Tilray Brands, Inc. (“Tilray”, “our”, “we” or the “Company”)

(Nasdaq: TLRY; TSX: TLRY), a leading global cannabis-lifestyle and

consumer packaged goods company, today reported financial results

for its first quarter fiscal year 2024 ended August 31, 2023. All

financial information in this press release is reported in U.S.

dollars, unless otherwise indicated.

Irwin D. Simon, Tilray Brands’ Chairman and

Chief Executive Officer, stated, “Today, Tilray Brands is the most

diversified global cannabis-lifestyle and CPG company in the world

with four distinct and complementary business segments – medical

and adult-use cannabis, beverages including, craft beer, spirits,

ready to drink mixed cocktails in a can, non-alcoholic drinks, THC

and CBD beverages, wellness products, and medical distribution. The

balance we have brought to our diversified business model has

positioned Tilray Brands as the #1 Canadian cannabis LP, the market

leader in medical cannabis across Europe, a leader in the hemp

foods industry, and a formidable player in the fast-growing craft

beverage-alcohol industry with a growing leadership position. We

have strategically diversified our company globally over the past

several years and, as a result, Tilray is now ideally positioned to

capture a wide range of opportunities across multiple industries

driving value through organic and acquisitive revenue growth,

operating efficiencies, and improved margins and profitability. We

will continue to invest in our future and accelerate our vision of

becoming a multi-billion-dollar company with a portfolio of

best-in-class brands.”

Mr. Simon continued, “Since the beginning of our

FY 2024, we have closed on three transactions: HEXO Corp. in June,

Truss Beverage Co. in August, and the acquisition of eight beer and

beverage brands from Anheuser-Busch earlier this week. The HEXO and

Truss acquisitions have already boosted our competitive cannabis

positioning in Canada, the largest, federally legalized cannabis

market in the world, by increasing our leading market share, while

the beer and beverage brands acquisition has made us the 5th

largest craft beer brewer in the U.S., up from the 9th position. We

are now working on the seamless integration of these acquisitions

into our efficient operating platforms by leveraging our deep CPG

expertise and established track record to drive revenue through

product innovation and expanded distribution and maximize cost

savings through synergy realization.”

Financial Highlights – First Quarter Fiscal Year

2024

- Net revenue increased 15% to $177

million in the first quarter compared to $153 million in the prior

year quarter.

- Gross profit was $44 million, while

adjusted gross profit was $49 million in the quarter. Gross margin

was 25%, while adjusted gross margin declined to 28% from 32% in

the prior year quarter.

- Cannabis net revenue increased 20%

to $70 million in the first quarter compared to $59 million in the

prior year quarter. On a constant currency basis, net cannabis

revenue was $71 million in the quarter, up 22% from the prior year

quarter.

- Cannabis gross margin decreased to

28% in the quarter from 51% in the prior year quarter and cannabis

adjusted gross margin decreased to 35% in the quarter from 51% in

the prior year quarter, reflecting the prior year’s inclusion of

the HEXO advisory fee revenue and the completion in our first

quarter of a wholesale transaction designed to optimize inventory

levels and generate $3.1 million of cash.

- Beverage alcohol net revenue

increased 17% to $24 million in the first quarter from $21 million

in the prior year quarter.

- Beverage alcohol gross margin

increased to 53% in the quarter from 47% in the prior year quarter

and adjusted gross beverage alcohol margin was 56% in the quarter

compared to 53% in the prior quarter, reflecting an increase in

beer as a percentage of sales mix along with the positive impact of

the Montauk acquisition.

- Distribution net revenue increased

14% to $69 million in the first quarter compared to $61 million in

the prior year quarter. On a constant currency basis, distribution

revenue was $67 million in the quarter, up 11% from the prior year

quarter.

- Distribution gross margin increased

to 11% in the quarter from 9% in the prior year quarter, reflecting

favorable sales mix and lower production costs.

- Net loss narrowed to $56 million in

the first quarter compared to net loss of $66 million in the prior

year quarter with a net loss per share of ($0.10) compared to

($0.13).

- Adjusted EBITDA was $11.4 million

in the first quarter compared to $13.5 million in the prior year

quarter primarily as a result of the prior year including HEXO

advisory fee revenue.

- Achieved $17.1 million in

annualized run-rate savings (and $2.9 million in actual cash cost

savings) as part of the $27 million synergy plan related to the

HEXO acquisition. We are on target to achieve our integration plan

goals and we are confident HEXO will prove to be a successful

acquisition.

- Achieved $6.8 million in annualized

run-rate savings in connection with the $8.0 million cost reduction

plan in Europe.

- Strong financial liquidity position

of ~$466 million, consisting of $179 million in cash, including

restricted cash and $287 million in marketable securities.

- Operating cash flow of $(16)

million in the first quarter compared to $(46) million in the prior

year quarter, representing an improvement of $30 million.

Operating Highlights

Leadership in Global Cannabis

Operations, Brands, and Market Share, Further Solidified through

Recent HEXO and Truss Acquisitions

- Tilray grew its #1 cannabis market

share position to 13.4% in Q1 2024. The Company continues to hold

the #1 market position across all major markets and a leading share

across most product categories. Tilray is #1 in cannabis Flower,

Oils, Concentrates and THC Beverages, and #2 in Pre-Rolls, #4 in

Vape, and in the Top 10 in all other categories. The Company closed

on the HEXO transaction in June 2023, significantly bolstering its

position supported by low-cost operations and complementary

distribution across all Canadian geographies.

- By capitalizing on the Company’s

unrivaled cultivation and distribution operations and the

leadership team’s depth of commercial and regulatory expertise,

Tilray is focused on growing its leading market share in medical

cannabis in the countries in which it distributes today and

achieving early-mover advantage in new countries as cannabis

legalization proliferates across Europe and other international

markets. During Q1, the increase in international cannabis revenue

was largely driven by expansion into emerging international medical

markets.

