Ascot Resources Ltd. (

TSX: AOT; OTCQX:

AOTVF) (“

Ascot” or the

“

Company”) is pleased to announce the Company’s

unaudited financial results for the three months ended March 31,

2023 (“

Q1 2023”), and also to provide a

construction update on the Company’s Premier Gold Project

(“

PGP” or the “

project”), located

on Nisga’a Nation Treaty Lands in the prolific Golden Triangle of

northwestern British Columbia. For details of the unaudited

condensed interim consolidated financial statements and

Management's Discussion and Analysis for the three months ended

March 31, 2023, please see the Company’s filings on SEDAR

(www.sedar.com).

Derek White, President and CEO, commented, "As a

result of the construction financing closed earlier this year, and

also the momentum started with last year’s construction season,

work crews have hit the ground running in the first quarter of 2023

with much progress being made in many areas. In mid-January

contractors started inside the mill building and progressed piping

and equipment installations, and outdoor construction has recently

been advancing the new water treatment plant and associated

infrastructure. As of Q1 2023, detailed engineering stands at 99%

complete, major procurement is over 95% complete, and project

construction excluding mine development is at 35%. We plan to

further ramp-up construction efforts in the coming months with the

mobilization of the earthworks and underground mining contractors

and continue to advance project development towards initial gold

pour in early 2024.”

All amounts herein are reported in $000s of

Canadian dollars (“C$”) unless otherwise

specified.

Q1 2023 AND RECENT

HIGHLIGHTS

- On January 19,

2023, the Company closed a previously announced financing package

for completion of construction of the Project. The financing

package consists of US$110 million as a deposit in respect of gold

and silver streaming agreements (the “Stream”) and

a strategic equity investment (the

“Strategic Investment”) of C$45 million, a

portion of which is structured as Canadian Development Expenditures

flow through shares, such that the total gross proceeds to the

Company was C$50 million. Concurrent with the closing of the

financing package, the outstanding principal and accrued interest

of the Senior Debt with Sprott Private Resource Lending II (CO)

Inc. (“Sprott Lending”) was repaid, the Production Payment

Agreement (“PPA”) in connection with the Senior Debt was terminated

and the existing gold stream from the Red Mountain property with

Sprott Private Resource Streaming and Royalty (B) Corp. (“Sprott

Streaming”) was terminated and replaced by the new gold and silver

stream.

- The Premier site

was preserved and winterized in late 2022. The Company recommenced

its construction activities in early 2023 by re-mobilizing various

construction contractors to site to complete the remaining scope on

mill construction and piping. Construction of the new water

treatment plant began in Q1 2023. Earthworks on tailings and the

construction of the new water treatment plant will commence in Q2

2023 once the snow has melted.

- On February 17,

2023, the Company reorganized its Board of Directors

(“Board”) by adding two new members: José Néstor

Marún and Stephen Altmann, both of whom were appointed pursuant to

the recently Strategic Investment with Ccori Apu S.A.C.

(“Ccori Apu”). The Company also reported the

voluntary resignation of Ken Carter and James Stypula from Ascot’s

Board. As a result, Ascot’s Board maintains its size of seven

directors, and its gender diversity with 29% women.

- On March 23,

2023, the Company published its second annual Sustainability

Report, which will continue to evolve as Ascot progresses from

development into production next year. The 2022 Sustainability

Report can be accessed and downloaded at

https://ascotgold.com/sustainability/sustainability-reports/

- On April 20,

2023, the Company closed a previously announced non-brokered

private placement (the “Offering”). The Offering

raised total gross proceeds of $4,050 and consisted of 5,000,000

common shares of the Company, which qualify as "flow-through

shares" within the meaning of the Income Tax Act (Canada) (the

“FT Shares”), at a price of C$0.81 per FT Share.

The proceeds from the Offering will be used to fund the 2023

exploration program at PGP. The gross proceeds from the issuance of

the FT Shares will be used for “Canadian exploration expenses”, and

will qualify as “flow-through mining expenditures” as those terms

are defined in the Income Tax Act (Canada), which will be renounced

to the purchaser of the FT Shares with an effective date no later

than December 31, 2023 in an aggregate amount not less than the

gross proceeds raised from the issue of the FT Shares.

