Grupo Aeroportuario del Pacifico, S.A.B. de C.V., (NYSE: PAC; BMV:

GAP) (“the Company” or “GAP”) announces the following resolutions

adopted at the Annual General Ordinary and Extraordinary

Shareholders’ Meetings today, with a quorum of 82.9% and 86.0%,

respectively:

ANNUAL GENERAL ORDINARY SHAREHOLDERS’

MEETING

- In compliance with Article 28, Section IV of the Mexican

Securities Market Law, the following were APPROVED:

- The Chief Executive Officer’s

report regarding the results of operations for the fiscal year

ended December 31, 2021, in accordance with Article 44, Section XI

of the Mexican Securities Market Law and Article 172 of the Mexican

General Corporations Law, together with the external auditor’s

report, with respect to the Company on an unconsolidated basis in

accordance with Mexican Financial Reporting Standards (“MFRS”), as

well as with respect to the Company and its subsidiaries on a

consolidated basis in accordance with International Financial

Reporting Standards (“IFRS”), each based on the Company’s most

recent financial statements for the fiscal year ended December 31,

2021, under both standards, as well as the 2021 Sustainability

Report.

- Board of Directors’ opinion to the

Chief Executive Officer’s report.

- Board of Directors’ report in

accordance with Article 172, clause b, of the Mexican General

Corporations Law, regarding the Company’s main accounting policies

and criteria, as well as the information used to prepare the

Company’s financial statements.

- Report on transactions and

activities undertaken by the Company’s Board of Directors during

the fiscal year ended December 31, 2021, pursuant to the Mexican

Securities Market Law.

- The annual report on the activities

undertaken by the Audit and Corporate Practices Committee in

accordance with Article 43 of the Mexican Securities Market Law, as

well as the ratification of the actions of the various committees,

and release from further obligations.

- Report on the Company’s compliance

with tax obligations for the fiscal year from January 1 to December

31, 2020, and an instruction to Company officials to comply with

tax obligations corresponding to the fiscal year from January 1 and

ended December 31, 2021, in accordance with Article 26, Section III

of the Mexican Fiscal Code.

II. APPROVAL of the ratification of the actions

by our Board of Directors and officers and release from further

obligations in the fulfillment of their duties as approved by the

governing bodies.III. APPROVAL of the Company’s financial

statements for the fiscal year from January 1 to December 31, 2021,

on an unconsolidated basis, in accordance with MFRS for purposes of

calculating legal reserves, net income, fiscal effects related to

dividend payments and capital reduction, as applicable, and

approval of the financial statements of the Company and its

subsidiaries on a consolidated basis in accordance with IFRS for

their publication to financial markets, with respect to our

operations that took place during the fiscal year from January 1 to

December 31, 2021; and approval of the external auditor’s report

regarding both aforementioned financial statements.IV. APPROVAL of

the Company’s net income for the fiscal year ended December 31,

2021, reported in its unconsolidated financial statements,

presented in agenda item III above and audited in accordance with

MFRS, which was Ps. 5,811,099,785.00 (FIVE BILLION EIGHT HUNDRED

ELEVEN MILLION NINETY-NINE THOUSAND SEVEN HUNDRED EIGHTY-FIVE PESOS

00/100 M.N.), the allocation of the entire amount towards

increasing the Company’s retained earnings account, without

separating an amount for the Company’s legal reserves, given that

the account currently represents more than 20% of the historical

common stock of the Company, thereby meeting the requirement

established in Article 20 of the Mexican General Corporations Law.