Maximizing the Growth Potential of U.S.

CPG and Craft-Beverage Lifestyle Brand Portfolio

- During Q1, Tilray made substantial

strides in performance across its five craft-beverage brands

including SweetWater Brewing Company, Breckenridge Distillery, and

Montauk Brewing Company, growing revenue in its beverage alcohol

segment by 17% and adjusted gross profit by 24%. Tilray’s wellness

brand, Manitoba Harvest, maintained its brand leadership position

in branded hemp with 52% market share and increased its gross

margin to 29% from 26% through price increases.

- On September 29, 2023, Tilray

closed on its acquisition of eight beer and beverage brands from

Anheuser-Busch (NYSE: BUD). The acquired brands, consisting of

Shock Top, Breckenridge Brewery, Blue Point Brewing Company, 10

Barrel Brewing Company, Redhook Brewery, Widmer Brothers Brewing,

Square Mile Cider Company, and HiBall Energy, possess strong

consumer loyalty and further diversify Tilray’s growing U.S.

beverage alcohol segment. Their expected sales volume elevate

Tilray Brands to the 5th largest position in the high-growth U.S.

craft beer market, up from the 9th position.

- Upon federal cannabis legalization

in the U.S., Tilray is well-positioned to immediately leverage its

strong U.S. leadership position and strategic strengths across

distribution and brands to include THC-infused products to maximize

all commercial opportunities and drive significant additional

revenue in adult-use cannabis through expanded recognition and

distribution.

Fiscal Year 2024 Guidance

For its fiscal year ending May 31, 2024, the

Company is reiterating its adjusted EBITDA target of $68 million to

$78 million representing growth of 11% to 27% as compared to fiscal

year 2023. In addition, the Company expects to generate positive

adjusted free cash flow.

Management’s guidance for adjusted EBITDA is

provided on a non-GAAP basis and excludes transaction expenses,

restructuring charges, litigation costs, facility start-up and

closure costs, lease expense, purchase price accounting step-up,

changes in fair value of contingent consideration and other items

carried at fair value, non-operating income (expenses), interest

expense, net, income tax expense and other non-recurring items that

may be incurred during the Company's fiscal year 2024, which the

Company will continue to identify as it reports its future

financial results. Management’s guidance for adjusted free cash

flow is provided on a non-GAAP basis and excludes our growth capex,

projected integration costs related to HEXO and the cash income

taxes related to Aphria Diamond.

The Company cannot reconcile its expected

adjusted EBITDA to net income or adjusted free cash flow to

operating cash flow under “Fiscal Year 2024 Guidance” without

unreasonable effort because of certain items that impact net income

and other reconciling metrics are out of the Company’s control

and/or cannot be reasonably predicted at this time.

Tilray Brands Strategic Growth Actions –

Fiscal Year 2024 to date

October 2023

- Tilray Brands Closes Transaction Acquiring Eight Beer &

Beverage Brands From Anheuser-Busch; Solidifies Leadership

Position in U.S. Craft Beer Market

September 2023

- Potently Canadian' Cannabis Brand,

CANACA, Launches ‘Let ‘Er Rip’ Campaign

- Tilray’s Best-Selling Beers Make

Landfall at Atlantis, Bahamas

- Montauk Brewing Expands

Distribution Beyond the Northeast

- Tilray Expands Market Leading

Cannabis Portfolio with Launch of New Redecan Products Across

Canada

August 2023

- RIFF Cannabis Launches New Diamond

Infused Pre-Rolls and Blunts

- A New Chilled Ritual is Here: Solei

Cannabis Launches Its First Sparkling CBD Beverages

- Tilray Brands Announces Acquisition

of Truss Beverage Co.™

- Good Supply’s Fan Favourite

Cannabis Strains Just Got ‘Juiced’

- Breckenridge Distillery Announces

New and Expanded Partnership with the Denver Broncos

- Tilray Brands Announces Agreement

to Acquire Eight Beer & Beverage Brands From Anheuser-Busch,

Fueling Tilray’s Future in the U.S. Craft Beer Industry

- Montauk Brewing Further Expands

Distribution Across Northeast and Launches Market Presence in

Pennsylvania

July 2023

- Tilray Renews Distribution

Agreement With Great North Distributors for Cannabis Sales Across

Canada With Newly Expanded Brand Portfolio

- SweetWater Brewing Announces

Partnership with ATLive and Mercedes Benz Stadium

- RIFF Cannabis Brand Launches New

THC Beverages for Summer

- SweetWater Brewing Launches Gummies

Beer A New Juicy Revolution

June 2023

- Tilray Brands Completes Acquisition

of HEXO Corp. Leading Next Evolution of Canadian Cannabis

- Breckenridge Distillery Launches

New Limited Release Collectors Art Series

- Montauk Brewing Company Celebrates

11-Year Anniversary and 2023 Summer Season Lineup

- Tilray Brands Expands Beer

Portfolio and Launches Good Supply Light Beer

Live Conference Call and Audio

WebcastTilray Brands will host a webcast to discuss these

results today at 8:30 a.m. ET. Investors may join the live webcast

available on the Investors section of the Company’s website at

www.tilray.com. A replay will be available and archived on the

Company’s website.

