Centerra Gold Inc. (“Centerra” or the “Company”) (TSX: CG) (NYSE:

CGAU) today announced its 2022 year-end estimates for mineral

reserves and mineral resources. 2022 year-end mineral reserves have

been estimated based on a gold price of $1,350 per ounce for the

Mount Milligan Mine and the Öksüt Mine, a copper price of $3.25 per

pound for the Mount Milligan Mine, and a gold price of $1,200 per

ounce and a copper price of $2.50 per pound for the Kemess Project.

The Company added 0.6 million proven and

probable gold mineral reserves in 2022, net of depletion, when

compared to the balances included in the 2021 year-end estimates

(released February 25, 2022).

On November 7, 2022, the Company released a

technical report for mineral resources and mineral reserves at the

Mount Milligan Mine (“Mount Milligan Mine TR”). The Mount Milligan

Mine TR added 1.1 million ounces of gold and 260 million pounds of

copper as of December 31, 2021. The balances as of December 31,

2021 used for comparative purposes in this document will consider

the updated figures included in the Mount Milligan Mine TR.

Centerra Mineral Reserves and Resources

Highlights as at December 31, 2022:

- Centerra’s proven and probable gold

mineral reserves total 5.5 million ounces of contained gold (358

million tonnes (Mt) at 0.46 grams of gold per tonne (g/t gold)), a

decrease of 0.48 million ounces of contained gold from December 31,

2021, as a result of depletion.

- Centerra’s overall measured and

indicated gold mineral resources, exclusive of mineral reserves,

decreased by 0.1 million ounces to 6.1 million ounces of contained

gold (551 Mt at 0.34 g/t gold).

- Centerra’s proven and probable

copper mineral reserves decreased by 94 million pounds to 1,532

million pounds of contained copper (331 Mt at 0.21% copper), as a

result of depletion.

- Centerra’s measured and indicated

copper mineral resources, exclusive of mineral reserves, were

6,453 million pounds of contained copper (1,144 Mt at 0.26%

copper).

Centerra Year-End Gold Mineral Reserves

and Mineral Resources

Mineral ReservesAs of December

31, 2022, Centerra’s proven and probable gold mineral reserves

total an estimated 5.45 million ounces (358 Mt at 0.46 g/t gold),

compared to 5.93 million ounces (384 Mt at 0.52 g/t gold) in the

prior year. In 2022, proven and probable gold mineral reserves

decreased by 0.48 million ounces, due to depletion.

Mount Milligan MineAt the Mount Milligan Mine,

proven and probable gold mineral reserves total an estimated 2.6

million ounces of contained gold (224 Mt at 0.37 g/t gold) as of

December 31, 2022, compared to 2.9 million contained ounces gold

(246 Mt at 0.18 g/t gold) as at December 31, 2021 as stated in the

Mount Milligan Mine TR. For 2022, proven and probable gold mineral

reserves decreased by 0.3 million contained ounces of gold, due to

depletion. A resource update is ongoing to include exploration

drilling completed in 2022 and will be included in the 2023 mineral

reserves and mineral resources update.

Öksüt MineAt the Öksüt Mine, proven and probable

gold mineral reserves total an estimated 0.9 million ounces of

contained gold (27.1 Mt at 1.08 g/t gold) as at December 31, 2022,

compared to the estimated 1.1 million ounces of contained gold

(30.5 Mt at 1.16 g/t gold) as at December 31, 2021. The decrease of

0.2 million ounces in proven and probable gold mineral reserves in

2022 is primarily attributable to depletion. A resource update to

include exploration drilling completed in 2022 is ongoing and will

be included in the 2023 mineral reserves and mineral resources

update.

A portion of the 2022 depletion at the Öksüt

Mine can be attributed to processing ore into gold-in-carbon. As at

December 31, 2022, the Company had approximately 100,000

recoverable ounces of stored gold-in-carbon and an additional

200,000 recoverable ounces of gold in ore stockpiles and on the

heap leach pad.

Kemess ProjectAt the Kemess Project, the proven

and probable gold mineral reserves for the Kemess Underground

Project are unchanged year over year at an estimated 1.9 million

contained ounces (107.4 Mt at 0.50 g/t gold) as at December 31,

2022.

Mineral ResourcesCenterra’s

measured and indicated gold mineral resources as at December 31,

2022, decreased by approximately 0.1 million ounces of contained

gold to 6.1 million ounces (551 Mt at 0.34 g/t gold), when compared

to the December 31, 2021 estimate. All measured and indicated gold

resource figures in this section are presented exclusive of gold

mineral reserves.

Mount Milligan MineAt the Mount Milligan Mine,

measured and indicated resources decreased by 0.1 million contained

ounces of gold, for a total of 1.7 million ounces of contained gold

(182.7 Mt at 0.30 g/t gold) as at December 31, 2022, as a result of

depletion.

Öksüt MineAt the Öksüt Mine, measured and

indicated gold resources are essentially unchanged year over year

when compared to December 31, 2021, totaling 0.3 million ounces of

contained gold (17.4 Mt at 0.49 g/t gold).

Kemess ProjectAt Kemess Underground and Kemess

East, measured and indicated gold resources are unchanged year over

year when compared to December 31, 2021, totaling 4.0 million

ounces of contained gold (351.2 Mt at 0.36 g/t gold).

Inferred Gold Mineral Resources

The Company’s inferred gold mineral resources as at December 31,

2022 are essentially unchanged, totaling 0.9 million contained

ounces of gold (85.0 Mt at 0.34 g/t gold), when compared to the

December 31, 2021 estimate.

Inferred mineral resources have a great amount

of uncertainty as to their grade and quantity because they are

based on limited geological evidence. It cannot be assumed that all

or part of the inferred mineral resources will ever be upgraded to

a higher category or converted to mineral reserves through the

application of modifying factors.

Centerra Year-End Copper Mineral

Reserves and Mineral Resources

Mineral ReservesProven and

probable copper mineral reserves total an estimated 1,532 million

pounds of contained copper (331 Mt at 0.21% copper).

Mount Milligan MineAt the Mount Milligan Mine,

proven and probable copper mineral reserves total an estimated 902

million pounds of contained copper (224 Mt at 0.18% copper) as of

December 31, 2022, compared to 996 million pounds of contained

copper (246 Mt at 0.18% copper) as at December 31, 2021. The

decrease of 94 million contained pounds of copper was primarily due

to depletion.

