Information Services Corporation (TSX:ISV) (“ISC” or the “Company”)

today announced the execution of an extension agreement (the

“Extension Agreement”) with the Province of Saskatchewan (the

“Province”) to extend the term of its exclusive Master Service

Agreement (the “MSA” and, together with the Extension Agreement and

certain ancillary agreements collectively the “Agreements”) until

2053 (the “Extension”). This means that the MSA between ISC

and the Province will continue for the next 30 years to 2053, for a

total of 40 years, which is in keeping with a concession of this

nature.

The Agreements extend ISC’s exclusive right to

manage and operate each of the Saskatchewan Land Registry, the

Saskatchewan Land Surveys Directory, the Saskatchewan Corporate

Registry and the Saskatchewan Personal Property Registry

(collectively, the “Saskatchewan Registries”).

Extension Terms

- The Agreements extend ISC’s

exclusive right to manage and operate the Saskatchewan Registries

to 2053.

- The consideration to be paid by ISC

to the Province consists of:

- An upfront cash payment of $150

million (the “Upfront Payment”), payable on or before July 28,

2023;

- Five cash payments of $30 million

per year, totaling $150 million, commencing in July 2024 with the

final payment expected to be made in 2028 (the “Subsequent

Payments”); and

- Annual contingent payments

potentially payable after 2033 if volume growth for certain land

registry transactions exceeds pre-defined benchmarks, subject to a

maximum (further described below).

Financial Highlights

- Immediate

new revenue enhances ISC’s scale and financial profile:

- Under the Agreements, ISC has been

granted the right to introduce and/or enhance fees on certain

transactions with applicable fee adjustments expected to go into

effect on July 29, 2023.

- Fee adjustments are expected to

result in estimated incremental annual revenue and Adjusted EBITDA1

to ISC of $17 million and $16 million, respectively.

- Accordingly, the Company expects

the impact to 2023 revenue to be an increase of $7 million and 2023

Adjusted EBITDA1 to be $6 million.

- ISC intends to formally update its

annual guidance for 2023 when it reports its financial results for

the second quarter of 2023.

- The

Agreements are expected to generate attractive economics to ISC’s

shareholders:

- Strong +10% unlevered internal rate

of return5 for a high-quality infrastructure asset that is already

operated by ISC.

- Compelling +30% accretion to ISC’s

Net Asset Value per share (“NAVPS”)2.

- Immediately accretive to Adjusted

Free Cash Flow Per Share (“Adjusted FCFPS”)1 and Adjusted Earnings

Per Share (“Adjusted EPS”)1.

- ISC will

continue to maintain a prudent and flexible capital

structure:

- Following funding of the Upfront

Payment, ISC will have pro forma Net Debt / LTM Adjusted EBITDA3 of

4.0x4 (prior to the Extension, Net Debt / LTM Adjusted EBITDA was

0.6x as at March 31, 2023).

- Rapid deleveraging towards

long-term net leverage target of 2.0x – 2.5x.

- ISC has a history of disciplined

capital allocation and will continue to focus on deleveraging,

maintaining and growing its dividend, and investing in growth.

- ISC will

make meaningful investments to enhance core registries:

- A registry

enhancement plan will leverage ISC-built technology to offer

best-in-class technology, security, and user experience.

- ISC’s continued

development of world-class registry technology supports the

Company’s pursuit of new registry opportunities globally while also

benefitting the Saskatchewan Registries.

- The

contingent payment structure allows ISC and the Province to share

in volume growth:

- ISC and the

Province to share in growth through annual contingent payments

potentially payable by ISC to the Province between 2033 and 2053 if

cumulative annual volume growth for certain Saskatchewan Land

Registry transactions falls within a pre-determined range,

calculated in any given year as follows:

- 25% of any revenue associated with

long-term volume growth between 0% - 1%

- 50% of any revenue associated with

long-term volume growth between 1% - 3%

- ISC to retain unlimited upside on

any incremental volume growth in excess of 3%.

The MSA has also been amended and restated to,

among other things, implement certain incremental terms and

conditions, the objectives of which are to enhance security

features and protocols for the Saskatchewan Registries, contemplate

emerging and future technology enhancements for the Saskatchewan

Registries and the services provided pursuant to the MSA, refresh

and clarify governance practices and structure, adjust the registry

fees chargeable by the Company, and provide flexibility for change

over the life of the extended term.

Shawn Peters, President & CEO commented,

“The extension of our Master Service Agreement with the Province

has been an important priority for us and I would like to thank our

partners in the Saskatchewan Ministry of Finance and Ministry of

Justice for helping us arrive at a successful conclusion today.”

