iPower Inc. (Nasdaq: IPW) (“iPower” or the “Company”), a tech and

data-driven online retailer and supplier of consumer home and

garden products, as well as a provider of value-added ecommerce

services, today announced financial results for its fiscal first

quarter ended September 30, 2023.

Fiscal Q1 2024 Results vs. Fiscal Q1

2023 (unless otherwise noted)

- Total revenue

increased 2% to $26.5 million compared to the Company’s record

$26.0 million in Q1 2023.

- Gross profit

increased 18% to $11.8 million, while gross margin increased 600

bps to 44.4% compared to 38.4%.

- Net loss

attributable to iPower improved 69% to $1.3 million or $(0.04) per

share, compared to net loss attributable to iPower of $4.2 million

or $(0.14) per share.

- As of September 30, 2023, net debt

(total debt less cash) was reduced by 48% to $4.3 million compared

to net debt of $8.1 million as of June 30, 2023.

Management Commentary

“We continued to generate revenue growth during

the quarter, surpassing the challenging comp against our record

revenues in fiscal Q1 2023,” said Lawrence Tan, CEO of iPower.

“Sales of our non-hydroponic products remained strong at more than

75% of revenue, largely driven by categories such as fans, shelving

and outdoor patio furniture. Business generated by our SuperSuite

supply chain partnerships has reached an annualized revenue

run-rate of approximately $7.0 million and continues to gain

momentum as we work through our growing pipeline of prospective

partnerships. We are pleased with the early financial results as

well as the invaluable insights that we are gaining from this

accelerating area of our business.”

iPower CFO, Kevin Vassily, added, “As

highlighted last quarter, we have continued to drive reductions to

our supply of higher cost inventory and are now beginning to

realize the benefit of our efforts through gross margin expansion,

which has reached our highest level in nearly two years.

Additionally, we made material improvements to our capitalization

during the quarter, with net debt decreasing 48% as compared to the

close of fiscal 2023. These actions place us in a good position to

capitalize on prospective acquisition opportunities as we continue

to drive growth and target a return to profitability in fiscal

2024.”

Fiscal First Quarter 2024 Financial

Results

Total revenue in the fiscal first quarter of

2024 increased 2% to $26.5 million as compared to $26.0 million for

the same period in fiscal 2023. The increase was driven in-part by

growth from the Company’s SuperSuite supply chain offerings, which

is generating approximately $600,000 in revenue per month, as well

as favorable seasonality in the Company’s product mix.

Gross profit in the fiscal first quarter of 2024

increased 18% to $11.8 million as compared to S10.0 million in the

same quarter in fiscal 2023. As a percentage of revenue, gross

margin increased 600 basis points to 44.4% compared to 38.4% in the

year-ago period. The increase in gross margin was primarily driven

by a favorable product mix.

Total operating expenses in the fiscal first

quarter of 2024 improved 11% to $13.0 million compared to $14.6

million for the same period in fiscal 2023. The decrease was driven

primarily by a $3.1 million decrease in impairment loss on

goodwill, partially offset by increased selling and fulfillment

expenses.

Net loss attributable to iPower in the fiscal

first quarter of 2024 improved to $1.3 million or $(0.04) per

share, as compared to a net loss attributable to iPower of $4.2

million or $(0.14) per share for the same period in fiscal 2023.

The improvement was driven by the aforementioned higher gross

profit and lower operating expenses.

Cash and cash equivalents were $2.7 million at

September 30, 2023, as compared to $3.7 million at June 30, 2023.

Total debt as of September 30, 2023 was $7.0 million as compared to

$11.8 million as of June 30, 2023. As a result of the Company’s

debt paydown, net debt (total debt less cash) was reduced by 48% to

$4.3 million compared to $8.1 million as of June 30, 2023.

Conference Call

The Company will hold a conference call today,

November 14, 2023, at 4:30 p.m. Eastern Time to discuss the results

for its fiscal first quarter ended September 30, 2023.

iPower’s management will host the conference

call, which will be followed by a question-and-answer session.

