AirBoss of America Corp. (TSX: BOS)(OTCQX:ABSSF) (the “Company” or

“AirBoss”) today announced its third quarter results as it moves

forward into the remainder of 2022. The Company will host a

conference call and webcast to discuss the results on November 9th

at 9 a.m. ET, the details of which are outlined below. All dollar

amounts are shown in thousands of United States dollars ("US $" or

"$"), except per share amounts, unless otherwise noted.

Recent Highlights

- Received orders of up to $40.6

million for Husky 2G Vehicles and accessories;

- Declared a quarterly dividend of

C$0.10 per common share;

- Generated Adjusted EBITDA of $1.3

million; and

- Net Debt to Adjusted EBITDA ratio

at September 30, 2022 (“Q3 2022”) of 1.92x.

“Our third quarter financial results were

negatively impacted by contract timing as well as market

challenges, with the most acute of these being the dramatic shift

in market pricing for nitrile gloves to date in 2022,” expressed

Chris Bitsakakis, President and COO of AirBoss. “Having taken a

substantial non-cash write-down against our gloves in inventory in

AirBoss Defense Group (“ADG”) during Q3 2022, we believe we are now

better positioned to generate profitable sales to the personal

protective equipment (“PPE”), health care and survivability sectors

going forward. During the quarter, we were pleased with the

continued strong performance within our AirBoss Rubber Solutions

(“ARS”) segment as we captured new sales opportunities with our

expanded product line-up and enhanced production capabilities. This

segment capitalized on strong demand in Q3 2022 which led to growth

over the third quarter in 2021. Our ability to offer specialized

products and a broader array of compounds has allowed us to capture

sales growth within new market segments, and we’re able to meet

this demand with expanded production capabilities. Our team’s

efforts to broaden our customer base and profitability within ARS

has produced strong results to date in 2022.”

“Within ADG, demand drivers remain strong.

Innovations like our Blast Gauge System represent important new

opportunities to use technology to ensure the safety of military

personnel, and worldwide military budgets continue to create

opportunities for our traditional defense products like the Husky,

Bandolier and CBRN-E equipment, as reflected in the recently

announced Husky order” noted Gren Schoch, Chairman and CEO of

AirBoss. “Our ADG team is highly focused on successfully securing

new sales agreements from our current pipeline of opportunities. As

our AirBoss Engineered Products (“AEP”) segment dealt with further

labor and supply chain challenges as well as continued raw

materials price inflation in Q3, our team accelerated its efforts

to pursue new pricing strategies with our key customers to ensure

we can re-gain profitable operations within AEP in the near

term.”

| |

Three-months ended September 30 |

Nine-months ended September 30 |

| In thousands of US

dollars, except share data |

|

|

|

(unaudited) |

2022 |

2021 |

2022 |

2021 |

|

Financial results: |

|

|

|

|

| Net sales |

104,682 |

112,027 |

359,702 |

337,805 |

| Profit |

(55,957) |

6,902 |

(43,889) |

31,541 |

| Adjusted Profit1 |

(11,843) |

7,040 |

234 |

31,833 |

| Earnings per share (US$) |

|

|

|

|

|

– Basic |

(2.07) |

0.26 |

(1.62) |

1.17 |

|

– Diluted |

(2.07) |

0.24 |

(1.62) |

1.11 |

| Adjusted earnings per

share1(US$) |

|

|

|

|

|

– Basic |

(0.44) |

0.26 |

0.01 |

1.18 |

|

– Diluted |

(0.44) |

0.25 |

0.01 |

1.12 |

| EBITDA1 |

(56,394) |

13,752 |

(26,239) |

53,056 |

| Adjusted EBITDA1 |

1,271 |

13,922 |

31,438 |

53,380 |

| Net cash provided by operating

activities |

(15,847) |

(125,723) |

(38,655) |

(136,392) |

| Free cash flow1 |

(18,525) |

(130,444) |

(45,625) |

(149,391) |

| Dividends declared per share

(CAD$) |

0.10 |

$0.10 |

0.30 |

$0.27 |

| Capital additions |

2,687 |

4,724 |

6,983 |

17,560 |

| Financial

position: |

September 30, 2022 |

December 31, 2021 |

| Total assets |

422,323 |

|

|

443,264 |

| Debt2 |

133,191 |

|

|

80,563 |

| Net Debt1 |

111,861 |

|

|

56,033 |

| Shareholders’ equity |

185,946 |

|

|

235,148 |

| Outstanding shares (#) * |

27,092,041 |

|

|

26,993,181 |

|

*27,092,041 at November 8, 2022 |

|

|

|

|

1 See Non-IFRS and Other Financial Measures.2

Debt as at September 30, 2022 and December 31, 2021 include lease

liabilities of $15,546 and $17,399, respectively.

