Goldmoney Inc. Announces Closing of Schiff Gold Sale and Cancellation of Securities

01 Dezembro 2023 - 9:25PM

Goldmoney Inc. (TSX:XAU) (US:XAUMF) (“Goldmoney” or the “Company”),

today announces that it has closed the transaction previously

announced on September 26, 2023 (the

“

Transaction”) with PDS Family Hycet Trust (the

“

Purchaser”) to sell all of its membership

interest in its wholly-owned subsidiary, Schiff Gold LLC.

(“

SGL”).

Pursuant to the terms of a securities exchange

agreement dated December 1, 2023, Goldmoney received 212,600 common

shares of Goldmoney (the “Goldmoney Shares”) and

280,000 common share purchase warrants of Goldmoney (the

“Goldmoney Warrants” and, together with the

Goldmoney Shares, the “Goldmoney Securities”) in

consideration for all of Goldmoney’s membership interests in SGL.

Goldmoney also received payment of USD$290,000 upon closing of the

Transaction. The Goldmoney Shares have a deemed value of

approximately CAD $1,798,596 (equivalent to CAD$8.46 per share for

212,600 Goldmoney Shares), and the Goldmoney Warrants have a deemed

value of approximately $147,657 based on a Black-Scholes

valuation.

Upon closing of the Transaction, the Goldmoney

Shares were cancelled by the Company (the

“Cancellation”). The Cancellation was made as part

of the Company’s ongoing normal course issuer bid pursuant to

National Instrument 62-104 Takeover Bids and Issuer Bids

(“NI 62-104”). The price per Goldmoney Share has

been calculated to comply with the requirements of section 1.11 of

NI 62-104.

Under applicable securities regulations, Mr.

Peter Schiff is a related party of SGL (being an affiliated entity

of Goldmoney) and a control person of the Purchaser. Accordingly,

the Transaction is considered a related party transaction under

Multilateral Instrument 61-101 Protection of Minority Security

Holders in Special Transactions (“MI

61-101”). The Company is exempt from the formal valuation

and minority approval requirements under MI 61-101 respecting the

Transaction as the fair market value of the Goldmoney Securities

does not exceed 25% of the Company’s market capitalization.

Following the Cancellation, Goldmoney now has 13,533,901 total

common shares outstanding.

About Goldmoney Inc.

Founded in 2001, Goldmoney (TSX:XAU) is a TSX

listed company invested in the real economy. The leading custodians

and traders of precious metals, Goldmoney Inc. also owns and

operates businesses in jeweler manufacturing, and property

investment. For more information about Goldmoney,

visit goldmoney.com.

Media and Investor Relations inquiries:

Mark OlsonChief Financial

OfficerGoldmoney Inc.+1 647 250 7098

Forward-Looking Statements

This news release contains or refers to certain

forward-looking information. Forward-looking information can often

be identified by forward-looking words such as “anticipate”,

“believe”, “expect”, “plan”, “intend”, “estimate”, “may”,

“potential” and “will” or similar words suggesting future outcomes,

or other expectations, beliefs, plans, objectives, assumptions,

intentions or statements about future events or performance. All

information other than information regarding historical fact, which

addresses activities, events or developments that the Goldmoney

Inc. believes, expects or anticipates will or may occur in the

future, is forward-looking information, including information

regarding the merits of the Transaction and the Cancellation.

Forward-looking information does not constitute historical fact but

reflects the current expectations the Company regarding future

results or events based on information that is currently available.

By their nature, forward-looking statements involve numerous

assumptions, known and unknown risks and uncertainties, both

general and specific, that contribute to the possibility that the

predictions, forecasts, projections and other forward-looking

information will not occur. Such forward-looking information in

this release speak only as of the date hereof.

Forward-looking information in this release

includes, but is not limited to, statements with respect to: the

impact of the Transaction and the Cancellation, service times for

transactions on the Goldmoney network, future business plans,

including joint ventures and acquisitions of real estate, future

plans to diversify the Company’s business, expectations on growth

of the Company’s business, expected results of operations, and the

market for the Company’s products and services and competitive

conditions. This forward-looking information is based on reasonable

assumptions and estimates of management of the Company at the time

it was made, and involves known and unknown risks, uncertainties

and other factors which may cause the actual results, performance

or achievements of the Company to be materially different from any

future results, performance or achievements expressed or implied by

such forward-looking information. Such factors include, among

others: the Company’s operating history; history of operating

losses; future capital needs and uncertainty of additional

financing; fluctuations in the market price of the Company’s common

shares; the effect of government regulation and compliance on the

Company and the industry; legal and regulatory change and

uncertainty; jurisdictional factors associated with international

operations; foreign restrictions on the Company’s operations;

product development and rapid technological change; dependence on

technical infrastructure; protection of intellectual property; use

and storage of personal information and compliance with privacy

laws; network security risks; risk of system failure or inadequacy;

the Company’s ability to manage rapid growth; competition; the

ability to identify opportunities for growth internally and through

acquisitions and strategic relationships on terms which are

economic or at all; effectiveness of the Company’s risk management

and internal controls; use of the Company’s services for improper

or illegal purposes; uninsured and underinsured losses; theft &

risk of physical harm to personnel; real estate acquisition and

maintenance risks; volatility of real estate prices & markets;

precious metal trading risks; volatility of precious metals prices

& public interest in precious metals investment; global

financial conditions and the viability of the Company’s business

strategy in response to them; and those risks set out in the

Company’s most recently filed annual information form, available

on SEDAR+. Although the Company has attempted to identify

important factors that could cause actual results to differ

materially, there may be other factors that cause results not to be

as anticipated, estimated or intended. There can be no assurance

that such statements will prove to be accurate as actual results

and future events could differ materially from those anticipated in

such statements. Accordingly, readers should not place undue

reliance on forward-looking information. The Company undertakes no

obligation to update or revise any forward-looking information,

except as required by law.

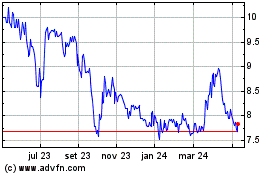

GoldMoney (TSX:XAU)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

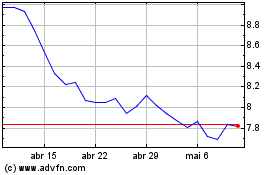

GoldMoney (TSX:XAU)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025