Kemess ProjectThe Kemess Underground’s proven

and probable copper mineral reserves are unchanged and are

estimated to be 630 million pounds of contained copper (107 Mt at

0.27% copper) as at December 31, 2022.

Mineral ResourcesMeasured and

indicated copper mineral resources total an estimated 6,453 million

pounds of contained copper (1,144 Mt at 0.26% copper). The copper

mineral resources are located at the Mount Milligan Mine, the

Kemess Underground, Kemess East and Berg properties, all of which

are located in Canada. All measured and indicated copper mineral

resource figures in this section are presented exclusive of mineral

reserves.

Mount Milligan MineAt the Mount Milligan Mine,

measured and indicated mineral resources decreased by 47 million

pounds of contained copper to an estimated 695 million pounds (183

Mt at 0.17% copper) as of December 31, 2022. The decrease in

measured and indicated mineral resources resulted from

depletion.

Kemess ProjectAt Kemess, measured and indicated

mineral resources are unchanged at 2,107 million pounds of

contained copper as of December 31, 2022. This figure is split

between the Kemess Underground measured and indicated mineral

resources, which total an estimated 697 million pounds of contained

copper (174 Mt at 0.18% copper), and Kemess East measured and

indicated mineral resources, which total an estimated 1,410 million

pounds of contained copper (178 Mt at 0.36% copper).

Inferred Copper Mineral

ResourcesCenterra’s inferred copper mineral resource

estimates total 559 million pounds of contained copper (111 Mt at

0.23% copper).

Inferred mineral resources have a great amount

of uncertainty as to their grade and quantity because they are

based on limited geological evidence. It cannot be assumed that all

or part of the inferred mineral resources will ever be upgraded to

a higher category or converted to mineral reserves through the

application of modifying factors.

Goldfield ProjectIn the first

quarter of 2022, the Company announced that it had entered into a

definitive agreement to acquire the Goldfield Project from Waterton

Nevada Splitter, LLC. The Goldfield Project consists of three known

deposits: Gemfield, Goldfield Main, and McMahon Ridge. Centerra is

targeting an initial resource estimate for the Goldfield Project by

mid-year 2023 followed by an updated resource estimate accompanied

by a Feasibility Study.

2022 Fourth Quarter Exploration

Update

Exploration activities in the fourth quarter of

2022 included drilling, surface sampling, geological mapping and

geophysical surveying at the Company’s various projects and earn-in

properties.

Exploration expenditures in the fourth quarter

of 2022 and year were $16.2 million and $50.8 million,

respectively. The activities were primarily focused on expanded

drilling programs at the Mount Milligan Mine in British Columbia,

the Öksüt Mine in Türkiye, the Goldfield Project in Nevada, and

greenfield projects in Canada, the United States of America and

Türkiye.

Mount Milligan Mine

The 2022 diamond drilling programs at the Mount

Milligan Mine totalled 55,139 metres in 100 drill holes. Resource

expansion and brownfield exploration targets included zones on the

western margin of the open-pit, i.e., DWBX and Goldmark zones, and

on the eastern margin of the open-pit, i.e., Great Eastern Fault

(“GEF”) zone, where positive drilling results were returned in

previous drilling campaigns from 2018-2021.

Mount Milligan Brownfield Drilling and

Exploration

Exploration and resource expansion drilling

continued in the fourth quarter of 2022 with the completion of 27

diamond drill holes totalling 10,516 metres. Resource expansion

drilling included 10 drill holes, totalling 2,513 metres, completed

in the Great Eastern, 66, and DWBX zones. Six drill holes,

totalling 1,143 metres, were completed in the Great Eastern zones,

infilling shallow mineralization associated with the GEF.

Additional infill drilling included three drill holes, totalling

1,065 metres, completed in the DWBX zone, and one drill hole,

totalling 305 metres, completed in the 66 Zone. Exploration

drilling was completed in five target areas and focused on the

northern margins of the pit in the Oliver zone where six drill

holes, totalling 2,061 metres, were completed. Exploration drilling

was also completed south and west of the current ultimate pit

boundary in the Boundary zone, including six drill holes totalling

2,786 metres; in the South Boundary zone, including one drill hole

totalling 640 metres; in the Southern Star zone, including one

drill hole totalling 605 metres; and in the North Slope zone,

including three drill holes totalling 1,911 metres.

Throughout the fourth quarter of 2022, complete

or partial assay results were returned for 38 drill holes,

including results from 10 holes drilled in the third quarter of

2022, and 28 holes drilled in the fourth quarter of 2022. These

include significant mineralized intervals from six target areas,

including the western margin of the open-pit in the DWBX, North

Slope, Boundary, and South Boundary zones, the eastern margin of

the open-pit in the Great Eastern zone, and the northern margin of

the open-pit in the Oliver zone.

Assays returned throughout the fourth quarter of

2022 include results from infill drilling in the DWBX and GEF

zones, showing potential for both shallow and deep resource

addition west and east of the ultimate pit boundary. In the DWBX

zone, porphyry-style gold-copper mineralization is associated with

potassic alteration and early quartz veins within the DWBX

composite stock and the stock margins. A moderately west-dipping

hydrothermal breccia body has been identified at shallow depth in

host volcanic rocks in the northern part of the DWBX zone,

interpreted to have formed during stock emplacement. In the GEF

zone on the eastern ultimate pit margins, shallow drilling has

defined a tabular body of gold and copper mineralization within the

hanging wall of the easterly dipping GEF.

Exploration drilling in the North Slope zone,

approximately 1,000 to 1,600 metres from the western margins of the

ultimate pit boundary, was completed in the fourth quarter of 2022.

Assays returned throughout the fourth quarter of 2022 show

porphyry-style gold and copper mineralization at depth, associated

with a series of narrow dykes, referred to as the North Slope dyke

complex. Mineralization is associated with increased density of

early, transitional, and late-stage veins in potassic

(magnetite-biotite) and inner propylitic (albite-epidote-chlorite)

altered volcanics and volcaniclastics.

