Centerra Gold Inc. (“Centerra” or the “Company”) (TSX: CG and NYSE:

CGAU) reports 2022 fourth quarter and full-year production, 2023

production and cost guidance for the Mount Milligan Mine and

provides an update on operations at the Öksüt Mine.

All figures are in United States dollars. All

production figures reflect payable metal quantities and are on a

100%-basis, unless otherwise stated. For references denoted with

NG, refer to the “Non-GAAP and Other Financial Measures” disclosure

at the end of this news release for a description of these

measures.

2022 Fourth Quarter and Annual

Production Highlights

- Gold production in the

fourth quarter of 2022 was 53,222 ounces

solely from the Mount Milligan Mine.

- Full year 2022 gold

production was 243,868 ounces, including

189,177 ounces of gold produced by the Mount Milligan Mine and

54,691 ounces produced by the Öksüt Mine. Additionally,

approximately 100,000 recoverable ounces was processed into

gold-in-carbon form in 2022 and remains stored at the Öksüt

Mine.

- Copper production was 16.9

million pounds in the fourth quarter and 73.9 million pounds for

the full year 2022.

2023 Mount Milligan Mine Guidance

Highlights

- 2023 guidance at the Mount

Milligan Mine is expected as follows:

- Gold production of

160,000 to 170,000 ounces.

- Copper production

of 60 to 70 million pounds.

- Gold production costs per

ounce - $900 to $950.

- All-in sustaining costs

(“AISC”) on a by-product basis per

ounceNG - $1,075 to

$1,125.

- All-in costs (“AIC”) on a

by-product basis per ounceNG - $1,125 to $1,175.

- Additions to

PP&E - $65 to $70 million.

- Total capital

expendituresNG

- $65 to $70 million.

Update on Öksüt Mine

Operations

Gold doré bar production remains suspended at

the Öksüt Mine due to mercury detected in the gold room at the ADR

plant in March 2022. The Company is currently completing

construction of a mercury abatement system to allow processing of

mercury bearing ores and is scheduled to be completed in late

January. The total capital costs are on target at approximately $5

million. The Company is working with the relevant authorities for

the required approvals to restart gold room operations at the ADR

plant, which the Company expects will occur shortly after the new

Environment Impact Assessment (“EIA”) for the Öksüt Mine is

approved.

The Company recently submitted its updated EIA.

The Company is now working with Turkish officials on the regulatory

review and approval of its EIA and such other permits that may be

required to allow a timely full restart of all operations.

The Company is also engaged in other ordinary

course permitting matters and in January 2023 it received notices

of approval of its operating license extension application for a

period of 10 years as well as approval of an enlarged grazing land

permit to allow expansion of the Keltepe and Güneytepe pits as

planned.

Paul Wright, Interim President and Chief

Executive Officer of Centerra, said: “Record annual mill throughput

highlighted the Mount Milligan Mine’s operating performance in

2022. We anticipate steady production at Mount Milligan in 2023,

with management continuing to focus on optimizing the life of mine

plan for future years. Cost guidance for the Mount Milligan Mine in

2023 includes the inflationary impact on costs that were prevalent

globally through 2022. I am also pleased to report that we have

received a 10-year operating license extension for the Öksüt Mine,

in addition to the approval of an enlarged grazing land permit.

Construction of the mercury abatement system is substantially

complete and we are working with the applicable Turkish officials

on their review and approval of the updated EIA.”

