Peyto Exploration & Development Corp. ("Peyto" or the

"Company") is pleased to report operating and financial results for

the fourth quarter and 2022 fiscal year. Peyto solidified the

sustainability of its dividend through reserves, production, and

cash flow growth while continuing to reduce debt.

Full Year and Q4 2022

Highlights:

- Strong

2022 financial metrics – Annual operating margin1,2 of

70%, combined with an annual profit margin3 of 32%, delivered a

2022 return on capital employed ("ROCE"4) of 16% and return on

equity ("ROE"4) of 19%.

- Record

Funds from Operations5 –

Annual funds from operations ("FFO") rose 76% from $470 million in

2021 to a record $828 million in 2022 (an increase of 71% per

diluted share), due to higher realized commodity prices and greater

production. Q4 2022 FFO was $221 million ($1.26/diluted share), up

33% from Q4 2021.

- Record

Earnings of $391 million – Annual earnings of

$2.23/diluted share, up 151% from 2021, represented a profit margin

of 32% and funded $0.60/share of dividends to shareholders. Fourth

quarter 2022 earnings were $113 million, for a 35% profit

margin.

- Annual

Production up 14% – Annual production increased 14% from

91,051 boe/d to 103,548 boe/d (544 MMcf/d of natural gas and 12,949

bbl/d of natural gas liquids). Q4 2022 production of 104,944 boe/d

(553 MMcf/d of natural gas and 12,840 bbl/d of natural gas

liquids), was up 8% over Q4 2021.

- Free

Funds Flow6 Tripled in

2022 – Free funds flow totaled $321 million in 2022 as

compared to $105 million in 2021. Net debt7 was reduced by $214

million and the Company returned $102 million to shareholders in

the form of dividends.

- Total

Cash Costs8 of $1.62/Mcfe (or

$0.88/Mcfe before royalties) – Full year 2022 cash costs

of $0.88/Mcfe before royalties were equivalent to 2021 and when

combined with a realized price of $5.29/Mcfe ($31.72/boe, inclusive

of $9.01/boe hedging loss), resulted in a cash netback of

$3.74/Mcfe ($22.43/boe) or a 70% operating margin. Q4 2022 cash

costs of $0.86/Mcfe, before royalties of $0.72/Mcfe, were 9% higher

than Q4 2021 due to inflationary pressures on costs. Q4 operating

costs of $0.41/Mcfe, transportation of $0.22/Mcfe, G&A of

$0.02/Mcfe and interest expense of $0.21/Mcfe resulted in a 74%

operating margin. Peyto continues to have the lowest cash costs in

the Canadian natural gas industry.

-

Low Production and Reserves

Replacement9 Costs – The

Company invested 64% of FFO in 2022 to replace over 165% of

produced reserves in the year and grew Proved Developed Producing

("PDP") reserves by 8% implying only 39% of FFO would have been

required to replace produced reserves. Capital efficiency9 for 2022

was $12,600/boe/d for the organic drilling program excluding two

separate acquisitions.

- Long

Life, Low Decline Production – Peyto’s base production

decline is forecast in the GLJ report at 29% for 2023, while its

PDP Reserve Life Index9 ("RLI") is 9 years, based on Q4 2022

production of 104,944 boe/d, which is one of the longest PDP RLIs

in the industry. Refer to February 16, 2023 press release.

-

Emissions Reduction – 2022 marks the first year

where all new well tie-ins were completed with ultra-low emissions

electric separators and along with other emissions reducing

projects, the Company is on target to reduce methane flaring and

venting intensity by the end of 2023 to 25% of 2016 levels.

- Dividend

Sustainability – The Company increased dividends in

January 2023 as a result of strong operational and financial

performance in 2022 along with a commitment to disciplined

spending, a mechanistic hedging program and confidence in free

funds flow under current strip pricing.

________________________1 This press release

contains certain non-GAAP and other financial measures to analyze

financial performance, financial position, and cash flow including,

but not limited to "operating margin", "profit margin", "return on

capital", "return on equity", "netback", "funds from operations",

"free funds flow", "total cash costs", and "net debt". These

non-GAAP and other financial measures do not have any standardized

meaning prescribed under IFRS and therefore may not be comparable

to similar measures presented by other entities. The non-GAAP and

other financial measures should not be considered to be more

meaningful than GAAP measures which are determined in accordance

with IFRS, such as earnings, cash flow from operating activities,

and cash flow used in investing activities, as indicators of

Peyto’s performance. See "Non-GAAP and Other Financial Measures"

included at the end of this press release and in Peyto's most

recently filed MD&A for an explanation of these financial

measures and reconciliation to the most directly comparable

financial measure under IFRS.2 Operating Margin is a non-GAAP

financial ratio. See "non-GAAP and Other Financial Measures" in

this news release.3 Profit Margin is a non-GAAP financial ratio.

See "non-GAAP and Other Financial Measures" in this news release.4

Return on capital employed and return on equity are non-GAAP

financial ratios. See "non-GAAP and Other Financial Measures" in

this news release and in the Q4 2022 MD&A.5 Funds from

operations is a non-GAAP financial measure. See "non-GAAP and Other

Financial Measures" in this news release and in the Q4 2022

MD&A.6 Free funds flow is a non-GAAP financial measure. See

"non-GAAP and Other Financial Measures" in this news release and in

the Q4 2022 MD&A.7 Net debt is a non-GAAP financial measure.

See "non-GAAP and Other Financial Measures" in this news release

and in the Q4 2022 MD&A.8 Total cash costs is a non-GAAP

financial ratio defined as the sum of royalties, operating

expenses, transportation expenses, G&A and interest, on a per

Mcfe basis. See "non-GAAP and Other Financial Measures" in this

news release.9 Reserve replacement, capital efficiency and reserve

life index are non-GAAP financial ratios. See "non-GAAP and Other

Financial Measures" in this news release.

