All figures are in United States dollars.

All production figures reflect payable metal quantities and are on

a 100%-basis, unless otherwise stated. For references denoted with

NG, refer to the “Non-GAAP and Other Financial Measures” disclosure

at the end of this news release for a description of these

measures.

TORONTO, Feb. 23, 2023 (GLOBE NEWSWIRE) --

Centerra Gold Inc. (“Centerra” or the “Company”) (TSX: CG and NYSE:

CGAU) today reported its fourth quarter and full-year 2022

results.

Significant financial and operating results of

the fourth quarter and year ended December 31, 2022 included:

- Net

loss for the quarter of $130.1 million or $0.59 per common

share (basic), including a non-cash impairment loss on the Kemess

Project of $138.2 million (net of tax). The Kemess Project

impairment loss was recorded as the Company is now classifying the

project as non-core with no exploration or development-related

expenditures incurred in 2022 or committed for future years. An

adjusted lossNG of $13.7 million or $0.06 per common

share (basic). Net loss for the year of $77.2 million or $0.29 per

common share (basic) and an adjusted net lossNG of $9.4

million or $0.04 per common share (basic).

- Cash

used in operating activities and free cash flow

deficitNG for the quarter of

$9.8 million and $25.3 million, respectively was primarily due to a

temporary suspension of leaching activities at the Öksüt Mine. Cash

used in operating activities at the Öksüt Mine was $11.9 million

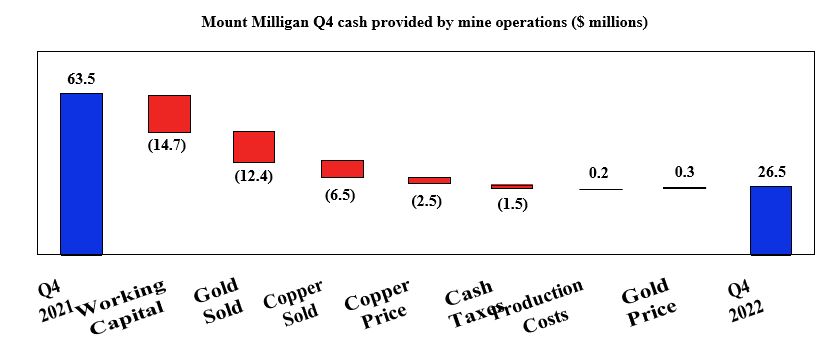

for the quarter with continued mining and stacking of ore. Mount

Milligan Mine generated cash provided by mine operating activities

and free cash flowNG of $26.5 million and $15.6 million

for the quarter, respectively. Cash used in operating activities

and free cash flow deficitNG for the year were $2.0

million and $82.9 million, respectively.

- In

January 2023, the Öksüt Mine received notice of approval of its

operating license extension application for a period of 10

years as well as approval of an enlarged grazing land

permit to allow expansion of the open pits. The regulatory review

of Öksüt Mine’s amended Environmental Impact Assessment (“EIA”),

which was submitted in mid-January 2023 for regulatory review,

remains on track.

- The Company’s mercury

abatement retrofit to the Öksüt Mine’s ADR plant is

complete. Upon restart of the ADR plant, and after

receiving regulatory approvals, the Company will be in a position

to process the gold-in-carbon inventory on hand of approximately

100,000 recoverable ounces. The ADR plant has capacity to produce

gold at a rate of approximately 35,000 ounces per month.

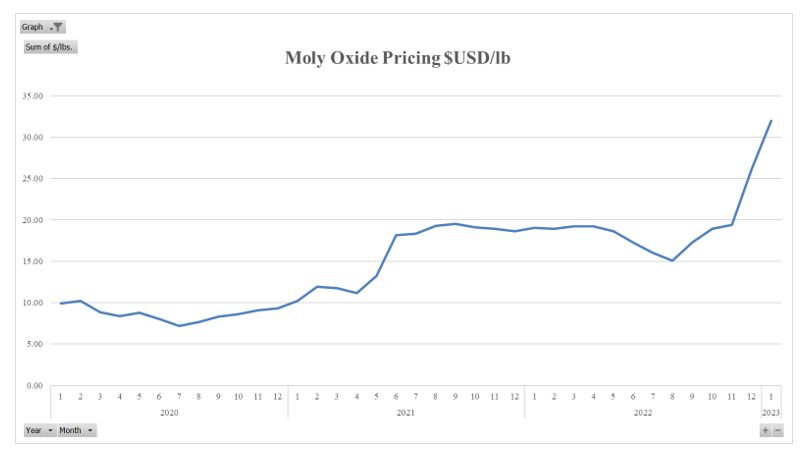

- The

Company continues to evaluate strategic options for the Molybdenum

Business Unit, including a potential restart of the

Thompson Creek Mine with improving global molybdenum

prices. The Company plans to issue a

Prefeasibility Study (“PFS”) on a restart of the Thompson Creek

Mine in the third quarter of 2023.

- Goldfield

Project drilling activities continued in the fourth

quarter of 2022. The Company plans to issue an initial resource

estimate by mid-year 2023 followed by an updated resource estimate

accompanied by a Feasibility Study.

- The

Company completed full rollout of Responsible Gold Mining

Principles in the fourth quarter of 2022.

- Strong balance

sheet with a cash position at the year-end of $531.9

million.

- Returns to

shareholders of $22.6 million for the quarter and $58.9

million for the year, through dividends and the buyback of shares

under a Normal Course Issuer Bid (“NCIB”).

- Gold

production for the quarter of 53,222 ounces, solely from

the Mount Milligan Mine.

- Copper

production for the quarter of 16.9 million pounds.

- Gold

production costs for the quarter of $790 per ounce.

- Copper

production costs for the quarter of $2.00 per pound.

- All-in

sustaining costs on a by-product

basisNG for the quarter of

$987 per ounce.

- All-in costs

on a by-product basisNG for

the quarter of $1,572 per ounce due to higher exploration and

project development costs incurred primarily at the Company’s

Goldfield Project.

- Quarterly

Dividend declared of CAD$0.07 per common share.

The Company’s 2022 full-year results on a

continuing basis, and previously disclosed full-year 2022 guidance

are summarized below:

|

|

|

2022

Guidance |

2022

Full-Year

results |

2022

Guidance |

2022

Full-Year

results |

|

|

|

Mount

Milligan |

Mount

Milligan |

Consolidated |

Consolidated |

|

Production |

|

|

|

|

|

|

Total gold production |

(Koz) |

190 - 210 |

189 |

245 - 265 |

244 |

|

Total copper production |

(Mlb) |

70 - 80 |

74 |

70 - 80 |

74 |

|

Costs |

|

|

|

|

|

|

Gold production costs |

($/oz) |

775 - 825 |

767 |

675 - 725 |

681 |

|

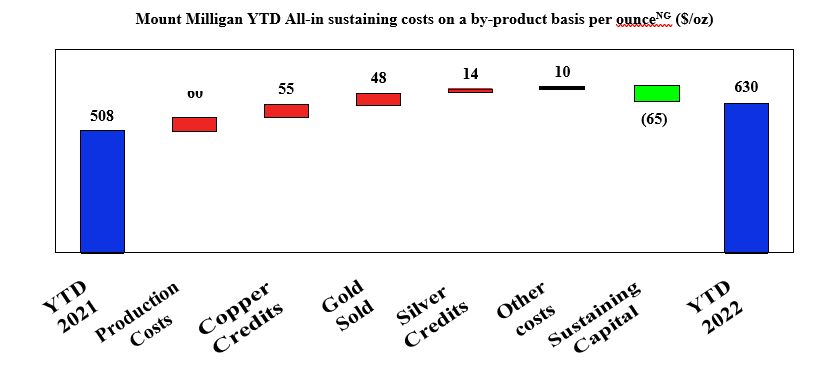

All-in sustaining costs on a by-product basisNG |

($/oz) |

775 - 825 |

630 |

1,000 - 1,050 |

860 |

|

All-in costs on a by-product basisNG |

($/oz) |

825 - 875 |

704 |

1,225 - 1,275 |

1,201 |

|

All-in sustaining costs on a co-product basisNG |

($/oz) |

1,000 - 1,050 |

956 |

1,175 - 1,225 |

1,112 |

|

Copper production costs |

($/lb) |

1.55 - 1.70 |

1.70 |

1.55 - 1.70 |

1.70 |

|

All-in sustaining costs on a co-product basisNG |

($/lb) |

2.25 - 2.40 |

2.12 |

2.25 - 2.40 |

2.12 |

CEO Discussion

Paul Wright, Interim President and Chief

Executive Officer of Centerra stated, “In 2022, the Company

continued to demonstrate that safety remains Centerra’s top

priority, with a number of our sites achieving milestones without a

lost time injury. We put a strategy in place to improve safety

performance at the Mount Milligan Mine during the year and

subsequent to the year-end, the Mount Milligan Mine’s team achieved

one million hours worked without a lost time injury.”