About Tilray Brands Tilray

Brands, Inc. (Nasdaq: TLRY; TSX: TLRY), is a leading global

cannabis-lifestyle and consumer packaged goods company with four

distinct and complementary business segments including medical and

adult-use cannabis, medical distribution, wellness foods, and

beverage-alcohol. Tilray Brands is on a mission to change people’s

lives for the better – one person at a time - by inspiring and

empowering the worldwide community to live their very best life,

enhanced by moments of connection and wellbeing. Patients and

consumers trust Tilray Brands to be the most responsible, trusted

and market leading cannabis and consumer products company in the

world with a portfolio of innovative, high-quality, and beloved

brands that address the needs of the consumers, customers, and

patients we serve. A pioneer in cannabis research, cultivation, and

distribution, today Tilray Brands’ unprecedented and diversified

production platform supports a portfolio of best-in-class brands in

over 20 countries including comprehensive adult-use and medical

cannabis offerings, hemp-based foods, and craft beverages across

North America, Europe, Australia, and Latin America.

For more information on Tilray Brands, visit

www.Tilray.com and follow @Tilray

Cautionary Statement Concerning

Forward-Looking Statements Certain statements in this

press release constitute forward-looking information or

forward-looking statements (together, “forward-looking statements”)

under Canadian securities laws and within the meaning of Section

27A of the Securities Act of 1933, as amended, and Section 21E of

the Securities Exchange Act of 1934, as amended, that are intended

to be subject to the “safe harbor” created by those sections and

other applicable laws. Forward-looking statements can be identified

by words such as “forecast,” “future,” “should,” “could,” “enable,”

“potential,” “contemplate,” “believe,” “anticipate,” “estimate,”

“plan,” “expect,” “intend,” “may,” “project,” “will,” “would” and

the negative of these terms or similar expressions, although not

all forward-looking statements contain these identifying words.

Certain material factors, estimates, goals, projections or

assumptions were used in drawing the conclusions contained in the

forward-looking statements throughout this communication.

Forward-looking statements include statements

regarding our intentions, beliefs, projections, outlook, analyses

or current expectations concerning, among other things: the

Company’s ability to become the world's leading cannabis-focused

consumer branded company; the Company’s ability to achieve long

term profitability; the Company’s ability to achieve operational

scale, market share, distribution, profitability and revenue growth

in particular business lines and markets; the Company’s ability to

successfully achieve revenue growth, production and supply chain

efficiencies, synergies and cost savings; the Company’s ability to

generate $68-$78 million of Adjusted EBITDA and expectation to be

cash-flow positive in its operating business in fiscal year 2024;

the Company’s expected revenue growth, sales volume, profitability,

synergies and accretion related to any of its acquisitions;

expected opportunities upon U.S. federal legalization; the

Company’s anticipated investments and acquisitions, including in

organic and strategic growth, partnership efforts, product

offerings and other initiatives; and the Company’s ability to

commercialize new and innovative products.

Many factors could cause actual results,

performance or achievement to be materially different from any

forward-looking statements, and other risks and uncertainties not

presently known to the Company or that the Company deems immaterial

could also cause actual results or events to differ materially from

those expressed in the forward-looking statements contained herein.

For a more detailed discussion of these risks and other factors,

see the most recently filed annual information form of the Company

and the Annual Report on Form 10-K (and other periodic reports

filed with the SEC) of the Company made with the SEC and available

on EDGAR. The forward-looking statements included in this

communication are made as of the date of this communication and the

Company does not undertake any obligation to publicly update such

forward-looking statements to reflect new information, subsequent

events or otherwise unless required by applicable securities

laws.

Use of Non-U.S. GAAP Financial

MeasuresThis press release and the accompanying tables

include non-GAAP financial measures, including Adjusted gross

margin, Adjusted gross profit, Adjusted EBITDA, free cash flow,

adjusted free cash flow, constant currency presentations of revenue

and cash and marketable securities. Management believes that the

non-GAAP financial measures presented provide useful additional

information to investors about current trends in the Company's

operations and are useful for period-over-period comparisons of

operations. These non-GAAP financial measures should not be

considered in isolation or as a substitute for the comparable GAAP

measures. In addition, these non-GAAP measures may not be the same

as similar measures provided by other companies due to potential

differences in methods of calculation and items being excluded.

They should be read only in connection with the Company's

Consolidated Statements of Operations and Cash Flows presented in

accordance with GAAP.

Certain forward-looking non-GAAP financial

measures included in this press release are not reconciled to the

comparable forward-looking GAAP financial measures. The Company is

not able to reconcile these forward-looking non-GAAP financial

measures to their most directly comparable forward-looking GAAP

financial measures without unreasonable efforts because the Company

is unable to predict with a reasonable degree of certainty the type

and extent of certain items that would be expected to impact GAAP

measures but would not impact the non-GAAP measures. Such items may

include litigation and related expenses, transaction costs,

impairments, foreign exchange movements and other items. The

unavailable information could have a significant impact on the

Company's GAAP financial results.

The Company believes presenting net sales at

constant currency provides useful information to investors because

it provides transparency to underlying performance in the Company's

consolidated net sales by excluding the effect that foreign

currency exchange rate fluctuations have on period-to-period

comparability given the volatility in foreign currency exchange

markets. To present this information for historical periods,

current period net sales for entities reporting in currencies other

than the U.S. dollar are translated into U.S. dollars at the

average monthly exchange rates in effect during the corresponding

period of the prior fiscal year, rather than at the actual average

monthly exchange rate in effect during the current period of the

current fiscal year. As a result, the foreign currency impact is

equal to the current year results in local currencies multiplied by

the change in average foreign currency exchange rate between the

current fiscal period and the corresponding period of the prior

fiscal year.