|

|

Three Months Ended Dec 31 |

% |

Year Ended Dec 31 |

% |

|

|

2022 |

|

2021 |

|

Change |

2022 |

|

2021 |

|

Change |

|

Operations |

|

|

|

|

|

|

| Production |

|

|

|

|

|

|

|

Natural gas (Mcf/d) |

552,627 |

|

517,606 |

|

7 |

% |

543,590 |

|

476,387 |

|

14 |

% |

|

NGLs (bbl/d) |

12,840 |

|

11,038 |

|

16 |

% |

12,949 |

|

11,653 |

|

11 |

% |

|

Thousand cubic feet equivalent (Mcfe/d @ 1:6) |

629,667 |

|

583,834 |

|

8 |

% |

621,286 |

|

546,303 |

|

14 |

% |

|

Barrels of oil equivalent (boe/d @ 6:1) |

104,944 |

|

97,306 |

|

8 |

% |

103,548 |

|

91,051 |

|

14 |

% |

| Production per million common

shares (boe/d) |

608 |

|

582 |

|

4 |

% |

606 |

|

550 |

|

10 |

% |

| Product prices |

|

|

|

|

|

|

|

Natural gas ($/Mcf) |

4.62 |

|

3.58 |

|

29 |

% |

4.12 |

|

2.82 |

|

46 |

% |

|

NGLs ($/bbl) |

75.95 |

|

64.71 |

|

17 |

% |

80.39 |

|

53.39 |

|

51 |

% |

| Operating expenses

($/Mcfe) |

0.41 |

|

0.32 |

|

28 |

% |

0.39 |

|

0.34 |

|

15 |

% |

| Transportation ($/Mcfe) |

0.22 |

|

0.23 |

|

-4 |

% |

0.26 |

|

0.21 |

|

24 |

% |

| Field netback(1) ($/Mcfe) |

4.39 |

|

3.34 |

|

31 |

% |

3.96 |

|

2.69 |

|

47 |

% |

| General & administrative

expenses ($/Mcfe) |

0.02 |

|

0.02 |

|

0 |

% |

0.02 |

|

0.03 |

|

-33 |

% |

| Interest expense ($/Mcfe) |

0.21 |

|

0.22 |

|

-5 |

% |

0.21 |

|

0.30 |

|

-30 |

% |

| Financial ($000,

except per share) |

|

|

|

|

|

|

| Revenue and realized hedging

losses (2) |

324,614 |

|

236,360 |

|

37 |

% |

1,198,999 |

|

716,922 |

|

67 |

% |

| Funds from operations(1) |

220,815 |

|

166,165 |

|

33 |

% |

827,596 |

|

469,672 |

|

76 |

% |

| Funds from operations per

share - basic(1) |

1.28 |

|

0.99 |

|

29 |

% |

4.85 |

|

2.83 |

|

71 |

% |

| Funds from operations per

share - diluted(1) |

1.26 |

|

0.96 |

|

31 |

% |

4.73 |

|

2.76 |

|

71 |

% |

| Total dividends |

25,908 |

|

16,779 |

|

54 |

% |

102,437 |

|

21,758 |

|

371 |

% |

| Total dividends per share |

0.15 |

|

0.10 |

|

50 |

% |

0.60 |

|

0.13 |

|

362 |

% |

| Earnings |

113,441 |

|

71,718 |

|

58 |

% |

390,663 |

|

152,248 |

|

157 |

% |

| Earnings per share –

basic |

0.66 |

|

0.43 |

|

53 |

% |

2.29 |

|

0.92 |

|

149 |

% |

| Earnings per share –

diluted |

0.64 |

|

0.42 |

|

52 |

% |

2.23 |

|

0.89 |

|

151 |

% |

| Total capital

expenditures(1) |

115,040 |

|

108,951 |

|

6 |

% |

506,860 |

|

365,058 |

|

39 |

% |

| Corporate acquisition |

- |

|

- |

|

|

22,220 |

|

- |

|

|

| Total payout ratio(1) |

64% |

|

76% |

|

-16 |

% |

74% |

|

82% |

|

-10 |

% |

| Weighted average common shares

outstanding - basic |

172,726,293 |

|

167,546,601 |

|

3 |

% |

170,739,471 |

|

166,107,837 |

|

3 |

% |

| Weighted average common shares

outstanding - diluted |

175,892,139 |

|

172,582,450 |

|

2 |

% |

175,040,978 |

|

170,137,599 |

|

3 |

% |

| |

|

|

|

|

|

|

| Net debt(1) |

|

|

|

885,137 |

|

1,098,748 |

|

-19 |

% |

| Shareholders' equity |

|

|

|

2,061,666 |

|

1,766,006 |

|

-100 |

% |

| Total

assets |

|

|

|

4,012,523 |

|

3,784,195 |

|

6 |

% |

(1) This is a Non-GAAP financial measure or

ratio. See "non-GAAP and Other Financial Measures" in this news

release and in the Q4 2022 MD&A(2) Excludes

revenue from sale of third-party volumes

2022 in Review

The year 2022 was the completion of Peyto’s 24th

year of successful operations. The Company delivered record funds

from operations of $828 million and record earnings of $391 million

in the year, allowing Peyto to return $102 million of dividends to

shareholders and to reduce net debt by $214 million. Peyto

increased its pace of capital investment in the year that grew

production 14% over 2021 and replaced 165% of annual production

with new PDP reserves. The Company’s activities paid particular

focus to the Greater Brazeau area, adding a new gas plant at

Chambers and consolidating area interests with two acquisitions in

2022. These acquisitions added an underutilized gas plant, 115

sections of land with future drilling locations, approximately

1,500 boe/d of combined production, and many other operational and

financial synergies. The greater Brazeau area now has three

interconnected plants with the total capability to process 250

MMcf/d of raw gas. Operating and profit margins were strong in 2022

with higher realized sales prices which more than offset the

increased capital and total cash costs associated with cost

inflation and higher royalties. Lastly, Peyto increased its monthly

dividend by 120% starting in January 2023 as a result of its strong

operational and financial performance, a commitment to disciplined

spending, a mechanistic hedging program and confidence in free

funds flow sustainability under current strip pricing.

The Peyto Strategy

The Peyto strategy has been one of the most

consistent strategies in the Canadian Energy industry over the last

two decades and has focused simply on maximizing the returns on

shareholders’ capital by investing that capital into the profitable

development of long life, low cost, and low risk natural gas

resource plays. Peyto’s strategy of maximizing returns doesn’t just

focus on the efficient execution of exploration and production

operations in the field but continues to the head office where the

management of corporate costs, including the cost of capital, is

carefully controlled to ensure true returns are ultimately

realized. Alignment of goals between what is good for the Company,

its shareholders, and its employees and what is good for the

environment and all stakeholders is critical to ensuring that the

greatest returns are achieved. Evidence of Peyto’s success

deploying this strategy through the years is illustrated in the

following table.

