CanAsia Energy Announces Upsize of Brokered Financing to $6.3 Million

13 Dezembro 2023 - 9:34AM

CanAsia Energy Corp. (“CanAsia”

or the “Company”) (CEC – TSXV) is pleased to

announce that, in connection with its previously announced brokered

private placement offering on December 4, 2023

(“Offering”), the Company has upsized the Offering

from CAD $4.0 million to up to CAD $6.3 million in common shares of

the Company (“Shares”) at an issue price of CAD

$0.10 per Share. The Offering is being led by Research Capital

Corporation as the sole agent and sole bookrunner (the

“Agent”) on a “best-efforts” basis. As a result of

the upsized Offering, the previously announced Agent’s Option to

increase the size of the Offering by up CAD $0.6 million no longer

applies.

As previously announced, CanAsia officers and

directors have advised CanAsia of their intention to participate in

the Offering by purchasing Accredited Investor Shares (as defined

below) alongside investors in the Offering.

CanAsia intends to use the net proceeds from the

Offering, combined with CanAsia's previously available working

capital, primarily for international new ventures focused initially

on Thailand, and general corporate purposes.

It is anticipated that an onshore Thailand

licensing round will be announced within the first quarter of 2024.

CanAsia intends to participate as part of a consortium alongside a

strategic partnership with a leading integrated resource and

technical service provider to the energy sector, with upstream to

downstream operations, which the Company’s management team has

previously established a strong relationship. No assurance can be

given that a CanAsia bid will be successful.

The closing of the Offering is expected to occur

on or about December 20, 2023 (the "Closing

Date"), or such other date or dates as CanAsia and the

Agent may agree. The outstanding CanAsia Shares are listed and

posted for trading on the TSX Venture Exchange (the

"TSXV") under the trading symbol "CEC". CanAsia

will apply to list the shares distributed under the Offering on the

TSXV. Listing will be subject to CanAsia fulfilling all the listing

requirements of the TSXV.

Pursuant to the Offering, 24,000,000 Shares

(“LIFE Shares”) will be offered to purchasers in

Canada (other than in Québec) under the listed issuer financing

exemption and up to 39,000,000 Shares ("Accredited Investor

Shares") will be offered to accredited investors under the

accredited investor exemption. An amended and restated offering

document relating to the LIFE Shares will be filed by CanAsia and

available under CanAsia's profile at www.sedarplus.ca and CanAsia's

website, at www.canasiacorp.com. Prospective purchasers of LIFE

Shares should read the amended and restated offering document

before making an investment decision. The first trade of LIFE

Shares will not be subject to any hold period or other resale

restrictions (subject to limited exceptions). Unless permitted

under securities legislation, the Accredited Investor Shares cannot

be traded before 4 months and a day after the Closing Date.

CanAsia will pay to the Agent a cash commission

of 6.0% of the aggregate gross proceeds of the Offering, other than

for sales to certain "president's list" purchasers identified by

CanAsia, for which a 3.0% cash commission will be payable. CanAsia

will also issue to the Agent non-transferable broker warrants equal

to 6.0% of the number of Shares sold under the Offering, other than

Shares sold to president's list purchasers. Each broker warrant

will entitle the Agent to purchase one Share at an exercise price

of CAD $0.10 until 24 months after the Closing Date. The underlying

Accredited Investor Shares of the broker warrants cannot be traded

before 4 months and a day after the Closing Date.

About CanAsia

CanAsia is a Calgary, Alberta based oil and gas

company with operations in Western Canada. CanAsia continues to

consider international oil and gas concessions, including Thailand.

CanAsia's management and directors have almost 20 years of oil

exploration and development experience in Thailand through

CanAsia's predecessor company Pan Orient Energy Corp.

Forward-Looking Information

This press release contains forward-looking

information. Forward-looking information is generally identifiable

by the terminology used, such as "will", "expect", "believe",

"estimate", "should", "anticipate" and "potential" or other similar

wording. Forward-looking information in this press release includes

references, express or implied, to the terms and other aspects of

the Offering; the anticipated Thailand onshore oil concession bid

round, CanAsia's intention to submit a bid as part of a consortium

and the success of that bid; the use of available funds in

connection with a Thailand onshore oil concession; and other

aspects of CanAsia's business. By its very nature, the

forward-looking information contained in this press release

requires CanAsia and its management to make assumptions that may

not materialize or that may not be accurate. In addition, the

forward-looking information is subject to known and unknown risks

and uncertainties and other factors, some of which are beyond the

control of CanAsia, which could cause actual results, expectations,

achievements or performance to differ materially. Although CanAsia

believes that the expectations reflected in its forward-looking

information are reasonable, it can give no assurances that those

expectations will prove to be correct. CanAsia undertakes no

obligation to update publicly or revise any forward-looking

information, whether as a result of new information, future events

or otherwise, except as required by applicable securities laws.

U.S. Securities Laws

These securities have not been and will not be

registered under the United States Securities Act of 1933, as

amended (the "U.S. Securities Act"), or the

securities laws of any state of the United States, and may not be

offered or sold within the United States or to, or for the account

or benefit of, U.S. persons or persons in the United States except

in compliance with, or pursuant to an available exemption from, the

registration requirements of the U.S. Securities Act and applicable

U.S. state securities laws. The Offering does not constitute an

offer to sell, or the solicitation of an offer to buy, any of these

securities within the United States or to, or for the account or

benefit of, U.S. persons or persons in the United States. "United

States" and "U.S. person" have the meanings ascribed to them in

Regulation S under the U.S. Securities Act.

Regulatory Disclaimer

Neither TSX Venture Exchange nor its Regulation

Services Provider (as that term is defined in the policies of the

TSX Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

FOR FURTHER INFORMATION, PLEASE

CONTACT:

CanAsia Energy Corp.Jeff

Chisholm, President and CEO (located in Bangkok, Thailand)Email:

jeff@panorient.ca- or -Marcel Nunes, Vice President Finance and

CFOEmail: marcel@canasiacorp.comTelephone: (403) 294-1770

Research Capital

CorporationKevin Shaw, Managing Director, Investment

Banking, Head of Energy Capital MarketsEmail:

kshaw@researchcapital.comTelephone: 403-750-1280

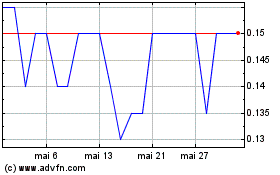

CanAsia Energy (TSXV:CEC)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

CanAsia Energy (TSXV:CEC)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025