Arras Minerals Corp. (TSX-V: ARK) (“Arras” or “the

Company”) is pleased to announce that it has closed the

previously announced non-brokered private placement that was

upsized on November 21, 2022 due to strong investor demand.

The Company sold an aggregate 15,938,250 common

shares at C$0.45 per share (the “Placement”) for

gross proceeds of C$7.17 million.

In connection with the Private Placement, the

Company paid finders’ fees in cash on a portion of the Private

Placement in the amount of C$84,432.

The common shares were offered by way of

prospectus exemptions in Canada and the common shares

sold in the Placement will be subject to a hold period of four

months plus one day.

A portion of the Private Placement is considered

a “related party transaction” within the meaning of Multilateral

Instrument 61-101 – Protection of Minority Security Holders in

Special Transactions (“MI 61-101”). The “related

party” portion of the Private Placement is exempt from the minority

approval requirement of Section 5.6 and the formal valuation

requirement of Section 5.4 of MI 61-101 as the board has determined

that neither the fair market value of the “related party” portion

of the Private Placement nor the fair market value of the

consideration for the “related party” portion of the Private

Placement exceeds 25% of the Company’s market capitalization.

The proceeds of the Placement will be used to

advance exploration activities at the Company’s projects in

Northeastern Kazakhstan and for general corporate purposes.

About the Beskauga Deposit: The

Beskauga deposit is a gold-copper-silver deposit with an

“Indicated” Mineral Resource of 111.2 million tonnes grading 0.49

g/t gold, 0.30% copper, and 1.3 g/t silver for 1.75 million ounces

of contained gold, 333.6 thousand tonnes of contained copper, and

4.79 million ounces of contained silver and an “Inferred” Mineral

Resource of 92.6 million tonnes grading 0.50 g/t gold, 0.24% copper

and 1.1 g/t silver for 1.49 million ounces of contained gold, 222.2

thousand tonnes of contained copper, and 3.39 million ounces of

contained silver. The constraining open pit was optimized and

calculated using a Gross Metal Value (“GMV”) cut-off of $20/tonne

based on a price of $1,750/oz for gold, $3.50/lb for copper, $22/oz

for silver, and with an average recovery of 85% for copper and

74.5% for gold and 50.0% for silver.

Based on exploration undertaken to date, the

Beskauga deposit is interpreted by Arras to represent a gold-rich

porphyry copper-gold deposit that has been overprinted by

high-sulfidation epithermal mineralization, either through

telescoping or due to clustering of multiple porphyry centers

within the Beskauga license that have superimposed alteration and

mineralization upon earlier phases. Beskauga is located within the

highly under-explored Bozshakol-Chingiz Volcanic Arc, which hosts

KAZ Minerals’ Bozshakol porphyry Cu-Au mine only 130 km west of

Beskauga. Bozshakol is one of the largest copper resources in

Kazakhstan with 1.123 billion tonnes at 0.35% Cu, 0.14 g/t Au and

1.0 g/t Ag in Measured and Indicated Resources. The mine has 30

Mtpa ore processing capacity and a remaining mine life of >40

years.

Arras has an Option to Purchase Agreement

(“Option Agreement”) in place on the Beskauga Project with

Copperbelt AG (“Copperbelt”), a private mineral exploration company

registered in Zug, Switzerland. The Option to Purchase agreement

was executed on January 26, 2021.

Qualified Person: The

scientific and technical disclosure for the Beskauga Project

included in this news release has been prepared under supervision

of and approved by Joshua Hughes MESci (Hons), Vice President

Exploration, and a full-time employee of Arras Minerals Corp., who

is also a Member and Chartered Professional Geologist (MAusIMM

CP(Geo)) of the Australasian Institute of Mining and Metallurgy, a

Fellow of the Society of Economic Geologists (FSEG) and a Fellow of

the Geological Society of London (FGS). Mr. Hughes has sufficient

experience, relevant to the styles of mineralization and type of

deposits under consideration and to the activity that he is

undertaking, to qualify as a Qualified Person (“QP”) for the

purposes of National Instrument 43-101 Standards of Disclosure of

Mineral Projects (“NI 43-101”).