Peters continued, “This Agreement is beneficial for all

stakeholders including the Province, the people of Saskatchewan and

ISC’s long-standing and extremely supportive shareholders. We look

forward to continuing to serve the users of the Saskatchewan

Registries for the next 30 years, while executing our long-term

growth strategy for the company overall.”

Deputy Premier and Minister of Finance Donna

Harpauer noted, “ISC’s history in our province of providing quality

services to people and businesses drove the extension of this

Agreement. Our Government has confidence in ISC, a home-grown

success story, and a company that will help our province continue

to grow and move forward.” Harpauer continued, “The payments we

will receive from ISC and the ability to participate in the

company’s growth will help our Government continue to invest in the

priority programs, services and infrastructure Saskatchewan people

value.”

Compelling Strategic

Rationale

- Reinforces

ISC’s position as a leading registry operator:

- Strategic extension

of the MSA keeps a successful public-private partnership in the

hands of a proven management team with a best-in-class operational

track record.

- Unlocks

value of the Saskatchewan Registries:

- The Saskatchewan

Registries are a valuable, high-quality infrastructure asset that

ISC has the exclusive right to operate until 2053.

- Provides

ISC with strong, stable, long-term free cash flow:

- Predictable,

high-margin revenue supported by an asset-light model drives

substantial cash flow generation.

- New revenue

meaningfully enhances ISC’s scale and financial profile:

- Immediate fee

adjustments significantly enhance ISC’s revenue, Adjusted EBITDA1,

Adjusted EBITDA margin1, Adjusted Net Income1, and Adjusted Free

Cash Flow1.

- Attractive

transaction economics create significant value for ISC’s

shareholders:

- Robust

risk-adjusted returns5 with low execution risk underpinned by

meaningful NAVPS2, Adjusted FCFPS1 and Adjusted EPS1

accretion.

- Long-term

growth catalyst:

- Significant

incremental cash flow generation enables ISC to accelerate its

long-term organic and acquisition growth strategy.

1 Adjusted EBITDA, Adjusted

EBITDA Margin, Adjusted Net Income and Adjusted Free Cash Flow are

not recognized measures under IFRS and do not have a meaning

prescribed by IFRS and, therefore, they may not be comparable to

similar measures reported by other companies. For more information,

please refer to section 8.8 “Non-IFRS Financial Measures” and

section 2 “Consolidated Financial Analysis” for a reconciliation of

Adjusted Net Income and Adjusted EBITDA to net income in

Management's Discussion and Analysis for the quarter ended March

31, 2023. Additionally see the “Non-IFRS Performance Measures”

section below for descriptions and historical reconciliation of

these measures. Adjusted Earnings Per Share and Adjusted Free Cash

Flow Per Share referenced in this news release are calculated by

dividing Adjusted Net Income and Adjusted Free Cash Flow by the

average number of shares outstanding, respectively. 2 Net Asset

Value is a supplementary financial measure and represents the

estimated fair value of each of ISC's business segments, less its

long-term debt, short-term and long-term lease liability,

Government of Saskatchewan liabilities, plus cash. Net Asset Value

per share represents the Net Asset Value divided by the number of

shares outstanding3 This financial ratio is a non-IFRS ratio used

by management to evaluate borrowing capacity and capital allocation

strategies. Pro forma Net Debt/ LTM Adj. EBITDA is defined as pro

forma Net Debt divided by pro forma LTM Adjusted EBITDA. Pro forma

Net Debt includes total bank debt plus lease obligations and the

present value of the commitments payable to the Province of

Saskatchewan pursuant to the Agreements, and certain

transaction-related expenses less cash. Pro forma LTM Adjusted

EBITDA is calculated as ISC’s net income plus net finance expense,

depreciation and amortization, taxes, share-based compensation,

acquisition, integration and other costs as well as an adjustment

to give effect to management's estimates of the annualized EBITDA

generated by fee adjustments offset by incremental expenses.4 This

is pro forma as at March 31, 2023.5 Unlevered internal rate of

return is a supplementary financial measure which represents the

rate of return by considering the present value of future cash

flows related to this agreement extension excluding the cost of

financing.6 Total shares outstanding at June 30, 2023 are

17,701,498.