“Despite all other challenges in 2022, I want to

highlight Mount Milligan Mine’s record annual mill throughput in

2022 of 21.3 million tonnes. The Company continues to optimize the

life of mine plan for Mount Milligan and anticipates increases in

both gold and copper production for 2024 and 2025 when compared to

the annual figures included in the most recent Technical Report for

the mine. To streamline our corporate structure, we recently

implemented changes that will lead to the closure of our regional

Prince George office and reduced workforce levels at the corporate

office in Toronto.”

“I’m also pleased to say that steady progress is

being made at the Öksüt Mine toward a restart of operations. The

retrofit of the ADR plant at the Öksüt Mine, was completed early in

2023, and we continue to work with the Turkish officials on the

restart of gold room operations at the ADR plant as well as an

updated EIA for the mine. We have received a 10-year operating

license extension for the Öksüt Mine as well as the approval of an

enlarged grazing land permit. The people of Türkiye continue to

deal with the devastating impact of the earthquakes and aftershocks

that occurred in the southeastern portion of the country in early

February. An emergency response team from the Öksüt Mine assisted

the Turkish state emergency preparedness authorities and regional

disaster response organizations during the search and rescue stage.

The Company continues to provide equipment and material support to

the ongoing recovery activities where possible. Centerra offers its

condolences to the people of Türkiye and all those that have lost

loved ones in this natural disaster.”

Update on Öksüt Mine

Operations

In March 2022, Centerra announced it had

temporarily suspended gold doré bar production at the Öksüt Mine

due to mercury detected in the gold room at the ADR plant. From the

date of suspension of gold room operations through to August 2022,

the Company continued to process ore into gold-in-carbon and had

approximately 100,000 recoverable ounces of stored gold-in-carbon

as of December 31, 2022, having incurred substantially all

associated production costs (excluding royalty charges). In

addition, the Öksüt Mine had approximately 200,000 recoverable

ounces of gold in ore stockpiles and on the heap leach pad as at

December 31, 2022. The Company has completed construction of a

mercury abatement system to allow processing of mercury-bearing

ores with capital costs below the original $5 million budget and it

continues to work with relevant authorities to obtain the required

approvals to restart gold room operations at the ADR plant. Once

operations resume, the ADR plant is expected to have sufficient

production capacity to process up to approximately 35,000 ounces of

gold per month.

Permitting

Following inspection by the Ministry of

Environment, Urbanization and Climate Change (the “Ministry of

Environment”) and several further discussions, the Company

determined that an updated EIA should be prepared and submitted to

clarify various production and other capacity limits and to align

the EIA production levels with current operating plans. The Öksüt

Mine suspended leaching of ore on the heap leach pad and ceased

using activated carbon on site effective late August 2022 though

mining, crushing and stacking activities continued in line with

existing EIA limits for the remainder of 2022.

The Öksüt Mine has built substantial inventories

of gold-in-carbon, ore stacked on the heap leach pad and ore

stockpiles and has therefore paused crushing and stacking

activities. The Öksüt Mine is currently focusing mining activities

on the Phase 5 pit wall pushback to expand the Keltepe pit.

The Öksüt Mine’s application to update its EIA

was submitted to regulators at the end of August 2022 and the new

updated EIA was submitted in January 2023. The Company is working

with Turkish officials and other stakeholders on the regulatory

review and approval of its EIA and other permits that may be

required to allow for a timely full restart of all operations.

In January 2023, the Öksüt Mine received notice

of approval of its operating license extension application for a

period of 10 years as well as approval of an enlarged grazing land

permit to allow expansion of the Keltepe and Güneytepe pits as

planned.

Exploration Update

Exploration activities in the fourth quarter of

2022 included drilling, surface sampling, geological mapping and

geophysical surveying at the Company’s various projects and earn-in

properties, targeting gold and copper mineralization in Canada,

Türkiye, and the United States of America. Exploration expenditures

in the fourth quarter of 2022 were $16.2 million. The activities

were primarily focused on expanded drilling programs at the Mount

Milligan Mine in British Columbia, the Öksüt Mine in Türkiye, the

Goldfield Project in Nevada, and greenfield projects in the USA and

Türkiye.

At the Mount Milligan Mine, 27 diamond drill

holes, totalling 10,516 metres, were completed in the fourth

quarter of 2022, including brownfield exploration drilling (8,003

metres in 17 drill holes) and resource expansion drilling (2,513

metres in ten drill holes). The 2022 drill programs at the Mount

Milligan Mine targeted porphyry-style gold-copper mineralization

below and adjacent to the current ultimate open-pit boundary, as

well as continued to test targets with potential for shallower

porphyry-style gold-copper mineralization and high gold-low copper

style mineralization peripheral to the current pits.

The planned 2023 exploration drilling programs

at the Mount Milligan Mine are expected to commence late in the

first quarter of 2023, targeting porphyry-style gold-copper

mineralization on the northern and southwestern margins of the

current ultimate open pit, and peripheral greenfield targets within

the Mount Milligan claim block.

At the Öksüt Mine, 43 diamond drill holes and 18

reverse circulation (“RC”) drill holes, totalling 15,840 metres,

were completed in the fourth quarter of 2022. Exploration drilling

activities were mainly undertaken at the Keltepe, Güneytepe,

Keltepe North, Keltepe Northwest, and Keltepe North-Northwest

deposits with the aim of expanding known oxide gold mineralization

resources. Drilling also continued testing peripheral targets, such

as the Yelibelen, Büyüktepe, and Boztepe prospects.

The planned 2023 exploration drilling programs

at the Öksüt Mine are expected to commence early in the second

quarter of 2023, targeting oxide gold mineralisation proximal to

the known deposits and the potential for porphyry-style gold-

copper mineralization at depth within the property.

At the Goldfield Project, 21 diamond drill holes

and 134 RC drill holes, totaling 35,259 metres of drilling, were

completed in the fourth quarter of 2022. Completed holes include

26,590 metres in 117 exploration, infill, and resource expansion

holes, 3,995 metres in 18 condemnation drill holes, 2,920 metres in

ten metallurgical holes, 1,512 metres in eight geotechnical holes,

and two water monitoring wells for 241 metres.

The planned 2023 exploration drilling programs

at the Goldfield Project commenced early in the first quarter of

2023, principally targeting extensions to gold mineralization

proximal to the known deposits.

Conference Call

Centerra invites you to join its 2022 fourth

quarter conference call on Friday, February 24, 2023 at 9:00 AM

Eastern Time. The call is open to all investors and the media. To

join the call, please dial toll-free in North America 1 (877)

210-1510. International participants may access the call at +1

(416) 620-9188. Results summary presentation slides are available

on Centerra’s website at www.centerragold.com.

Alternatively, an audio feed webcast will be broadcast live by

Notified and can be accessed live at Centerra’s website at www.centerragold.com. A

recording of the call will be available after the call and via

telephone until midnight Eastern Standard Time on March 10, 2023 by

calling +1 (416) 626-4100 or (800) 558-5253 and using passcode

22026083.

Non-GAAP and Other Financial Measures

This document contains “specified financial

measures” within the meaning of NI 52-112, specifically the

non-GAAP financial measures and non-GAAP ratios described below.

Management believes that the use of these measures assists

analysts, investors and other stakeholders of the Company in

understanding the costs associated with producing gold and copper,

understanding the economics of gold and copper mining, assessing

operating performance, the Company’s ability to generate free cash

flow from current operations and on an overall Company basis, and

for planning and forecasting of future periods. However, the

measures have limitations as analytical tools as they may be

influenced by the point in the life cycle of a specific mine and

the level of additional exploration or other expenditures a company

has to make to fully develop its properties. The specified

financial measures used in this document do not have any

standardized meaning prescribed by IFRS and may not be comparable

to similar measures presented by other issuers, even as compared to

other issuers who may be applying the World Gold Council (“WGC”)

guidelines. Accordingly, these specified financial measures should

not be considered in isolation, or as a substitute for, analysis of

the Company’s recognized measures presented in accordance with

IFRS.

Definitions:

The following is a description of the non-GAAP

financial measures and non-GAAP ratios used in this news

release:

- All-in

sustaining costs on a by-product basis per ounce is a non-GAAP

ratio calculated as all-in sustaining costs on a by-product basis

divided by ounces of gold sold. All-in sustaining costs on a

by-product basis is a non-GAAP financial measure calculated as the

aggregate of production costs as recorded in the consolidated

statements of loss, refining and transport costs, the cash

component of capitalized stripping and sustaining capital

expenditures, lease payments related to sustaining assets,

corporate general and administrative expenses, accretion expenses,

asset retirement depletion expenses, copper and silver revenue and

the associated impact of hedges of by-product sales revenue (added

in the current period and applied retrospectively to the previous

period). When calculating all-in sustaining costs on a by-product

basis, all revenue received from the sale of copper from the Mount

Milligan Mine, as reduced by the effect of the copper stream, is

treated as a reduction of costs incurred. A reconciliation of

all-in sustaining costs on a by-product basis to the nearest IFRS

measure is set out below. Management uses these measures to monitor

the cost management effectiveness of each of its operating

mines.