Financial Results

Consolidated net sales for Q3 2022 decreased by

6.6% to $104,682 compared to the three-month period ended September

30, 2021 (“Q3 2021”). This decrease was primarily attributable to

ADG’s delivery of nitrile gloves to the U.S. Department for Health

and Human Services (“HHS”) in the prior year, partly offset by

increased sales at ARS across the majority of customer sectors.

Consolidated net sales for 2022 year-to-date increased by 6.5% to

$359,702 compared with 2021 year-to-date due to increased sales at

ARS across the majority of customer sectors, partially offset by

ADG's delivery of filters and nitrile gloves to HHS in the prior

year, and softer volumes in the AirBoss Engineered Products (“ARS”)

segment.

Consolidated gross profit for Q3 2022 decreased

by $72,813 to $(47,037), compared with Q3 2021, driven by a $57.0

million non-cash write-down at ADG related to nitrile glove

inventory, the delivery of nitrile gloves to HHS in 2021 and lower

volume at AEP, partially offset by strong improvement at ARS driven

by higher volumes. Consolidated gross profit for 2022 year-to-date

decreased by $85,490 to $(636) compared with 2021 year-to-date,

driven by the $57.0 million non-cash write-down at ADG related to

nitrile gloves, the delivery of filters and nitrile gloves to HHS

in 2021, the elimination of government-directed wage subsidies, and

margin compression at AEP due to labor, freight and raw material

increases, partially offset by significant improvements at ARS.

Adjusted EBITDA for Q3 2022 decreased by 90.9%

compared to Q3 2021 and decreased by 41.1% for the nine-month

period ended September 30, 2022 compared with the nine-month period

ended September 30, 2021.

Financial Position

The Company retains a $250 million credit

facility and a net debt to Adjusted EBITDA ratio of 1.92x (from

0.70x at December 31, 2021).

Dividend

The Board of Directors of the Company has

approved a quarterly dividend of C$0.10 per common share, to be

paid on January 16, 2023 to shareholders of record at December 30,

2022.

Segment Results

Net sales at ADG for Q3 2022 decreased by 54.9%

to $23,553, from $52,179 in Q3 2021 and by 26.4% to $113,354 for

2022 year-to-date, from $154,026 for 2021 year-to-date. The

decrease in Q3 2022 was primarily the result of the large HHS

nitrile patient examination contract in 2021 and the decrease

year-to-date was primarily the result of large HHS contracts

delivered in 2021. Gross profit at ADG for Q3 2022 decreased by

324.7% to $(51,299), from $22,827 in Q3 2021 and by 120.2% to

$(13,874), from $68,834 for 2021 year-to-date. In both cases, the

decreases were primarily the result of the one-time $57.0 million

inventory write-down, deliveries to HHS in 2021, partially offset

by favorable volume in ADG's industrial products line.

Net sales at ARS for Q3 2022 increased by 46.7%

to $58,484, from $39,861 in Q3 2021 and increased by 50.0% to

$178,371, from $118,937 for 2021 year-to-date. For Q3 2022, volume

was up 1.3%, with increases across many sectors despite continuing

supply chain challenges related to raw material supply and elevated

freight costs. Year-to-date, volume was up 7.8%, with increases

across the majority of sectors and continued ramp up of most

customer’s operations despite residual softness due to certain

economic headwinds. Tolling volume was down 50.3% for the quarter

and 3.5% year-to-date, while non-tolling volume was up 13.3% for

the quarter and 10.6% year-to-date. Gross profit at ARS for Q3 2022

increased by 96.1% to $8,370 (14.3% of net sales) from $4,268

(10.7% of net sales) in Q3 2021 and by 74.8% to $26,169 (14.7% of

net sales), from $14,967 (12.6% of net sales) for 2021

year-to-date. For the quarter, this increase was primarily the

result of improvement in non-tolling volume, raw material pass

through mechanisms and managing controllable overhead costs,

partially offset by labor challenges and logistics costs.

