Tenaris S.A. (NYSE and Mexico: TS and EXM Italy: TEN) (“Tenaris”)

today announced its results for the fourth quarter and year ended

December 31, 2022 with comparison to its results for the fourth

quarter and year ended December 31, 2021.

Summary of 2022 Fourth Quarter Results

|

|

4Q 2022 |

3Q 2022 |

4Q 2021 |

|

Net sales ($ million) |

3,620 |

2,975 |

22% |

2,057 |

76% |

|

Operating income ($ million) |

1,013 |

803 |

26% |

273 |

271% |

|

Net income ($ million) |

803 |

608 |

32% |

336 |

139% |

|

Shareholders’ net income ($ million) |

807 |

606 |

33% |

370 |

118% |

|

Earnings per ADS ($) |

1.37 |

1.03 |

33% |

0.63 |

118% |

|

Earnings per share ($) |

0.68 |

0.51 |

33% |

0.31 |

118% |

|

EBITDA ($ million) |

1,269 |

946 |

34% |

483 |

163% |

|

EBITDA margin (% of net sales) |

35.1% |

31.8% |

|

23.5% |

|

In the fourth quarter of 2022, our sales rose

sequentially 22%, driven by further increases in shipments and

realized prices in most regions. Our quarterly EBITDA continues to

grow with the margin rising to 35%, despite higher raw material and

energy costs. Our operating income, which included $77 million in

impairment charges on certain idle assets and some small cash

generating assets, amounted to $1,013 million. Shareholders’ net

income reached $807 million, or 22% of net sales.

Our free cash flow for the quarter increased to

$416 million after capex payments of $108 million and our operating

working capital days declined to 128. After a dividend payment of

$201 million in November 2022, our net cash position increased to

$921 million at December 31, 2022.

Summary of 2022 Annual Results

|

|

12M 2022 |

12M 2021 |

Increase/(Decrease) |

|

Net sales ($ million) |

11,763 |

6,521 |

80% |

|

Operating income ($ million) |

2,963 |

708 |

319% |

|

Net income ($ million) |

2,549 |

1,053 |

142% |

|

Shareholders’ net income ($ million) |

2,553 |

1,100 |

132% |

|

Earnings per ADS ($) |

4.33 |

1.86 |

133% |

|

Earnings per share ($) |

2.16 |

0.93 |

132% |

|

EBITDA ($ million) |

3,648 |

1,359 |

168% |

|

EBITDA margin (% of net sales) |

31.0% |

20.8% |

|

In 2022, our net income reached a record high

while our net sales and EBITDA were close to the all-time highs

recorded in 2008 just prior to the global financial crisis. Our

results rose strongly throughout the year and reached record

quarterly levels in the fourth quarter. The increase in sales

reflect the strong recovery of oil and gas drilling activity in the

Americas, a more delayed recovery in Eastern Hemisphere activity,

which is now picking up steam, and the solid contribution of the

great majority of our market and product segments.

Operating margins expanded reflecting the higher

prices realized on the sales of most of our products that have more

than compensated for higher raw material and energy costs and a

good industrial performance with increased levels of activity and

utilization of production capacity.

Net income more than doubled compared to 2021,

despite a much lower contribution from our non-consolidated

companies and higher income taxes.

Operating cash flow for the year amounted to

$1,167 million after accounting for a $2,131 million build up in

working capital to support the higher level of sales and the ramp

up of our industrial system. After capital expenditures of $378

million and dividend payments of $531 million during the year, our

net cash position increased to $921 million at the end of the

year.

Market Background and Outlook

In an environment where geopolitical and

macro-economic risks as well as inflation remain high, global

economic prospects have improved following the fall in energy

prices in Europe and the reversal of China’s COVID lockdown

strategy. Conditions remain in place for a further increase in

investment in the energy industry, with low levels of spare

capacity, the implementation of further sanctions on Russian

exports and a renewed focus on energy security around the

world.

