Centerra Gold Announces TSX Acceptance of Renewed Normal Course Issuer Bid

05 Novembro 2024 - 9:30AM

Centerra Gold Inc. (TSX: CG) (NYSE: CGAU) (“Centerra” or the

“Company”) is pleased to announce that the Toronto Stock Exchange

(“TSX”) has accepted its renewal of a normal course issuer bid

(“NCIB”) to purchase for cancellation up to an aggregate of

18,800,929 common shares in the capital of the Company (“Common

Shares”) during the twelve-month period commencing on November 7,

2024 and ending on November 6, 2025, representing approximately

8.9% of Centerra’s total issued and outstanding Common Shares, or

10% of the public float. As of November 5, 2024, Centerra had

211,321,285 issued and outstanding Common Shares.

Under the NCIB, daily purchases would be limited

to 213,230 Common Shares, other than purchases made under block

purchase exemptions. Once the NCIB is commenced, the exact timing

and amount of any purchases will depend on market conditions and

other factors. Centerra will not be obligated to acquire any Common

Shares and may suspend or discontinue purchases under the NCIB at

any time. Any purchases made under the NCIB will be made at market

price at the time of purchase through the facilities of the TSX

and/or alternative Canadian trading systems in accordance with

applicable securities laws and stock exchange rules. The Company’s

previous NCIB authorized the purchase of up to 18,293,896 Common

Shares and expires on November 6, 2024. As of October 31, 2024, a

total of 5,799,800 Common Shares of the Company were repurchased

through the facilities of the TSX and alternative Canadian trading

systems at a volume weighted average price of $8.74 per Common

Share under the Company’s previous NCIB.

Centerra intends to establish an automatic share

purchase plan in connection with its renewed NCIB to facilitate the

purchase of Common Shares during times when Centerra would

ordinarily not be permitted to purchase Common Shares due to

regulatory restrictions or self-imposed black-out periods. Before

entering a black-out period, Centerra may, but is not required to,

instruct its designated broker to make purchases under the NCIB

based on parameters set by Centerra in accordance with the

automatic share purchase plan, applicable securities laws and stock

exchange rules.

Centerra believes that the Common Shares

continue to be trading in a price range which does not adequately

reflect the value of such shares in relation to Centerra’s assets

and its future prospects. As a result, Centerra believes that the

NCIB will provide the Company with a flexible tool to deploy a

portion of its cash balance pursuant to its capital allocation

framework to, depending upon future Common Share price movements

and other factors, purchase Common Shares for cancellation while

preserving its strong balance sheet position.

About Centerra Gold

Centerra Gold Inc. is a Canadian-based gold

mining company focused on operating, developing, exploring and

acquiring gold and copper properties in North America, Türkiye, and

other markets worldwide. Centerra operates two mines: the Mount

Milligan Mine in British Columbia, Canada, and the Öksüt Mine in

Türkiye. The Company also owns the Goldfield District Project in

Nevada, United States, the Kemess Project in British Columbia,

Canada, and owns and operates the Molybdenum Business Unit in the

United States and Canada. Centerra’s shares trade on the Toronto

Stock Exchange (“TSX”) under the symbol CG and on the New York

Stock Exchange (“NYSE”) under the symbol CGAU. The Company is based

in Toronto, Ontario, Canada.

For more information: Lisa

WilkinsonVice President, Investor Relations & Corporate

Communications(416) 204-3780Lisa.Wilkinson@centerragold.com

Additional information on Centerra is

available on the Company’s website at

www.centerragold.com, on SEDAR+

at www.sedarplus.ca and EDGAR

at

www.sec.gov/edgar.

Cautionary Note Regarding Forward-Looking

Information

Information contained in this document which are

not statements of historical facts may be “forward looking

information” for the purposes of Canadian securities laws and

within the meaning of the United States Private Securities

Litigation Reform Act of 1995. Such forward-looking information

involves risks, uncertainties and other factors that could cause

actual results, performance, prospects and opportunities to differ

materially from those expressed or implied by such forward looking

information. The words “expect”, “contemplate”, “may”, “will”,

“intend” and similar expressions identify forward-looking

information. In particular, such forward-looking statements

include, but are not limited to, statements relating to the TSX’s

approval of the NCIB, Centerra’s intention to renew the NCIB and

the timing, methods and quantity of any purchases of Common Shares

under the NCIB, the availability of cash for repurchases of Common

Shares under the NCIB, compliance with applicable laws and

regulations pertaining to the NCIB, Centerra’s perceptions of

historical trends, current conditions and expected future

developments, as well as other considerations that are believed to

be appropriate in the circumstances.

Forward-looking information is necessarily based

upon a number of estimates and assumptions that, while considered

reasonable by Centerra, are inherently subject to significant

political, business, technical, economic and competitive

uncertainties and contingencies. Known and unknown factors could

cause actual results to differ materially from those projected in

the forward-looking information. Factors and assumptions that could

cause actual results or events to differ materially from current

expectations include the risk factors set forth in the section

titled “Risk Factors” in the Company’s most recently filed Annual

Information Form, which is available on SEDAR+ at www.sedarplus.com

and EDGAR at www.sec.gov/edgar. There can be no assurances that

forward-looking information and statements will prove to be

accurate, as many factors and future events, both known and unknown

could cause actual results, performance or achievements to vary or

differ materially from the results, performance or achievements

that are or may be expressed or implied by the forward-looking

statements contained or referred to herein. Accordingly, all such

factors should be considered carefully when making decisions with

respect to Centerra, and prospective investors should not place

undue reliance on forward looking information. Forward-looking

information contained herein is given as of the date of this press

release. Centerra assumes no obligation to update or revise

forward-looking information to reflect changes in assumptions,

changes in circumstances or any other events affecting such

forward-looking information, except as required by applicable

law.

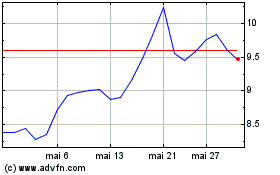

Centerra Gold (TSX:CG)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Centerra Gold (TSX:CG)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024