In addition, proposal to cancel from the Company’s current legal

reserves such amount exceeding 20% of the historical common stock

of the Company, in accordance with the requirements established in

Articles 20 and 21 of the Mexican General Corporations Law and

allocating said excess amount to the Company’s retained earnings

account.V. APPROVAL that from the retained earnings account pending

application which amounts to a total of Ps. 10,529,179,720.00 (TEN

BILLION FIVE HUNDRED TWENTY-NINE MILLION ONE HUNDRED AND

SEVENTY-NINE THOUSAND SEVEN HUNDRED AND TWENTY PESOS 00/100 M.N.),

a dividend be declared equal to Ps. 14.40 (FOURTEEN PESOS 40/100

M.N.) pesos per share, to be paid to the holders of each share

outstanding on the payment date, excluding any shares repurchased

by the Company in accordance with Article 56 of the Mexican

Securities Market Law; any amounts of retained earnings pending

application remaining after the payment of such dividend will

remain in the retained earnings account pending application. The

dividend will be payable in one or more installments within 12

(twelve) months after April 22, 2022.VI. APPROVAL for the

cancellation of any amounts outstanding under the Share Repurchase

Program approved at the General Ordinary Shareholders’ Meetings

that took place on April 27, 2021 and September 14, 2021, which

amounts to Ps. 2,031,782,227.00 (TWO BILLION THIRTY-ONE MILLION

SEVEN HUNDRED EIGHTY-TWO THOUSAND TWO HUNDRED TWENTY SEVEN PESOS

00/100 M.N.), approved, and approval of Ps. 2,000,000,000.00 (TWO

BILLION PESOS 00/100 M.N.) as the maximum amount to be allocated

toward the repurchase of the Company’s shares or credit instruments

that represent such shares for the 12-month period following April

22, 2022, in accordance with Article 56, Section IV of the Mexican

Securities Market Law.VII. RATIFICATOIN of the four members of the

Board of Directors and their respective alternates appointed by the

Series BB shareholders as follows:

| Propietary

Members |

Alternate

Members |

|

Laura Diez Barroso Azcárraga |

Carlos Laviada Ocejo |

|

María Ángeles Rubio Alfayate |

Emilio Rotondo Inclán |

|

Juan Gallardo Thurlow |

Alejandro Cortina Gallardo |

|

Eduardo Sánchez Navarro Redo |

Carlos Alberto Rohm Campos |

VIII. It is registered that there was no

designation of person(s) that will serve as member(s) of the

Company’s board of directors, by any holder or group of holders of

Series B shares that owns, individually or collectively, 10% or

more of the Company’s capital stock.IX. RATIFICATION of Mr. Carlos

Cárdenas Guzmán, Mr. Ángel Losada Moreno, Joaquín Vargas Guajardo,

Mr. Juan Díez-Canedo Ruíz, Mr. Álvaro Fernández Garza and Mr. Luis

Tellez Kuenzler, as members of the Board of Directors, designated

by the Series “B” shareholders. In addition, Ms. Alejandra Palacios

Prieto was designated. As of this date, the Board of Directors will

be comprised as follows:

| Propietary

Members |

Alternate

Members |

|

Laura Diez Barroso Azcárraga |

Carlos Laviada Ocejo |

|

María Ángeles Rubio Alfayate |

Emilio Rotondo Inclán |

|

Juan Gallardo Thurlow |

Alejandro Cortina Gallardo |

|

Eduardo Sánchez Navarro Redo |

Carlos Alberto Rohm Campos |

|

Carlos Cárdenas Guzmán |

Not applicable |

|

Ángel Losada Moreno |

Not applicable |

|

Joaquín Vargas Guajardo |

Not applicable |

|

Juan Diez-Canedo Ruíz |

Not applicable |

|

Álvaro Fernández Garza |

Not applicable |

|

Luis Tellez Kuenzler |

Not applicable |

|

Alejandra Palacios Prieto |

Not applicable |

X. RATIFICATION of Ms. Laura Diez Barroso

Azcárraga as Chairwoman of the Company’s board of directors, and

the designation of Mr. Carlos Laviada Ocejo as Alternate, in

accordance with Article 16 of the Company’s by-laws.XI. APPROVAL of

(i) the compensation paid to the members of the Company’s Board of

Directors during the 2021 fiscal year and (ii) the compensation to

be paid to the Company’s Board of Directors for the 2022 fiscal

year proposed by the Compensation and Nominations Committee.

XII. RATIFICATION of Mr. Álvaro Fernández Garza,

as member of the Board of Directors designated by the Series “B”

shareholders to serve as a member of the Company’s Nominations and

Compensation Committee, in accordance with Article 28 of the

Company’s bylaws.XIII. RATIFICATION of Mr. Carlos Cárdenas Guzmán

as President of the Audit and Corporate Practices Committee. The

Audit and Corporate Practices Committee will be comprised as

follows:Carlos Cárdenas Guzmán, PresidentÁngel Losada Moreno,

MemberJoaquín Vargas Guajardo, Member

XIV. The report concerning compliance with

Article 29 of the Company’s bylaws regarding acquisitions of goods

or services or contracting of projects or asset sales that are

equal to or greater than US$ 3,000,000.00 (THREE MILLION U.S.

DOLLARS), or its equivalent in Mexican pesos or other legal tender

in circulation outside Mexico, or, if applicable, regarding

transactions with relevant shareholders.

XV. Presentation of our Public Objectives for

environmental, social responsibility and corporate governance of

the Company for the year 2030.

XVI. APPROVAL of special delegates that can appear before a

notary public to formalize the resolutions adopted at this

meeting.

