ESCO Technologies Inc. (NYSE: ESE) (ESCO, or the Company) today

reported its operating results for the second quarter ended March

31, 2023 (Q2 2023).

Operating Highlights

- Q2 2023 GAAP EPS increased 8 percent to $0.69 per share

compared to $0.64 per share in Q2 2022. Q2 2023

Adjusted EPS increased 17 percent to $0.76 per share compared to

$0.65 per share in Q2 2022.

- Q2 2023 Sales increased $24.2 million (11.8 percent) to $229.1

million compared to $204.9 million in Q2 2022.

- Q2 2023 Entered Orders increased $15.1 million (6 percent) over

the prior year period to $251.6 million (book-to-bill of 1.10x),

resulting in record ending backlog of $741 million.

- Net cash used by operating activities was $5 million YTD 2023,

as cash flow was negatively impacted by higher working capital

requirements, with higher accounts receivable being driven by

increased sales and higher inventory related to timing and supply

chain issues.

- Net debt (total borrowings less cash on hand) was $113 million,

resulting in a 0.86x leverage ratio and $582 million in liquidity

at March 31, 2023.

Bryan Sayler, Chief Executive Officer and President, commented,

“Q2 was another solid quarter operationally, as ESCO delivered

double-digit revenue growth, expanded operating margins, and

achieved 17 percent adjusted earnings per share growth.

It has been an exciting time for me to step into the CEO role. The

business has clear momentum and secular growth drivers that should

carry us through this year and beyond. We continue to see exciting

developments across our aerospace and defense portfolio, with

commercial aerospace, military aerospace and Navy customers driving

high levels of business activity. We also see growth drivers

continue to solidify in the utility and renewable energy markets,

which makes us feel good about the long-term prospects for our

Utility Solutions Group. Our Test business had a slightly down

quarter but serves a variety of strong end markets and offers broad

capabilities that give us confidence in its long-term outlook. It

is an exciting time to be at ESCO and I look forward to working

with leadership across the company as we move our businesses

forward.

“Entered orders remained strong in the quarter, with solid

growth in commercial aerospace and renewables. All

three segments had book-to-bills above 1.0 and for the second

consecutive quarter, we achieved record ending backlog at $741

million.

“Our teams across the company continue to do an excellent job

driving growth and delivering solid operating results while

navigating challenges related to inflation, supply chain

constraints and labor shortages. Even with our strong performance

year-to-date, we are still managing some past-due backlog

challenges driven by these factors. I’d like to personally thank

all of our employees for their dedication, persistence, and

tremendous efforts. Their commitment is key to our solid

results.”

Segment Performance

Aerospace & Defense (A&D)

- Sales increased $14.2 million (17 percent) to $99.0 million in

Q2 2023 from $84.8 million in Q2 2022. Sales growth was driven by

commercial aerospace, which increased $8.1 million (27 percent) to

$38.2 million in the quarter. In addition, defense aerospace and

Navy also delivered solid sales growth.

- Q2 2023 EBIT increased $4.5 million to $18.8 million from $14.3

million in Q2 2022. Adjusted EBIT increased $5.1 million (35.2

percent) in Q2 2023 to $19.6 million (19.8 percent margin) from

$14.5 million (17.1 percent margin) in Q2 2022.

- Entered Orders increased $17 million (18 percent) to $112

million in Q2 2023 compared to $95 million in Q2 2022.

The orders strength was driven by commercial OEM build rate

increases, market share gains at Mayday, a large aftermarket order

at PTI, and $7 million in acquired backlog related to CMT.

A&D’s book-to-bill of 1.13x in the quarter resulted in record

ending backlog of $435 million.

Utility Solutions Group (USG)

- Sales increased $15.0 million (23 percent) to $79.2 million in

Q2 2023 from $64.2 million in Q2 2022. Doble’s sales increased by

$10.5 million (19 percent) driven by a strong quarter for condition

monitoring products, services, and high voltage test equipment at

Phenix. NRG sales increased $4.5 million (47 percent)

on continued strength in the renewables end-market.

- EBIT increased $2.8 million in Q2 2023 to $14.1 million from

$11.3 million in Q2 2022. There were no adjustments to Q2 2023 EBIT

of $14.1 million (17.8 percent margin), which also increased $2.8

million from Q2 2022 Adjusted EBIT of $11.3 million (17.7 percent

margin). Margins were unfavorably impacted by product mix and

increased event costs as trade show activity continued to normalize

post-COVID.

