Brookfield Renewable today announced that the Toronto Stock

Exchange (the “

TSX”) has accepted notices filed by

- Brookfield

Renewable Partners L.P. (TSX: BEP.UN;

NYSE: BEP) (“BEP”) of its

intention to renew its normal course issuer bids for its limited

partnership units (“LP Units”) and Class A

preferred limited partnership units (“Preferred

Units”);

- Brookfield

Renewable Corporation (TSX: BEPC; NYSE:

BEPC) (“BEPC” and together with BEP,

“Brookfield Renewable”) of its intention to renew

its normal course issuer bid for its outstanding class A

exchangeable subordinate voting shares (“Exchangeable

Shares”); and

- Brookfield

Renewable Power Preferred Equity Inc. (“BRP

Equity”) of its intention to renew its normal course

issuer bid for its outstanding Class A preference shares

(“Preferred Shares”). BRP Equity is a wholly-owned

subsidiary of BEP.

Brookfield Renewable believes that in the event

that the LP Units, Preferred Units, Exchangeable Shares or

Preferred Shares trade in a price range that does not fully reflect

their value, the acquisition of such securities may represent an

attractive use of available funds. There are currently four series

of Preferred Units and five series of Preferred Shares outstanding

and listed on the TSX.

Under BEP’s normal course issuer bid for LP

Units, BEP is authorized to repurchase up to 14,361,497 LP Units,

representing 5% of its issued and outstanding LP Units. At the

close of business on December 6, 2023, there were 287,229,948 LP

Units issued and outstanding. Under BEP’s normal course issuer bid,

it may repurchase up to 56,459 LP Units on the TSX during any

trading day, which represents 25% of the average daily trading

volume of 225,839 LP Units for the six months ended November 30,

2023.

Under BEPC’s normal course issuer bid for

Exchangeable Shares, BEPC is authorized to repurchase up to

8,982,586 Exchangeable Shares, representing 5% of its issued and

outstanding Exchangeable Shares. At the close of business on

December 6, 2023, there were 179,651,726 Exchangeable Shares issued

and outstanding. Under BEPC’s normal course issuer bid, it may

repurchase up to 54,658 Exchangeable Shares on the TSX during any

trading day, which represents 25% of the average daily trading

volume of 218,634 Exchangeable Shares for the six months ended

November 30, 2023.

Under BEP’s normal course issuer bid for

Preferred Units, BEP is authorized to repurchase a total of

approximately 10% of the public float of each respective series of

the Preferred Units as follows:

|

Series |

Ticker |

Issued and outstanding

units1 |

Public float1 |

Average daily trading

volume2 |

Maximum number of units subject to purchase |

|

|

|

|

|

|

Total |

Daily |

|

7 |

BEP.PR.G |

7,000,000 |

7,000,000 |

5,331 |

700,000 |

1,332 |

|

13 |

BEP.PR.M |

10,000,000 |

10,000,000 |

7,014 |

1,000,000 |

1,753 |

|

15 |

BEP.PR.O |

7,000,000 |

7,000,000 |

5,750 |

700,000 |

1,437 |

|

18 |

BEP.PR.R |

6,000,000 |

6,000,000 |

7,975 |

600,000 |

1,993 |

1. Calculated as at December 6,

2023.2. For the 6 months ended November 30,

2023.

Under BRP Equity’s normal course issuer bid for

Preferred Shares, BRP Equity is authorized to repurchase a total of

approximately 10% of the public float of each respective series of

the Preferred Shares as follows:

|

Series |

Ticker |

Issued and outstanding

shares3 |

Public float3 |

Average daily trading

volume4 |

Maximum number of shares subject to

purchase5 |

|

|

|

|

|

|

Total |

Daily |

|

1 |

BRF.PR.A |

6,849,533 |

6,849,533 |

5,852 |

684,953 |

1,463 |

|

2 |

BRF.PR.B |

3,110,531 |

3,110,531 |

1,219 |

311,053 |

1,000 |

|

3 |

BRF.PR.C |

9,961,399 |

9,961,399 |

13,884 |

996,139 |

3,471 |

|

5 |

BRF.PR.E |

7,000,000 |

4,114,504 |

3,255 |

411,450 |

1,000 |

|

6 |

BRF.PR.F |

7,000,000 |

7,000,000 |

5,224 |

700,000 |

1,306 |

3. Calculated as at December 6,

2023.4. For the 6 months ended November 30,

2023.5. In accordance with TSX rules, any daily

repurchases with respect to the Series 2 Preferred Shares and the

Series 5 Preferred Shares would be limited to 1,000 Preferred

Shares of such series.

Repurchases under each normal course issuer bid

are authorized to commence on December 18, 2023 and each normal

course issuer bid will terminate on December 17, 2024, or earlier

should Brookfield Renewable or BRP Equity, as applicable, complete

repurchases under its respective normal course issuer bids prior to

such date.

Under BEP’s prior normal course issuer bid for

LP Units that commenced on December 16, 2022 and expires on

December 15, 2023, BEP previously sought and received approval from

the TSX to repurchase up to 13,764,352 LP Units. As of December 3,

2023, BEP has repurchased 1,696,344 LP Units under its current

normal course issuer bid through open market transactions on the

TSX and alternative trading systems at a weighted average price per

LP Unit of approximately CDN$31.38.

Under BEPC’s prior normal course issuer bid that

commenced on December 16, 2022 and expires on December 15, 2023,

BEPC previously sought and received approval from the TSX to

repurchase up to 8,610,905 Exchangeable Shares. BEPC has not

repurchased any Exchangeable Shares under its existing normal

course issuer bid in the past 12 months.

Under BEP’s prior normal course issuer bid for

Preferred Units that commenced on December 16, 2022 and expires on

December 15, 2023, BEP previously sought and received approval from

the TSX to repurchase up to 700,000 Series 7 Preferred Units,

1,000,000 Series 13 Preferred Units, 700,000 Series 15 Preferred

Units and 600,000 Series 18 Preferred Units. BEP did not repurchase

any Preferred Units under this normal course issuer bid.

Under BRP Equity’s prior normal course issuer

bid that commenced on December 16, 2022 and expires on December 15,

2023, BRP Equity previously sought and received approval from the

TSX to repurchase up to 684,953 Series 1 Preferred Shares, 311,053

Series 2 Preferred Shares, 996,139 Series 3 Preferred Shares,

411,450 Series 5 Preferred Shares and 700,000 Series 6 Preferred

Shares. BRP Equity did not repurchase any Preferred Shares under

this normal course issuer bid.

All purchases of the LP Units and Exchangeable

Shares will be effected through the facilities of the TSX and/or

the New York Stock Exchange and/or alternative trading systems in

Canada and/or the United States. All purchases of Preferred Units

and Preferred Shares will be effected through facilities of the TSX

and/or alternative trading systems in Canada. All LP Units,

Preferred Units, Exchangeable Shares and Preferred Shares acquired

under the applicable normal course issuer bid will be cancelled.

Repurchases will be subject to compliance with applicable Canadian

securities laws.

BEP and BEPC intend to enter into automatic

share purchase plans, which have been pre-cleared by the TSX, on or

about the week of December 25, 2023 in relation to their respective

normal course issuer bids. The automatic share purchase plans will

allow for the purchase of LP Units, Preferred Units and

Exchangeable Shares, as applicable, subject to certain trading

parameters, at times when BEP or BEPC, as applicable, ordinarily

would not be active in the market due to its own internal trading

blackout periods, insider trading rules or otherwise. Outside these

periods, LP Units, Preferred Units or Exchangeable Shares, as

applicable, will be repurchased in accordance with management’s

discretion, in compliance with applicable law.

