Star Equity Fund, LP (“Star Equity Fund” or “we”) is an investment

fund focused on unlocking shareholder value and improving corporate

governance at its portfolio companies. Star Equity Fund owns 6.2%

of the common stock of Firsthand Technology Value Fund, Inc.

(Nasdaq GM: SVVC) (“Firsthand” or “Company”) and announced today

that Institutional Shareholder Services (“ISS”), a leading

independent proxy voting advisory firm, has recommended that

Firsthand’s shareholders vote on Star Equity Fund’s

WHITE proxy card to elect both its nominees –

Robert Pearse and Hannah Bible – to the Company’s board of

directors (the “Board”) at its upcoming 2023 annual meeting of

shareholders (the “Annual Meeting”). ISS recommended that

Firsthand’s stockholders “DO NOT VOTE” on the Company’s blue proxy

card. SVVC’s Annual Meeting will be held in a virtual format on May

26, 2023, at 5:00 p.m. ET / 2:00 p.m. PT.

Jeff Eberwein, Portfolio Manager of Star Equity

Fund, remarked, “We are gratified by the overwhelming endorsement

from the proxy advisor firm ISS in our election campaign at

Firsthand Value Technology Fund. Our nominees have the right

skillsets, determination, and commitment to drive meaningful change

at the Company with the goal of unlocking value for all

shareholders.”

In reaching its conclusion, ISS conducted a

thorough analysis of Star Equity Fund’s candidates and case for

change at Firsthand. In its report, ISS focused on the Company’s

poor shareholder returns, its significant expense ratio in

comparison to its returns, and its deeply flawed corporate

governance profile. ISS concluded that shareholders should

vote on the WHITE proxy

card saying:

“There are grave concerns with corporate

governance that need to be addressed, and it is clear that a more

independent presence will be necessary to hold the company's

external manager to account. Thus, support for dissident nominees

Bible and Pearse is warranted.”

Additional Excerpts from ISS’ Analysis &

Recommendation

On the Company’s stock price performance compared to

NAV

“The company's discount to NAV has been greater

than 40 percent since mid-2016, and as of March 31, 2023, the

company's share price traded at a 74.7 percent discount to NAV. The

significance of the discount's magnitude is diminished by the fact

that the company's holdings are mainly not marketable securities

and thus any valuation of them requires a high degree of

subjectivity. Likewise, in the dissident's opinion, the company's

NAV is likely inflated. Nonetheless, while the precise degree of

the NAV discount is difficult to pinpoint, the large and

persistent discount of the company's trading price to NAV

is undeniably concerning for

shareholders.”

On the Company’s poor performance and

external management fees

“While the company's NAV is somewhat subjective,

it is difficult to argue that the company's discount to NAV of over

40 percent since 2016 represents anything but a clear

indictment of the company's board and external advisor.

Even though shareholder returns have been poor, shareholders have

paid an increasing proportion of the market price of their holdings

to the external manager to oversee the company's investments. In

2022, this proportion exceeded 15 percent. The external manager is

run by the company's CEO/chair Landis, one of the targets of the

dissident's campaign. Given the company's performance and

governance, it is reasonable that shareholders should seek

to hold him accountable.”

On the Company’s indifference to

shareholder concerns

“At each of the last three director elections,

at least one of the incumbent nominees has failed to obtain more

votes in favor than withhold votes. Throughout this period of time,

the company has made no public acknowledgment of these persistent

displays of shareholder dissatisfaction. The board has not

only ignored shareholders, but it has actively sought to undermine

their rights, which has been evidenced in the adoption of

a worst-of-all-worlds vote standard for director elections and in

opting into coverage under the MCSAA.”

IMPORTANT VOTING

INFORMATION

It is imperative that any shareholder

wanting to effect change on the Board vote “FOR” Star Equity Fund’s

director candidates on the WHITE

proxy card. Voting “AGAINST” the incumbent

director candidates on the Company’s blue proxy card will not

affect the outcome of the election as what ISS called the Company’s

"worst of all worlds" voting standards require at least 50% of the

total shares outstanding to vote “FOR” a dissident director

candidate in order to be elected. Please note you can vote

again if you have already voted – the last vote that you

submit will be the one that officially counts toward the election

results. Vote the WHITE proxy card

NOW to effect meaningful change at SVVC.

If you have any questions, require

assistance with voting your proxy card,or need

additional copies of proxy material, please contact InvestorCom

LLCInvestorCom LLC19 Old Kings

Highway S., Suite 130Darien, CT

06820proxy@investor-com.com(203)

972-9300 or Toll-Free (877) 972-0090

ADDITIONAL INFORMATION AND WHERE TO FIND IT

Star Equity Fund, LP (“Star Equity Fund”),

together with the other participants in its proxy solicitation

(collectively, “Star Equity”), filed a definitive proxy statement

and accompanying WHITE proxy card with the Securities and Exchange

Commission (“SEC”) to be used to solicit votes for the election of

its slate of highly qualified director nominees at the 2023 annual

meeting of stockholders of Firsthand Technology Value Fund, Inc., a

Maryland corporation (the “Company”).

STAR EQUITY STRONGLY ADVISES ALL STOCKHOLDERS OF

THE COMPANY TO READ THE PROXY STATEMENT AND OTHER PROXY MATERIALS

AS THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT

INFORMATION. SUCH PROXY MATERIALS WILL BE AVAILABLE AT NO CHARGE ON

THE SEC'S WEB SITE AT HTTP://WWW.SEC.GOV. IN ADDITION, THE

PARTICIPANTS IN THIS PROXY SOLICITATION WILL PROVIDE COPIES OF THE

PROXY STATEMENT WITHOUT CHARGE, WHEN AVAILABLE, UPON REQUEST.

About Star Equity Fund, LP

Star Equity Fund, LP is an investment fund

affiliated with Star Equity Holdings, Inc. Star Equity Fund seeks

to unlock shareholder value and improve corporate governance at its

portfolio companies.

About Star Equity Holdings, Inc.

Star Equity Holdings, Inc. is a diversified

holding company with two divisions: Construction and

Investments.

For more information contact:Star

Equity Fund, LP Jeffrey E.

EberweinPortfolio Manager

203-489-9501jeff.eberwein@starequity.com

The Equity GroupLena CatiSenior

Vice President212-836-9611lcati@equityny.com

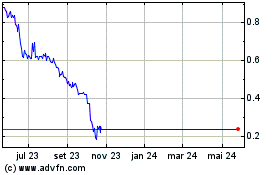

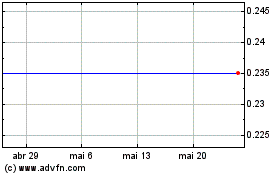

Firsthand Technology Value (NASDAQ:SVVC)

Gráfico Histórico do Ativo

De Abr 2024 até Mai 2024

Firsthand Technology Value (NASDAQ:SVVC)

Gráfico Histórico do Ativo

De Mai 2023 até Mai 2024