- Entered Orders decreased $2 million (2 percent) to $85 million

in Q2 2023. The decrease in orders was primarily driven by an $8

million (11 percent) decrease at Doble related to the timing of a

large multi-year DUC contract renewal in the prior year Q2. Order

strength continues across the Doble portfolio, highlighted by

significant condition monitoring orders. NRG orders increased by $6

million (54 percent) related to continuing strength in both wind

and solar, and with significant orders by solar resource monitoring

(SRM) customers in the U.S. and Europe. USG’s book-to-bill of 1.07x

in the quarter resulted in an ending backlog of $143 million, which

is up $26 million compared to prior year.

Test

- Sales decreased $4.9 million (9 percent) to $51.0 million in Q2

2023 from $55.9 million in Q2 2022, with sales increases in Europe

more than offset by declines in the U.S. and Asia. There were

disruptions in test and measurement project execution in China

related to re-opening of the economy after prior zero-COVID

policies.

- EBIT decreased $1.3 million in Q2 2023 to $7.2 million (14.2

percent margin) from $8.5 million (15.2 percent margin) in Q2 2022

related to lower volume in China. There were no adjustments in

either year for the Test segment.

- Entered Orders decreased $0.1 million to $55.3 million in Q2

2023 compared to $55.4 million in Q2 2022. Despite the slight

decrease in orders, it was a solid orders quarter for Test with a

book-to-bill of 1.09x, which resulted in an ending backlog of $163

million.

Share Repurchase ProgramDuring Q2 2023, the

Company repurchased approximately 81,000 shares for $7.1 million.

$8.1 million was paid in the quarter related to the Q2 shares

purchased and included $1.0 million related to December purchases

that settled in January. Year-to-date, the company has repurchased

approximately 138,000 shares for $12.2 million.

Dividend PaymentThe next

quarterly cash dividend of $0.08 per share will be paid on July 19,

2023 to stockholders of record on July 5, 2023.

Business Outlook –

2023 The strength of our first

half results gives us added confidence in our ability to deliver

solid revenue and earnings growth in 2023 and we are again

increasing our earnings guidance. We now expect current year

adjusted EPS in the range of $3.55 to $3.65 (11 to 14 percent

growth). This is based on sales in a range of $930 to $950 million

(8 to 11 percent annual growth). Consistent with prior years,

revenues and Adjusted EPS are expected to grow sequentially

throughout the year. Our expectation is for Q3 Adjusted EPS to be

in the range of $0.96 to $1.01 per share (8 to 13 percent

growth).

Board of DirectorsEffective June 30, 2023, and

consistent with the succession plan previously announced, Vic

Richey will retire from his roles as a director of the Company, the

Executive Chair of the Board, and an employee of the Company.

Related to this change, independent director Robert Phillippy has

been appointed to serve as Chair of the Board. James Stolze will

remain a director but has resigned his position as Lead Director.

In addition, given that the role of Board Chair will be held by an

independent director, the position of Lead Director has been

eliminated by the Board. Patrick Dewar has been appointed to serve

as Chair of the Audit and Finance Committee. All of the

foregoing changes are effective June 30, 2023.

Conference CallThe Company

will host a conference call today, May 9, at 4:00 p.m. Central

Time, to discuss the Company’s Q2 2023 results. A live audio

webcast and an accompanying slide presentation will be available on

ESCO’s investor website at https://investor.escotechnologies.com.

For those unable to participate, a webcast replay will be available

after the call on ESCO’s investor website.

Forward-Looking

StatementsStatements in this press release regarding

Management’s expectations for fiscal 2023, the effects of

continuing inflationary pressures, higher interest rates, pressures

related to supply chain performance and labor shortages, our

guidance for 2023 including revenues, revenue growth, Adjusted EPS,

Adjusted EBIT and Adjusted EBITDA margin; the effects of

acquisitions, and any other statements which are not strictly

historical, are “forward-looking statements” within the meaning of

the safe harbor provisions of the U.S. securities laws.