Brookfield Renewable

Brookfield Renewable operates one of the world’s

largest publicly traded, pure-play renewable power platforms. Our

portfolio consists of hydroelectric, wind, utility-scale solar and

storage facilities in North America, South America, Europe and

Asia, and totals approximately 31,800 megawatts of installed

capacity and a development pipeline of approximately 143,400

megawatts of renewable power assets, 14 million metric tonnes per

annum (“MMTPA”) of carbon capture and storage, 2

million tons of recycled material and 4 million metric million

British thermal units of renewable natural gas production annually.

Investors can access its portfolio either through Brookfield

Renewable Partners L.P. (NYSE: BEP; TSX: BEP.UN), a Bermuda-based

limited partnership, or Brookfield Renewable Corporation (NYSE,

TSX: BEPC), a Canadian corporation. Further information is

available at https://bep.brookfield.com. Important information may

be disseminated exclusively via the website; investors should

consult the site to access this information.

Brookfield Renewable is the flagship listed

renewable power company of Brookfield Asset Management, a leading

global alternative asset manager with approximately $850 billion of

assets under management.

Please note that Brookfield Renewable’s previous

audited annual and unaudited quarterly reports filed with the U.S.

Securities and Exchange Commission (“SEC”) and

securities regulators in Canada, are available on our website at

https://bep.brookfield.com, on SEC’s website at www.sec.gov and on

SEDAR+’s website at www.sedarplus.com. Hard copies of the annual

and quarterly reports can be obtained free of charge upon

request.

|

Contact information: |

|

|

|

|

|

Media: |

Investors: |

|

Simon Maine |

Alex Jackson |

|

+44 7398 909 278 |

+1 647-484-8525 |

|

simon.maine@brookfield.com |

alexander.jackson@brookfield.com |

|

|

|

Cautionary Statement Regarding Forward-looking

Statements

This news release contains forward-looking

statements and information within the meaning of Canadian

securities laws and “forward-looking statements” within the meaning

of applicable U.S. securities laws. Forward-looking statements and

information may include estimates, plans, expectations, opinions,

forecasts, projections, guidance or other statements that are not

statements of fact. Forward-looking statements and information can

be identified by the use of words such as “will”, “believes” and

“may” or variations of such words and phrases and include

statements regarding the potential future purchases by BEP of its

LP Units and Preferred Units, by BEPC of its Exchangeable Shares

and by BRP Equity of its Preferred Shares pursuant to their

respective normal course issuer bids and, as applicable, automatic

repurchase plans. Although Brookfield Renewable believes that

these forward-looking statements and information are based upon

reasonable assumptions and expectations, the reader should not

place undue reliance on them, or any other forward-looking

statements or information in this news release. The future

performance and prospects of Brookfield Renewable are subject to a

number of known and unknown risks and uncertainties. Factors that

could cause actual results of Brookfield Renewable to differ

materially from those contemplated or implied by the statements in

this news release include: general economic conditions; interest

rate changes; availability of equity and debt financing; the

performance of the LP Units, the Preferred Units, the Exchangeable

Shares or the Preferred Shares or the stock exchanges generally;

and other risks and factors described in the documents filed by

Brookfield Renewable with securities regulators in Canada and the

United States including under “Risk Factors” in Brookfield

Renewable’s most recent Annual Report on Form 20-F and other risks

and factors that are described therein.

Except as required by law, Brookfield Renewable

does not undertake any obligation to publicly update or revise any

forward-looking statements or information, whether written or oral,

whether as a result of new information, future events or

otherwise.

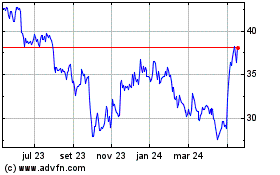

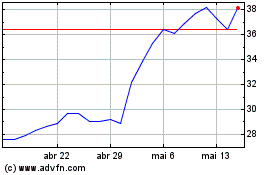

Brookfield Renewable Par... (TSX:BEP.UN)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Brookfield Renewable Par... (TSX:BEP.UN)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024