Birchcliff Energy Ltd. Announces Declaration of Quarterly Common Share Dividend

30 Agosto 2022 - 12:56PM

Birchcliff Energy Ltd. (“

Birchcliff” or the

“

Corporation”) (TSX: BIR) is pleased to announce

that its board of directors has declared a quarterly cash dividend

of $0.02 per common share for the quarter ending September 30,

2022. The dividend will be payable on October 3, 2022 to

shareholders of record at the close of business on September 15,

2022. The ex-dividend date is September 14, 2022. The dividend has

been designated as an eligible dividend for the purposes of the

Income Tax Act (Canada).

On August 4, 2022, Birchcliff announced the

redemption of all of its issued and outstanding cumulative

redeemable preferred shares, Series A (the “Series A

Preferred Shares”) and cumulative redeemable preferred

shares, Series C (the “Series C Preferred Shares”)

on September 30, 2022 for an aggregate redemption price of

approximately $88.2 million. Additionally, the Corporation

announced that its board of directors had declared a quarterly cash

dividend of $0.527677 per Series A Preferred Share and $0.441096

per Series C Preferred Share, which dividends will be paid on

October 3, 2022 to the holders of record at the close of business

on September 15, 2022. The dividends have been designated as

eligible dividends for the purposes of the Income Tax Act (Canada).

These will be the final quarterly dividends on the Series A and

Series C Preferred Shares.

Forward-Looking Statements

Certain statements contained in this press

release constitute forward‐looking statements and forward-looking

information (collectively referred to as “forward‐looking

statements”) within the meaning of applicable Canadian

securities laws. The forward-looking statements contained in this

press release relate to future events or Birchcliff’s future plans,

operations, performance or financial position and are based on

Birchcliff’s current expectations, estimates, projections, beliefs

and assumptions. Such forward-looking statements have been made by

Birchcliff in light of the information available to it at the time

the statements were made and reflect its experience and perception

of historical trends. All statements and information other than

historical fact may be forward‐looking statements. Such

forward‐looking statements are often, but not always, identified by

the use of words such as “plan”, “future”, “expect”, “intend”,

“believe”, “anticipate”, “potential”, “proposed”, “continue”,

“may”, “will”, “could”, “might”, “should”, “would” and other

similar words and expressions.

By their nature, forward-looking statements

involve known and unknown risks, uncertainties and other factors

that may cause actual results or events to differ materially from

those anticipated in such forward‐looking statements. Accordingly,

readers are cautioned not to place undue reliance on such

forward-looking statements. Although Birchcliff believes that the

expectations reflected in the forward-looking statements are

reasonable, there can be no assurance that such expectations will

prove to be correct and Birchcliff makes no representation that

actual results achieved will be the same in whole or in part as

those set out in the forward-looking statements.

In particular, this press release contains

forward‐looking statements relating to the payment of dividends and

the redemption of the Series A and Series C Preferred Shares. With

respect to the forward‐looking statements contained in this press

release, assumptions have been made regarding, among other things:

prevailing and future commodity prices and differentials, exchange

rates, interest rates, inflation rates, royalty rates and tax

rates; the regulatory framework; future cash flow, debt and

dividend levels; future expenses; Birchcliff’s ability to access

capital and obtain financing on acceptable terms; and the ability

to obtain any necessary regulatory or other approvals in a timely

manner.

Birchcliff’s actual results, performance or

achievements could differ materially from those anticipated in the

forward-looking statements as a result of both known and unknown

risks and uncertainties including, but not limited to: actions

taken by OPEC and other major producers of crude oil and the impact

such actions may have on supply and demand and commodity prices;

general economic, market and business conditions; volatility of

crude oil and natural gas prices; fluctuations in exchange and

interest rates; stock market volatility; an inability to access

sufficient capital from internal and external sources on terms

acceptable to the Corporation; risks associated with Birchcliff’s

credit facilities, including a failure to comply with covenants

under the agreement governing the credit facilities; changes to the

regulatory framework; actions by government authorities; an

inability of the Corporation to comply with existing and future

laws; default under or breach of agreements by counterparties;

uncertainties associated with the outcome of litigation or other

proceedings involving Birchcliff; risks associated with the

declaration and payment of future dividends; the failure to obtain

any required approvals in a timely manner or at all; and risks

associated with the ownership of the Corporation’s securities.

Readers are cautioned that the foregoing lists

of factors are not exhaustive. Additional information on these and

other risk factors that could affect results of operations,

financial performance or financial results are included in the

Corporation’s most recent Annual Information Form under the heading

“Risk Factors” and in other reports filed with Canadian securities

regulatory authorities.

Management has included the above summary of

assumptions and risks related to forward-looking statements

provided in this press release in order to provide readers with a

more complete perspective on Birchcliff’s future operations and

management’s current expectations relating to Birchcliff’s future

performance. Readers are cautioned that this information may not be

appropriate for other purposes.

The forward-looking statements contained in this

press release are expressly qualified by the foregoing cautionary

statements. The forward-looking statements contained herein are

made as of the date of this press release. Unless required by

applicable laws, Birchcliff does not undertake any obligation to

publicly update or revise any forward-looking statements, whether

as a result of new information, future events or otherwise.

About Birchcliff:

Birchcliff is a Calgary, Alberta based

intermediate oil and natural gas company with operations focused on

the Montney/Doig Resource Play in Alberta. Birchcliff’s common

shares and Series A and Series C Preferred Shares, are listed for

trading on the Toronto Stock Exchange under the symbols “BIR”,

“BIR.PR.A” and “BIR.PR.C”, respectively.

|

For further information, please contact: |

|

Birchcliff Energy Ltd.Suite 1000, 600 – 3rd Avenue

S.W. Calgary, Alberta T2P 0G5Telephone: (403) 261-6401Email:

info@birchcliffenergy.comwww.birchcliffenergy.com |

|

Jeff Tonken – Chief Executive OfficerChris

Carlsen – President and Chief Operating

OfficerBruno Geremia – Executive Vice President

and Chief Financial Officer |

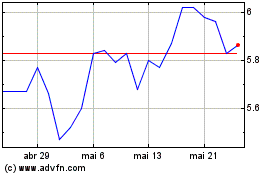

Birchcliff Energy (TSX:BIR)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

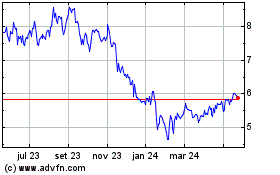

Birchcliff Energy (TSX:BIR)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025