Year-to-date, this increase was primarily as a result of increased

non-tolling volumes compared to the same period in 2021, managing

controllable overhead costs, partially offset by labor and

logistics costs and a decrease in government-directed

subsidies.

Net sales at AEP for Q3 2022 increased by 3.0%

to $29,176, from $28,328 in Q3 2021 and decreased by 2.8% to

$85,857, from $88,312 for 2021 year-to-date. For the quarter, the

increase was due to a favourable mix in SUV, light truck and

mini-van platforms, partially offset by lower production of other

automotive platforms and certain molded defense products.

Year-to-date, the decrease was due to lower automotive volumes

across many platforms and specifically in SUV, light truck and

mini-van platforms compared to the same period in 2021 as the

automotive sector continued to manage volume volatility given the

challenges with global electronic chip shortages in addition to

freight and logistics constraints. Gross profit at AEP for Q3 2022

decreased to $(4,108) from $(1,319) in Q3 2021 and to $(12,931)

from $1,053 for 2021 year-to-date. For the quarter, this decrease

was primarily the result of lower volumes in part due to the

continued global electronic chip shortages in the automotive sector

combined with a slowing economy, continued raw material escalations

not passed on to customers and freight and logistics constraints

partially offset by a continued focus on controllable operational

cost containment. Year-to-date, this decrease was primarily the

result of a government-directed wage subsidy in 2021 and challenges

associated with global electronic chip shortages in the automotive

sector combined with raw material cost escalations, customer

indexing constraints, freight and logistics challenges and higher

related costs partially offset by a continued focus on controllable

operational cost containment and managing overhead costs.

Overview

The Company worked diligently to address the

impact of current economic conditions during the quarter, including

actions to mitigate on-going global freight, labor and logistics

challenges, as well as raw material price escalations. We remained

focused on operational execution, growth initiatives and key

investments, with strong traction for the quarter at ARS, ADG’s

continued focus on its opportunities pipeline, and continued

progress to address the related commercial impacts to AEP. The

Company remains committed to solidifying its position in the PPE,

health care and survivability sectors and supporting its customers,

employees and stakeholders.

Despite the challenges faced during this

quarter, the Company continued to exercise risk mitigation

initiatives within its supply chain, securing alternative raw

material sources and remaining focused on optimization of supply

chain strategies. Continued recovery of volumes remains subject to

the ongoing management of stable and sustained operations of

businesses globally, which remains complex and volatile,

specifically considering evolving and ongoing challenges such as

inflation pressure. Notwithstanding these challenges, including

further constraints on our supply chain for the foreseeable future

in the remainder of 2022 and into 2023, the Company believes it is

positioned to capture continued opportunities during the coming

quarters.

ADG remains focused on its survivability

solutions platform while targeting traditional defense contracts,

which could result in the execution of meaningful opportunities

over the next several years. In addition, ADG continues to work

with its key customers to leverage the opportunities in its

pipeline, which remains robust and is expected to support growth

initiatives, subject to timing as delays in the conversion of these

opportunities are expected to continue through the fourth quarter

of 2022. Management continues to believe that the future sourcing

of PPE for first responders and healthcare professionals will

remain a necessity and priority for front line workers, evidenced

by the strong pipeline of PPE-related opportunities that ADG is

currently pursuing.

ARS continued to see strong demand despite labor

constraints that adversely affected volume in the quarter. The

segment remains focused on optimizing its equipment capacity across

all its locations and executing on its strategy to deliver strong

results with specialized products, expanded production of a broader

array of compounds (white and color) and enhanced flexibility in

attracting and fulfilling new business through identified synergies

and margin expansion. ARS continues to leverage its scale and

global supply chain management expertise to manage ongoing

logistics and raw material risks while supporting new customers to

drive volume and growth. The segment also continue to focus on

research and development investments with its broad expertise to

support enhanced collaboration with customers to develop innovative

and proprietary technical solutions.