Drilling activity increased during 2022 and,

although it has plateaued in North America as we enter 2023, it

continues to increase in the Middle East and offshore regions.

Global demand for OCTG in 2023 is expected to reach its highest

level since 2014. Pipeline activity is also advancing to support

oil and gas developments, notably in Argentina and the Middle

East.

For the first half of 2023, we expect our sales

and EBITDA to show a further increase as we continue to ramp up

production in North America and increase shipments to pipeline

projects. The pricing momentum we saw over the last year is

levelling out and we expect that margins will remain close to the

current level. Cash flow from operations will increase and we

expect to stabilize our working capital requirements by the second

quarter.

Annual Dividend Proposal

Upon approval of the Company´s annual accounts

in March 2023, the board of directors intends to propose, for

approval of the annual general shareholders’ meeting to be held on

May 3, 2023, the payment of dividends in an aggregate amount of

approximately $602 million, which would include the interim

dividend of approximately $201 million paid in November 2022. If

the annual dividend is approved by the shareholders, a dividend of

$0.34 per share ($0.68 per ADS), or approximately $401 million,

will be paid on May 24, 2023, with an ex-dividend date on May 22,

2023 and record date on May 23, 2023.

Analysis of 2022 Fourth Quarter Results

|

Tubes Sales volume (thousand metric tons) |

4Q 2022 |

3Q 2022 |

4Q 2021 |

|

Seamless |

809 |

750 |

8% |

731 |

11% |

|

Welded |

156 |

106 |

47% |

68 |

130% |

|

Total |

965 |

856 |

13% |

799 |

21% |

|

Tubes |

4Q 2022 |

3Q 2022 |

4Q 2021 |

|

(Net sales - $ million) |

|

|

|

|

|

|

North America |

2,105 |

1,761 |

20% |

1,118 |

88% |

|

South America |

802 |

600 |

34% |

341 |

136% |

|

Europe |

185 |

190 |

(3%) |

167 |

11% |

|

Middle East & Africa |

303 |

234 |

30% |

209 |

45% |

|

Asia Pacific |

70 |

46 |

51% |

75 |

(7%) |

|

Total net sales ($ million) |

3,466 |

2,832 |

22% |

1,910 |

81% |

|

Operating income ($ million) |

980 |

780 |

26% |

245 |

300% |

|

Operating margin (% of sales) |

28.3% |

27.5% |

|

12.8% |

|

Net sales of tubular products and services

increased 22% sequentially and 81% year on year. Volumes increased

13% sequentially and 21% year on year while average selling prices

increased 9% sequentially and 50% year on year. In North America,

sales increased 20% sequentially reflecting higher volumes for OCTG

throughout the region and higher OCTG prices in the United States.

In South America sales increased 34% sequentially, mainly due to

the start of deliveries for a gas pipeline and higher OCTG sales in

Argentina. In Europe sales decreased 3% sequentially due to a

slight reduction in sales to distributors of mechanical and

structural products. In the Middle East and Africa sales increased

30% reflecting higher sales of OCTG in the United Arab Emirates and

higher sales of line pipe in Iraq and the Caspian area. In Asia

Pacific sales increased 51% sequentially, due to higher sales in

Indonesia and sales of casing to a geothermal project in the

Philippines.

Operating income from tubular products and

services, amounted to $980 million in the fourth quarter of 2022,

compared to $780 million in the previous quarter and $245 million

in the fourth quarter of 2021. Operating results of the quarter

include a $63 million impairment charge on certain idle assets and

some small cash generating units. During the quarter the operating

margin increased following a 9% increase in average selling prices

which more than offset higher energy and raw material costs.

|

Others |

4Q 2022 |

3Q 2022 |

4Q 2021 |

|

Net sales ($ million) |

154 |

143 |

8% |

147 |

5% |

|

Operating income ($ million) |

33 |

23 |

42% |

29 |

16% |

|

Operating margin (% of sales) |

21.4% |

16.2% |

|

19.4% |

|

Net sales of other products and services

increased 8% sequentially and 5% year on year. Sequentially, sales

and operating income improved mainly due to higher sales and

results from our oil services business in Argentina which offers

hydraulic fracturing and coiled tubing services. Operating results

of the quarter include a $14 million impairment charge.

