AirBoss of America Corp. (TSX: BOS)(OTCQX:ABSSF) (the “Company” or

“AirBoss”) today announced its second-quarter results. The Company

will host a conference call and webcast to discuss the results on

August 10th at 9 a.m. (ET), the details of which are outlined

below. All dollar amounts are shown in thousands of United States

dollars ("U.S. $" or "$"), except per share amounts, unless

otherwise noted.

Recent Highlights

- Awarded a contract for AirBoss Defense Group’s (“ADG”) AirBoss

Molded Glove (“AMG”), expected to be worth up to an aggregate

amount of $18.5 million over a term of three years;

- ADG reselected by a partner nation to supply its Bandolier

multipurpose line charge system, expected to be worth $3.8 million

over a period of 12 months;

- Cash from operations increased by $7.0 million to $16.9 million

for the three-month period ended June 30, 2023 ("Q2 2023”) vs. the

three-month period ended June 30, 2022 (“Q2 2022”); and

- Declared a quarterly dividend of C$0.10 per common share.

“AirBoss experienced stable consolidated sales

levels and volume recovery in certain segments as compared to last

year, however an unfavorable product mix and elevated operating

expenses had a negative impact on profitability for Q2 2023. From a

market demand perspective, some of the improvements we saw toward

the latter part of Q1 2023 continued through this quarter, but

customer volumes remained below those experienced in 2022,

especially within Rubber Solutions and AirBoss Defense Group.

Within Rubber Solutions, we were able to successfully offset

reduced sales volumes with improved margin contributions resulting

from past investments in production automation. Our Engineered

Products business segment continued to deliver strong performance,

supported by our past investments in automation and elevated demand

across several customer categories,” stated Chris Bitsakakis,

President and Co-CEO of AirBoss. “In addition, solid free cash flow

generation of $19.7 million year-to-date in 2023 has allowed us to

continue to strategically invest in the business while reducing our

net debt levels, which have declined by over $14.6 million since

the beginning of 2023.”

“Within ADG, delays in converting sales

opportunities from our expanded survivability solutions platform

have led us to put a series of measures in place to reduce costs

and streamline our operations,” noted Gren Schoch, Chairman and

Co-CEO of AirBoss. “We remain confident that our capabilities to

deliver against awarded as well as future agreements remain strong.

Our recent announcement of new contracts for our AirBoss Molded

Glove and Bandolier line charge system demonstrate the diversity of

ADG’s lineup of survivability solutions.”

