Ero Copper Corp. (TSX: ERO, NYSE: ERO) ("Ero" or

the “Company”) is pleased to announce it has entered into a binding

term sheet ("Term Sheet") with Salobo Metais S.A, part of the Vale

Base Metals business ("VBM") to advance its Furnas copper project

("Furnas" or the "Project") located in the Carajás Mineral Province

in Pará State, Brazil. The Term Sheet contemplates Ero Copper

earning a 60% interest in the Project upon completion of several

exploration, engineering and development milestones over a period

of five years from the execution of a definitive earn-in agreement.

In exchange for its 60% interest, Ero will solely fund a phased

exploration and engineering work program during the earn-in period

and grant VBM up to an 11.0% free carry on future Project

construction capital expenditures (see "Summary of Key Terms").

"We are delighted for the opportunity to partner

with VBM to advance the Furnas copper project. We are fully

committed to unlocking value for all stakeholders by accelerating

what we believe is a world-class project," said David Strang, Chief

Executive Officer. "This partnership will leverage VBM and Ero's

collective strengths as well as our shared vision for sustainable

mine development."

"As construction of our Tucumã Project

approaches completion in the coming year, we look forward to Furnas

further contributing to the growth of copper production within the

broader Carajás region and solidifying Brazil's position as a

leader in low carbon-intensity production of critical

minerals."

Furnas is an IOCG project located approximately

50 kilometers southeast of VBM's Salobo operations and

approximately 190 kilometers northeast of Ero's Tucumã Project.

Covering an area of approximately 2,400 hectares, the Project sits

within fifteen kilometers of extensive regional infrastructure,

including paved roads, an industrial-scale cement plant, a power

substation and Vale's railroad loadout facility. A map of the

Carajás Mineral Province and Project location is shown in Figure

1.

Ero's exploration and development efforts will

focus on two discrete high-grade zones identified within the

overall mineralized body, known as the SE and NW Zones, that extend

over a combined strike length of approximately five kilometers. The

Company's initial work program will include infill drilling to

increase confidence around, and continuity of, these two high-grade

zones, as well as extensional drilling to depth where limited prior

drilling suggests increasing grades and thickness. Known high-grade

mineralization ranges between approximately 20 to 60 meters in

thickness and has been drilled to a general depth from surface of

approximately 300 meters (vertical). A plan view map of the Project

is shown in Figure 2. Cross-sections of the high-grade SE and NW

Zones are shown in Figures 3 and 4, respectively. Drill intercepts

within these zones are highlighted by:

- SE Zone

- PKC-FURN-FD024:

- 59.0 meters grading 2.11% Cu and

0.54 gpt Au (2.48% CuEq) from 58.0 meters, including 5.0 meters

grading 15.24% Cu and 0.06 gpt Au (15.28% CuEq) from 99.0

meters

- FUR-FURN-DH00170:

- 8.6 meters grading 10.20% Cu and

0.06 gpt Au (10.24% CuEq) from 81.0 meters

- PKC-FURN-DH00036:

- 36.0 meters grading 1.04% Cu and

0.94 gpt Au (1.69% CuEq) from 236.0 meters, including 20.0 meters

at 1.25% Cu and 1.59 gpt Au (2.34% CuEq) from 242.0 meters

- NW Zone

- FUR-FURN-DH00102:

- 32.0 meters grading 1.22% Cu and

0.64 gpt Au (1.67% CuEq) from 293.5 meters, including 14.0 meters

grading 1.98% Cu and 0.68 gpt Au (2.45% CuEq) from 297.4

meters

- FUR-FURN-DH00177:

- 54.9 meters grading 0.88% Cu and

0.63 gpt Au (1.31% CuEq) from 381.1 meters, including 12.9 meters

grading 1.28% Cu and 0.63 gpt Au (1.72% CuEq) from 381.1

meters

As part of its overall work program, Ero intends

to validate the historical exploration drill database, develop

block models incorporating planned infill and extensional drilling

to prepare a mineral resource estimate that complies with NI 43-101

(as defined below), generate selective mine designs, perform

confirmatory metallurgical test work, develop process flow sheet

designs, undertake geotechnical and environmental studies, and

advance various community and social programs.