Selling, general and administrative

expenses, or SG&A, amounted to $454 million (12.6% of

net sales), compared to $403 million (13.6%) in the previous

quarter and $338 million (16.4%) in the fourth quarter of 2021.

While SG&A expenses increased sequentially, mainly due to

higher logistic costs, taxes and labor costs, they declined as a

percentage of sales.

Impairment charge. In December,

2022, we recorded an impairment of $63 million on our Tubes segment

and $14 million on our Others segment.

Other operating result amounted

to a $12 million loss in the fourth quarter of 2022, compared with

$2 million loss in the previous quarter and $12 million gain in the

fourth quarter of 2021.

Financial results were a gain

of $36 million in the fourth quarter of 2022, compared with a $29

million loss in the previous quarter and $2 million gain in the

fourth quarter of 2021. Results of the quarter are mainly derived

from higher net interest income and positive net foreign exchange

results.

Equity in earnings of non-consolidated

companies generated a gain of $13 million in the fourth

quarter of 2022, compared to $5 million in the previous quarter and

$133 million in the same period of 2021. Quarter results are mainly

derived from our equity investment in Ternium (NYSE:TX), Usiminas

and Techgen, the Mexican power plant in which we hold a 22% equity

interest.

Income tax charge amounted to

$258 million in the fourth quarter of 2022, compared to $171

million in the previous quarter and $72 million in the fourth

quarter of 2021. Taxes increased during the quarter due to the

better results at several subsidiaries following the improvement in

activity.

Cash Flow and Liquidity of 2022 Fourth

Quarter

Net cash provided by operations during the

fourth quarter of 2022 was $524 million, compared with $242 million

in the previous quarter and $46 million in the fourth quarter of

2021. As activity continues to increase working capital continues

to rise showing a $682 million increase during the quarter, driven

by higher sales. Our operating working capital days declined to 128

at year end compared to 134 at the end of the previous quarter.

With capital expenditures of $108 million for

the fourth quarter of 2022 ($129 million in the previous quarter

and $69 million in the fourth quarter of 2021), during the quarter

we had a positive free cash flow of $416 million.

Following dividend payments of $201 million during the quarter,

our positive net cash position increased to $921 million at

December 31, 2022.

Analysis of 2022 Annual Results

|

Net sales ($ million) |

12M 2022 |

12M 2021 |

Increase/(Decrease) |

|

Tubes |

11,133 |

95% |

5,994 |

92% |

86% |

|

Others |

630 |

5% |

528 |

8% |

19% |

|

Total |

11,763 |

|

6,521 |

|

80% |

|

Tubes Sales volume (thousand metric tons) |

12M 2022 |

12M 2021 |

Increase/(Decrease) |

|

Seamless |

3,146 |

2,514 |

25% |

|

Welded |

387 |

289 |

34% |

|

Total |

3,533 |

2,803 |

26% |

|

Tubes |

12M 2022 |

12M 2021 |

Increase/(Decrease) |

|

(Net sales - $ million) |

|

|

|

|

North America |

6,796 |

3,240 |

110% |

|

South America |

2,213 |

1,051 |

111% |

|

Europe |

867 |

622 |

39% |

|

Middle East & Africa |

980 |

832 |

18% |

|

Asia Pacific |

277 |

249 |

11% |

|

Total net sales ($ million) |

11,133 |

5,994 |

86% |

|

Operating income ($ million) |

2,867 |

613 |

368% |

|

Operating margin (% of sales) |

25.8% |

10.2% |

|

Net sales of tubular products and services

increased 86% to $11,133 million in 2022, compared to $5,994

million in 2021, reflecting a 26% increase in volumes and a 47%

increase in average selling prices. Sales increased in all regions,

mainly in North America where there was a recovery in volumes and

prices throughout the region, led by the U.S. onshore market and in

South America mainly due to higher OCTG sales in the region and

deliveries for a gas pipeline in Argentina.

