Lithium Americas Corp. (TSX: LAC) (NYSE: LAC)

(“

Lithium Americas”

or the

“

Company”) has reported financial and operating

results for the fourth quarter and year ended December 31, 2022.

HIGHLIGHTS

Argentina

Caucharí-Olaroz

- Construction is

substantially complete and on track to deliver first production by

end of H1 2023.

- Caucharí-Olaroz

expects to ramp up in H2 2023 and reach full production rate of

40,000 tonnes per annum (“tpa”) of lithium

carbonate by Q1 2024.

- Commissioning of

the solvent exchange and purification plants are underway with

additional purification necessary to achieve battery-quality

expected to be completed in H2 2023 following the start of

pre-commercial production. Ponds and liming plant are fully

operational.

- As of March 30,

2023, the Company expects its remaining funding requirement to be

less than $50 million for capital costs, valued added taxes and

working capital to reach production and positive cash flow.

- The Company’s

portion of funding in Q1 2023 was $38 million.

- Capital cost

estimates and funding requirements have been updated to reflect

current production schedule, increased operating costs and

inflationary environment in Argentina.

- Total capital

costs, on a 100% basis, have been updated to $979 million at the

official Argentina exchange rate from $852 million previously, and

compared to an estimated $645 million at the realized market-based

exchange rate.

- Substantially

all of the increase in capital costs since the 2020 feasibility

study has been offset by realization of higher market-based

exchange rate for Argentine pesos.

- Development

planning for Stage 2 expansion of at least 20,000 tpa of lithium

carbonate continues to progress to align with completion of Stage

1.

Pastos Grandes Basin

- The Company

continues to advance the Pastos Grandes’ $30 million development

plan, targeting completion of the plan and a construction decision

in Q4 2023.

- On December 20,

2022, the Company entered into a definitive arrangement agreement

to acquire Arena Minerals Inc. (“Arena Minerals”)

for $227 million in shares (on a 100% basis) with a view to

consolidating the highly prospective Pastos Grandes basin. The

transaction is expected to close in April 2023.

United States

Thacker Pass

- On March 2,

2023, the Company announced the start of construction activities at

Thacker Pass following receipt of notice to proceed from the Bureau

of Land Management (“BLM”).

- Major earthworks

are expected to commence in H2 2023 and support the target to

commence production in the second half of 2026.

- On February 22,

2023, the Company announced that it received a Letter of

Substantial Completion from the U.S. Department of Energy

(“DOE”) Loans Program Office for its application

for the DOE’s Advanced Technology Vehicles Manufacturing Loan

Program (“ATVM Loan Program”).

- The Company

expects the DOE ATVM Loan Program process to be completed in 2023

and if approved, to fund up to 75% of the total capital costs for

construction for Phase 1.

- The Company has

approved a construction budget of $125 million to Q3 2023 with

increased spending expected following completion of the DOE ATVM

Loan Program process.

- On February 6,

2023, the US District Court, District of Nevada (“Federal

Court”) ruled favorably for the Company in the appeal

filed against the BLM by declining to vacate the Record of Decision

(“ROD”).

- The Federal

Court ordered the BLM to consider one issue under the mining law

relating to the area designated for waste storage and tailings

which is not expected to impact the overall construction

timeline.

- On January 31,

2023, the Company released an independent National Instrument

43-101 feasibility study (the “Thacker Pass

Feasibility Study”) and continues to advance the

Thacker Pass construction plan targeting 80,000 tpa of

battery-quality lithium carbonate production capacity in two phases

(“Phase 1” and “Phase 2”) of

40,000 tpa, respectively.

- On January 31,

2023, mineral reserves and mineral resource estimates were updated

with a measured and indicated (“M&I”) mineral

resource estimate of 16.1 million tonnes (“Mt”)

lithium carbonate equivalent (“LCE”) at an average

grade of 2,070 parts per million lithium (“ppm

Li”), and proven and probable mineral reserves of 3.7 Mt

LCE at an average grade of 3,160 ppm Li.

- In Q4 2022,

Bechtel Corporation was awarded the engineering, procurement and

construction management (“EPCM”) contract for

Thacker Pass Phase 1, Aquatech International LLC was awarded the

contract for the magnesium sulfate and lithium carbonate chemical

plants, and EXP Global Inc. received the contract for the sulfuric

acid plant.

Corporate

- As at December

31, 2022, the Company had $352 million in cash and cash equivalents

and short-term bank deposits, with an additional $75 million in

available credit.

- As of March 30,

2023, following the receipt of $320 million from a first tranche

investment by General Motors (NYSE: GM) (“GM”),

the Company has approximately $600 million in cash and cash

equivalents and short-term bank deposits.

- On January 30,

2023, Lithium Americas entered into a purchase agreement with GM

whereby GM agreed to make a $650 million equity investment in the

Company and receive exclusive access to Phase 1 production at

Thacker Pass through a binding supply agreement.