Where applicable, copper equivalent ("CuEq") in

this press release has been calculated using the following formula:

CuEq = Cu + (Au x 0.687) based on long-term copper and gold prices

of $3.50 per pound and $1,650 per ounce, respectively. No

adjustment for metallurgical recoveries has been made when

calculating CuEq.

SUMMARY OF KEY TERMS

- To earn a 60% interest in the

Project, the Term Sheet requires Ero to complete three phases of

work:

- Phase 1: Ero to

conduct a minimum of 28,000 meters of exploration drilling and

produce a scoping study within 18 months of signing a definitive

earn-in agreement

- Phase 2: Ero to

conduct an additional minimum of 17,000 meters of exploration

drilling and produce a pre-feasibility study within 18 months of

completing Phase 1

- Phase 3: Ero to

conduct an additional minimum of 45,000 meters of exploration

drilling, unless otherwise mutually agreed, and produce a

definitive feasibility study ("DFS") within 24 months of completing

Phase 2

- Following the completion of a DFS,

subject to customary technical review periods, and with Ero

positive investment approval, the parties will enter into a joint

venture agreement whereby VBM will transfer 60% of the equity

interest in the Project to Ero, and Ero will grant VBM a "free

carry" on certain capital expenditures related to Project

development(1)

- Ero to grant VBM an initial 11%

free carry, funding 71% of the first $1.0 billion of Project

capital expenditures(1)

- If applicable, Ero to grant VBM a

subsequent 5.5% free carry, funding 65.5% of the next $1.0 billion

of Project capital expenditures(1)

- If applicable, each party to fund

its then pro rata share of capital expenditures(1) beyond $2.0

billion

- As long as VBM maintains greater

than 30% ownership, it will have 100% offtake rights on the copper

concentrate produced by the Project

- Prior to a positive Ero investment

decision and the formation of a joint venture, VBM will retain 100%

ownership of the Project with Ero solely responsible for funding

the phased exploration and engineering work programs related to the

Project as well as ongoing payments to maintain the property in

good standing. Failure of Ero achieving the prescribed milestones

within the earn-in period, will have the earn-in option drop

away

(1) The free carry will apply only to initial

capital expenditures and future growth capital related to the

expansion of mining and milling capacities, and will not apply to

any sustaining capital required for the operations. The applicable

capital will be inflation-adjusted based on a US-Dollar denominated

benchmark inflation index with reference to the month in which the

definitive earn-in agreement is signed.

Figure 1: Map of the Carajás

Mineral Province, highlighting the location of Furnas as well as

the Tucumã

Project.https://www.globenewswire.com/NewsRoom/AttachmentNg/d9cbf5fa-a5c2-4f7c-a226-e3dd0c6a336a

Figure 2: Furnas Plan View Map,

including drill collar

locations.https://www.globenewswire.com/NewsRoom/AttachmentNg/93f135b6-f41d-48fe-9fc9-2d1c89831258Rock

types include:

|

Abbreviation |

|

Rock Type |

|

HCS |

|

Calco-sodic hydrothermal rock |

|

GRA |

|

Granite |

|

DIO |

|

Diorite |

|

RCL HD |

|

Chlorite-rich hydrothermal

rock |

|

GMF HD |

|

Grunerite-garnet-magnetite

hydrothermal rock |

|

GMF HD-2 |

|

Grunerite-garnet-magnetite

hydrothermal rock |

|

XTA |

|

Aluminous schist |

|

RSL Host |

|

Quartz-rich rock |

|

GMF RSL |

|

Magnetite-rich hydrothermal

rock / quartz-rich rock |

|

|

|

|

Figure 3: Cross section within

the high-grade SE Zone of

Furnas.https://www.globenewswire.com/NewsRoom/AttachmentNg/8678bb92-b575-4dc5-b7cd-ea3936194d67Rock

types include:

|

Abbreviation |

|

Rock Type |

|

XTA |

|

Aluminous schist |

|

GMF HD |

|

Grunerite-garnet-magnetite

hydrothermal rock |

|

RCL HD |

|

Chlorite-rich hydrothermal rock |

|

RSL Host |

|

Quartz-rich rock |

|

|

|

|

Figure 4: Cross section within

the high-grade NW Zone of

Furnas.https://www.globenewswire.com/NewsRoom/AttachmentNg/4ee07d7b-9bff-47ee-a9c0-5cd60f039b90Rock

types include:

|

Abbreviation |

|

Rock Type |

|

HCS |

|

Calco-sodic hydrothermal rock |

|

GRA |

|

Granite |

|

RCL HD |

|

Chlorite-rich hydrothermal

rock |

|

GMF HD |

|

Grunerite-garnet-magnetite

hydrothermal rock |

|

XTA |

|

Aluminous schist |

|

RSL Host |

|

Quartz-rich rock |

|

GMF RSL |

|

Magnetite-rich hydrothermal

rock / quartz-rich rock |

|

|

|

|

QUALIFIED PERSONS

Mr. Cid Gonçalves Monteiro Filho, SME RM

(04317974), MAIG (No. 8444), FAusIMM (No. 3219148) has reviewed and

approved the scientific and technical information contained in this

press release. Mr. Monteiro is Resource Manager of the Company and

is a “qualified person” within the meanings of NI 43-101.

QUALITY ASSURANCE & QUALITY CONTROL

Four diamond exploration drilling campaigns were

previously carried out on Furnas, with control sample protocols

applied to each campaign. Historical quality assurance and quality

control (QA/QC) data were evaluated, including duplicates, blanks

and standard samples from the most recent drilling campaign.

In all drilling campaigns, a quarter of the

recovered core sample was collected. In the first three exploration

campaigns, one-meter sampling intervals were used. In the fourth

exploration campaign one-meter sampling intervals were used in the

mineralized zone and two-meter sampling intervals were used in the

weathered zone and in waste rock.

Physical preparation of the quarter-core samples

was performed in the following laboratories: Vale/Carajás,

Intertek-Parauapebas-PA, Intertek-Nova Lima-MG, SGS GEOSOL, or

Lakefield-Geosol. Chemical analysis was performed by ACME,

Lakefield-Geosol in Belo Horizonte/MG, and SGS Geosol Laboratories

in Vespasiano/MG. The selection of analytical methods and the

number of elements analyzed varied across exploration

campaigns.

To verify the accuracy of older sampling

campaigns, a re-analysis program was performed on Cu and Au for

select assay intervals. The reanalysis program demonstrates good

performance, particularly for Cu and Au, allowing for the inclusion

of historical campaign data for the purposes of this press

release.

The Company intends to validate the entirety of

the historical exploration database as part of its Phase 1 work

program.

ABOUT ERO COPPER CORP

Ero is a high-margin, high-growth, low

carbon-intensity copper producer with operations in Brazil and

corporate headquarters in Vancouver, B.C. The Company's primary

asset is a 99.6% interest in the Brazilian copper mining company,

Mineração Caraíba S.A. ("MCSA"), 100% owner of the Company's

Caraíba Operations (formerly known as the MCSA Mining Complex),

which are located in the Curaçá Valley, Bahia State, Brazil and

include the Pilar and Vermelhos underground mines and the Surubim

open pit mine, and the Tucumã Project (formerly known as Boa

Esperança), an IOCG-type copper project located in Pará, Brazil.

The Company also owns 97.6% of NX Gold S.A. ("NX Gold") which owns

the Xavantina Operations (formerly known as the NX Gold Mine),

comprised of an operating gold and silver mine located in Mato

Grosso, Brazil. Additional information on the Company and its

operations, including technical reports on the Caraíba Operations,

Xavantina Operations and Tucumã Project, can be found on the

Company's website (www.erocopper.com), on SEDAR (www.sedar.com),

and on EDGAR (www.sec.gov). The Company’s shares are publicly

traded on the Toronto Stock Exchange and the New York Stock

Exchange under the symbol “ERO”.