Investors are cautioned that such statements are only

predictions and speak only as of the date of this release, and the

Company undertakes no duty to update them except as may be required

by applicable laws or regulations. The Company’s actual results in

the future may differ materially from those projected in the

forward-looking statements due to risks and uncertainties that

exist in the Company’s operations and business environment

including but not limited to those described in Item 1A, “Risk

Factors”, of the Company’s Annual Report on Form 10-K for the

fiscal year ended September 30, 2022; the availability and

acceptance of viable COVID-19 vaccines by enough of the U.S. and

world’s population to curtail the pandemic; the continuing impact

of the COVID-19 pandemic and the effects of known or unknown

COVID-19 variants including labor shortages, facility closures,

shelter in place policies or quarantines, material shortages,

transportation delays, termination or delays of Company contracts,

and the inability of our suppliers or customers to perform; the

impacts of natural disasters on the Company’s operations and those

of the Company’s customers and suppliers; the timing and content of

future contract awards or customer orders; the appropriation,

allocation and availability of Government funds; the termination

for convenience of Government and other customer contracts or

orders; weakening of economic conditions in served markets; the

success of the Company’s competitors; changes in customer demands

or customer insolvencies; competition; intellectual property

rights; technical difficulties; the success of the Company’s

acquisition efforts; delivery delays or defaults by customers;

performance issues with key customers, suppliers and

subcontractors; changes in the costs and availability of certain

raw materials; labor disputes; changes in U.S. tax laws and

regulations; other changes in laws and regulations including but

not limited to changes in accounting standards and foreign

taxation; changes in interest rates; costs relating to

environmental matters arising from current or former facilities;

uncertainty regarding the ultimate resolution of current disputes,

claims, litigation or arbitration; and the integration of recently

acquired businesses.

Non-GAAP Financial MeasuresThe financial

measures EBIT, Adjusted EBIT, EBITDA, Adjusted EBITDA and Adjusted

EPS are presented in this press release. The Company defines “EBIT”

as earnings before interest and taxes, “EBITDA” as earnings before

interest, taxes, depreciation and amortization, “Adjusted EBIT” and

“Adjusted EBITDA” as excluding the net impact of the items

described in the attached Reconciliation of Non-GAAP Financial

Measures, and “Adjusted EPS” as GAAP earnings per share (EPS)

excluding the net impact of the items described and reconciled in

the attached Reconciliation of Non-GAAP Financial Measures.

EBIT, Adjusted EBIT, EBITDA, Adjusted EBITDA and Adjusted EPS

are not recognized in accordance with U.S. generally accepted

accounting principles (GAAP). However, Management believes EBIT,

Adjusted EBIT, EBITDA and Adjusted EBITDA are useful in assessing

the operational profitability of the Company’s business segments

because they exclude interest, taxes, depreciation and

amortization, which are generally accounted for across the entire

Company on a consolidated basis. EBIT and EBITDA are also measures

used by Management in determining resource allocations within the

Company as well as incentive compensation. The presentation of

EBIT, Adjusted EBIT, EBITDA, Adjusted EBITDA and Adjusted EPS

provides important supplemental information to investors by

facilitating comparisons with other companies, many of which use

similar non-GAAP financial measures to supplement their GAAP

results. The use of non-GAAP financial measures is not intended to

replace any measures of performance determined in accordance with

GAAP.

About ESCO TechnologiesESCO is a global

provider of highly engineered products and solutions serving

diverse end-markets. It manufactures filtration and fluid control

products for the aviation, Navy, space, and process markets

worldwide and composite-based products and solutions for Navy,

defense, and industrial customers. ESCO is the industry leader in

RF shielding and EMC test products; and provides diagnostic

instruments, software and services to industrial power users and

the electric utility and renewable energy industries. Headquartered

in St. Louis, Missouri, ESCO and its subsidiaries have offices and

manufacturing facilities worldwide. For more information on ESCO

and its subsidiaries, visit the Company’s website at

www.escotechnologies.com.

