SL Green Completes $500 Million Refinancing of 919 Third Avenue

26 Abril 2023 - 5:13PM

SL Green Realty Corp. (NYSE: SLG), Manhattan’s largest office

landlord, together with an institutional investor advised by J.P.

Morgan Global Alternatives, today announced that the partnership

has completed the refinancing of 919 Third Avenue, a premier 1.5

million square foot Class A office building located in Midtown

Manhattan.

The new $500.0 million mortgage loan bears interest at a rate of

250 basis points over Term SOFR, which the partnership has swapped

to a fixed rate of 6.11%, has a 3-year term, with two, one-year

extension options, and was provided by an international and

domestic lending group co-led by Aareal Capital Corporation and

Credit Agricole Corporate and Investment Bank.

“We are pleased to have secured this refinancing for 919 Third

Avenue, which reaffirms the liquidity in the market for high

quality assets with high quality sponsors,” said Harrison

Sitomer, Chief Investment Officer of SL Green. “The deep

relationships we have with financial institutions around the world

coupled with the caliber of our portfolio and operating platform

give us confidence in our ability to continue to execute in the

capital markets, notwithstanding current credit market

conditions."

“919 Third Avenue is an ideal candidate for refinancing given

the preeminent asset quality, core tenant base and respected

sponsorship,” said Doug Traynor, CEO of Aareal Capital

Corporation.

“In a moment in time where relationships and credibility matter,

we are happy to act as the Green Structuring Agent on a transaction

of this quality for a partner with a strong commitment to

sustainability like SL Green,” said Attila Coach, Head of

Real Estate, Lodging and Gaming for the Americas of Credit Agricole

Corporate and Investment Bank.

Designed by the internationally renowned architecture firm

Skidmore, Owings & Merrill, 919 Third Avenue has a commanding

presence within the Midtown East neighborhood. The 1.5

million-square-foot, 47-story tower was completed in 1970. The

building was designed to accommodate an existing NYC landmark, the

famed restaurant and saloon, P.J. Clarke’s. 919 Third Avenue is 80

percent leased and home to several notable tenants such as

Bloomberg L.P, Shulte Roth & Zabel LLP, and Mintz, Levin, Cohn,

Ferris, Glovsky and Popeo, P.C.

James Millon, Tom Traynor and Mark Finan of CBRE advised on the

transaction.

About SL Green Realty Corp.

SL Green Realty Corp., Manhattan’s largest office landlord, is a

fully integrated real estate investment trust, or REIT, that is

focused primarily on acquiring, managing and maximizing value of

Manhattan commercial properties. As of December 31, 2022, SL Green

held interests in 61 buildings totaling 33.1 million square feet.

This included ownership interests in 28.9 million square feet of

Manhattan buildings and 3.4 million square feet securing debt and

preferred equity investments.

Forward Looking Statement

This press release includes certain statements that may be

deemed to be “forward-looking statements” within the meaning of the

Private Securities Litigation Reform Act of 1995 and are intended

to be covered by the safe harbor provisions thereof. All

statements, other than statements of historical facts, included in

this press release that address activities, events or developments

that we expect, believe or anticipate will or may occur in the

future, are forward-looking statements. Forward-looking statements

are not guarantees of future performance and actual results or

developments may differ materially, and we caution you not to place

undue reliance on such statements. Forward-looking statements are

generally identifiable by the use of the words “may,” “will,”

“should,” “expect,” “anticipate,” “estimate,” “believe,” “intend,”

“project,” “continue,” or the negative of these words, or other

similar words or terms.

Forward-looking statements contained in this press release are

subject to a number of risks and uncertainties, many of which are

beyond our control, that may cause our actual results, performance

or achievements to be materially different from future results,

performance or achievements expressed or implied by forward-looking

statements made by us. Factors and risks to our business that could

cause actual results to differ from those contained in the

forward-looking statements include the risks and uncertainties

described in our filings with the Securities and Exchange

Commission. Except to the extent required by law, we undertake no

obligation to publicly update or revise any forward-looking

statements, whether as a result of future events, new information

or otherwise.

SLG - FIN

PRESS CONTACTslgreen@berlinrosen.com

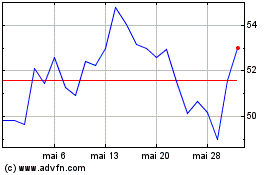

SL Green Realty (NYSE:SLG)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

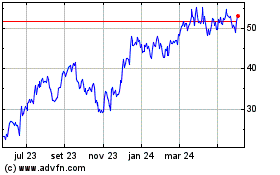

SL Green Realty (NYSE:SLG)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025