Exploration drilling in the Boundary zone,

approximately 350 metres from the western margins of the ultimate

pit boundary, was completed in the fourth quarter of 2022. Assays

returned throughout the fourth quarter of 2022 show shallow and

deep porphyry-style gold and copper mineralization associated with

a series of monzonite ± hornblende porphyry dykes in the shallow

Boundary zone and underlying northwestern extension of the Southern

Star composite stock. Mineralization is hosted within dykes and at

dyke margins in potassic (magnetite-biotite) and inner propylitic

(albite-epidote-chlorite) altered andesite tuffs, often overprinted

by quartz-sericite-pyrite alteration, with early quartz veins and

chalcopyrite ± pyrite veins.

Exploration drilling in the Oliver zone, along

the northwestern margins of the ultimate pit boundary was completed

in the fourth quarter of 2022. Assays returned throughout the

fourth quarter of 2022 show potential for deep resource addition

adjacent to and below the current ultimate pit boundary.

Significant intersections with high gold-low copper mineralization

are hosted within quartz-sericite-pyrite altered bedded trachyte

tuff with pyrite ± chalcopyrite ± calcite veins. Porphyry-style

gold and copper mineralization at depth is hosted by potassic

(magnetite-biotite) altered latite crystal tuff overprinted by

quartz-sericite-pyrite alteration, with early quartz veins and

pyrite ± chalcopyrite veins.

A full listing of the drill results, drill hole

locations and plan map (including the azimuth, dip of drill holes,

and depth of the sample intervals) for the Mount Milligan Mine have

been filed on SEDAR at www.sedar.com, EDGAR at www.sec.gov/edgar,

are available on the Company’s website at www.centerragold.com and

are available at the following

link: http://ml.globenewswire.com/Resource/Download/b61c87e0-4c7e-40d5-b040-84433dc640fe

Goldfield Project

Drill programs at the Goldfield Project

commenced in June 2022, following the purchase of the project in

February 2022. The 2022 diamond drilling and RC drilling programs

included 149 exploration, infill, and resource expansion holes, 16

metallurgical holes, 17 geotechnical holes, 22 condemnation holes,

and two water monitoring wells. Exploration drilling in 2022

principally targeted gold mineralization below and adjacent to the

known mineralization at the Gemfield and Goldfield Main deposits.

As of the end of 2022, a total of 48,765 metres of drilling was

completed in 206 drill holes (200 holes were completed and six

holes were abandoned due to ground conditions).

At the Goldfield Project, 21 diamond drill holes

and 134 RC drill holes, totalling 35,259 metres of drilling, were

completed during the fourth quarter. Completed holes include 26,590

metres in 117 exploration, infill, and resource expansion holes,

3,995 metres in 18 condemnation drill holes, 2,920 metres in 10

metallurgical holes, 1,512 metres in eight geotechnical holes, and

two water monitoring wells for 241 metres.

Gemfield DepositThe planned 2022 drilling

programs at the Gemfield deposit totalled 29,279 metres in 25

diamond drill holes and 105 RC drill holes for a total of 130 drill

holes. Drilling activities in the fourth quarter of 2022 at the

Gemfield deposit consisted of two diamond drill holes and 86 RC

holes totalling 17,287 metres. Drilling was generally undertaken

around the margins of and within the confines of the known

mineralization at the Gemfield deposit.

As of the end of the fourth quarter, complete or

partial assay results were returned for 57 drill holes at the

Gemfield deposit, including results from holes drilled in the

second, third, and fourth quarters of 2022.

Assay results from the 2022 exploration drilling

at the Gemfield deposit identified extensions to known gold

mineralization to the west and south of the deposit. This

mineralization is relatively deep and forms broad zones of

low-grade gold mineralization. This gold mineralization is

associated alteration with quartz–alunite alteration with sulfides,

mainly pyrite. Preliminary metallurgical test work (shake tests and

bottle roll tests) has commenced and is ongoing. Resource expansion

drilling peripheral to the eastern and northeastern margins of the

known mineralization intersected shallow, oxidized gold

mineralization, some of which lies beneath the historic

Consolidated Mill tailings pile. Oxidation at the Gemfield deposit

is generally no deeper than 90 metres but can extend deeper

depending on the thickness and depth of erosion of an overlying,

post-mineral sedimentary unit, the Siebert Formation.

Goldfield Main DepositThe 2022 drilling programs

at the Goldfield Main Deposit totalled 19,121 metres in 26 diamond

drill holes and 48 RC drill holes for a total of 74 drill holes.

Drilling activities in the fourth quarter of 2022 at the Goldfield

Main deposit consisted of 17 diamond drill holes and 48 RC holes

totalling 17,606 metres. Drilling was generally undertaken around

the margins of and within the confines of the known mineralization

at the Goldfield Main deposit.

As of the end of the fourth quarter, complete or

partial assay results were returned for 10 drill holes at the

Goldfield Main deposit, including results from holes drilled in the

second, third, and fourth quarters of 2022. The gold mineralization

encountered is consistent with nearby historic drill intervals,

confirming and slightly expanding the known mineralization along

the splay structures present within the Goldfield Main deposit.

Infill drilling also confirmed that oxidation is relatively shallow

but extends deeper along the Columbia Fault and the secondary splay

structures present within the deposit.

McMahon Ridge DepositDrilling activities

commenced in the fourth quarter of 2022 at the McMahon Ridge

deposit. Two diamond drill holes, totalling 366 metres, were

drilled for geotechnical purposes. Assay results are awaited.

Öksüt Mine

The planned 2022 diamond and RC drilling

programs were completed at the Öksüt Mine in the fourth quarter

with 122 diamond holes, totaling 31,787 metres, and 40 RC drill

holes, totaling 7,465 metres, being completed for an aggregate of

39,252 metres of drilling. In the fourth quarter, 21 diamond holes,

totaling 5,495 metres, and 21 RC drill holes, totaling 3,841

metres, were completed for an aggregate of 9,336 metres of

drilling. Drilling in the fourth quarter focused on targeting the

potential expansion of oxide gold mineralization at the Keltepe,

Güneytepe, Keltepe North, Keltepe Northwest, and Keltepe North

Northwest deposits as well as testing the potential for new oxide

gold mineralization at peripheral targets such as the Yelibelen,

Büyüktepe, and Boztepe prospects.