|

ESCO TECHNOLOGIES INC. AND SUBSIDIARIES |

|

|

Condensed Consolidated Statements of Operations (Unaudited) |

|

|

(Dollars in thousands, except per share amounts) |

|

|

|

|

| |

|

|

|

|

Three MonthsEnded March 31, 2023 |

|

Three MonthsEndedMarch 31, 2022 |

|

| |

|

|

|

|

|

|

|

|

| Net Sales |

$ |

229,136 |

|

204,928 |

|

|

| Cost and

Expenses: |

|

|

|

|

|

| |

Cost of sales |

|

142,296 |

|

128,375 |

|

|

| |

Selling, general

and administrative expenses |

|

53,877 |

|

47,959 |

|

|

| |

Amortization of

intangible assets |

|

7,030 |

|

6,510 |

|

|

| |

Interest

expense |

|

2,269 |

|

1,020 |

|

|

| |

Other expenses

(income), net |

|

314 |

|

(604 |

) |

|

| |

|

Total costs and

expenses |

|

205,786 |

|

183,260 |

|

|

| |

|

|

|

|

|

|

|

|

| Earnings before

income taxes |

|

23,350 |

|

21,668 |

|

|

| Income tax

expense |

|

5,472 |

|

5,085 |

|

|

| |

|

|

|

|

|

|

|

|

| |

|

Net earnings |

$ |

17,878 |

|

16,583 |

|

|

| |

|

|

|

|

|

|

|

|

| |

|

|

Diluted - GAAP |

$ |

0.69 |

|

0.64 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Diluted - As Adjusted

Basis |

$ |

0.76 |

(1 |

) |

0.65 |

|

(2 |

) |

|

|

|

|

|

|

|

|

|

|

| |

|

|

Diluted average common shares

O/S: |

|

25,895 |

|

26,045 |

|

|

| |

|

|

|

|

|

|

|

|

|

(1 |

) |

Q2 2023 Adjusted EPS

excludes $0.07 per share of after-tax charges consisting of $0.04

of executive management transition costs at Corporate, $0.02 of CMT

acquisition inventory step-up charges and $0.01 of restructuring

charges within the A&D segment. |

| |

|

|

|

|

|

|

|

|

|

(2 |

) |

Q2 2022 Adjusted EPS

excludes $0.01 per share of after-tax charges associated with the

NEco acquisition inventory step-up charge and Corporate acquisition

related costs. |

|

ESCO TECHNOLOGIES INC. AND SUBSIDIARIES |

|

|

Condensed Consolidated Statements of Operations (Unaudited) |

|

|

(Dollars in thousands, except per share amounts) |

|

|

|

|

| |

|

|

|

|

Six MonthsEndedMarch 31, 2023 |

|

Six MonthsEndedMarch 31, 2022 |

|

| |

|

|

|

|

|

|

|

|

| Net Sales |

$ |

434,637 |

|

381,938 |

|

|

| Cost and

Expenses: |

|

|

|

|

|

| |

Cost of sales |

|

268,679 |

|

236,680 |

|

|

| |

Selling, general

and administrative expenses |

|

105,179 |

|

94,594 |

|

|

| |

Amortization of

intangible assets |

|

13,891 |

|

12,977 |

|

|

| |

Interest

expense |

|

3,927 |

|

1,753 |

|

|

| |

Other expenses

(income), net |

|

712 |

|

(571 |

) |

|

| |

|

Total costs and

expenses |

|

392,388 |

|

345,433 |

|

|

| |

|

|

|

|

|

|

|

|

| Earnings before

income taxes |

|

42,249 |

|

36,505 |

|

|

| Income tax

expense |

|

9,644 |

|

8,398 |

|

|

| |

|

|

|

|

|

|

|

|

| |

|

Net earnings |

$ |

32,605 |

|

28,107 |

|

|

| |

|

|

|

|

|

|

|

|

| |

|

|

Diluted - GAAP |

$ |

1.26 |

|

1.08 |

|

|

| |

|

|

|

|

|

|

|

|

| |

|

|

Diluted - As Adjusted

Basis |

$ |

1.36 |

(1 |

) |

1.11 |

|

(2 |

) |

|

|

|

|

|

|

|

|

|

|

| |

|

|

Diluted average common shares

O/S: |

|

25,919 |

|

26,098 |

|

|

| |

|

|

|

|

|

|

|

|

|

(1 |

) |

YTD Q2 2023 Adjusted

EPS excludes $0.10 per share of after-tax charges consisting of

