Arteris, Inc. (Nasdaq: AIP), a leading provider of system IP which

accelerates system-on-chip (SoC) creation, today announced

financial results for the second quarter ended June 30, 2023 as

well as estimated third quarter and full year 2023 guidance.

“In the second quarter we continued our

momentum, with Annual Contract Value plus Trailing-Twelve-Month

Royalties of $58.2 million, up 21% year-over-year when

adjusted to exclude DJI and up 6% sequentially,” said K. Charles

Janac, President and CEO of Arteris. “Also noteworthy in the second

quarter, five of the top 10 largest technology companies engaged

with Arteris, demonstrating the accelerating shift to commercial

system IP products across a multitude of end markets including

automotive, AI and data center applications. As the complexities of

SoCs continues to increase, companies who historically utilized

in-house solutions are increasingly looking to outsource system IP

connectivity needs which we expect to benefit Arteris."

Second Quarter 2023 Financial Highlights:

- Annual Contract

Value (ACV) and Trailing-twelve-month (TTM) royalties of

$58.2 million, up 13% year-over-year

- Revenue of $14.7 million,

exceeding the top end of our guidance

- Remaining performance obligation

(RPO) of $65.1 million, up $7.8 million sequentially

- Operating loss of $8.7 million

or 59% of revenue

- Non-GAAP operating loss of $4.2

million or 29% of revenue, compared to a loss of $1.9 million in

the year-ago period

- Net loss of $9.2 million or

$0.26 per share

- Non-GAAP net loss of

$4.7 million or $0.13 per share

- Non-GAAP free cash flow of

$(2.2) million or (15)% of revenue

Second Quarter 2023 Business Highlights:

- 22 confirmed designs starts in the

second quarter, including 12 that enable AI technologies;

- Added 12 Active Customers in the second quarter across key

verticals, including Enterprise Computing, Automotive, Industrial,

and Consumer Electronics;

- Closed deals with three of the top 10 global semiconductor

companies which historically used internal System IP

solutions;

- Continued success in the automotive industry with numerous

deals in the space, including direct license deals with five OEMs,

and a new automotive Tier 1 customer;

- BOS Semiconductor selected Arteris interconnect and SoC

integration automation technology for use in its next-generation

automotive chips; and

- Due to certain changes in deal structures and contract terms,

we expect a significant majority of revenue contracts to be

recognized ratably going forward.

Estimated Third Quarter and Full Year 2023

Guidance:

|

|

Q3 2023 |

FY 2023 |

|

|

(in millions, except %) |

|

ACV + TTM royalties |

$57.0 - $61.0 |

$60.4 - $65.4 |

|

Revenue |

$12.5 - $13.5 |

$54.0 - $56.0 |

|

Non-GAAP operating loss (%) |

42.0% - 62.0% |

34.5% - 49.5% |

|

Free cash flow (%) |

(35.6)% - (10.6)% |

(20.5)% - (10.5)% |

The guidance provided above are forward-looking

statements and reflect Arteris' expectations as of today's date.

Actual results may differ materially. Refer to the section titled

"Forward-Looking Statements" below for information on the factors,

among others, that could cause our actual results to differ

materially from these forward-looking statements.

Non-GAAP gross profit, Non-GAAP gross margin,

Non-GAAP operating loss, Non-GAAP operating loss margin, Non-GAAP

net loss, Non-GAAP net loss per share, free cash flow and free cash

flow margin are Non-GAAP financial measures. Additional information

on Arteris’ historic reported results, including a reconciliation

of these Non-GAAP financial measures to their most comparable GAAP

measures, is included in the financial tables below. A

reconciliation of Non-GAAP guidance measures reported above to

corresponding GAAP measures is not available on a forward-looking

basis without unreasonable effort due to the uncertainty of

expenses that may be incurred in the future, although it is

important to note that these factors could be material to Arteris'

results computed in accordance with GAAP.

Definitions of the other business metrics used

in this press release including ACV, active customers, confirmed

design starts and RPO are included below under the heading “Other

Business Metrics.”