Transaction FinancingISC is

well-positioned to fund the Extension with its strong balance

sheet, cash flow profile and access to capital. In connection with

the Extension, ISC has entered into an amended and restated credit

agreement (the “Amended and Restated Credit Facility”) with its

syndicate of lenders. The aggregate amount available under the

Amended and Restated Credit Facility has been increased from $150

million to $250 million and will consist of ISC’s existing $150

million revolving credit facility plus a new $100 million revolving

credit facility. In addition, ISC will maintain access to a $100

million accordion option, providing the flexibility to upsize the

aggregate revolving credit facility up to $350 million, and the

Consolidated Net Funded Debt to EBITDA financial covenant has been

increased to provide additional balance sheet flexibility to ISC.

The expiry date of the Amended and Restated Credit Facility of

September 2026 remains unchanged. Royal Bank of Canada acted as

Administrative Agent with RBC Capital Markets and Canadian Imperial

Bank of Commerce serving as Joint Lead Arrangers and Joint

Bookrunners for the Amended and Restated Credit Facility.

ISC intends to fund the Upfront Payment and

other related transaction costs by drawing on its Amended and

Restated Credit Facility and with cash-on-hand. The Subsequent

Payments are expected to be financed using internally-generated

cash flow.

Special Committee of the Board of

Directors and Fairness Opinion

To evaluate and approve the Agreements, the

Board of Directors (the “Board”) formed a special committee

comprised exclusively of elected independent directors (the

“Special Committee”). RBC Capital Markets provided a fairness

opinion to ISC’s Special Committee to the effect that, as of the

date of the fairness opinion, subject to the assumptions,

limitations and qualifications contained therein, the consideration

to be paid by the Company pursuant to the Agreements is fair from a

financial point of view to the Company. The Special Committee

reviewed and unanimously approved the execution of the

Agreements.

Advisors and Counsel

RBC Capital Markets acted as financial advisor

to ISC. Stikeman Elliott LLP served as counsel to ISC.

Note to ReadersThe Board

carries out its responsibility for review and approval of this

disclosure through the Special Committee, which is comprised

exclusively of independent elected directors.

Conference Call and WebcastISC

will hold an investor conference call on July 5, 2023 at 5:30 p.m.

ET to discuss the transaction. Those joining the call on a

listen-only basis are encouraged to join the live audio webcast

which will be available on our website at

www.company.isc.ca/investor-relations/events. Participants who wish

to ask a question on the live call may do so through the ISC

website or by registering through the following live call

URL: https://register.vevent.com/register/BI3deaa146cfac4effaef057c05ca5a254

Once registered, participants will receive the

dial-in numbers and their unique PIN number. When dialing in,

participants will input their PIN and be placed into the call. The

audio file with a replay of the webcast will be available about 24

hours after the event on our website at the link above. We invite

media to attend on a listen-only basis.

About ISCHeadquartered in

Canada, ISC is a leading provider of registry and information

management services for public data and records. Throughout our

history, we have delivered value to our clients by providing

solutions to manage, secure and administer information through our

Registry Operations, Services and Technology Solutions segments.

ISC is focused on sustaining its core business while pursuing new

growth opportunities. The Class A Shares of ISC trade on the

Toronto Stock Exchange under the symbol ISV.

Cautionary Note Regarding

Forward-Looking InformationThis news release contains

forward-looking information within the meaning of applicable

Canadian securities laws including, without limitation, those

statements related to payment of the transaction consideration,

including the upfront payment, subsequent payments and contingent

payment structure, anticipated fee adjustments, our future

financial position and results of operations including anticipated

changes in revenue, Adjusted EBITDA, Adjusted Net Income and

Adjusted Free Cash Flow, expectations for value creation and

economics to ISC’s shareholders, capital structure changes and

anticipated accretion of the transaction, growth opportunities,

technology enhancements and continued development of registry

technology and capital allocation strategy. Forward-looking

information involves known and unknown risks, uncertainties and

other factors that may cause actual results or events to differ

materially from those expressed or implied by such forward-looking

information. Important factors that could cause actual results to

differ materially from the Company's plans or expectations include

risks relating to ISC’s payment of the upfront or subsequent

amounts, changes in the condition of the economy, reliance on key

customers and licences, dependence on key projects and clients,

securing new business and fixed-price contracts, identification of

viable growth opportunities, implementation of our growth strategy,

competition and other risks detailed from time to time in the

filings made by the Company including those detailed in ISC’s

Annual Information Form for the year ended December 31, 2022 and

ISC’s unaudited Condensed Consolidated Interim Financial Statements

and Notes and Management’s Discussion and Analysis for the first

quarter ended March 31, 2023, copies of which are filed on SEDAR at

www.sedar.com.

