Victoria Gold Corp. (TSX-VGCX) (“Victoria” or the “Company”)

provides an update on operations along with its second quarter 2023

summary financial and operating results.

Due to fire activity in the area of the Eagle

Gold mine, specifically, the East McQuesten wildfire, the operation

was partially evacuated on July 30, 2023. Progress was made in

managing the fire and, on August 1, 2023, employees returned to

work at the Eagle Gold mine. On August 4, 2023, the fire again

approached the Eagle Gold mine and employees were evacuated for a

second time. The danger to the Eagle mine site posed by the fire

has since subsided and the Company is in the process of

remobilizing employees back to site. It is expected that the mine

will be back to full operation soon. As a result of a separate

fire, the Talbot Creek Fire, the nearby Village of Mayo has

been evacuated. The Company’s Eagle Gold mine remobilization

activities will take into consideration the evolving situation in

Mayo. Having just went through the challenging and stressful task

of evacuating a large group of people, our thoughts are certainly

with the Mayo community.

The Company will host a video conference call on

Thursday, August 10th at 8:30am PST (11:30am EST) to discuss the

second quarter 2023 results (call-in details are provided at the

end of this news release).

The Company uses certain non-IFRS performance

measures throughout this news release. Please refer to the

“Non-IFRS Performance Measures” section of this news release for

more information. All currency figures are in Canadian $ unless

otherwise indicated.

This release should be read in conjunction with

the Company’s Financial Statements and Management’s Discussion and

Analysis (“MD&A”) for the three and six months ended June 30,

2023 and 2022, available on the Company’s website or on

SedarPlus.

|

Second Quarter 2023 Highlights |

|

|

Gold produced |

45,568 ounces |

|

Average gold price realized |

C$ 2,660 |

|

Revenue (000s) |

C$ 118,803 |

|

Gross Profit (000s) |

C$ 24,633 |

|

Net Income (000s) |

C$ 15,962 |

|

Earnings per share – Basic |

C$ 0.24 |

|

EBITDA (000s) |

C$ 52,338 |

“Record second quarter gold production in 2023

is testament to the success of operational improvement initiatives

implemented over the past few quarters. While earnings and cash

flows are higher quarter over quarter and year over year, we are

focused on further improvements. Several cost savings initiatives

are underway which have the potential to grow earnings and cash

flows going forward,” noted Mr. John McConnell, President and

CEO.

Operational highlights – Second Quarter

2023

- Mine production was 2.4 million tonnes (“t”)

of ore in the quarter.

- Ore stacked on the heap leach facility (‘HLF”)

in the quarter was 2.5 million tonnes at an average grade of 0.74

grams per tonne (“g/t”).

- Gold production was 45,568 ounces (“oz”) in

the quarter.

Financial highlights – Second Quarter

2023

- Gold sold in the quarter was 44,710 oz, at an

average realized price1 of $2,660 (US$1,981) per oz.

- Recognized revenue was $118.8 million based on

sales of 44,710 oz of gold in the quarter.

- Operating earnings were $22.4 million in the

quarter.

- Net income was $16.0 million, or $0.24 per

share on a basic basis and $0.24 per share on a diluted basis for

the quarter.

- Cash costs1 were US$1,253 per oz of gold sold

in the quarter.

- All-in sustaining costs (“AISC”)1 were

US$1,466 per oz of gold sold in the quarter.

- EBITDA1 were $52.3 million in the quarter, or

$0.79 per share1 in the quarter.

- Free cash flow1 before adjustments was $14.2

million in the quarter.

- Adjusted free cash flow1 was a deficiency of

$13.5 million in the quarter.

- Cash and cash equivalents

were $27.5 million at June 30, 2023.

________________________1 Refer to the “Non-IFRS Performance

Measures” section.