- On May 11, 2023,

the Company announced the 2023 exploration program at PGP. The

program consists of an initial 10,000 metres of surface drilling

and will include exploration drilling for resource expansion as

well as in-fill drilling of early mining areas at the Big Missouri

and Premier deposits. The exploration drilling will focus on

extending the Day Zone at Big Missouri and the Sebakwe Zone north

of the Premier mill. Up to an additional 4,000 meters of drilling

have been budgeted and will be deployed towards surface and

underground drilling depending on results of the initial 10,000

metres.

PROJECT CONSTRUCTION

Upon securing the new project financing in

January 2023, Ascot re-engaged various contractors to progress

activities in the mill building for the remainder of mill

construction scope. Starting from approximately 65 people working

at site at the end of January, there are now approximately 130

workers on site, and this will continue to increase with the

mobilization of earthworks and mining contractors in the coming

months to a peak of approximately 200 workers on site.

At the end of Q1 2023, detailed engineering was

at 99% completion. Major procurement was more than 95% complete.

Key orders remaining in the plant relate mostly to piping,

instrumentation and bulk consumables.

Mechanical work continued in the mill; various

trommels, dust collection and chute infrastructure were installed

around the SAG and Ball mills. The Intensive Leach Reactor was

assembled. Electricians continued installing electrical cabinetry,

pulling wire, installing cable trays, and working in the MCC room.

Concrete and structural steel contractors also have been restarted

and their scope updated for the mill completion. Crews have also

made progress on the new water treatment plant

(“WTP”) and associated infrastructure, including

the tailings thickener, lime silos, moving bed bio-reactor

(“MBBR”) tanks, and clarifier foundation

pedestals.

The earthworks contract was signed in March

2023. In order to de-water the tailings facility for the required

upcoming earthworks, an additional temporary water treatment plant

has been mobilized to site. This temporary de-watering will occur

for a period of approximately 4-6 weeks. By the end of May 2023,

the earthworks contractor will be mobilized to re-start work on the

Cascade Creek Diversion Channel (“CCDC”) and

tailings facility, which is anticipated to be completed by October

2023.

At the end of Q1 2023, overall construction

excluding mine development was at 35.3% completion. By the end of

2022, Ascot had invested a total of approximately C$153 million in

construction of PGP. By March 31, 2023, Ascot had spent C$173

million on the project. Ascot’s cash balance at March 31, 2023 was

C$149 million.

UNDERGROUND MINE

DEVELOPMENT

Mine plan and sequencing optimization were

completed in October 2022, developing a plan to minimize upfront

development while accessing early ore in an optimized sequence

starting at Premier Northern Lights (“PNL”) then ramping up

production at Big Missouri (“BM”), while developing over to Silver

Coin (“SC”), where the upper levels of the deposit will be

initially developed to maximize ore tonnage per linear metre. Based

on the recently completed plan, we anticipate starting mine

development in late July 2023 with the collaring of the PNL ramp

portal, while development will recommence at BM in late September

2023, after completion of the plug on the 2350 level in August

2023. Engineering on a pipe and valve assembly for the 2350 plug

design that was approved in February 2023 is in progress.

Limitations on ore storage on surface have

resulted in a realignment of the mine plan. The initial focus in

PNL will be “just in time” with long-hole drilled inventory blasted

as required, while more priority will be put on BM in the early

plan because material can be stored in the Dago Pit and brought to

the temporary mill pad from there. The realignment of the mine plan

is expected to complete by the end of mid-June 2023.

A consultant continued work on underground

ventilation plans in Ventsim for all three mine areas, developing a

unique plan to use the historical workings in conjunction with a

“pull” system near the PNL portal. This work and the SC/BM system

will be finalized and added to the updated mine plan.

Ascot is currently in the process of finalizing

a mining contract with a mine contractor for development and

initial production, this process will be completed during Q2

2023.

Mine development will progress throughout 2023

and delivery of ore is expected to commence late in the fourth

quarter of 2023, enabling the start of mill commissioning and first

gold pour in early 2024.