|

($/Mcfe) |

2012 |

|

2013 |

|

2014 |

|

2015 |

|

2016 |

|

2017 |

|

2018 |

|

2019 |

|

2020 |

|

2021 |

2022 |

|

|

24 YearWt. Avg. |

|

Sales Price1 |

$4.21 |

|

$4.43 |

|

$5.04 |

|

$3.83 |

|

$3.18 |

|

$3.39 |

|

$3.27 |

|

$2.78 |

|

$2.23 |

|

$3.61 |

$5.36 |

|

|

$4.42 |

|

All cash costs but royalties2 |

($0.73) |

|

($0.75) |

|

($0.71) |

|

($0.67) |

|

($0.63) |

|

($0.68) |

|

($0.79) |

|

($0.87) |

|

($0.88) |

|

($0.88) |

($0.88) |

|

|

($0.79) |

|

Capital costs3 |

($2.22) |

|

($2.35) |

|

($2.25) |

|

($1.64) |

|

($1.44) |

|

($1.36) |

|

($1.18) |

|

($1.55) |

|

($1.06) |

|

($0.97) |

($1.41) |

|

|

($1.63) |

|

Financial Benefit4 |

$1.26 |

|

$1.33 |

|

$2.08 |

|

$1.52 |

|

$1.12 |

|

$1.35 |

|

$1.30 |

|

$0.35 |

|

$0.29 |

|

$1.75 |

$3.07 |

|

|

$2.00 |

|

|

30% |

|

30% |

|

41% |

|

40% |

|

35% |

|

40% |

|

40% |

|

13% |

|

13% |

|

49% |

57% |

|

|

45% |

|

Royalty Owners |

$0.32 |

|

$0.31 |

|

$0.37 |

|

$0.14 |

|

$0.13 |

|

$0.15 |

|

$0.13 |

|

$0.08 |

|

$0.13 |

|

$0.37 |

$0.74 |

|

|

$0.46 |

|

Current Taxes |

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

- |

$0.09 |

|

|

- |

|

Shareholders |

$0.94 |

|

$1.02 |

|

$1.71 |

|

$1.38 |

|

$0.99 |

|

$1.19 |

|

$1.17 |

|

$0.27 |

|

$0.16 |

|

$1.38 |

$2.24 |

|

|

$1.54 |

|

Div./Dist. paid |

$1.04 |

|

$1.01 |

|

$1.05 |

|

$1.11 |

|

$1.01 |

|

$0.97 |

|

$0.59 |

|

$0.22 |

|

$0.08 |

|

$0.11 |

$0.45 |

|

|

$1.05 |

- Sales price includes third party sales net of purchases and

other income.

- Cash costs not including royalties but including Operating

costs, Transportation, G&A and Interest.

- Capital costs to develop new producing reserves is the PDP

FD&A

- Financial Benefit above is defined as the Sales Price, less all

cash costs but royalties, less the PDP FD&A.

Table may not add due to rounding.

The consistency and repeatability of Peyto’s

operational execution in the field, combined with strict cost

control in all aspects of its business has resulted in 45% of the

average sales price being retained in financial benefit over the

past 24 years. This healthy margin of benefit (as shown above),

which rewards both royalty owners and shareholders, has been

preserved for over a decade. Out of that financial benefit, royalty

owners have received approximately 23%, while shareholders, whose

capital has been at risk, have received the balance. This margin of

benefit is what has and will continue to help insulate Peyto and

its stakeholders from future volatility in commodity prices.

Economic Benefit to

Canadians

Over Peyto’s 24 year history, the Company has

invested a cumulative $7.3 billion in capital programs to drill

wells, construct facilities, shoot seismic, and buy mineral rights

in the province of Alberta. This significant expenditure has

provided high quality employment opportunities for many Canadians

to improve their quality of life. In addition, the Company has made

payments to various levels of government that include provincial

crown royalties, municipal property taxes, provincial mineral lease

payments, carbon taxes, regulatory administration fees, federal and

provincial corporate income taxes, and miscellaneous payments to

the benefit of Albertans and all Canadians. Over the past decade,

these payments have totaled $665.7 million.

|

($000) |

|

2013 |

|

2014 |

|

2015 |

|

2016 |

|

2017 |

|

2018 |

|

2019 |

|

2020 |

|

2021 |

|

2022 |

|

Total |

|

Revenue |

575,845 |

|

843,797 |

|

717,836 |

|

678,388 |

|

760,956 |

|

658,906 |

|

489,822 |

|

388,981 |

|

716,922 |

|

1,198,999 |

|

7,030,452 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Payments to Government (Included in Opex) |

6,968 |

|

9,710 |

|

11,818 |

|

13,723 |

|

15,022 |

|

16,994 |

|

17,744 |

|

16,995 |

|

20,361 |

|

21,059 |

|

150,394 |

|

|

Crown Royalties |

40,450 |

|

61,324 |

|

27,019 |

|

28,330 |

|

34,104 |

|

26,622 |

|

13,653 |

|

22,014 |

|

73,091 |

|

168,379 |

|

494,986 |

|

|

Current taxes |

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

20,277 |

|

20,277 |

|

|

Total Payments to Governments |

47,418 |

|

71,034 |

|

38,837 |

|

42,053 |

|

49,126 |

|

43,616 |

|

31,397 |

|

39,009 |

|

93,452 |

|

209,715 |

|

665,657 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

% of Revenue |

8% |

|

8% |

|

5% |

|

6% |

|

6% |

|

7% |

|

6% |

|

10% |

|

13% |

|

17% |

|

9% |

|

Capital Expenditures

Peyto drilled 95 gross (82.4 net) horizontal

wells in 2022 and completed 102 gross (87.9 net) wells for a

capital investment of $332 million inclusive of 6 gross (2.5 net)

non-operated wells. The Company also invested $39 million to bring

these wells on production using ultra low emissions electric

wellsite equipment and pipeline connections. Drilling costs per

meter were up 30% from 2021 while completion costs per meter and

per stage were up 31% and 27%, respectively, due to service rate

increases and increased frac intensities. A typical basket of goods

analysis for drilling and completion costs, including rig rates,

fuel, tubulars and stimulations, indicates an average increase of

30% for 2022 versus 2021. The Company continued to pursue Extended

Reach Horizontal (“ERH”) wells in the year resulting in an increase

in average measured depth and horizontal length, as a means to

improving resource capture efficiency. As well, increased stage

count and frac size, in order to enhance productivity, contributed

to higher year over year completion costs.

|

|

|

2011 |

|

2012 |

|

2013 |

|

2014 |

|

2015 |

|

2016 |

|

2017 |

|

2018 |

|

2019 |

|

2020 |

|

2021 |

|

2022 |

|

Gross Hz Spuds |

|

70 |

|

86 |

|

99 |

|

123 |

|

140 |

|

126 |

|

135 |

|

70 |

|

61 |

|

64 |

|

95 |

|

95 |

| Measured

Depth (m) |

|

3,903 |

|

4,017 |

|

4,179 |

|

4,251 |

|

4,309 |

|

4,197 |

|

4,229 |

|

4,020 |

|

3,848 |

|

4,247 |

|

4,453 |

|

4,611 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Drilling

($MM/well) |

$2.82 |

$2.79 |

$2.72 |

$2.66 |

$2.16 |

$1.82 |

$1.90 |

$1.71 |

$1.62 |

$1.68 |

$1.89 |

$2.56 |

| $ per

meter |

$723 |

$694 |

$651 |

$626 |

$501 |

$433 |

$450 |

$425 |

$420 |

$396 |

$424 |

$555 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Completion ($MM/well) |

$1.68 |

$1.67 |

$1.63 |

$1.70 |

$1.21 |

$0.86 |

$1.00 |

$1.13 |

$1.01* |

$0.94 |

$1.00 |

$1.35 |

| Hz

Length (m) |

|

1,303 |

|

1,358 |

|

1,409 |

|

1,460 |

|

1,531 |

|

1,460 |

|

1,241 |

|

1,348 |

|

1,484 |

|

1,682 |

|

1,612 |

|

1,661 |

| $ per Hz

Length (m) |

$1,286 |

$1,231 |

$1,153 |

$1,166 |

$792 |

$587 |

$803 |

$751 |

$679 |

$560 |

$620 |

$813 |

|

$ ‘000 per Stage |

$246 |

$257 |

$188 |

$168 |

$115 |

$79 |

$81 |

$51 |

$38 |

$36 |

$37 |

$47 |

*Peyto’s Montney well is excluded from drilling and completion

cost comparison.