Conference Call

Arteris will host a conference call today,

August 3, 2023, to review its second quarter 2023 financial results

and discuss its financial outlook.

|

|

Time: |

4:30 PM ET |

|

| |

United States/Canada Toll

Free: |

1-888-886-7786 |

|

| |

International Toll: |

1-416-764-8658 |

|

A live webcast will also be available in the

Investor Relations section of Arteris’ website at:

https://ir.arteris.com/events-and-presentations

A replay of the webcast will be available in the

Investor Relations section of Arteris' website approximately two

hours after the conclusion of the call and remain available for

approximately 30 calendar days.

About Arteris

Arteris is a leading provider of system IP for

the acceleration of system-on-chip (SoC) development across today’s

electronic systems. Arteris network-on-chip (NoC) interconnect IP

and SoC integration automation technology enable higher product

performance with lower power consumption and faster time to market,

delivering better SoC economics so its customers can focus on

dreaming up what comes next. Learn more at arteris.com.

© 2004-2023 Arteris, Inc. All rights reserved

worldwide. Arteris, Arteris IP, the Arteris IP logo, and the other

Arteris marks found at https://www.arteris.com/trademarks are

trademarks or registered trademarks of Arteris, Inc. or its

subsidiaries. All other trademarks are the property of their

respective owners.

Investor Contacts:ArterisNick HawkinsChief

Financial OfficerIR@arteris.com

Sapphire Investor RelationsErica Mannion and Michael Funari+1

617 542 6180IR@arteris.com

Forward-Looking Statements

This press release contains forward-looking

statements within the meaning of the Private Securities Litigation

Reform Act of 1995, as amended, including but not limited to,

statements regarding our future financial and operating

performance, including our GAAP and Non-GAAP guidance for the first

quarter and full year 2023; our market opportunity and its

potential growth; our position within the market and our ability to

drive customer value; and our ability to make progress even in a

challenging economic environment. The words "may," "might," "will,"

"could," "would," "should," "expect," "plan," "anticipate,"

"intend," "believe," "expect," "estimate," "seek," "predict,"

"future," "project," "potential," "continue," "target" and similar

words or expressions are intended to identify forward-looking

statements, although not all forward-looking statements contain

these identifying words. Any forward-looking statements contained

herein are based on our historical performance and our current

plans, estimates and expectations and are not a representation that

such plans, estimates, or expectations will be achieved. These

forward-looking statements represent our expectations as of the

date of this press release. Subsequent events may cause these

expectations to change, and we disclaim any obligation to update

the forward-looking statements in the future, except as required by

law. These forward-looking statements are subject to known and

unknown risks and uncertainties that may cause actual results to

differ materially from our current expectations. Important factors

that could cause actual results to differ materially from those

anticipated in our forward-looking statements include, but are not

limited to, the significant competition we face from larger

companies and third-party providers; our history of net losses;

whether semiconductor companies in the automotive market,

enterprise computing market, communications market, consumer

electronics market, and industrial markets incorporate our

solutions into their end products and the growth and economic

stability of these end markets; our ability to attract new

customers and the extent to which our customers renew their

subscriptions for our solutions; the ability of our customers’ end

products achieving market acceptance or growth; our ability to

sustain or grow our licensing revenue; our ability, and the cost,

to successfully execute on research and development efforts; the

occurrence of product errors or defects in our solutions; if we

fail to offer high-quality support; the occurrence of

macro-economic conditions that adversely impact us, our customers

and their end product markets; the effects of geopolitical

conflicts, such as the military conflict between Russia and

Ukraine; the range of regulatory, operational, financial and

political risks we are exposed to as a result of our dependence on

international customers and operations; our ability to protect our

proprietary technology and inventions through patents and other IP

rights; whether we are subject to any liabilities or fines as a

result of government regulation, including import, export and

economic sanctions laws and regulations; the occurrence of a

disruption in our networks or a security breach; risks associated

with doing business in China; and the other factors described under

the heading “Risk Factors” in our Quarterly Report on Form 10-Q for

the quarter ended June 30, 2023 to be filed with the Securities and

Exchange Commission (SEC) on August 3, 2023. All forward-looking

statements reflect our beliefs and assumptions only as of the date

of this press release. We undertake no obligation to update

forward-looking statements to reflect future events or

circumstances. Our results for the quarter ended June 30, 2023 are

not necessarily indicative of our operating results for any future

periods.