Mount Milligan Mine 2023

Guidance

|

|

|

Guidance |

Actuals |

|

|

Units |

2023 |

Q3 YTD 2022 |

Q4 2022 |

2022 |

|

Production |

|

|

|

|

|

|

Unstreamed gold production |

|

104-111 |

88 |

35 |

123 |

|

Streamed gold production |

|

56-59 |

48 |

18 |

66 |

|

Gold production(1)(2) |

(Koz) |

160-170 |

136 |

53 |

189 |

|

Unstreamed copper production |

|

49-57 |

46 |

14 |

60 |

|

Streamed copper production |

|

11-13 |

11 |

3 |

14 |

|

Copper production(1)(2) |

(Mlb) |

60-70 |

57 |

17 |

74 |

|

Costs(3) |

|

|

|

|

|

| Gold

production costs |

($/oz) |

900-950 |

759 |

- |

- |

| AISC on a

by-product basisNG |

($/oz) |

1,075-1,125 |

629 |

- |

- |

| AIC on a

by-product basisNG |

($/oz) |

1,125-1,175 |

713 |

- |

- |

| AISC on a

co-product basisNG |

($/oz) |

1,150-1,200 |

958 |

- |

- |

| Copper

production costs |

($/lb) |

1.90-2.15 |

1.63 |

- |

- |

|

AISC on a co-product basisNG |

($/lb) |

2.75-3.00 |

2.04 |

- |

- |

|

Capital Expenditures |

|

|

|

|

|

|

Additions to PP&E |

($M) |

65-70 |

34.6 |

- |

- |

|

Total Capital ExpendituresNG |

($M) |

65-70 |

44.7 |

- |

- |

|

SustainingNG |

($M) |

65-70 |

43.2 |

- |

- |

|

Non-sustainingNG |

($M) |

- |

1.5 |

- |

- |

|

(1) |

The Mount Milligan Mine is subject to an arrangement with RGLD Gold

AG and Royal Gold, Inc. (together, “Royal Gold”) which entitles

them to purchase 35% and 18.75% of gold and copper produced,

respectively, and requires Royal Gold to pay $435 per ounce of gold

and 15% of the spot price per metric tonne of copper delivered

(“Mount Milligan Streaming Arrangement”). Using an assumed market

gold price of $1,600 per ounce and a blended copper price of $3.55

per pound for 2023, the Mount Milligan Mine’s average realized gold

and copper price would be $1,192 per ounce and $2.98 per pound,

respectively, when factoring in the Mount Milligan Streaming

Arrangement. The blended copper price of $3.55 per pound factors in

2023 copper hedges and a market price of $3.25 per pound for the

unhedged portion. |

| (2) |

Gold and copper production at the Mount Milligan Mine assumes

recoveries of 66% and 81%, respectively. 2023 gold ounces and

copper pounds sold are expected to be consistent with

production. |

| (3) |

Material assumptions used for cost guidance includes an exchange

rate of $1USD:$1.30CAD and a diesel fuel price of $1.00/litre

(CAD$1.30/litre) after reflecting the impact of current diesel

hedges in place. In this table, units noted as ($/oz) relates to

gold ounces and ($/lb) relates to copper pounds. |

The Mount Milligan Mine’s 2023 copper production

is expected to be back-end weighted with approximately 35% of

concentrate sales expected to occur in the fourth quarter of

2023.

The 2023 cost guidance and capital expenditure

metrics are higher when compared to the Mount Milligan Mine’s

December 31, 2021 NI 43-101 Technical Report (“Mount Milligan Mine

TR”) and results for nine months ended September 30, 2022, driven

by the inflationary environment throughout 2022. Inflationary cost

pressures have been noted in various areas of the Mount Milligan

Mine’s operations, mainly labour, energy and consumables such as

grinding media, tires, equipment parts and diesel fuel.

The Company continues to optimize the life of

mine plan for the Mount Milligan Mine and anticipates increases in

both gold and copper production for 2024 and 2025 when compared to

the annual figures included in the Mount Milligan Mine TR.

Exploration

ExpendituresExploration expenditures for 2023 are expected

to be $35 to $45 million, including $10 million towards the

Goldfield Project, approximately $13 to $17 million for brownfield

exploration (Mount Milligan - $10 to $12 million and Öksüt - $3 to

$5 million), and the balance for greenfield and generative

exploration programs.

Other Material AssumptionsOther

material assumptions used in forecasting production and costs for

2023 can be found under the heading “Caution Regarding

Forward-Looking Information” in this document. Production, cost,

and capital forecasts for 2023 are forward-looking information and

are based on key assumptions and subject to material risk factors

that could cause actual results to differ materially, and which are

discussed under the heading “Material Risks” in the Company’s most

recent Annual Information Form.

