Altitude Acquisition Corp. Announces Letter of Intent for a Business Combination with a Leading Global Medical Device Manufacturer

09 Dezembro 2022 - 11:00AM

Altitude Acquisition Corp. (“Altitude”) (NASDAQ:ALTU) a

publicly traded special purpose acquisition company (SPAC), today

announced the signing of a non-binding letter-of-intent (“LOI”) for

a business combination with a leading global medical device

manufacturer (the “Target”).

The Target, a leader in its medical device field with a product

that is commercially available and approved for use in over 30

countries, seeks additional expansion in the U.S. and globally.

Under the terms of the LOI, Altitude and the Target would be

become a combined entity, with the Target’s existing equity holders

rolling 100% of their equity into the combined public company. The

proposed transaction values the Target at an enterprise value of

$480 million and calls for the combined company to have at least

$30 million in net cash at the time of closing. Altitude expects to

announce additional details regarding the proposed business

combination when a definitive merger agreement is executed, which

is expected in the first quarter of 2023.

Completion of a business combination with the Target is subject

to, among other matters, the completion of due diligence, the

negotiation of a definitive agreement providing for the

transaction, satisfaction of the conditions negotiated therein and

approval of the transaction by the board and stockholders of both

Altitude and the Target . There can be no assurance that a

definitive agreement will be entered into or that the proposed

transaction will be consummated on the terms or timeframe currently

contemplated, or at all.

About Altitude Acquisition Corp.

Altitude Acquisition Corp. (Nasdaq: ALTUU, ALTU, ALTUW) is a

blank check company incorporated as a Delaware corporation for the

purpose of effecting a merger, capital stock exchange, asset

acquisition, stock purchase, reorganization or similar business

combination with one or more businesses or entities.

Additional Information and Where to Find It

If a legally binding definitive agreement with respect to the

proposed business combination is executed, Altitude intends to file

with the U.S. Securities and Exchange Commission’s (the “SEC”) a

registration statement on Form S-4, which will include a

preliminary proxy statement/prospectus (a “Proxy

Statement/Prospectus”). A definitive Proxy Statement/Prospectus

will be mailed to Altitude’s stockholders as of a record date to be

established for voting on the proposed transaction. Stockholders

will also be able to obtain copies of the Proxy

Statement/Prospectus, without charge, at the SEC’s website at

www.sec.gov or by directing a request to: Altitude Acquisition

Corp., 400 Perimeter Center Terrace Suite 151, Atlanta, GA

30346.

This communication may be deemed to be offering or solicitation

material in respect of the proposed transaction, which will be

submitted to the stockholders of Altitude for their consideration.

Altitude urges investors, stockholders and other interested persons

to carefully read, when available, the preliminary and definitive

Proxy Statement/Prospectus as well as other documents filed with

the SEC (including any amendments or supplements to the Proxy

Statement/Prospectus, as applicable), in each case, before making

any investment or voting decision with respect to the proposed

transaction, because these documents will contain important

information about Altitude, the Target and the proposed

transaction.

Participants in the Solicitation

Altitude and its directors and executive officers may be

considered participants in the solicitation of proxies with respect

to the proposed transaction described herein under the rules of the

SEC. Information about the directors and executive officers of

Altitude and a description of their interests in Altitude and the

proposed transaction are set forth in Altitude’s Annual Report on

Form 10-K for the year ended December 31, 2021,

which was filed with the SEC on Mach 29, 2022 (as amended on August

23, 2022, the “Annual Report”) and the Proxy Statement/Prospectus,

when it is filed with the SEC. These documents can be obtained free

of charge from the sources indicated above.

No Offer or Solicitation

This release shall not constitute a solicitation

of a proxy, consent, or authorization with respect to any

securities or in respect of any business combination. This release

shall not constitute an offer to sell or the solicitation of an

offer to buy any securities, nor shall there be any sale of

securities in any states or jurisdictions in which such offer,

solicitation, or sale would be unlawful prior to registration or

qualification under the securities laws of any such jurisdiction.

No offering of securities shall be made except by means of a

prospectus meeting the requirements of Section 10 of the Securities

Act of 1933, as amended, or an exemption therefrom.

Forward-Looking Statements

Certain statements made in this release are “forward looking

statements” within the meaning of the “safe harbor” provisions of

the United States Private Securities Litigation Reform Act of 1995.

When used in this release, the words “estimates,” “projected,”

“expects,” “anticipates,” “forecasts,” “plans,” “intends,”

“believes,” “seeks,” “may,” “will,” “should,” “future,” “propose”

and variations of these words or similar expressions (or the

negative versions of such words or expressions) are intended to

identify forward-looking statements. These forward-looking

statements are not guarantees of future performance, conditions or

results, and involve a number of known and unknown risks,

uncertainties, assumptions and other important factors, many of

which are outside Altitude’s control, that could cause actual

results or outcomes to differ materially from those discussed in

the forward-looking statements. Important factors, among others,

that may affect actual results or outcomes include: the inability

of Altitude to enter into a definitive agreement with respect to an

initial business combination with the Target within the time

provided in Altitude’s amended and restated certificate of

incorporation; performance of the Target’s business; the risk that

the approval of the stockholders of Altitude for the proposed

transaction is not obtained; failure to realize the anticipated

benefits of the proposed transaction, including as a result of a

delay in consummating the proposed transaction; the amount of

redemption requests made by Altitude’s stockholders and the amount

of funds remaining in Altitude’s trust account after satisfaction

of such requests; Altitude’s and the Target’s ability to satisfy

the conditions to closing the proposed transaction; and those

factors discussed in the Annual Report under the heading “Risk

Factors,” and other documents of Altitude filed, or to be filed,

with the SEC. Altitude does not undertake any obligation to update

or revise any forward-looking statements, whether as a result of

new information, future events or otherwise, except as required by

law.

Contact

Cody Slach or Matthew

HauschGatewayALTU@gatewayir.com949-574-3860

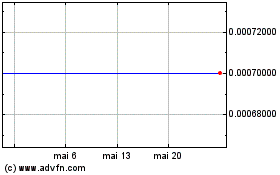

Altitude Acquisition (NASDAQ:ALTUW)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

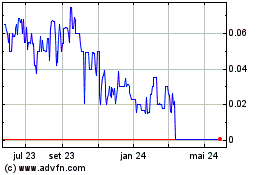

Altitude Acquisition (NASDAQ:ALTUW)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025