|

Arteris, IncCondensed Consolidated

Statements of Loss(in thousands, except share and per

share data)(Unaudited) |

| |

| |

Three Months EndedJune 30, |

|

Six Months Ended June 30, |

| |

2023 |

|

2022 |

|

2023 |

|

2022 |

| Revenue |

|

|

|

|

|

|

|

|

Licensing, support and maintenance |

$ |

12,998 |

|

|

$ |

14,033 |

|

|

$ |

24,842 |

|

|

$ |

24,608 |

|

|

Variable royalties and other |

|

1,736 |

|

|

|

789 |

|

|

|

3,046 |

|

|

|

1,969 |

|

| Total revenue |

|

14,734 |

|

|

|

14,822 |

|

|

|

27,888 |

|

|

|

26,577 |

|

| Cost of revenue |

|

1,225 |

|

|

|

1,289 |

|

|

|

2,349 |

|

|

|

2,268 |

|

| Gross profit |

|

13,509 |

|

|

|

13,533 |

|

|

|

25,539 |

|

|

|

24,309 |

|

| Operating expense: |

|

|

|

|

|

|

|

|

Research and development |

|

12,087 |

|

|

|

10,371 |

|

|

|

23,468 |

|

|

|

19,827 |

|

|

Sales and marketing |

|

5,601 |

|

|

|

4,456 |

|

|

|

10,606 |

|

|

|

8,377 |

|

|

General and administrative |

|

4,504 |

|

|

|

4,132 |

|

|

|

8,905 |

|

|

|

8,147 |

|

| Total operating expenses |

|

22,192 |

|

|

|

18,959 |

|

|

|

42,979 |

|

|

|

36,351 |

|

| Loss from operations |

|

(8,683 |

) |

|

|

(5,426 |

) |

|

|

(17,440 |

) |

|

|

(12,042 |

) |

| Interest expense |

|

(27 |

) |

|

|

(18 |

) |

|

|

(59 |

) |

|

|

(38 |

) |

| Other income (expense),

net |

|

835 |

|

|

|

127 |

|

|

|

1,743 |

|

|

|

66 |

|

| Loss before provision for

income taxes and loss from equity method investment |

|

(7,875 |

) |

|

|

(5,317 |

) |

|

|

(15,756 |

) |

|

|

(12,014 |

) |

| Loss from equity method

investment, net of tax |

|

734 |

|

|

|

— |

|

|

|

1,568 |

|

|

|

— |

|

| Provision for income

taxes |

|

556 |

|

|

|

351 |

|

|

|

851 |

|

|

|

474 |

|

| Net loss |

$ |

(9,165 |

) |

|

$ |

(5,668 |

) |

|

$ |

(18,175 |

) |

|

$ |

(12,488 |

) |

| |

|

|

|

|

|

|

|

| Net loss per share

attributable to common stockholders, basic and diluted |

$ |

(0.26 |

) |

|

$ |

(0.18 |

) |

|

$ |

(0.52 |

) |

|

$ |

(0.39 |

) |

| Weighted average shares used

on computing per share amounts, basic and diluted |

|

35,250,157 |

|

|

|

32,258,228 |

|

|

|

34,925,800 |

|

|

|

31,940,293 |

|

|

Arteris, IncCondensed Consolidated Balance

Sheets (In thousands, except share and per share

data)(unaudited) |

| |

| |

As of |

| |

June 30, 2023 |

|

December 31, 2022 |

|

ASSETS |

|

|

|

| Current

assets: |

|

|

|

|

Cash and cash equivalents |

$ |

26,334 |

|

|

$ |

37,423 |

|

|

Short-term investments |

|

28,640 |

|

|

|

30,728 |

|

| Accounts

receivable, net of allowance of $250 for both periods |

|

9,582 |

|

|

|

7,143 |

|

| Prepaid

expenses and other current assets |

|

5,856 |

|

|

|

5,818 |

|

|

Total current assets |

|

70,412 |

|

|

|

81,112 |

|

| Property

and equipment, net |

|

5,171 |

|

|

|

3,617 |

|

|

Long-term investments |

|

5,838 |

|

|

|

4,427 |

|

| Equity

method investment |

|

10,329 |

|

|

|

11,897 |

|

|

Operating lease right-of-use assets |

|

1,859 |

|

|

|

1,883 |

|

|

Intangibles, net |

|

4,192 |

|

|

|

4,575 |

|

|

Goodwill |

|

4,178 |

|

|

|

4,218 |

|

| Other

assets |

|

4,847 |

|

|

|

3,787 |

|

| TOTAL

ASSETS |

$ |

106,826 |

|

|

$ |

115,516 |

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

| Current

liabilities: |

|

|

|

| Accounts

payable |

$ |

210 |

|

|

$ |

572 |

|

| Accrued

expenses and other current liabilities |

|

10,825 |

|

|

|

12,095 |

|

|

Operating lease liabilities, current |

|

709 |

|

|

|

899 |