Qualified Person & QA/QC –

Production InformationThe production information and other

scientific and technical information presented in this document,

including the production estimates, were prepared in accordance

with the standards of the Canadian Institute of Mining, Metallurgy

and Petroleum and National Instrument 43-101 Standards of

Disclosure for Mineral Projects (“NI 43-101”) and were prepared,

reviewed, verified, and compiled by Centerra’s geological and

mining staff under the supervision of Paul Chawrun, P.Eng who is a

member of the Professional Engineers Ontario and Centerra’s Vice

President and Chief Operating Officer, who is a qualified person

for the purpose of NI 43-101.

The Mount Milligan deposit is described in a NI

43-101 technical report dated November 7, 2022 and filed on SEDAR

at www.sedar.com. The technical report describes, amount other

things, the exploration history, geology, and style of gold

mineralization at the Mount Milligan deposit.

Non-GAAP and Other Financial

Measures This document contains “specified financial

measure”, denoted with NG, within the meaning of National

Instrument 52-112 Non-GAAP and Other Financial Measures Disclosure

of the Canadian Securities Administrators, specifically the

non-GAAP financial measures. None of these specified financial

measures are standardized financial measures under International

Financial Reporting Standards (“IFRS”) and these specified

financial measures might not be comparable to similar financial

measures disclosed by other issuers.

Management believes that the use of these

non-GAAP measures assists analysts, investors and other

stakeholders of the Company in understanding the costs associated

with producing gold and copper, understanding the economics of gold

and copper mining, assessing operating performance, the Company’s

ability to generate free cash flow from current operations and on

an overall Company basis, and for planning and forecasting of

future periods. However, the measures have limitations as

analytical tools as they may be influenced by the point in the life

cycle of a specific mine and the level of additional exploration or

other expenditures a company has to make to fully develop its

properties. The specified financial measures used in this document

do not have any standardized meaning prescribed by IFRS and may not

be comparable to similar measures presented by other issuers, even

as compared to other issuers who may be applying the World Gold

Council (“WGC”) guidelines. Accordingly, these specified financial

measures should not be considered in isolation, or as a substitute

for, analysis of the Company’s recognized measures presented in

accordance with IFRS.

Definitions

The following is a description of the non-GAAP

measures used in this news release:

- All-in sustaining costs on a

by-product basis per ounce is a non-GAAP ratio calculated as all-in

sustaining costs on a by-product basis divided by ounces of gold

sold. All-in sustaining costs on a by-product basis is a non-GAAP

financial measure calculated as the aggregate of production costs

as recorded in the consolidated statements of earnings, refining

and transport costs, capitalized stripping and sustaining capital

expenditures, lease payments related to sustaining assets,

corporate general and administrative expenses, accretion expenses,

asset retirement depletion expenses, copper and silver revenue and

the associated impact of hedges of by-product sales revenue (added

in the current period and applied retrospectively to the previous

period). When calculating all-in sustaining costs on a by-product

basis, all revenue received from the sale of copper from the Mount

Milligan Mine, as reduced by the effect of the copper stream, is

treated as a reduction of costs incurred. A reconciliation of

all-in sustaining costs on a by-product basis to the nearest IFRS

measure is set out below. Management uses these measures to monitor

the cost management effectiveness of each of its operating

mines.

- All-in sustaining costs on a

co-product basis per ounce of gold or per pound of copper, is a

non-GAAP ratio calculated as all-in sustaining costs on a

co-product basis divided by ounces of gold or pounds of copper

sold, as applicable. All-in sustaining costs on a co-product basis

is a non-GAAP financial measure based on an allocation of

production costs between copper and gold based on the conversion of

copper production to equivalent ounces of gold. The Company uses a

conversion ratio for calculating gold equivalent ounces for its

copper sales calculated by multiplying the copper pounds sold by

estimated average realized copper price and dividing the resulting

figure by estimated average realized gold price. For 2023, based on

the assumed copper price of $3.25 per pound and assumed gold price

of $1,600 per ounce, 492 pounds of copper was equivalent to one

ounce of gold. A reconciliation of all-in sustaining costs on a

co-product basis to the nearest IFRS measure is set out below.

