Element Fleet Management Corp. (TSX:EFN) (“Element” or the

“Company”), the largest pure-play automotive fleet manager in the

world, today announced strong financial and operating results for

the three months ended December 31, 2022 and record financial

and operating results for the twelve months ended December 31,

2022.

Element grew net revenue 16.2% year-over-year to

a record $1.1 billion for 2022. Excluding the $25 million

of non-recurring items previously communicated, net revenue grew

13.7% in 2022. Adjusted operating income (“AOI”) of $624.5 million

constitutes 22.0% year-over-year growth (17.1% excluding

non-recurring items from 2022), highlighting the scalability of

Element’s market-leading platform, which underpinned a 48.5%

pre-tax income margin and 55.2% operating margin for 2022 (54.2%

operating margin excluding non-recurring items in both net revenue

and AOI).

The Company’s Q4 2022 EPS were $0.24 and

adjusted EPS were $0.27, up 3 cents and 6 cents per

share, respectively, over Q4 2021. Element generated $0.30 of free

cash flow per share in the quarter -- 1 cent more than in Q4

2021 -- and $1.35 of free cash flow per share for the full-year

2022 -- 30 cents or 28.6% more than in 2021. ROE and pre-tax ROE

were 11.9% and a record 18.6%, respectively, at December 31,

2022.

"Element’s fourth quarter performance -- for our

clients, our people, and our investors -- caps off the most

successful year in the Company’s history," said Jay Forbes,

Element's Chief Executive Officer. "With the headwinds of both the

pandemic and vehicle shortages abating, 2022 was the first real

opportunity for Element to illustrate the commercial, operational

and financial capabilities we rebuilt through Transformation. The

Company has never performed better, nor been better positioned; we

enter 2023 on a wave of strong momentum that materially de-risks

the attainment of our full-year results guidance."

Full-year 2023 results

guidance

Element is confident in its ability to deliver

the following results1 for full-year 2023, with growing conviction

in the Company's ability to meet the high-end of certain of these

ranges:

- Net revenue of $1.14 to $1.17 billion

- Operating margin of 54-55%

- Adjusted operating income of $615 to $645 million

- Adjusted EPS2 of $1.12 to $1.17

- Free cash flow per share2 of $1.45 to $1.50

- Originations of approximately $7.5 to $8.0 billion

- Syndication of approximately $3.0 to $4.0 billion3

Profitable organic net revenue growth

atop a scalable operating platform

Element generated $158.2 million or 16.2%

more net revenue in 2022 than 2021. As previously communicated,

approximately $25 million is net revenue the Company does not

expect to generate in future years. Excluding such non-recurring

items, net revenue grew 13.7% "organically" in 2022.

"Organic" net revenue growth was led by services

revenue, which grew 20.6% or $97.6 million year-over-year excluding

non-recurring items. Such services revenue growth was driven by

increased vehicles under management at Element, and share of wallet

gains: increased client enrollment in Element services

("penetration"); increased client utilization of those services;

and inflationary tailwinds.

Net financing revenue ("NFR") also contributed

to full-year 2022 organic revenue growth: NFR grew 9.8% or $42.8

million in 2022 excluding non-recurring items. "Organic" NFR growth

was driven by strong gains-on-sale of vehicles, particularly in ANZ

and increased NFR 'yield' on net earning assets, which largely

reflects the growth of Element's business in Mexico.

Element's 2022 net revenue growth was

demonstrably profitable -- pre-tax income and AOI growth both

outpaced net revenue growth for the year -- highlighting the

scalability of the Company’s market-leading operating platform.

Element's 2022 pre-tax income margin expanded 150 basis points

year-over-year to 48.5%, and adjusted operating margin expanded 260

basis points year-over-year from 52.6% to 55.2%, or 160 basis

points to 54.2% "organic" operating margin for 2022.

A capital-lighter business

model

Growing services revenue is one of two planks of

the Company's capital-lighter business model. (Services revenue has

much lower funding needs than net financing revenue: only the net

working capital required to procure fuel, parts and services for

clients.)