- On February 16,

2023, the initial tranche of $320 million closed with GM’s purchase

of 15 million Lithium Americas’ common shares at $21.34 per share.

GM is now Lithium Americas largest shareholder and offtake

partner.

- The second

tranche of $330 million is contemplated to be invested into the

Company’s U.S. business following the proposed separation of its

U.S. and Argentine businesses.

- On November 3,

2022, the Company announced that it intended to advance a

reorganization that will result in the separation of its U.S. and

Argentine business units into two independent public companies (the

“Separation”). The Company continues to advance

the execution plan for the Separation, targeting completion in H2

2023.

TECHNICAL INFORMATION

The Technical Information in this news release

has been reviewed and approved by Rene LeBlanc, PhD, SME, Chief

Technical Officer of Lithium Americas, and a Qualified Person as

defined by National Instrument 43-101.

FINANCIAL RESULTS

Selected consolidated financial information is

presented as follows:

|

(in US$ million except per share information) |

Year ended December 31, |

|

|

2022 |

|

|

2021 |

|

|

|

$ |

|

|

$ |

|

|

Expenses |

(163.4 |

) |

|

(46.1 |

) |

|

Net loss |

(93.6 |

) |

|

(38.5 |

) |

|

Loss per share – basic |

(0.70 |

) |

|

(0.32 |

) |

|

(in US$ million) |

As at December 31, 2022 |

|

|

As at December 31, 2021 |

|

|

|

$ |

|

|

$ |

|

| Cash, cash equivalents and

short-term bank deposits |

352.1 |

|

|

510.6 |

|

| Total assets |

1,016.5 |

|

|

817.3 |

|

| Total

long-term liabilities |

(212.9 |

) |

|

(272.8 |

) |

| |

|

|

|

|

|

During the year ended December 31, 2022,

expenses and net loss increased primarily due to increased share of

loss of the Caucharí-Olaroz project mainly as a result of foreign

exchange revaluation of intercompany loans, increases in

exploration and evaluation expenditures as result of the timing of

Lithium Nevada project development activities and other items.

In 2022, total assets

increased primarily due to the acquisition of Millennial Lithium

Corp. Total long-term liabilities decreased due to a decrease in

the fair value of the convertible senior notes derivative

liability, offset by accrued interest on convertible senior notes,

and the repayment of the subordinate loan facility in early

2022.

This news release

should be read in conjunction with Lithium Americas’ consolidated

financial statements and management's discussion and analysis for

the year ended December 31, 2022, which are available on SEDAR. All

amounts are in U.S. dollars unless otherwise indicated.

ABOUT LITHIUM AMERICAS

Lithium Americas is focused on advancing lithium

projects in Argentina and the United States to production. In

Argentina, Caucharí-Olaroz is advancing towards first production

and Pastos Grandes represents regional growth. In the United

States, Thacker Pass has received its Record of Decision and

commenced construction. The Company trades on both the Toronto

Stock Exchange and on the New York Stock Exchange, under the ticker

symbol “LAC”.

For further information contact:Investor

RelationsTelephone: 778-656-5820Email:

ir@lithiumamericas.comWebsite: www.lithiumamericas.com

FORWARD-LOOKING

STATEMENTS

This news release contains “forward-looking

information” and “forward-looking statements” (which we refer to

collectively as forward-looking information) under the provisions

of applicable securities legislation. All statements, other than

statements of historical fact, are forward-looking information.

Examples of forward-looking information in this news release

include, among other things, statements related to: successful

development of the Caucharí-Olaroz project and the Thacker Pass

project, including timing, progress, construction, milestones,

scale, anticipated production, results thereof including with

respect to Caucharí-Olaroz project Stage 2 expansion plans; plans

for the Caucharí-Olaroz project to prioritize commissioning and the

expected timing to complete deferred construction items as a result

of such prioritization; expected initial capital costs for Stage 1

of the Caucharí-Olaroz project and the expected amount of the

Company’s share of remaining funding requirements for the initial

capital costs, including in light of inflationary and other

economic conditions; the expected timing to complete a development

plan and to make a construction decision for the Pastos Grandes

project; successful completion of the acquisition of Arena

Minerals, including anticipated timing, ability to meet conditions

to closing, including receipt of court, Arena Minerals

securityholders and stock exchange approvals, and expected benefits

from such transaction, including successful consolidation of the

Pastos Grandes basin; the outcome of the Company’s loan application

filed under the DOE ATVM Loan Program, and the expected amount of

funding for the Thacker Pass project expected to be provided

thereunder; the Company’s ability to fund its development programs

through debt or equity financing; the expected impact of ongoing

litigation on the construction schedule for the Thacker Pass

project, and the outcome of such litigation; timing and anticipated

closing of the second tranche investment by GM, and the expected

benefits of the GM investment; and the proposed Separation,

timeline for completion and announcement of an execution plan for

the Separation, and the successful completion of the Separation,

including the receipt of necessary approvals related thereto.