Adjusted EBITDA is calculated as net income

(loss) before income tax benefits, net; interest expense, net;

non-operating income (expense), net; amortization; stock-based

compensation; change in fair value of contingent consideration;

purchase price accounting step-up; facility start-up and closure

costs; lease expense; litigation costs; restructuring costs and

transaction (income) costs. A reconciliation of Adjusted EBITDA to

net loss, the most directly comparable GAAP measure, has been

provided in the financial statement tables included below in this

press release. Adjusted gross profit, is calculated as gross profit

adjusted to exclude the impact of inventory valuation adjustment

and purchase price accounting valuation step-up. A reconciliation

of Adjusted gross profit, excluding purchase price accounting

valuation step-up, to gross profit, the most directly comparable

GAAP measure, has been provided in the financial statement tables

included below in this press release. Adjusted gross margin,

excluding inventory valuation adjustments and purchase price

accounting valuation step-up, is calculated as revenue less cost of

sales adjusted to add back inventory valuation adjustments and

amortization of inventory step-up, divided by revenue. A

reconciliation of Adjusted gross margin, excluding inventory

valuation adjustments and purchase price accounting valuation

step-up, to gross margin, the most directly comparable GAAP

measure, has been provided in the financial statement tables

included below in this press release. Free cash flow is comprised

of two GAAP measures which are net cash flow provided by (used in)

operating activities less investments in capital and intangible

assets, net. A reconciliation of net cash flow provided by (used

in) operating activities to free cash flow, the most directly

comparable GAAP measure, has been provided in the financial

statement tables included below in this press release. Adjusted

free cash flow is comprised of two GAAP measures which are net cash

flow provided by (used in) operating activities less investments in

capital and intangible assets, net, and the exclusion of growth

CAPEX from investments in capital and intangible assets, net, which

excludes the amount of capital expenditures that are considered to

be associated with growth of future operations rather than to

maintain the existing operations of the Company, and excludes our

projected integration costs related to HEXO and the cash income

taxes related to Aphria Diamond to align with management’s

prescribed guidance. A reconciliation of net cash flow provided by

(used in) operating activities to adjusted free cash flow, the most

directly comparable GAAP measure, has been provided in the

financial statement tables included below in this press release.

Constant currency presentations of revenue are used to normalize

the effects of foreign currency. To present this information for

historical periods, current period net sales for entities reporting

in currencies other than the U.S. Dollar are translated into U.S.

Dollars at the average monthly exchange rates in effect during the

corresponding period of the prior fiscal year rather than at the

actual average monthly exchange rate in effect during the current

period of the current fiscal year. As a result, the foreign

currency impact is equal to the current year results in local

currencies multiplied by the change in average foreign currency

exchange rate between the current fiscal period and the

corresponding period of the prior fiscal year. A reconciliation of

prior year revenue to constant currency revenue the most directly

comparable GAAP measure, has been provided in the financial

statement tables included below in this press release. Cash and

marketable securities are comprised of two GAAP measures, cash and

cash equivalents added to marketable securities. The Company’s

management believes that this presentation provides useful

information to management, analysts and investors regarding certain

additional financial and business trends relating to its short-term

liquidity position by combing these two GAAP metrics.

For further information: Media:

Berrin Noorata, news@tilray.com Investors: Raphael Gross,

+1-203-682-8253, Raphael.Gross@icrinc.com

|

|

|

|

|

|

|

|

|

|

|

Consolidated Statements of Financial Position |

|

|

|

|

|

August 31, |

|

May 31, |

|

(in thousands of US dollars) |

2023 |

|

2023 |

|

Assets |

|

|

|

|

Current assets |

|

|

|

|

Cash and cash equivalents |

$ |

177,519 |

|

|

$ |

206,632 |

|

|

Restricted cash |

|

1,613 |

|

|

|

- |

|

|

Marketable securities |

|

287,333 |

|

|

|

241,897 |

|

|

Accounts receivable, net |

|

82,076 |

|

|

|

86,227 |

|

|

Inventory |

|

232,075 |

|

|

|

200,551 |

|

|

Prepaids and other current assets |

|

44,943 |

|

|

|

37,722 |

|

|

Assets held for sale |

|

3,696 |

|

|

|

- |

|

|

Total current assets |

|

829,255 |

|

|

|

773,029 |

|

|

Capital assets |

|

494,619 |

|

|

|

429,667 |

|

|

Right-of-use assets |

|

5,605 |

|

|

|

5,941 |

|

|

Intangible assets |

|

967,568 |

|

|

|

973,785 |

|

|

Goodwill |

|

2,009,673 |

|

|

|

2,008,843 |

|

|

Interest in equity investees |

|

4,638 |

|

|

|

4,576 |

|

|

Long-term investments |

|

7,564 |

|

|

|

7,795 |

|

|

Convertible notes receivable |

|

74,681 |

|

|

|

103,401 |

|

|

Other assets |

|

8,647 |

|

|

|

222 |

|

|

Total assets |

$ |

4,402,250 |

|

|

$ |

4,307,259 |

|

|

Liabilities |

|

|

|

|

Current liabilities |

|

|

|

|

Bank indebtedness |

$ |

14,594 |

|

|

$ |

23,381 |

|

|

Accounts payable and accrued liabilities |

|

238,081 |

|

|

|

190,682 |

|

|

Contingent consideration |

|

7,181 |

|

|

|

16,218 |

|

|

Warrant liability |

|

10,015 |

|

|

|

1,817 |

|

|

Current portion of lease liabilities |

|

2,324 |

|

|

|

2,423 |

|

|

Current portion of long-term debt |

|

13,489 |

|

|

|

24,080 |

|

|

Current portion of convertible debentures payable |

|

251,590 |

|

|

|

174,378 |

|

|

Total current liabilities |

|

537,274 |

|

|

|

432,979 |

|

|

Long - term liabilities |

|

|

|

|

Contingent consideration |

|

13,000 |

|

|

|

10,889 |

|

|

Lease liabilities |

|

7,462 |

|

|

|

7,936 |

|

|

Long-term debt |

|

152,390 |

|

|

|

136,889 |

|

|

Convertible debentures payable |

|

120,861 |

|

|

|

221,044 |

|

|

Deferred tax liabilities |

|

169,633 |

|

|

|

167,364 |

|

|

Other liabilities |

|

74 |

|

|

|

215 |

|

|

Total liabilities |

|

1,000,694 |

|

|

|

977,316 |

|

|

Commitments and contingencies (refer to Note

18) |

|

|

|

|

Stockholders' equity |

|

|

|

|

Common stock ($0.0001 par value; 980,000,000 common shares;

