Arras Minerals Corp. (TSX-V: ARK)

(“Arras”, or the “Company”) is pleased to announce

it has filed an updated Mineral Resource estimate report on the

Beskauga copper-gold project onto the SEDAR website. Highlights of

the updated Mineral Resource report include:

- An open pit constrained

Indicated Mineral Resource of 111.2 million tonnes grading 0.49 g/t

gold, 0.30% copper and 1.34 g/t silver for 1.75 million ounces of

gold, 333.6 thousand tonnes of copper, & 4.79 million ounces of

silver.

- An open pit constrained

Inferred Mineral Resource of 92.6 million tonnes grading 0.50 g/t

gold, 0.24% copper and 1.14 g/t silver for 1.49 million ounces of

gold, 222.2 thousand tonnes of copper, & 3.39 million ounces of

silver.

- The constraining pit was

optimised and calculated using a Gross Metal Value (“GMV”) cut-off

of $20/tonne based on a price of: $1,750/oz for gold, $3.50/lb for

copper, $22/oz for silver, and with an average recovery of 85% for

copper and 74.5% for gold and 50% for silver.

Tim Barry, CEO and Director of Arras states, “We

are very pleased with this resource update which gives a good sense

of the high-grade core of mineralization we currently see at

Beskauga. It is important to note that the mineralization starts at

the old paleo-surface of the bedrock and is covered by just over 40

meters of largely unconsolidated soils and gravels. The size and

grade of the resource, combined with the low strip, and excellent

near-by infrastructure, shows a strong viability for the project

moving forward.

Work for 2022 will now focus on step-outs from

the known deposit testing the largely unexplored immediate

surrounding area.”

Beskauga Resource: The Beskauga

resource was estimated from 118 historical diamond drill holes,

totalling 45,605.8 meters drilled between 2007 and 2017 by the

private Swiss company, Copperbelt AG. In addition to the historical

holes included in this resource, four new drill holes totaling

3,694.2 meters drilled by Arras, in the known zone of

mineralization have also been included in the resource calculation.

All Holes were drilled from surface using an HQ or NQ sized core

diameter and vary in depth between 150m to 1163.8m. The estimated

Mineral Resource is shown in the table below.

Table 1 - Mineral Resource estimate for

the Beskauga deposit with an effective date of 27 December

2021

|

Category |

Tonnage (Mt) |

Cu (%) |

Au (g/t) |

Ag (g/t) |

|

Indicated |

111.2 |

0.30 |

0.49 |

1.34 |

|

Inferred |

92.6 |

0.24 |

0.50 |

1.14 |

Notes:

- A GMV $/t cut-off of $20/t was used,

and the GMV formula is: GMV $/t = Au(grams)*74.5%*$56.26+

Cu(tonnes)*85%*$7.714 + Ag(grams)*50%*$0.71

- Base metal prices considered were

$3.50/lb copper, $22.00/oz silver, and $1,750/oz gold.

- The Mineral Resource is stated within a

pit shell using the base-case metal prices.

- Mineral Resources are estimated and

reported in accordance with the CIM Definition Standards for

Mineral Resources and Mineral Reserves adopted 10 May 2014.

- Matthew Dumala (P.Eng.), is the

independent Qualified Person with respect to the Mineral Resource

estimate.

- The Mineral Resource is not believed to

be materially affected by any known environmental, permitting,

legal, title, taxation, socio-economic, marketing, political or

other relevant factors.

- These Mineral Resources are not Mineral

Reserves as they do not have demonstrated economic viability.

- The quantity and grade of reported

Inferred Resources in this Mineral Resource estimate are uncertain

in nature and there has been insufficient exploration to define

these Inferred Resources as Indicated or Measured; however, it is

reasonably expected that most of the Inferred Mineral Resources

could be upgraded to Indicated Mineral Resources with continued

exploration.