Operating results from tubular products and

services, amounted to a gain of $2,867 million in 2022, compared to

a gain of $613 million in 2021. Tubes operating income in 2022 is

net of a $63 million impairment charge, while in 2021 it includes

an impairment charge of $57 million. The improvement in operating

results was driven by the recovery in shipment volumes and in

prices and higher level of utilization of production capacity,

which more than offset an increase in energy and raw material

costs.

|

Others |

12M 2022 |

12M 2021 |

Increase/(Decrease) |

|

Net sales ($ million) |

630 |

528 |

19% |

|

Operating income ($ million) |

96 |

95 |

1% |

|

Operating margin (% of sales) |

15.2% |

17.9% |

|

Net sales of other products and services

increased 19% from $528 million in 2021 to $630 million in 2022,

mainly due to higher sales of sucker rods, of our oilfield services

business in Argentina which offers hydraulic fracturing and coiled

tubing services and excess raw materials, partially offset by lower

sales from the discontinued industrial equipment business in

Brazil.

Operating results from other products and

services, amounted to a gain of $96 million in 2022, similar to the

$95 million gained in 2021. Results were mainly derived from our

sucker rods business and our oilfield services business in

Argentina, partially offset by $20 million loss related to our

discontinued industrial equipment business in Brazil. The operating

income for other products and services in 2022 includes a $14

million impairment charge.

Selling, general and administrative

expenses, or SG&A, amounted to $1,635 million (13.9%

of net sales), compared to $1,207 million (18.5%) in 2021. The 2022

increase in SG&A is mainly due to higher logistic costs, while

they decrease as a percentage of sales.

Impairment charge, in 2022, we

recorded a $77 million impairment: $63 million on our Tubes segment

and $14 million on our Others segment, while in 2021 we recorded a

$57 million impairment on our Tubes segment, as a result of the

termination of the NKKTubes joint venture.

Other operating results

amounted to zero in 2022, compared to a gain of $62 million in

2021. Results in 2022 include a $78 million charge from the

settlement with the U.S. SEC, a $71 million non-cash gain from the

reclassification to the income statement of NKKTubes’s cumulative

foreign exchange adjustments belonging to the shareholders due to

the cease of its operations and an $18 million gain from the sale

of land in Canada after the relocation of the Prudential facility.

The gain in 2021 was mainly due to a $36 million recognition of

fiscal credits in Brazil and the profit from the sale of

assets.

Financial results amounted to a

loss of $6 million in 2022, compared to a gain of $23 million in

2021. 2022 financial loss includes a loss of $10 million related to

the change in fair value of certain financial instruments obtained

in an operation of settlement of trade receivables and a $30

million loss related to the transfer of Argentine sovereign bonds

paid as dividend from an Argentine subsidiary to its

shareholders.

Equity in earnings of non-consolidated

companies generated a gain of $209 million in 2022,

compared to $513 million in 2021. These results were mainly derived

from our equity investment in Ternium (NYSE:TX). In 2022 they

included $34 million impairment charges on our participations in

the joint venture with Severstal ($15 million) and in Usiminas ($19

million).

Income tax charge amounted to

$617 million in 2022, compared to $189 million in 2021, reflecting

the improvement in results in several subsidiaries.

Cash Flow and Liquidity of 2022

Net cash provided by operations in 2022 was

$1,167 million (net of $2,131 million used in working capital),

compared to $119 million (net of $1,071 million used in working

capital) in 2021.

With capital expenditures of $378 million, we

had a positive free cash flow of $789 million in 2022, compared to

a negative free cash flow of $120 million in 2021.

Following dividend payments of $531 million during 2022, our

positive net cash position increased to $921 million at December

31, 2022.