________________________________

1 Based on a CAD:USD exchange rate of 1.29:12 Both adjusted EPS

and free cash flow per share growth will be aided by common share

buybacks under Element's NCIB, the upshot of which is a projected

weighted average outstanding common share count of 385-395 million

for 2023.3 Full-year 2023 syndication volume guidance has been

lowered to reflect Element's decision to – in the short-term – hold

on book some of the leases the Company had planned to syndicate.

Given the volatile interest rate environment, Management thought it

best to inventory these assets in the short-term, re-evaluating

syndication options as corporate spreads return to more historical

norms.

The second plank of Element's capital-lighter

business model is "syndication" -- the sale of fleet assets to

financial buyers with a lower cost of capital on terms that are

economically superior to holding the assets on balance sheet.

Element syndicated $745.4 million of assets

in the fourth quarter, generating $17.7 million of net

revenue; and $2.8 billion of assets in 2022, generating

$62.3 million of net revenue.

The Company's advance of its capital-lighter

business model continues to enhance ROE: year-over-year at December

31, 2022, return on common equity improved 150 basis points to

11.9% and pre-tax return on common equity improved 320 basis points

to 18.6%.

Growing free cash flow per share and the

return of capital to shareholders

Element generated $0.30 of free cash flow per

share in the quarter -- 1 cent more than in Q4 2021. The

Company's free cash flow per share for full-year 2022 was $1.35 --

a 30 cents per share or 28.6% improvement over 2021.

Per share growth is aided by Element’s return of

capital to common shareholders through buybacks pursuant to the

Company’s NCIBs. Element returned $192.9 million cash to

common shareholders through buybacks of 13.9 million common

shares in 2022.

Combined with its common dividend payouts,

Element returned $316.7 million cash to common shareholders in 2022

-- and $466.7 million to all shareholders, including the Company's

$150 million Series I preferred share redemption in Q2 2022.

As stated last quarter, Element plans to

maintain an annual common dividend representing between 25% and 35%

of the Company's last twelve months' free cash flow per share,

which the Company expects to grow (as guided). Element also

continues to plan to redeem its outstanding preferred share series

-- at the time (and in lieu) of rate reset -- thereby further

optimizing the Company's balance sheet and maturing its capital

structure.