Out of the 95 gross wells drilled in 2022, 90

wells were brought onstream during the year and 34 of those wells

(36%) fully recovered their capital investment before the end of

2022.

Facilities and pipeline expenditures in 2022

totaled $100 million and included a new 65 MMcf/d low emissions gas

plant in the Chambers area that was commissioned in Q2 2022.

Additionally, major pipeline projects in 2022 included pipeline and

gathering infrastructure expansions to accommodate future growth

and the interconnection and optimization of production in the

greater Brazeau area. Other pipeline investments were made in the

greater Sundance and Whitehorse areas to accommodate new and future

drilling and to debottleneck several areas of the gas gathering

system.

In 2022, Peyto closed two strategic acquisitions

in the Greater Brazeau area. The first transaction was a corporate

acquisition that added a 100% owned, operated, and underutilized 45

MMcf/d sweet natural gas plant, 880 boe/d of production from 20 net

wells, and 73 net sections of land. The second transaction was a

property acquisition that added 42 net sections of land and 600

boe/d from 12 net producing wells. Since that time, the Company has

integrated the infrastructure within the existing Brazeau area

complex to allow for efficient development of both assets and

flexibility to maximize production from the area.

During 2022, Peyto drilled and brought onstream 4 gross (4 net)

development wells on the acquired lands and grew production to

5,100 boe/d by year end. This production growth was accommodated

through the newly acquired Aurora gas plant and by routing gas

through the interconnected gathering system to other Peyto plants

in the area. The Company’s 2022 year-end reserve report also

recognized 17 proved and 3 probable additional future locations on

the acquired lands. Internally, the Company has identified many

more locations which will be the focus of 2023 drilling. In

addition to the Brazeau acquisitions, Peyto acquired 28 sections of

new land at various 2022 Crown land sales. Internally, the Company

recognizes over 100 future locations on these lands. Additionally

in the fourth quarter of 2022, Peyto committed to a multi-well

farm-in intended to earn an additional 35 gross sections of Deep

Basin rights in the Minehead and Ansell areas, which contain over

60 internally identified ERH development locations.

Reserves

Peyto was successful in growing reserve volumes

in all categories. The value of reserves in all categories was up

significantly as commodity price forecasts rebounded. The following

table illustrates the change in reserve volumes and Net Present

Value ("NPV") of future cash flows, discounted at 5%, before income

tax and using the 3-Consultant average forecast pricing.

|

|

As at December

312022

2021 |

% Change,per share(basic outstanding)1 |

|

Reserves (BCFe) |

|

|

|

| Proved Producing |

1,971 |

1,823 |

5% |

| Total Proved |

3,541 |

3,407 |

1% |

| Total Proved + Probable |

5,574 |

5,421 |

0% |

| |

|

|

|

| Net Present Value

($millions) Discounted at 5% |

|

|

|

| Proved Producing |

$5,603 |

$3,965 |

37% |

| Total Proved |

$9,476 |

$6,900 |

33% |

| Total

Proved + Probable |

$13,236 |

$10,191 |

26% |

1 Basic shares outstanding as at Dec 31, 2022

were 173,470,242 and Dec 31, 2021 were 168,151,219 Note: based on

the GLJ Ltd Petroleum Consultants ("GLJ") report effective December

31, 2022. The GLJ 3-consultant price forecast is available at

www.GLJPC.com.

For more information on Peyto’s reserves, refer

to the Press Release dated February 16, 2023, announcing the Year

End Reserve Report which is available on the website at

www.peyto.com. The complete statement of reserves data and required

reporting in compliance with NI 51-101 will be included in Peyto's

Annual Information Form to be released in March 2023.

Fourth Quarter 2022

Peyto continued a steady drilling pace

throughout the fourth quarter of 2022 and ended the year with four

drilling rigs operating across the Company’s Deep Basin core areas.

Drilling and completion capital of $88 million was invested in the

drilling of 19 gross (18.9 net) wells and the completion of 24

gross (23.9 net) wells. In addition, $9 million was invested in

wellsite equipment and tie-ins while $16 million was invested in

facility and major pipeline infrastructure including additional

liquids capacity at Chambers, processing optimization at Cecilia

and several new pipeline and debottlenecking projects in the

Sundance, Brazeau and Whitehorse areas.

Production volumes during the fourth quarter

2022 averaged 104,944 boe/d, up 8% from Q4 2021. Natural gas

production was up 7% from Q4 2021, condensate and pentanes

production was up 14%, and propane and butane production was up

20%. The larger increase in propane and butane production in the

quarter was attributable to a Q4 2021 temporary outage at a major

fractionation facility that lowered propane and butane production

in the prior period.

The Company’s realized price for natural gas in

Q4 2022 was $6.98/Mcf, prior to $0.66/Mcf of market diversification

activities and a $1.70/Mcf hedging loss, while its realized liquids

price was $79.83/bbl, prior to a $3.88/bbl hedging loss, which

yielded a average net sale price of $5.60/Mcfe. The net sale price

per unit for Q4 2022 was up 27% from $4.41/Mcfe in Q4 2021 due to

higher commodity prices and despite the $1.57/Mcfe hedging loss.

Total cash costs in Q4 2022 were $1.58/Mcfe ($9.46/boe) up from

$1.32/Mcfe in Q4 2021 due to higher royalty and operating expenses,

partially offset by lower transportation and interest costs. The

total Q4 2022 cash cost included royalties of $0.72/Mcfe (46%),

operating costs of $0.41/Mcfe (26%), transportation of $0.22/Mcfe

(14%), interest of $0.21/Mcfe (13%), and G&A of $0.02/Mcfe

(1%). Peyto's cash netback (before current tax expense) was

$4.16/Mcfe, up 34% from Q4 2021, or a 74% operating margin.

Peyto generated record funds from operations of

$221 million in the quarter, or $1.26/diluted share, which included

a current tax expense of $20 million, or $0.12/diluted share. Q4

2022 funds from operations increased by 33% from $166 million in Q4

2021. Earnings totaled $113 million in the quarter, or

$0.64/diluted share, up 52% from $0.42/diluted share in Q4 2021.

The Q4 2022 profit margin was 35%, up from 31% in Q4 2021.

Commodity Prices

Peyto's natural gas was sold in Q4 2022 at

various hubs including AECO, Empress, Malin, Dawn, Ventura, Emerson

2 and Henry Hub using both physical fixed price and basis

transactions to access those locations (diversification

activities). Natural gas prices were left to float on daily or

monthly pricing or locked in using fixed price financial and

physical swaps at those hubs. In Q4 2022, net of

diversification activities of $0.66/Mcf, Peyto realized a natural

gas price of $6.32/Mcf before natural gas hedging losses reduced

this price by $1.70/Mcf, to $4.62/Mcf.

Condensate and pentanes volumes were sold in Q4

2022 for an average price of $109.29/bbl, which is up 15% from

$94.80/bbl in Q4 2021, and as compared to Canadian WTI oil price

that averaged $112.22/bbl. Butane and propane volumes were sold in

combination at an average price of $37.97/bbl, or 34% of light oil

price, down 15% from $44.52/bbl in Q4 2021, due to increased NGL

supplies. Liquid hedging losses reduced the combined realized

liquids price of $79.83/bbl by $3.88/bbl to $75.95 in Q4 2022.