Management uses these measures to monitor the cost management

effectiveness of each of its operating mines.

- All-in costs on a by-product basis

per ounce is a non-GAAP ratio calculated as all-in costs on a

by-product basis divided by ounces sold. All-in costs on a

by-product basis is a non-GAAP financial measure which includes

all-in sustaining costs on a by-product basis. exploration and

study costs, non-sustaining capital expenditures, care and

maintenance and predevelopment costs. A reconciliation of all-in

costs on a by-product basis to the nearest IFRS measures is set out

below. Management uses these measures to monitor the cost

management effectiveness of each of its operating mines.

- Sustaining capital expenditures and

Non-sustaining capital expenditures are non-GAAP financial

measures. Sustaining capital expenditures are defined as those

expenditures required to sustain current operations and exclude all

expenditures incurred at new operations or major projects at

existing operations where these projects will materially benefit

the operation. Non-sustaining capital expenditures are primarily

costs incurred at ‘new operations’ and costs related to ‘major

projects at existing operations’ where these projects will

materially benefit the operation. A material benefit to an existing

operation is considered to be at least a 10% increase in annual or

life of mine production, net present value, or reserves compared to

the remaining life of mine of the operation. A reconciliation of

sustaining capital expenditures and non-sustaining capital

expenditures to the nearest IFRS measures is set out below.

Management uses the distinction of the sustaining and

non-sustaining capital expenditures as an input into the

calculation of all-in sustaining costs per ounce and all-in costs

per ounce.

|

|

Nine months ended September 30,

2022 |

|

(Unaudited - $millions, unless otherwise

specified) |

Mount Milligan |

|

Production costs attributable to gold |

104.8 |

|

Production costs attributable to copper |

94.3 |

| Total

production costs as reported |

199.1 |

| Adjust

for: |

|

| Third

party smelting, refining and transport costs |

8.4 |

|

By-product and co-product credits |

(169.5) |

| Adjusted

production costs |

37.9 |

| Corporate

general administrative and other costs |

0.6 |

|

Reclamation and remediation - accretion |

1.3 |

|

Sustaining capital expenditures |

43.2 |

|

Sustaining lease payments |

3.9 |

| All-in

sustaining costs on a by-product basis |

86.9 |

|

Exploration and study costs |

10.1 |

|

Non-sustaining capital expenditures |

1.5 |

| All-in

costs on a by-product basis |

98.5 |

| Ounces

sold (000s) |

138.0 |

| Pounds

sold (millions) |

58.0 |

|

Gold production costs ($/oz) |

759 |

|

All-in sustaining costs on a by-product basis

($/oz) |

629 |

|

All-in costs on a by-product basis ($/oz) |

713 |

|

Gold - All-in sustaining costs on a co-product basis

($/oz) |

958 |

|

Copper production costs ($/lb) |

1.63 |

|

Copper - All-in sustaining costs on a co-product basis

($/lb) |

2.04 |

|

|

Nine months ended September 30,

2022 |

|

(Unaudited - $millions, unless otherwise

specified) |

Mount Milligan |

|

Additions to PP&E |

34.6 |

|

Adjust for: |

|

|

Costs capitalized to the ARO assets |

9.9 |

|

Other(1) |

0.2 |

|

Capital expenditures |

44.7 |

|

Sustaining capital expenditures |

43.2 |

|

Non-sustaining capital expenditures |

1.5 |

(1) Includes reclassification of insurance

and capital spares from supplies inventory to PP&E.