Conference call

Tenaris will hold a conference call to discuss

the above reported results, on February 16, 2023, at 09:00 a.m.

(Eastern Time). Following a brief summary, the conference call will

be opened to questions. To listen to the conference please join

through one of the following options:

ir.tenaris.com/events-and-presentations or

https://edge.media-server.com/mmc/p/emnrvnrfIf you wish to

participate in the Q&A session please register at the following

link:

https://register.vevent.com/register/BI64374f61f04b4af9b05406336279305b

Please connect 10 minutes before the scheduled start time.A

replay of the conference call will also be available on our webpage

at:ir.tenaris.com/events-and-presentations

Some of the statements contained in this press

release are “forward-looking statements”. Forward-looking

statements are based on management’s current views and assumptions

and involve known and unknown risks that could cause actual

results, performance or events to differ materially from those

expressed or implied by those statements. These risks include but

are not limited to risks arising from uncertainties as to future

oil and gas prices and their impact on investment programs by oil

and gas companies.

Consolidated Income Statement

|

(all amounts in thousands of U.S. dollars) |

Three-month period ended December 31, |

Twelve-month period ended December 31, |

|

|

2022 |

2021 |

2022 |

2021 |

|

|

|

|

|

|

|

Net sales |

3,620,210 |

2,057,164 |

11,762,526 |

6,521,207 |

|

Cost of sales |

(2,063,969) |

(1,400,370) |

(7,087,739) |

(4,611,602) |

|

Gross profit |

1,556,241 |

656,794 |

4,674,787 |

1,909,605 |

|

Selling, general and administrative expenses |

(454,478) |

(338,050) |

(1,634,575) |

(1,206,569) |

|

Impairment charge |

(76,725) |

(57,075) |

(76,725) |

(57,075) |

|

Other operating income (expense), net |

(11,987) |

11,646 |

(212) |

61,548 |

|

Operating income |

1,013,051 |

273,315 |

2,963,275 |

707,509 |

|

Finance income |

37,756 |

5,845 |

80,020 |

38,048 |

|

Finance cost |

(20,237) |

(6,851) |

(45,940) |

(23,677) |

|

Other financial results |

18,127 |

2,591 |

(40,120) |

8,295 |

|

Income before equity in earnings of non-consolidated

companies and income tax |

1,048,697 |

274,900 |

2,957,235 |

730,175 |

|

Equity in earnings of non-consolidated companies |

12,701 |

133,482 |

208,702 |

512,591 |

|

Income before income tax |

1,061,398 |

408,382 |

3,165,937 |

1,242,766 |

|

Income tax |

(258,226) |

(72,246) |

(617,236) |

(189,448) |

|

Income for continuing operations |

803,172 |

336,136 |

2,548,701 |

1,053,318 |

|

|

|

|

|

|

|

Attributable to: |

|

|

|

|

|

Shareholders’ Equity |

807,318 |

370,034 |

2,553,280 |

1,100,191 |

|

Non-controlling interests |

(4,146) |

(33,898) |

(4,579) |

(46,873) |

|

|

803,172 |

336,136 |

2,548,701 |

1,053,318 |

Consolidated Statement of Financial

Position

|

(all amounts in thousands of U.S. dollars) |

At December 31, 2022 |

|

At December 31, 2021 |

|

|

|

|

|

|

|

ASSETS |

|

|

|

|

|

|

Non-current assets |

|

|

|

|

|

|

Property, plant and equipment, net |

5,556,263 |

|

|

5,824,801 |

|

|

Intangible assets, net |

1,332,508 |

|

|

1,372,176 |

|

|

Right-of-use assets, net |

111,741 |

|

|