| |

|

|

| |

Three-months ended

June 30 |

Six-months ended

June 30 |

| In thousands

of US dollars, except share data |

|

|

|

(unaudited) |

2023 |

2022 |

2023 |

2022 |

|

Financial results: |

|

|

|

|

| Net

sales |

114,058 |

110,547 |

231,134 |

255,020 |

| Profit

(loss) |

(2,613) |

2,492 |

(1,158) |

12,068 |

| Adjusted

profit1 |

(2,613) |

2,492 |

(1,042) |

12,068 |

| Earnings per

share (US$) |

|

|

|

|

| –

Basic |

(0.10) |

0.09 |

(0.04) |

0.45 |

| –

Diluted |

(0.10) |

0.09 |

(0.04) |

0.43 |

| Adjusted

earnings per share1 (US$) |

|

|

|

|

| – Basic |

(0.10) |

0.09 |

(0.04) |

0.45 |

| –

Diluted |

(0.10) |

0.09 |

(0.04) |

0.43 |

| EBITDA1 |

5,167 |

10,460 |

15,335 |

30,155 |

| Adjusted

EBITDA1 |

5,167 |

10,460 |

15,487 |

30,155 |

| Net cash

provided by operating activities (used in) |

16,897 |

9,878 |

22,899 |

(22,808) |

| Free cash

flow1 |

14,540 |

7,727 |

19,721 |

(27,100) |

| Dividends

declared per share (CAD$) |

0.10 |

0.10 |

0.20 |

0.20 |

| Capital

additions |

2,410 |

2,155 |

3,515 |

4,296 |

|

Financial position: |

June 30, 2023 |

|

|

December

31, 2022 |

| Total

assets |

414,044 |

|

|

440,766 |

| Debt2 |

128,342 |

|

|

143,642 |

| Net

Debt1 |

95,498 |

|

|

110,083 |

|

Shareholders’ equity |

192,513 |

|

|

196,997 |

| Outstanding

shares (#) * |

27,130,556 |

|

|

27,092,041 |

|

*27,130,556 at August 9, 2023 |

|

|

|

|

1 See Non-IFRS and Other Financial Measures. 2

Debt as at June 30, 2023 and December 31, 2022 include lease

liabilities of $14,108 and $15,007, respectively.

Financial Results

Consolidated net sales for Q2 2023 increased by

3.2% to $114,058 compared to Q2 2022. The increase was primarily

attributable to higher sales at Engineered Products, partially

offset by lower volume at Rubber Solutions. Consolidated net sales

for 2023 year-to-date decreased by 9.4% to $231,134 compared with

2022 year-to-date primarily due to lower sales at AirBoss Defense

Group and Rubber Solutions partially offset by strong sales growth

at Engineered Products.

Consolidated gross profit for Q2 2023 increased

by $2,786 to $17,586, compared with Q2 2022, driven primarily by

improvements in volumes at Engineered Products offset by reductions

at ADG related to unfavorable product mix in its traditional molded

defense products and softness in its industrial line of business as

well as a modest reduction at Rubber Solutions. Gross profit as a

percentage of net sales increased to 15.4% in Q2 2023 compared with

13.4% for Q2 2022, primarily due to improvements at Engineered

Products and improvements at Rubber Solutions driven by favorable

mix, offset by significant reductions at ADG driven by unfavorable

product mix. Consolidated gross profit for 2023 year-to-date

decreased by $6,878 to $39,523 compared with 2022 year-to-date,

driven by lower volume at ADG due to the completion of the large

HHS nitrile examination glove order in the comparable period of

2022, partially offset by improved margins at Engineered Products.

Gross profit as a percentage of net sales decreased to 17.1% for

2023 year-to-date compared with 18.2% for 2022 year-to-date. These

decreases were primarily a result of product mix and lower margin

at ADG driven by volume from the large HHS nitrile examination

glove order completed in the early part of the comparable period in

2022, offset by significant improvements at Engineered Products

driven by volume and operational improvements, and modest

improvements at Rubber Solutions.

Adjusted EBITDA for Q2 2023 decreased by 50.6%

compared to Q2 2022 and decreased by 48.6% for the six-month period

ended June 30, 2023 compared with the six-month period ended June

30, 2022.

Financial Position

The Company retains a $250 million credit

facility and a net debt to trailing twelve-month Adjusted EBITDA

ratio of 3.11x.

Dividend

The Board of Directors of the Company has

approved a quarterly dividend of C$0.10 per common share, to be

paid on October 16, 2023 to shareholders of record at September 30,

2023.

Segment Results

Net sales in the AirBoss Defense Group segment

increased by 0.6% to $26,003 for Q2 2023 from $25,839 in Q2 2022

and decreased by 39.1% to $54,646 for 2023 year-to-date, from

$89,801 for 2022 year-to-date. For the quarter, the increase was

primarily the result of modest increases in volume for certain

molded defense products. Year-to-date, the decrease was

primarily the result of the completion of the large HHS nitrile

examination glove order in the comparable period of 2022, in

addition to softness experienced in the molded defense products and

the industrial lines of business. Gross profit at ADG decreased by

56.6% to $4,230 for the quarter and by 65.3% to $12,978,

year-to-date, from the comparable periods in 2022. The decrease in

gross profit for Q2 2023 was primarily due to unfavorable mix and

higher overhead costs. The decrease in gross profit year-to-date

was primarily due to lower volume primarily driven by the large HHS

nitrile examination glove order delivered in the same period in

2022.