The reported Mineral Resource falls within an

optimized Lerch-Grossman pit shell that uses the following

parameters:

Table 2 - Parameters used in the resource

update

|

Parameter |

|

Unit |

|

Metal prices |

|

|

|

Copper |

3.50 |

$/lb |

|

Gold |

1,750 |

$/oz |

|

Silver |

22.00 |

$/oz |

|

Mining and transport |

|

|

|

Mining cost |

1.50 |

$/t |

|

Incremental mining cost |

0.02 |

$/t per level |

|

Recoveries |

|

|

|

Copper |

85.0 |

% |

|

Gold |

74.5 |

% |

|

Silver |

50.0 |

% |

|

Processing cost |

|

|

|

Processing cost (including G&A) |

15.00 |

$/t |

|

Discount rate |

8.0 |

% |

|

Pit slopes |

|

|

|

Pit slope for overburden |

35 |

° |

|

Pit slope |

55 |

° |

|

Density for model and waste |

2.73 |

t/m3 |

|

Density for overburden |

1.50 |

t/m3 |

A Gross metal value (“GMV”) cut-off of $20/tonne

was used to determine economic viability and was calculated using

the following formula: “GMV $/t = Au(grams)*74.5%*$56.26+

Cu(tonnes)*85%*$7.714 + Ag(grams)*50%*$0.71”

Mineral resources were estimated by Ordinary

Kriging (OK) and Inverse Distance Weighting (IDW) using Geovia GEMS

software (version 6.7.2) modeling software in multiple passes using

20 meter X 20 meter X 20 meter blocks as the SMU size. Blocks have

been classified as Indicated or Inferred Mineral Resources. The

mineral resource has been estimated by Matthew Dumala, P.Eng., of

Archer, Cathro & Associates (1981) Limited, and David

Underwood, a registered Professional Natural Scientist with the

South African Council for Natural Scientific Professions (Pr. Sci.

Nat. No.400323/11). Both Mr. Dumala and Mr. Underwood are Qualified

Persons as defined by National Instrument 43-101 and are

responsible for the Technical Report filed onto the SEDAR website

located at www.sedar.com.

Figure 1

- https://www.globenewswire.com/NewsRoom/AttachmentNg/d81ee634-d266-4162-af16-b22d9fc34826

Infrastructure: The Beskauga

deposit has excellent infrastructure. All operations are based out

of the nearby mining town of Ekibastuz, which services the largest

coal mine in Kazakhstan and provides a highly trained workforce for

Arras to draw upon. Paved road access, 1100 KVA power lines and

heavy rail all lie within a 25 kilometer radius of the project. The

capital city of Nur-Sultan, located approximately 300 kilometers

along a double lane highway to the west of the project, has a major

international airport allowing for easy access and administration

of the Beskauga project.

Figure 2

- https://www.globenewswire.com/NewsRoom/AttachmentNg/c1a71ee7-7cb0-49d0-b109-130cde9c2ec2

Changes in the resource: The

NI43-101 resource update completed by Arras supersedes a NI43-101

resource filed by Silver Bull Resources in February 2021. With

significant movement in the metal prices of gold, copper, and

silver, since February 2021, the new resource calculation

represents a recalibration of Beskauga in the current price

environment.

Compared to the resource report of February

2021, a new grade shell was created to incorporate a better

understanding of the geology of the Beskauga deposit. The new

resource calculation also included an increase from US$2.80/lb to

$US3.50/lb for copper, US$1,500/oz to $US1,750/oz for gold and

US$17.25/oz to $US22 for silver. An increase in metal recovery of

81.7% to 85% for copper, 51.8% to 75% for gold and a decrease from

51.8% to 50% for silver was also included in the calculation. The

February 2021 resource used an NSR cutoff calculation of $5.70/t

with a pit shell factor of 1.25 above metal prices, whereas this

resource update used a “Gross Metal Value” cutoff of $20/t.

These changes described above have resulted in a

new resource on Beskauga deposit having lower tonnage, but

significantly a higher grade for both gold and copper.