Adjusted Operating Results as

reported

|

|

Three-month periods ended |

Twelve-month periods ended |

|

(in $000’s for stated values, except per share amounts) |

December 31,2022 |

September 30,2022 |

December 31,2021 |

December 31,2022 |

December 31,2021 |

|

|

$ |

$ |

$ |

$ |

$ |

|

Net revenue |

|

|

|

|

|

|

Servicing income, net |

149,208 |

149,931 |

123,716 |

581,018 |

472,465 |

|

Net financing revenue |

125,449 |

124,859 |

107,245 |

488,741 |

436,945 |

|

Syndication revenue, net |

17,671 |

15,998 |

14,521 |

62,290 |

64,412 |

|

Net revenue |

292,328 |

290,788 |

245,482 |

1,132,049 |

973,822 |

|

Adjusted operating expenses4 |

|

|

|

|

|

|

Salaries, wages and benefits |

88,180 |

80,708 |

82,112 |

322,886 |

306,884 |

|

General and administrative expenses |

38,453 |

29,654 |

27,074 |

124,848 |

104,401 |

|

Depreciation and amortization |

15,388 |

15,020 |

13,735 |

59,799 |

50,537 |

|

Adjusted operating expenses |

142,021 |

125,382 |

122,921 |

507,533 |

461,822 |

|

Adjusted operating income |

150,307 |

165,406 |

122,561 |

624,516 |

512,000 |

|

Provision for taxes applicable to adjusted operating income |

37,607 |

42,179 |

28,189 |

159,250 |

124,313 |

|

Cumulative preferred share dividends |

5,946 |

5,923 |

8,103 |

28,074 |

32,412 |

|

After-tax adjusted operating income attributable to common

shareholders4 |

106,754 |

117,304 |

86,269 |

437,192 |

355,275 |

|

Weighted average number of shares outstanding [basic] |

392,811 |

395,117 |

409,175 |

396,907 |

423,070 |

|

After-tax adjusted operating income per

share4 [basic] |

0.27 |

0.30 |

0.21 |

1.10 |

0.84 |

|

Net income |

101,216 |

103,703 |

94,664 |

409,643 |

356,006 |

|

Earnings per share [basic] |

0.24 |

0.25 |

0.21 |

0.96 |

0.76 |

Adjusted Operating Results in constant

currency5

|

|

Three-month periods ended |

Twelve-month periods ended |

|

(in $000’s for stated values, except per share amounts) |

December 31,2022 |

September 30,2022 |

December 31,2021 |

December 31,2022 |

December 31,2021 |

|

|

$ |

$ |

$ |

$ |

$ |

|

Net revenue |

|

|

|

|

|

| Servicing income, net |

149,208 |

154,582 |

131,009 |

581,018 |

484,496 |

| Net financing revenue |

125,449 |

130,158 |

113,937 |

488,741 |

443,434 |

|

Syndication revenue, net |

17,671 |

16,541 |

15,546 |

62,290 |

66,657 |

|

Net revenue |

292,328 |

301,281 |

260,492 |

1,132,049 |

994,587 |

|

Salaries, wages and benefits |

88,180 |

83,225 |

86,497 |

322,886 |

313,446 |

|

General and administrative expenses |

38,453 |

30,572 |

28,594 |

124,848 |

106,796 |

|

Depreciation and amortization |

15,388 |

15,502 |

14,554 |

59,799 |

51,740 |

|

Adjusted operating expenses4 |

142,021 |

129,299 |

129,645 |

507,533 |

471,982 |

|

Adjusted operating income |

150,307 |

171,982 |

130,847 |

624,516 |

522,605 |

| Provision for taxes applicable

to adjusted operating income |

37,607 |

43,855 |

32,725 |

159,250 |

128,993 |

|

Cumulative preferred share dividends |

5,946 |

5,923 |

8,103 |

28,074 |

32,412 |

|

After-tax adjusted operating income attributable to common

shareholders4 |

106,754 |

122,204 |

90,019 |

437,192 |

361,200 |

|

Weighted average number of shares outstanding [basic] |

392,811 |

395,117 |

409,175 |

396,907 |

423,070 |

|

After-tax adjusted operating income per

share [basic] |

0.27 |

0.31 |

0.22 |

1.10 |

0.85 |

________________________________

4 Please refer to the Descriptions of Non-GAAP Measures section

of the MD&A for a description of this non-GAAP measure.5 Please

refer to the Effect of Foreign Currency Exchange Rate Changes

section of the MD&A for reconciliations of certain non-GAAP

"constant currency" measures to their counterpart IFRS measures as

reported.

CEO LETTER TO SHAREHOLDERS

My fellow shareholders,

As today’s Q4 and full-year 2022 results amply

demonstrate, Element continues to perform better than ever. We have

successfully pivoted the organization to a client-centric focus

on

- profitable organic

net revenue growth atop a scalable operating platform,

- the advancement of

a capital-lighter business model, which enhances return on equity,

and

- double-digit annual

free cash flow per share growth, which enables Element to

predictably return generous sums of capital to shareholders through

growing common dividends and share buybacks.

Importantly, we could not be better positioned

to sustain and build on this success. Over the last 4+ years, we

devised and ably executed “Transformation” and “Pivot to Growth”

strategies that have balanced and dutifully served the best

interests of all our stakeholders. And, critically, we stayed the

course on those strategies, first through the global pandemic and

then through an industry-first vehicle shortage.

Accordingly, Element enters 2023 riding a wave

of momentum that is propelled by every team and function across our

organization, performing at their very best: delivering a

consistent, superior client experience and making the complex

simple for our clients, prospects and drivers.