723,292,600 and 656,655,455 common shares issued and outstanding,

respectively) |

|

72 |

|

|

|

66 |

|

|

Preferred shares ($0.0001 par value; 10,000,000 preferred shares

authorized; nil and nil preferred shares issued and outstanding,

respectively) |

|

- |

|

|

|

- |

|

|

Additional paid-in capital |

|

5,909,895 |

|

|

|

5,777,743 |

|

|

Accumulated other comprehensive loss |

|

(43,561 |

) |

|

|

(46,610 |

) |

|

Accumulated Deficit |

|

(2,487,032 |

) |

|

|

(2,415,507 |

) |

|

Total Tilray Brands, Inc. stockholders'

equity |

|

3,379,374 |

|

|

|

3,315,692 |

|

|

Non-controlling interests |

|

22,182 |

|

|

|

14,251 |

|

|

Total stockholders' equity |

|

3,401,556 |

|

|

|

3,329,943 |

|

|

Total liabilities and stockholders' equity |

$ |

4,402,250 |

|

|

$ |

4,307,259 |

|

|

|

|

|

|

Condensed Consolidated Statements of Net Income (Loss) and

Comprehensive Income (Loss) |

|

|

| |

For the three months |

|

|

|

|

|

|

ended August 31, |

|

Change |

|

% Change |

|

(in thousands of U.S. dollars, except for per share

data) |

2023 |

|

2022 |

|

2023 vs. 2022 |

|

Net revenue |

$ |

176,949 |

|

|

$ |

153,211 |

|

|

$ |

23,738 |

|

|

15 |

% |

|

Cost of goods sold |

|

132,753 |

|

|

|

104,597 |

|

|

|

28,156 |

|

|

27 |

% |

|

Gross profit |

|

44,196 |

|

|

|

48,614 |

|

|

|

(4,418 |

) |

|

(9 |

)% |

|

Operating expenses: |

|

|

|

|

|

|

|

|

General and administrative |

|

40,516 |

|

|

|

40,508 |

|

|

|

8 |

|

|

0 |

% |

|

Selling |

|

6,859 |

|

|

|

9,671 |

|

|

|

(2,812 |

) |

|

(29 |

)% |

|

Amortization |

|

22,225 |

|

|

|

24,359 |

|

|

|

(2,134 |

) |

|

(9 |

)% |

|

Marketing and promotion |

|

8,535 |

|

|

|

7,248 |

|

|

|

1,287 |

|

|

18 |

% |

|

Research and development |

|

79 |

|

|

|

166 |

|

|

|

(87 |

) |

|

(52 |

)% |

|

Change in fair value of contingent consideration |

|

(11,107 |

) |

|

|

211 |

|

|

|

(11,318 |

) |

|

(5,364 |

)% |

|

Litigation costs |

|

2,034 |

|

|

|

445 |

|

|

|

1,589 |

|

|

357 |

% |

|

Restructuring costs |

|

915 |

|

|

|

— |

|

|

|

915 |

|

|

0 |

% |

|

Transaction (income) costs |

|

8,502 |

|

|

|

(12,816 |

) |

|

|

21,318 |

|

|

(166 |

)% |

|

Total operating expenses |

|

78,558 |

|

|

|

69,792 |

|

|

|

8,766 |

|

|

13 |

% |

|

Operating loss |

|

(34,362 |

) |

|

|

(21,178 |

) |

|

|

(13,184 |

) |

|

62 |

% |

|

Interest expense, net |

|

(9,835 |

) |

|

|

(4,413 |

) |

|

|

(5,422 |

) |

|

123 |

% |

|

Non-operating income (expense), net |

|

(4,402 |

) |

|

|

(32,992 |

) |

|

|

28,590 |

|

|

(87 |

)% |

|

Loss before income taxes |

|

(48,599 |

) |

|

|

(58,583 |

) |

|

|

9,984 |

|

|

(17 |

)% |

|

Income tax expense |

|

7,264 |

|

|

|

7,211 |

|

|

|

53 |

|

|

1 |

% |

|

Net loss |

$ |

(55,863 |

) |

|

$ |

(65,794 |

) |

|

$ |

9,931 |

|

|

(15 |

)% |

|

Net loss per share - basic and diluted |

$ |

(0.10 |

) |

|

$ |

(0.13 |

) |

|

$ |

0.02 |

|

|

(19 |

)% |

|

|

|

|

|

|

|

|

|

|

Condensed Consolidated Statements of Cash

Flows |

|

|

|

|

|

|

|

| |

For the three months |

|

|

|

|

| |

ended August 31, |

|

Change |

|

% Change |

|

(in thousands of US dollars) |

2023 |

|

2022 |

|

2023 vs. 2022 |

|

Cash used in operating activities: |

|

|

|

|

|

|

|

|

Net loss |

$ |

(55,863 |

) |

|

$ |

(65,794 |

) |

|

$ |

9,931 |

|

|

(15)% |

|

Adjustments for: |

|

|

|

|

|

|

|

|

Deferred income tax recovery |

|

59 |

|

|

|

796 |

|

|

|

(737 |

) |

|

(93)% |

|

Unrealized foreign exchange (gain) loss |

|

(3,127 |

) |

|

|

10,026 |

|

|

|

(13,153 |

) |

|

(131)% |

|

Amortization |

|

30,789 |

|

|

|

34,069 |

|

|

|

(3,280 |

) |

|

(10)% |

|

Loss on sale of capital assets |

|

3 |

|

|

|

77 |

|

|

|

(74 |

) |

|

(96)% |

|