In the Rubber Solutions segment, net sales for

Q2 2023 decreased by 8.5% to $57,786 from $63,180 and by 5.8% to

$112,940 from $119,887 year-to-date from the comparable periods in

2022. For Q2 2023, volume was down 18.8% with decreases across the

vast majority of sectors due to decreased momentum at most

customers’ operations although there was some traction from the

softness experienced in the prior quarter. Year-to-date, volume was

down 21.4% with decreases across the majority of sectors and

continued signs of softness with many customer’s operations.

Tolling volume was down by 56.4% for the quarter and 68.6%

year-to-date, and non-tolling volume was down by 9.2% for the

quarter and 9.1% year to date, from the comparable periods in 2022.

Gross profit in the Rubber Solutions segment decreased by 1.7% to

$9,627 for the quarter and by 3.3% to $17,211 year-to-date, from

the comparable periods in 2022. For the quarter, this was primarily

the result of volume reductions and product mix partially offset by

managing controllable overhead costs and driving continuous

improvement initiatives. Year to date, the decrease in gross profit

was primarily as a result of decreased tolling and non-tolling

volumes compared to the same period in 2022, partially offset by

managing controllable overhead costs.

At Engineered Products, net sales in the quarter

increased by 40.3% to $37,651 and by 38.6% to $78,566 year-to-date

from the comparable periods in 2022. For the quarter, the increase

was due to higher volumes and favorable mix in SUV and light truck

platforms despite some economic headwinds which continue to impact

production schedules across certain OEMs and Tier 1 suppliers.

Year-to-date, the increase was due to stronger volumes in the SUV,

light truck and mini-van platforms compared to the same period in

the prior year and was further supported by the ongoing

collaboration with key suppliers and customers resulting in

improved revenue. Gross profit in the Engineered Products segment

for Q2 2023 increased to $3,729 from $(4,745) in Q2 2022 and to

$9,334 for 2023 year-to-date from $(8,823) for 2022 year-to-date.

For the quarter, this was primarily a result of improved

arrangements with key suppliers and customers, favorable volume and

product mix in the automotive sector in addition to operational

cost improvements and reduced overhead costs. Year-to-date, the

increase in gross profit was primarily a result of improved

arrangements with key suppliers and customers with a continued

focus on controllable operational cost containment and managing

overhead costs.

Overview

During Q2 2023, AirBoss remained focused on

operational execution, growth initiatives and key investments

despite continued economic headwinds. AirBoss Engineered Products

(“AEP”) maintained strong traction, as the segment continued to

build on momentum established in the prior quarter with key

suppliers and customers to strengthen its financial position for

long term sustainability. AirBoss Rubber Solutions (“ARS”) saw some

progressive traction in demand compared to the prior quarter,

specifically in volumes, although residual softness was still

present. ADG experienced some contraction in its industrial and

defense businesses with continued efforts focused on strategic

priorities to support conversion of sales opportunities in the

coming quarters. The Company navigated ongoing economic impacts

being experienced to varying degrees in each segment. Labor,

logistics challenges and the availability of raw materials continue

to create challenges that each segment is working through to

support stability moving forward. Recovery in volumes in 2023 for

each segment remains subject to the ongoing management of stable

and sustained operations of businesses globally, which remains

complex and volatile, with ongoing challenges such as continued

inflation pressure and global conflicts, as well as successful

conversion of sales opportunities.

The Rubber Solutions segment saw modest

improvements in demand during the quarter and while it was a marked

improvement over the prior quarter, it was still below the same

quarter in the prior year. Despite the economic pressures

previously noted, the segment continues to execute on its strategy

of delivering strong results with specialty products and fulfilling

new business through identified synergies and margin expansion. As

a segment, Rubber Solutions continued to invest in research and

development to support enhanced collaboration with customers and

remained focused on expanding on Ace Elastomer’s (“Ace”)

specialized products into its wide range of solutions.