Table 3 - Comparison between the Beskauga

resource filed by Silver Bull Resources in February 2021 and

Arras’s resource update filed in February 2022

|

16 FEBRUARY 2021 MINERAL RESOURCE ESTIMATE (Silver Bull

Resources) |

|

Estimate |

Mt |

Au g/t |

Cu % |

Ag g/t |

Au Moz |

Cu t (000’s) |

Ag Moz |

|

Indicated |

207 |

0.35 |

0.23 |

1.09 |

2.33 |

476.1 |

7.25 |

|

Inferred |

147 |

0.33 |

0.15 |

1.04 |

1.56 |

220.5 |

4.82 |

|

31 MAY 2022 MINERAL RESOURCE ESTIMATE (Arras Minerals

Corp.) |

|

Estimate |

Mt |

Au g/t |

Cu % |

Ag g/t |

Au Moz |

Cu t (000’s) |

Ag Moz |

|

Indicated |

111.2 |

0.49 |

0.30 |

1.34 |

1.75 |

333.6 |

4.79 |

|

Inferred |

92.6 |

0.50 |

0.24 |

1.14 |

1.49 |

222.2 |

3.39 |

About the Beskauga Deposit: The

Beskauga deposit is a gold-copper-silver deposit with a NI 43-101

compliant “Indicated” Mineral Resource of 111.2 million tonnes

grading 0.49 g/t gold, 0.30% copper and 1.34 g/t silver for 1.75

million ounces of contained gold, 333.6 thousand tonnes of

contained copper, and 4.79 million ounces of contained silver and

an “Inferred” Mineral Resource of 92.6 million tonnes grading 0.50

g/t gold, 0.24% copper and 1.14 g/t silver for 1.49 million ounces

of contained gold, 222.2 thousand tonnes of contained copper, and

3.39 million ounces of contained silver. This resource is based on

122 drill holes completed between 2007 and 2021. For further

details regarding the Mineral Resource estimate at the Beskauga

project, please see the technical report entitled “Beskauga

Copper-Gold Project, Pavlodar Province, Republic of Kazakhstan,

dated February 20, 2022 and filed on the Company’s website and on

the Company’s SEDAR profile at www.sedar.com.

The constraining pit was optimised and

calculated using a NSR cut-off based on a price of: $1,750/oz for

gold, $3.50/lb for copper, $22.00/oz for silver, and with an

average recovery of 85% for copper and 74.5% for gold and 50% for

silver.

Assay and QAQC Procedures: All

sample preparation and geochemical analysis of the diamond drill

core referenced in the drill assay results described above was

undertaken by ALS Global at its laboratories in Karaganda

(Kazakhstan) and Loughrea (Republic of Ireland), respectively.

After drying and fine crushing, a 250 g split

was pulverised to 85 % passing a -75-micron screen. A 30 g split of

the pulp was analysed for gold using fire assay and Atomic

Absorption Spectroscopy (AAS) finish (ALS method Au-AA25™) at ALS

Karaganda. A second pulp split was then air freighted to ALS

Loughrea and analysed for 48 elements by Inductively Coupled Plasma

Mass Spectrometry (ICP-MS) after 4-acid digestion on a 0.25 g

aliquot (ALS method ME-MS61™). Where samples exceeded 1% copper,

they were re-analysed using a 4-acid digest ICP-MS ore grade method

(ALS method Cu-OG62™). ALS Global and its laboratories are entirely

independent of Arras Minerals Corp.

Arras operates according to its rigorous Quality

Assurance and Quality Control (QA/QC) protocol, which is consistent

with industry best practices. This includes insertion of certified

standards, blanks, and field duplicates comprising of quarter drill

core at an insertion rate of 2.5%, 2.5% and 5% respectively, which

is deemed appropriate for this stage of exploration. The blanks and

standards are Certified Reference Materials (CRM’s) supplied by Ore

Research and Exploration, Australia, who are entirely independent

of Arras Minerals Corp. Internal QA/QC samples were also inserted

by the analytical laboratories and reviewed by the Company prior to

release. No material QA/QC issues have been identified with respect

to sample collection, security and assaying.

Qualified Person

The technical disclosure presented in this news

release has been reviewed and approved by Tim Barry, CEO and

Director of Arras Minerals Corp., a Chartered Professional

Geologist (MAusIMM CP Geo) with the Australasian Institute of

Mining and Metallurgy and a “Qualified Person” for the purposes of

National Instrument 43-101.

On behalf of the Board of Directors "Tim Barry"

Tim Barry, CPAusIMM Chief Executive Officer and

Director

INVESTOR RELATIONS: +1 604 687 5800

info@arrasminerals.com

About Arras Minerals Corp.