The AirBoss Engineered Products segment

continued to be impacted by labor and supply chain challenges and

significant raw material price increases including electronic chip

shortages impacting OEM production schedules. Management continues

to accelerate pricing strategies with its key customers to ensure a

fair and equitable path forward and is optimistic of results

materializing in the near term. The Company remains committed to

addressing key challenges in this segment including margin

improvement with targeted cost management, enhanced pricing

strategies with raw material indexing and by fully leveraging its

investments in advanced manufacturing. AEP also continued to focus

on its operational improvement plan with a heightened focus on

sustaining a stable hourly workforce while dealing with volume

reductions in the automotive sector, as well as focus on

diversification of its product lines into sectors adjacent to the

automotive space.

Despite the continued headwinds associated with

economic and geopolitical issues, the Company’s longer-term

priorities remain intact and include:

- Growing the core Rubber

Solutions segment by positioning it as a specialty

supplier of choice in the consolidating North American market, with

a growing focus on building defensible leadership positions in

selected compounds;

- Capitalizing on ADG’s

enhanced scale and capabilities to pursue an array of

growth and value-creation opportunities in the broader

survivability solutions segment serving both defense and first

responder markets;

- Driving improved

performance from Engineered Products through a combination

of disciplined cost containment, client relationship expansion, new

product development and sector diversification; and

- Targeting additional

acquisition opportunities across the business with a focus

on adding new compounds and products, technical capabilities, and

geographic reach into selected North American and international

markets.

As before, management remains dedicated to the

creation of long-term value for all stakeholders through a

combination of strategic initiatives that both drive organic growth

and support possible transactions.

Conference Call Details and Investor

Presentation

A conference call to discuss the quarterly

results is scheduled for 9:00 a.m. ET on Wednesday, November 9,

2022. Please go to https://www.gowebcasting.com/12233 or dial in to

the following numbers: 1-800-319-4610 or 416-915-3239, pass code:

55506. Please connect approximately 10 minutes prior to the call to

ensure participation. A replay of the conference call as well as

the Company’s updated investor presentation will also be made

available at: https://airboss.com/investor-media-center.

AirBoss of America Corp.

AirBoss of America is a leading and diversified

developer, manufacturer and provider of innovative survivability

solutions, advanced custom rubber compounds and finished rubber

products that are designed to outperform in the most challenging

environments. Founded in 1989, the company operates through three

divisions. AirBoss Defense Group is a global leader in personal and

respiratory protective equipment and technology for the defense,

healthcare, medical and first responder communities. AirBoss Rubber

Solutions is a top-tier North American custom rubber compounder

with 500 million turn pounds of annual capacity. AirBoss Engineered

Products is a supplier of innovative anti-vibration solutions to

the North American automotive market and other sectors. The

Company’s shares trade on the TSX under the symbol BOS and on the

OTCQX under the symbol ABSSF. Visit www.airboss.com for more

information.

Non-IFRS and Other Financial

Measures

This earnings release is based on financial

statements prepared in accordance with International Financial

Reporting Standards (“IFRS”) and Non-IFRS and Other Financial

Measures. Management believes that these measures provide useful

information to investors in measuring the financial performance of

the Company. These measures do not have a standardized meaning

prescribed by IFRS and therefore they may not be comparable to

similarly titled measures presented by other companies and should

not be construed as an alternative to other financial measures

determined in accordance with IFRS. These terms are not a measure

of performance under IFRS and should not be considered in isolation

or as a substitute for net income under IFRS.