Other non-cash items |

|

(816 |

) |

|

|

2,080 |

|

|

|

(2,896 |

) |

|

(139)% |

|

Stock-based compensation |

|

8,257 |

|

|

|

9,193 |

|

|

|

(936 |

) |

|

(10)% |

|

Loss on long-term investments & equity investments |

|

47 |

|

|

|

1,193 |

|

|

|

(1,146 |

) |

|

(96)% |

|

Loss on derivative instruments |

|

10,345 |

|

|

|

6,336 |

|

|

|

4,009 |

|

|

63% |

|

Change in fair value of contingent consideration |

|

(11,107 |

) |

|

|

211 |

|

|

|

(11,318 |

) |

|

(5,364)% |

|

Change in non-cash working capital: |

|

|

|

|

|

|

|

|

Accounts receivable |

|

13,044 |

|

|

|

(3,068 |

) |

|

|

16,112 |

|

|

(525)% |

|

Prepaids and other current assets |

|

(4,654 |

) |

|

|

(34,891 |

) |

|

|

30,237 |

|

|

(87)% |

|

Inventory |

|

3,650 |

|

|

|

(232 |

) |

|

|

3,882 |

|

|

(1,673)% |

|

Accounts payable and accrued liabilities |

|

(6,469 |

) |

|

|

(6,265 |

) |

|

|

(204 |

) |

|

3% |

|

Net cash used in operating activities |

|

(15,842 |

) |

|

|

(46,269 |

) |

|

|

30,427 |

|

|

(66)% |

|

Cash used in investing activities: |

|

|

|

|

|

|

|

|

Investment in capital and intangible assets, net |

|

(4,152 |

) |

|

|

(3,000 |

) |

|

|

(1,152 |

) |

|

38% |

|

Proceeds from disposal of capital and intangible assets |

|

342 |

|

|

|

1,463 |

|

|

|

(1,121 |

) |

|

(77)% |

|

Purchase of marketable securities, net |

|

(45,436 |

) |

|

|

- |

|

|

|

(45,436 |

) |

|

0% |

|

Net cash acquired from business acquisitions |

|

22,956 |

|

|

|

- |

|

|

|

22,956 |

|

|

0% |

|

Net cash used in investing activities |

|

(26,290 |

) |

|

|

(1,537 |

) |

|

|

(24,753 |

) |

|

1,610% |

|

Cash provided by (used in) financing

activities: |

|

|

|

|

|

|

|

|

Share capital issued, net of cash issuance costs |

|

- |

|

|

|

129,593 |

|

|

|

(129,593 |

) |

|

(100)% |

|

Shares effectively repurchased for employee withholding tax |

|

- |

|

|

|

(1,189 |

) |

|

|

1,189 |

|

|

(100)% |

|

Proceeds from long-term debt and convertible debt |

|

29,174 |

|

|

|

1,288 |

|

|

|

27,886 |

|

|

2,165% |

|

Repayment of long-term debt and convertible debt |

|

(6,369 |

) |

|

|

(5,196 |

) |

|

|

(1,173 |

) |

|

23% |

|

Repayment of lease liabilities |

|

- |

|

|

|

(1,035 |

) |

|

|

1,035 |

|

|

(100)% |

|

Net increase in bank indebtedness |

|

(8,787 |

) |

|

|

159 |

|

|

|

(8,946 |

) |

|

(5,626)% |

|

Net cash provided by (used in) financing activities |

|

14,018 |

|

|

|

123,620 |

|

|

|

(109,602 |

) |

|

(89)% |

|

Effect of foreign exchange on cash and cash equivalents |

|

614 |

|

|

|

(1,080 |

) |

|

|

1,694 |

|

|

(157)% |

|

Net decrease in cash and cash equivalents |

|

(27,500 |

) |

|

|

74,734 |

|

|

|

(102,234 |

) |

|

(137)% |

|

Cash and cash equivalents, beginning of period |

|

206,632 |

|

|

|

415,909 |

|

|

|

(209,277 |

) |

|

(50)% |

|

Cash and cash equivalents, end of period |

$ |

179,132 |

|

|

$ |

490,643 |

|

|

$ |

(311,511 |

) |

|

(63)% |

|

|

|

|

|

|

|

|

|

|

Net Revenue by Operating Segment |

|

|

|

|

|

|

|

|

|

For the three months |

|

|

|

For the three months |

|

|

|

(In thousands of U.S. dollars) |

August 31, 2023 |

|

% of Total Revenue |

|

August 31, 2022 |

|

% of Total Revenue |

|

Cannabis business |

$ |

70,333 |

|

|

39% |

|

$ |

58,570 |

|

|

38% |

|

Distribution business |

|

69,157 |

|

|

39% |

|

|

60,585 |

|

|

40% |

|

Beverage alcohol business |

|

24,162 |

|

|

14% |

|

|

20,654 |

|

|

13% |

|

Wellness business |

|

13,297 |

|

|

8% |

|

|

13,402 |

|

|

9% |

|

Total net revenue |

$ |

176,949 |

|

|

100% |

|

$ |

153,211 |

|

|

100% |

|

|

|

|

|

|

|

|

|

|

Net Revenue by Operating Segment in Constant

Currency |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the three months |

