Major Canadian Cities Continue to Struggle to Balance Burden Between Commercial and Residential Taxpayers

26 Outubro 2022 - 9:32AM

Altus Group Limited (ʺAltus” or “the Company”) (TSX: AIF), a market

leading Intelligence as a Service provider to the global commercial

real estate industry, in partnership with the Real Property

Association of Canada (“REALPAC”), today released the 2022 Canadian

Property Tax Rate Benchmark Report which provides an in-depth look

at commercial and residential property tax rates in 11 major cities

across Canada.

Across Canada, all property owners pay tax based

on the assessed value of their property, but the tax rate per

dollar of property value varies depending on whether that property

is used for residential or commercial purposes. This report

examines how shifts in value between classes of property influence

tax increases with a spotlight on how municipal efforts to mitigate

tax increases can further contribute to inequities.

Commercial-to-residential tax

ratio

The commercial-to-residential tax ratio is the

key measure in the report that compares the commercial tax rate to

the residential tax rate. For example, if the ratio is 2.50, this

means that the commercial tax rate is two-and-a-half times (2.5x)

the residential tax rate.

The 2022 report found that seven out of the 11

cities surveyed have a commercial tax rate that is more than double

the residential tax rate, which means that a commercial property

incurs property taxes more than twice the amount of an equally

valued residential property. The average commercial-to-residential

tax ratio in 2022 was 2.80, reflecting a slight increase of 2.42%

from the 2021 average ratio of 2.73. The rise in the average ratio

was largely driven by the ratio increases in Calgary, Edmonton, and

Halifax, ranging from 6.5% to more than 10%.

|

Year-Over-Year Commercial-to-Residential Tax

Ratios |

|

City |

2022 |

2021 |

% Change 2021 to 2022 |

|

Montreal |

4.21 |

4.17 |

1.08% |

| Quebec

City |

3.51 |

3.47 |

1.30% |

|

Vancouver |

3.46 |

3.41 |

1.35% |

| Toronto |

3.36 |

3.44 |

-2.42% |

| Calgary |

3.07 |

2.78 |

10.27% |

| Halifax |

3.06 |

2.85 |

7.16% |

|

Average |

2.80 |

2.73 |

2.42% |

|

Edmonton |

2.68 |

2.52 |

6.53% |

| Ottawa |

2.39 |

2.37 |

0.95% |

|

Winnipeg |

1.92 |

1.93 |

-0.23% |

|

Saskatoon |

1.61 |

1.61 |

0.18% |

| Regina |

1.51 |

1.51 |

-0.09% |

“The post pandemic market is incredibly

volatile, and governments need to be proactive to address the value

shifts without increasing inequities between commercial and

residential taxpayers,” said Kyle Fletcher, President of Property

Tax Canada at Altus Group. “There are two factors that drive

property taxes – assessed values and municipal revenue

requirements. To achieve equitable taxation and to support economic

recovery, governments like Ontario’s need to embrace more frequent

reassessment to keep up with market changes, and municipalities

need to move away from policies that shift a greater portion of the

tax burden to commercial properties.”

Regional trend analysis

- Calgary observed

the largest commercial-to-residential ratio increase of the cities

surveyed, climbing 10.27% to 3.07. Continuing the trend since 2015,

the commercial assessment base contracted year-over-year due once

again to declining office assessment values, while the residential

assessment base experienced a notable increase of 8% year-over-year

due to a surging single-family market.

- Halifax made

positive changes in its ratio for 2021 taxation, but reversed

course for 2022. The Halifax Regional Municipality increased the

commercial tax rate and dropped the residential rate, resulting in

a 7.16% increase in its commercial-to-residential ratio, to

3.06.

- Edmonton faced

similar pressures to Calgary as a result of the latest

reassessment, causing its ratio to increase by 6.5% to 2.68.

- Vancouver saw a

decrease in both residential and commercial tax rates, reporting

the lowest rates of the cities surveyed. As the rate of taxation

for residential properties dropped further than the commercial

rate, its commercial-to-residential tax ratio increased by 1.35% to

3.46, ranking the third highest out of all cities surveyed.

- Quebec City first

climbed above the average in 2013 and remains well above the

average in 2022 with a ratio of 3.51.

- Montreal reduced

both residential and commercial tax rates in 2022, but a greater

reduction to residential resulted in a ratio increase of 1.08% to

4.21, continuing a four-year trend of posting the highest

commercial-to-residential ratio of all cities surveyed. With shifts

in assessment expected to occur with the 2023 triennial role, the

city will face pressure to further increase the commercial tax rate

relative to residential.

- Ottawa raised its

commercial rate by a greater percentage than residential, resulting

in a 0.95% increase to its ratio for the first time since 2017, now

sitting just below the national average at 2.39.

- Saskatoon and

Regina continued a six-year trend of posting a

ratio below 2.0 and remained static between 2021 and 2022 at 1.61

and 1.51, respectively, the lowest in the survey. Saskatchewan is

in the second year of its four-year assessment cycle and values

have not shifted.

- Winnipeg’s ratio

dropped slightly from 1.93 to 1.92 but would be above 2.20 if the

School Rebate and business tax were considered. It is anticipated

that the School Rebate will be increased for 2023, further widening

the gap between commercial and residential taxes.

- Toronto continued

to move toward tax equity, increasing the tax rate for residential

properties by a higher percentage than commercial. As a result, the

commercial-to-residential ratio continued its 18-year downward

trend and dropped by 2.42%, the most substantial reduction in the

survey.

Tax mitigation tools

New for 2022, the report provides a spotlight on

tax mitigation tools that are currently being implemented or

proposed across the cities surveyed. In response to sudden or

significant increases in tax burden, or for other policy reasons,

provincial or local governments may implement certain measures such

as assessment phase-ins, tax rate adjustments, capping or rebate

programs to impact the amount of taxes paid by a segment of

properties. The challenge with tax mitigation tools is that for

every property that benefits, another property must subsidize those

benefits.

A copy of the Altus Group 2022 Canadian Property

Tax Rate Benchmark Report can be downloaded at:

https://www.altusgroup.com/reports/canadian-property-tax-benchmark-report/

About Altus Group

Altus Group provides the global commercial real

estate industry with vital actionable intelligence solutions driven

by our de facto standard ARGUS technology, unparalleled asset level

data, and market leading expertise. A market leader in providing

Intelligence as a Service, Altus Group empowers CRE professionals

to make well-informed decisions with greater speed and scale to

maximize returns and reduce risk. Trusted by most of the world’s

largest CRE leaders, our solutions for the valuation, performance,

and risk management of CRE assets are integrated into workflows

critical to success across the CRE value chain. Founded in 2005,

Altus Group is a global company with approximately 2,650 employees

across North America, EMEA and Asia Pacific. For more information

about Altus (TSX: AIF) please visit altusgroup.com.

FOR FURTHER INFORMATION PLEASE

CONTACT:

Elizabeth Lambe Director, Global Communications,

Altus Group (416) 641-9787 Elizabeth.Lambe@altusgroup.com

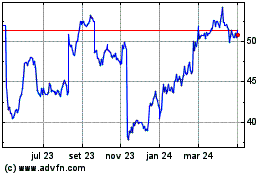

Altus (TSX:AIF)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

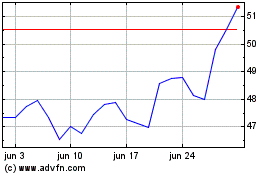

Altus (TSX:AIF)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025