Whether it be

- our Commercial

organization outperforming all past years’ KPIs – new client wins,

share of wallet penetration, contracted revenue units, etc. – by

leaps and bounds in 2022, and securing the Rentokil-Terminix “mega”

fleet to cap off the year;

- our Operating teams

delivering tech-enabled, market leading client services – and

earning best-in-class Net Promoter Scores to prove it – while

continuously improving our cost-to-serve, thereby enabling net

revenue growth to expand our operating margins;

- our Strategic

Consultants identifying another $1.4 billion of

fleet-operating-cost-savings opportunities for our clients and

prospects in 2022 – one of Element’s primary competitive

differentiators in terms of capabilities;

- our Syndication

team continuing to expand that market for our assets both

categorically and geographically, advancing our capital-lighter

business model that enhances returns on equity and accelerates the

velocity of revenue and cash flow – for re-investment in our

business and return to our shareholders;

- our Treasury group

maintaining our cost-efficient access to diversified sources of

capital, optimizing cash flow management, and appropriately

mitigating risk in a volatile interest rate and FX environment;

or

- our Mexico and ANZ

businesses converting self-managed fleets into Element clients,

growing our global Vehicles Under Management, and expanding our

relationship with Armada in both of those regions,

again, Element has never performed better, nor

been better positioned to continue capitalizing on our vast

opportunity set as the perennial market-leading FMC everywhere we

operate.

And this wave of momentum we’ve created within

Element seems perfectly timed to converge with positive trends in

our industry and the broader economy, bolstering our confidence in

our full-year 2023 results guidance (and beyond):

- OEM production is

improving thereby reducing vehicle delivery delays, as evidenced by

our $6.6 billion originations in 2022, 33% more volume than last

year;

- Our competitors are

distracted by new ownership structures and operational integration

projects, affording us opportunities to both steal market share and

secure self-managed fleets; and

- Our business

benefits from inflation, which enhances our “cost-plus” revenue

streams and, perhaps more importantly, makes our fleet-cost-saving

value proposition all-the-more compelling. A recessionary

environment increases this value to our current and prospective

clients, including self-managed fleets.

With full confidence in the people, processes

and systems we have put in place to continue the advancement of our

three-prong growth strategy, early last year, I informed our Board

of my desire to plan for an orderly retirement. This provided the

Board ample opportunity to carefully manage a comprehensive and

uncompromising search for my successor. By now, you all know that

our search for that proverbial “needle in a haystack” identified

the perfect successor: Laura Dottori-Attanasio.

I am squarely focused on ensuring a seamless and

successful leadership transition to Laura by continuing in my CEO

role until May 10th and remaining a strategic advisor to Laura and

the Chair of the Board for two years thereafter.

Like everyone else at Element, I am absolutely

thrilled to have Laura as the next CEO of our company. In Laura we

have found someone (i) with a mutual conviction in Element’s

established strategy that has proven to create value for all

stakeholders, and (ii) who is an innate “fit” with the culture

we've been curating and nurturing since my arrival in 2018:

client-centricity, accountability, agility, collaboration,

connection, and transparency.

Laura has had a long and successful career in

the financial services sector, including several senior executive

roles over the last 14 years at the Canadian Imperial Bank of

Commerce (CIBC). Laura’s track record leading complex organizations

and operations, coupled with her familiarity with Element by virtue

of our company’s long-standing relationship with CIBC – and the

extensive interview process for this role – ideally positions Laura

to assume the CEO role in May.

Importantly, Laura is a well-known and highly

regarded champion of diversity, equity, and inclusion, with deep

roots in community engagement as an active member of several local

and national boards and charities. She has a proven ability to

unify teams around growth, empower leaders to make informed

decisions, and invest in digital innovation. Laura’s approach is

data-driven, comprehensive, and measured with the right level of

risk tolerance.

I look forward to continuing to work closely

with Laura over the coming months through our rigorous orientation

and integration agenda. We are focused on enabling Laura to build

relationships across Element and with many of our key external

stakeholders; develop her knowledge of the business and “how we

make money”; and immerse herself in the remarkable culture of this

organization, with which Laura is such a strong fit.