|

|

|

For the three months |

|

|

|

|

August 31, 2023 |

|

|

|

August 31, 2022 |

|

|

|

(In thousands of U.S. dollars) |

as reported in constant currency |

|

% of Total Revenue |

|

as reported in constant currency |

|

% of Total Revenue |

|

Cannabis business |

$ |

71,389 |

|

|

40% |

|

$ |

58,570 |

|

|

38% |

|

Distribution business |

|

66,952 |

|

|

38% |

|

|

60,585 |

|

|

40% |

|

Beverage alcohol business |

|

24,162 |

|

|

14% |

|

|

20,654 |

|

|

13% |

|

Wellness business |

|

13,459 |

|

|

8% |

|

|

13,402 |

|

|

9% |

|

Total net revenue |

$ |

175,962 |

|

|

100% |

|

$ |

153,211 |

|

|

100% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Cannabis Revenue by Market Channel |

|

|

|

|

|

|

|

|

|

For the three months |

|

|

|

For the three months |

|

|

|

(In thousands of U.S. dollars) |

August 31, 2023 |

|

% of Total Revenue |

|

August 31, 2022 |

|

% of Total Revenue |

|

Revenue from Canadian medical cannabis |

$ |

6,142 |

|

|

9% |

|

$ |

6,520 |

|

|

11% |

|

Revenue from Canadian adult-use cannabis |

|

71,195 |

|

|

102% |

|

|

58,355 |

|

|

100% |

|

Revenue from wholesale cannabis |

|

5,295 |

|

|

7% |

|

|

392 |

|

|

1% |

|

Revenue from international cannabis |

|

14,252 |

|

|

20% |

|

|

10,422 |

|

|

18% |

|

Less excise taxes |

|

(26,551 |

) |

|

-38% |

|

|

(17,119 |

) |

|

-30% |

|

Total |

$ |

70,333 |

|

|

100% |

|

$ |

58,570 |

|

|

100% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Cannabis Revenue by Market Channel in Constant