Peyto’s realized prices for the three months

ended December 31, 2022 and 2021 and are shown in the following

table.

| Peyto Realized

Commodity Prices |

|

Three Months EndedDecember 31 |

|

|

|

2022 |

|

2021 |

|

| Natural gas ($/Mcf) |

|

6.98 |

|

5.68 |

|

|

Diversification activities ($/Mcf) |

|

(0.66 |

) |

(0.72 |

) |

|

Realized natural gas price – before hedging ($/Mcf) |

|

6.32 |

|

4.96 |

|

| Gas

hedging loss ($/Mcf) |

|

(1.70 |

) |

(1.38 |

) |

|

Realized natural gas price – after hedging and diversification

($/Mcf) |

|

4.62 |

|

3.58 |

|

|

|

|

|

|

| Condensate and Pentanes

Plus(1) ($/bbl) |

|

109.29 |

|

94.80 |

|

| Other

Natural gas liquids(1) ($/bbl) |

|

37.97 |

|

44.52 |

|

|

NGL price – before hedging ($/bbl) |

|

79.83 |

|

74.69 |

|

| NGL

hedging loss ($/bbl) |

|

(3.88 |

) |

(9.98 |

) |

|

Realized NGL price – after hedging ($/bbl) |

|

75.95 |

|

64.71 |

|

|

|

|

|

|

Peyto gas has an average heating value of

approx. 1.15GJ/Mcf.1Liquids prices are Peyto realized prices in

Canadian dollars adjusted for fractionation, transportation, and

market differentials.

Hedging

In general, Peyto’s commodity risk management

program is designed to smooth out the short-term fluctuations in

the price of natural gas and natural gas liquids through future

sales. This smoothing gives greater predictability of cashflows for

the purposes of capital planning and dividend payments. The future

sales are meant to be methodical and consistent to avoid

speculation. In general, this approach will show hedging losses

when short term prices climb and hedging gains when short term

prices fall.

Peyto currently has 323,306 Mcf/d hedged for

2023 at $4.59/Mcf. The Company's current financial commodity hedges

and foreign exchange forward contracts are summarized below:

|

Natural

gas(1) |

Units |

Q1 2023 |

Q2 2023 |

Q3 2023 |

Q4 2023 |

2024 |

2025 |

|

AECO (7A & 5A) |

GJ/d |

245,333 |

247,500 |

247,500 |

134,783 |

53,900 |

32,685 |

| NYMEX |

MMBtu/d |

140,000 |

125,000 |

125,000 |

151,522 |

99,495 |

- |

|

Malin |

MMBtu/d |

40,000 |

- |

- |

- |

- |

- |

| Total volume(2) |

Mcf/d |

378,475 |

329,899 |

329,899 |

256,217 |

138,152 |

28,422 |

| Average

Price(3) |

$/Mcf |

4.83 |

4.21 |

4.21 |

5.25 |

5.75 |

4.51 |

(1) Includes financial hedges

only. Fixed-price physical and basis contracts are excluded. See

the "Marketing" section in Peyto's Q4 2022 MD&A for additional

information on hedge contracts and prices.

(2) 1MMBtu = 1.0551GJ and Peyto's gas has an

average heating value of approx.

1.15GJ/Mcf.(3) Average price is calculated using a

weighted average of notional volumes and prices, converted to

$/Mcf. USD contracts are converted at 1.35 CAD/USD FX rate.

|

NGLs |

Units |

Q1 2023 |

Q2 2023 |

Q3 2023 |

Q4 2023 |

2024 |

2025 |

|

WTI CAD |

|

|

|

|

|

|

|

| Fixed price swaps |

Bbl/d |

3,600 |

3,100 |

1,900 |

1,300 |

50 |

- |

| Average Price |

$/Bbl |

112.64 |

110.00 |

106.34 |

103.13 |

101.60 |

- |

| WTI CAD |

|

|

|

|

|

|

|

| Collars |

Bbl/d |

- |

- |

500 |

500 |

124 |

- |

| Put |

$/Bbl |

- |

- |

95.00 |

90.00 |

90.00 |

- |

|

Call |

$/Bbl |

- |

- |

115.25 |

116.25 |

110.20 |

- |

|

Foreign Exchange Forwards |

Units |

Q1 2023 |

Q2 2023 |

Q3 2023 |

Q4 2023 |

H1 2024 |

2025 |

|

Amount |

USD |

$30 million |

$30 million |

$30 million |

$30 million |

$60 million |

- |

|

Exchange Rate |

CAD/USD |

1.3601 |

1.3601 |

1.3601 |

1.3601 |

1.350 |

- |

Details of Peyto’s ongoing marketing and diversification efforts

are available on Peyto’s website at:

http://www.peyto.com/Files/Operations/Marketing/Marketing_Mar_2023.pdf

Activity Update

Drilling operations resumed with four rigs

drilling across the Company’s core areas after an extended holiday

break due to the extreme cold weather that shut down operations

before Christmas. Since the start of 2023, 13 gross (12.1 net)

wells have been drilled, 12 gross (11.7 net) wells have been

brought on production, while 7 gross (6.4 net) wells are waiting on

completion and/or tie-in. Two rigs have been drilling in the

Brazeau area focused on continued Chambers development and the

newly acquired assets in the Aurora area. To maximize value from

these newly acquired assets, the Aurora plant was shut down for a

period in February to accommodate the switching of the sales line

to a gathering line to optimize and increase throughput to the

plant. In Sundance, Peyto has been active targeting underdeveloped

Falher zones using longer laterals and more intense completions.

This has enabled the Company to increase the inventory of these

high-quality opportunities. Results thus far have exceeded

expectations and Peyto intends to actively continue development of

the Falher throughout 2023. The Company has also drilled two wells

in the Minehead area, kicking-off the initial phase of a

multi-section farm-in agreement signed in 2022.

Peyto is currently 75% complete on the

construction of the 23 km large diameter pipeline that directly

connects Peyto’s Swanson gas plant to the Cascade power plant near

the town of Edson, AB. This highly efficient 900 megawatt combined

cycle power plant is expected to start operations in late 2023 and

Peyto will supply 60,000 GJ/d (approximately 10% of current gas

production) under a 15 year gas supply agreement.

2023 Outlook

Despite recent lower seasonal prices, the long

term outlook for natural gas remains positive as the world looks to

secure safe, reliable, and affordable sources of energy that is

responsibly developed. Peyto is well positioned to provide that

supply with a 24 year proven track record of low cost, profitable

returns to shareholders from the Company’s low emissions intensity

core assets in the Deep Basin.

The Company plans to execute a 2023 capital

program between $425 to $475 million specifically designed with

flexibility in the back half of the year to adjust to changing

commodity prices. In the meantime, Peyto will target the lower

range of the capital guidance while the Company’s systematic

hedging and market diversification programs help secure revenues

for future dividends and continued strengthening of the balance

sheet.

