LACROIX : 9.9% increase in revenue for the first 9 months of the

year.

07/11/2023

9.9% increase in

revenuefor the first 9 months of the

year

Stable business in third quarter (+0.9%)

despite unfavorable base effect and the slow down

in the automotive market

Financial targets for 2023

:€750 million revenue

confirmedEBITDA expected around €45

million

3rd

quarter marked by unfavorable base

effectSolid growth over the first 9 months of the

year

In the 3rd quarter of the year, LACROIX recorded

a revenue of 179.7 million euros (M€), up 0.9% on the same period

of 2022. This trend, which stems solely from organic growth,

includes a positive currency effect of 0.15 M€. At constant scope

of consolidation and exchange rates(1), sales were up 0.8%.

The 3rd quarter was marked by strong momentum in

the City (+16.4%) and Environment (+10.2%) activities, while the

Electronics activity recorded a slight contraction (-3.2%). As a

reminder, in the 3rd quarter of 2022, it included significant

re-invoicing to customers of additional costs for electronic

components (- €4.8 million in 2023 vs 2022). Without this one-off

increase in revenue in 2022 - carrying zero margin – Electronics

activity sales would have risen in Q3 2023.

Cumulatively for the first 9 months of the year,

LACROIX revenue is still up by a sustained 9.9% (+9.6% on a

like-for-like basis and at constant exchange rates), at 567.4 M€

over the period.

|

Revenue in millions euros |

Q32023 |

Q3 2022 |

Variation |

9M2023 |

9M2022 |

Variation |

|

Electronics Activity |

131,1 |

135,4 |

-3,2% |

426,0 |

383,5 |

+11,1% |

|

City Activity |

28,4 |

24,4 |

+16,4% |

82,0 |

75,8 |

+8,2% |

|

Environment Activity |

20,1 |

18,3 |

+10,2% |

59,4 |

57,1 |

+4,1% |

|

Total LACROIX Group |

179,7 |

178,1 |

+0,9% |

567,4 |

516,4 |

+9,9% |

Electronics Activity

Sales in the Electronics division came to €131.1

million in Q3 2023, down -3.2% on the strong 18.8% increase

recorded in the first six months of the year. Apart from the base

effect linked to past component re-invoicing, this trend is the

result of a slowdown in the two geographic zones addressed. In

EMEA, growth remained solid in the Industry and Avionics segments,

slowed in the Automotive sector and remained downgraded on HBAS

(Home and Building Automation Systems) after several years of

hypergrowth. In North America, business was impacted at the end of

the quarter by the first postponements of deliveries caused by the

labor unrest at American car manufacturers.

Over the first nine months of the year,

Electronics sales rose by 11.1% to €426.0 million, buoyed by the

introduction of numerous new projects.

City Activity

City revenue came to €28.4 million in Q3,

showing a clear acceleration of +16.4%. This dynamic performance

continues to be driven by the remarkable trajectory of the Street

Lighting division, but also by the excellent performance of the

Traffic division, with major international orders in progress, and

by growth in the Road signs segment.

With these three segments in positive territory

since the start of the year, total revenue for the City activity

came to €82.0 million over 9 months, up 8.2%.

Environment Activity

Revenue is also up sharply in the 3rd quarter

(+10.2%), totaling €20.1 million. As anticipated, it was driven by

two segments: International Water, with growth of over 30%, driven

in particular by the delivery of projects in Saudi Arabia, and

Smart Grids.

Overall, Environment revenue for the first nine

months of the year came to €59.4 million, up 4.1% on the comparable

period in 2022.

2023 objectives :

Revenue target confirmedAdjustment of

Ebitda target, still expected to be higher than in

2022

LACROIX enjoys good visibility on the growth

momentum of its City and Environment activities, whose order books

to September 30, 2023 remain solid. Regarding Electronics, the

uncertainties mentioned at the end of September concerning the

evolution of automotive demand across the Atlantic have not been

lifted, despite the recent ending of the social movement that began

mid-september. In addition, in the EMEA region, despite the

positive trend in the Industry and Avionics segments, the slowdown

in growth in the Automotive and HBAS segments is proving more

marked than anticipated.

Overall, LACROIX remains confident in exceeding

a revenue of €750 million by 2023 on a like-for-like basis, i.e. an

increase of at least 6%. In terms of profitability, the target of

EBITDA is now expected to be around €45 million, compared with an

initial target of over €50 million, with the difference coming

entirely from the Electronics activity in North America, impacted

by the concomitance of several transitory factors. This target

adjusted to take account of recent changes in business conditions,

remains higher than the EBITDA achieved for fiscal year 2022 (€44,3

million). In the longer run, structural growth drivers

remain in force, and all the financial targets set out in the

Leadership 2025 plan remain achievable. Their confirmation,

however, remains dependent on the performance recovery of the North

American activity and the market evolution of the automotive

segment in a context of lower visibility.

Upcoming eventsAnnual

revenue : 8th february after the market close

Find more financial information in the

Investor’s

Zonehttps://www.lacroix-group.com/investors/

About LACROIX

Convinced that technology should contribute to

simple, sustainable, and safer environments, LACROIX supports its

customers in the construction and management of intelligent living

ecosystems, thanks to connected equipment and

technologies. As a publicly listed family-owned mid-cap,

with a turnover of €708 million in 2022, LACROIX combines the

essential agility required to innovate in an ever-changing

technological sector with the ability to industrialize robust and

secure equipment, cutting-edge know-how in industrial IoT solutions

and electronic equipment for critical applications and the

long-term vision to invest and build for the

future. LACROIX designs and manufactures its customers’

electronic equipment, as well as IoT (hardware, software, and

cloud) and AI solutions, for the automotive, industrial, smart home

and building, avionics and defense, and healthcare sectors. The

Group also provides connected and secure equipment and solutions to

optimize the management of critical infrastructures such as smart

roads (street lighting, traffic management, V2X and traffic signs)

and the remote control of water and energy

infrastructures. Drawing on its extensive experience and

expertise, LACROIX works with its customers and partners to build

the connection between the world of today and the world of

tomorrow. It helps them to create the industry of the future and to

make the most of the opportunities for innovation that surround

them, supplying them with the equipment and solutions for a smarter

world.

|

Contacts

LACROIX COO & Executive

Vice-PresidentNicolas Bedouin

investors@lacroix.group Tel.: +33 (0)2 72 25 68 80 |

ACTIFIN

Press RelationsJennifer Jullia jjullia@actifin.fr

Tel. : +33 (0)1 56 88 11 19 |

ACTIFIN

Financial CommunicationMarianne Pympy@actifin.fr

Tel. : +33 (0)6 88 78 59 99 |

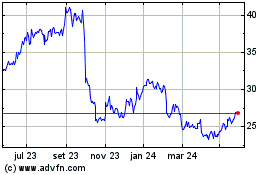

Lacroix (EU:LACR)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

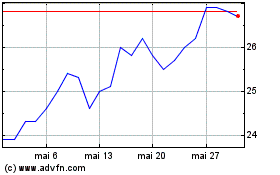

Lacroix (EU:LACR)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025