FINANCIAL RESULTS FOR THE THREE MONTHS

ENDED MARCH 31, 2023

The Company reported a net loss of $7,589 for Q1

2023 compared to $1,370 for Q1 2022. The higher net loss in Q1 2023

is driven by a $4,202 loss on extinguishment of Senior Debt, $1,430

change in fair value of derivatives and $1,127 in fees and expenses

associated with Stream.

LIQUIDITY AND CAPITAL

RESOURCES

As at March 31, 2023, the Company had cash &

cash equivalents of $149,261 and working capital of $131,631

excluding the current portion of the credit facilities. In Q1 2023,

the Company issued 109,208,928 common shares, 400,000 stock

options, and 18,963 Deferred Share Units. Also, 500,000 stock

options expired unexercised and 55,530 stock options and 653,398

Restricted Share Units were exercised in Q1 2023.

MANAGEMENT’S OUTLOOK FOR

2023

With the financing package closed on January 19,

2023, the Company believes that it has sufficient funding to

complete construction of the Project and achieve first gold

production in early 2024. The key activities for 2023 include:

- During Q1 2023,

contractors were re-mobilized to the mill and significant progress

has been made since then in the area of mechanical installation,

piping, electrical and related surface infrastructure

- Construction of

the process plant and associated surface infrastructure such that

the plant is expected to be in pre-commissioning by the end of

2023

- Completion of

the tailings dam improvements and start up of the new water

treatment plant by Q4 2023, and in order to facilitate the

dewatering of the tailing dam for construction, a temporary water

treatment plant has been installed and dewatering activities are

planned for the month of May, June and July 2023

- Advancement of

the PNL portal and underground development and additional

underground development of the Big Missouri mine

- Maintaining a

Health and Safety record of zero lost time incidents and achieving

the 2023 goals outlined in the Company’s 2022 Sustainability

Report

- Advancing the

recruitment of site personnel in line with the site personnel plan

by the end of 2023

- Maintaining

permitting and environmental compliance so that there are no delays

in the project construction schedule

- More exploration

and infill drilling north and west of existing resources

2023 AGM PRESENTATION

WEBCAST

Ascot’s Annual General Meeting

(“AGM”) is taking place on Thursday, June 22 at

10:00 AM PST. Please join President & CEO Derek White for a

presentation via webcast at 1:15 PM PST for the results of the AGM

and an overview of Ascot’s progress and plans in 2023. Please join

5 to 10 minutes prior to the scheduled time.Time:

Thursday, June 2022, 2023, at 1:15PM PTWebcast:

http://services.choruscall.ca/links/ascot20230622.htmlTelephone:

toll free Canada/USA 1‐800‐319‐4610; International

1‐604‐638‐5340

CONSTRUCTION PROGRESS

PHOTOS

Figure 1 – Mill building mechanical

equipment

installationhttps://www.globenewswire.com/NewsRoom/AttachmentNg/e0ae5785-ebfa-48dd-9246-cb8d3ceef739

Figure 2 – Mill building top floor

mechanical equipment

installationhttps://www.globenewswire.com/NewsRoom/AttachmentNg/b0a3a11e-7e93-4db2-b981-f1002bda4925

Figure 3 – Tailings thickener

constructionhttps://www.globenewswire.com/NewsRoom/AttachmentNg/6de1c984-f2b0-4bc0-888b-178f2f985875

Figure 4 – Temporary WTP for tailings

facility Spring water

dischargehttps://www.globenewswire.com/NewsRoom/AttachmentNg/817cfbc6-c1c7-4a95-9e0e-262d43eca61f

Figure 5 – New WTP lime silos

installedhttps://www.globenewswire.com/NewsRoom/AttachmentNg/3ba67c39-9a30-4691-99cd-9c6559bb9685

Figure 6 – New WTP clarifier foundation

pedestals

installedhttps://www.globenewswire.com/NewsRoom/AttachmentNg/cbe0e9c6-5c3f-4037-955e-82378a7feea4

Figure 7 – New WTP MBBR tanks

installedhttps://www.globenewswire.com/NewsRoom/AttachmentNg/5c626b63-e90d-410f-af37-a50837a00dac

Figure 8 – Electrical substation

foundation

constructionhttps://www.globenewswire.com/NewsRoom/AttachmentNg/d9bbc00f-cdc4-4ae7-aee6-605141a4bae8

Qualified Person

John Kiernan, P.Eng., Chief Operating Officer of

the Company is the Company’s Qualified Person (QP) as defined by

National Instrument 43-101 and has reviewed and approved the

technical contents of this news release.

