolidated statements of comprehensive income (loss).

Reconciliation of

Adjusted Earnings (Loss) Per Share to

Profit (Loss)

The following table provides a reconciliation

between Adjusted EPS and profit (loss):

|

|

Year ended December 31, |

Quarter ended December 31, |

|

In thousands of dollars, except for per share amounts |

|

2021 |

|

|

2020 |

|

|

2021 |

|

|

2020 |

|

|

Profit (loss) for the period |

$ |

25,573 |

|

$ |

21,433 |

|

$ |

6,890 |

|

$ |

4,346 |

|

|

(Profit) loss for the period from discontinued operations |

|

- |

|

|

5,576 |

|

|

- |

|

|

276 |

|

|

Occupancy costs calculated on a similar basis prior to the adoption

of IFRS 16 (1) |

|

(13,199) |

|

|

(12,312) |

|

|

(3,477) |

|

|

(3,053) |

|

|

Depreciation of right-of-use assets |

|

12,119 |

|

|

11,210 |

|

|

3,209 |

|

|

2,706 |

|

|

Finance costs (income), net - leases |

|

2,219 |

|

|

2,494 |

|

|

515 |

|

|

584 |

|

|

Amortization of intangibles of acquired businesses |

|

28,435 |

|

|

23,533 |

|

|

7,654 |

|

|

5,724 |

|

|

Unrealized foreign exchange loss (gain) |

|

1,104 |

|

|

165 |

|

|

(145) |

|

|

382 |

|

|

Loss (gain) on disposal of right-of-use assets, property, plant and

equipment and intangibles |

|

(248) |

|

|

457 |

|

|

- |

|

|

454 |

|

|

Non-cash share-based compensation costs |

|

19,455 |

|

|

10,261 |

|

|

6,178 |

|

|

2,133 |

|

|

Loss (gain) on equity derivatives net of mark-to-market adjustments

on related RSUs and DSUs being hedged |

|

(2,040) |

|

|

471 |

|

|

(1,035) |

|

|

2,237 |

|

|

Interest accretion on contingent consideration payables |

|

- |

|

|

102 |

|

|

- |

|

|

- |

|

|

Restructuring costs (recovery) |

|

15 |

|

|

11,984 |

|

|

(238) |

|

|

3,374 |

|

|

Loss (gain) on hedging transactions, including currency forward

contracts and interest expense (income) on swaps |

|

- |

|

|

138 |

|

|

- |

|

|

- |

|

|

Acquisition and related transition costs (income) |

|

10,137 |

|

|

(887) |

|

|

2,025 |

|

|

217 |

|

|

Loss (gain) on investments |

|

(2,930) |

|

|

(21) |

|

|

(1,091) |

|

|

1 |

|

|

Share of loss (profit) of joint venture |

|

(1,187) |

|

|

(459) |

|

|

(745) |

|

|

(9) |

|

|

Impairment charge - leases |

|

- |

|

|

36 |

|

|

- |

|

|

- |

|

|

Other non-operating and/or non-recurring costs (income) |

|

11,517 |

|

|

3,429 |

|

|

2,944 |

|

|

1,631 |

|

|

Tax impact on above |

|

(10,656) |

|

|

(9,836) |

|

|

(3,840) |

|

|

(2,933) |

|

|

Adjusted earnings (loss) for the period |

$ |

80,314 |

|

$ |

67,774 |

|

$ |

18,844 |

|

$ |

18,070 |

|

| Weighted

average number of shares - basic |

|

41,684,077 |

|

|

40,158,543 |

|

|

43,945,167 |

|

|

40,379,692 |

|

|

Weighted average number of restricted shares |

|

580,280 |

|

|

351,452 |

|

|

680,150 |

|

|

345,089 |

|

|

Weighted average number of shares - adjusted |

|

42,264,357 |

|

|

40,509,995 |

|

|

44,625,317 |

|

|

40,724,781 |

|

|

Adjusted earnings (loss) per share

(2) |

$ |

1.90 |

|

$ |

1.67 |

|

$ |

0.42 |

|

$ |

0.44 |

|

(1) Management uses the non-GAAP occupancy costs calculated on a

similar basis prior to the adoption of IFRS 16 when analyzing

financial and operating performance.(2) Refer to the Non-GAAP and

Other Measures section above for the definition of Adjusted

EPS.

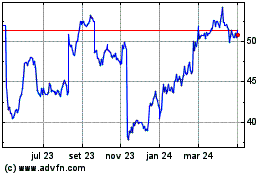

Altus (TSX:AIF)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

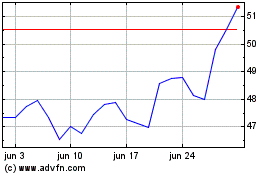

Altus (TSX:AIF)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025