AbraSilver Announces Closing of C$10M Bought Deal Private Placement

06 Dezembro 2022 - 11:07AM

AbraSilver Resource Corp. (“

AbraSilver” or the

“

Company”) (TSXV: ABRA; OTCQX: ABBRF) is pleased

to announce that it has closed its previously announced

underwritten private placement financing (the “Offering”),

including the exercise in full of the underwriters’ option.

Pursuant to the Offering, the Company issued an aggregate of

27,027,000 units (the “Units”) for gross proceeds of $9,999,990.

Each Unit, priced at $0.37 per Unit (the “Issue

Price”), consists of one common share in the capital of the Company

(each, a “Common Share”) and one-half of one Common Share purchase

warrant (each whole warrant, a “Warrant”). Each Warrant entitles

the holder thereof to purchase one additional Common Share at an

exercise price of $0.50 until December 6, 2024.

The Company intends to use the net proceeds of

the Offering: (i) to complete the ongoing Phase III drilling

program on the Diablillos Project in the Salta province of

Argentina; (ii) to commence and complete a drilling program on the

La Coipita Project in the San Juan province of Argentina; (iii) to

satisfy the Company’s mineral interest commitments for the

Diablillos Project and the La Coipita Project; and (iv) for working

capital purposes, as further described in the Company’s offering

document under the Listed Issuer Financing Exemption dated November

29, 2022.

The Offering was led by a syndicate of

underwriters, with Eight Capital acting as lead underwriter and

sole bookrunner and including National Bank Financial Inc., Clarus

Securities Inc., and Stifel GMP (collectively, the “Underwriters”).

In connection with the Offering, the Underwriters received an

aggregate cash commission in the amount of approximately $565,000

and an aggregate of 1,527,075 non-transferable broker warrants

(each, a “Broker Warrant”). Each Broker Warrant entitles the holder

thereof to acquire one Unit at an exercise price of $0.37 until

June 6, 2024.

The Offering was completed pursuant to the

Listed Issuer Financing Exemption (as defined in National

Instrument 45-106 – Prospectus Exemptions), and the securities

issued to purchasers in the Offering are not subject to a hold

period pursuant to applicable Canadian securities laws.

The Offering is subject to the final approval of

the TSX Venture Exchange (the “Exchange”). The securities issued to

certain insiders of the Company in the Offering are subject to a

four-month hold period ending on April 7, 2023 in accordance with

the policies of the Exchange.

Certain directors of the Company participated in

the Offering and purchased an aggregate of 190,000 Units. The

insider participation in the Offering constitutes a related party

transaction pursuant to Multilateral Instrument 61-101 – Protection

of Minority Security Holders in Special Transactions (“MI

61-101”).

The Company has relied on exemptions from the

formal valuation and minority shareholder approval requirements of

MI 61-101 contained in sections 5.5(a) and 5.7(1)(a) of MI 61- 101

in respect of related party participation in the Offering as

neither the fair market value (as determined under MI 61-101) of

the subject matter of, nor the fair market value of the

consideration for, the transaction, insofar as it involved related

parties, exceeded 25% of the Company’s market capitalization as

determined under MI 61-101.

Advisors

Dentons Canada LLP acted as counsel to the

Company. Borden Ladner Gervais LLP acted as counsel to the

Underwriters.

About

AbraSilver

AbraSilver is an advanced-stage exploration

company focused on rapidly advancing its 100%-owned Diablillos

silver-gold project in the mining-friendly Salta province of

Argentina. The current Measured and Indicated Mineral Resource

estimate for Diablillos consists of 51.3 Mt grading 66g/t Ag and

0.79g/t Au, containing approximately 109Moz silver and 1.3Moz gold,

with significant further upside potential based on recent

exploration drilling. The Company is led by an experienced

management team and has long-term supportive shareholders including

Mr. Eric Sprott. In addition, AbraSilver owns a portfolio of

earlier-stage copper-gold projects including the La Coipita

copper-gold project in the San Juan province of Argentina.

AbraSilver is listed on the TSX-V under the symbol “ABRA” and in

the U.S. under the symbol “ABBRF”.

For further information please visit the

AbraSilver Resource website at www.abrasilver.com, our LinkedIn

page at AbraSilver Resource Corp., and follow us on Twitter at

www.twitter.com/abrasilver

Alternatively please contact:

John Miniotis, President and CEO

info@abrasilver.comTel: +1 416-306-8334

Cautionary Note Regarding

Forward-Looking Information

This news release includes certain

“forward-looking statements” under applicable Canadian securities

legislation, including statements related to the use of proceeds.

Forward-looking statements are necessarily based upon a number of

estimates and assumptions that, while considered reasonable, are

subject to known and unknown risks, uncertainties, and other

factors which may cause the actual results and future events to

differ materially from those expressed or implied by such

forward-looking statements. All statements that address future

plans, activities, events or developments that the Company

believes, expects or anticipates will or may occur are

forward-looking information. There can be no assurance that such

statements will prove to be accurate, as actual results and future

events could differ materially from those anticipated in such

statements. Accordingly, readers should not place undue reliance on

forward-looking statements. When considering this forward-looking

information, readers should keep in mind the risk factors and other

cautionary statements in the Company’s disclosure documents filed

with the applicable Canadian securities regulatory authorities on

SEDAR at www.sedar.com. The risk factors and other factors noted in

the disclosure documents could cause actual events or results to

differ materially from those described in any forward-looking

information. The Company disclaims any intention or obligation to

update or revise any forward-looking statements, whether as a

result of new information, future events or otherwise, except as

required by law.

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this news release.

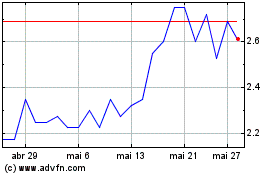

Abra Silver Resource (TSXV:ABRA)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Abra Silver Resource (TSXV:ABRA)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024