Conference Call and Webcast

A conference call will be held with senior

management of Peyto to answer questions with respect to the

Company’s Q4 2022 results on Thursday, March 9, 2023, at 9:00 a.m.

Mountain Time (MT), or 11:00 a.m. Eastern Time (ET).

Access to the webcast can be found at:

https://edge.media-server.com/mmc/p/i3o2kioz.To

participate in the call, please register for the event at:

https://register.vevent.com/register/BI92cd1942fca84a75beb2dd0a70a87236.

Participants will be issued a dial in number and PIN to join the

conference call and ask questions. Alternatively, questions can be

submitted prior to the call at info@peyto.com. The conference call

will be archived on the Peyto Exploration & Development website

at www.peyto.com.

Annual General Meeting

Peyto’s Annual General Meeting of Shareholders

is scheduled for 3:00 p.m. on Thursday, May 17, 2023, at the Eau

Claire Tower, +15 level, 600 – 3rd Avenue SW, Calgary, Alberta.

Shareholders who do not wish to attend are encouraged to visit the

Peyto website at www.peyto.com where there is a wealth of

information designed to inform and educate investors and where a

copy of the AGM presentation will be posted. A monthly President’s

Report can also be found on the website which follows the progress

of the capital program and the ensuing production growth, along

with video and audio commentary from Peyto’s senior management.

Management’s Discussion and

Analysis

A copy of the fourth quarter report to

shareholders, including the MD&A, audited consolidated

financial statements and related notes, is available at

http://www.peyto.com/Files/Financials/2022/Q42022FS.pdf and at

http://www.peyto.com/Files/Financials/2022/Q42022MDA.pdf and will

be filed at SEDAR, www.sedar.com at a later date.

Jean-Paul Lachance President & Chief Executive

Officer March 8, 2023

Cautionary Statements

Forward-Looking Statements

This news release contains certain

forward-looking statements or information ("forward-looking

statements") as defined by applicable securities laws that involve

substantial known and unknown risks and uncertainties, many of

which are beyond Peyto's control. These statements relate to future

events or the Company's future performance. All statements other

than statements of historical fact may be forward-looking

statements. The use of any of the words "plan", "expect",

"prospective", "project", "intend", "believe", "should",

"anticipate", "estimate", or other similar words or statements that

certain events "may" or "will" occur are intended to identify

forward-looking statements. The projections, estimates and beliefs

contained in such forward-looking statements are based on

management's estimates, opinions, and assumptions at the time the

statements were made, including assumptions relating to:

macro-economic conditions, including public health concerns and

other geopolitical risks, the condition of the global economy and,

specifically, the condition of the crude oil and natural gas

industry, and the ongoing significant volatility in world markets;

other industry conditions; changes in laws and regulations

including, without limitation, the adoption of new environmental

laws and regulations and changes in how they are interpreted and

enforced; increased competition; the availability of qualified

operating or management personnel; fluctuations in other commodity

prices, foreign exchange or interest rates; stock market volatility

and fluctuations in market valuations of companies with respect to

announced transactions and the final valuations thereof; results of

exploration and testing activities; and the ability to obtain

required approvals and extensions from regulatory authorities.

Management of the Company believes the expectations reflected in

those forward-looking statements are reasonable, but no assurances

can be given that any of the events anticipated by the

forward-looking statements will transpire or occur, or if any of

them do so, what benefits that Peyto will derive from them. As

such, undue reliance should not be placed on forward-looking

statements. Forward-looking statements contained herein include,

but are not limited to, statements regarding: management's

assessment of Peyto's future plans and operations, including the

2023 capital expenditure program, the volumes and estimated value

of Peyto's reserves, the life of Peyto's reserves, production

estimates, project economics including NPV, the number of future

drilling locations, the commencement date of the Cascade Power

Plant, the sustainability of the Company's dividend; expectations

regarding future drilling inventory including the continued

development of the lower Falher zones at Sundance; the timing of

Peyto's annual general meeting; and the Company's overall strategy

and focus.

The forward-looking statements contained herein

are subject to numerous known and unknown risks and uncertainties

that may cause Peyto's actual financial results, performance or

achievement in future periods to differ materially from those

expressed in, or implied by, these forward-looking statements,

including but not limited to, risks associated with: continued

changes and volatility in general global economic conditions

including, without limitations, the economic conditions in North

America and public health concerns (including the impact of the

COVID-19 pandemic); continued fluctuations and volatility in

commodity prices, foreign exchange or interest rates; continued

stock market volatility; imprecision of reserves estimates;

competition from other industry participants; failure to secure

required equipment; increased competition; the lack of availability

of qualified operating or management personnel; environmental

risks; changes in laws and regulations including, without

limitation, the adoption of new environmental and tax laws and

regulations and changes in how they are interpreted and enforced;

the results of exploration and development drilling and related

activities; and the ability to access sufficient capital from

internal and external sources. In addition, to the extent that any

forward-looking statements presented herein constitutes

future-oriented financial information or financial outlook, as

defined by applicable securities legislation, such information has

been approved by management of Peyto and has been presented to

provide management's expectations used for budgeting and planning

purposes and for providing clarity with respect to Peyto's

strategic direction based on the assumptions presented herein and

readers are cautioned that this information may not be appropriate

for any other purpose. Readers are encouraged to review the

material risks discussed in Peyto's annual information form for the

year ended December 31, 2021 under the heading "Risk Factors" and

in Peyto's annual management's discussion and analysis under the

heading "Risk Management".

The Company cautions that the foregoing list of

assumptions, risks and uncertainties is not exhaustive. Readers are

cautioned that the assumptions used in the preparation of such

information, although considered reasonable at the time of

preparation, may prove to be imprecise and, as such, undue reliance

should not be placed on forward-looking statements. Peyto's actual

results, performance or achievement could differ materially from

those expressed in, or implied by, these forward-looking statements

and, accordingly, no assurance can be given that any of the events

anticipated by the forward-looking statements will transpire or

occur, or if any of them do so, what benefits Peyto will derive

there from. The forward-looking statements, including any

future-oriented financial information or financial outlook,

contained in this news release speak only as of the date hereof and

Peyto does not assume any obligation to publicly update or revise

them to reflect new information, future events or circumstances or

otherwise, except as may be required pursuant to applicable

securities laws.

Information Regarding Disclosure on Oil

and Gas Reserves

Some values set forth in the tables above may

not add due to rounding. It should not be assumed that the

estimates of future net revenues presented in the tables above

represent the fair market value of the reserves. There is no

assurance that the forecast prices and costs assumptions will be

attained, and variances could be material. The aggregate of the

exploration and development costs incurred in the most recent

financial year and the change during that year in estimated future

development costs generally will not reflect total finding and

development costs related to reserves additions for that year.

Barrels of Oil Equivalent

To provide a single unit of production for

analytical purposes, natural gas production and reserves volumes

are converted mathematically to equivalent barrels of oil (BOE).