Forward-looking information is based upon a

number of factors and assumptions that, if untrue, could cause the

actual results, performances or achievements of the Company to be

materially different from future results, performances or

achievements expressed or implied by such information. Such

information reflects the Company’s current views with respect to

future events and is necessarily based upon a number of assumptions

that, while considered reasonable by the Company today, are

inherently subject to significant uncertainties and contingencies.

These assumptions include, among others, the following: the

Company’s ability to fund, advance and develop its projects,

including results therefrom and timing thereof; capital costs,

operating costs, and sustaining capital requirements of the

Caucharí-Olaroz project and the Thacker Pass project, significant

increases to such estimates and ability to finance any such

increases; successful closing of second tranche of the GM

investment to advance the Thacker Pass project; successfully

operating under co-ownership arrangements and the Company

maintaining cordial business relationships with key strategic

partners and contractors; ability of the Company to secure

additional debt or equity funding as needed to advance its

projects; uncertainties relating to maintaining mining,

exploration, environmental and other permits or approvals in Nevada

and Argentina, and the outcome of any litigation or regulatory

processes concerning such permits; realizing on the expected

benefits from transactions with existing partners; stable and

supportive legislative, regulatory and community environments in

the jurisdictions where the Company operates; demand for lithium,

including that such demand is supported by continued growth in the

electric vehicle market; the Company’s ability to produce battery

grade lithium products; the impact of increasing competition in the

lithium business, and the Company’s competitive position in the

industry; currency exchange and interest rates; general economic

conditions, including inflationary conditions and their impact on

the Company’s projects, contractors and suppliers; the feasibility

and costs of proposed project designs and plans; availability of

technology, including low carbon energy sources and water rights,

on acceptable terms to advance the Thacker Pass project; stability

and inflation of the Argentinian peso, including any foreign

exchange or capital controls which may be enacted in respect

thereof, and the effect of current or any additional regulations on

the Company’s operations; the impact of unknown financial

contingencies, including costs of litigation and regulatory

processes, on the Company’s operations; gains or losses, in each

case, if any, from short-term investments in Argentine bonds and

equities; estimates of and unpredictable changes to the market

prices for lithium products; technological advancements and

changes; estimates of mineral resources and mineral reserves,

including whether mineral resources not included in current mineral

reserves will ever be developed into mineral reserves; reliability

of technical data; that pending patent applications are approved;

government regulation of mining operations and M&A activity,

and treatment under governmental, regulatory and taxation regimes;

accuracy of development budget and construction estimates;

successful integration of newly acquired businesses, and

realization of expected benefits from investments made in third

parties; changes to the Company’s current and future business plans

and the strategic alternatives available to the Company; and stock

market and economic conditions generally.

Forward-looking information also involves known

and unknown risks that may cause actual results to differ

materially. These risks include, among others, inherent risks in

the development of capital intensive mineral projects (including as

co-owners), variations in mineral resources and mineral reserves,

changes in budget estimation, global demand for lithium, recovery

rates and lithium pricing, risks associated with successfully

securing adequate financing, including the outcome of the Company’s

loan application with the U.S. Department of Energy, changes in

project parameters and funding thereof, risks related to growth of

lithium markets and pricing for products thereof, changes in

legislation, governmental or community policy, changes in public

perception concerning mining projects generally and opposition

thereto, political risk associated with foreign operations,

including co-ownership arrangements with foreign domiciled partners

and risks of enhanced political involvement in the lithium and

critical minerals industries, permitting risk, including receipt of

new permits and maintenance of existing permits, outcomes of

litigation and regulatory processes concerning the Company’s

projects, title and access risk, cost overruns, unpredictable

weather and maintenance of natural resources, risks associated with

climate change and its impact on the Company’s projects and

operations, unanticipated delays, intellectual property risks,

currency and interest rate fluctuations, competitive industry

risks, operational risks, health and safety risks, information

technology and cybersecurity risks, economic conditions and

economic uncertainty flowing from the COVID-19 pandemic, the

Russian war in the Ukraine and inflationary conditions, dependency

on key personnel and talent risks, and volatility in general market

and industry conditions. Additional risks, assumptions and other

factors are set out in the Company’s most recent annual management

discussion analysis and annual information form, copies of which

are available under the Company’s profile on SEDAR at www.sedar.com

and on the SEC website at www.sec.gov.

Although the Company has attempted to identify

important risks and assumptions, given the inherent uncertainties

in such forward-looking information, there may be other factors

that cause results to differ materially. Forward-looking

information is made as of the date hereof and the Company does not

intend, and expressly disclaims any obligation to, update or revise

the forward-looking information contained in this news release,

except as required by law. Accordingly, readers are cautioned not

to place undue reliance on such forward-looking

information.

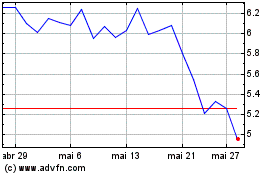

Lithium Americas (TSX:LAC)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Lithium Americas (TSX:LAC)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024