E Split Corp. Announces New Preferred Share Distribution Rate

26 Abril 2023 - 6:39PM

(TSX: ENS, ENS.PR.A) The board of directors of E Split Corp. (the

“Company”) has extended the maturity date of the Company for an

additional 5-year term to June 30, 2028, as was detailed in the

press release dated February 1, 2023.

The Company is pleased to announce that the

distribution rate for the Preferred Shares for the new 5-year term

from June 30, 2023 to June 30, 2028 will be $0.70 per annum (7.0%

on the original issue price of $10) payable quarterly. The new

distribution rate represents a 33.3% increase from the current

$0.525 per annum distribution rate and provides investors with a

competitive yield reflecting current market yields for preferred

shares with similar terms. The new 5-year term extension also

offers Preferred shareholders the opportunity to enjoy preferential

cash dividends until June 30, 2028. Since inception from June 29,

2018 to March 31, 2023, the Preferred Share has delivered an

attractive 5.3% per annum return.

In addition, the Company intends to maintain the

targeted monthly Class A Share distribution rate at $0.13 per Class

A Share. Since inception to March 31, 2023, the Class A shares have

delivered a 11.1% per annum total return, including cash

distributions of $7.01 per share. Class A shareholders also have

the option to reinvest their cash distributions in a dividend

reinvestment plan which is commission free to participants.

The term extension allows Class A shareholders

to continue to have exposure to common shares of Enbridge Inc.

(“Enbridge”), a leading North American pipeline, natural gas

processing and distribution company, while benefiting from an

attractive distribution rate of 11.0% per annum based on the April

25, 2023 net asset value per share and the opportunity for capital

appreciation. As North America’s largest midstream company,

Enbridge has generated highly predictable, resilient cash flow and

has provided superior dividend growth and value creation through

various commodity price cycles.

In connection with the extension, Shareholders

can continue to hold their shares of both Classes and receive the

new, higher distribution rate on the Preferred Shares by taking no

action. Shareholders who do not wish to continue their investment

in the Company, will be able to retract Preferred Shares or Class A

Shares on June 30, 2023 pursuant to a special retraction right and

receive a retraction price that is calculated in the same way that

such price would be calculated if the Company were to terminate on

June 30, 2023. Pursuant to this option, the retraction price may be

less than the market price if the shares are trading at a premium

to net asset value. To exercise this retraction right, shareholders

must provide notice to their investment dealer by May 31, 2023 at

5:00 p.m. (Toronto time). Alternatively, shareholders may sell

their Preferred Shares and/or Class A Shares through their

securities dealer for the market price at any time, potentially at

a higher price than would be achieved through retraction.

E Split Corp. invests in common shares of

Enbridge and intends to purchase Enbridge common shares from time

to time in the market or through participation in future public

offerings by Enbridge.

About Middlefield

Founded in 1979, Middlefield is a specialist and

independent equity income manager headquartered in Toronto, Canada.

Middlefield’s actively managed, award-winning funds are designed to

be “investments that work for you” by distributing consistent and

high levels of income through various market cycles. Middlefield’s

funds span a number of market sectors including real estate,

healthcare, innovation, sustainability, infrastructure and energy.

Investors can access these strategies in a variety of product types

including ETFs, Mutual Funds, Closed-End Funds, Split-Share Funds

and Flow-through LPs.

For further information, please visit our

website at www.middlefield.com or contact Nancy

Tham in our Sales and Marketing Department at 1.888.890.1868. You

will usually pay brokerage fees to your dealer if you purchase or

sell shares of the investment funds on the Toronto Stock Exchange

or other alternative Canadian trading system (an “exchange”). If

the shares are purchased or sold on an exchange, investors may pay

more than the current net asset value when buying shares of the

investment fund and may receive less than the current net asset

value when selling them.

There are ongoing fees and expenses associated

with owning shares of an investment fund. An investment fund must

prepare disclosure documents that contain key information about the

funds. You can find more detailed information about the fund in the

public filings available at www.sedar.com. The indicated rates of

return are the historical annual compounded total returns including

changes in share value and reinvestment of all distributions and do

not take into account certain fees such as redemption costs or

income taxes payable by any securityholder that would have reduced

returns. Investment funds are not guaranteed, their values change

frequently and past performance may not be repeated.

Certain statements in this press release may be

viewed as forward-looking statements. Any statements that express

or involve discussions with respect to predictions, expectations,

beliefs, plans, intentions, projections, objectives, assumptions or

future events or performance (often, but not always, using words or

phrases such as "expects", "is expected", "anticipates", "plans",

"estimates" or "intends" (or negative or grammatical variations

thereof), or stating that certain actions, events or results "may",

"could", "would", "might" or "will" be taken, occur or be achieved)

are not statements of historical fact and may be forward-looking

statements. Forward-looking statements are subject to a variety of

risks and uncertainties which could cause actual events or results

to differ from those reflected in the forward-looking statements

including as a result of changes in the general economic and

political environment, changes in applicable legislation, and the

performance of each fund. There are no assurances the funds can

fulfill such forward-looking statements and the funds do not

undertake any obligation to update such statements. Such

forward-looking statements are only predictions; actual events or

results may differ materially as a result of risks facing one or

more of the funds, many of which are beyond the control of the

funds. Investors should not place undue reliance on forward-looking

statements.

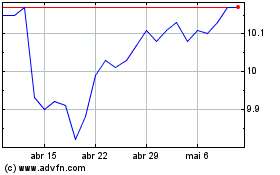

E Split (TSX:ENS.PR.A)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

E Split (TSX:ENS.PR.A)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025