EBITDA and Adjusted EBITDA are non-IFRS measures

used to measure the Company's ability to generate cash from

operations for debt service, to finance working capital and capital

expenditures, potential acquisitions and to pay dividends. EBITDA

is defined as earnings before income taxes, finance costs,

depreciation, amortization, and impairment costs. Adjusted EBITDA

is defined as EBITDA excluding acquisition costs, and non-recurring

costs. A reconciliation of Profit to EBITDA and Adjusted EBITDA is

below.

| |

Three-months ended September 30 |

Nine-months ended September 30 |

|

|

(unaudited) |

(unaudited) |

|

In thousands of US dollars |

2022 |

2021 |

2022 |

2021 |

|

EBITDA: |

|

|

|

|

| Profit (loss) |

(55,957) |

6,902 |

(43,889) |

31,541 |

| Finance costs |

1,282 |

1,740 |

3,767 |

3,421 |

| Depreciation, amortization and

impairment |

5,412 |

4,885 |

16,401 |

14,378 |

| Income

tax expense (recovery) |

(7,131) |

225 |

(2,518) |

3,716 |

|

EBITDA |

(56,394) |

13,725 |

(26,239) |

53,056 |

| Write-down of inventory |

57,001 |

— |

57,001 |

— |

| AFP professional fees |

664 |

— |

676 |

— |

| Prospectus and acquisition

fees |

— |

170 |

— |

324 |

|

Adjusted EBITDA |

1,271 |

13,922 |

31,438 |

53,380 |

Adjusted profit is a non-IFRS measure defined as

profit before acquisition costs and non-recurring costs. This

measure and Adjusted earnings per share are used to evaluate

operating results of the Company. A reconciliation of Profit to

Adjusted profit and Adjusted earnings per share is below.

| |

Three-months ended September 30 |

Six-months ended September 30 |

|

|

(unaudited) |

(unaudited) |

|

In thousands of US dollars |

2022 |

2021 |

2022 |

2021 |

|

Adjusted profit: |

|

|

|

|

| Profit (loss) |

(55,957) |

6,902 |

(43,889) |

31,541 |

| Write-down of inventory |

43,606 |

— |

43,606 |

— |

| AFP professional fees |

508 |

— |

517 |

— |

| Prospectus and acquisition

fees |

— |

138 |

— |

292 |

|

Adjusted profit |

(11,843) |

7,040 |

234 |

31,833 |

|

|

|

|

|

|

| Basic weighted average number

of shares outstanding |

27,092 |

26,985 |

27,063 |

26,964 |

| Diluted weighted average

number of shares outstanding |

27,092 |

28,370 |

27,063 |

28,305 |

| |

|

|

|

|

| Adjusted earnings per share

(in US dollars):Basic |

(0.44) |

0.26 |

0.01 |

1.18 |

| Diluted |

(0.44) |

0.25 |

0.01 |

1.12 |

Net Debt measures the financial indebtedness of

the Company assuming that all cash on hand is used to repay a

portion of the outstanding debt. A reconciliation of loans and

borrowings to Net Debt is below.

|

|

September 30, 2022 |

December 31, 2021 |

| In

thousands of US dollars |

(unaudited) |

|

|

Net debt: |

|

|

| Loans and borrowings -

current |

2,259 |

2,356 |

| Loans and borrowings -

non-current |

130,932 |

78,207 |

| Leases included in loans and

borrowings |

(15,546) |

(17,399) |

| Cash

and cash equivalents |

(5,784) |

(7,131) |

|

Net debt |

111,861 |

56,033 |

Free cash flow is a non-IFRS measure used to

evaluate cash flow after investing in the maintenance or expansion

of the Company's business. It is defined as cash provided by

operating activities, less cash expenditures on long-term assets. A

reconciliation of cash from operating activities to free cash flow

is below.

| |

Three-months ended September 30 |

Nine-months ended September 30 |

|

|

(unaudited) |

(unaudited) |

|

In thousands of US dollars |

2022 |

2021 |

2022 |

2021 |

|

Free cash flow: |

|

|

|

|

| Net cash provided by (used in)