Meanwhile, Element has the best leaders in our

industry across all functions to both support Laura’s onboarding

and, at the same time, continue executing on our growth

strategy.

In a matter of weeks, Laura will be comfortably

running alongside all of us, and shoulder-to-shoulder with me such

that – come May 10th – I can pass her the baton with the ultimate

confidence that Element will continue its momentum in 2023 and

beyond with Laura as both our President and CEO.

Until next quarter,

Jay

Conference Call and Webcast

A conference call to discuss these results will

be held on Tuesday, March 7, 2023 at 8:00 a.m. Eastern Time.

The conference call and webcast can be accessed

as follows:

|

Webcast: |

https://services.choruscall.ca/links/elementfleet2022Q4.html |

| |

|

| Telephone: |

Click here to join the call most efficiently, or dial one

of the following numbers to speak with an operator: |

| |

|

| |

Canada/USA toll-free: 1-800-319-4610 |

| |

|

| |

International: +1-604-638-5340 |

The webcast will be available on the Company’s website for three

months thereafter. A taped recording of the conference call may be

accessed through April 7, 2023 by dialing 1-800-319-6413 or

+1-604-638-9010 and entering the access code 9854.

Dividends Declared

The Company’s Board of Directors has authorized

and declared a quarterly dividend of $0.10 per outstanding common

share of Element for the first quarter of 2023. The dividend will

be paid on April 14, 2023 to shareholders of record as at the close

of business on March 31, 2023.

Element’s Board of Directors also declared the

following dividends on Element’s preferred shares:

|

Series |

TSX Ticker |

Amount |

Record Date |

Payment Date |

| Series A |

EFN.PR.A |

$0.4333125 |

March 16, 2023 |

March 31, 2023 |

| Series C |

EFN.PR.C |

$0.3881300 |

March 16, 2023 |

March 31, 2023 |

| Series E |

EFN.PR.E |

$0.3689380 |

March 16, 2023 |

March 31, 2023 |

The Company’s common and preferred share

dividends are designated to be eligible dividends for purposes of

section 89(1) of the Income Tax Act (Canada).

Normal Course Issuer Bids

On November 10, 2021, the TSX approved Element's

notice of intention to renew its normal course issuer bid (the

"2021 NCIB"). The 2021 NCIB allowed the Company to repurchase on

the open market (or as otherwise permitted), at its discretion

during the period commencing on November 15, 2021 and ending on the

earlier of November 14, 2022 and the completion of purchases under

the 2021 NCIB, up to 40,968,811 common shares, subject to the rules

of the TSX and applicable law. Under the 2021 NCIB, 19,223,100

common shares were repurchased for cancellation for an aggregate

amount of approximately $261.1 million at a volume weighted

average price of $13.58 per common share.

On November 11, 2022, the TSX approved Element’s

notice of intention to renew its normal course issuer bid (the

“2022 NCIB”). The 2022 NCIB allows Element to repurchase on the

open market (or as otherwise permitted), at its discretion during

the period from November 15, 2022 to November 14, 2023, up to

39,228,719 common shares, subject to rules of the TSX and

applicable law. As of December 31, 2022, under the 2022 NCIB,

26,400 common shares were repurchased for cancellation for an

aggregate amount of approximately $0.5 million at a volume

weighted average price of $18.26 per common share.

Element applies trade date accounting in

determining the date on which the share repurchase is reflected in

the consolidated financial statements. Trade date accounting is the

date on which the Company commits itself to purchase the

shares.

Non-GAAP Measures

The Company’s condensed consolidated financial

statements have been prepared in accordance with International

Financial Reporting Standards (IFRS) as issued by the International

Accounting Standards Board (IASB) and the accounting policies

Element adopted in accordance with IFRS.

The Company believes that certain non-GAAP

measures can be useful to investors because they provide a means by

which investors can evaluate the Company’s underlying key drivers

and operating performance of the business, exclusive of certain

adjustments and activities that investors may consider to be

unrelated to the underlying economic performance of the business of

a given period. Throughout this News Release, management used a

number of terms and ratios which do not have a standardized meaning

under IFRS and are unlikely to be comparable to similar measures

presented by other organizations. A full description of these

measures can be found in the Management Discussion & Analysis

that accompanies the financial statements for the quarter ended

December 31, 2022.