Peyto uses the industry-accepted standard conversion of six

thousand cubic feet of natural gas to one barrel of oil (6 Mcf = 1

bbl). The 6:1 BOE ratio is based on an energy equivalency

conversion method primarily applicable at the burner tip. It does

not represent a value equivalency at the wellhead and is not based

on current prices. While the BOE ratio is useful for comparative

measures and observing trends, it does not accurately reflect

individual product values and might be misleading, particularly if

used in isolation. As well, given that the value ratio, based on

the current price of crude oil to natural gas, is significantly

different from the 6:1 energy equivalency ratio, using a 6:1

conversion ratio may be misleading as an indication of value.

Thousand Cubic Feet Equivalent

(Mcfe)

Natural gas volumes recorded in thousand cubic

feet (mcf) are converted to barrels of oil equivalent (boe) using

the ratio of six (6) thousand cubic feet to one (1) barrel of oil

(bbl). Natural gas liquids and oil volumes in barrel of oil (bbl)

are converted to thousand cubic feet equivalent (Mcfe) using a

ratio of one (1) barrel of oil to six (6) thousand cubic feet. This

could be misleading, particularly if used in isolation as it is

based on an energy equivalency conversion method primarily applied

at the burner tip and does not represent a value equivalency at the

wellhead.

Drilling Locations

This news release discloses drilling locations

or targets with respect to the Company's assets, all of which are

unbooked locations. Unbooked locations are internal estimates based

on the Company's prospective acreage and an assumption as to the

number of wells that can be drilled per section based on industry

practice and internal review. Unbooked locations do not have

attributed reserves or resources. Unbooked locations have been

identified by management as an estimation of our multi-year

drilling activities based on evaluation of applicable geologic,

seismic, engineering, production, and reserves information. There

is no certainty that the Company will drill any unbooked drilling

locations and if drilled there is no certainty that such locations

will result in additional oil and gas reserves, resources, or

production. The drilling locations on which the Company actually

drill wells will ultimately depend upon the availability of

capital, receipt of regulatory approvals, seasonal restrictions,

oil and natural gas prices, costs, actual drilling results,

additional reservoir information that is obtained and other

factors. While certain of the unbooked drilling locations may have

been derisked by drilling existing wells in relatively close

proximity to such unbooked drilling locations, management has less

certainty whether wells will be drilled in such locations and if

drilled there is more uncertainty that such wells will result in

additional oil and gas reserves, resources or production.

Non-GAAP and Other Financial

Measures

Throughout this press release, Peyto employs

certain measures to analyze financial performance, financial

position, and cash flow. These non-GAAP and other financial

measures do not have any standardized meaning prescribed under IFRS

and therefore may not be comparable to similar measures presented

by other entities. The non-GAAP and other financial measures should

not be considered to be more meaningful than GAAP measures which

are determined in accordance with IFRS, such as net income (loss),

cash flow from operating activities, and cash flow used in

investing activities, as indicators of Peyto’s performance.

Non-GAAP Financial Measures

Funds from Operations"Funds

from operations" is a non-GAAP measure which represents cash flows

from operating activities before changes in non-cash operating

working capital and provision for future performance-based

compensation. Management considers funds from operations and per

share calculations of funds from operations to be key measures as

they demonstrate the Company’s ability to generate the cash

necessary to pay dividends, repay debt and make capital

investments. Management believes that by excluding the temporary

impact of changes in non-cash operating working capital, funds from

operations provides a useful measure of Peyto’s ability to generate

cash that is not subject to short-term movements in operating

working capital. The most directly comparable GAAP measure is cash

flows from operating activities.

|

|

Three Months ended December 31 |

Year ended December 31 |

|

($000) |

|

2022 |

2021 |

2022 |

2021 |

|

Cash flows from operating activities |

199,943 |

150,226 |

811,778 |

457,874 |

|

Change in non-cash working capital |

19,226 |

8,212 |

5,593 |

4,071 |

|

Decommissioning expenditures |

1,089 |

- |

4,668 |

- |

|

Performance based compensation |

557 |

7,727 |

5,557 |

7,727 |

|

Funds from operations |

220,815 |

166,165 |

827,596 |

469,672 |

Free Funds FlowPeyto uses free

funds flow as an indicator of the efficiency and liquidity of

Peyto’s business, measuring its funds after capital investment

available to manage debt levels, pay dividends, and return capital

to shareholders through activities such as share repurchases. Peyto

calculates free funds flow as funds from operations generated

during the period less additions to property, plant and equipment,

included in cash flow from investing activities in the statement of

cash flows. By removing the impact of current period additions to

property, plant and equipment from funds from operations,

Management monitors its free funds flow to inform its capital

allocation decisions. The most directly comparable GAAP measure to

free funds flow is cash from operating activities. The following

table details the calculation of free funds flow and the

reconciliation from cash flow from operating activities to free

funds flow.

|

|

Three Months ended December 31 |

Year ended December 31 |

|

($000) |

|

2022 |

|

2021 |

|

2022 |

|

2021 |

|

|

Cash flows from operating activities |

199,943 |

|

150,226 |

|

811,778 |

|

457,874 |

|

|

Change in non-cash working capital |

19,226 |

|

8,212 |

|

5,593 |

|

4,071 |

|

|

Decommissioning expenditures |

1,089 |

|

- |

|

4,668 |

|

- |

|

|

Performance based compensation |

557 |

|

7,727 |

|

5,557 |

|

7,727 |

|

|

Funds from operations |

220,815 |

|

166,165 |

|

827,596 |

|

469,672 |

|

|

Total capital expenditures |

(115,040 |

) |

(108,951 |

) |

(506,860 |

) |

(365,058 |

) |

|

Free funds flow |

105,775 |

|

57,214 |

|

320,736 |

|

104,614 |

|

Total Capital ExpendituresPeyto

uses the term total capital expenditures as a measure of capital

investment in exploration and production activity, as well as

property acquisitions and divestitures, and such spending is

compared to the Company's annual budgeted capital expenditures. The

most directly comparable GAAP measure for total capital

expenditures is cash flow used in investing activities. The

following table details the calculation of cash flow used in

investing activities to total capital expenditures.

|

|

Three Months ended December 31 |

Year ended December 31 |

|

($000) |

|

2022 |

|

2021 |

2022 |

|

2021 |

|

| Cash flows

used in investing activities |

115,300 |

|

100,045 |

516,912 |

|

351,431 |

|

| Change in prepaid

capital |

(594 |

) |

377 |

7,596 |

|

(4,310 |

) |

| Corporate

acquisitions |

- |

|

- |

(22,220 |

) |

- |

|

| Change

in non-cash working capital relating to investing activities |

334 |

|

8,529 |

4,572 |

|

17,937 |

|

|

Total capital expenditures |

115,040 |

|

108,951 |

506,860 |

|

365,058 |

|

Net Debt"Net debt" is a

non-GAAP financial measure that is the sum of long-term debt and

working capital excluding the current financial derivative

instruments and current portion of lease obligations. It is used by

management to analyze the financial position and leverage of the

Company. Net debt is reconciled to long-term debt which is the most

directly comparable GAAP measure.

|

($000) |

|

As at December 31, 2021 |

|

As at December 31, 2021 |

|

|

Long-term debt |

|

759,176 |

|

1,065,712 |

|

|

Current assets |

|

(218,550 |

) |

(144,370 |

) |

|

Current liabilities |

|

471,858 |

|

239,620 |

|

|

Financial derivative instruments |

|

(126,081 |

) |

(61,091 |

) |

|

Current portion of lease obligation |

|

(1,266 |

) |

(1,123 |

) |

|

Net debt |

|

885,137 |

|

1,098,748 |

|

Non-GAAP Financial Ratios

Funds from Operations per

SharePeyto presents funds from operations per share by

dividing funds from operations by the Company's diluted or basic

weighted average common shares outstanding. "Funds from operations"

is a non-GAAP financial measure. Management believes that funds

from operations per share provides investors an indicator of funds

generated from the business that could be allocated to each

shareholder's equity position.