Second Quarter and First Half-Year 2023

Operating Results

|

|

THREE MONTHS ENDED |

SIX MONTHS ENDED |

|

|

June 30, 2023 |

June 30, 2022 |

June 30, 2023 |

June 30,

2022 |

|

Operating data |

|

|

|

|

|

|

Ore mined |

t |

2,351,471 |

2,167,250 |

4,503,275 |

3,495,273 |

|

Waste mined |

t |

2,146,292 |

2,162,172 |

5,219,514 |

4,437,066 |

|

Total mined |

t |

4,497,763 |

4,329,422 |

9,722,789 |

7,932,339 |

|

Strip ratio |

w:o |

0.91 |

1.00 |

1.16 |

1.27 |

|

Mining rate |

tpd |

49,426 |

47,576 |

53,717 |

43,825 |

|

Ore stacked on pad |

t |

2,512,798 |

2,303,776 |

4,607,539 |

3,185,191 |

|

Ore stacked grade |

g/t Au |

0.74 |

0.85 |

0.80 |

0.81 |

|

Throughput (stacked) |

tpd |

27,613 |

25,316 |

25,456 |

17,598 |

|

Gold ounces produced |

oz |

45,568 |

32,055 |

83,188 |

56,413 |

|

Gold ounces sold |

oz |

44,710 |

28,580 |

82,911 |

54,098 |

Notes - Strip ratio: waste to ore (“w:o”)

Mining rate: tonnes per

day (“tpd”)

Gold production and sales

During the three months ended June 30, 2023, the Eagle Gold Mine

produced 45,568 ounces of gold, compared to the 32,055 ounces of

gold production in Q2 2022. The 42% increase in gold production is

attributed to year-round stacking and improved heap leach pad

operations over the winter period in 2023 and higher gold inventory

on the heap leach pad.

During the three months ended June 30, 2023, the

Company sold 44,710 ounces of gold, compared to the 28,580 gold

ounces sold in Q2 2022. The 56% increase in gold sold is the result

of increased gold production.

Mining During the three months

ended June 30, 2023, a total of 2.4 million tonnes of ore was

mined, at a waste to ore strip ratio of 0.91:1 with a total of 4.5

million tonnes of material mined. In comparison, a total of 2.2

million tonnes of ore was mined, at a strip ratio of 1.00:1 with a

total of 4.3 million tonnes of material mined for the prior

comparable period in 2022. Total tonnes mined were 4% higher during

the three months ended June 30, 2023.

During three months ended June 30, 2023, mining

rates, waste movement and the resultant strip ratio were lower than

expected due to mine sequencing which led to longer haul distances

and fewer active mining faces. During the remainder of 2023, haul

distances are expected to be shorter and active mining faces are

expected to increase leading to increased waste movement and strip

ratio.

Processing During the three

months ended June 30, 2023, a total of 2.5 million tonnes of ore

was stacked on the HLF at a throughput rate of 27.6 k tpd. A total

of 2.3 million tonnes of ore was stacked on the HLF at a throughput

rate of 25.3 k tpd for the prior comparable period in 2022. Ore

stacked on the HLF increased by 9% for the three months ended June

30, 2023 as incremental improvements to the reliability of the

material handling circuit have been realized.

Ore stacked for the quarter had an average grade

of 0.74 g/t Au, compared to 0.85 g/t Au in the prior comparable

period in 2022 in line with the Eagle mine plan. Reconciliation

versus the Eagle reserve model remains strong.

During the three months ended June 30, 2023, the

Company focused on several fixed plant maintenance programs. These

programs were successful in improving preventative maintenance

activities but did incur excess costs for parts and

contractors.

As at June 30, 2023, the Company estimates there

are 100,136 recoverable oz within mineral inventory.

Capital The Company incurred a

total of $17.6 million in capital expenditures during the three

months ended June 30, 2023:

- sustaining capital of $9.0 million, including:

- scheduled capital component rebuilds on mobile mining fleet of

$3.6 million,

- upgrades and capital component rebuilds on material handling

system of $3.1 million,

- purchases of additional mining fleet equipment of $1.2 million,

and

- other ongoing sustaining capital initiatives of $1.1

million;

- $5.8 million spend on growth capital expenditures (primarily

due to heap leach pad expansion);

- capitalized stripping activities of $1.4 million, and;

- $1.4 million adjustment to the Company’s asset retirement

obligation during the quarter.