|

| Deferred

revenue, current |

|

30,413 |

|

|

|

28,839 |

|

| Vendor

financing arrangements, current |

|

1,581 |

|

|

|

1,264 |

|

|

Total current liabilities |

|

43,738 |

|

|

|

43,669 |

|

| Deferred

revenue, noncurrent |

|

22,963 |

|

|

|

21,840 |

|

|

Operating lease liabilities, noncurrent |

|

1,181 |

|

|

|

1,009 |

|

| Vendor

financing arrangements, noncurrent |

|

1,348 |

|

|

|

448 |

|

| Deferred

income, noncurrent |

|

9,405 |

|

|

|

9,993 |

|

| Other

liabilities |

|

1,271 |

|

|

|

1,022 |

|

|

Total liabilities |

|

79,906 |

|

|

|

77,981 |

|

|

Stockholders' equity: |

|

|

|

|

Preferred stock, par value of $0.001 - 10,000,000 shares authorized

and no shares issued and outstanding as of June 30, 2023 and

December 31, 2022, respectively |

|

— |

|

|

|

— |

|

|

Common stock, par value of $0.001 - 300,000,000 shares authorized

as of June 30, 2023 and December 31, 2022; 36,033,361 and

34,625,875 shares issued and outstanding as of June 30, 2023

and December 31, 2022, respectively |

|

36 |

|

|

|

34 |

|

|

Additional paid-in capital |

|

111,403 |

|

|

|

103,778 |

|

|

Accumulated other comprehensive income |

|

34 |

|

|

|

101 |

|

|

Accumulated deficit |

|

(84,553 |

) |

|

|

(66,378 |

) |

|

Total stockholders' equity |

|

26,920 |

|

|

|

37,535 |

|

| TOTAL

LIABILITIES AND STOCKHOLDERS’ EQUITY |

$ |

106,826 |

|

|

$ |

115,516 |

|

|

Arteris, Inc.Condensed Consolidated

Statements of Cash Flows (In thousands)(unaudited) |

| |

| |

Six Months EndedJune 30, |

| |

2023 |

|

2022 |

| CASH

FLOWS FROM OPERATING ACTIVITIES: |

|

|

|

|

Net loss |

$ |

(18,175 |

) |

|

$ |

(12,488 |

) |

|

Adjustments to reconcile net loss to net cash used in operating

activities: |

|

|

|

|

Depreciation and amortization |

|

1,275 |

|

|

|

929 |

|

|

Stock-based compensation |

|

7,267 |

|

|

|

5,693 |

|

|

Amortization of deferred income |

|

(585 |

) |

|

|

— |

|

|

Loss from equity method investment |

|

1,568 |

|

|

|

— |

|

|

Net accretion of discounts on available-for-sale securities |

|

(497 |

) |

|

|

— |

|

|

Gain on deconsolidation of subsidiary |

|

— |

|

|

|

(149 |

) |

|

Other, net |

|

10 |

|

|

|

12 |

|

|

Changes in operating assets and liabilities: |

|

|

|

|

Accounts receivable, net |

|

(2,438 |

) |

|

|

9,168 |

|

|

Prepaid expenses and other assets |

|

(710 |

) |

|

|

(2,232 |

) |

|

Accounts payable |

|

(371 |

) |

|

|

(1 |

) |

|

Accrued expenses and other liabilities |

|

16 |

|

|

|

(704 |

) |

|

Deferred revenue |

|

2,696 |

|

|

|

(1,391 |

) |

|

Net cash used in operating activities |

|

(9,944 |

) |

|

|

(1,163 |

) |

| CASH

FLOWS FROM INVESTING ACTIVITIES: |

|

|

|

|

Purchases of property and equipment |

|

(735 |

) |

|

|

(205 |

) |

|

Purchases of available-for-sale securities |

|

(19,544 |

) |

|

|

— |

|

| Proceeds

from maturities of available-for-sale securities |

|

20,650 |

|

|

|

— |

|

| Payments

relating to investment in equity method investment |

|

— |

|

|

|

(520 |

) |

|

Net cash provided by (used in) investing activities |

|

371 |

|

|

|

(725 |

) |

| CASH

FLOWS FROM FINANCING ACTIVITIES: |

|

|

|

| Payments

of contingent consideration for business combination |

|

(1,000 |

) |

|

|

(1,573 |

) |

|

Principal payments under vendor financing arrangements |

|

(488 |

) |

|

|

(407 |

) |

| Proceeds

from exercise of stock options |

|

417 |

|

|

|

443 |

|

| Payments

to tax authorities for shares withheld from employees |

|

(57 |

) |

|

|

(843 |

) |

| Payments