As of the end of the fourth quarter, complete or

partial assay results were returned for 94 drill holes at the Öksüt

Mine, including results from holes drilled in the second, third,

and fourth quarters of 2022. Generally, relatively narrow and low

to moderate grade oxide gold intervals were returned from drilling

in 2022.

A full listing of the drill results, drill hole

locations and plan map (including the azimuth, dip of drill holes,

and depth of the sample intervals) for the Öksüt Mine have been

filed on SEDAR at www.sedar.com, EDGAR at www.sec.gov/edgar, are

available on the Company’s website at www.centerragold.com and are

available at the following

link: http://ml.globenewswire.com/Resource/Download/b61c87e0-4c7e-40d5-b040-84433dc640fe

Table 1 (see additional footnotes on

pages 10-11)Centerra Gold Inc. 2022 Year-End

Mineral Reserve and Resources Summary – Gold

(1)as of December 31, 2022

|

Proven and Probable Gold Mineral Reserves |

|

|

Proven |

Probable |

Total Proven and Probable |

|

Property |

Tonnes(kt) |

Grade(g/t) |

Contained Gold (koz) |

Tonnes(kt) |

Grade(g/t) |

Contained Gold (koz) |

Tonnes(kt) |

Grade(g/t) |

Contained Gold (koz) |

|

Mount Milligan Mine(4) |

68,866 |

0.37 |

818 |

155,091 |

0.37 |

1,824 |

223,957 |

0.37 |

2,643 |

|

Öksüt Mine |

3,173 |

1.77 |

180 |

23,925 |

0.99 |

761 |

27,098 |

1.08 |

941 |

|

Kemess Underground |

- |

- |

- |

107,381 |

0.50 |

1,868 |

107,381 |

0.50 |

1,868 |

|

Total |

72,039 |

0.43 |

998 |

286,397 |

0.47 |

4,453 |

358,436 |

0.46 |

5,452 |

|

|

|

Measured and Indicated Gold Mineral

Resources(2) |

|

|

Measured |

Indicated |

Total Measured and Indicated |

|

Property |

Tonnes(kt) |

Grade(g/t) |

Contained Gold (koz) |

Tonnes(kt) |

Grade(g/t) |

Contained Gold (koz) |

Tonnes(kt) |

Grade(g/t) |

Contained Gold (koz) |

|

Mount Milligan Mine(4) |

37,047 |

0.26 |

304 |

145,686 |

0.31 |

1,436 |

182,734 |

0.30 |

1,740 |

|

Öksüt Mine |

11,436 |

0.52 |

189 |

5,941 |

0.43 |

82 |

17,377 |

0.49 |

272 |

|

Kemess Underground |

- |

- |

- |

173,719 |

0.31 |

1,737 |

173,719 |

0.31 |

1,737 |

|

Kemess East |

- |

- |

- |

177,500 |

0.40 |

2,305 |

177,500 |

0.40 |

2,305 |

|

Total |

48,484 |

0.32 |

493 |

502,846 |

0.34 |

5,560 |

551,330 |

0.34 |

6,053 |

|

|

|

Inferred Gold Mineral

Resources(3) |

|

|

Property |

Tonnes(kt) |

Grade(g/t) |

Contained Gold (koz) |

|

Mount Milligan Mine(4) |

5,685 |

0.46 |

83 |

|

Öksüt Mine |

2,329 |

0.41 |

31 |

|

Kemess Underground |

47,700 |

0.34 |

529 |

|

Kemess East |

29,300 |

0.30 |

283 |

|

Total |

85,014 |

0.34 |

926 |

|

1) |

|

Centerra’s equity interests as of this news release are as follows:

Mount Milligan Mine 100%, Öksüt Mine 100%, Kemess Underground and

Kemess East 100%. Numbers may not add up due to rounding. |

| 2) |

|

Mineral resources are in addition

to mineral reserves. Mineral resources do not have demonstrated

economic viability. |

| 3) |

|

Inferred mineral resources have a

great amount of uncertainty as to their existence and as to whether

they can be mined economically. It cannot be assumed that all or

part of the inferred mineral resources will ever be upgraded to a

higher category. |

| 4) |

|

The Mount Milligan Mine is

subject to an arrangement with RGLD Gold AG and Royal Gold, Inc.