On behalf of the Board of Directors of

Ascot Resources Ltd.“Derek C. White”President &

CEO

For further information

contact:

David Stewart, P.Eng.

VP, Corporate Development & Shareholder

Communications dstewart@ascotgold.com 778-725-1060 ext. 1024

About Ascot Resources Ltd.

Ascot is a Canadian junior exploration and

development company focused on re-starting the past producing

Premier gold mine, located on Nisga’a Nation Treaty Lands, in

British Columbia’s prolific Golden Triangle. Ascot shares trade on

the TSX under the ticker AOT. Concurrent with progressing the

development of Premier, the Company continues to successfully

explore its properties for additional high-grade underground

resources. Ascot is committed to the safe and responsible

development of Premier in collaboration with Nisga’a Nation as

outlined in the Benefits Agreement.

For more information about the Company, please

refer to the Company’s profile on SEDAR at www.sedar.com or visit

the Company’s web site at www.ascotgold.com, or for a virtual tour

visit www.vrify.com under Ascot Resources.

The TSX has not reviewed and does not accept

responsibility for the adequacy or accuracy of this release.

Cautionary Statement Regarding

Forward-Looking Information

All statements and other information contained

in this press release about anticipated future events may

constitute forward-looking information under Canadian securities

laws ("forward-looking statements"). Forward-looking statements are

often, but not always, identified by the use of words such as

"seek", "anticipate", "believe", "plan", "estimate", "expect",

"targeted", "outlook", "on track" and "intend" and statements that

an event or result "may", "will", "should", "could" or "might"

occur or be achieved and other similar expressions. All statements,

other than statements of historical fact, included herein are

forward-looking statements, including statements in respect of the

advancement and development of the PGP and the timing related

thereto, the exploration of the Company’s properties and

management’s outlook for the remainder of 2023 and beyond. These

statements involve known and unknown risks, uncertainties and other

factors that may cause actual results or events to differ

materially from those anticipated in such forward-looking

statements, including risks associated with the business of Ascot;

risks related to exploration and potential development of Ascot's

projects; business and economic conditions in the mining industry

generally; fluctuations in commodity prices and currency exchange

rates; uncertainties relating to interpretation of drill results

and the geology, continuity and grade of mineral deposits; the need

for cooperation of government agencies and indigenous groups in the

exploration and development of properties and the issuance of

required permits; the need to obtain additional financing to

develop properties and uncertainty as to the availability and terms

of future financing; the possibility of delay in exploration or

development programs and uncertainty of meeting anticipated program

milestones; uncertainty as to timely availability of permits and

other governmental approvals; risks associated with COVID-19

including adverse impacts on the world economy, construction timing

and the availability of personnel; and other risk factors as

detailed from time to time in Ascot's filings with Canadian

securities regulators, available on Ascot's profile on SEDAR at

www.sedar.com including the Annual Information Form of the Company

dated March 23, 2023 in the section entitled "Risk Factors".

Forward-looking statements are based on assumptions made with

regard to: the estimated costs associated with construction of the

Project; the timing of the anticipated start of production at the

Project; the ability to maintain throughput and production levels

at the Premier Mill; the tax rate applicable to the Company; future

commodity prices; the grade of Resources and Reserves; the ability

of the Company to convert inferred resources to other categories;

the ability of the Company to reduce mining dilution; the ability

to reduce capital costs; and exploration plans. Forward-looking

statements are based on estimates and opinions of management at the

date the statements are made. Although Ascot believes that the

expectations reflected in such forward-looking statements and/or

information are reasonable, undue reliance should not be placed on

forward-looking statements since Ascot can give no assurance that

such expectations will prove to be correct. Ascot does not

undertake any obligation to update forward-looking statements. The

forward-looking information contained in this news release is

expressly qualified by this cautionary statement.

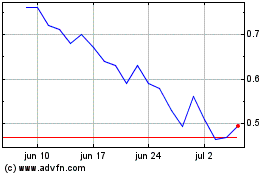

Ascot Resources (TSX:AOT)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Ascot Resources (TSX:AOT)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025