operating activities |

(15,847) |

(125,723) |

(38,655) |

(136,392) |

| Acquisition of property, plant

and equipment |

(2,374) |

(4,559) |

(6,131) |

(12,302) |

| Acquisition of intangible

assets |

(304) |

(165) |

(839) |

(706) |

| Proceeds from disposition |

— |

3 |

— |

9 |

|

Free cash flow |

(18,525) |

(130,444) |

(45,625) |

(149,391) |

| Basic weighted average number

of shares outstanding |

27,092 |

26,985 |

27,063 |

26,964 |

| Diluted weighted average

number of shares outstanding |

27,092 |

26,985 |

27,063 |

26,964 |

| Free cash flow per share (in

US dollars): |

|

|

|

|

|

Basic |

(0.68) |

(4.83) |

(1.69) |

(5.54) |

|

Diluted |

(0.68) |

(4.83) |

(1.69) |

(5.54) |

AIRBOSS FORWARD LOOKING INFORMATION

DISCLAIMER

Certain statements contained or incorporated by

reference herein, including those that express management’s

expectations or estimates of future developments or AirBoss’ future

performance, constitute “forward-looking information” or

“forward-looking statements” within the meaning of applicable

securities laws, and can generally be identified by words such as

“will”, “may”, “could” “expects”, “believes”, “anticipates”,

“forecasts”, “plans”, “intends” or similar expressions. These

statements are not historical facts but instead represent

management’s expectations, estimates and projections regarding

future events and performance.

Statements containing forward-looking

information are necessarily based upon a number of opinions,

estimates and assumptions that, while considered reasonable by

management at the time the statements are made, are inherently

subject to significant business, economic and competitive risks,

uncertainties and contingencies. AirBoss cautions that such

forward-looking information involves known and unknown

contingencies, uncertainties and other risks that may cause

AirBoss’ actual financial results, performance or achievements to

be materially different from its estimated future results,

performance or achievements expressed or implied by the

forward-looking information. Numerous factors could cause actual

results to differ materially from those in the forward-looking

information, including without limitation: impact of general

economic conditions, notably including its impact on demand for

rubber solutions and products; dependence on key customers; global

defense budgets, notably in the Company’s target markets, and

success of the Company in obtaining new or extended defense

contracts; cyclical trends in the tire and automotive,

construction, mining and retail industries; sufficient availability

of raw materials at economical costs; weather conditions affecting

raw materials, production and sales; AirBoss’ ability to maintain

existing customers or develop new customers in light of increased

competition; AirBoss’ ability to successfully integrate

acquisitions of other businesses and/or companies or to realize on

the anticipated benefits thereof; changes in accounting policies

and methods, including uncertainties associated with critical

accounting assumptions and estimates; changes in the value of the

Canadian dollar relative to the US dollar; changes in tax laws and

potential litigation; ability to obtain financing on acceptable

terms; environmental damage and non-compliance with environmental

laws and regulations; impact of global health situations; potential

product liability and warranty claims and equipment malfunction.

COVID-19 could also negatively impact the Company’s operations and

financial results in future periods. There is increased uncertainty

associated with future operating assumptions and expectations as

compared to prior periods. As such, it is not possible to estimate

the impacts COVID-19 will have on the Company’s financial position

or results of operations in future periods. While the direct

impacts of COVID-19 are not determinable at this time, the Company

has a credit facility that can provide financing up to $250

million. This list is not exhaustive of the factors that may affect

any of AirBoss’ forward-looking information.

All of the forward-looking information in this

press release is expressly qualified by these cautionary

statements. Investors are cautioned not to put undue reliance on

forward-looking information. All subsequent written and oral

forward-looking information attributable to AirBoss or persons

acting on its behalf are expressly qualified in their entirety by

this notice. Forward-looking information contained herein is made

as of the date of this Interim Report and, whether as a result of

new information, future events or otherwise, AirBoss disclaims any

intent or obligation to update publicly the forward-looking

information except as required by applicable laws. Risks and

uncertainties about AirBoss’ business are more fully discussed

under the heading “Risk Factors” in our most recent Annual

Information Form and are otherwise disclosed in our filings with

securities regulatory authorities which are available on SEDAR at

www.sedar.com.

Investor Contact: Chris Bitsakakis, President or Gren Schoch, CEO at 905-751-1188.

Media Contact: media@airboss.com

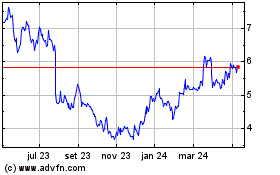

AirBoss of America (TSX:BOS)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

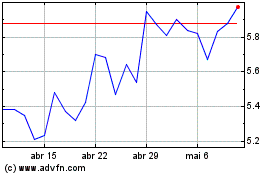

AirBoss of America (TSX:BOS)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025