(together, “Royal Gold”) which entitles them to purchase 35% of

gold produced and requires Royal Gold to pay $435 per ounce of gold

delivered. Mineral reserves and resources for the Mount Milligan

Mine are presented on a 100% basis. |

Table 2 (see additional footnotes on

pages 10-11)Centerra Gold Inc. 2022 Year-End

Mineral Reserve and Resources Summary - Other Metals

(1) as of December 31, 2022

|

Property |

Tonnes(kt) |

Copper Grade

(%) |

Contained Copper (Mlbs) |

Molybdenum Grade

(%) |

Contained Molybdenum(Mlbs) |

SilverGrade(g/t) |

Contained Silver(koz) |

|

Proven Mineral Reserves |

|

Mount Milligan Mine(4) |

68,866 |

0.20 |

302 |

- |

- |

- |

- |

|

Probable Mineral Reserves |

|

Mount Milligan Mine (4) |

155,091 |

0.18 |

600 |

- |

- |

- |

- |

|

Kemess Underground |

107,381 |

0.27 |

630 |

- |

- |

1.99 |

6,878 |

|

|

|

Total Proven and Probable Mineral Reserves |

|

Mount Milligan

Mine(4) |

223,957 |

0.18 |

902 |

- |

- |

- |

- |

|

Kemess Underground |

107,381 |

0.27 |

630 |

- |

- |

1.99 |

6,878 |

|

Total Copper and Silver |

331,338 |

0.21 |

1,532 |

- |

- |

0.65 |

6,878 |

|

|

|

Measured Mineral Resources

(2) |

|

Mount Milligan Mine(4) |

37,047 |

0.20 |

165 |

- |

- |

- |

- |

|

Berg(5) |

207,229 |

0.34 |

1,541 |

0.03 |

149 |

3.02 |

20,104 |

|

Thompson Creek Mine |

57,645 |

- |

- |

0.07 |

92 |

- |

- |

|

Endako Mine |

47,100 |

- |

- |

0.05 |

48 |

- |

- |

|

|

|

Indicated Mineral Resources

(2) |

|

Mount Milligan Mine (4) |

145,686 |

0.16 |

530 |

- |

- |

- |

- |

|

Berg(5) |

402,757 |

0.24 |

2,110 |

0.03 |

270 |

3.01 |

38,966 |

|

Kemess Underground |

173,719 |

0.18 |

697 |

- |

- |

1.55 |

8,632 |

|

Kemess East |

177,500 |

0.36 |

1,410 |

- |

- |

1.97 |

11,240 |

|

Thompson Creek Mine |

59,498 |

- |

- |

0.07 |

85 |

- |

- |

|

Endako Mine |

122,175 |

- |

- |

0.04 |

118 |

- |

- |

|

|

|

Total Measured and Indicated Mineral

Resources(2) |

|

Mount Milligan Mine(4) |

182,734 |

0.17 |

695 |

- |

- |

- |

- |

|

Berg(5) |

609,986 |

0.27 |

3,651 |

0.03 |

419 |

3.01 |

59,070 |

|

Kemess Underground |

173,719 |

0.18 |

697 |

- |

- |

1.55 |

8,632 |

|

Kemess East |

177,500 |

0.36 |

1,410 |

- |

- |

1.97 |

11,240 |

|

Total Copper and Silver |

1,143,939 |

0.26 |

6,453 |

- |

- |

2.56 |

78,942 |

|

Thompson Creek Mine |

117,143 |

- |

- |

0.07 |

177 |

- |

- |

|

Endako Mine |

169,275 |

- |

- |

0.04 |

166 |

- |

- |

|

Total Molybdenum(incl. Berg) |

896,404 |

- |

- |

0.04 |

762 |

- |

- |

|

|

|

Inferred Mineral

Resources(3) |

|

Mount Milligan Mine(4) |

5,685 |

0.07 |

8 |

- |

- |

- |

- |

|

Berg(5) |

28,066 |

0.22 |

138 |

0.02 |

11 |

3.75 |

3,386 |

|

Kemess Underground |

47,700 |

0.20 |

210 |

- |

- |

1.65 |

2,530 |

|

Kemess East |

29,300 |

0.31 |

203 |

- |

- |

2 |

1,880 |

|

Total Copper and Silver |

110,751 |

0.23 |

559 |

|

|

2.31 |

7,796 |

|

Thompson Creek Mine |

806 |

- |

- |

0.04 |

1 |

- |

- |

|

Endako Mine |

47,325 |

- |

- |

0.04 |

44 |

- |

- |

|

Total Molybdenum(incl. Berg) |

76,197 |

- |

- |

0.03 |

56 |

- |

- |

|

1) |

|

Centerra’s equity interests as of this news release are as follows:

Mount Milligan Mine 100%, Kemess Underground 100%, Kemess East

100%, Berg 100%, Thompson Creek Mine 100%, and

Endako Mine 75%. Numbers may not add up due to rounding. |

| 2) |

|

Mineral resources are in addition

to mineral reserves. Mineral resources do not have demonstrated

economic viability. |

| 3) |

|

Inferred mineral resources have a

great amount of uncertainty as to their existence and as to whether

they can be mined economically. It cannot be assumed that all or

part of the inferred mineral resources will ever be upgraded to a

higher category. |

| 4) |

|

The Mount Milligan Mine is

subject to an arrangement with RGLD Gold AG and Royal Gold, Inc.

(together, “Royal Gold”) which entitles them to purchase 18.75% of

copper produced and requires Royal Gold to pay 15% of the spot

price per metric tonne of copper delivered. Mineral reserves and

resources for the Mount Milligan Mine are presented on a 100%

basis. |

| 5) |

|

In December 2020, the Berg

property was optioned to a third party, which has the right to

acquire a 70% interest in the property over a period of up to five

years. |

Table 3 - Centerra Gold Inc. (see

additional footnotes on pages 10-11)Reconciliation

of Mineral Reserves and Mineral

Resources(1)(2)

– Contained Gold (koz) as of December 31,

2022

|

|

December

31,2021(2) |

2022Throughput(3) |

2022

Addition(Deletion)(4) |

December 31,2022 |

|

Proven and Probable Gold Mineral Reserves |

|

Mount Milligan Mine |

2,925 |

282 |

- |

2,643 |

|

Öksüt Mine(5) |

1,143 |

221 |

20 |

941 |

|

Kemess Underground |

1,868 |

- |

- |

1,868 |

|

Total |

5,936 |

483 |

- |

5,452 |

|

Measured and Indicated Gold Mineral Resources |

|

Mount Milligan Mine |

1,828 |

- |

(88) |

1,740 |

|

Öksüt Mine(5) |

283 |

- |

(11) |

272 |

|

Kemess Underground |

1,737 |

- |

- |

1,737 |

|

Kemess East |

2,305 |

- |

- |

2,305 |

|

Total |

6,153 |

- |

(99) |

6,053 |

|

Inferred Gold Mineral

Resources(6) |

|

Mount Milligan Mine |

70 |

- |

13 |

83 |

|

Öksüt Mine(5) |

17 |

- |

14 |

31 |

|

Kemess Underground |

529 |

- |

- |

529 |

|

Kemess East |

283 |

- |

- |

283 |

|

Total |

899 |

- |

27 |

926 |

|

1) |

|

Centerra’s equity interests as of this news release are as follows:

Mount Milligan Mine 100%, Öksüt Mine 100%, Kemess Underground and

Kemess East 100%. |

| 2) |

|

Mineral reserves and mineral

resources for the Öksüt Mine, Kemess Underground, and Kemess East

reported in Centerra’s Annual Information Form filed in March 2022

and for the Mount Milligan Mine reported in Centerra’s Mount

Milligan Mine TR with an effective date of December 31, 2021 (filed

on November 7, 2022). The amount of reported mineral resources does

not include those amounts identified as mineral reserves. Mineral

resources do not have demonstrated economic viability. Numbers may

not add due to rounding. |

| 3) |

|

Corresponds to process plant feed

at both the Mount Milligan Mine and the Öksüt Mine. |

| 4) |

|

Changes in mineral reserves or

mineral resources, as applicable, are attributed to: (i) changes to

metal price and foreign exchange assumptions, (ii) information

provided by drilling and subsequent reinterpretation and

reclassification of mineral resources, and (iii) changes to cost

estimates and metallurgical recoveries. |

| 5) |

|

The Öksüt Mine open pit mineral

reserves and mineral resources include the Keltepe and Güneytepe

deposits. |

| 6) |

|

Inferred mineral resources have a

great amount of uncertainty as to their grade and quantity because

they are based on limited geological evidence. It cannot be assumed

that all or part of the inferred mineral resources will ever be

upgraded to a higher category or converted to mineral reserves

through the application of modifying factors. |

| |

|

|

Additional Footnotes for Tables 1, 2,

3General

- A conversion factor of 31.1035

grams per troy ounce of gold is used in the mineral reserve and

mineral resource estimates.