ADG experienced residual softness in its

industrial and defense businesses, making for a challenging

quarter. As a result of this and the delay in converting

opportunities, ADG has taken a series of cost cutting measures

across the organization including a reduction in its workforce. The

changes are intended to streamline this segment given reduced

activity. ADG remains focused on its survivability solutions

platform while targeting traditional defense contracts, which

management is focused on converting over the next several years. In

addition, ADG continues to work with its key customers to leverage

the opportunities in its pipeline, as was evidenced with the recent

award of the AMG gloves and Bandolier opportunities. Conversion of

pipeline opportunities remained subject to timing as delays are

expected to continue through the next few quarters. In particular,

execution of the previously announced awards for Husky 2G vehicles

has been delayed further due to ongoing global challenges, and

management now anticipates execution of those orders to commence in

early 2024.

Within the Engineered Products segment, the

momentum generated in the prior quarter continued through this

quarter, despite ongoing challenges of raw material availability,

supply chain challenges and production volatility by the original

equipment manufacturers (OEMs). The segment continued to execute on

its financial sustainability plan and work with key suppliers and

customers to deliver improved financial results in the quarter

versus the same quarter in the prior year. Management also

continued to focus on operational improvements including managing

variable costs and sustaining a stable hourly workforce, while

dealing with volume volatility in the automotive sector and

specifically on AEP’s products for SUV, light truck and mini-van

platforms. The segment also continued its focus and commitment to

drive efficiencies and best-in-class automation, as well as

diversification of its product lines into sectors adjacent to the

automotive space.

Despite the continued headwinds associated with

economic and geopolitical issues, the Company’s longer-term

priorities remain intact and include:

- Growing the core Rubber Solutions segment by

positioning it as a specialty supplier of choice in the

consolidating North American market, with a growing focus on

building defensible leadership positions in selected

compounds;

- Capitalizing on ADG’s scale and capabilities

to pursue an array of growth and value-creation opportunities in

the broader survivability solutions segment serving both defense

and first responder markets;

- Driving improved performance from Engineered

Products through a combination of disciplined cost

containment, client relationship expansion, new product development

and sector diversification; and

- Targeting additional acquisition opportunities across

the business with a focus on adding new compounds and

products, technical capabilities, and geographic reach into

selected North American and international markets.

As before, management remains dedicated to the

creation of long-term value for all stakeholders through a

combination of strategic initiatives that both drive organic growth

and support possible transactions.

Conference Call Details and Investor

Presentation

A conference call to discuss the quarterly

results is scheduled for 9:00 a.m. ET on Thursday, August 10, 2023.

Please go to https://www.gowebcasting.com/12647 or dial in to the

following numbers: 1-800-898-3989 or 416-406-0743, pass code:

6965982#. Please connect approximately 10 minutes prior to the call

to ensure participation. A replay of the conference call as well as

the Company’s updated investor presentation will also be made

available at: https://airboss.com/investor-media-center.

Investor Contact:

investor.relations@airboss.com

Media Contact:

media@airboss.com

AirBoss of America Corp.

AirBoss of America is a leading and diversified

developer, manufacturer and provider of innovative survivability

solutions, advanced custom rubber compounds and finished rubber

products that are designed to outperform in the most challenging

environments. Founded in 1989, the company operates through three

divisions. AirBoss Defense Group is a global leader in personal and

respiratory protective equipment and technology for the defense,

healthcare, medical and first responder communities. AirBoss Rubber

Solutions is a top-tier North American custom rubber compounder

with 500 million turn pounds of annual capacity. AirBoss Engineered

Products is a supplier of innovative anti-vibration solutions to

the North American automotive market and other sectors. The

Company’s shares trade on the TSX under the symbol BOS and on the

OTCQX under the symbol ABSSF. Visit www.airboss.com for more

information.

Non-IFRS and Other Financial

Measures

This earnings release is based on financial

statements prepared in accordance with International Financial

Reporting Standards (“IFRS”) and Non-IFRS Financial Measures.

Management believes that these measures provide useful information

to investors in measuring the financial performance of the Company.

These measures do not have a standardized meaning prescribed by

IFRS and therefore they may not be comparable to similarly titled

measures presented by other companies and should not be construed

as an alternative to other financial measures determined in

accordance with IFRS. These terms are not measures of performance

under IFRS and should not be considered in isolation or as a

substitute for net income under IFRS.

