AvePoint Announces Anchor Investment by 65 Equity Partners

18 Setembro 2023 - 10:00AM

AvePoint (NASDAQ: AVPT), the most advanced platform to optimize

SaaS operations and secure collaboration, today announced a

definitive agreement has been entered into for an anchor investment

by 65 Equity Partners through its purchase of 16,666,600 AvePoint

shares of common stock (representing approximately 9.0% of

AvePoint’s total outstanding common stock) from Sixth Street.

“We are pleased to welcome 65 Equity Partners as a substantial

long-term stockholder of AvePoint,” said Dr. Tianyi Jiang (TJ),

Co-Founder & CEO, AvePoint. “This investment reflects their

confidence in our vision to advance the digital workplace, capture

growing markets and prioritize profitable growth. The APAC region

represents an enormous growth opportunity for us, and given that

Singapore is an important innovation center for AvePoint, we

believe that an eventual dual listing on the Singapore Exchange

(SGX) will garner additional investor support in the region.”

65 Equity Partners is a global investment firm that seeks to

support founders in their growth journey, with a mandate to invest

in family-owned and entrepreneur-led businesses in Southeast Asia,

Europe and the United States across the technology, business

services, consumer, industrials and healthcare sectors. Backed by

Temasek, 65 Equity Partners has $3.3 billion in funds under

management. Sixth Street, which led AvePoint’s Series C Preferred

Equity investment in January 2020, remains an investor in

AvePoint.

“AvePoint is a leader in digital workplace transformation, and

we believe it has a strong competitive advantage in the market,”

said Michael McGinn, Partner at Sixth Street Partners and Co-Head

of Sixth Street Growth. “We are proud to have been a part of

AvePoint’s journey from a private company to a public one, and we

look forward to the company continuing to execute against its

strategic priorities.”

For more information, visit the AvePoint Investor Relations

website.

About Sixth Street Sixth Street is a leading

global investment firm with over $70 billion in assets under

management and committed capital. Sixth Street uses its long-term

flexible capital, data-enabled capabilities, and One Team culture

to develop themes and offer solutions to companies across all

stages of growth. For more information, follow Sixth Street on

social media and visit www.sixthstreet.com.

About 65 Equity Partners65 Equity Partners is

an independently managed wholly-owned investment platform of

Temasek which focuses on providing equity and structured capital

solutions to established companies with regional or global

aspirations, in Southeast Asia, Europe and the United States. In

Southeast Asia (including Singapore), the strategy of 65 Equity

Partners is to invest in leading companies and new economy

businesses, ahead of their eventual listing in Singapore. 65 Equity

Partners also provides capital solutions to Singapore-based local

enterprises with fundamentally sound businesses that are

well-positioned to scale globally. For more information, please

visit www.65equitypartners.com.

About AvePointCollaborate with Confidence.

AvePoint provides the most advanced platform to optimize SaaS

operations and secure collaboration. Over 17,000 customers

worldwide rely on our solutions to modernize the digital workplace

across Microsoft, Google, Salesforce and other collaboration

environments. AvePoint's global channel partner program includes

over 3,500 managed service providers, value added resellers and

systems integrators, with our solutions available in more than 100

cloud marketplaces. To learn more, visit www.avepoint.com.

Disclosure InformationAvePoint uses

the https://ir.avepoint.com/ website as a means of

disclosing material non-public information and for complying with

its disclosure obligations under Regulation FD.

Forward-Looking StatementsThis press release

contains certain forward-looking statements within the meaning of

the “safe harbor” provisions of the United States Private

Securities Litigation Reform Act of 1995 and other federal

securities laws including statements regarding the future

performance of and market opportunities for AvePoint. These

forward-looking statements generally are identified by the words

“believe,” “project,” “expect,” “anticipate,” “estimate,” “intend,”

“strategy,” “future,” “opportunity,” “plan,” “may,” “should,”

“will,” “would,” “will be,” “will continue,” “will likely result,”

and similar expressions. Forward-looking statements are

predictions, projections and other statements about future events

that are based on current expectations and assumptions and, as a

result, are subject to risks and uncertainties. Many factors could

cause actual future events to differ materially from the

forward-looking statements in this press release, including but not

limited to: changes in the competitive and regulated industries in

which AvePoint operates, variations in operating performance across

competitors, changes in laws and regulations affecting AvePoint’s

business and changes in AvePoint’s ability to implement business

plans, forecasts, and ability to identify and realize additional

opportunities, and the risk of downturns in the market and the

technology industry. You should carefully consider the foregoing

factors and the other risks and uncertainties described in the

“Risk Factors” section of AvePoint’s most recent Quarterly Report

on Form 10-Q and its registration statement on Form S-1 and related

prospectus and prospectus supplements filed with the SEC. Copies of

these and other documents filed by AvePoint from time to time are

available on the SEC's website, www.sec.gov. These filings identify

and address other important risks and uncertainties that could

cause actual events and results to differ materially from those

contained in the forward-looking statements. Forward-looking

statements speak only as of the date they are made. Readers are

cautioned not to put undue reliance on forward-looking statements,

and AvePoint does not assume any obligation and does not intend to

update or revise these forward-looking statements after the date of

this release, whether as a result of new information, future

events, or otherwise, except as required by law. AvePoint does not

give any assurance that it will achieve its expectations.

Investor Contact AvePoint Jamie Arestia

ir@avepoint.com (551) 220-5654

Media Contact AvePoint Nicole Caci

pr@avepoint.com (201) 201-8143

AvePoint (NASDAQ:AVPT)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

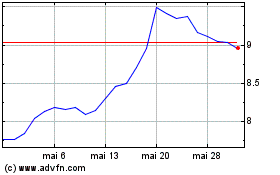

AvePoint (NASDAQ:AVPT)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025