$0.06 of executive management transition costs at Corporate, $0.02

of CMT acquisition inventory step-up charges and $0.02 of

restructuring charges within the A&D segment. |

| |

|

|

|

|

|

|

|

|

|

(2 |

) |

YTD Q2 2022 Adjusted

EPS excludes $0.03 per share of after-tax charges associated with

the Altanova & NEco acquisition inventory step-up charges and

Corporate acquisition related costs. |

|

ESCO TECHNOLOGIES INC. AND SUBSIDIARIES |

|

Condensed Business Segment Information (Unaudited) |

|

(Dollars in thousands) |

|

|

|

|

|

|

|

GAAP |

|

As Adjusted |

|

| |

|

|

|

Q2 2023 |

|

Q2 2022 |

|

Q2 2023 |

|

Q2 2022 |

|

| Net Sales |

|

|

|

|

|

|

|

|

|

| |

Aerospace &

Defense |

$ |

98,982 |

|

|

84,821 |

|

|

98,982 |

|

|

84,821 |

|

|

| |

USG |

|

79,161 |

|

|

64,191 |

|

|

79,161 |

|

|

64,191 |

|

|

| |

Test |

|

50,993 |

|

|

55,916 |

|

|

50,993 |

|

|

55,916 |

|

|

| |

|

Totals |

$ |

229,136 |

|

|

204,928 |

|

|

229,136 |

|

|

204,928 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| EBIT |

|

|

|

|

|

|

|

|

|

|

| |

Aerospace &

Defense |

$ |

18,795 |

|

|

14,349 |

|

|

19,595 |

|

|

14,489 |

|

|

| |

USG |

|

14,061 |

|

|

11,314 |

|

|

14,061 |

|

|

11,331 |

|

|

| |

Test |

|

7,226 |

|

|

8,494 |

|

|

7,226 |

|

|

8,494 |

|

|

| |

Corporate |

|

(14,463 |

) |

|

(11,469 |

) |

|

(12,963 |

) |

|

(11,344 |

) |

|

| |

|

Consolidated EBIT |

|

25,619 |

|

|

22,688 |

|

|

27,919 |

|

|

22,970 |

|

|

| |

|

Less: Interest expense |

|

(2,269 |

) |

|

(1,020 |

) |

|

(2,269 |

) |

|

(1,020 |

) |

|

| |

|

Less: Income tax

expense |

(5,472 |

) |

|

(5,085 |

) |

|

(6,001 |

) |

|

(5,150 |

) |

|

| |

|

Net earnings |

$ |

17,878 |

|

|

16,583 |

|

|

19,649 |

|

|

16,800 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Note 1: Adjusted

net earnings were $19.6 million in Q2 2023 which excludes $0.07 per

share of after-tax charges consisting of $0.04 of executive

management transition costs at Corporate, $0.02 of CMT acquisition

inventory step-up charges and $0.01 of restructuring charges within

the A&D segment. |

| |

|

|

|

|

|

|

|

|

|

|

|

| Note 2: Adjusted

net earnings were $16.8 million in Q2 2022 which excludes $0.01 per

share of after-tax charges associated with the NEco acquisition

inventory step-up charge and Corporate acquisition related

costs. |

| |

|

|

|

|

|

|

|

|

|

|

|

|

EBITDA Reconciliation to Net earnings: |

|

|

|

Q2 2023 |

|

Q2 2022 |

|

|

|

|

|

|

Q2 2023 |

|

Q2 2022 |

|

- As Adjusted |

|

- As Adjusted |

|

|

Consolidated EBITDA |

$ |

38,162 |

|

|

34,808 |

|

|

40,462 |

|

|

35,090 |

|

|

| Less:

Depr & Amort |

|

(12,543 |

) |

|

(12,120 |

) |

|

(12,543 |

) |

|

(12,120 |

) |

|

|

Consolidated EBIT |

|

25,619 |

|

|

22,688 |

|

|

27,919 |

|

|

22,970 |

|

|

| Less:

Interest expense |

|

(2,269 |

) |

|

(1,020 |

) |

|

(2,269 |

) |

|

(1,020 |

) |

|

| Less:

Income tax expense |

|

(5,472 |

) |

|

(5,085 |

) |

|

(6,001 |

) |

|

(5,150 |

) |

|

| Net

earnings |

$ |

17,878 |

|

|

16,583 |

|

|

19,649 |

|

|

16,800 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ESCO TECHNOLOGIES INC. AND SUBSIDIARIES |