EBITDA and Adjusted EBITDA are non-IFRS measures

used to measure the Company's ability to generate cash from

operations for debt service, to finance working capital and capital

expenditures, potential acquisitions and to pay dividends. EBITDA

is defined as earnings before income taxes, finance costs,

depreciation, amortization, and impairment costs. Adjusted EBITDA

is defined as EBITDA excluding acquisition costs, and non-recurring

costs. A reconciliation of Profit to EBITDA and Adjusted EBITDA is

below.

| |

|

|

| |

Three-months ended

June 30 |

Six-months ended

June 30 |

|

|

(unaudited) |

(unaudited) |

|

In thousands of US dollars |

2023 |

2022 |

2023 |

2022 |

|

EBITDA: |

|

|

|

|

| Profit

(loss) |

(2,613) |

2,492 |

(1,158) |

12,068 |

| Finance

costs |

2,613 |

1,533 |

5,342 |

2,485 |

|

Depreciation, amortization and impairment |

5,734 |

5,492 |

11,271 |

10,989 |

|

Income tax expense (recovery) |

(567) |

943 |

(120) |

4,613 |

|

EBITDA |

5,167 |

10,460 |

15,335 |

30,155 |

| Professional

fees related to AEP Negotiations |

— |

— |

152 |

— |

|

Adjusted EBITDA |

5,167 |

10,460 |

15,487 |

30,155 |

| |

|

|

|

|

Adjusted profit is a non-IFRS measure defined as

profit before acquisition costs and non-recurring costs. This

measure and Adjusted earnings per share are used to evaluate

operating results of the Company. A reconciliation of Profit to

Adjusted profit and Adjusted earnings per share is below.

| |

|

|

| |

Three-months ended

June 30 |

Six-months ended

June 30 |

|

|

(unaudited) |

(unaudited) |

|

In thousands of US dollars |

2023 |

2022 |

2023 |

2022 |

|

Adjusted profit: |

|

|

|

|

| Profit

(loss) |

(2,613) |

2,492 |

(1,158) |

12,068 |

| Professional

fees related to AEP negotiations (after tax) |

— |

— |

116 |

— |

|

Adjusted profit |

(2,613) |

2,492 |

(1,042) |

12,068 |

|

|

|

|

|

|

| Basic

weighted average number of shares outstanding |

27,117 |

27,092 |

27,104 |

27,049 |

| Diluted

weighted average number of shares outstanding |

27,117 |

28,193 |

27,104 |

28,225 |

| Adjusted

earnings per share (in US dollars): |

|

|

|

|

| Basic |

(0.10) |

0.09 |

(0.04) |

0.45 |

| Diluted |

(0.10) |

0.09 |

(0.04) |

0.43 |

| |

|

|

|

|

Net Debt measures the financial indebtedness of

the Company assuming that all cash on hand is used to repay a

portion of the outstanding debt. A reconciliation of loans and

borrowings to Net Debt is below.

|

|

|

|

| |

June 30,

2023 |

December 31,

2022 |

|

In thousands of US dollars |

(unaudited) |

|

|

Net debt: |

|

|

| Loans and

borrowings - current |

2,345 |

2,286 |

| Loans and

borrowings - non-current |

125,997 |

141,356 |

| Leases

included in loans and borrowings |

(14,108) |

(15,007) |

|

Cash and cash equivalents |

(18,736) |

(18,552) |

|

Net debt |

95,498 |

110,083 |

| |

|

|

The Company has a Net Debt to trailing

twelve-month Adjusted EBITDA ratio of 3.11x (December 31, 2022:

2.43x).

