Lithium Americas Corp. (TSX: LAC) (NYSE: LAC) ("Lithium

Americas" or the "Company") and Arena Minerals Inc.

(TSX-V:AN) (“

Arena”) are pleased to announce the

completion of the previously announced plan of arrangement (the

“

Arrangement”) whereby Lithium Americas has

acquired all of the issued and outstanding common shares of Arena.

Arena owns 65% of the Sal de la Puna project covering approximately

13,200 hectares of the Pastos Grandes basin located in Salta,

Argentina.

"With the completion

of the acquisition, we have taken a big step towards consolidating

the Pastos Grandes basin,” said John Kanellitsas, Vice Chairman of

Lithium Americas. “While our focus remains on near-term startup of

production at Caucharí-Olaroz, the addition of Arena provides

increased flexibility as we continue to advance our growth plans in

Argentina.”

Pursuant to the

Arrangement, Lithium Americas has acquired 100% of the issued and

outstanding shares of Arena (the “Arena Shares”

and each an “Arena Share”) and Arena shareholders

are entitled to receive 0.0226 of a common share of Lithium

Americas and $0.0001 in cash in exchange for each Arena Share held

immediately prior to closing of the Arrangement. In aggregate, the

Company issued approximately 8.4 million Lithium Americas common

shares under the Arrangement to former Arena securityholders as

consideration for their respective Arena Shares and convertible

securities.

Trading of the Arena

Shares on the TSX Venture Exchange will remain halted until

delisting.

Arena securityholders

who have questions or who may need assistance with the completion

of letters of transmittal are advised to contact Computershare at

1-800-564-6253 toll-free in North America, or by email at

corporateactions@computershare.com.

BMO Capital Markets

acted as financial advisor to Lithium Americas, and Cassels Brock

& Blackwell LLP acted as Lithium Americas’ legal advisor.

Cormark Securities acted as financial advisor to Arena, and

Stikeman Elliott LLP acted as Arena’s legal advisor. Stifel GMP

acted as financial advisor to the Special Committee of Arena.

This press release

does not constitute an offer to sell, or the solicitation of an

offer to buy, any securities.

ABOUT LITHIUM AMERICAS

Lithium Americas is focused on advancing lithium

projects in Argentina and the United States to production. In

Argentina, Caucharí-Olaroz is advancing towards first production

and the Pastos Grandes basin represents regional growth. In the

U.S., Thacker Pass has commenced construction and is targeting

first production in the second half of 2026. The Company trades on

both the Toronto Stock Exchange and on the New York Stock Exchange,

under the ticker symbol “LAC”.

For further information contact:Investor

RelationsTelephone: 778-656-5820Email:

ir@lithiumamericas.comWebsite: www.lithiumamericas.com

NEITHER THE TSX VENTURE EXCHANGE NOR ITS

REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE

POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR

THE ADEQUACY OR ACCURACY OF THIS RELEASE.

FORWARD-LOOKING STATEMENTS

This news release may contain certain

“Forward-Looking Statements” within the meaning of the United

States Private Securities Litigation Reform Act of 1995 and

applicable Canadian securities laws. When used in this news

release, the words “anticipate”, “believe”, “estimate”, “expect”,

“target”, “plan”, “forecast”, “may”, “schedule” and similar words

or expressions identify forward-looking statements or information.

These forward-looking statements or information may relate to the

Arrangement, including statements with respect to the expected

benefits of the Arrangement, Lithium Americas’ plans for the Pastos

Grandes basin, the synergies resulting from the Arrangement and

future plans and objectives of Lithium Americas.

Such statements represent the Lithium Americas’

current views with respect to future events and are necessarily

based upon a number of assumptions and estimates that, while

considered reasonable by management, are inherently subject to

significant business, economic, competitive, political and social

risks, contingencies and uncertainties. Risks and uncertainties

include, but are not limited to the following: uncertainties with

respect to the ability of the consolidated entity to realize the

benefits anticipated from the Arrangement and the timing to realize

such benefits; changes to current and future business plans;

uncertainties with growth prospects and outlook of Lithium

Americas’ business, including commencing commercial production at

the Cauchari-Olaroz project; uncertainties with respect to

regulatory matters; any impacts of COVID-19 on the business of the

consolidated entity and the ability to advance projects; stock

market conditions generally; demand, supply and pricing for

lithium; and general economic and political conditions in Canada,

Argentina and other jurisdictions where the Company conducts

business.

Additional risks, assumptions and other factors

upon which forward-looking information is based, as it pertains to

Lithium Americas and its business, are set out in its latest

management’s discussion and analysis and its most recent annual

information form, and with respect to Arena, in its latest

management’s discussion and analysis, copies of which are available

under Lithium Americas’ profile and Arena’s profile on SEDAR at

www.sedar.com. Also for further information on the transaction,

including certain key risks, please refer to the March 6, 2023

information circular of Arena filed under the Arena's profile at

www.sedar.com.

Although the Company has attempted to identify

important risks and assumptions, given the inherent uncertainties

in such forward-looking information, there may be other factors

that cause results to differ materially. Forward-looking

information is made as of the date hereof and the Company does not

intend, and expressly disclaims any obligation to update or revise

the forward-looking information contained in this news release,

except as required by applicable law. Accordingly, readers are

cautioned not to place undue reliance on forward-looking

information.

EARLY WARNING DISCLOSURE

Prior to the Arrangement, Lithium Americas held

80,816,146 Arena Shares, representing approximately 19.9% of issued

and outstanding Arena Shares on a non-diluted basis, and 6,838,571

Arena warrants. On completion of the Arrangement, Lithium

Americas holds all outstanding Arena securities. An early warning

report will be filed by Lithium Americas on SEDAR at

www.sedar.com in accordance with applicable securities laws. To

obtain a copy of the early warning report, please contact the

Corporate Secretary of Lithium Americas at 778-656-5820 or

legal@lithiumamericas.com. The Company’s head office is located at

900 West Hastings Street, Suite 300, Vancouver, British Columbia,

V6C 1E5.

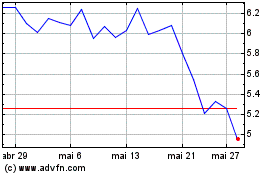

Lithium Americas (TSX:LAC)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Lithium Americas (TSX:LAC)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024