Essential Energy Services Ltd. (TSX: ESN) (“Essential” or the

“Company”) announces that it has entered into a definitive

amalgamation agreement (the “Amalgamation Agreement”) with Element

Technical Services Inc. (“Element”) under which Element, through a

wholly-owned subsidiary, will acquire all of the issued and

outstanding common shares of Essential (each, an “Essential Share”)

for a purchase price of $0.40 per Essential Share, payable in cash

(the “Consideration”). Element is a privately held entity that has

fracturing and coiled tubing operations in western Canada and the

United States.

Garnet Amundson, President and CEO of Essential

commented, “We have successfully led Essential and its predecessor

entities through almost two decades of turbulent oilfield service

industry and capital markets dynamics. Throughout this long

history, we have strived to maximize value for stakeholders of our

business. As a part of our normal course of business, and in

particular over the past seven years, Essential has actively

evaluated and explored numerous opportunities, culminating in this

transaction with Element. We believe this transaction provides

compelling value for Essential’s shareholders and enhanced product

offerings to Essential’s customers.”

Strategic Rationale - Attractive Value

for Essential Shareholders

- The Consideration

implies an enterprise value for Essential of approximately $77.7

million, including all transaction-related expenses. The resulting

transaction metric is estimated to be 4.1 times trailing

twelve-month EBITDAS(1) as of June 30, 2023.

All Cash Premium to Market Trading

Price

- The Consideration

represents a premium of approximately 12% to Essential’s 20-day

volume weighted average trading price on the Toronto Stock Exchange

(the “TSX”) and a premium of approximately 10% to Essential’s

closing price as of close of markets on September 14, 2023.

The Amalgamation Agreement and

Approvals

Element will, among other things, through

2544592 Alberta Ltd., (“Subco”), a wholly-owned subsidiary of

Element, acquire all of the Essential Shares by way of a statutory

amalgamation (the “Amalgamation”). Pursuant to the terms of the

Amalgamation Agreement, Essential will amalgamate with Subco, with

the amalgamated entity (“Amalco”) becoming a wholly-owned

subsidiary of Element. Subject to the terms of the Amalgamation

Agreement, each holder (collectively, the “Essential Shareholders”)

of Essential Shares (other than any Essential Shareholder who

validly exercises dissent rights in relation to the Amalgamation)

will, upon completion of the Amalgamation, receive one redeemable

preferred share of Amalco (each, an "Amalco Redeemable Preferred

Share") for each Essential Share held by such Essential Shareholder

and the Amalco Redeemable Preferred Shares will each be immediately

redeemed for $0.40 in cash.

The Company will seek approval of the

Amalgamation by the Essential Shareholders at a special meeting

expected to be held on or about November 7, 2023 (the “Special

Meeting”). The Amalgamation requires the approval of:

a) 66 2/3% of the votes cast by the Essential

Shareholders present in person or by proxy at the Special Meeting;

and

b) if required, a majority of the votes cast by

Essential Shareholders in person or represented by proxy at the

Special Meeting, after excluding the votes cast by those Essential

Shareholders whose votes are required to be excluded in accordance

with Multilateral Instrument 61-101 – Protection of Minority

Security Holders in Special Transactions.

Upon closing of the Amalgamation, it is expected

that the Essential Shares will be de-listed from the TSX and Amalco

will apply to cease to be a reporting issuer under applicable

securities laws. The Amalgamation is subject to various closing

conditions, including the required Essential Shareholder approvals

at the Special Meeting, the approval of the TSX and certain

regulatory and other approvals customary in transactions of this

nature.

The Amalgamation Agreement contains customary

representations and warranties of each party and interim

operational covenants of Essential. The Amalgamation Agreement also

provides for, among other things, customary board support and

non-solicitation covenants, subject to a “fiduciary out” for

unsolicited “superior proposals” in favor of Essential and a

provision for the right to match superior proposals in favor of

Element.

The Amalgamation Agreement provides for a

non-completion fee of $5.5 million payable in the event that the

Amalgamation is not completed or is terminated by Essential or

Element in certain circumstances, including if Essential enters

into an agreement with respect to a superior proposal or if

Essential’s board of directors withdraws or modifies its

recommendation with respect to the Amalgamation.

All of the directors and executive officers of

Essential, representing approximately 3.1% of the issued and

outstanding Essential Shares, have entered into support agreements

pursuant to which they have agreed to vote such Essential Shares in

favor of the Amalgamation, subject to the provisions of such

support agreements.