Arras Minerals Corp. is British Columbia

incorporated public company trading on the TSX-V exchange under the

symbol “ARK.” The Company is advancing a portfolio of copper and

gold assets in northeastern Kazakhstan, including the Option

Agreement on the Beskauga copper and gold project.

Cautionary Note to U.S. Investors

concerning estimates of Measured, Indicated, and Inferred

Resources: This press release uses the terms “measured

resources”, “indicated resources”, and “inferred resources” which

are defined in, and required to be disclosed by, NI 43-101. The

Company advises U.S. investors that these terms are not recognized

by the SEC. The estimation of measured, indicated and inferred

resources involves greater uncertainty as to their existence and

economic feasibility than the estimation of proven and probable

reserves. U.S. investors are cautioned not to assume that measured

and indicated mineral resources will be converted into reserves.

The estimation of inferred resources involves far greater

uncertainty as to their existence and economic viability than the

estimation of other categories of resources. U.S. investors are

cautioned not to assume that estimates of inferred mineral

resources exist, are economically minable, or will be upgraded into

measured or indicated mineral resources. Under Canadian securities

laws, estimates of inferred mineral resources may not form the

basis of feasibility or other economic studies.

Disclosure of “contained ounces” in a resource

is permitted disclosure under Canadian regulations, however the SEC

normally only permits issuers to report mineralization that does

not constitute “reserves” by SEC standards as in place tonnage and

grade without reference to unit measures. Accordingly, the

information contained in this press release may not be comparable

to similar information made public by U.S. companies that are not

subject NI 43-101.

Cautionary note regarding forward

looking statements: This news release contains

forward-looking statements regarding future events and Arras’

future results that are subject to the safe harbors created under

the U.S. Private Securities Litigation Reform Act of 1995, the

Securities Act of 1933, as amended, and the Exchange Act, and

applicable Canadian securities laws. Forward-looking statements

include, among others, statements regarding the use of net proceeds

from the recent private placement, plans and expectations of the

drill program Arras is in the process of undertaking, including the

expansion of the Mineral Resource, and other aspects of the Mineral

Resource estimates for the Beskauga project. These statements are

based on current expectations, estimates, forecasts, and

projections about Arras’ exploration projects, the industry in

which Arras operates and the beliefs and assumptions of Arras’

management. Words such as “expects,” “anticipates,” “targets,”

“goals,” “projects,” “intends,” “plans,” “believes,” “seeks,”

“estimates,” “continues,” “may,” variations of such words, and

similar expressions and references to future periods, are intended

to identify such forward-looking statements. Forward-looking

statements are subject to a number of assumptions, risks and

uncertainties, many of which are beyond management’s control,

including undertaking further exploration activities, the results

of such exploration activities and that such results support

continued exploration activities, unexpected variations in ore

grade, types and metallurgy, volatility and level of commodity

prices, the availability of sufficient future financing, and other

matters discussed under the caption “Risk Factors” in the

Non-Offering Prospectus filed on the Company’s profile on SEDAR on

May 31, 2022 and in the Company’s Annual Report on Form 20-F for

the fiscal year ended October 31, 2021 filed with the U.S.

Securities and Exchange Commission filed on February 17, 2022

available on www.sec.gov. Readers are cautioned that

forward-looking statements are not guarantees of future performance

and that actual results or developments may differ materially from

those expressed or implied in the forward-looking statements. Any

forward-looking statement made by the Company in this release is

based only on information currently available and speaks only as of

the date on which it is made. The Company undertakes no obligation

to publicly update any forward-looking statement, whether written

or oral, that may be made from time to time, whether as a result of

new information, future developments or otherwise.

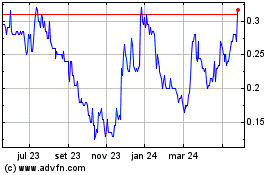

Arras Minerals (TSXV:ARK)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

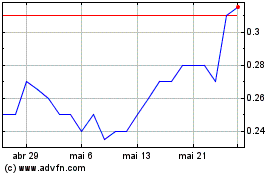

Arras Minerals (TSXV:ARK)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025