Second Quarter and First Half-Year 2023

Financial Results

|

Expressed in 000s, except per share amounts |

THREE MONTHS ENDED |

SIX MONTHS ENDED |

|

|

June 30, 2023 |

June 30, 2022 |

June 30, 2023 |

June 30, 2022 |

|

Financial data |

|

|

|

|

|

|

Revenue |

$ |

118,803 |

69,381 |

215,352 |

128,834 |

|

Gross profit |

$ |

24,633 |

22,865 |

45,618 |

49,161 |

|

Net income |

$ |

15,962 |

17,124 |

16,946 |

33,169 |

|

Earnings per share – Basic |

$ |

0.24 |

0.27 |

0.26 |

0.52 |

|

Earnings per share - Diluted |

$ |

0.24 |

0.25 |

0.26 |

0.49 |

|

Expressed in 000s, except per share amounts |

|

As at June 30, 2023 |

As at December 31, 2022 |

|

Financial position |

|

|

|

|

Cash and cash equivalents |

$ |

27,544 |

20,572 |

|

Working capital |

$ |

156,746 |

94,687 |

|

Property, plant and equipment |

$ |

668,361 |

670,813 |

|

Total assets |

$ |

1,010,151 |

1,016,806 |

|

Long-term debt |

$ |

200,169 |

184,512 |

Revenue For the three months

ended June, 2023, the Company recognized revenue of $118.8 million

compared to $69.4 million for the previous year’s comparable

period. The increase in revenue is attributed to a higher average

realized price, a higher number of gold oz sold and a higher C$/US$

exchange rate. Revenue is net of treatment and refining charges,

which were $0.5 million for the three months ended June 30, 2023.

The Company sold 44,710 oz of gold at an average realized price of

$2,660 (US$1,981) (see “Non-IFRS Performance Measures” section),

compared to 28,580 oz at an average realized price of $2,427

(US$1,901) (see “Non-IFRS Performance Measures” section), in the

second quarter of 2022.

Cost of goods sold Cost of

goods sold was $75.3 million for the three months ended June 30,

2023 compared to $30.3 million for the previous year’s comparable

period. The increase in cost of goods sold is attributed to the

higher number of gold ounces sold combined with a higher average

cost per ounce of gold within inventory. The average cost per ounce

of gold in inventory is higher in the current quarter due to

inflation combined with higher production costs per ounce compared

to the prior comparable quarter.

Depreciation and depletion

Depreciation and depletion was $18.9 million for the three months

ended June 30, 2023 compared to $16.2 million for the previous

year’s comparable period. Assets are depreciated on a straight-line

basis over their useful life, or depleted on a units-of-production

basis over the reserves to which they relate.

Liquidity and Capital Resources

At June 30, 2023, the Company had cash and cash equivalents of

$27.5 million (December 31, 2022 - $20.6 million) and a working

capital surplus of $156.7 million (December 31, 2022 – $94.7

million surplus). The increase in cash and cash equivalents of $7.0

million over the year ended December 31, 2022, was due to operating

activities ($37.9 million increase in cash) primarily from

operating cash flow before working capital adjustments, and

financing activities ($26.3 million increase in cash) from draws

made on credit facilities and long-term debt and exercises of stock

options and warrants. This is partially offset by investing

activities ($57.2 million decrease in cash) primarily from the

settlement of gold call options and capital expenditures incurred

at the Eagle Gold Mine.

2023 Outlook Note that cost

information in this Outlook section, including AISC1 and capital,

are in US currency to allow for ease of comparison with our peers,

who often report in US currency.

2023 Production Guidance remains intact at the

Eagle Gold Mine and is estimated to be between 160,000 and 180,000

ounces of gold.

Prior to the impacts of the East McQuesten

wildfire, which led to the evacuation of the Eagle mine site in

late July and early August, the Company expected to achieve annual

production toward the top end of the Guidance range. After

considering the impact of the evacuation, the Company expects

production to be closer to the lower end of the Guidance range.

Should wildfire activity in the Yukon cause further disruption to

the Eagle mine site, the Company may need to revise Production

Guidance.

The seasonality experienced in 2021 and 2022,

where gold production was lower in the first half of the year

compared to the last half of the year, has been reduced in 2023 as

the Company has successfully demonstrated the feasibility of

year-round stacking on the heap leach pad. Seasonality is further

moderated as gold ounces in inventory, primarily on the heap leach

pad, is higher than in previous years and regularly scheduled

maintenance periods, which were previously weighted to the first

quarter, are now spread over the year.