FOR MORE INFORMATION, PLEASE CONTACT

Courtney Lynn, SVP, Corporate Development,

Investor Relations & Sustainability(604)

335-7504info@erocopper.com

CAUTION REGARDING FORWARD LOOKING INFORMATION

AND STATEMENTS

This press release contains “forward-looking

statements” within the meaning of the United States Private

Securities Litigation Reform Act of 1995 and “forward-looking

information” within the meaning of applicable Canadian securities

legislation (collectively, “forward-looking statements”).

Forward-looking statements include statements that use

forward-looking terminology such as “may”, “could”, “would”,

“will”, “should”, “intend”, “target”, “plan”, “expect”, “budget”,

“estimate”, “forecast”, “schedule”, “anticipate”, “believe”,

“continue”, “potential”, “view” or the negative or grammatical

variation thereof or other variations thereof or comparable

terminology. Forward-looking statements may include, but are not

limited to, statements with respect to the signing of a definitive

earn-in agreement by Ero and Vale, Ero's ability to create value at

and/or maximize the value of the Furnas Project through the

definitive earn-in agreement and joint venture partnership with

Vale; Ero's ability to leverage Vale's historic database on the

Furnas Project; Ero's ability to define an economically viable

development and operating strategy for the Furnas Project; Ero's

ability to complete each phase of the earn-in agreement, including

its ability to conduct the required amount of exploration and

produce the required study within the defined timeframe for each

earn-in phase; and any other statement that may predict, forecast,

indicate or imply future plans, intentions, levels of activity,

results, performance or achievements.

Forward-looking statements are not a guarantee

of future performance. There can be no assurance that

forward-looking statements will prove to be accurate, as actual

results and future events could differ materially from those

anticipated in such statements. Forward-looking statements involve

statements about the future and are inherently uncertain, and the

Company’s actual results, achievements or other future events or

conditions may differ materially from those reflected in the

forward-looking statements due to a variety of risks, uncertainties

and other factors, including, without limitation, those referred to

herein and in the AIF under the heading “Risk Factors”.

The Company’s forward-looking statements are

based on the assumptions, beliefs, expectations and opinions of

management on the date the statements are made, many of which may

be difficult to predict and beyond the Company’s control. In

connection with the forward-looking statements contained in this

press release and in the AIF, the Company has made certain

assumptions about, among other things: continued effectiveness of

the measures taken by the Company to mitigate the possible impact

of COVID-19 on its workforce and operations; favourable equity and

debt capital markets; the ability to raise any necessary additional

capital on reasonable terms to advance the production, development

and exploration of the Company’s properties and assets; future

prices of copper, gold and other metal prices; the timing and

results of exploration and drilling programs; the accuracy of any

mineral reserve and mineral resource estimates; the geology of the

Caraíba Operations, the Xavantina Operations and the Tucumã Project

being as described in the respective technical report for each

property; production costs; the accuracy of budgeted exploration,

development and construction costs and expenditures; the price of

other commodities such as fuel; future currency exchange rates and

interest rates; operating conditions being favourable such that the

Company is able to operate in a safe, efficient and effective

manner; work force continuing to remain healthy in the face of

prevailing epidemics, pandemics or other health risks (including

COVID-19), political and regulatory stability; the receipt of

governmental, regulatory and third party approvals, licenses and

permits on favourable terms; obtaining required renewals for

existing approvals, licenses and permits on favourable terms;

requirements under applicable laws; sustained labour stability;

stability in financial and capital goods markets; availability of

equipment; positive relations with local groups and the Company’s

ability to meet its obligations under its agreements with such

groups; and satisfying the terms and conditions of the Company’s

current loan arrangements. Although the Company believes that the

assumptions inherent in forward-looking statements are reasonable

as of the date of this press release, these assumptions are subject

to significant business, social, economic, political, regulatory,

competitive and other risks and uncertainties, contingencies and

other factors that could cause actual actions, events, conditions,

results, performance or achievements to be materially different

from those projected in the forward-looking statements. The Company

cautions that the foregoing list of assumptions is not exhaustive.

Other events or circumstances could cause actual results to differ

materially from those estimated or projected and expressed in, or

implied by, the forward-looking statements contained in this press

release. There can be no assurance that forward-looking statements

will prove to be accurate, as actual results and future events

could differ materially from those anticipated in such statements.