EXTRAORDINARY SHAREHOLDERS’

MEETING

- APPROVAL to increase the Company's

Common Stock, through the capitalization of the "Restatement effect

of Common Stock" account, as recorded in the Company's

unconsolidated financial statements as of December 31, 2021, in the

amount of Ps. 8,027,154,754.00 (EIGHT BILLION TWENTY-SEVEN MILLION

ONE HUNDRED AND FIFTY-FOUR THOUSAND SEVEN HUNDRED AND FIFTY-FOUR

PESOS 00/100 M.N.).

- APPROVAL of the cancellation of

13,273,970 (THIRTEEN MILLION TWO HUNDRED SEVENTY-THREE THOUSAND

NINE HUNDRED SEVENTY) Company’s treasury shares.

- APPROVAL to perform all corporate

legal formalities required, including the amendment of SIXTH

Article of the Company’s by-laws, derived from the adoption of

resolutions at this Shareholders’ Meeting, to read as follows

“SIXTH ARTICLE.- Common Stock. The common stock will be variable.

The minimum fixed part of the capital is Ps. 8,197,535,635.20

(EIGHT BILLION ONE HUNDRED NINETY-SEVEN MILLION FIVE HUNDRED

THIRTY-FIVE THOUSAND SIX HUNDRED THIRTY-FIVE PESOS 20/100 M.N.),

represented by 512,301,577 (FIVE HUNDRED TWELVE MILLION THREE

HUNDRED ONE THOUSAND FIVE HUNDRED SEVENTY-SEVEN) ordinary shares,

nominative, of Class I and without expression of nominal value,

fully subscribed and paid.”

- APPROVAL of special delegates that

can appear before a notary public to formalize the resolutions

adopted at this meeting.

Company Description

Grupo Aeroportuario del Pacífico, S.A.B. de C.V. (GAP) operates

12 airports throughout Mexico’s Pacific region, including the major

cities of Guadalajara and Tijuana, the four tourist destinations of

Puerto Vallarta, Los Cabos, La Paz and Manzanillo, and six other

mid-sized cities: Hermosillo, Guanajuato, Morelia, Aguascalientes,

Mexicali and Los Mochis. In February 2006, GAP’s shares were listed

on the New York Stock Exchange under the ticker symbol “PAC” and on

the Mexican Stock Exchange under the ticker symbol “GAP”. In April

2015, GAP acquired 100% of Desarrollo de Concesiones

Aeroportuarias, S.L., which owns a majority stake in MBJ Airports

Limited, a company operating Sangster International Airport in

Montego Bay, Jamaica. In October 2018, GAP entered into a

concession agreement for the operation of the Norman Manley

International Airport in Kingston, Jamaica. In October 2018, GAP

entered into a concession agreement for the operation of the Norman

Manley International Airport in Kingston, Jamaica and took control

of the operation in October 2019.

This press release may contain

forward-looking statements. These statements are statements that

are not historical facts, and are based on management’s current

view and estimates of future economic circumstances, industry

conditions, company performance and financial results. The words

“anticipates”, “believes”, “estimates”, “expects”, “plans” and

similar expressions, as they relate to the company, are intended to

identify forward-looking statements. Statements regarding the

declaration or payment of dividends, the implementation of

principal operating and financing strategies and capital

expenditure plans, the direction of future operations and the

factors or trends affecting financial condition, liquidity or

results of operations are examples of forward-looking statements.

Such statements reflect the current views of management and are

subject to a number of risks and uncertainties. There is no

guarantee that the expected events, trends or results will actually

occur. The statements are based on many assumptions and factors,

including general economic and market conditions, industry

conditions, and operating factors. Any changes in such assumptions

or factors could cause actual results to differ materially from

current expectations.

In accordance with Section 806 of the Sarbanes-Oxley Act of 2002

and article 42 of the “Ley del Mercado de Valores”, GAP has

implemented a “whistleblower” program, which

allows complainants to anonymously and confidentially report

suspected activities that may involve criminal conduct or

violations. The telephone number in Mexico, facilitated by a third

party that is in charge of collecting these complaints, is 01 800

563 00 47. The web site is www.lineadedenuncia.com/gap. GAP’s Audit

Committee will be notified of all complaints for immediate

investigation.

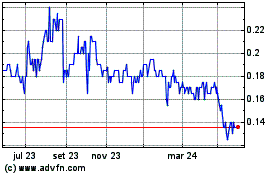

Gale Pacific (ASX:GAP)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

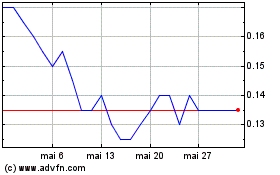

Gale Pacific (ASX:GAP)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025