The forward-looking information in this release

is made as of the date hereof and, except as required under

applicable securities laws, ISC assumes no obligation to update or

revise such information to reflect new events or circumstances.

Non-IFRS Performance

MeasuresIncluded within this news release is reference to

the following non-IFRS performance measures. These measures, which

are reconciled below are reviewed regularly by management and the

Board of Directors in assessing our performance and making

decisions regarding the ongoing operations of our business and its

ability to generate returns. In connection with the Extension,

management has made the decision to add Adjusted Net Income and

Adjusted Free Cash Flow as new financial measures that exclude

certain items outside the normal course of business and are

believed to be useful to management and the market in reviewing

ISC’s performance. They are not recognized measures under IFRS and

do not have a standardized meaning under IFRS, so may not be

reliable ways to compare us to other companies.

Below, information is presented on the non-IFRS

measures used by ISC, why we use them, how they are calculated, the

most comparable IFRS financial measures and a reconciliation of the

measures as at December 31, 2022. Where new reconciling items exist

following this Extension that did not exist before, a line is

included in the reconciliation however the historical values

presented are nil.

|

Non-IFRS Performance Measure |

Why we use it |

How we calculate it |

Most comparable IFRS financial measure |

|

Adjusted Net IncomeAdjusted Earnings Per Share, BasicAdjusted

Earnings Per Share, Diluted |

- To evaluate performance and profitability while excluding

non-operational and share-based volatility.

- We believe that certain investors and analysts will use

Adjusted Net Income and Adjusted Earnings Per share to evaluate

performance while excluding items that management believes do not

contribute to our ongoing operations.

|

Adjusted Net Income;Net Income AddShare-based compensation expense,

acquisitions, integration and other costs, effective interest

component of interest expense, debt finance costs expensed to

professional and consulting, amortization of the intangible asset

related to the Extension and amortization of registry enhancements

required by the Agreements, accretion on the liability to

Government of Saskatchewan and the tax effect of these adjustments

at ISC’s statutory tax rate.Adjusted Earnings Per Share,

Basic;Adjusted Net Income divided by weighted average number of

common shares outstandingAdjusted Earnings Per Share,

Diluted;Adjusted Net Income divided by diluted weighted average

number of common shares outstanding |

Net IncomeEarnings Per Share, BasicEarnings Per Share, Diluted |

|

Adjusted EBITDAAdjusted EBITDA Margin |

- To evaluate performance and profitability of segments and

subsidiaries as well as the conversion of revenue while excluding

non-operational and share-based volatility.

- We believe that certain investors and analysts use Adjusted

EBITDA to measure our ability to service debt and meet other

performance obligations.

|

Adjusted EBITDA:Net Income add (remove)Depreciation and

amortization, net finance expense, income tax expense, share-based

compensation expense, and acquisition, integration and other

costsAdjusted EBITDA Margin:Adjusted EBITDA divided byTotal

revenue |

Net Income |

|

Free Cash Flow |

- To show cash available for debt repayment and reinvestment into

the Company on a levered basis.

- We believe that certain investors and analysts use this measure

to value a business and its underlying assets.

|

Net cash flow provided by operating activities deduct

(add)Net change in non-cash working capital, cash additions to

property, plant and equipment, cash additions to intangible assets,

interest received and paid as well as interest paid on lease

obligations and principal repayments on lease obligations |

Net cash flow provided by operating activities |

|

Adjusted Free Cash FlowAdjusted Free Cash Flow Per Share |

- To show cash available for debt repayment and reinvestment into

the Company on a levered basis from continuing operations while

excluding non-operational and share-based volatility.

- We believe that certain investors and analysts use this measure

to value a business and its underlying assets based on continuing

operations while excluding short term non-operational items.

|

Free Cash Flow deduct (add)Share-based compensation expense,

acquisition, integration and other costs and registry enhancement

capital expenditures required by the Extension |

Net cash flow provided by operating activities |

Reconciliation of Adjusted EBITDA to Net

Income

| |

Year Ended December 31, |

|

|

(thousands of CAD) |

|

2022 |

|

|

|

2021 |

|

|

Adjusted EBITDA |

$ |

64,390 |

|

|

$ |

67,815 |

|

|

|

|

|

|

|

|

|

|

|

Adjust: |

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

(14,735 |

) |

|

|

(13,778 |

) |

|

Net finance expense1 |

|

(3,177 |

) |

|

|

(2,673 |

) |

|

Income tax expense |

|

(12,249 |

) |

|

|

(12,003 |

) |

|

Share-based compensation expense |

|

(1,483 |

) |

|

|

(6,060 |

) |

|

Acquisition, integration and other costs |

|

(1,981 |

) |

|

|

(1,225 |

) |

|

Gain on disposal of property, plant and equipment assets |

|

4 |

|

|

|

2 |

|

|

Net income |

$ |

30,769 |

|

|

$ |

32,078 |

|

|

|

|

|

|

|

|

|

|

_______________1 Net finance expense includes interest income

net of interest expense and includes interest on lease obligations

and the effective interest component of interest expense.