Accordingly, readers should not place undue reliance on

forward-looking statements.

Forward-looking statements contained herein are

made as of the date of this press release and the Company disclaims

any obligation to update or revise any forward-looking statement,

whether as a result of new information, future events or results or

otherwise, except as and to the extent required by applicable

securities laws.

CAUTIONARY NOTES REGARDING MINERAL RESOURCE AND

MINERAL RESERVE ESTIMATES

Unless otherwise indicated, all reserve and

resource estimates included in this press release and the documents

incorporated by reference herein have been prepared in accordance

with National Instrument 43-101, Standards of Disclosure for

Mineral Projects (“NI 43-101") and the Canadian Institute of

Mining, Metallurgy and Petroleum (the “CIM”) — CIM Definition

Standards on Mineral Resources and Mineral Reserves, adopted by the

CIM Council, as amended (the “CIM Standards”). NI 43-101 is a rule

developed by the Canadian Securities Administrators that

establishes standards for all public disclosure an issuer makes of

scientific and technical information concerning mineral projects.

Canadian standards, including NI 43-101, differ significantly from

the requirements of the United States Securities and Exchange

Commission (the “SEC”), and reserve and resource information

included herein may not be comparable to similar information

disclosed by U.S. companies. In particular, and without limiting

the generality of the foregoing, this press release and the

documents incorporated by reference herein use the terms “measured

resources,” “indicated resources” and “inferred resources” as

defined in accordance with NI 43-101 and the CIM Standards.

Further to recent amendments, mineral property

disclosure requirements in the United States (the “U.S. Rules”) are

governed by subpart 1300 of Regulation S-K of the U.S. Securities

Act of 1933, as amended (the “U.S. Securities Act”) which differ

from the CIM Standards. As a foreign private issuer that is

eligible to file reports with the SEC pursuant to the

multi-jurisdictional disclosure system (the “MJDS”), Ero is not

required to provide disclosure on its mineral properties under the

U.S. Rules and will continue to provide disclosure under NI 43-101

and the CIM Standards. If Ero ceases to be a foreign private issuer

or loses its eligibility to file its annual report on Form 40-F

pursuant to the MJDS, then Ero will be subject to the U.S. Rules,

which differ from the requirements of NI 43-101 and the CIM

Standards.

Pursuant to the new U.S. Rules, the SEC

recognizes estimates of “measured mineral resources”, “indicated

mineral resources” and “inferred mineral resources.” In addition,

the definitions of “proven mineral reserves” and “probable mineral

reserves” under the U.S. Rules are now “substantially similar” to

the corresponding standards under NI 43-101. Mineralization

described using these terms has a greater amount of uncertainty as

to its existence and feasibility than mineralization that has been

characterized as reserves. Accordingly, U.S. investors are

cautioned not to assume that any measured mineral resources,

indicated mineral resources, or inferred mineral resources that Ero

reports are or will be economically or legally mineable. Further,

“inferred mineral resources” have a greater amount of uncertainty

as to their existence and as to whether they can be mined legally

or economically. Under Canadian securities laws, estimates of

“inferred mineral resources” may not form the basis of feasibility

or pre-feasibility studies, except in rare cases. While the above

terms under the U.S. Rules are “substantially similar” to the

standards under NI 43-101 and CIM Standards, there are differences

in the definitions under the U.S. Rules and CIM Standards.

Accordingly, there is no assurance any mineral reserves or mineral

resources that Ero may report as “proven mineral reserves”,

“probable mineral reserves”, “measured mineral resources”,

“indicated mineral resources” and “inferred mineral resources”

under NI 43-101 would be the same had Ero prepared the reserve or

resource estimates under the standards adopted under the U.S.

Rules.

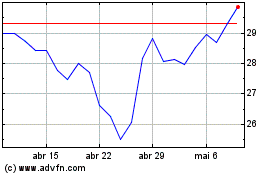

Ero Copper (TSX:ERO)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Ero Copper (TSX:ERO)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025