- All-in

sustaining costs on a co-product basis per ounce of gold or per

pound of copper, is a non-GAAP ratio calculated as all-in

sustaining costs on a co-product basis divided by ounces of gold or

pounds of copper sold, as applicable. All-in sustaining costs on a

co-product basis is a non-GAAP financial measure based on an

allocation of production costs between copper and gold based on the

conversion of copper production to equivalent ounces of gold. The

Company uses a conversion ratio for calculating gold equivalent

ounces for its copper sales calculated by multiplying the copper

pounds sold by estimated average realized copper price and dividing

the resulting figure by estimated average realized gold price. For

the fourth quarter and year ended December 31, 2022, 394 pounds and

450 pounds, respectively, of copper were equivalent to one ounce of

gold. A reconciliation of all-in sustaining costs on a co-product

basis to the nearest IFRS measure is set out below. Management uses

these measures to monitor the cost management effectiveness of each

of its operating mines.

- Sustaining

capital expenditures and Non-sustaining capital

expenditures are non-GAAP financial measures. Sustaining

capital expenditures are defined as those expenditures required to

sustain current operations and exclude all expenditures incurred at

new operations or major projects at existing operations where these

projects will materially benefit the operation. Non-sustaining

capital expenditures are primarily costs incurred at ‘new

operations’ and costs related to ‘major projects at existing

operations’ where these projects will materially benefit the

operation. A material benefit to an existing operation is

considered to be at least a 10% increase in annual or life of mine

production, net present value, or reserves compared to the

remaining life of mine of the operation. A reconciliation of

sustaining capital expenditures and non-sustaining capital

expenditures to the nearest IFRS measures is set out below.

Management uses the distinction of the sustaining and

non-sustaining capital expenditures as an input into the

calculation of all-in sustaining costs per ounce and all-in costs

per ounce.

- All-in

costs on a by-product

basis per ounce is a non-GAAP ratio

calculated as all-in costs on a by-product basis divided by ounces

sold. All-in costs on a by-product basis is a non-GAAP financial

measure which includes all-in sustaining costs on a by-product

basis, exploration and study costs, non-sustaining capital

expenditures, care and maintenance and predevelopment costs. A

reconciliation of all-in costs on a by-product basis to the nearest

IFRS measures is set out below. Management uses these measures to

monitor the cost management effectiveness of each of its operating

mines.

- Adjusted net

(loss) earnings is a non-GAAP financial measure calculated by

adjusting net (loss) earnings as recorded in the consolidated

statements of loss and comprehensive loss for items not associated

with ongoing operations. The Company believes that this generally

accepted industry measure allows the evaluation of the results of

continuing income-generating capabilities and is useful in making

comparisons between periods. This measure adjusts for the impact of

items not associated with ongoing operations. A reconciliation of

adjusted net (loss) earnings to the nearest IFRS measures is set

out below. Management uses this measure to monitor and plan for the

operating performance of the Company in conjunction with other data

prepared in accordance with IFRS.

- Free cash

flow (deficit) from operations is a non-GAAP financial measure

calculated as cash provided by operating activities from continuing

operations less property, plant and equipment additions. A

reconciliation of free cash flow from continuing operations to the

nearest IFRS measures is set out below. Management uses this

measure to monitor the amount of cash available to reinvest in the

Company and allocate for shareholder returns.

- Free cash

flow (deficit) from mine operations is a non-GAAP financial

measure calculated as cash provided by mine operations less

property, plant and equipment additions. A reconciliation of free

cash flow from mine operations to the nearest IFRS measures is set

out below. Management uses this measure to monitor the degree of

self-funding of each of its operating mines and facilities.

Certain unit costs,

including all-in sustaining costs on a by-product basis (including

and excluding revenue-based taxes) per ounce, are non-GAAP ratios

which include as a component certain non-GAAP financial measures

including all-in sustaining costs on a by-product basis which can

be reconciled as follows:

|

|

Three months ended December 31, |

|

|

Consolidated(2) |

Mount Milligan |

Öksüt |

|

Kumtor |

|

(Unaudited - $millions, unless otherwise

specified) |

2022 |

|

2021 |

|

2022 |

|

2021 |

|

2022 |

2021 |

|

2022 |

2021 |

|

Production costs attributable to gold |

39.0 |

|

49.7 |

|

39.0 |

|

39.3 |

|

— |

10.4 |

|

— |

— |

|

Production costs attributable to copper |

30.8 |

|

30.7 |

|

30.8 |

|

30.7 |

|

— |

— |

|

— |

— |

| Total

production costs excluding molybdenum segment, as reported |

69.8 |

|

80.4 |

|

69.8 |

|

70.0 |

|

— |

10.4 |

|

— |

— |

| Adjust

for: |

|

|

|

|

|

|

|

|

|

| Third

party smelting, refining and transport costs |

3.5 |

|

2.3 |

|

3.5 |

|

2.2 |

|

— |

0.1 |

|

— |

— |

|

By-product and co-product credits |

(54.3 |

) |

(63.8 |

) |

(54.3 |

) |

(63.8 |

) |

— |

— |

|

— |

— |

| Adjusted

production costs |

19.0 |

|

18.9 |

|

19.0 |

|

8.4 |

|

— |

10.5 |

|

— |

— |

| Corporate

general administrative and other costs |

12.1 |

|

7.3 |

|

0.4 |

|

(0.1 |

) |

— |

— |

|

— |

— |

|

Reclamation and remediation - accretion (operating sites) |

1.7 |

|

1.5 |

|

0.5 |

|

0.5 |

|

1.2 |

1.0 |

|

— |

— |

|

Sustaining capital expenditures |

14.5 |

|

24.3 |

|

9.9 |

|

20.2 |

|

4.6 |

4.1 |

|

— |

— |

|

Sustaining leases |

1.5 |

|

1.4 |

|

1.3 |

|

1.3 |

|

0.2 |

0.1 |

|

— |

— |

| All-in

sustaining costs on a by-product basis |

48.8 |

|

53.4 |

|

31.1 |

|

30.3 |

|

6.0 |

15.7 |

|

— |

— |

|

Exploration and evaluation costs |

23.0 |

|

6.4 |

|

2.0 |

|

1.1 |

|

1.4 |

— |

|

— |

— |

|

Non-sustaining capital expenditures(1) |

0.1 |

|

2.4 |

|

0.1 |

|

2.2 |

|

— |

0.2 |

|

— |

— |

| Care and

maintenance and other costs |

5.8 |

|

4.0 |

|

— |

|

— |

|

1.3 |

— |

|

— |

— |

| All-in

costs on a by-product basis |

77.7 |

|

66.2 |

|

33.2 |

|

33.6 |

|

8.7 |

15.9 |

|

— |

— |

| Ounces

sold (000s) |

49.4 |

|

90.3 |

|

49.4 |

|

58.6 |

|

— |

31.7 |

|

— |

— |

| Pounds

sold (millions) |

15.4 |

|

17.2 |

|

15.4 |

|

17.2 |

|

— |

— |

|

— |

— |

| Gold

production costs ($/oz) |

790 |

|

550 |

|

790 |

|

670 |

|

n/a |

328 |

|

— |

— |

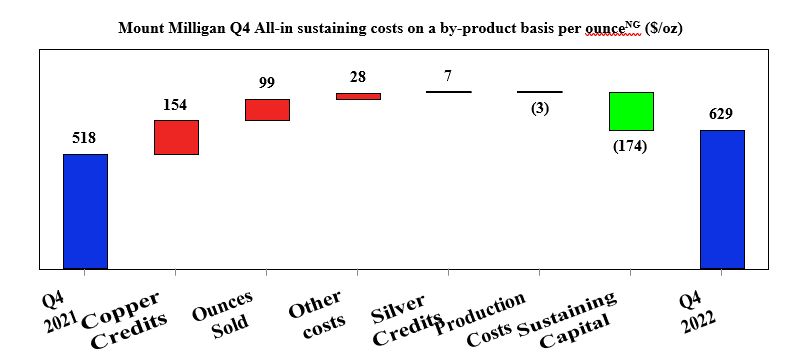

| All-in

sustaining costs on a by-product basis ($/oz) |

987 |

|

591 |

|

629 |

|

518 |

|

n/a |

495 |

|

— |

— |

| All-in

costs on a by-product basis ($/oz) |

1,572 |

|

732 |

|

672 |

|

573 |

|

n/a |

501 |

|

— |

— |

| Gold -

All-in sustaining costs on a co-product basis ($/oz) |

1,308 |

|

829 |

|

950 |

|

883 |

|

n/a |

495 |

|

— |

— |

| Copper

production costs ($/pound) |

2.00 |

|

1.79 |

|

2.00 |

|

1.79 |

|

n/a |

n/a |

|

n/a |

n/a |

|

Copper - All-in sustaining costs on a co-product basis

($/pound) |

2.40 |

|

2.34 |

|

2.40 |

|

2.34 |

|

n/a |

n/a |

|

n/a |

n/a |

(1) Non-sustaining capital

expenditures are distinct projects designed to have a significant

increase in the net present value of the mine. In the current

quarter, non-sustaining capital expenditures include costs related

to the installation of the staged flotation reactors at the Mount

Milligan Mine.