108,738 |

|

|

Investments in non-consolidated companies |

1,540,646 |

|

|

1,383,774 |

|

|

Other investments |

119,902 |

|

|

320,254 |

|

|

Derivative financial instruments |

- |

|

|

7,080 |

|

|

Deferred tax assets |

208,870 |

|

|

245,547 |

|

|

Receivables, net |

211,720 |

9,081,650 |

|

205,888 |

9,468,258 |

|

Current assets |

|

|

|

|

|

|

Inventories, net |

3,986,929 |

|

|

2,672,593 |

|

|

Receivables and prepayments, net |

183,811 |

|

|

96,276 |

|

|

Current tax assets |

243,136 |

|

|

193,021 |

|

|

Trade receivables, net |

2,493,940 |

|

|

1,299,072 |

|

|

Derivative financial instruments |

30,805 |

|

|

4,235 |

|

|

Other investments |

438,448 |

|

|

397,849 |

|

|

Cash and cash equivalents |

1,091,527 |

8,468,596 |

|

318,127 |

4,981,173 |

|

Total assets |

|

17,550,246 |

|

|

14,449,431 |

|

EQUITY |

|

|

|

|

|

|

Shareholders' equity |

|

13,905,709 |

|

|

11,960,578 |

|

Non-controlling interests |

|

128,728 |

|

|

145,124 |

|

Total equity |

|

14,034,437 |

|

|

12,105,702 |

|

LIABILITIES |

|

|

|

|

|

|

Non-current liabilities |

|

|

|

|

|

|

Borrowings |

46,433 |

|

|

111,432 |

|

|

Lease liabilities |

83,616 |

|

|

82,694 |

|

|

Deferred tax liabilities |

269,069 |

|

|

274,721 |

|

|

Other liabilities |

230,142 |

|

|

231,681 |

|

|

Provisions |

98,126 |

727,386 |

|

83,556 |

784,084 |

|

Current liabilities |

|

|

|

|

|

|

Borrowings |

682,329 |

|

|

219,501 |

|

|

Lease liabilities |

28,561 |

|

|

34,591 |

|

|

Derivative financial instruments |

7,127 |

|

|

11,328 |

|

|

Current tax liabilities |

376,240 |

|

|

143,486 |

|

|

Other liabilities |

260,614 |

|

|

203,725 |

|

|

Provisions |

11,185 |

|

|

9,322 |

|

|

Customer advances |

242,910 |

|

|

92,436 |

|

|

Trade payables |

1,179,457 |

2,788,423 |

|

845,256 |

1,559,645 |

|

Total liabilities |

|

3,515,809 |

|

|

2,343,729 |

|

Total equity and liabilities |

|

17,550,246 |

|

|

14,449,431 |

Consolidated Statement of Cash Flows

| |

Three-month period ended December 31, |

Twelve-month period ended December 31, |

|

(all amounts in thousands of U.S. dollars) |

2022 |

2021 |

2022 |

2021 |

|

|

|

|

|

|

|

Cash flows from operating activities |

|

|

|

|

|

Income for the year |

803,172 |

336,136 |

2,548,701 |

1,053,318 |

|

Adjustments for: |

|

|

|

|

|

Depreciation and amortization |

179,135 |

152,160 |

607,723 |

594,721 |

|

Impairment charge |

76,725 |

57,075 |

76,725 |

57,075 |

|

Income tax accruals less payments |

139,061 |

23,972 |

257,651 |

35,602 |

|

Equity in earnings of non-consolidated companies |

(12,701) |

(133,482) |

(208,702) |

(512,591) |

|

Interest accruals less payments, net |

(3,672) |

1,174 |

1,480 |

(11,363) |

|

Changes in provisions |

7,164 |

(6,835) |

16,433 |

7,381 |

|

Reclassification of currency translation adjustment reserve |

- |

- |

(71,252) |

- |

|

Result of sale of subsidiaries |

- |

(6,768) |

- |

(6,768) |

|

Changes in working capital |

(682,115) |

(381,720) |

(2,131,245) |

(1,071,464) |

|

Currency translation adjustment and others |

17,173 |

4,318 |

69,703 |

(26,836) |

|

Net cash provided by operating activities |

523,942 |

