Birchcliff Energy Ltd. Receives TSX Approval for Renewal of Normal Course Issuer Bid

21 Novembro 2024 - 6:00PM

Birchcliff Energy Ltd. (“

Birchcliff” or the

“

Corporation”) (TSX: BIR) is pleased to announce

that the Toronto Stock Exchange (the “

TSX”) has

accepted the Corporation’s notice of intention to make a normal

course issuer bid (the “

NCIB”).

The NCIB allows Birchcliff to purchase up to

13,489,975 common shares, which represents 5% of its 269,799,514

common shares outstanding as at November 14, 2024. The NCIB will

commence on November 27, 2024 and will terminate no later than

November 26, 2025. Under the NCIB, common shares may be purchased

in open market transactions on the TSX and/or alternative Canadian

trading systems at the prevailing market price at the time of such

transaction. Subject to exceptions for block purchases, the total

number of common shares that Birchcliff is permitted to purchase on

the TSX during a trading day is subject to a daily purchase limit

of 276,992 common shares, which represents 25% of the average daily

trading volume on the TSX of 1,107,970 common shares for the

six-month period ended October 31, 2024. All common shares

purchased under the NCIB will be cancelled.

Birchcliff believes that at times, the market

price of its common shares may not reflect the underlying value of

the Corporation’s business and that purchasing its common shares

for cancellation may represent an attractive opportunity to

allocate capital resources to reduce the number of common shares

outstanding, thereby increasing the value of the remaining common

shares and shareholders’ ownership in the underlying business. In

addition, Birchcliff may use the NCIB to offset the number of

common shares it issues throughout the year pursuant to the

exercise of options granted under its stock option plan to minimize

or eliminate associated dilution to shareholders.

The actual number of common shares purchased

pursuant to the NCIB and the timing of such purchases will be

determined by Birchcliff. Decisions to purchase common shares under

the NCIB will be based on market conditions, the trading price of

the common shares and alternative uses of capital resources

available to the Corporation. There cannot be any assurance as to

how many common shares, if any, will ultimately be acquired by

Birchcliff.

Under Birchcliff’s existing normal course issuer

bid, it obtained the approval of the TSX to purchase up to

13,328,267 common shares over the period from November 27, 2023 to

November 26, 2024. The Corporation has not purchased any common

shares under this normal course issuer bid.

Forward-Looking Statements

Certain statements contained in this press

release constitute forward-looking statements and forward-looking

information (collectively referred to as “forward-looking

statements”) within the meaning of applicable Canadian

securities laws. All statements and information other than

historical fact may be forward-looking statements. By their nature,

forward-looking statements involve known and unknown risks,

uncertainties and other factors that may cause actual results or

events to differ materially from those anticipated in such

forward-looking statements. Accordingly, readers are cautioned not

to place undue reliance on such forward-looking statements.

Although Birchcliff believes that the expectations reflected in the

forward-looking statements are reasonable, there can be no

assurance that such expectations will prove to be correct and

Birchcliff makes no representation that actual results achieved

will be the same in whole or in part as those set out in the

forward-looking statements.

In particular, this press release contains

forward-looking statements relating to the NCIB, including

potential purchases under the NCIB and the effects and benefits of

the NCIB. With respect to the forward-looking statements contained

in this press release, assumptions have been made regarding, among

other things: the anticipated benefits of the NCIB; prevailing and

future commodity prices and differentials, exchange rates, interest

rates, inflation rates, royalty rates and tax rates; the state of

the economy, financial markets and the exploration, development and

production business; the political environment; the regulatory

framework; future cash flow, debt and dividend levels; future

operating, transportation, marketing, G&A and other expenses;

Birchcliff’s ability to access capital and obtain financing on

acceptable terms; the timing and amount of capital expenditures and

the sources of funding for capital expenditures and other

activities; the sufficiency of budgeted capital expenditures to

carry out planned operations; the successful and timely

implementation of capital projects; results of operations;

Birchcliff’s ability to continue to develop its assets and obtain

the anticipated benefits therefrom; the performance of existing and

future wells; and the ability to obtain any necessary regulatory

approvals in a timely manner. Birchcliff’s actual results,

performance or achievements could differ materially from those

anticipated in the forward-looking statements as a result of both

known and unknown risks and uncertainties including, but not

limited to: the failure to realize the anticipated benefits of the

NCIB; a failure to execute purchases under the NCIB; the risks

posed by global conflict and their impacts on supply and demand and

commodity prices; actions taken by OPEC and other major producers

of crude oil and the impact such actions may have on supply and

demand and commodity prices; general economic, market and business

conditions which will, among other things, impact the demand for

and market prices of Birchcliff’s products and Birchcliff’s access

to capital; volatility of crude oil and natural gas prices; risks

associated with increasing costs, whether due to high inflation

rates, supply chain disruptions or other factors; stock market

volatility; an inability to access sufficient capital from internal

and external sources on terms acceptable to the Corporation; risks

associated with Birchcliff’s credit facilities; operational risks

and liabilities inherent in oil and natural gas operations;

uncertainty that development activities in connection with

Birchcliff’s assets will be economic; geological, technical,

drilling, construction and processing problems; the accuracy of

cost estimates and variances in Birchcliff’s actual costs and

economic returns from those anticipated; and changes to the

regulatory framework in the locations where the Corporation

operates.

Readers are cautioned that the foregoing lists

of factors are not exhaustive. Additional information on these and

other risk factors that could affect Birchcliff’s results of

operations, financial performance or financial results are included

in Birchcliff’s most recent annual information form under the

heading “Risk Factors” and in other reports filed with Canadian

securities regulatory authorities. Management has included the

above summary of assumptions and risks related to forward-looking

statements provided in this press release in order to provide

readers with a more complete perspective on Birchcliff’s future

operations and management’s current expectations relating to

Birchcliff’s future performance. Readers are cautioned that this

information may not be appropriate for other purposes. The

forward-looking statements contained in this press release are

expressly qualified by the foregoing cautionary statements. The

forward-looking statements contained herein are made as of the date

of this press release. Unless required by applicable laws,

Birchcliff does not undertake any obligation to publicly update or

revise any forward-looking statements, whether as a result of new

information, future events or otherwise.

ABOUT BIRCHCLIFF:

Birchcliff is a dividend-paying, intermediate

oil and natural gas company based in Calgary, Alberta with

operations focused on the Montney/Doig Resource Play in Alberta.

Birchcliff’s common shares are listed for trading on the TSX under

the symbol “BIR”.

| For further

information, please contact: |

| |

|

Birchcliff Energy Ltd.Suite 1000, 600 – 3rd Avenue

S.W.Calgary, Alberta T2P 0G5Telephone: (403) 261-6401Email:

birinfo@birchcliffenergy.com www.birchcliffenergy.com |

|

Chris Carlsen – President and Chief Executive

OfficerBruno Geremia – Executive Vice President

and Chief Financial Officer |

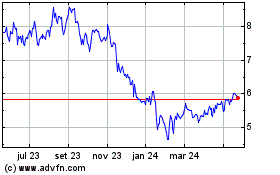

Birchcliff Energy (TSX:BIR)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

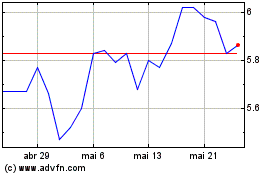

Birchcliff Energy (TSX:BIR)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025