Certain unit costs, including all-in

sustaining costs on a by-product basis (including and excluding

revenue-based taxes) per ounce, are non-GAAP ratios which include

as a component certain non-GAAP financial measures including all-in

sustaining costs on a by-product basis which can be reconciled as

follows:

|

|

Years ended December 31, |

|

|

Consolidated(2) |

Mount Milligan |

Öksüt |

|

Kumtor(3) |

|

(Unaudited - $millions, unless otherwise

specified) |

2022 |

|

2021 |

|

2022 |

|

2021 |

|

2022 |

2021 |

|

2022 |

2021 |

|

Production costs attributable to gold |

164.9 |

|

189.9 |

|

143.8 |

|

138.8 |

|

21.1 |

51.1 |

|

— |

72.6 |

|

Production costs attributable to copper |

125.1 |

|

118.0 |

|

125.1 |

|

118.0 |

|

— |

— |

|

— |

— |

| Total

production costs excluding molybdenum segment, as reported |

290.0 |

|

307.9 |

|

268.9 |

|

256.8 |

|

21.1 |

51.1 |

|

— |

72.6 |

| Adjust

for: |

|

|

|

|

|

|

|

|

|

| Third

party smelting, refining and transport costs |

12.1 |

|

11.1 |

|

11.9 |

|

10.1 |

|

0.2 |

1.0 |

|

— |

1.2 |

|

By-product and co-product credits |

(223.8 |

) |

(238.0 |

) |

(223.8 |

) |

(238.0 |

) |

— |

— |

|

— |

— |

| Community

costs related to current operations |

— |

|

— |

|

— |

|

— |

|

— |

— |

|

— |

2.6 |

| Adjusted

production costs |

78.3 |

|

81.0 |

|

57.0 |

|

28.9 |

|

21.3 |

52.1 |

|

— |

76.4 |

| Corporate

general administrative and other costs |

47.8 |

|

27.7 |

|

1.1 |

|

1.0 |

|

— |

— |

|

— |

— |

|

Reclamation and remediation - accretion (operating sites) |

7.2 |

|

4.9 |

|

1.8 |

|

1.8 |

|

5.4 |

3.1 |

|

— |

0.3 |

|

Sustaining capital expenditures |

69.1 |

|

85.5 |

|

53.1 |

|

66.7 |

|

16.0 |

18.8 |

|

— |

60.6 |

|

Sustaining lease payments |

5.8 |

|

5.4 |

|

5.1 |

|

4.8 |

|

0.6 |

0.6 |

|

— |

— |

| All-in

sustaining costs on a by-product basis |

208.2 |

|

204.5 |

|

118.1 |

|

103.2 |

|

43.3 |

74.6 |

|

— |

137.3 |

|

Revenue-based taxes |

— |

|

— |

|

— |

|

— |

|

— |

— |

|

— |

37.0 |

|

Exploration and study costs |

65.7 |

|

23.6 |

|

12.2 |

|

5.6 |

|

3.8 |

2.1 |

|

— |

8.8 |

|

Non-sustaining capital expenditures(1) |

2.1 |

|

5.3 |

|

1.6 |

|

4.1 |

|

— |

0.8 |

|

— |

25.9 |

| Care and

maintenance and other costs |

14.8 |

|

14.1 |

|

— |

|

— |

|

1.7 |

— |

|

— |

— |

| All-in

costs on a by-product basis |

290.8 |

|

247.4 |

|

131.9 |

|

112.9 |

|

48.8 |

77.5 |

|

— |

209.0 |

| Ounces

sold (000s) |

242.2 |

|

314.8 |

|

187.5 |

|

203.1 |

|

54.7 |

111.7 |

|

— |

147.8 |

| Pounds

sold (millions) |

73.4 |

|

78.0 |

|

73.4 |

|

78.0 |

|

— |

— |

|

— |

— |

| Gold

production costs ($/oz) |

681 |

|

604 |

|

767 |

|

683 |

|

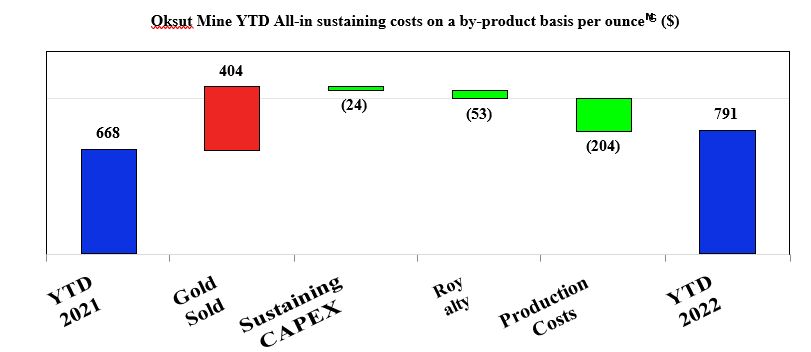

386 |

457 |

|

— |

491 |

| All-in

sustaining costs on a by-product basis ($/oz) |

860 |

|

649 |

|

630 |

|

508 |

|

791 |

668 |

|

— |

929 |

| All-in

costs on a by-product basis ($/oz) |

1,201 |

|

785 |

|

704 |

|

556 |

|

891 |

694 |

|

— |

1,414 |

| Gold -

All-in sustaining costs on a co-product basis ($/oz) |

1,112 |

|

891 |

|

956 |

|

883 |

|

791 |

668 |

|

— |

929 |

| Copper

production costs ($/pound) |

1.70 |

|

1.51 |

|

1.70 |

|

1.51 |

|

n/a |

n/a |

|

n/a |

n/a |

|

Copper - All-in sustaining costs on a co-product basis

($/pound) |

2.12 |

|

1.94 |

|

2.12 |

|

1.94 |

|

n/a |

n/a |

|

n/a |

n/a |

(1) Non-sustaining

capital expenditures are distinct projects designed to have a

significant increase in the net present value of the mine. In the

current year, non-sustaining capital expenditures include costs

related to the installation of the staged flotation reactors at the

Mount Milligan Mine.

(2) Presented on a continuing

operations basis, excluding the results from the Kumtor Mine.

(3) Results from the period ended

December 31, 2021 from the Kumtor Mine are prior to the seizure of

the mine on May 15, 2021.

Adjusted net (loss) earnings is a non-GAAP financial

measure and can be reconciled as follows:

|

|

Three months ended December 31, |

Years ended December 31, |

|

($millions, except as noted) |

|

2022 |

|

|

2021 |

|

|

2022 |

|

|

2021 |

|

|

Net (loss) earnings |

$ |

(130.1 |

) |

$ |

274.9 |

|

$ |

(77.2 |

) |

$ |

(381.8 |

) |

|

Adjust for items not associated with ongoing operations: |

|

|

|

|

|

Loss of control of the Kumtor Mine |

|

— |

|

|

— |

|

|

— |

|

|

926.4 |

|

|

Kumtor Mine legal costs and other related costs |

|

— |

|

|

11.3 |

|

|

15.0 |

|

|

27.5 |

|

|

Gain from the discontinuance of Kumtor Mine hedge instruments |

|

— |

|

|

— |

|

|

— |

|

|

(15.3 |

) |

|

Impairment loss (reversal), net of tax |

|

138.2 |

|

|

(117.3 |

) |

|

138.2 |

|

|

(117.3 |

) |

|

Gain on the sale of Greenstone property |

|

— |

|

|

(25.0 |

) |

|

— |

|

|

(97.3 |

) |

|

Reclamation (recovery) expense at sites on care and

maintenance |

|

(3.4 |

) |

|

24.2 |

|

|

(94.2 |

) |

|

24.1 |

|

|

Gain on derecognition of the employee health plan benefit provision

at the Langeloth Facility |

|

(4.4 |

) |

|

— |

|

|

(4.4 |

) |

|

— |

|

|

Income and mining tax adjustments(1) |

|

(14.0 |

) |

|

(132.7 |

) |

|

13.2 |

|

|

(132.7 |

) |

|

Adjusted net (loss) earnings |

$ |

(13.7 |

) |

$ |

35.4 |

|

$ |

(9.4 |

) |

$ |

233.6 |

|

Net (loss) earnings per share - basic |

$ |

(0.59 |

) |

$ |

0.93 |

|

$ |

(0.29 |

) |

$ |

(1.29 |

) |

|

Net (loss) earnings per share - diluted |

$ |

(0.59 |

) |

$ |

0.92 |

|

$ |

(0.31 |

) |

$ |

(1.29 |

) |

|

Adjusted net (loss) earnings per share -

basic |

$ |

(0.06 |

) |

$ |

0.12 |

|

$ |

(0.04 |

) |

$ |

0.79 |

|

|

Adjusted net (loss) earnings per share -

diluted |

$ |

(0.06 |

) |

$ |

0.12 |

|

$ |

(0.04 |

) |

$ |

0.77 |

|

(1) Income tax adjustments reflect

the impact of foreign currency translation on deferred income taxes

and an election made under local legislation to account for

inflation and increase the tax value of Öksüt Mine’s assets

Free cash flow (deficit) from

continuing operations and adjusted free cash flow (deficit) from

continuing operations are non-GAAP financial measures and can be

reconciled as follows:

|

|

Three months ended December 31, |

|

|

Consolidated |

Mount Milligan |

Öksüt |

Molybdenum |

Other |

|

|

|

2022 |

|

|

2021 |

|

|

2022 |

|

|

2021 |

|

|

2022 |

|

|

2021 |

|

|

2022 |

|

2021 |

|

|

2022 |

|

|

2021 |

|

|

Cash (used in) provided by operating activities from

continuing operations(1) |

$ |

(9.8 |

) |

$ |

61.8 |

|

$ |

26.5 |

|

$ |

63.5 |

|

$ |

(11.9 |

) |

$ |

39.5 |

|

$ |

8.6 |

$ |

(15.8 |

) |

$ |

(33.0 |

) |

$ |

(25.4 |

) |

|

Deduct: |

|

|

|

|

|

|

|

|

|

|

|

Property, plant & equipment additions(1) |

|

(15.5 |

) |

|

(23.1 |

) |

|

(10.9 |

) |

|

(17.3 |

) |

|

(4.6 |

) |

|

(4.2 |

) |

|

— |

|

(1.4 |

) |

|

— |

|

|

(0.2 |

) |

|

Free cash flow (deficit) from continuing

operations |

$ |

(25.3 |

) |

$ |

38.7 |

|

$ |

15.6 |

|

$ |

46.2 |

|

$ |

(16.5 |

) |

$ |

35.3 |

|

$ |

8.6 |

$ |

(17.2 |

) |

$ |

(33.0 |

) |

$ |

(25.6 |

) |

(1) As presented in

the Company’s consolidated statements of cash flows.

|

|

Years ended December 31, |

|

|

Consolidated |

Mount Milligan |

Öksüt |

Molybdenum |

Other |

|

|

|

2022 |

|

|

2021 |

|

|

2022 |

|

|

2021 |

|

|

2022 |

|

|

2021 |

|

|

2022 |

|

|

2021 |

|

|

2022 |

|

|

2021 |

|

|

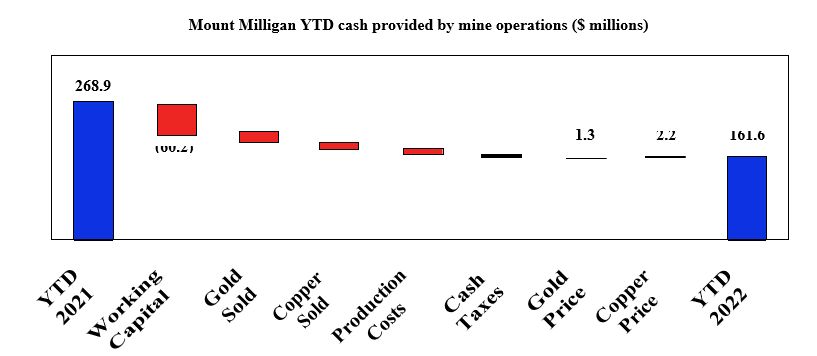

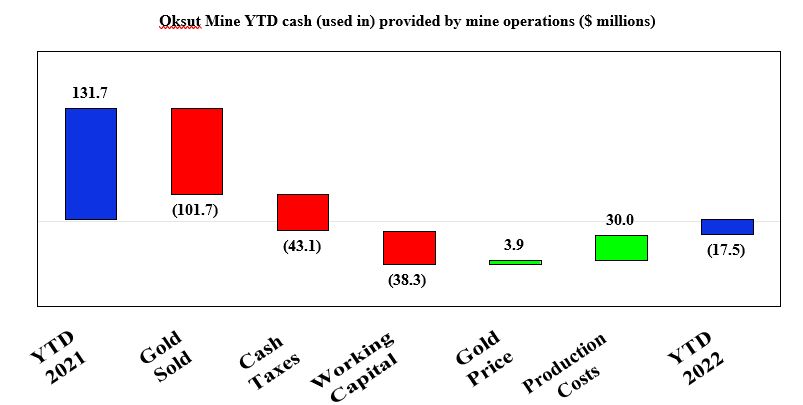

Cash provided by (used in) operating activities from

continuing operations(1) |

$ |

(2.0 |

) |

$ |

270.9 |

|

$ |

161.6 |

|

$ |

268.9 |

|

$ |

(17.5 |

) |

$ |

131.7 |

|

$ |

(9.3 |

) |

$ |

(37.3 |

) |

$ |

(136.8 |

) |

$ |

(92.4 |

) |

|

Deduct: |

|

|

|

|

|

|

|

|

|

|

|

Property, plant & equipment additions at continuing

operations(1) |

|

(80.9 |

) |

|

(92.5 |

) |

|

(61.2 |

) |

|

(67.4 |

) |

|

(16.0 |

) |

|

(20.1 |

) |

|

(1.1 |

) |

|

(2.5 |

) |

|

(2.6 |

) |

|

(2.5 |

) |

|

Free cash flow (deficit) from continuing

operations |

$ |

(82.9 |

) |

$ |

178.4 |

|

$ |

100.4 |

|

$ |

201.5 |

|

$ |

(33.5 |

) |

$ |

111.6 |

|

$ |

(10.4 |

) |

$ |

(39.8 |

) |

$ |

(139.4 |

) |

$ |

(94.9 |

) |

(1) As presented in

the Company’s consolidated statements of cash flows.

Sustaining capital expenditures and

non-sustaining capital expenditures are non-GAAP measures and can

be reconciled as follows:

|

|

Three months ended December 31, |

|

|

Consolidated |

Mount Milligan |

Öksüt |

Molybdenum |

Other |

|

|

|

2022 |

|

|

2021 |

|

|

2022 |

|

|

2021 |

|

|

2022 |

|

|

2021 |

|

|

2022 |

|

2021 |

|

2022 |

|

|

2021 |

|

|

Additions to

PP&E(1) |

$ |

27.9 |

|

$ |

46.9 |

|

$ |

14.6 |

|

$ |

28.9 |

|

$ |

5.1 |

|

$ |

9.3 |

|

$ |

0.8 |

$ |

1.4 |

$ |

7.4 |

|

$ |

7.3 |

|

| Adjust

for: |

|

|

|

|

|

|

|

|

|

|

|

Costs capitalized to the ARO assets |

|

(11.7 |

) |

|

(17.9 |

) |

|

(4.4 |

) |

|

(5.3 |

) |

|

— |

|

|

(5.2 |

) |

|

— |

|

— |

|

(7.3 |

) |

|

(7.4 |

) |

|

Costs capitalized to the ROU assets |

|

(0.2 |

) |

|

(1.3 |

) |

|

— |

|

|

(1.5 |

) |

|

(0.2 |

) |

|

0.2 |

|

|

— |

|

— |

|

— |

|

|

— |

|

|

Other(2) |

|

(0.6 |

) |

|

0.4 |

|

|

(0.2 |

) |

|

0.3 |

|

|

(0.3 |

) |

|

— |

|

|

— |

|

— |

|

(0.1 |

) |

|

0.1 |

|

|

Capital expenditures |

$ |

15.4 |

|

$ |

28.1 |

|

$ |

10.0 |

|

$ |

22.4 |

|

$ |

4.6 |

|

$ |

4.3 |

|

$ |

0.8 |

$ |

1.4 |

$ |

— |

|

$ |

— |

|

|

Sustaining capital expenditures |

|

15.3 |

|

|

25.7 |

|

|

9.9 |

|

|

20.2 |

|

|

4.6 |

|

|

4.1 |

|

|

0.8 |

|

1.4 |

|

— |

|

|

— |

|

|

Non-sustaining capital expenditures |

|

0.1 |

|

|

2.4 |

|

|

0.1 |

|

|

2.2 |

|

|

— |

|

|

0.2 |

|

|

— |

|

— |

|

— |

|

|

— |

|

(1) As presented in

the Company’s consolidated financial statements.