|

Condensed Business Segment Information (Unaudited) |

|

(Dollars in thousands) |

|

|

|

|

|

|

|

GAAP |

|

As Adjusted |

|

| |

|

|

|

YTD Q2 2023 |

|

YTD Q2 2022 |

|

YTD Q2 2023 |

|

YTD Q2 2022 |

|

| Net Sales |

|

|

|

|

|

|

|

|

|

| |

Aerospace &

Defense |

$ |

181,965 |

|

|

155,065 |

|

|

181,965 |

|

|

155,065 |

|

|

| |

USG |

|

150,206 |

|

|

127,676 |

|

|

150,206 |

|

|

127,676 |

|

|

| |

Test |

|

102,466 |

|

|

99,197 |

|

|

102,466 |

|

|

99,197 |

|

|

| |

|

Totals |

$ |

434,637 |

|

|

381,938 |

|

|

434,637 |

|

|

381,938 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| EBIT |

|

|

|

|

|

|

|

|

|

|

| |

Aerospace &

Defense |

$ |

31,331 |

|

|

24,304 |

|

|

32,330 |

|

|

24,639 |

|

|

| |

USG |

|

30,192 |

|

|

24,705 |

|

|

30,192 |

|

|

25,172 |

|

|

| |

Test |

|

12,637 |

|

|

12,459 |

|

|

12,637 |

|

|

12,459 |

|

|

| |

Corporate |

|

(27,984 |

) |

|

(23,210 |

) |

|

(25,691 |

) |

|

(22,905 |

) |

|

| |

|

Consolidated EBIT |

|

46,176 |

|

|

38,258 |

|

|

49,468 |

|

|

39,365 |

|

|

| |

|

Less: Interest expense |

|

(3,927 |

) |

|

(1,753 |

) |

|

(3,927 |

) |

|

(1,753 |

) |

|

| |

|

Less: Income tax

expense |

(9,644 |

) |

|

(8,398 |

) |

|

(10,401 |

) |

|

(8,653 |

) |

|

| |

|

Net earnings |

$ |

32,605 |

|

|

28,107 |

|

|

35,140 |

|

|

28,959 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Note 1: Adjusted

net earnings were $35.1 million in YTD 2023 which excludes $0.10

per share of after-tax charges consisting of $0.06 of executive

management transition costs at Corporate, $0.02 of CMT acquisition

inventory step-up charges and $0.02 of restructuring charges within

the A&D segment. |

| |

|

|

|

|

|

|

|

|

|

|

|

| Note 2: Adjusted

net earnings were $29.0 million in YTD Q2 2022 which excludes $0.03

per share of after-tax charges associated with the Altanova &

NEco acquisition inventory step-up charges and Corporate

acquisition related costs. |

| |

|

|

|

|

|

|

|

|

|

|

|

|

EBITDA Reconciliation to Net earnings: |

|

|

|

YTD Q2 2023 |

|

YTD Q2 2022 |

|

|

|

|

|

|

YTD Q2 2023 |

|

YTD Q2 2022 |

|

- As Adjusted |

|

- As Adjusted |

|

|

Consolidated EBITDA |

$ |

71,086 |

|

|

62,550 |

|

|

74,378 |

|

|

63,657 |

|

|

| Less:

Depr & Amort |

|

(24,910 |

) |

|

(24,292 |

) |

|

(24,910 |

) |

|

(24,292 |

) |

|

|

Consolidated EBIT |

|

46,176 |

|

|

38,258 |

|

|

49,468 |

|

|

39,365 |

|

|

| Less:

Interest expense |

|

(3,927 |

) |

|

(1,753 |

) |

|

(3,927 |

) |

|

(1,753 |

) |

|

| Less:

Income tax expense |

|

(9,644 |

) |

|

(8,398 |

) |

|

(10,401 |

) |

|

(8,653 |

) |

|

| Net

earnings |

$ |

32,605 |

|

|

28,107 |

|

|

35,140 |

|

|

28,959 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ESCO TECHNOLOGIES INC. AND SUBSIDIARIES |

|

Condensed Consolidated Balance Sheets (Unaudited) |

|

(Dollars in thousands) |

|

|

|

|

|

|

|

March 31,2023 |

|

September 30,2022 |

|

|

|

|

|

|

|

|

| Assets |

|

|

|

|

|

| |

Cash and cash

equivalents |

$ |

48,221 |

|

97,724 |

|

|

Accounts

receivable, net |

|

180,817 |

|

164,645 |

|

|

Contract

assets |

|

128,205 |

|

125,154 |

|

|

Inventories |

|

185,753 |

|

162,403 |

|

|

Other current

assets |

|

27,144 |

|

22,696 |

|

|

|

Total current assets |

|

570,140 |

|

572,622 |

|

|

Property, plant

and equipment, net |

|

154,020 |

|

155,973 |

|

|

Intangible assets,

net |

|

401,717 |

|

394,464 |

|

|

Goodwill |

|

505,194 |

|

492,709 |

|

|

Operating lease

assets |

|

41,418 |

|

29,150 |

|

|

Other assets |

|

10,113 |

|

9,538 |

|

|

|

|

$ |

1,682,602 |

|

1,654,456 |

|

|

|

|

|

|

|

|

| Liabilities and

Shareholders' Equity |

|

|

|

|

| |

Current maturities

of long-term debt |

$ |

20,000 |

|

20,000 |

|

|

Accounts

payable |

|

79,619 |

|

78,746 |

|

|

Contract

liabilities |

|

119,970 |

|

125,009 |

|

|

Other current

liabilities |

|

77,466 |

|

94,374 |

|

|

|

Total current liabilities |

|

297,055 |

|

318,129 |

|

|

Deferred tax

liabilities |

|

81,150 |

|

82,023 |

|

|

Non-current

operating lease liabilities |

|

37,657 |

|

24,853 |

|

|

Other

liabilities |

|

44,945 |

|

48,294 |

|

|

Long-term

debt |

|

141,000 |

|

133,000 |

|

|

Shareholders'