Mount Milligan Mine

- The mineral reserves have been

estimated based on a gold price of $1,350 per ounce, copper price

of $3.25 per pound and an exchange rate of 1USD:1.30CAD.

- The open pit mineral reserves are

estimated based on a Net Smelter Return (“NSR”) cut-off of $7.40

per tonne (C$9.62 per tonne) that takes into consideration

metallurgical recoveries, concentrate grades, transportation costs,

smelter treatment charges, and royalty and streaming arrangements

in determining economic viability.

- The mineral resources have been

estimated based on a gold price of $1,550 per ounce, copper price

of $3.50 per pound, and an exchange rate of 1USD:1.30CAD.

- The open pit mineral resources are

constrained by a pit shell and are reported based on a copper

equivalent (“CuEq”) value of 0.20% CuEq. This value is equivalent

to a NSR cut-off of $7.35 per tonne (C$9.55 per tonne) and takes

into consideration metallurgical recoveries, concentrate grades,

transportation costs, smelter treatment charges and royalty and

streaming arrangements in determining economic viability. Copper

equivalent was calculated using the following formula:

CuEq=Cu%+((Au recovery*Au price*14.5833)/(Cu recovery* Cu

price))*Au g/t/10,000.

- Further information concerning the

Mount Milligan deposit, including key assumptions, parameters, and

methods used to estimate mineral resources and mineral reserves, as

well as environmental and other risks are described in Centerra’s

most recently filed Annual Information Form and in the Mount

Milligan Mine TR, each of which has been filed on SEDAR at

www.sedar.com and EDGAR at www.sec.gov/edgar.

Öksüt Mine

- The mineral reserves have been

estimated based on a gold price of $1,350 per ounce and an exchange

rate of 1USD:7.5TL.

- The open pit mineral reserves are

estimated based on 0.16 grams of gold per tonne cut-off grade.

- Open pit optimization used a

tonne-weighted LOM metallurgical recovery of 77% (Keltepe Pit 75%,

Güneytepe Pit 85%).

- The mineral resources have been

estimated based on a gold price of $1,550 per ounce.

- Open pit mineral resources are

constrained by a pit shell and are estimated based on 0.16 grams of

gold per tonne cut-off grade.

- Further information concerning the

Öksüt deposit, including key assumptions, parameters, and methods

used to estimate mineral resources and mineral reserves, as well as

environmental and other risks are described in Centerra’s most

recently filed Annual Information Form which is available on SEDAR

at www.sedar.com and EDGAR at www.sec.gov/edgar and the

Technical Report on the Öksüt Project, dated September 3, 2015,

which is available on SEDAR at www.sedar.com.

Kemess Underground

- The mineral reserves have been

estimated based on a gold price of $1,200 per ounce, copper price

of $2.50 per pound and an exchange rate of 1USD:1.33CAD.

- The mineral reserves are estimated

based on a NSR cut-off of C$17.30 per tonne that takes into

consideration metallurgical recoveries, concentrate grades,

transportation costs and smelter treatment charges in determining

economic viability.

- The mineral resources have been

estimated based on a gold price of $1,275 per ounce, copper price

of $3.20 per pound and an exchange rate of 1USD:1.33CAD.

- The mineral resources are estimated

based on a NSR cut-off ranging between C$14.00 and C$16.00 per

tonne that takes into consideration metallurgical recoveries,

concentrate grades, transportation costs, and smelter treatment

charges.

- Further information concerning the

Kemess Underground deposit is described in the technical report

dated July 14, 2017 and filed on SEDAR at www.sedar.com by AuRico

Metals Inc. The technical report describes the exploration history,

geology, and style of gold mineralization at the Kemess Underground

deposit. Sample preparation, analytical techniques, laboratories

used, and quality assurance-quality control protocols used during

the exploration drilling programs are consistent with industry

standards and were carried out by independent, certified assay

labs.

Kemess East

- The mineral resources have been

estimated based on a gold price of $1,275 per ounce, copper price

of $3.20 per pound, and an exchange rate of 1USD:1.33CAD.

- The mineral resources are estimated

based on a NSR cut-off of C$17.30 per tonne that takes into

consideration metallurgical recoveries, concentrate grades,

transportation costs, and smelter treatment charges.

- Further information concerning the

Kemess East project is described in the technical report dated July

14, 2017 and filed on SEDAR by AuRico Metals Inc. The technical

report describes the exploration history, geology, and style of

gold mineralization at the Kemess East project. Sample preparation,

analytical techniques, laboratories used, and quality

assurance-quality control protocols used during the exploration

drilling programs are consistent with industry standards and were

carried out by independent, certified assay labs.

Thompson Creek Mine

- The mineral resources have been

estimated based on a molybdenum price of $14.00 per pound.

- The open pit mineral resources are

constrained by a pit shell and are estimated based on a 0.030%

molybdenum cut-off grade.

- Further information concerning the

Thompson Creek deposit is described in the technical report dated

February, 2011 and filed on SEDAR at www.sedar.com by Thompson

Creek Metals Company Inc. The technical report describes the

exploration history, geology, and style of molybdenum

mineralization at the Thompson Creek deposit. Sample preparation,

analytical techniques, laboratories used, and quality

assurance-quality control protocols used during the exploration

drilling programs are consistent with industry standards and were

carried out by independent, certified assay labs.