Netback per MCFE and

BOE"Netback" is a non-GAAP measure that represents the

profit margin associated with the production and sale of petroleum

and natural gas. Peyto computes "field netback per Mcfe" as

commodity sales from production, plus net third party sales, if

any, plus other income, less royalties, operating, and

transportation expense divided by production. "Cash netback" is

calculated as "field netback" less interest, less general and

administration expense and plus or minus realized gain (loss) on

foreign exchange, divided by production. Netbacks are per unit of

production measures used to assess Peyto’s performance and

efficiency. The primary factors that produce Peyto’s strong

netbacks and high margins are a low-cost structure and the high

heat content of its natural gas that results in higher commodity

prices.

|

|

Three Months ended December 31 |

|

Year ended December 31 |

|

|

($/Mcfe) |

2022 |

|

2021 |

|

2022 |

|

2021 |

|

|

Gross Sale Price |

7.17 |

|

5.83 |

|

6.79 |

|

4.58 |

|

|

Realized hedging loss |

(1.57 |

) |

(1.42 |

) |

(1.50 |

) |

(0.98 |

) |

|

Net Sale Price |

5.60 |

|

4.41 |

|

5.29 |

|

3.60 |

|

| Net third party sales |

0.01 |

|

- |

|

0.02 |

|

- |

|

| Other income |

0.13 |

|

0.01 |

|

0.05 |

|

0.01 |

|

| Royalties |

(0.72 |

) |

(0.53 |

) |

(0.74 |

) |

(0.37 |

) |

| Operating costs |

(0.41 |

) |

(0.32 |

) |

(0.39 |

) |

(0.34 |

) |

|

Transportation |

(0.22 |

) |

(0.23 |

) |

(0.26 |

) |

(0.21 |

) |

|

Field netback(1) |

4.39 |

|

3.34 |

|

3.96 |

|

2.69 |

|

| Net general and

administrative |

(0.02 |

) |

(0.02 |

) |

(0.02 |

) |

(0.03 |

) |

| Interest on long-term

debt |

(0.21 |

) |

(0.22 |

) |

(0.21 |

) |

(0.30 |

) |

|

Realized gain on foreign exchange |

- |

|

- |

|

0.01 |

|

- |

|

|

Cash netback(1) ($/Mcfe) |

4.16 |

|

3.10 |

|

3.74 |

|

2.36 |

|

| Cash

netback(1) ($/boe) |

24.97 |

|

18.60 |

|

22.43 |

|

14.18 |

|

Return on EquityPeyto

calculates ROE, expressed as a percentage, as Earnings divided by

the Equity. Peyto uses ROE as a measure of long- term financial

performance, to measure how effectively Management utilizes the

capital it has been provided by shareholders and to demonstrate to

shareholders the returns generated over the long term.

Return on Capital EmployedPeyto

calculates ROCE, expressed as a percentage, as EBIT divided by

Total Assets less Current Liabilities per the Financial Statements.

Peyto uses ROCE as a measure of long-term financial performance, to

measure how effectively Management utilizes the capital (debt and

equity) it has been provided and to demonstrate to shareholders the

returns generated over the long term.

Total Payout Ratio"Total payout

ratio" is a non-GAAP measure which is calculated as the sum of

dividends declared plus additions to property, plant and equipment,

divided by funds from operations. This ratio represents the

percentage of the capital expenditures and dividends that is funded

by cashflow. Management uses this measure, among others, to assess

the sustainability of Peyto’s dividend and capital program.

|

|

Three Months ended December 31 |

|

Year ended December 31 |

|

|

($000, except total payout ratio) |

2022 |

|

2021 |

|

2022 |

|

2021 |

|

|

Total dividends declared |

25,908 |

|

16,779 |

|

102,437 |

|

21,758 |

|

|

Total capital expenditures |

115,040 |

|

108,951 |

|

506,860 |

|

365,058 |

|

|

Total payout |

140,948 |

|

125,730 |

|

609,297 |

|

368,816 |

|

|

Funds from operations |

220,815 |

|

166,165 |

|

827,596 |

|

469,672 |

|

|

Total payout ratio (%) |

64 |

% |

76 |

% |

74 |

% |

82 |

% |

Operating Margin Operating

Margin is a non-GAAP financial ratio defined as funds from

operations, before current tax, divided by revenue before royalties

but including realized hedging gains/losses and third-party sales

net of purchases.

Profit Margin Profit Margin is

a non-GAAP financial ratio defined as net earnings divided by

revenue before royalties but including realized hedging

gains/losses and third-party sales net of purchases.

Free Cash flow Ratio Free Cash

Flow Ratio is a non-GAAP financial ratio defined as Free Funds Flow

for the quarter divided by Funds From Operations for the quarter.

Management monitors its Free Cash Flow Ratio to inform its capital

allocation decisions.

Total Cash CostsTotal cash

costs is a non-GAAP financial ratio defined as the sum of

royalties, operating expenses, transportation expenses, G&A and

interest, on a per Mcfe basis. Peyto uses total cash costs to

assess operating margin and profit margin.

Reserve Life IndexThe RLI is

calculated by dividing the reserves (in boes) in each category by

the annualized Q4 average production rate in boe/year (eg. 2022

Proved Developed Producing 328,424/(104.9x365) =8.6). Peyto

believes that the most accurate way to evaluate the current reserve

life is by dividing the proved developed producing reserves by the

annualized actual fourth quarter average production. In Peyto’s

opinion, for comparative purposes, the proved developed producing

reserve life provides the best measure of sustainability.

Reserve Replacement RatioThe

reserve replacement ratio is determined by dividing the yearly

change in reserves before production by the actual annual

production for the year. (eg. 2022 Total Proved

(590.2-567.9+37.8)/37.8 =159%).

Capital Efficiency Capital

efficiency is the cost to add new production in the year and is

calculated as capital expenditures divided by total production

added at year end.(eg. 2022 Capital efficiency, before acquisitions

($481MM/38.1=$12,600/boe/d).

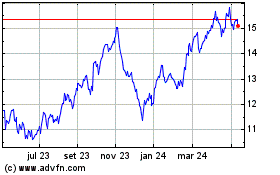

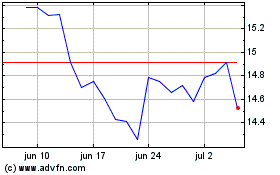

Peyto Exploration and De... (TSX:PEY)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Peyto Exploration and De... (TSX:PEY)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025