equity |

|

1,080,795 |

|

1,048,157 |

|

|

|

|

$ |

1,682,602 |

|

1,654,456 |

|

ESCO TECHNOLOGIES INC. AND SUBSIDIARIES |

|

Consolidated Statements of Cash Flows (Unaudited) |

|

(Dollars in thousands) |

|

|

|

|

| |

|

Six MonthsEndedMarch 31, 2023 |

|

Six MonthsEnded March 31, 2022 |

| Cash flows from operating

activities: |

|

|

|

|

| Net earnings |

$ |

32,605 |

|

|

28,107 |

|

| Adjustments to reconcile net

earnings to net cash |

|

|

|

|

| (used) provided by operating

activities: |

|

|

|

|

| Depreciation and

amortization |

|

24,910 |

|

|

24,292 |

|

| Stock compensation expense |

|

5,309 |

|

|

3,428 |

|

| Changes in assets and

liabilities |

|

(67,140 |

) |

|

(41,451 |

) |

| Effect of deferred taxes |

|

(1,145 |

) |

|

8,627 |

|

| Net cash (used) provided by

operating activities |

|

(5,461 |

) |

|

23,003 |

|

|

|

|

|

|

|

| Cash flows from investing

activities: |

|

|

|

|

| Acquisition of business, net of

cash acquired |

|

(17,901 |

) |

|

(15,592 |

) |

| Capital expenditures |

|

(10,305 |

) |

|

(20,715 |

) |

| Additions to capitalized

software |

|

(5,918 |

) |

|

(4,727 |

) |

| Net cash used by investing

activities |

|

(34,124 |

) |

|

(41,034 |

) |

|

|

|

|

|

|

| Cash flows from financing

activities: |

|

|

|

|

| Proceeds from long-term debt |

|

68,000 |

|

|

88,000 |

|

| Principal payments on long-term

debt and short-term borrowings |

|

(60,000 |

) |

|

(46,000 |

) |

| Dividends paid |

|

(4,128 |

) |

|

(4,150 |

) |

| Purchases of common stock into

treasury |

|

(12,217 |

) |

|

(17,878 |

) |

| Other |

|

(2,374 |

) |

|

(2,719 |

) |

| Net cash (used) provided by

financing activities |

|

(10,719 |

) |

|

17,253 |

|

|

|

|

|

|

|

| Effect of exchange rate changes

on cash and cash equivalents |

|

801 |

|

|

(1,130 |

) |

|

|

|

|

|

|

| Net decrease in cash and cash

equivalents |

|

(49,503 |

) |

|

(1,908 |

) |

| Cash and cash equivalents,

beginning of period |

|

97,724 |

|

|

56,232 |

|

| Cash and cash equivalents, end of

period |

$ |

48,221 |

|

|

54,324 |

|

|

ESCO TECHNOLOGIES INC. AND SUBSIDIARIES |

|

Other Selected Financial Data (Unaudited) |

|

(Dollars in thousands) |

|

|

|

Backlog And Entered Orders - Q2 2023 |

|

Aerospace & Defense |

|

USG |

|

Test |

|

Total |

|

|

Beginning Backlog

- 1/1/23 |

$ |

422,551 |

|

|

137,286 |

|

|

158,584 |

|

|

718,421 |

|

|

|

Entered

Orders |

|

111,677 |

|

|

84,571 |

|

|

55,328 |

|

|

251,576 |

|

|

|

Sales |

|

|

(98,982 |

) |

|

(79,161 |

) |

|

(50,993 |

) |

|

(229,136 |

) |

|

|

Ending Backlog -

3/31/23 |

$ |

435,246 |

|

|

142,696 |

|

|

162,919 |

|

|

740,861 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

Backlog And Entered Orders - YTD Q2 2023 |

|

Aerospace & Defense |

|

USG |

|

Test |

|

Total |

|

|

Beginning Backlog

- 10/1/22 |

$ |

408,269 |

|

|

128,156 |

|

|

158,597 |

|

|

695,022 |

|

|

|

Entered

Orders |

|

208,942 |

|

|

164,746 |

|

|

106,788 |

|

|

480,476 |

|

|

|

Sales |

|

|

(181,965 |

) |

|

(150,206 |

) |

|

(102,466 |

) |

|

(434,637 |

) |

|

|

Ending Backlog -