of deferred offering costs |

|

— |

|

|

|

(256 |

) |

|

Net cash used in financing activities |

|

(1,128 |

) |

|

|

(2,636 |

) |

| NET

DECREASE IN CASH, CASH EQUIVALENTS AND RESTRICTED CASH |

|

(10,701 |

) |

|

|

(4,524 |

) |

| CASH.

CASH EQUIVALENTS AND RESTRICTED CASH, beginning of period |

|

37,423 |

|

|

|

85,825 |

|

| CASH,

CASH EQUIVALENTS AND RESTRICTED CASH, end of period |

$ |

26,722 |

|

|

$ |

81,301 |

|

| |

Non-GAAP Financial Measures

To supplement our financial results, which are

prepared and presented in accordance with GAAP, we use certain

non-GAAP financial measures, as described below, to understand and

evaluate our core performance. These non-GAAP measures, which may

be different than similarly-titled measures used by other

companies, are presented to enhance investors’ overall

understanding of our financial performance and should not be

considered a substitute for, or superior to, the financial

information prepared and presented in accordance with GAAP.

We define "Non-GAAP gross profit and Non-GAAP

gross margin" as GAAP gross profit and GAAP gross margin, adjusted

for stock-based compensation expense included in cost of revenue.

We define “Non-GAAP Loss from Operations” as our income (loss) from

operations adjusted to exclude stock-based compensation,

acquisition costs and amortization of acquired intangible assets.

We define “Non-GAAP Net Loss” as our net income (loss) adjusted to

exclude stock-based compensation, acquisition costs, amortization

of acquired intangible assets and gain on extinguishment of

debt.

We define “Non-GAAP EPS”, as our Non-GAAP Net

Income (Loss) divided by our GAAP weighted-average number of shares

outstanding for the period on a diluted basis. Management uses

Non-GAAP EPS to evaluate the performance of our business on a

comparable basis from period to period.

The above items are excluded from our Non-GAAP

Gross Profit, Non-GAAP Income (Loss) from Operations and Non-GAAP

Net Income (Loss) because these items are non-cash in nature, or

are not indicative of our core operating performance, and render

comparisons with prior periods and competitors less meaningful. We

believe Non-GAAP Gross Profit, Non-GAAP Income (Loss) from

Operations and Non-GAAP Net Income (Loss) provide useful

supplemental information to investors and others in understanding

and evaluating our results of operations, as well as provide a

useful measure for period-to-period comparisons of our business

performance.

We define free cash flow as net cash (used in)

provided by operating activities less cash used for purchases of

property and equipment. We believe that free cash flow is a useful

indicator of liquidity that provides information to management and

investors, even if negative, about the amount of cash used in our

operations other than that used for investments in property and

equipment.

Other Business Metrics

Annual Contract Value (ACV) –

we define Annual Contract Value for an individual customer

agreement as the total fixed fees under the agreement divided by

the number of years in the agreement term. Our total ACV is the

aggregate ACVs for all our customers as measured at a given point

in time. Total fixed fees includes licensing, support and

maintenance and other fixed fees under IP licensing or software

licensing agreements but excludes variable revenue derived from

licensing agreements with customers, particularly royalties. We

monitor ACV to measure our success and believe the increase in the

number shows our progress in expanding our customers’ adoption of

our solutions. ACV fluctuates due to a number of factors, including

the timing, duration and dollar amount of customer contracts.