Caution Regarding Forward-Looking

InformationInformation contained in this news release

which is not a statement of historical fact, and the documents

incorporated by reference herein, may be “forward-looking

information” for the purposes of Canadian securities laws and

within the meaning of the United States Private Securities

Litigation Reform Act of 1995. Such forward-looking information

involves risks, uncertainties and other factors that could cause

actual results, performance, prospects and opportunities to differ

materially from those expressed or implied by such forward-looking

information. The words “anticipate”, “assume”, “believe”, “budget”,

“contemplate”, “continue”, “estimate”, “expect”, “intends”, “life

of mine” or “LOM”, “may”, “plan”, “schedule”, “understand”, “will”,

and similar expressions identify forward-looking information. These

forward-looking statements relate to, among other things: the

Company’s expectations regarding 2023 and future gold and copper

production; gold production costs per ounce, all-in sustaining

costs on a by-product basis per ounceNG; all-in costs on a

by-product basis per ounceNG; additions to PP&E, total capital

spending and other statements made under the headings “Update on

Öksüt Mine Operations”, “Mount Milligan Mine 2023 Guidance” and

“Exploration Expenditures” including expectations regarding the

effects of inflation on the Company’s costs; submissions relating

to the EIA amendment for the Öksüt Mine and further discussions and

regulatory review thereof; completion of mercury abatement,

containment and safety work in the gold room of the ADR plant at

the Öksüt Mine, including construction progress; the expected

restart of gold room operations, related regulatory approvals and

the expected timing thereof; 2023 capital expenditures; and 2023

exploration expenditures.

Forward-looking information is necessarily based

upon a number of estimates and assumptions that, while considered

reasonable by Centerra, are inherently subject to significant

technical, political, business, economic and competitive

uncertainties and contingencies. Known and unknown factors could

cause actual results to differ materially from those projected in

the forward-looking information. Factors and assumptions that could

cause actual results or events to differ materially from current

expectations include, among other things: (A) strategic, legal,

planning and other risks, including: political risks associated

with the Company’s operations in Türkiye, the USA and Canada,

including potential uncertainty created by upcoming presidential

elections in Türkiye and their potential to disrupt or delay

Turkish bureaucratic processes and decision making; resource

nationalism including the management of external stakeholder

expectations; the impact of changes in, or to the more aggressive

enforcement of, laws, regulations and government practices,

including unjustified civil or criminal action against the Company,

its affiliates, or its current or former employees; risks that

community activism may result in increased contributory demands or

business interruptions; the risks related to outstanding litigation

affecting the Company; risks of actions taken by the Kyrgyz

Republic, or any of its instrumentalities, in connection with the

Company’s prior ownership of the Kumtor Mine or the Global

Arrangement Agreement; including unjustified civil or criminal

action against the Company, its affiliates, or its current or

former employees; the impact of constitutional changes or political

events or elections in Türkiye; risks that Turkish regulators

pursue aggressive enforcement of the Öksüt Mine’s current EIA and

permits or that the Company experiences delay or disruption in its

applications for new or amended EIA or other permits; the impact of

any sanctions imposed by Canada, the United States or other

jurisdictions against various Russian and Turkish individuals and

entities; potential defects of title in the Company’s properties

that are not known as of the date hereof; the inability of the

Company and its subsidiaries to enforce their legal rights in

certain circumstances; risks related to anti-corruption

legislation; Centerra not being able to replace mineral reserves;

Indigenous claims and consultative issues relating to the Company’s

properties which are in proximity to Indigenous communities; and,

potential risks related to kidnapping or acts of terrorism; (B)