Reconciliation of Adjusted Net Income to Net

Income

|

|

Year Ended December 31, |

|

|

(thousands of CAD) |

|

2022 |

|

|

|

2021 |

|

|

Adjusted Net Income |

$ |

33,350 |

|

|

$ |

37,409 |

|

|

|

|

|

|

|

|

|

|

|

Adjust: |

|

|

|

|

|

|

|

|

Share-based compensation expense |

|

(1,483 |

) |

|

|

(6,060 |

) |

|

Acquisition, integration and other costs |

|

(1,981 |

) |

|

|

(1,225 |

) |

|

Effective interest component of interest expense2 |

|

(72 |

) |

|

|

(18 |

) |

|

Amortization of the intangible assets related to the extension of

the MSA with GoS |

|

- |

|

|

|

- |

|

|

Debt finance costs expensed to professional and consulting |

|

- |

|

|

|

- |

|

|

Accretion on Liability to Government of Saskatchewan2 |

|

- |

|

|

|

- |

|

|

Amortization of Registry Transformation Intangible Assets |

|

- |

|

|

|

- |

|

|

Tax effect on above adjustments3 |

|

955 |

|

|

|

1,972 |

|

|

Net Income |

$ |

30,769 |

|

|

$ |

32,078 |

|

|

|

|

|

|

|

|

|

|

Reconciliation of Adjusted Free Cash Flow to Net Cash

Flow Provided by Operating Activities

| |

Year Ended December 31, |

|

|

(thousands of CAD) |

|

2022 |

|

|

|

2021 |

|

| Adjusted Free Cash Flow |

$ |

44,394 |

|

|

$ |

47,310 |

|

| Adjustments: |

|

|

|

|

|

|

|

|

Share-based compensation expense |

|

(1,483 |

) |

|

|

(6,060 |

) |

|

Acquisition, integration, and other costs |

|

(1,981 |

) |

|

|

(1,225 |

) |

|

Registry enhancement capital expenditures required by

extension2 |

|

- |

|

|

|

- |

|

|

Free Cash Flow |

$ |

40,930 |

|

|

$ |

40,025 |

|

| Adjustments: |

|

|

|

|

|

|

|

|

Cash additions to property, plant and equipment |

|

574 |

|

|

|

10 |

|

|

Cash additions to intangible assets |

|

890 |

|

|

|

2,217 |

|

|

Interest received |

|

(463 |

) |

|

|

(140 |

) |

|

Interest paid |

|

2,902 |

|

|

|

2,547 |

|

|

Interest paid on lease obligations |

|

403 |

|

|

|

354 |

|

|

Principal repayment on lease obligations |

|

2,137 |

|

|

|

2,014 |

|

|

Net change in non-cash working capital |

|

(3,837 |

) |

|

|

14,185 |

|

|

Net Cash Flow provided by operating activities |

$ |

43,536 |

|

|

$ |

61,212 |

|

|

|

|

|

|

|

|

|

|

_______________2 This Extension will result in new adjustments

that have not occurred historically. These new non-IFRS

adjustments, are expected to be incurred in the future and have

therefore been included with nil values in these historical

reconciliations.3 Calculated at ISC’s statutory tax rate of 27.0

per cent.

Investor ContactJonathan HackshawSenior

Director, Investor Relations & Capital MarketsToll Free:

1-855-341-8363 in North America or

1-306-798-1137investor.relations@isc.ca

Media ContactJodi BosnjakExternal

Communications SpecialistToll Free: 1-855-341-8363 in North America

or 1-306-798-1137corp.communications@isc.ca

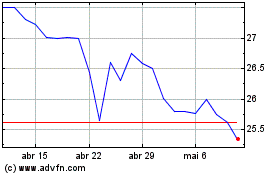

Information Services (TSX:ISV)

Gráfico Histórico do Ativo

De Abr 2024 até Mai 2024

Information Services (TSX:ISV)

Gráfico Histórico do Ativo

De Mai 2023 até Mai 2024