Element’s consolidated financial statements and

related management discussion and analysis as at and for the year

ended December 31, 2022 have been filed on SEDAR

(www.sedar.com).

About Element Fleet

Management

Element Fleet Management (TSX: EFN) is the

largest pure-play automotive fleet manager in the world, providing

the full range of fleet services and solutions to a growing base of

loyal, world-class clients – corporates, governments and

not-for-profits – across North America, Australia and New Zealand.

Element enjoys proven resilient cash flow, a significant proportion

of which is returned to shareholders in the form of dividends and

share buybacks; a scalable operating platform that magnifies

revenue growth into earnings growth; and an evolving

capital-lighter business model that enhances return on equity.

Element’s services address every aspect of clients’ fleet

requirements, from vehicle acquisition, maintenance, accidents and

remarketing, to integrating EVs and managing the complexity of

gradual fleet electrification. Clients benefit from Element’s

expertise as the largest fleet solutions provider in its markets,

offering unmatched economies of scale and insight used to reduce

fleet operating costs and improve productivity and performance. For

more information, visit www.elementfleet.com/investors.

This press release includes forward-looking

statements regarding Element and its business. Such statements are

based on the current expectations and views of future events of

Element’s management. In some cases the forward-looking statements

can be identified by words or phrases such as “may”, “will”,

“expect”, “plan”, “anticipate”, “intend”, “potential”, “estimate”,

“believe” or the negative of these terms, or other similar

expressions intended to identify forward-looking statements,

including, among others, statements regarding Element’s

enhancements to clients’ service experience and service levels;

enhancement of financial performance; improvements to client

retention trends; reduction of operating expenses; increases in

efficiency; EV strategy and capabilities; global EV adoption rates;

redemption of the Series I Shares; dividend policy and the payment

of future dividends; creation of value for all stakeholders;

expectations regarding syndication; growth prospects and expected

revenue growth; level of workforce engagement; improvements to

magnitude and quality of earnings; executive hiring and retention;

focus and discipline in investing; balance sheet management and

plans to reduce leverage ratios; anticipated benefits of the

balanced scorecard initiative; Element’s proposed share purchases,

including the number of common shares to be repurchased, the timing

thereof and TSX acceptance of the NCIB and any renewal thereof; and

expectations regarding financial performance. No forward-looking

statement can be guaranteed. Forward-looking statements and

information by their nature are based on assumptions and involve

known and unknown risks, uncertainties and other factors which may

cause Element's actual results, performance or achievements, or

industry results, to be materially different from any future

results, performance or achievements expressed or implied by such

forward-looking statement or information. Accordingly, readers

should not place undue reliance on any forward-looking statements

or information. Such risks and uncertainties include those

regarding the ongoing COVID-19 pandemic, risks regarding the fleet

management and finance industries, economic factors and many other

factors beyond the control of Element. A discussion of the material

risks and assumptions associated with this outlook can be found in

Element's annual MD&A, and Annual Information Form for the year

ended December 31, 2021, each of which has been filed on SEDAR and

can be accessed at www.sedar.com. Except as required by applicable

securities laws, forward-looking statements speak only as of the

date on which they are made and Element undertakes no obligation to

publicly update or revise any forward-looking statement, whether as

a result of new information, future events, or otherwise.

Contact:

Michael Barrett

Vice President, Investor Relations

(416) 646-5698

mbarrett@elementcorp.com

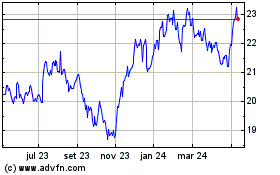

Element Fleet Management (TSX:EFN)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

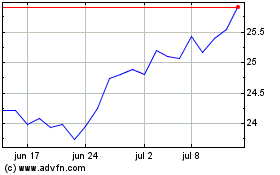

Element Fleet Management (TSX:EFN)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025