(2) Includes reclassification of

insurance and capital spares from supplies inventory to

PP&E.

|

|

Years ended December 31, |

|

|

Consolidated |

Mount Milligan |

Öksüt |

Molybdenum |

Other |

|

|

|

2022 |

|

|

2021 |

|

|

2022 |

|

2021 |

|

|

2022 |

|

|

2021 |

|

|

2022 |

|

2021 |

|

2022 |

|

|

2021 |

|

|

Additions to

PP&E(1) |

$ |

275.1 |

|

$ |

118.9 |

|

$ |

49.2 |

$ |

83.7 |

|

$ |

14.2 |

|

$ |

24.9 |

|

$ |

1.8 |

$ |

2.5 |

$ |

209.9 |

|

$ |

7.8 |

|

| Adjust

for: |

|

|

|

|

|

|

|

|

|

|

|

Costs capitalized to the ARO assets |

|

6.4 |

|

|

(17.8 |

) |

|

5.5 |

|

(5.3 |

) |

|

1.9 |

|

|

(5.20 |

) |

|

— |

|

— |

|

(1.0 |

) |

|

(7.3 |

) |

|

Costs capitalized to the ROU assets |

|

(0.4 |

) |

|

(6.9 |

) |

|

— |

|

(6.8 |

) |

|

(0.4 |

) |

|

(0.1 |

) |

|

— |

|

— |

|

— |

|

|

— |

|

|

Costs relating to the acquisition of Goldfield Project |

|

(208.2 |

) |

|

— |

|

|

— |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

— |

|

(208.2 |

) |

|

— |

|

|

Other(2) |

|

0.3 |

|

|

(0.9 |

) |

|

— |

|

(0.8 |

) |

|

0.3 |

|

|

— |

|

|

0.1 |

|

— |

|

(0.1 |

) |

|

(0.1 |

) |

|

Capital expenditures |

$ |

73.2 |

|

$ |

93.3 |

|

$ |

54.7 |

$ |

70.8 |

|

$ |

16.0 |

|

$ |

19.6 |

|

$ |

1.9 |

$ |

2.5 |

$ |

0.6 |

|

$ |

0.4 |

|

|

Sustaining capital expenditures |

|

71.1 |

|

|

88.0 |

|

|

53.1 |

|

66.7 |

|

|

16.0 |

|

|

18.8 |

|

|

1.9 |

|

2.5 |

|

0.1 |

|

|

— |

|

|

Non-sustaining capital expenditures |

|

2.1 |

|

|

5.3 |

|

|

1.6 |

|

4.1 |

|

|

— |

|

|

0.8 |

|

|

— |

|

— |

|

0.5 |

|

|

0.4 |

|

(1) As presented in

the Company’s consolidated financial statements.

(2) Includes reclassification of

insurance and capital spares from supplies inventory to

PP&E.

About Centerra

Centerra Gold Inc. is a Canadian-based mining

company focused on operating, developing, exploring and acquiring

gold and copper properties in North America, Türkiye, and other

markets worldwide. Centerra operates two mines: the Mount Milligan

Mine in British Columbia, Canada, and the Öksüt Mine in Türkiye.

The Company also owns the Goldfield Project in Nevada, United

States, the Kemess Underground Project in British Columbia, Canada,

and owns and operates the Molybdenum Business Unit in the United

States and Canada. Centerra's shares trade on the Toronto Stock

Exchange (“TSX”) under the symbol CG and on the New York Stock

Exchange (“NYSE”) under the symbol CGAU. The Company is based in

Toronto, Ontario, Canada.

Additional information on Centerra is available on the

Company’s website at www.centerragold.com and

at SEDAR at www.sedar.com and EDGAR

at www.sec.gov/edgar.

Management’s Discussion and

Analysis

For the Years Ended December 31, 2022

and 2021

This Management’s

Discussion and Analysis

(“MD&A”) has been prepared

as of February 23,

2023 and is intended

to provide a review of

the financial position and

results of operations of

Centerra Gold Inc. (“Centerra”

or the “Company”) for

the three and twelve months ended December

31, 2022 in comparison with the corresponding periods ended

December 31, 2021. This discussion should be read in conjunction

with the Company’s audited financial statements and the notes

thereto for the year ended December 31, 2022 prepared in accordance

with International Financial Reporting Standards (“IFRS”). The

Company’s audited financial statements

and the notes thereto

for the year ended

December 31, 2022, are

available at www.centerragold.com and

on the System for

Electronic Document Analysis

and Retrieval (“SEDAR”) at

www.sedar.com and EDGAR

at www.sec.gov/

edgar. In addition, this discussion contains

forward-looking information regarding Centerra’s business and

operations. Such forward-looking statements

involve risks, uncertainties

and other factors that

could cause actual results

to differ materially from those

expressed or implied by such forward-looking statements. See

“Caution Regarding Forward-Looking Information” below.

All dollar amounts are

expressed in United States

dollars (“USD”), except as

otherwise indicated. All

references in this document denoted

with NG indicate a “specified

financial measure” within the meaning of National Instrument 52-112

Non-GAAP and Other Financial Measures Disclosure of the Canadian

Securities Administrators. None of these measures is a standardized

financial measure under IFRS and these measures might not be

comparable to similar financial measures disclosed by other

issuers. See section “Non-GAAP

and Other Financial Measures”

below for a discussion

of the specified financial

measures used in this document and a reconciliation to

the most directly comparable IFRS measure.

Caution Regarding Forward-Looking

Information

Information contained in this document which

is not a statement of historical fact, and the documents

incorporated by reference herein, may be

“forward-looking information” for

the purposes of Canadian

securities laws and within

the meaning of the United

States Private Securities

Litigation Reform Act of

1995. Such forward-looking

information involves risks,

uncertainties and other factors that could

cause actual results, performance, prospects and opportunities to

differ materially from those expressed or implied by such

forward-looking information. The words “believe”, “expect”,

“anticipate”, “contemplate”, “plan”, “intends”, “continue”,

“budget”, “estimate”, “may”, “will”, “schedule”, “understand” and

similar expressions identify forward-looking information. These

forward-looking statements relate to, among other things:

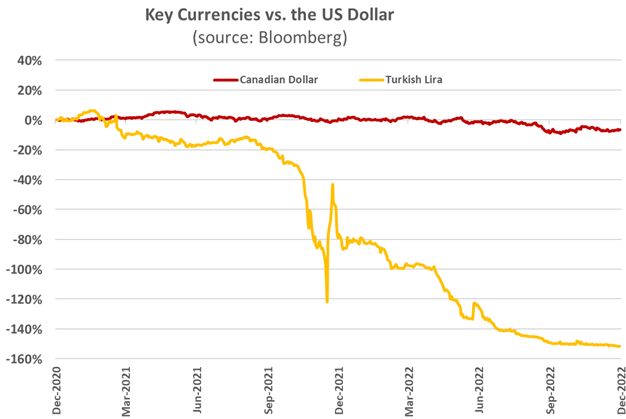

statements regarding 2023 Outlook and 2023 Guidance, including

production, costs, capital expenditures, depreciation, depletion

and amortization expenses and taxes; the effects of inflation on

the Company’s costs; the weakening of the Canadian dollar and

Turkish lira relative to the U.S. dollar; expectations regarding

copper credits and copper prices in 2023; the expected trend of the

Company’s performance toward achieving guidance; expected cash

outflows at the Oksut Mine for 2023; completion of mercury

abatement, containment and safety work in the gold room of the ADR

plant at the Öksüt Mine, including construction progress; the

expected restart of gold room operations, related regulatory

approvals and the expected timing thereof; the capacity of the

Öksüt Mine’s ADR plant to process inventories of loaded gold in

carbon ; preparation and timing of further submissions relating to

the EIA amendment for the Öksüt Mine and further discussions and

regulatory review thereof; progress on ordinary course permitting,

including the formal issuance of such permits at the Öksüt Mine and

the ability to mine the Keltepe and Guneytepe pits; expectations

for continued mining, crushing and

stacking operations at the

Öksüt Mine in 2023;

highlights of a new

life of mine plan for

the Mount Milligan Mine, including reserves and

resources, costs, inflationary pressures and expectations regarding

the release of further guidance; expectations

for optimization of Mount

Milligan Mine’s staged

flotation reactors; strategic

options for the Molybdenum BU,

including a potential restart of the Thompson Creek Mine, net cash

required to maintain the business and expectations for molybdenum

prices; expectations for ongoing activities at the Goldfield

project, including drilling, resource estimation and a feasibility

study; expectations for market purchases under a normal course

issuer bid; possible impact to operations relating to COVID-19;

leadership transition of the Chief Executive Officer position; and

expectations regarding contingent payments to be received from the

sale of Greenstone Partnership.