Endako Mine

- The mineral resources have been

estimated based on a molybdenum price of CAD14.00 per pound and an

exchange rate of 1USD:1.25CAD.

- The open pit mineral resources are

constrained by a pit shell and are estimated based on a 0.025%

molybdenum cut-off grade.

- Further information concerning the

Endako deposit is described in the technical report dated September

12, 2011 and filed on SEDAR at www.sedar.com by Thompson Creek

Metals Company Inc. The technical report describes the exploration

history, geology, and style of molybdenum mineralization at the

Endako deposit. Sample preparation, analytical techniques,

laboratories used, and quality assurance-quality control protocols

used during the exploration drilling programs are consistent with

industry standards and were carried out by independent, certified

assay labs.

Berg

- Mineral Resources have an effective

date of March 9, 2021

- CuEq calculated using metal prices

of $3.10 /lb Cu, $10.00 /lb Mo, and $20 /oz Ag. Recoveries were

applied to correspond with estimated individual metal recoveries

based on limited metallurgical testwork for production of a copper

and molybdenum concentrate; the leach zone (Cu = 0%, Mo = 61%, and

Ag = 52%), supergene zone (Cu = 73%, Mo = 61%, and Ag = 52%), and

hypogene zone (Cu = 81%, Mo = 71%, and Ag = 67%). Smelter loss was

not applied.

- A cut-off value of 0.20% CuEq was

used as the base case for reporting mineral resources that are

subject to open pit potential. The resource block model has been

constrained by a conceptual open pit shell. Resource classification

adheres to CIM Definition Standards; it cannot be assumed that all

or any part of Inferred Mineral Resources will be upgraded to

Indicated or Measured as a result of continued exploration.

- Dry bulk density has been estimated

based on 2,996 in situ specific gravity measurements collected

between 2007 and 2011. Values were applied by geology model domain

(n = 18) representing the weathering profiles and major

lithological units; values ranged from 2.38 t/m³ to 2.74 t/m³.

- There are no known legal,

political, unnatural environmental, or other risks that could

materially affect the potential development of the mineral

resources.

- All numbers are rounded. Overall

numbers may not be exact due to rounding.

- Further information concerning the

Berg deposit is described in the technical report dated May 3, 2021

and filed on SEDAR at www.sedar.com by Surge Copper Corp. The

technical report describes the exploration history, geology, and

style of mineralization at the Berg deposit. Sample preparation,

analytical techniques, laboratories used, and quality

assurance-quality control protocols used during the exploration

drilling programs are consistent with industry standards and were

carried out by independent, certified assay labs.

Qualified PersonJean-Francois

St-Onge, Professional Engineer, member of the Professional Engineer

of Ontario (PEO) and Centerra’s Senior Director, Technical

Services, has reviewed and approved the scientific and technical

information related to mineral reserves contained in this news

release. Mr. St-Onge is a Qualified Person within the meaning of

Canadian Securities Administrator’s NI 43-101 Standards of

Disclosure for Mineral Projects.

Lars Weiershäuser, PhD, PGeo, and Centerra’s

Director, Geology, has reviewed and approved the scientific and

technical information related to mineral resources estimates

contained in this news release. Dr. Weiershäuser is a Qualified

Person within the meaning of Canadian Securities Administrator’s NI

43-101 Standards of Disclosure for Mineral Projects.

All mineral reserve and resources have been

estimated in accordance with the standards of the Canadian

Institute of Mining, Metallurgy and Petroleum and NI 43-101.

Mineral reserve and mineral resource estimates

are forward-looking information and are based on key assumptions

and are subject to material risk factors. If any event arising from

these risks occurs, the Company’s business, prospects, financial

condition, results of operations or cash flows, and the market

price of Centerra’s shares could be adversely affected. Additional

risks and uncertainties not currently known to the Company, or that

are currently deemed immaterial, may also materially and adversely

affect the Company's business operations, prospects, financial

condition, results of operations or cash flows, and the market

price of Centerra’s shares. See the section entitled “Risk That Can

Affect Centerra’s Business” in the Company’s annual Management’s

Discussion and Analysis (MD&A) for the year-ended December 31,

2022, available on SEDAR at www.sedar.com and EDGAR at

www.sec.gov/edgar and see also the discussion below under the

heading “Caution Regarding Forward-looking Information”.

Qualified Person & QA/QC –

Exploration

Exploration information and related scientific

and technical information in this document regarding the Mount

Milligan Mine were prepared, reviewed, verified, and compiled in

accordance with the standards of NI 43-101 by Cheyenne Sica, Member

of the Association of Professional Geoscientists Ontario,

Exploration Manager at Centerra’s Mount Milligan Mine, who is the

qualified person for the purpose of NI 43-101. Sample preparation,

analytical techniques, laboratories used, and quality assurance and

quality control protocols used during the exploration drilling

programs are done consistent with industry standards while

independent certified assay labs are used. The Mount Milligan

Mine’s deposit is described in the Company’s most recent AIF, which

is available on SEDAR at www.sedar.com and EDGAR at

www.sec.gov/edgar.

Exploration information and related scientific

and technical information in this document regarding the Öksüt Mine

were prepared, reviewed, verified, and compiled in accordance with

the standards of NI 43-101 by Malcolm Stallman, Member of the

Australian Institute of Geoscientists and Vice President,

Exploration at Centerra Gold Inc., who is the qualified person for

the purpose of NI 43-101. Sample preparation, analytical

techniques, laboratories used, and quality assurance and quality

control protocols used during the exploration drilling programs are

done consistent with industry standards while independent certified

assay labs are used. The Öksüt deposit is described in the

Company’s most recent, which is available on SEDAR at

www.sedar.com and EDGAR at www.sec.gov/edgar, and in a

technical report dated September 3, 2015 (with an effective date of

June 30, 2015) prepared in accordance with NI 43-101, which is

available on SEDAR at www.sedar.com.

Exploration information and related scientific

and technical information in this document regarding the Goldfield

Project were prepared, reviewed, verified, and compiled in

accordance with the standards of NI 43-101 by Boris Kotlyar, Member

of the American Institute of Professional Geologists (AIPG) and

Chief Geologist, Global Exploration at Centerra Gold Inc., who is

the qualified person for the purpose of NI 43-101. Sample

preparation, analytical techniques, laboratories used, and quality

assurance and quality control protocols used during the exploration

drilling programs are done consistent with industry standards while

independent certified assay labs are used. The Goldfield Project is

described in in the Company’s most recent AIF, which is available

on SEDAR at www.sedar.com and EDGAR at www.sec.gov/edgar.