risks relating to financial matters, including: sensitivity of the

Company’s business to the volatility of gold, copper and other

mineral prices; the use of provisionally-priced sales contracts for

production at the Mount Milligan Mine; reliance on a few key

customers for the gold-copper concentrate at the Mount Milligan

Mine; use of commodity derivatives; the imprecision of the

Company’s mineral reserves and resources estimates and the

assumptions they rely on; the accuracy of the Company’s production

and cost estimates; the impact of restrictive covenants in the

Company’s credit facilities which may, among other things, restrict

the Company from pursuing certain business activities or making

distributions from its subsidiaries; changes to tax regimes; the

Company’s ability to obtain future financing; the impact of global

financial conditions; the impact of currency fluctuations; the

effect of market conditions on the Company’s short-term

investments; the Company’s ability to make payments, including any

payments of principal and interest on the Company’s debt

facilities, which depends on the cash flow of its subsidiaries; and

(C) risks related to operational matters and geotechnical issues

and the Company’s continued ability to successfully manage such

matters, including the stability of the pit walls at the Company’s

operations; the integrity of tailings storage facilities and the

management thereof, including as to stability, compliance with

laws, regulations, licenses and permits, controlling seepages and

storage of water where applicable; the risk of having sufficient

water to continue operations at the Mount Milligan Mine and achieve

expected mill throughput; changes to, or delays in the Company’s

supply chain and transportation routes, including cessation or

disruption in rail and shipping networks whether caused by

decisions of third-party providers or force majeure events

(including, but not limited to, flooding, wildfires, COVID-19, or

other global events such as wars); the success of the Company’s

future exploration and development activities, including the

financial and political risks inherent in carrying out exploration

activities; inherent risks associated with the use of sodium

cyanide in the mining operations; the adequacy of the Company’s

insurance to mitigate operational and corporate risks; mechanical

breakdowns; the occurrence of any labour unrest or disturbance and

the ability of the Company to successfully renegotiate collective

agreements when required; the risk that Centerra’s workforce and

operations may be exposed to widespread epidemic including, but not

limited to, the COVID-19 pandemic; seismic activity; wildfires;

long lead-times required for equipment and supplies given the

remote location of some of the Company’s operating properties and

disruptions caused by global events and disruptions caused by

global events; reliance on a limited number of suppliers for

certain consumables, equipment and components; the ability of the

Company to address physical and transition risks from climate

change and sufficiently manage stakeholder expectations on

climate-related issues; the Company’s ability to accurately predict

decommissioning and reclamation costs; the Company’s ability to

attract and retain qualified personnel; competition for mineral

acquisition opportunities; risks associated with the conduct of

joint ventures/partnerships; and the Company’s ability to manage

its projects effectively and to mitigate the potential lack of

availability of contractors, budget and timing overruns and project

resources. For additional risk factors, please see section titled

“Risk Factors” in the Company’s most recently filed Annual

Information Form available on SEDAR at www.sedar.com and EDGAR at

www.sec.gov/edgar.

There can be no assurances that forward-looking

information and statements will prove to be accurate as many

factors and future events, both known and unknown, could cause

actual results, performance, or achievements to vary or differ

materially from the results, performance, or achievements that are

or may be expressed or implied by such forward-looking statements

contained herein or incorporated by reference. Accordingly, all

such factors should be considered carefully when making decisions

with respect to Centerra, and prospective investors should not

place undue reliance on forward-looking information.

Forward-looking information is as of January 16, 2023. Centerra

assumes no obligation to update or revise forward-looking

information to reflect changes in assumptions, changes in

circumstances, or any other events affecting such forward-looking

information, except as required by applicable law.

About Centerra Gold

Centerra Gold Inc. is a Canadian-based mining

company focused on operating, developing, exploring and acquiring

gold and copper properties in North America, Türkiye, and other

markets worldwide. Centerra operates two mines: the Mount Milligan

Mine in British Columbia, Canada, and the Öksüt Mine in Türkiye.

The Company also owns the Goldfield District Project in Nevada,

United States, the Kemess Underground Project in British Columbia,

Canada, and owns and operates the Molybdenum Business Unit in the

United States and Canada. Centerra's shares trade on the Toronto

Stock Exchange (“TSX”) under the symbol CG and on the New York

Stock Exchange (“NYSE”) under the symbol CGAU. The Company is based

in Toronto, Ontario, Canada.

For more information:

|

Toby Caron |

Shae Frosst |

| Treasurer and Director,

Investor Relations |

Manager, Investor

Relations |

| (416) 204-1694 |

(416) 204-2159 |

|

toby.caron@centerragold.com |

shae.frosst@centerragold.com |

| |

|

Additional information on Centerra Gold

is available on the Company’s website at

www.centerragold.com and on SEDAR at www.sedar.com and EDGAR

at www.sec.gov/edgar.

A PDF accompanying this announcement is available

at:http://ml.globenewswire.com/Resource/Download/2e1b9757-a549-4a13-a17a-c12eb14fc8a2

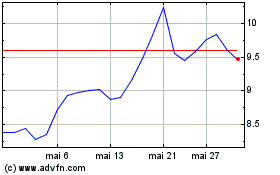

Centerra Gold (TSX:CG)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Centerra Gold (TSX:CG)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024