Further details with respect to the Amalgamation

will be included in the information circular to be mailed to

Essential Shareholders in connection with the Special Meeting. The

Special Meeting is expected to be held on or around November 7,

2023, with closing of the Amalgamation to occur thereafter upon

satisfaction of all conditions precedent, currently anticipated to

occur in mid-November, 2023. A copy of the Amalgamation Agreement

and the information circular will be filed on Essential’s SEDAR+

profile and will be available for viewing on www.sedarplus.ca.

Recommendation of the Essential

Board

Through discussions with the Company’s financial

and legal advisors, and after considering the Fairness Opinion (as

defined below), Essential’s board of directors has unanimously

determined: (i) that the transactions contemplated by the

Amalgamation Agreement are in the best interests of Essential; and

(ii) to recommend that Essential Shareholders vote in favor of the

Amalgamation.

Advisors

Peters & Co. Limited is acting as exclusive

financial advisor to Essential in connection with the Amalgamation

and has provided a verbal fairness opinion (the “Fairness Opinion”)

to Essential’s board of directors to the effect that, as at the

date of such Fairness Opinion and based upon and subject to the

assumptions, limitations and qualifications to be set forth in the

written opinion of Peters & Co. Limited, the consideration to

be received by Essential Shareholders pursuant to the Amalgamation

is fair, from a financial point of view, to Essential

Shareholders.

Fasken Martineau DuMoulin LLP is acting as legal

counsel to Essential.

FORWARD-LOOKING ADVISORY

This news release contains “forward‐looking

statements” and “forward‐looking information” (collectively

referred to herein as “forward-looking statements”) within the

meaning of applicable securities legislation. Such forward‐looking

statements include, without limitation, expectations and objectives

for future operations that are subject to a number of material

factors, assumptions, risks and uncertainties, many of which are

beyond the control of the Company.

Forward‐looking statements are statements that

are not historical facts and are generally, but not always,

identified by the words “anticipates”, “believes”, “expects” and

similar expressions or are events or conditions that “will” occur

or be achieved. This news release contains forward‐looking

statements pertaining to, among other things, the following: the

benefits of the Amalgamation to Essential’s shareholders and

customers; Amalco, including its status as a reporting issuer

following completion of the Amalgamation; the Amalgamation and the

timing thereof; the Consideration; the issuance and redemption of

the Amalco Redeemable Preferred Shares and the timing thereof; the

Special Meeting and the timing thereof; the mailing and filing on

SEDAR+ of the information circular; and the de-listing of the

Essential Shares from the TSX following the completion of the

Amalgamation.

The forward‐looking statements contained in this

news release reflect several material factors and expectations and

assumptions of Essential including, without limitation: the ability

of the parties to receive, in a timely manner, the necessary

regulatory, securityholder, stock exchange and other third-party

approvals; the ability of Essential and Element to satisfy, in a

timely manner, the other conditions to the closing of the

Amalgamation; the ability to complete the Amalgamation on the terms

contemplated by the Amalgamation Agreement, or at all; that

Essential will continue to conduct its operations in a manner

consistent with past operations; and the general continuance of

current or, where applicable, assumed industry conditions.

Although the Company believes that the material

factors, expectations and assumptions expressed in such

forward‐looking statements are reasonable based on information

available to it on the date such statements are made, undue

reliance should not be placed on the forward‐looking statements

because the Company can give no assurances that such statements and

information will prove to be correct and such statements are not

guarantees of future performance. Since forward‐looking statements

address future events and conditions, by their very nature they

involve inherent risks and uncertainties.

Actual performance and results could differ

materially from those currently anticipated due to a number of

factors and risks. These include, but are not limited to, known and

unknown risks, including: the completion and the timing of the

Amalgamation; the ability of Essential and Element to receive, in a

timely manner, the necessary regulatory, securityholder, stock

exchange and other third-party approvals; the ability of Essential

and Element to satisfy, in a timely manner, the other conditions to

the closing of the Amalgamation; interloper risk; the ability to

complete the Amalgamation on the terms contemplated by the

Amalgamation Agreement, or at all; the consequences of not

completing the Amalgamation, including the volatility of the share

price of Essential, negative reactions from the investment

community and the required payment of certain costs related to the

Amalgamation; actions taken by government entities or others

seeking to prevent or alter the terms of the Amalgamation;