3/31/23 |

$ |

435,246 |

|

|

142,696 |

|

|

162,919 |

|

|

740,861 |

|

|

ESCO TECHNOLOGIES INC. AND SUBSIDIARIES |

|

Reconciliation of Non-GAAP Financial Measures (Unaudited) |

|

|

| EPS – Adjusted

Basis Reconciliation – Q2 2023 |

|

|

|

|

|

| |

EPS – GAAP Basis – Q2

2023 |

$ |

0.69 |

|

|

|

| |

Adjustments (defined

below) |

|

0.07 |

|

|

|

| |

EPS – As Adjusted Basis – Q2

2023 |

$ |

0.76 |

|

|

|

| |

|

|

|

|

|

|

| |

Adjustments

exclude $0.07 per share consisting of executive management

transition costs |

| |

at Corporate, CMT

acquisition inventory step-up charges and restructuring charges

within |

| |

the A&D segment in the

second quarter of 2023. |

|

|

|

|

|

| |

The $0.07 of EPS

adjustments per share consists of $2.3M of pre-tax charges |

|

| |

offset by $529K of tax benefit

for net impact of $1,771K. |

|

|

|

|

|

| |

|

|

|

|

|

|

| EPS – Adjusted

Basis Reconciliation – Q2 2022 |

|

|

|

|

|

| |

EPS – GAAP Basis – Q2

2022 |

$ |

0.64 |

|

|

|

| |

Adjustments (defined

below) |

|

0.01 |

|

|

|

| |

EPS – As Adjusted Basis – Q2

2022 |

$ |

0.65 |

|

|

|

| |

|

|

|

|

|

|

| |

Adjustments

exclude $0.01 per share consisting of NEco acquisition

inventory |

|

| |

step-up charges

and Corporate related acquisition costs in the second quarter of

2022. |

| |

The $0.01 of EPS

adjustments per share consists of $282K of pre-tax charges |

|

| |

offset by $65K of tax benefit

for net impact of $217K. |

|

|

|

|

|

| |

|

|

|

|

|

|

| EPS – Adjusted

Basis Reconciliation – YTD Q2 2023 |

|

|

|

|

|

| |

EPS – GAAP Basis – YTD Q2

2023 |

$ |

1.26 |

|

|

|

| |

Adjustments (defined

below) |

|

0.10 |

|

|

|

| |

EPS – As Adjusted Basis – YTD

Q2 2023 |

$ |

1.36 |

|

|

|

| |

|

|

|

|

|

|

| |

Adjustments

exclude $0.10 per share consisting of executive management

transition costs |

| |

at Corporate, CMT

acquisition inventory step-up charges and restructuring charges

within |

| |

the A&D segment in the

first six months of 2023. |

|

|

|

|

|

| |

The $0.10 of EPS

adjustments per share consists of $3,292K of pre-tax charges |

| |

offset by $757K of tax benefit

for net impact of $2,535K. |

|

|

|

|

|

| |

|

|

|

|

|

|

| EPS – Adjusted

Basis Reconciliation – YTD Q2 2022 |

|

|

|

|

|

| |

EPS – GAAP Basis – YTD Q2

2022 |

$ |

1.08 |

|

|

|

| |

Adjustments (defined

below) |

|

0.03 |

|

|

|

| |

EPS – As Adjusted Basis – YTD

Q2 2022 |

$ |

1.11 |

|

|

|

| |

|

|

|

|

|

|

| |

Adjustments

exclude $0.03 per share consisting of Altanova & NEco

acquisition inventory |

| |

step-up charges

and Corporate related acquisition costs in the first six months of

2022. |

| |

The $0.03 of EPS

adjustments per share consists of $1,107K of pre-tax charges |

| |

offset by $255K of tax benefit

for net impact of $852K. |

|

|

|

|

|

SOURCE

ESCO Technologies Inc.Kate Lowrey, Vice President of Investor

Relations, (314) 213-7277

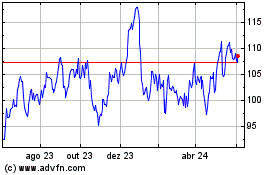

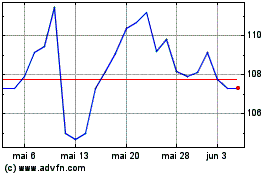

ESCO Technologies (NYSE:ESE)

Gráfico Histórico do Ativo

De Abr 2024 até Mai 2024

ESCO Technologies (NYSE:ESE)

Gráfico Histórico do Ativo

De Mai 2023 até Mai 2024