Forward-looking information

is necessarily based upon

a number of estimates

and assumptions that, while

considered reasonable by Centerra, are inherently

subject to significant technical, political, business, economic and

competitive uncertainties and contingencies. Known and unknown

factors could cause actual results to differ materially from those

projected in the forward- looking information. Factors and

assumptions that could cause actual results or events to differ

materially from current expectations include,

among other things: (A)

strategic, legal, planning and

other risks, including:

political risks associated with the

Company’s operations in Türkiye, the USA and Canada, including

potential uncertainty created by upcoming presidential elections in

Türkiye and their potential to disrupt or delay Turkish

bureaucratic processes and decision making; resource nationalism

including the management of external stakeholder expectations; the

impact of changes in, or to the more aggressive enforcement of,

laws, regulations and government practices, including unjustified

civil or criminal action against the Company, its affiliates, or

its current or former employees; risks that community activism may

result in increased contributory demands or business interruptions;

the risks related to outstanding litigation affecting the Company;

risks of actions taken by the Kyrgyz Republic, or any of its

instrumentalities, in connection with the Company’s prior ownership

of the Kumtor Mine or the Global Arrangement

Agreement; including unjustified

civil or criminal action

against the Company, its

affiliates, or its current

or former employees; the impact of constitutional

changes or political events or elections in Türkiye; risks that

Turkish regulators pursue aggressive enforcement of the Öksüt

Mine’s current EIA and permits or that the Company experiences

delay or disruption in its applications for

new or amended EIA or

other permits, including the

formal issuance thereof; the

impact of any

sanctions imposed by Canada, the United States or

other jurisdictions against various Russian and Turkish individuals

and entities; potential defects of

title in the Company’s

properties that are not

known as of the date

hereof; the inability of

the Company and its

subsidiaries to enforce their

legal rights in certain

circumstances; risks related to

anti-corruption legislation; Centerra

not being able to replace mineral reserves; Indigenous

claims and consultative issues relating to the Company’s properties

which are in proximity to Indigenous

communities; and potential

risks related to kidnapping

or acts of terrorism;

(B) risks relating to

financial matters, including: sensitivity of the Company’s

business to the volatility of gold, copper and other mineral

prices; the use of provisionally-priced sales contracts for

production at the Mount Milligan Mine; reliance on a few key

customers for the gold- copper concentrate at the Mount Milligan

Mine; use of commodity derivatives; the imprecision of the

Company’s mineral reserves and resources

estimates and the assumptions

they rely on; the

accuracy of the Company’s

production and cost estimates; the

impact of restrictive covenants in the Company’s credit facilities

which may, among other things, restrict the Company from pursuing

certain business activities or making distributions from its

subsidiaries; changes to tax regimes; the Company’s ability to

obtain future financing; the impact of global financial conditions;

the impact of currency fluctuations; the effect of market

conditions on the Company’s short-term investments; the Company’s

ability to make payments, including any payments of principal

and interest on the

Company’s debt facilities,

which depends on the

cash flow of its

subsidiaries; and (C) risks

related to operational matters

and geotechnical issues and

the Company’s continued ability

to successfully manage such

matters, including the stability of the pit walls at

the Company’s operations; the integrity of tailings storage

facilities and the management thereof, including as to stability,

compliance with laws, regulations, licenses and permits,

controlling seepages and storage of water where

applicable; the risk of

having sufficient water to

continue operations at the

Mount Milligan Mine and

achieve expected mill throughput; changes to,

or delays in the Company’s supply chain and transportation routes,

including cessation or disruption in rail and shipping networks

whether caused by decisions of third-party providers or force

majeure events (including, but not limited to,

flooding, wildfires, earthquakes,

COVID-19, or other global

events such as wars);

the success of the

Company’s future exploration and development

activities, including the financial and political risks inherent in

carrying out exploration activities; inherent risks associated with

the use of sodium cyanide in the mining operations; the adequacy of

the Company’s insurance to mitigate operational and corporate

risks; mechanical breakdowns; the occurrence of any labour unrest

or disturbance and the ability of the Company to successfully

renegotiate collective agreements when required; the risk that

Centerra’s workforce and operations may be exposed to widespread

epidemic including, but not limited to, the COVID-19 pandemic;

seismic activity including earthquakes; wildfires; long lead-times

required for equipment and supplies given the remote location of

some of the Company’s operating properties and disruptions caused

by global events; reliance on a limited number of suppliers for

certain consumables, equipment and

components; the ability of

the Company to address

physical and transition risks

from climate change and sufficiently manage

stakeholder expectations on climate-related issues; the Company’s

ability to accurately predict decommissioning and

reclamation costs and the

assumptions they rely upon;

the Company’s ability to

attract and retain qualified

personnel; competition for mineral acquisition opportunities; risks

associated with the conduct of joint ventures/partnerships; and,

the Company’s ability to manage its projects effectively and to

mitigate the potential lack of availability of contractors, budget

and timing overruns and project resources. For additional risk

factors, please see section titled “Risks Factors” in the Company’s

most recently filed Annual Information Form (“AIF”) available on

SEDAR at www.sedar.com

and EDGAR at www.sec.gov/edgar.

There can be no assurances that

forward-looking information and statements will prove to be

accurate, as many factors and future events,

both known and unknown

could cause actual results,

performance or achievements to

vary or differ materially

from the results, performance or achievements that are or may

be expressed or implied by such forward-looking statements

contained herein or incorporated by reference. Accordingly, all

such factors should be considered carefully when making decisions

with respect to Centerra, and

prospective investors should

not place undue reliance

on forward-looking information.

Forward-looking information is as

of February 23, 2023.

Centerra assumes no obligation

to update or revise

forward-looking information to

reflect changes in assumptions, changes in circumstances or any

other events affecting such forward-looking information, except as

required by applicable law.

|

TABLE OF CONTENTS |

|

Overview |

1 |

| Overview of Consolidated

Financial and Operational Highlights |

2 |

| Overview of Consolidated

Results |

3 |

| Outlook |

6 |

| Recent Events and

Developments |

11 |

| Risks That Can Affect

Centerra's Business |

14 |

| Market

Conditions |

17 |

| Liquidity and Capital

Resources |

19 |

| Financial

Performance |

20 |

| Financial

Instruments |

24 |

| Balance Sheet

Review |

25 |

| Contractual

Obligations |

26 |

| 2023 Liquidity and

Capital Resources Analysis |

27 |

| Operating Mines and

Facilities |

27 |

| Discontinued

Operations |

39 |

| Annual Results – Previous

Three Years |

40 |

| Quarterly Results –

Previous Eight Quarters |

40 |

| Related Party

Transactions |

41 |

| Accounting Estimates,

Policies and Changes |

41 |

| Disclosure Controls and

Procedures and Internal Control Over Financial

Reporting |

42 |

| Non-GAAP and Other

Financial Measures |

42 |

| Mineral Reserves and

Mineral Resources |

49 |

| Qualified Person &

QA/QC – Production, Mineral Reserves and Mineral

Resources |

51 |

Overview

Centerra’s Business

Centerra is a Canada-based mining company

focused on operating, developing, exploring and acquiring gold and

copper properties in North America, Türkiye, and other markets

worldwide. Centerra’s principal continuing operations are the Mount

Milligan gold-copper mine located in British Columbia, Canada (the

“Mount Milligan Mine”), and the Öksüt gold mine located in Türkiye

(the “Öksüt Mine”). The Company also owns the Goldfield District

Project (the “Goldfield Project”) in Nevada, United States, the

Kemess Underground Project (the “Kemess Project”) in British

Columbia, Canada as well as exploration properties in Canada, the

United States of America and Türkiye and has options to acquire

exploration joint venture properties in Canada, Türkiye, and the

United States. The Company owns and operates a Molybdenum Business

Unit (the “Molybdenum BU”), which includes the Langeloth

metallurgical processing facility, operating in Pennsylvania, USA

(the “Langeloth Facility”), and two primary molybdenum mines on

care and maintenance: the Thompson Creek Mine in Idaho, USA, and

the Endako Mine (75% ownership) in British Columbia, Canada.

Prior to May 15, 2021, the Company also

consolidated the results of the Kumtor mine, located in the Kyrgyz

Republic, (the “Kumtor Mine”), through its wholly-owned subsidiary,

Kumtor Gold Company CJSC (“KGC”). The seizure of the Kumtor Mine

and the actions of the Kyrgyz Republic and Kyrgyzaltyn JSC

(“Kyrgyzaltyn”) resulted in the following: (i) the carrying value

of the net assets of the mine were derecognized from the Company’s

balance sheet, (ii) no value was ascribed to the Company’s interest

in KGC, (iii) the Company recognized a loss on the change of

control in the second quarter of 2021, and (iv) results of the

Kumtor Mine’s operations are now presented as a discontinued

operation in the Company’s financial statements. The Company

entered into a global arrangement agreement (“Arrangement

Agreement”) dated April 4, 2022 with, among others, Kyrgyzaltyn and

the Kyrgyz Republic to effect a separation of the parties,

including through the disposition of Centerra’s ownership of the

Kumtor Mine and its investment in the Kyrgyz Republic, the purchase

for cancellation by Centerra of Kyrgyzaltyn’s Centerra common

shares, the termination of Kyrgyzaltyn’s involvement in the

Company, and the resolution of disputes (the “Transaction”). The

Transaction closed on July 29, 2022.