potential undisclosed liabilities unidentified during the due

diligence process; the focus of management's time and attention on

the Amalgamation and other disruptions arising from the

Amalgamation; general economic, market or business conditions

including those in the event of an epidemic, natural disaster or

other event; global economic events; changes to Essential’s

financial position and cash flow and the uncertainty related to the

estimates and judgements made in the preparation of financial

statements; potential industry developments; and other unforeseen

conditions which could impact the use of services supplied by the

Company. Accordingly, readers should not place undue importance or

reliance on the forward‐looking statements. Readers are cautioned

that the foregoing list of factors is not exhaustive and should

refer to the “Risk Factors” section set out in the Company’s most

recent annual information form (a copy of which can be found under

Essential’s profile on SEDAR+ at www.sedarplus.ca).

Statements, including forward‐looking

statements, contained in this news release are made as of the date

they are given and the Company disclaims any intention or

obligation to publicly update or revise any forward‐looking

statements, whether as a result of new information, future events

or otherwise, unless so required by applicable securities laws. The

forward‐looking statements contained in this news release are

expressly qualified by this cautionary statement.

Additional information on these and other

factors that could affect the Company’s operations and financial

results are included in reports on file with applicable securities

regulatory authorities and may be accessed under Essential’s

profile on SEDAR+ at www.sedarplus.ca.

This announcement does not constitute an offer

of securities for sale in the United States, nor may any securities

referred to herein be offered or sold in the United States absent

registration or an exemption from registration as provided in the

U.S. Securities Act of 1933 as amended (the "Securities Act") and

the rules and regulations thereunder. The securities referred to

herein have not been registered pursuant to the Securities Act and

there is no intention to register any of the securities in the

United States or to conduct a public offering of securities in the

United States.

(1)NON-IFRS FINANCIAL

MEASURES

Certain specified financial measures in this

news release, including “enterprise value as a multiple of trailing

twelve-month EBITDAS”, do not have a standardized meaning as

prescribed under International Financial Reporting Standards

(“IFRS”). These measures should not be used as an alternative to

IFRS measures because they may not be comparable to similar

financial measures used by other companies.

“Enterprise value as a multiple of trailing

twelve-month EBITDAS” is a non-IFRS ratio calculated as enterprise

value divided by EBITDAS. “Enterprise value” is calculated as the

sum of (i) Consideration multiplied by the number of Essential

Shares issued and outstanding as at August 31, 2023, (ii) long-term

debt, (iii) lease liabilities, (iv) certain transaction-related

expenses permitted to be incurred by Essential pursuant to the

terms of the Amalgamation Agreement, (v) less cash. EBITDAS is a

non-IFRS financial measure and a component of this ratio. This

ratio is used as a supplemental financial measure by management and

investors to assess the valuation of the Essential Shares.

“EBITDAS” is not a standardized financial

measure under IFRS and might not be comparable to similar financial

measures disclosed by other companies. The most directly comparable

IFRS measure for “EBITDAS” is net loss. “EBITDAS” is further

explained in the “Non-IFRS and Other Financial Measures” section of

the Company’s Management’s Discussion and Analysis for the quarter

ended June 30, 2023 (available on the Company’s profile on SEDAR+

at www.sedarplus.ca), which section is incorporated by reference

herein.

ABOUT ESSENTIAL

Essential provides oilfield services to oil and

natural gas producers, primarily in western Canada. Essential

offers completion, production and wellsite restoration services to

a diverse customer base. Services are offered with coiled tubing,

fluid and nitrogen pumping and the sale and rental of downhole

tools and equipment. Essential offers one of the largest active

coiled tubing fleets in Canada. Further information can be found at

www.essentialenergy.ca.

The TSX has neither approved nor disapproved the

contents of this news release.

PDF

available: http://ml.globenewswire.com/Resource/Download/0823fae2-7dc8-4b0a-ac79-4547ac86ad81

For further information, please contact:

Garnet K. Amundson

President and CEO

Phone: (403) 513-7272

service@essentialenergy.ca

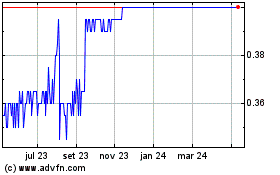

Essential Energy Services (TSX:ESN)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Essential Energy Services (TSX:ESN)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025