The conference call details are as follows:

Date: Tuesday, November 14, 2023Time: 4:30 p.m. Eastern

timeDial-in registration link: hereLive webcast registration link:

here

Please dial into the conference call 5-10

minutes prior to the start time. If you have any difficulty

connecting with the conference call, please contact the Company’s

investor relations team at IPW@elevate-ir.com.

The conference call will also be broadcast live

and available for replay in the Events & Presentations section

of the Company’s website at www.meetipower.com.

About iPower Inc.

iPower Inc. is a tech and data-driven online

retailer and supplier of consumer home and garden products, as well

as a provider of value-added ecommerce services for third-party

products and brands. iPower offers thousands of stock keeping units

from its in-house brands as well as hundreds of other brands

through its ecommerce channel partners and its websites,

www.zenhydro.com and www.simpledeluxe.com. iPower has a diverse

customer base that includes both commercial businesses and

individuals. For more information, please visit iPower's website at

www.meetipower.com.

Forward-Looking Statements

All statements other than statements of

historical fact in this press release are forward-looking

statements. These forward-looking statements involve known and

unknown risks and uncertainties and are based on current

expectations and projections about future events and financial

trends that iPower believes may affect its financial condition,

results of operations, business strategy, and financial needs.

Investors can identify these forward-looking statements by words or

phrases such as "may," "will," "expect," "anticipate," "aim,"

"estimate," "intend," "plan," "believe," "potential," "continue,"

"is/are likely to" or other similar expressions. iPower undertakes

no obligation to update forward-looking statements to reflect

subsequent events or circumstances, or changes in its expectations,

except as may be required by law. Although iPower believes that the

expectations expressed in these forward-looking statements are

reasonable, it cannot assure you that such expectations will turn

out to be correct, and iPower cautions investors that actual

results may differ materially from the anticipated results and

encourages investors to review other factors that may affect its

future results and performance in iPower's Annual Report on Form

10-K, as filed with the SEC on September 15, 2023, its Quarterly

Report on Form 10-Q, as filed with the SEC on November 14, 2023,

and in its other SEC filings.

Investor Relations Contact:

Sean Mansouri, CFAElevate IR(720)