Caution Regarding Forward-Looking

InformationInformation contained in this news release,

which are not statements of historical facts, and the documents

incorporated by reference herein, may be “forward-looking

information” for the purposes of Canadian securities laws. Such

forward-looking information involves risks, uncertainties, and

other factors that could cause actual results, performance,

prospects, and opportunities to differ materially from those

expressed or implied by such forward-looking information. The words

“believe”, “expect”, “anticipate”, “contemplate”, “target”, “plan”,

“intends”, “continue”, “budget”, “estimate”, “may”, “will”,

“schedule”, and similar expressions identify forward-looking

information. These forward-looking statements relate to, among

other things, mineral reserve and mineral resource estimates, life

of mine estimates and operating and capital costs, future

exploration potential, timing and scope of future exploration

(brownfields or greenfields), and anticipated costs and

expenditures and other information that is based on forecasts of

future operational or financial results, estimates of amounts not

yet determinable, and assumptions of management. Forward-looking

information is necessarily based upon a number of estimates and

assumptions that, while considered reasonable by Centerra, are

inherently subject to significant political, business, economic,

and competitive uncertainties and contingencies. Known and unknown

factors could cause actual results to differ materially from those

projected in the forward-looking information. For a full list of

the risk factors that can affect the Company, see its management’s

discussion and analysis for the year ended December 31, 2022, and

its most recently filed annual information form.

Market price fluctuations in gold, copper, and

other metals, as well as increased capital or production costs or

reduced recovery rates may render ore reserves containing lower

grades of mineralization uneconomic and may ultimately result in a

restatement of mineral reserves. The extent to which mineral

resources may ultimately be reclassified as proven or probable

mineral reserves is dependent upon the demonstration of their

profitable recovery. Economic and technological factors, which may

change over time, always influence the evaluation of mineral

reserves or mineral resources. Centerra has not adjusted mineral

resource figures in consideration of these risks and, therefore,

Centerra can give no assurances that any mineral resource estimate

will ultimately be reclassified as proven and probable mineral

reserves.

Mineral resources are not mineral reserves, and

do not have demonstrated economic viability, but do have reasonable

prospects for economic extraction. Measured and indicated mineral

resources are sufficiently well defined to allow geological and

grade continuity to be reasonably assumed and permit the

application of technical and economic parameters in assessing the

economic viability of the resource. Inferred mineral resources are

estimated on limited information not sufficient to verify

geological and grade continuity or to allow technical and economic

parameters to be applied. Inferred mineral resources are too

speculative geologically to have economic considerations applied to

them to enable them to be categorized as mineral reserves. There is

no certainty that mineral resources of any category can be upgraded

to mineral reserves through continued exploration.

Centerra’s mineral reserve and mineral resource

figures are estimates, and Centerra can provide no assurances that

the indicated levels of gold or copper will be produced, or that

Centerra will receive the metal prices assumed in determining its

mineral reserves. Such estimates are expressions of judgment based

on knowledge, mining experience, analysis of drilling results, and

industry practices. Valid estimates made at a given time may

significantly change when new information becomes available. While

Centerra believes that these mineral reserve and mineral resource

estimates are well established, and the best estimates of

Centerra’s management, by their nature mineral reserve and mineral

resource estimates are imprecise and depend, to a certain extent,

upon analysis of drilling results and statistical inferences, which

may ultimately prove unreliable. If Centerra’s mineral reserve or

mineral reserve estimates for its properties are inaccurate or are

reduced in the future, this could have an adverse impact on

Centerra’s future cash flows, earnings, results, or operations and

financial condition.

Centerra estimates the future mine life of its

operations. Centerra can give no assurance that mine life estimates

will be achieved. Failure to achieve these estimates could have an

adverse impact on Centerra’s future cash flows, earnings, results

of operations, and financial condition.

There can be no assurances that forward-looking

information and statements will prove to be accurate, as many

factors and future events, both known and unknown, could cause

actual results, performance, or achievements to vary or differ

materially from the results, performance, or achievements that are,

or may be, expressed or implied by such forward-looking statements

contained herein or incorporated by reference. Accordingly, all

such factors should be considered carefully when making decisions

with respect to Centerra, and prospective investors should not

place undue reliance on forward-looking information.

Forward-looking information is as of February 24, 2023. Centerra

assumes no obligation to update or revise forward-looking

information to reflect changes in assumptions, changes in

circumstances, or any other events affecting such forward-looking

information, except as required by applicable law.

About Centerra

Centerra Gold Inc. is a Canadian-based mining

company focused on operating, developing, exploring, and acquiring

gold and copper properties in North America, Türkiye, and other

markets worldwide. Centerra operates two mines: the Mount Milligan

Mine in British Columbia, Canada, and the Öksüt Mine in Türkiye.

The Company also owns the Goldfield Project in Nevada, United

States, the Kemess Underground Project in British Columbia, Canada,

and owns and operates the Molybdenum Business Unit in the United

States and Canada. Centerra's shares trade on the Toronto Stock

Exchange (“TSX”) under the symbol CG and on the New York Stock

Exchange (“NYSE”) under the symbol CGAU. The Company is based in

Toronto, Ontario, Canada.

For more information:

|

Toby Caron |

Shae Frosst |

| (416) 204-1694 |

(416) 204-2159 |

|

toby.caron@centerragold.com |

shae.frosst@centerragold.com |

Additional information on Centerra is

available on the Company’s website at

www.centerragold.com and at SEDAR

at www.sedar.com and EDGAR

at www.sec.gov/edgar.

A PDF accompanying this announcement is

available

at: http://ml.globenewswire.com/Resource/Download/f5a712ee-8f6f-4924-a761-284280e3febc

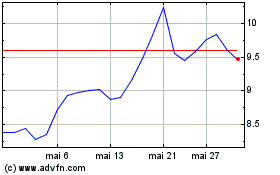

Centerra Gold (TSX:CG)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Centerra Gold (TSX:CG)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024