As of December 31, 2022, Centerra’s significant

subsidiaries were as follows:

|

Entity |

Property - Location |

Current Status |

Ownership |

|

Thompson Creek Metals Company Inc. |

Mount Milligan Mine - Canada |

Operation |

100% |

| |

Endako Mine - Canada |

Care and maintenance |

75% |

| Öksüt Madencilik A.S. |

Öksüt Mine - Türkiye |

Operation |

100% |

| Langeloth Metallurgical Company

LLC |

Langeloth - USA |

Operation |

100% |

| Gemfield Resources LLC |

Goldfield Project - USA |

Advanced exploration |

100% |

| AuRico Metals Inc. |

Kemess Project - Canada |

Care and maintenance |

100% |

| Thompson Creek Mining Co. |

Thompson Creek Mine - USA |

Care and maintenance |

100% |

The Company’s common shares are listed on the

Toronto Stock Exchange and the New York Stock Exchange and trade

under the symbols “CG” and “CGAU”, respectively.

As of February 23, 2023, there

are 218,494,646 common shares issued and outstanding, options

to acquire 3,686,129 common shares outstanding under the

Company’s stock option plan, and 983,933 restricted share

units outstanding under the Company’s restricted share unit plan

(exercisable on a 1:1 basis for common shares).

Overview of Consolidated Financial and

Operating Highlights

($millions,

except as

noted)

|

Three months ended December

31,

|

Years ended December 31, |

|

Financial Highlights (continuing operations basis, except

as noted) |

2022 |

2021 |

%

Change |

2022 |

2021 |

%

Change |

|

Revenue |

208.3 |

|

251.1 |

(17 |

)% |

850.2 |

|

900.1 |

|

(6 |

)% |

| Production costs |

158.1 |

|

132.0 |

20 |

% |

574.6 |

|

487.7 |

|

18 |

% |

|

Depreciation, depletion, and amortization ("DDA") |

17.2 |

|

31.0 |

(45 |

)% |

97.1 |

|

120.5 |

|

(19 |

)% |

|

Earnings from mine operations |

33.0 |

|

88.1 |

(63 |

)% |

178.5 |

|

292.0 |

|

(39 |

)% |

| Net (loss) earnings from

continuing operations |

(130.1 |

) |

274.9 |

(147 |

)% |

(77.2 |

) |

446.9 |

|

(117 |

)% |

| Adjusted net (loss) earnings

from continuing operations(1) |

(13.7 |

) |

35.4 |

(139 |

)% |

(9.4 |

) |

149.2 |

|

(106 |

)% |

| Net loss from discontinued

operations(2) |

— |

|

— |

— |

% |

— |

|

(828.7 |

) |

(100 |

)% |

| Net (loss)

earnings(2) |

(130.1 |

) |

274.9 |

(147 |

)% |

(77.2 |

) |

(381.8 |

) |

80 |

% |

| Adjusted net (loss)

earnings(1)(2) |

(13.7 |

) |

35.4 |

(139 |

)% |

(9.4 |

) |

233.6 |

|

(104 |

)% |

| Cash (used in) provided by

operating activities from continuing operations |

(9.8 |

) |

61.8 |

(116 |

)% |

(2.0 |

) |

270.9 |

|

(101 |

)% |

| Free cash flow (deficit) from

continuing operations(1) |

(25.3 |

) |

38.7 |

(165 |

)% |

(82.9 |

) |

178.4 |

|

(146 |

)% |

| Adjusted free cash flow

(deficit) from continuing operations(1) |

(25.3 |

) |

44.0 |

(158 |

)% |

(62.0 |

) |

192.6 |

|

(132 |

)% |

| Cash provided by operating

activities from discontinued operations |

— |

|

— |

— |

% |

— |

|

143.9 |

|

(100 |

)% |

| Net cash flow from

discontinued operations(2)(3) |

— |

|

— |

— |

% |

— |

|

47.8 |

|

(100 |

)% |

| Additions to property, plant

and equipment (“PP&E”) |

27.9 |

|

46.9 |

(41 |

)% |

275.1 |

|

118.9 |

|

131 |

% |

| Capital expenditures -

total(1) |

15.4 |

|

28.1 |

(45 |

)% |

73.2 |

|

93.3 |

|

(22 |

)% |

|

Sustaining capital expenditures(1) |

15.3 |

|

25.7 |

(40 |

)% |

71.1 |

|

88.0 |

|

(19 |

)% |

|

Non-sustaining capital expenditures(1) |

0.1 |

|

2.4 |

(96 |

)% |

2.1 |

|

5.3 |

|

(60 |

)% |

| Net (loss) earnings from

continuing operations per common share -

basic(4) |

(0.59 |

) |

0.93 |

(163 |

)% |

(0.29 |

) |

1.51 |

|

(119 |

)% |

| Net (loss) earnings per common

share - $/share basic(2)(4) |

(0.59 |

) |

0.93 |

(163 |

)% |

(0.29 |

) |

(1.29 |

) |

(77 |

)% |

| Adjusted net (loss) earnings

from continuing operations per common share -

basic(1)(4) |

(0.06 |

) |

0.12 |

(150 |

)% |

(0.04 |

) |

0.50 |

|

(108 |

)% |

|

Adjusted net (loss) earnings per common share - $/share

basic(1)(2)(4) |

(0.06 |

) |

0.12 |

(150 |

)% |

(0.04 |

) |

0.79 |

|

(105 |

)% |

|

Operating highlights (continuing operations

basis) |

|

|

|

|

|

|

| Gold produced (oz) |

53,222 |

|

91,197 |

(42 |

)% |

243,867 |

|

308,141 |

|

(21 |

)% |

| Gold sold (oz) |

49,443 |

|

90,312 |

(45 |

)% |

242,193 |

|

314,757 |

|

(23 |

)% |

| Average market gold price

($/oz) |

1,728 |

|

1,795 |

(4 |

)% |

1,800 |

|

1,799 |

|

— |

% |

| Average realized gold price

($/oz )(5) |

1,352 |

|

1,504 |

(10 |

)% |

1,446 |

|

1,485 |

|

(3 |

)% |

| Copper produced (000s

lbs) |

16,909 |

|

16,993 |

— |

% |

73,864 |

|

73,275 |

|

1 |

% |

| Copper sold (000s lbs) |

15,374 |

|

17,184 |

(11 |

)% |

73,392 |

|

78,017 |

|

(6 |

)% |

| Average market copper price

($/lb) |

3.63 |

|

4.40 |

(18 |

)% |

3.99 |

|

4.23 |

|

(6 |

)% |

| Average realized copper price

($/lb)(5) |

3.43 |

|

3.59 |

(4 |

)% |

2.95 |

|

2.92 |

|

1 |

% |

| Molybdenum sold (000s

lbs) |

4,040 |

|

2,361 |

71 |

% |

13,448 |

|

11,461 |

|

17 |

% |

| Average

market molybdenum price ($/lb) |

21.49 |

|

18.89 |

14 |

% |

18.73 |

|

15.98 |

|

17 |

% |

|

Unit costs (continuing operations basis) |

|

|

|

|

|

|

| Gold production costs

($/oz) |

790 |

|

550 |

44 |

% |

681 |

|

604 |

|

13 |

% |

| All-in sustaining costs on a

by-product basis ($/oz)(1) |

987 |

|

591 |

67 |

% |

860 |

|

649 |

|

33 |

% |

| All-in costs on a by-product

basis ($/oz)(1) |

1,572 |

|

732 |

115 |

% |

1,201 |

|

785 |

|

53 |

% |

| Gold - All-in sustaining costs

on a co-product basis ($/oz)(1) |

1,308 |

|

829 |

58 |

% |

1,112 |

|

891 |

|

25 |

% |

| Copper production costs

($/lb) |

2.00 |

|

1.79 |

12 |

% |

1.70 |

|

1.51 |

|

13 |

% |

| Copper - All-in sustaining

costs on a co-product basis – ($/lb)(1) |

2.40 |

|

2.34 |

3 |

% |

2.12 |

|

1.94 |

|

9 |

% |

(1) Non-GAAP financial measure. All

per unit costs metrics are expressed on a metal sold basis. See

discussion under “Non-GAAP and Other Financial Measures”.

(2) Inclusive of the results from the Kumtor Mine prior

to the loss of control on May 15, 2021.

(3) Calculated as the sum of cash flow provided by

operating activities from discontinued operations, cash flow used

in investing activities from discontinued operations and cash flow