330-2829IPW@elevate-ir.com

| iPower Inc. and

Subsidiaries |

| Unaudited Condensed

Consolidated Balance Sheets |

| As of September 30,

2023 and June 30, 2023 |

| |

|

|

|

September 30, |

|

June 30, |

|

|

|

2023 |

|

2023 |

|

|

|

(Unaudited) |

|

|

|

| ASSETS |

|

|

|

|

|

|

| Current

assets |

|

|

|

|

|

|

|

Cash and cash equivalent |

|

$ |

2,729,161 |

|

|

$ |

3,735,642 |

|

|

Accounts receivable, net |

|

|

13,237,282 |

|

|

|

14,071,543 |

|

|

Inventories, net |

|

|

15,056,623 |

|

|

|

20,593,889 |

|

|

Other receivable - related party |

|

|

- |

|

|

|

- |

|

|

Prepayments and other current assets |

|

|

1,811,499 |

|

|

|

2,858,196 |

|

|

Total current assets |

|

|

32,834,565 |

|

|

|

41,259,270 |

|

| |

|

|

|

|

|

|

| Non-current

assets |

|

|

|

|

|

|

|

Right of use - non-current |

|

|

7,763,712 |

|

|

|

7,837,345 |

|

|

Property and equipment, net |

|

|

496,901 |

|

|

|

536,418 |

|

|

Deferred tax assets |

|

|

2,432,439 |

|

|

|

2,155,250 |

|

|

Non-current prepayments |

|

|

461,034 |

|

|

|

531,456 |

|

|

Goodwill |

|

|

3,034,110 |

|

|

|

3,034,110 |

|

|

Investment in joint venture |

|

|

32,088 |

|

|

|

33,113 |

|

|

Intangible assets, net |

|

|

4,117,728 |

|

|

|

4,280,071 |

|

|

Other non-current assets |

|

|

417,639 |

|

|

|

427,254 |

|

|

Total non-current assets |

|

|

18,755,651 |

|

|

|

18,835,017 |

|

| |

|

|

|

|

|

|

|

Total assets |

|

$ |

51,590,216 |

|

|

$ |

60,094,287 |

|

| |

|

|

|

|

|

|

| LIABILITIES

AND EQUITY |

|

|

|

|

|

|

| Current

liabilities |

|

|

|

|

|

|

|

Accounts payable |

|

|

12,031,323 |

|

|

|

13,244,957 |

|

|

Credit cards payble |

|

|

693,327 |

|

|

|

366,781 |

|

|

Customer deposit |

|

|

362,826 |

|

|

|

350,595 |

|

|

Other payables and accrued liabilities |

|

|

3,292,581 |

|

|

|

4,831,067 |

|

|

Advance from shareholders |

|

|

84,718 |

|

|

|

85,200 |

|

|

Investment payable |

|

|

- |

|

|

|

- |

|

|

Lease liability - current |

|

|

2,169,603 |

|

|

|

2,159,173 |

|

|

Short-term loan payable - related party |

|

|

1,006,060 |

|

|

|

2,017,852 |

|

|

Long-term promissory note payable - current portion |

|

|

1,149,961 |

|

|

|

- |

|

|

Income taxes payable |

|

|

275,117 |

|

|

|

276,683 |

|

|

Total current liabilities |

|

|

21,065,516 |

|

|

|

23,332,308 |

|

| |

|

|

|

|

|

|

| Non-current

liabilities |

|

|

|

|

|

|

|

Long-term revolving loan payable, net |

|

|

4,808,322 |

|

|

|

9,791,191 |

|

|

Long-term promissory note payable, net |

|

|

0 |

|

|

|

- |

|

|

Deferred tax liabilities |

|

|

- |

|

|

|

- |

|

|

Lease liability - non-current |

|

|

6,023,813 |

|

|

|

6,106,047 |

|

| |

|

|

|

|

|

|

|

Total non-current liabilities |

|

|

10,832,135 |

|

|

|

15,897,238 |

|

| |

|

|

|

|

|

|

|

Total liabilities |

|

|

31,897,651 |

|

|

|

39,229,546 |

|

| |

|

|

|

|

|

|

| Commitments

and contingency |

|

|

- |

|

|

|

- |

|

| |

|

|

|

|

|

|

|

Stockholders' Equity |

|

|

|

|

|

|

|

Preferred stock, $0.001 par value; 20,000,000 shares authorized; 0

shares issued and |

|

|

|

|

|

|

|

outstanding at June 30, 2023 and 2022 |

|

|

- |

|

|

|

- |

|

|

Common stock, $0.001 par value; 180,000,000 shares authorized;

