SL Green Announces Sale of 49.9% Interest in 245 Park Avenue

26 Junho 2023 - 8:30AM

SL Green Realty Corp. (NYSE:SLG), New York City’s largest office

landlord, today announced that it has sold a 49.9% interest in 245

Park Avenue to a U.S. affiliate of Mori Trust Co., Ltd. at a gross

asset valuation of $2.0 billion.

“We are thrilled to partner with Mori Trust Co., a premier

development and investment company based in Tokyo. The formation of

this new partnership with Mori Trust reflects the continuing allure

of investing in trophy midtown NY assets and resilience of the Park

Avenue corridor as New York’s most desirable office market. It is

also an affirmation of the institutional capital markets’

recognition of the enormous potential for 245 Park to benefit from

strategic investments and thoughtful stewardship,” said

Harrison Sitomer, Chief Investment Officer of SL

Green. “We are seeing strong demand from tenants and

investors for high quality, amenitized office properties located in

highly commutable areas. As their first investment in New York

City, Mori Trust shares our belief in this market and commitment to

elevate 245 Park to one of the best office assets in the Midtown

East submarket.”

SL Green acquired the 1.8 million-square-foot,

headquarters-quality office property on the coveted Park Avenue

corridor between 46th and 47th Streets in September 2022 with the

intent to reposition the asset with a partner. The company has

retained Kohn Pedersen Fox Associates to assist in a redesign of

the building that is focused on a new Park Avenue podium façade,

new windows, improvements to both the Park Avenue and Lexington

Avenue lobbies, the Park Avenue plaza, retail storefronts, numerous

infrastructure upgrades, and an expansion of SL Green’s premier

amenity program.

The sale of a joint venture interest in 245 Park Avenue is the

largest component of the company’s financial plan for 2023,

following the successful $500 million refinancing of 919 Third

Avenue in April.

About SL Green Realty Corp.SL Green Realty

Corp., Manhattan’s largest office landlord, is a fully integrated

real estate investment trust, or REIT, that is focused primarily on

acquiring, managing and maximizing value of Manhattan commercial

properties. As of March 31, 2023, SL Green held interests in 60

buildings totaling 33.1 million square feet. This included

ownership interests in 28.8 million square feet of Manhattan

buildings and 3.4 million square feet securing debt and preferred

equity investments.

About Mori Trust Co., Ltd. Mori Trust operates

66 buildings, residences, and commercial retails, and 31 hotels and

resort facilities across Japan (as of March 2023), centering on

three businesses: real estate business, hotel & resort

business, and investment business, as well as a wide range of

businesses that enhance the value of cities. On the real estate

developments side, aiming to contribute to improving the quality of

engagement and communication, in 2021 Mori formulated its new

office vision, DESTINATION OFFICE, in order to support the creation

of offices that attract workers. On the hotels and resorts side,

Mori is building a luxury destination network in Japan of premium

hotels located in prime urban and resort locations throughout the

country, as part of its vision to promote Japan as a high-end

tourism destination. On the investments side, in order to respond

quickly to changes in the business environment which may occur in

the future, Mori is actively promoting investment in a broad sense,

including capital participation in various companies, business

alliances, and other venture investments to ensure the growth of

the Group. Aiming to create new value by thinking outside the

framework of existing businesses, Mori is working on businesses in

new areas. In particular, the Group is promoting the workcation

business by combining know-how in the real estate business and

hotels & resorts business to propose a variety of work styles

and to stimulate tourism demand. In addition, Mori is focused on

the importance of wellness and launched a full-fledged wellness

business in 2020. For additional information, please visit

www.mori-trust.co.jp/english/.

Forward Looking StatementThis press release

includes certain statements that may be deemed to be

“forward-looking statements” within the meaning of the Private

Securities Litigation Reform Act of 1995 and are intended to be

covered by the safe harbor provisions thereof. All statements,

other than statements of historical facts, included in this press

release that address activities, events or developments that we

expect, believe or anticipate will or may occur in the future, are

forward-looking statements. Forward-looking statements are not

guarantees of future performance and actual results or developments

may differ materially, and we caution you not to place undue

reliance on such statements. Forward-looking statements are

generally identifiable by the use of the words “may,” “will,”

“should,” “expect,” “anticipate,” “estimate,” “believe,” “intend,”

“project,” “continue,” or the negative of these words, or other

similar words or terms.

Forward-looking statements contained in this press release are

subject to a number of risks and uncertainties, many of which are

beyond our control, that may cause our actual results, performance

or achievements to be materially different from future results,

performance or achievements expressed or implied by forward-looking

statements made by us. Factors and risks to our business that could

cause actual results to differ from those contained in the

forward-looking statements include the risks and uncertainties

described in our filings with the Securities and Exchange

Commission. Except to the extent required by law, we undertake no

obligation to publicly update or revise any forward-looking

statements, whether as a result of future events, new information

or otherwise.

SLG – A&D

PRESS CONTACTslgreen@berlinrosen.com

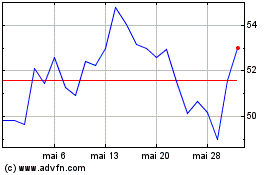

SL Green Realty (NYSE:SLG)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

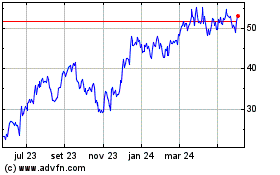

SL Green Realty (NYSE:SLG)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025