Free cash flow is a non-IFRS measure used to

evaluate cash flow after investing in the maintenance or expansion

of the Company's business. It is defined as cash provided by

operating activities, less cash expenditures on long-term assets. A

reconciliation of cash from operating activities to free cash flow

is below.

| |

|

|

| |

Three-months ended

June 30 |

Six-months ended

June 30 |

|

|

(unaudited) |

(unaudited) |

|

In thousands of US dollars |

2023 |

2022 |

2023 |

2022 |

|

Free cash flow: |

|

|

|

|

| Net cash

provided by (used in) operating activities |

16,897 |

9,878 |

22,899 |

(22,808) |

| Acquisition

of property, plant and equipment |

(2,033) |

(1,923) |

(2,602) |

(3,757) |

| Acquisition

of intangible assets |

(324) |

(228) |

(576) |

(535) |

|

Free cash flow |

14,540 |

7,727 |

19,721 |

(27,100) |

|

|

|

|

|

|

| Basic

weighted average number of shares outstanding |

27,117 |

27,092 |

27,104 |

27,049 |

| Diluted

weighted average number of shares outstanding |

27,524 |

28,193 |

27,597 |

27,049 |

| Free cash

flow per share (in US dollars): |

|

|

|

|

| Basic |

0.54 |

0.29 |

0.73 |

(1.00) |

| Diluted |

0.53 |

0.27 |

0.71 |

(1.00) |

| |

|

|

|

|

AIRBOSS FORWARD LOOKING INFORMATION DISCLAIMER

Statements containing forward-looking

information are necessarily based upon a number of opinions,

estimates and assumptions that, while considered reasonable by

management at the time the statements are made, are inherently

subject to significant business, economic and competitive risks,

uncertainties and contingencies. AirBoss cautions that such

forward-looking information involves known and unknown

contingencies, uncertainties and other risks that may cause

AirBoss’ actual financial results, performance or achievements to

be materially different from its estimated future results,

performance or achievements expressed or implied by the

forward-looking information. Numerous factors could cause actual

results to differ materially from those in the forward-looking

information, including without limitation: impact of general

economic conditions, notably including their impact on demand for

rubber solutions and products; dependence on key customers; global

defense budgets, notably in the Company’s target markets, and

success of the Company in obtaining new or extended defense

contracts; cyclical trends in the tire and automotive,

construction, mining and retail industries; sufficient availability

of raw materials at economical costs; weather conditions affecting

raw materials, production and sales; AirBoss’ ability to maintain

existing customers or develop new customers in light of increased

competition; AirBoss’ ability to successfully integrate

acquisitions of other businesses and/or companies or to realize on

the anticipated benefits thereof; changes in accounting policies

and methods, including uncertainties associated with critical

accounting assumptions and estimates; changes in the value of the

Canadian dollar relative to the US dollar; changes in tax laws;

current and future litigation; ability to obtain financing on

acceptable terms; environmental damage and non-compliance with

environmental laws and regulations; impact of global health

situations; potential product liability and warranty claims and

equipment malfunction. This list is not exhaustive of the factors

that may affect any of AirBoss’ forward-looking information.

All of the forward-looking information in this

press release is expressly qualified by these cautionary

statements. Investors are cautioned not to put undue reliance on

forward-looking information. All subsequent written and oral

forward-looking information attributable to AirBoss or persons

acting on its behalf are expressly qualified in their entirety by

this notice. Forward-looking information contained herein is made

as of the date of this Interim Report and, whether as a result of

new information, future events or otherwise, AirBoss disclaims any

intent or obligation to update publicly the forward-looking

information except as required by applicable laws. Risks and

uncertainties about AirBoss’ business are more fully discussed

under the heading “Risk Factors” in our most recent Annual

Information Form and are otherwise disclosed in our filings with

securities regulatory authorities which are available on SEDAR+ at

www.sedarplus.com.

Investor Contact: investor.relations@airboss.com

Media Contact: media@airboss.com

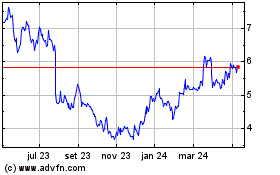

AirBoss of America (TSX:BOS)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

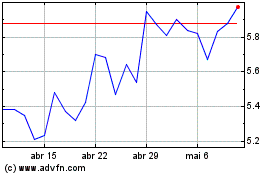

AirBoss of America (TSX:BOS)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025