Currency |

|

|

|

|

|

|

|

|

For the three months |

|

|

|

For the three months |

|

|

|

|

August 31, 2023 |

|

|

|

August 31, 2022 |

|

|

|

(In thousands of U.S. dollars) |

as reported in constant currency |

|

% of Total Revenue |

|

as reported in constant currency |

|

% of Total Revenue |

|

Revenue from Canadian medical cannabis |

$ |

6,310 |

|

|

9% |

|

$ |

6,520 |

|

|

11% |

|

Revenue from Canadian adult-use cannabis |

|

73,111 |

|

|

102% |

|

|

58,355 |

|

|

100% |

|

Revenue from wholesale cannabis |

|

5,458 |

|

|

8% |

|

|

392 |

|

|

1% |

|

Revenue from international cannabis |

|

13,777 |

|

|

19% |

|

|

10,422 |

|

|

18% |

|

Less excise taxes |

|

(27,267 |

) |

|

-38% |

|

|

(17,119 |

) |

|

-30% |

|

Total |

$ |

71,389 |

|

|

100% |

|

$ |

58,570 |

|

|

100% |

|

|

|

|

|

|

|

|

|

|

Other Financial Information: Key Operating

Metrics |

|

|

|

| |

For the

three months |

| |

ended August 31, |

| (in

thousands of U.S. dollars) |

2023 |

|

2022 |

|

Net cannabis revenue |

$ |

70,333 |

|

$ |

58,570 |

| Distribution

revenue |

|

69,157 |

|

|

60,585 |

| Net beverage

alcohol revenue |

|

24,162 |

|

|

20,654 |

| Wellness

revenue |

|

13,297 |

|

|

13,402 |

| Cannabis

costs |

|

50,517 |

|

|

28,861 |

| Beverage

alcohol costs |

|

11,266 |

|

|

10,849 |

| Distribution

costs |

|

61,468 |

|

|

54,984 |

| Wellness

costs |

|

9,502 |

|

|

9,903 |

| Adjusted

gross profit (excluding PPA step-up)(1) |

|

49,302 |

|

|

49,721 |

| Cannabis

adjusted gross margin (excluding PPA step-up)(1) |

|

35% |

|

|

51% |

| Beverage

alcohol adjusted gross margin (excluding PPA step-up)(1) |

|

56% |

|

|

53% |

| Distribution

gross margin |

|

11% |

|

|

9% |

| Wellness

gross margin |

|

29% |

|

|

26% |

| Adjusted

EBITDA(1) |

|

11,434 |

|

|

13,531 |

| Cash and

marketable securities(1)as at the period ended: |

|

464,852 |

|

|

490,643 |

| Working

capital as at the period ended: |

|

291,981 |

|

|

637,623 |

|

|

|

|

|

|

|

|

|

Other Financial Information: Gross Margin and Adjusted

Gross Margin |

|

|

|

|

|

|

| |

For the three months ended August 31,

2023 |

| (In

thousands of U.S. dollars) |

Cannabis |

|

Beverage |

|

Distribution |

|

Wellness |

|

Total |

|

Net revenue |

$ |

70,333 |

|

$ |

24,162 |

|

$ |

69,157 |

|

$ |

13,297 |

|

$ |

176,949 |

| Cost of

goods sold |

|

50,517 |

|

|

11,266 |

|

|

61,468 |

|

|

9,502 |

|

|

132,753 |

| Gross

profit |

|

19,816 |

|

|

12,896 |

|

|

7,689 |

|

|

3,795 |

|

|

44,196 |

| Gross

margin |

|

28% |

|

|

53% |

|

|

11% |

|

|

29% |

|

|

25% |

|

Adjustments: |

|

|

|

|

|

|

|

|

|

| Purchase

price accounting step-up |

|

4,516 |

|

|

590 |

|

|

- |

|

|

- |

|

|

5,106 |

| Adjusted

gross profit |

|

24,332 |

|

|

13,486 |

|

|

7,689 |

|

|

3,795 |

|

|

49,302 |

| Adjusted

gross margin |

|

35% |

|

|

56% |

|

|

11% |

|

|

29% |

|

|

28% |

| |

|

|

|

|

|

|

|

|

|

| |

For the three months ended August 31,

2022 |

| (In

thousands of U.S. dollars) |

Cannabis |

|

Beverage |

|

Distribution |

|

Wellness |

|

Total |

| Net

revenue |

$ |

58,570 |

|

$ |

20,654 |

|

$ |

60,585 |

|

$ |

13,402 |

|

$ |

153,211 |

| Cost of

goods sold |

|

28,861 |

|

|

10,849 |

|

|

54,984 |

|

|

9,903 |

|

|

104,597 |

| Gross

profit |

|

29,709 |

|

|

9,805 |

|

|

5,601 |

|

|

3,499 |

|

|

48,614 |

| Gross

margin |

|

51% |

|

|

47% |

|

|

9% |

|

|

26% |

|

|

32% |

|

Adjustments: |

|

|

|

|

|

|

|

|

|

| Purchase

price accounting step-up |

|

- |

|

|

1,107 |

|

|

- |

|

|

- |

|

|

1,107 |

| Adjusted

gross profit |

|

29,709 |

|

|

10,912 |

|

|

5,601 |

|

|

3,499 |

|

|

49,721 |

| Adjusted

gross margin |

|

51% |

|

|

53% |

|

|

9% |

|

|

26% |

|

|

32% |

|

Other Financial Information: Adjusted Earnings Before

Interest, Taxes and Amortization |

|

|

|

|

For the three months |

|

|

|

|

| |

ended August 31, |

|

Change |

|

% Change |

|

(In thousands of U.S. dollars) |

2023 |

|

2022 |

|

2023 vs. 2022 |

|

Net loss |

$ |

(55,863 |

) |

|

$ |

(65,794 |

) |

|

$ |

9,931 |

|

|

(15)% |

|

Income tax expense |

|

7,264 |

|

|

|

7,211 |

|

|

|

53 |

|

|

1% |

|

Interest expense, net |

|

9,835 |

|

|

|

4,413 |

|

|

|

5,422 |

|

|

123% |

|

Non-operating income (expense), net |

|

4,402 |

|

|

|

32,992 |

|

|

|

(28,590 |

) |

|

(87)% |

|

Amortization |

|

30,789 |

|

|

|

34,069 |

|

|

|

(3,280 |

) |

|

(10)% |

|

Stock-based compensation |

|

8,257 |

|

|

|

9,193 |

|

|

|

(936 |

) |

|

(10)% |

|

Change in fair value of contingent consideration |

|

(11,107 |

) |

|

|

211 |

|

|

|

(11,318 |

) |

|

(5,364)% |

|

Purchase price accounting step-up |

|

5,106 |

|

|

|

1,107 |

|

|

|

3,999 |

|

|

361% |

|

Facility start-up and closure costs |

|

600 |

|

|

|

1,800 |

|

|

|

(1,200 |

) |

|

(67)% |

|

Lease expense |

|

700 |

|

|

|

700 |

|

|

|

- |

|

|

0% |

|

Litigation costs |

|

2,034 |

|

|

|

445 |

|

|

|

1,589 |

|

|

357% |

|

Restructuring costs |

|

915 |

|

|

|

- |

|

|

|

915 |

|

|

NM |

|

Transaction (income) costs |

|

8,502 |

|

|

|

(12,816 |

) |

|

|

21,318 |

|

|

(166)% |

|

Adjusted EBITDA |

$ |

11,434 |

|

|

$ |

13,531 |

|

|

$ |

(2,097 |

) |

|

(15)% |

|

|

|

|

|

|

|

|

|

|

Other Financial Information: Free Cash Flow and Adjusted

Free Cash Flow |

|

|

|

|

|

|

|

|

|

For the three months |

|

|

|

|

|

|

ended August 31, |

|

Change |

|

% Change |

|

(In thousands of U.S. dollars) |

2023 |

|

2022 |

|

2023 vs. 2022 |

|

Net cash used in operating activities |

$ |

(15,842 |

) |

|

$ |

(46,269 |

) |

|

$ |

30,427 |

|

|

(66)% |

|

Less: investments in capital and intangible assets, net |

|

(3,810 |

) |

|

|

(1,537 |

) |

|

|

(2,273 |

) |

|

148% |

|

Free cash flow |

$ |

(19,652 |

) |

|

$ |

(47,806 |

) |

|

$ |

28,154 |

|

|

(59)% |

|

Add: growth CAPEX |

|

1,687 |

|

|

|

- |

|

|

|

1,687 |

|

|

NM |

|

Add: cash income taxes related to Aphria Diamond |

|

5,714 |

|

|

|

5,487 |

|

|

|

227 |

|

|

4% |

|

Add: integration costs related to HEXO |

|

5,915 |

|

|

|

- |

|

|

|

5,915 |

|

|

NM |

|

Adjusted free cash flow |

$ |

(6,336 |

) |

|

$ |

(42,319 |

) |

|

$ |

35,983 |

|

|

(85)% |

|

|

|

|

|

|

|

|

|

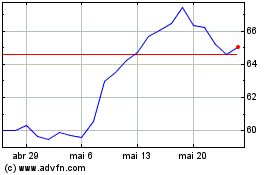

Anheuser Busch Inbev SA NV (NYSE:BUD)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Anheuser Busch Inbev SA NV (NYSE:BUD)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025