On behalf of the Board of Directors “Tim Barry”

Tim BarryCEO and Director

INVESTOR RELATIONS: +1 604 687 5800

info@arrasminerals.com

Further information can be found on the Company’s website

https://www.arrasminerals.com or follow us on LinkedIn:

https://www.linkedin.com/company/arrasminerals or on twitter:

https://twitter.com/arrasminerals

About Arras Minerals Corp.

Arras is a Canadian exploration and development

company advancing a portfolio of copper and gold assets in

northeastern Kazakhstan, including the Option Agreement on the

Beskauga copper and gold project. The company’s shares are listed

on the TSX-V under the trading symbol “ARK”.

Cautionary Note to U.S. Investors

concerning estimates of Measured, Indicated, and Inferred

Resources: This press release uses the terms “measured

resources”, “indicated resources”, and “inferred resources” which

are defined in, and required to be disclosed by, NI 43-101. The

Company advises U.S. investors that these terms are not recognized

by the SEC. The estimation of measured, indicated and inferred

resources involves greater uncertainty as to their existence and

economic feasibility than the estimation of proven and probable

reserves. U.S. investors are cautioned not to assume that measured

and indicated mineral resources will be converted into reserves.

The estimation of inferred resources involves far greater

uncertainty as to their existence and economic viability than the

estimation of other categories of resources. U.S. investors are

cautioned not to assume that estimates of inferred mineral

resources exist, are economically minable, or will be upgraded into

measured or indicated mineral resources. Under Canadian securities

laws, estimates of inferred mineral resources may not form the

basis of feasibility or other economic studies.

Disclosure of “contained ounces” in a resource

is permitted disclosure under Canadian regulations, however the SEC

normally only permits issuers to report mineralization that does

not constitute “reserves” by SEC standards as in place tonnage and

grade without reference to unit measures. Accordingly, the

information contained in this press release may not be comparable

to similar information made public by U.S. companies that are not

subject NI 43-101.

Cautionary note regarding

forward-looking statements: This news release contains

forward-looking statements regarding future events and Arras’

future results that are subject to the safe harbors created under

the U.S. Private Securities Litigation Reform Act of 1995, the

Securities Act of 1933, as amended, and the Exchange Act, and

applicable Canadian securities laws. Forward-looking statements

include, among others, statements regarding the use of net proceeds

from the recent private placement, plans and expectations of the

drill program Arras is in the process of undertaking, including the

expansion of the Mineral Resource, and other aspects of the Mineral

Resource estimates for the Beskauga project. These statements are

based on current expectations, estimates, forecasts, and

projections about Arras’ exploration projects, the industry in

which Arras operates and the beliefs and assumptions of Arras’

management. Words such as “expects,” “anticipates,” “targets,”

“goals,” “projects,” “intends,” “plans,” “believes,” “seeks,”

“estimates,” “continues,” “may,” variations of such words, and

similar expressions and references to future periods, are intended

to identify such forward-looking statements. Forward-looking

statements are subject to a number of assumptions, risks and

uncertainties, many of which are beyond management’s control,

including undertaking further exploration activities, the results

of such exploration activities and that such results support

continued exploration activities, unexpected variations in ore

grade, types and metallurgy, volatility and level of commodity

prices, the availability of sufficient future financing, and other

matters discussed under the caption “Risk Factors” in the

Non-Offering Prospectus filed on the Company’s profile on SEDAR on

May 31, 2022 and in the Company’s Annual Report on Form 20-F for

the fiscal year ended October 31, 2021 filed with the U.S.

Securities and Exchange Commission filed on February 17, 2022

available on www.sec.gov. Readers are cautioned that

forward-looking statements are not guarantees of future performance

and that actual results or developments may differ materially from

those expressed or implied in the forward-looking statements. Any

forward-looking statement made by the Company in this release is

based only on information currently available and speaks only as of

the date on which it is made. The Company undertakes no obligation

to publicly update any forward-looking statement, whether written

or oral, that may be made from time to time, whether as a result of

new information, future developments, or otherwise.

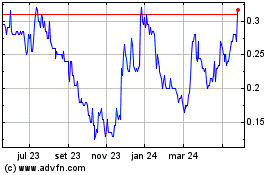

Arras Minerals (TSXV:ARK)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

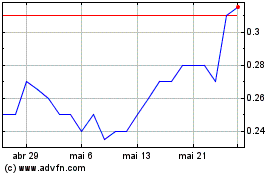

Arras Minerals (TSXV:ARK)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025