Active Customers – we define

Active Customers as customers who have entered into a license

agreement with us that remains in effect. The retention and

expansion of our relationships with existing customers are key

indicators of our revenue potential.

Confirmed Design Starts – we

define Confirmed Design Starts as when customers confirm their

commencement of new semiconductor designs using our interconnect IP

and notify us. Confirmed Design Starts is a metric management uses

to assess the activity level of our customers in terms of the

number of new semiconductor designs that are started using our

interconnect IP in a given period. We believe that the number of

Confirmed Design Starts is an important indicator of the growth of

our business and future royalty revenue trends.

Remaining Performance Obligations (RPO)

– we define Remaining Performance Obligations as the

amount of contracted future revenue that has not yet been

recognized, including both deferred revenue and unbilled cancelable

and non-cancelable contracted amounts that will be invoiced and

recognized as revenue in future periods.

|

Arteris, Inc.Reconciliation of GAAP

Measures to Non-GAAP Measures(In thousands, except share

and per share data)(unaudited) |

| |

| |

Three Months Ended June 30, |

|

Six Months Ended June 30, |

| |

2023 |

|

2022 |

|

2023 |

|

2022 |

|

Gross profit |

$ |

13,509 |

|

|

$ |

13,533 |

|

|

$ |

25,539 |

|

|

$ |

24,309 |

|

| Stock-based compensation

expense included in cost of revenue |

|

122 |

|

|

|

260 |

|

|

|

205 |

|

|

|

356 |

|

| Amortization of acquired

intangible assets (1) |

|

49 |

|

|

|

— |

|

|

|

49 |

|

|

|

— |

|

| Non-GAAP gross profit |

$ |

13,680 |

|

|

$ |

13,793 |

|

|

$ |

25,793 |

|

|

$ |

24,665 |

|

| Gross margin |

|

92 |

% |

|

|

91 |

% |

|

|

92 |

% |

|

|

91 |

% |

| Non-GAAP gross margin |

|

93 |

% |

|

|

93 |

% |

|

|

92 |

% |

|

|

93 |

% |

| |

|

|

|

|

|

|

|

| Research and development |

$ |

12,087 |

|

|

$ |

10,371 |

|

|

$ |

23,468 |

|

|

$ |

19,827 |

|

| Stock-based compensation

expense |

|

(2,485 |

) |

|

|

(1,493 |

) |

|

|

(3,914 |

) |

|

|

(2,637 |

) |

| Amortization of acquired

intangible assets (1) |

|

(85 |

) |

|

|

(85 |

) |

|

|

(220 |

) |

|

|

(170 |

) |

| Non-GAAP research and

development |

$ |

9,517 |

|

|

$ |

8,793 |

|

|

$ |

19,334 |

|

|

$ |

17,020 |

|

| |

|

|

|

|

|

|

|

| Sales and marketing |

$ |

5,601 |

|

|

$ |

4,456 |

|

|

$ |

10,606 |

|

|

$ |

8,377 |

|

| Stock-based compensation

expense |

|

(737 |

) |

|

|

(728 |

) |

|

|

(1,422 |

) |

|

|

(999 |

) |

| Amortization of acquired

intangible assets (1) |

|

(57 |

) |

|

|

(35 |

) |

|

|

(114 |

) |

|

|

(69 |

) |

| Non-GAAP sales and

marketing |

$ |

4,807 |

|

|

$ |

3,693 |

|

|

$ |

9,070 |

|

|

$ |

7,309 |

|

| |

|

|

|

|

|

|

|

| General and

administrative |

$ |

4,504 |

|

|

$ |

4,132 |

|

|

$ |

8,905 |

|

|

$ |

8,147 |

|

| Stock-based compensation

expense |

|

(938 |

) |

|

|

(903 |

) |

|

