Ninepoint Partners Announces Estimated Annual 2022 Capital Gains Distributions for ETF Series Securities

16 Dezembro 2022 - 7:35PM

Ninepoint Partners LP (“Ninepoint Partners”) today announced the

estimated annual 2022 capital gains distributions for its ETF

Series securities. Ninepoint Partners expects to announce the final

year-end distribution amounts on or about December 21, 2022. The

record date for the distributions is December 30, 2022 All

distributions are payable on January 9, 2023.

The per-unit estimated distributions are detailed below:

|

Ninepoint ETF Series |

Ticker |

Estimated Notional CapitalGain Distribution per

unit |

CUSIP |

|

Ninepoint Energy Fund |

NNRG |

$4.89 |

65443T203 |

NOTE: All estimates in this document do not

incorporate forward looking information and are based on the

accounting data as of November 1, 2022. Due to the market

conditions, the actual year end allocable amount may differ from

these estimates and the difference could be material. The

information included in this letter is for reference purposes only.

Please reconcile all information against your official client

statements. This is not intended to be a statement for official tax

reporting purposes or any form of tax advice. NNRG.U will pay the

$USD equivalent of the NNRG capital gain distribution.

Ninepoint Partners confirms that as of November 1, 2022, the

following Funds are not expected to have annual capital gains

distributions for the 2022 tax year:

Ninepoint High Interest Savings Fund (ETF Series)Ninepoint

Alternative Credit Opportunities Fund (ETF Series)Ninepoint

Diversified Bond Fund (ETF Series)Ninepoint Target Income Fund (ETF

Series)Ninepoint Alternative Health Fund (ETF Series)Ninepoint

Carbon Credit ETF (ETF Series)Ninepoint Energy Income Fund (ETF

Series)Ninepoint Gold & Precious Minerals Fund (ETF

Series)Ninepoint Silver Equities Fund (ETF Series)Ninepoint Bitcoin

ETF

About Ninepoint Partners

Based in Toronto, Ninepoint Partners is one of

Canada’s leading alternative investment management firms overseeing

$8.2 billion in assets under management and institutional

contracts. Committed to helping investors explore innovative

investment solutions that have the potential to enhance returns and

manage portfolio risk, Ninepoint offers a diverse set of

alternative strategies spanning Equities, Fixed Income, Alternative

Income, Real Assets, F/X and Digital Assets.

For more information on Ninepoint Partners LP,

please visit www.ninepoint.com or for inquiries regarding the

offering, please contact us at (416) 943-6707 or (866) 299-9906 or

invest@ninepoint.com.

Ninepoint Partners LP is the investment manager

to the Ninepoint Funds (collectively, the “Funds”). Commissions,

trailing commissions, management fees, performance fees (if any),

and other expenses all may be associated with investing in the

Funds. Please read the prospectus carefully before investing. The

information contained herein does not constitute an offer or

solicitation by anyone in the United States or in any other

jurisdiction in which such an offer or solicitation is not

authorized or to any person to whom it is unlawful to make such an

offer or solicitation. Prospective investors who are not resident

in Canada should contact their financial advisor to determine

whether securities of the Fund may be lawfully sold in their

jurisdiction.

Please note that distribution factors (breakdown

between income, capital gains and return of capital) can only be

calculated when a fund has reached its year-end. Distribution

information should not be relied upon for income tax reporting

purposes as this is only a component of total distributions for the

year. For accurate distribution amounts for the purpose of filing

an income tax return, please refer to the appropriate T3/T5 slips

for that particular taxation year. Please refer to the prospectus

or offering memorandum of each Fund for details of the Fund’s

distribution policy.

The payment of distributions and distribution

breakdown, if applicable, is not guaranteed and may fluctuate. The

payment of distributions should not be confused with a Fund's

performance, rate of return, or yield. If distributions paid by the

Fund are greater than the performance of the Fund, then an

investor’s original investment will shrink. Distributions paid as a

result of capital gains realized by a Fund and income and dividends

earned by a Fund are taxable in the year they are paid. An

investor’s adjusted cost base will be reduced by the amount of any

returns of capital. If an investor’s adjusted cost base goes below

zero, then capital gains tax will have to be paid on the amount

below zero.

Sales Inquiries:

Ninepoint Partners LPNeil

Ross416-945-6227nross@ninepoint.com

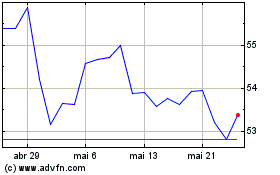

Ninepoint Energy (NEO:NNRG)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Ninepoint Energy (NEO:NNRG)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024