46,030 |

1,167,217 |

119,075 |

|

|

|

|

|

|

|

Cash flows from investing activities |

|

|

|

|

|

Capital expenditures |

(107,646) |

(68,647) |

(378,446) |

(239,518) |

|

Changes in advance to suppliers of property, plant and

equipment |

(13,108) |

(655) |

(18,901) |

(5,075) |

|

Proceeds from sale of subsidiaries, net of cash |

- |

24,332 |

- |

24,332 |

|

Acquisition of subsidiaries, net of cash acquired |

- |

- |

(4,082) |

- |

|

Investment in companies under cost method |

- |

- |

- |

(692) |

|

Proceeds from disposal of property, plant and equipment and

intangible assets |

1,690 |

8,380 |

48,458 |

22,735 |

|

Dividends received from non-consolidated companies |

20,674 |

26,798 |

66,162 |

75,929 |

|

Changes in investments in securities |

38,079 |

111,763 |

123,254 |

390,186 |

|

Net cash (used in) provided by investing

activities |

(60,311) |

101,971 |

(163,555) |

267,897 |

|

|

|

|

|

|

|

Cash flows from financing activities |

|

|

|

|

|

Dividends paid |

(200,658) |

(153,469) |

(531,242) |

(318,744) |

|

Dividends paid to non-controlling interest in subsidiaries |

- |

- |

(10,432) |

(3,355) |

|

Changes in non-controlling interests |

2,099 |

- |

(1,407) |

- |

|

Payments of lease liabilities |

(13,560) |

(10,252) |

(52,396) |

(48,473) |

|

Proceeds from borrowings |

161,785 |

267,970 |

1,511,503 |

843,668 |

|

Repayments of borrowings |

(300,783) |

(446,728) |

(1,094,370) |

(1,121,053) |

|

Net cash used in financing activities |

(351,117) |

(342,479) |

(178,344) |

(647,957) |

|

|

|

|

|

|

|

Increase (decrease) in cash and cash

equivalents |

112,514 |

(194,478) |

825,318 |

(260,985) |

|

|

|

|

|

|

|

Movement in cash and cash equivalents |

|

|

|

|

|

At the beginning of the year |

990,803 |

513,665 |

318,067 |

584,583 |

|

Effect of exchange rate changes |

(11,883) |

(1,120) |

(51,952) |

(5,531) |

|

Increase (decrease) in cash and cash equivalents |

112,514 |

(194,478) |

825,318 |

(260,985) |

|

At December 31, |

1,091,434 |

318,067 |

1,091,433 |

318,067 |

Exhibit I – Alternative performance

measures

Alternative performance measures should be

considered in addition to, not as substitute for or superior to,

other measures of financial performance prepared in accordance with

IFRS.

EBITDA, Earnings before interest, tax, depreciation and

amortization.

EBITDA provides an analysis of the operating

results excluding depreciation and amortization and impairments, as

they are recurring non-cash variables which can vary substantially

from company to company depending on accounting policies and the

accounting value of the assets. EBITDA is an approximation to

pre-tax operating cash flow and reflects cash generation before

working capital variation. EBITDA is widely used by investors when

evaluating businesses (multiples valuation), as well as by rating

agencies and creditors to evaluate the level of debt, comparing

EBITDA with net debt.

EBITDA is calculated in the following manner:

EBITDA = Net income for the period + Income tax

charges +/- Equity in Earnings (losses) of non-consolidated

companies +/- Financial results + Depreciation and amortization +/-

Impairment charges/(reversals)

EBITDA is a non-IFRS alternative performance measure.

