BlackRock® Canada Announces Final March Cash Distributions for iShares U.S. High Yield Fixed Income Index ETF (CAD-Hedged) and iShares Short Term High Quality Canadian Bond Index ETF

21 Março 2023 - 6:31PM

BlackRock Asset Management Canada Limited (“BlackRock Canada”), an

indirect, wholly-owned subsidiary of BlackRock, Inc. (NYSE: BLK),

today announced the final March 2023 cash distributions for iShares

U.S. High Yield Fixed Income Index ETF (CAD-Hedged) and iShares

Short Term High Quality Canadian Bond Index ETF. Unitholders of

record on March 23, 2023 will receive cash distributions payable on

March 31, 2023.

Details regarding the final “per unit” distribution amounts are

as follows:

|

Fund Name |

Fund Ticker |

Cash Distribution Per Unit ($) |

|

iShares U.S. High Yield Fixed Income Index ETF (CAD-Hedged) |

CHB |

0.09113 |

|

iShares Short Term High Quality Canadian Bond Index ETF |

XSQ |

0.04328 |

Further information on the iShares ETFs can be found at

http://www.blackrock.com/ca.

About BlackRock

BlackRock’s purpose is to help more and more

people experience financial well-being. As a fiduciary to investors

and a leading provider of financial technology, we help millions of

people build savings that serve them throughout their lives by

making investing easier and more affordable. For additional

information on BlackRock, please

visit www.blackrock.com/corporate | Twitter: @BlackRockCA

About iShares

iShares unlocks opportunity across markets to

meet the evolving needs of investors. With more than twenty years

of experience, a global line-up of 1300+ exchange traded funds

(ETFs) and US$2.91 trillion in assets under management as of

December 31, 2022, iShares continues to drive progress for the

financial industry. iShares funds are powered by the expert

portfolio and risk management of BlackRock.

iShares® ETFs are managed by BlackRock Asset

Management Canada Limited.

Commissions, trailing commissions, management

fees and expenses all may be associated with investing in iShares

ETFs. Please read the relevant prospectus before investing. The

funds are not guaranteed, their values change frequently and past

performance may not be repeated. Tax, investment and all other

decisions should be made, as appropriate, only with guidance from a

qualified professional.

Contact for

Media: Reem

Jazar Email:

reem.jazar@blackrock.com

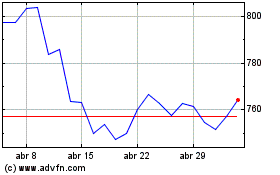

BlackRock (NYSE:BLK)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

BlackRock (NYSE:BLK)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024