Cost Guidance for 2023 remains intact and AISC1

are expected to be between US$1,350 and US$1,550 per oz of gold

sold.

As a result of the East McQuesten wildfire and

resulting mine site evacuation, the Company expects AISC1 to be

near the top end of the Guidance range. Should wildfire activity in

the Yukon cause further disruption to the Eagle mine site, the

Company may need to revise Cost Guidance.

Sustaining capital, not including waste

stripping, is estimated at C$30 million (US$23 million) for 2023.

Sustaining capital during 2023 is materially lower than previous

years due to the absence of major one-time infrastructure

construction (water treatment plant in 2022 and truck shop in

2021). Major items included in 2023 sustaining capital include

mobile equipment rebuilds and fixed maintenance rebuilds.

Capitalized waste stripping is estimated at C$35

million (US$26 million). This is lower than previously estimated

(C$50 million) due to timing of waste mining. Capitalized waste

stripping is included in AISC1 but is not included in the

sustaining capital above. Waste stripping is expensed or

capitalized based on the actual quarterly stripping ratio versus

the expected life of mine stripping ratio and may be quite variable

quarter over quarter and year over year.

Growth capital related to Eagle Gold Mine

expansion initiatives is estimated at C$15 million (US$11 million)

for 2023 and includes heap leach pad expansion. In addition, growth

exploration spending in 2023 is estimated to be C$10 million (US$8

million).

Qualified Person The technical

content of this news release has been reviewed and approved by Paul

D. Gray, P.Geo, as the “Qualified Person” as defined in National

Instrument 43-101 - Standards of Disclosure for Mineral

Projects.

Video Conference Call

Details

The video conference call to discuss the 2023

second quarter operating and financial results and updates will

take place on Thursday, August 10, 2023 at 8:30am PST

(11:30am EST).

Zoom Video Conference Details

Victoria Gold Corp invites you to join the video conference via

Zoom.

Join Zoom Meeting

https://us02web.zoom.us/j/87317642031?pwd=Zk9pdEFGQlFFUG4yRUcyTlYyMnlqdz09

Meeting ID: 873 1764 2031 One tap mobile

+16892781000,,87317642031#,,,,*933078# US

+17193594580,,87317642031#,,,,*933078# US

Find your local number:

https://us02web.zoom.us/u/kp77hA9NE

A playback version will be available following the

call on the Company’s website at www.vgcx.com

About the Dublin Gulch Property

Victoria Gold's 100%-owned Dublin Gulch gold property (the

“Property”) is situated in central Yukon Territory, Canada,

approximately 375 kilometers north of the capital city of

Whitehorse, and approximately 85 kilometers from the town of Mayo.

The Property is accessible by road year round, and is located

within Yukon Energy's electrical grid.

The Property covers an area of approximately 555

square kilometers, and is the site of the Company's Eagle and Olive

Gold Deposits. The Eagle and Olive deposits include Proven and

Probable Reserves of 2.6 million ounces of gold from 124 million

tonnes of ore with a grade of 0.65 grams of gold per tonne. The

Mineral Resource for the Eagle and Olive Gold Deposits has been

estimated to host 245 million tonnes averaging 0.59 grams of gold

per tonne, containing 4.7 million ounces of gold in the "Measured

and Indicated" category, inclusive of Proven and Probable Reserves,

and a further 36 million tonnes averaging 0.63 grams of gold per

tonne, containing 0.7 million ounces of gold in the "Inferred"

category.

Non-IFRS Performance Measures

The Company has included certain non-IFRS measures in this new

release. Refer to the Company’s MD&A for an explanation,

discussion and reconciliation of non-IFRS measures. The Company

believes that these measures, in addition to measures prepared in

accordance with International Financial Reporting Standards

(“IFRS”), provide readers with an improved ability to evaluate the

underlying performance of the Company and to compare it to

information reported by other companies. The non-IFRS measures are

intended to provide additional information and should not be

considered in isolation or as a substitute for measures of

performance prepared in accordance with IFRS. These measures do not

have any standardized meaning prescribed under IFRS, and therefore

may not be comparable to similar measures presented by other

issuers.