29,710,939 and |

|

|

|

|

|

|

|

29,572,382 shares issued and outstanding at June 30, 2023 and

2022 |

|

|

29,712 |

|

|

|

29,712 |

|

|

Additional paid in capital |

|

|

29,742,402 |

|

|

|

29,624,520 |

|

|

(Accumulated deficits) Retained earnings |

|

|

(9,988,957 |

) |

|

|

(8,702,442 |

) |

|

Non-controlling interest |

|

|

(27,751 |

) |

|

|

(24,915 |

) |

|

Accumulated other comprehensive income (loss) |

|

|

(62,841 |

) |

|

|

(62,134 |

) |

|

Total equity |

|

|

19,692,565 |

|

|

|

20,864,741 |

|

| |

|

|

|

|

|

|

| Total

liabilities and equity |

|

$ |

51,590,216 |

|

|

$ |

60,094,287 |

|

| |

|

|

|

|

|

|

| iPower Inc. and

Subsidiaries |

| Unaudited Condensed

Consolidated Statements of Operations |

| For the Three Months

Ended September 30, 2023 and 2022 |

| |

|

|

|

For the Three Months

Ended September 30, |

| |

|

2023 |

|

2022 |

| |

|

(Unaudited) |

|

(Unaudited) |

| |

|

|

|

|

|

|

|

REVENUES |

|

$ |

26,508,487 |

|

|

$ |

26,022,673 |

|

| |

|

|

|

|

|

|

| TOTAL

REVENUES |

|

|

26,508,487 |

|

|

|

26,022,673 |

|

| |

|

|

|

|

|

|

| COST OF

REVENUES |

|

|

14,749,529 |

|

|

|

16,036,957 |

|

| |

|

|

|

|

|

|

| GROSS

PROFIT |

|

|

11,758,845 |

|

|

|

9,985,716 |

|

| |

|

|

|

|

|

|

| OPERATING

EXPENSES: |

|

|

|

|

|

|

| Selling and fulfillment |

|

|

10,063,471 |

|

|

|

8,418,812 |

|

| General and administrative |

|

|

2,964,051 |

|

|

|

3,100,176 |

|

| Impairment loss - goodwill |

|

|

- |

|

|

|

3,060,034 |

|

| Total operating expenses |

|

|

13,027,522 |

|

|

|

14,579,022 |

|

| |

|

|

|

|

|

|

| (LOSS)

INCOME FROM OPERATIONS |

|

|

(1,268,677 |

) |

|

|

(4,593,306 |

) |

| |

|

|

|

|

|

|

| OTHER INCOME

(EXPENSE) |

|

|

|

|

|

|

| Interest expenses |

|

|

(228,365 |

) |

|

|

(248,041 |

) |

| Other financing expenses |

|

|

- |

|

|

|

- |

|

| Loss on equity method investment |

|

|

(1,025 |

) |

|

|

(3,390 |

) |

| Other non-operating income |

|

|

(67,166 |

) |

|

|

211,760 |

|

| Total other expenses, net |

|

|

(296,556 |

) |

|

|

(39,671 |

) |

| |

|

|

|

|

|

|

| (LOSS)

INCOME BEFORE INCOME TAXES |

|

|

(1,565,233 |

) |

|

|

(4,632,977 |

) |

| |

|

|

|

|

|

|

| PROVISION

FOR INCOME TAX (BENEFIT) EXPENSE |

|

|

(275,882 |

) |

|

|

(447,796 |

) |

| NET (LOSS)

INCOME |

|

|

(1,289,351 |

) |

|

|

(4,185,181 |

) |

| |

|

|

|

|

|

|

| Non-controlling interest |

|

|

(2,836 |

) |

|

|

(2,805 |

) |

| |

|

|

|

|

|

|

| NET (LOSS)

INCOME ATTRIBUTABLE TO IPOWER INC. |

|

$ |

(1,286,515 |

) |

|

$ |

(4,182,376 |

) |

| |

|

|

|

|

|

|

| OTHER

COMPREHENSIVE LOSS |

|

|

|

|

|

|

|

Foreign currency translation adjustments |

|

|

(707 |

) |

|

|

(111,475 |

) |

| |

|

|

|

|

|

|

|

COMPREHENSIVE (LOSS) INCOME ATTRIBUTABLE TO IPOWER INC. |

|

$ |

(1,287,222 |

) |

|

$ |

(4,293,851 |

) |

| |

|

|

|

|

|

|

| WEIGHTED

AVERAGE NUMBER OF COMMON STOCK |

|

|

|

|

|

|

|

Basic |

|

|

29,764,515 |

|

|

|

29,665,716 |

|

| |

|

|

|

|

|

|

|

Diluted |

|

|

29,764,515 |

|

|

|

29,665,716 |

|

| |

|

|

|

|

|

|

| (LOSSES)

EARNINGS PER SHARE |

|

|

|

|

|

|

|

Basic |

|

$ |

(0.04 |

) |

|

$ |

(0.14 |

) |

| |

|

|

|

|

|

|

|

Diluted |

|

$ |

(0.04 |

) |

|

$ |

(0.14 |

) |

| |

|

|

|

|

|

|

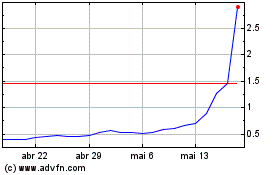

iPower (NASDAQ:IPW)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

iPower (NASDAQ:IPW)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024