|

(all amounts in thousands of U.S. dollars) |

Three-month period ended December 31, |

Twelve-month period ended December 31, |

|

|

2022 |

2021 |

2022 |

2021 |

|

Income for continuing operations |

803,172 |

336,136 |

2,548,701 |

1,053,318 |

|

Income tax |

258,226 |

72,246 |

617,236 |

189,448 |

|

Equity in earnings of non-consolidated companies |

(12,701) |

(133,482) |

(208,702) |

(512,591) |

|

Financial results |

(35,646) |

(1,585) |

6,040 |

(22,666) |

|

Depreciation and amortization |

179,135 |

152,160 |

607,723 |

594,721 |

|

Impairment charge |

76,725 |

57,075 |

76,725 |

57,075 |

|

EBITDA |

1,268,911 |

482,550 |

3,647,723 |

1,359,305 |

Free Cash Flow

Free cash flow is a measure of financial performance, calculated

as operating cash flow less capital expenditures. FCF represents

the cash that a company is able to generate after spending the

money required to maintain or expand its asset base.

Free cash flow is calculated in the following manner:

Free cash flow = Net cash (used in) provided by operating

activities - Capital expenditures.

Free cash flow is a non-IFRS alternative performance

measure.

|

(all amounts in thousands of U.S. dollars) |

Three-month period ended December 31, |

Twelve-month period ended December 31, |

|

|

2022 |

2021 |

2022 |

2021 |

|

Net cash provided by operating activities |

523,942 |

46,030 |

1,167,217 |

119,075 |

|

Capital expenditures |

(107,646) |

(68,647) |

(378,446) |

(239,518) |

|

Free cash flow |

416,296 |

(22,617) |

788,771 |

(120,443) |

Net Cash / (Debt)

This is the net balance of cash and cash

equivalents, other current investments and fixed income investments

held to maturity less total borrowings. It provides a summary of

the financial solvency and liquidity of the company. Net cash /

(debt) is widely used by investors and rating agencies and

creditors to assess the company’s leverage, financial strength,

flexibility and risks.

Net cash/ debt is calculated in the following manner:

Net cash = Cash and cash equivalents + Other investments

(Current and Non-Current)+/- Derivatives hedging borrowings and

investments - Borrowings (Current and Non-Current).

Net cash/debt is a non-IFRS alternative performance measure.

|

(all amounts in thousands of U.S. dollars) |

Year ended December 31, |

|

|

2022 |

2021 |

|

Cash and cash equivalents |

1,091,527 |

318,127 |

|

Other current investments |

438,448 |

397,849 |

|

Non-current investments |

113,574 |

312,619 |

|

Derivatives hedging borrowings and investments |

6,480 |

2,325 |

|

Current borrowings |

(682,329) |

(219,501) |

|

Non-current borrowings |

(46,433) |

(111,432) |

|

Net cash / (debt) |

921,267 |

699,987 |

Operating working capital days

Operating working capital is the difference

between the main operating components of current assets and current

liabilities. Operating working capital is a measure of a company’s

operational efficiency, and short-term financial health.

Operating working capital days is calculated in

the following manner:

Operating working capital days = [(Inventories +

Trade receivables – Trade payables – Customer advances) /

Annualized quarterly sales ] x 365

Operating working capital days is a non-IFRS alternative

performance measure.

|

(all amounts in thousands of U.S. dollars) |

Three-month period ended December 31, |

|

|

2022 |

2021 |

|

Inventories |

3,986,929 |

2,672,593 |

|

Trade receivables |

2,493,940 |

1,299,072 |

|

Customer advances |

(242,910) |

(92,436) |

|

Trade payables |

(1,179,457) |

(845,256) |

|

Operating working capital |

5,058,502 |

3,033,973 |

|

Annualized quarterly sales |

14,480,840 |

8,228,656 |

|

Operating working capital days |

128 |

135 |

Giovanni

Sardagna Tenaris

1-888-300-5432www.tenaris.com

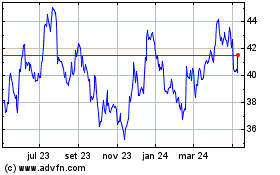

Ternium (NYSE:TX)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

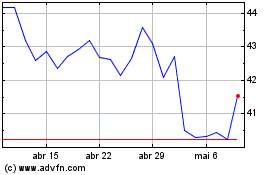

Ternium (NYSE:TX)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024