|

(1,726 |

) |

|

|

(1,701 |

) |

| Non-GAAP general and

administrative |

$ |

3,566 |

|

|

$ |

3,229 |

|

|

$ |

7,179 |

|

|

$ |

6,446 |

|

| |

|

|

|

|

|

|

|

| Loss from operations |

$ |

(8,683 |

) |

|

$ |

(5,426 |

) |

|

$ |

(17,440 |

) |

|

$ |

(12,042 |

) |

| Stock-based compensation

expense |

|

4,282 |

|

|

|

3,384 |

|

|

|

7,267 |

|

|

|

5,693 |

|

| Amortization of acquired

intangible assets (1) |

|

191 |

|

|

|

120 |

|

|

|

383 |

|

|

|

239 |

|

| Non-GAAP loss from

operations |

$ |

(4,210 |

) |

|

$ |

(1,922 |

) |

|

$ |

(9,790 |

) |

|

$ |

(6,110 |

) |

| |

|

|

|

|

|

|

|

| Net loss |

$ |

(9,165 |

) |

|

$ |

(5,668 |

) |

|

$ |

(18,175 |

) |

|

$ |

(12,488 |

) |

| Stock-based compensation

expense |

|

4,282 |

|

|

|

3,384 |

|

|

|

7,267 |

|

|

|

5,693 |

|

| Amortization of acquired

intangible assets (1) |

|

191 |

|

|

|

120 |

|

|

|

383 |

|

|

|

239 |

|

| Non-GAAP net loss (2) |

$ |

(4,692 |

) |

|

$ |

(2,164 |

) |

|

$ |

(10,525 |

) |

|

$ |

(6,556 |

) |

| |

|

|

|

|

|

|

|

| Net loss per share

attributable to common stockholders, basic and diluted |

$ |

(0.26 |

) |

|

$ |

(0.18 |

) |

|

$ |

(0.52 |

) |

|

$ |

(0.39 |

) |

| Per share impacts of

adjustments to net loss (3) |

$ |

0.13 |

|

|

$ |

0.11 |

|

|

$ |

0.22 |

|

|

$ |

0.18 |

|

| Non-GAAP EPS, basic and

diluted |

$ |

(0.13 |

) |

|

$ |

(0.07 |

) |

|

$ |

(0.30 |

) |

|

$ |

(0.21 |

) |

| |

|

|

|

|

|

|

|

| Weighted average shares used

in computing per share amounts, basic and diluted |

|

35,250,157 |

|

|

|

32,258,228 |

|

|

|

34,925,800 |

|

|

|

31,940,293 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Represents the amortization expenses of our

intangible assets attributable to our acquisitions.(2) Our GAAP tax

provision is primarily related to foreign withholding taxes and

income tax in profitable foreign jurisdictions. We maintain a full

valuation allowance against our deferred tax assets in the US.

Accordingly, there is no significant tax impact associated with

these Non-GAAP adjustments.(3) Reflects the aggregate adjustments

made to reconcile Non-GAAP Net Loss to our net loss as noted in the

above table, divided by the GAAP diluted weighted average number of

shares of the relevant period.

| Free Cash

Flow |

| |

| |

Six Months Ended June 30, |

| |

2023 |

|

2022 |

| |

(in thousands) |

|

Net cash used in operating activities |

$ |

(9,944 |

) |

|

$ |

(1,163 |

) |

| Less: |

|

|

|

| Purchases of property and

equipment |

|

(735 |

) |

|

|

(205 |

) |

| Free cash flow |

$ |

(10,679 |

) |

|

$ |

(1,368 |

) |

| Net cash provided by (used in)

investing activities |

$ |

371 |

|

|

$ |

(725 |

) |

| Net cash used in financing

activities |

$ |

(1,128 |

) |

|

$ |

(2,636 |

) |

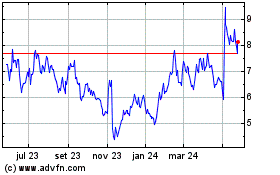

Arteris (NASDAQ:AIP)

Gráfico Histórico do Ativo

De Abr 2024 até Mai 2024

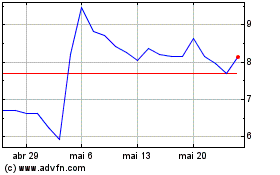

Arteris (NASDAQ:AIP)

Gráfico Histórico do Ativo

De Mai 2023 até Mai 2024