Slate Office REIT (the “REIT”) (TSX: SOT.UN), an owner and operator

of high-quality workplace real estate, announced today that it has

closed its previously announced bought deal public offering (the

“Offering”) by way of its short form base shelf prospectus dated

April 29, 2021, as supplemented by a prospectus supplement dated

October 19, 2022 (collectively, the “Prospectus”). CIBC Capital

Markets, BMO Capital Markets and RBC Capital Markets acted as joint

bookrunners for the Offering on behalf of a syndicate of

underwriters which also included TD Securities Inc., Scotia Capital

Inc., National Bank Financial Inc., Raymond James Ltd., Canaccord

Genuity Corp., iA Private Wealth Inc., Cormark Securities Inc. and

Laurentian Bank Securities Inc. (collectively, the “Underwriters”),

whereby the Underwriters purchased $45 million aggregate principal

amount of 7.50% convertible unsecured subordinated debentures of

the REIT (the “Initial Debentures”). The REIT has also granted the

Underwriters an option (the “Over-Allotment Option”) to purchase up

to an additional $6.75 million of 7.50% convertible unsecured

subordinated debentures of the REIT (the “Additional Debentures”,

and together with the Initial Debentures, the “Debentures”) on the

same terms and conditions, exercisable at any time, in whole or in

part, up to 30 days after the closing of the Offering. The REIT has

received conditional approval from the Toronto Stock Exchange (the

“TSX”) to list the Debentures on the TSX.

The net proceeds from the Offering will be used to partially

fund the REIT’s previously announced US$19.8 million acquisition of

a newly retrofitted Class A office property located in Chicago,

Illinois (the “Acquisition”), reduce the REIT’s secured

indebtedness, and for other general corporate purposes, which could

include execution of the REIT’s normal course issuer bid in

accordance with applicable securities laws.

The Debentures bear an interest rate of 7.50% per annum, payable

semi-annually in arrears on June 30 and December 31 in each year

commencing June 30, 2023. The June 30, 2023 interest payment will

represent accrued interest for the period from, and including,

October 24, 2022 to, but excluding, June 30, 2023.

Each Debenture is convertible into freely tradeable trust units

of the REIT (“Units”) at the option of the holder at any time

following closing of the Offering and prior to the close of

business on the earliest of (i) the last business day before

December 31, 2027 (the “Maturity Date”); or (ii) if called for

redemption, the business day immediately preceding the date

specified by the REIT for redemption of the Debentures, at a

conversion price of $5.50 per Unit (the “Conversion Price”), being

a ratio of approximately 181.8182 Units per $1,000 principal amount

of Debentures. The conversion right is subject to standard

anti-dilution provisions. Debenture-holders converting their

Debentures will, in addition to the applicable number of Units to

be received on conversion, receive accrued and unpaid interest, if

any, for the period from the last interest payment date on their

Debentures to and including the last record date set by the REIT

occurring prior to the date of conversion for determining the

REIT’s Unitholders entitled to receive a distribution on the Units.

The Debentures may not be redeemed by the REIT prior to December

31, 2025. On and from December 31, 2025, and prior to December 31,

2026, the Debentures may be redeemed by the REIT, in whole at any

time, or in part from time to time, at a price equal to the

principal amount thereof plus accrued and unpaid interest on not

more than 60 days’ and not less than 30 days’ prior written notice,

provided that the volume weighted-average trading price of the

Units on the TSX for the 20 consecutive trading days ending five

trading days preceding the date on which notice of redemption is

given is not less than 125% of the Conversion Price. On and from

December 31, 2026, and prior to the Maturity Date, the Debentures

may be redeemed by the REIT, in whole at any time or in part from

time to time, at a price equal to the principal amount thereof plus

accrued and unpaid interest on not more than 60 days’ and not less

than 30 days’ prior written notice.

In connection with the Offering, the Underwriters are entitled

to a cash commission equal to 3.75% of the gross proceeds of the

Offering, including any Additional Debentures sold pursuant to the

exercise of the Over-Allotment Option.

The Debentures have not been and will not be registered under

the United States Securities Act of 1933, as amended (the “1933

Act”), or any state securities laws. Accordingly, the Debentures

may not be offered or sold within the United States, its

territories or possessions, any state of the United States or the

District of Columbia (collectively, the “United States”) except in

transactions exempt from the registration requirements of the 1933

Act and applicable state securities laws. This press release does

not constitute an offer to sell or a solicitation of an offer to

buy any Debentures within the United States.

About Slate Office REIT (TSX: SOT.UN)

Slate Office REIT is a global owner and operator of high-quality

workplace real estate. The REIT owns interests in and operates a

portfolio of strategic and well-located real estate assets in North

America and Europe. The majority of the REIT’s portfolio is

comprised of government and high-quality credit tenants. The REIT

acquires quality assets at a discount to replacement cost and

creates value for unitholders by applying hands-on asset management

strategies to grow rental revenue, extend lease term and increase

occupancy. Visit slateofficereit.com to learn more.

About Slate Asset Management

Slate Asset Management is a global alternative investment

platform targeting real assets. We focus on fundamentals with the

objective of creating long-term value for our investors and

partners. Slate’s platform has a range of real estate and

infrastructure investment strategies, including opportunistic,

value add, core plus and debt investments. We are supported by

exceptional people and flexible capital, which enable us to

originate and execute on a wide range of compelling investment

opportunities. Visit slateam.com to learn more.

Forward-Looking Statements

Certain information herein constitutes “forward-looking

information” as defined under Canadian securities laws which

reflect management’s expectations regarding objectives, plans,

goals, strategies, future growth, results of operations,

performance, business prospects and opportunities of the REIT. The

words “plans”, “expects”, “does not expect”, “scheduled”,

“estimates”, “intends”, “anticipates”, “does not anticipate”,

“projects”, “believes”, or variations of such words and phrases or

statements to the effect that certain actions, events or results

“may”, “will”, “could”, “would”, “might”, “occur”, “be achieved”,

or “continue” and similar expressions identify forward-looking

statements. Forward-looking statements include, without limitation,

statements regarding, any expected exercise of the Over-Allotment

Option by the Underwriters and the anticipated use of proceeds of

the Offering. Such forward-looking statements are qualified in

their entirety by the inherent risks and uncertainties surrounding

future expectations.

Forward-looking statements are necessarily based on a number of

estimates and assumptions that, while considered reasonable by

management as of the date hereof, are inherently subject to

significant business, economic and competitive uncertainties and

contingencies. When relying on forward-looking statements to make

decisions, the REIT cautions readers not to place undue reliance on

these statements, as forward-looking statements involve significant

risks and uncertainties and should not be read as guarantees of

future performance or results, and will not necessarily be accurate

indications of whether or not the times at or by which such

performance or results will be achieved. A number of factors could

cause actual results to differ, possibly materially, from the

results discussed in the forward-looking statements. Additional

information about risks and uncertainties is contained in the

filings of the REIT with securities regulators, including the

Prospectus.

SOT-AD

For Further Information

Investor Relations+1 416 644 4264ir@slateam.com

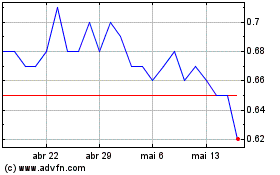

Slate Office REIT (TSX:SOT.UN)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Slate Office REIT (TSX:SOT.UN)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025