Cautionary Language and Forward-Looking

Statements This press release includes certain statements

that may be deemed "forward-looking statements". Except for

statements of historical fact relating to Victoria, information

contained herein constitutes forward-looking information, including

any information related to the intended use of proceeds from the

Term Facility and the Revolving Credit Facility, the amended terms

and conditions of the Loan Facility, and Victoria's strategy, plans

or future financial or operating performance. Forward-looking

information is characterized by words such as “plan”, “expect”,

“budget”, “target”, “project”, “intend”, “believe”, “anticipate”,

“estimate” and other similar words, or statements that certain

events or conditions “may”, “will”, “could” or “should” occur, and

includes any guidance and forecasts set out herein (including, but

not limited to, production and operational guidance of the

Corporation). In order to give such forward-looking information,

the Corporation has made certain assumptions about its business,

operations, the economy and the mineral exploration industry in

general, in particular in light of the impact of the novel

coronavirus and the COVID-19 disease (“COVID-19”) on each of the

foregoing. In this respect, the Corporation has assumed that

production levels will remain consistent with management’s

expectations, contracted parties provide goods and services on

agreed timeframes, equipment works as anticipated, required

regulatory approvals are received, no unusual geological or

technical problems occur, no material adverse change in the price

of gold occurs and no significant events occur outside of the

Corporation's normal course of business. Forward-looking

information is based on the opinions, assumptions and estimates of

management considered reasonable at the date the statements are

made, and are inherently subject to a variety of risks and

uncertainties and other known and unknown factors that could cause

actual events or results to differ materially from those described

in, or implied by, the forward-looking information. These factors

include the impact of general business and economic conditions,

risks related to COVID-19 on the Company, global liquidity and

credit availability on the timing of cash flows and the values of

assets and liabilities based on projected future conditions,

anticipated metal production, fluctuating metal prices, currency

exchange rates, estimated ore grades, possible variations in ore

grade or recovery rates, changes in accounting policies, changes in

Victoria's corporate resources, changes in project parameters as

plans continue to be refined, changes in development and production

time frames, the possibility of cost overruns or unanticipated

costs and expenses, uncertainty of mineral reserve and mineral

resource estimates, higher prices for fuel, steel, power, labour

and other consumables contributing to higher costs and general

risks of the mining industry, failure of plant, equipment or

processes to operate as anticipated, final pricing for metal sales,

unanticipated results of future studies, seasonality and

unanticipated weather changes, costs and timing of the development

of new deposits, success of exploration activities, requirements

for additional capital, permitting time lines, government

regulation of mining operations, environmental risks, unanticipated

reclamation expenses, title disputes or claims, limitations on

insurance coverage and timing and possible outcomes of pending

litigation and labour disputes, risks related to remote operations

and the availability of adequate infrastructure, fluctuations in

price and availability of energy and other inputs necessary for

mining operations. Although Victoria has attempted to identify

important factors that could cause actual actions, events or

results to differ materially from those described in, or implied

by, the forward-looking information, there may be other factors

that cause actions, events or results not to be anticipated,

estimated or intended. There can be no assurance that

forward-looking information will prove to be accurate, as actual

results and future events could differ materially from those

anticipated in such statements. The reader is cautioned not to

place undue reliance on forward-looking information. The

forward-looking information contained herein is presented for the

purpose of assisting investors in understanding Victoria's expected

financial and operational performance and Victoria's plans and

objectives and may not be appropriate for other purposes. All

forward-looking information contained herein is given as of the

date hereof, as the case may be, and is based upon the opinions and

estimates of management and information available to management of

the Corporation as at the date hereof. The Corporation undertakes

no obligation to update or revise the forward-looking information

contained herein and the documents incorporated by reference

herein, whether as a result of new information, future events or

otherwise, except as required by applicable laws.

For Further Information

Contact: John McConnell President & CEO Victoria Gold

Corp. Tel: 604-696-6605 ceo@vgcx.com

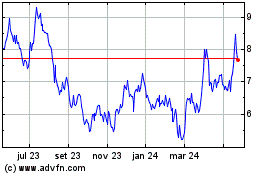

Victoria Gold (TSX:VGCX)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

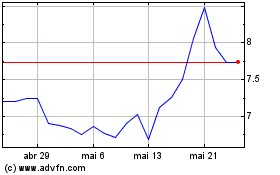

Victoria Gold (TSX:VGCX)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025