Wallbridge Mining Company Limited (TSX:WM,

OTCQX:WLBMF) (“

Wallbridge” or the

“

Company”) has filed a final short form base shelf

prospectus (the “

Shelf Prospectus”) with the

securities regulatory authorities in each of the provinces and

territories of Canada. As previously announced, the Shelf

Prospectus will allow Wallbridge to offer from time to time over a

25-month period up to $50 million of equity, debt or certain other

securities (collectively, the “

Securities”). The

Company currently has no plans to undertake a financing in

connection with the Shelf Prospectus.

Concurrently with the filing of the Shelf

Prospectus, the Company filed an amended technical report entitled

“Amended and Restated: NI 43-101 Technical Report for the

Detour-Fenelon Gold Trend Property and Preliminary Economic

Assessment of the Fenelon Gold Project, Quebec, Canada” (the

“Amended Technical Report”). The Amended Technical

Report addresses comments raised by staff of the Ontario Securities

Commission (the “OSC”) in connection with the

OSC’s review of the Company’s Shelf Prospectus. The Amended

Technical Report contains no material differences to the technical

report filed on August 10, 2023 (the “August

Report”) and there are no differences with respect to the

mineral resource estimates, the preliminary economic assessment

(“PEA”) or the conclusions contained in the August

Report.

A summary description of the changes to the

Amended Technical Report include:

- Deletion of

certain disclosure with respect to a “Blue Sky Scenario” regarding

the Detour-Fenelon Gold Trend Property’s potential.

- Deletion of

certain appendices providing additional disclosure regarding the

electrical and ventilation infrastructure of the Fenelon Gold

(“Fenelon”) project.

A copy of the Amended Technical Report may be

found on SEDAR+ at www.sedarplus.ca and the Company’s website at

https://wallbridgemining.com.

About Wallbridge Mining

Wallbridge is focused on creating value through

the exploration and sustainable development of gold projects along

the Detour-Fenelon Gold Trend while respecting the environment and

communities where it operates.

Wallbridge’s flagship project, Fenelon, is

located on the highly prospective Detour-Fenelon Gold Trend

Property in Québec’s Northern Abitibi region. An updated mineral

resource estimate completed in January 2023 yielded significantly

improved grades and additional ounces at the 100%-owned Fenelon and

Martiniere projects, incorporating a combined 3.05 million ounces

of indicated gold resources and 2.35 million ounces of inferred

gold resources. Fenelon and Martiniere are located within an 830

square kilometre exploration land package controlled by Wallbridge.

In addition, Wallbridge believes that the extensive land package is

extremely prospective for the discovery of additional gold

deposits.

Wallbridge has reported a positive PEA on its

100%-owned Fenelon gold Project with an estimated average annual

gold production of 212,000 ounces over 12.3 years (see Wallbridge’s

press release of June 26, 2023).

Wallbridge also holds a 15.9% interest in the

common shares of Archer Exploration Corp.

(“Archer”) as a result of the sale of the

Company’s portfolio of nickel assets in Ontario and Québec in

November of 2022.

The scientific and technical content of this

news release has been reviewed and approved by Francois Chabot.,

Eng., the Company’s Manager of Technical Services, a "Qualified

Person" as defined in National Instrument 43-101 - Standards of

Disclosure for Mineral Projects (“NI 43-101”).

For further information please visit the

Company’s website at https://wallbridgemining.com/ or contact:

Wallbridge Mining Company

Limited

Brian Penny, CPA, CMAInterim CEOTel: (416)

716-8346Email: bpenny@wallbridgemining.com

Victoria Vargas, B.Sc. (Hon.) Economics,

MBACapital Markets AdvisorEmail: vvargas@wallbridgemining.com

ON BEHALF OF THE BOARD OF

DIRECTORS

Brian PennyInterim CEO

Cautionary Note Regarding

Forward-Looking Information

The information in this document may contain

forward-looking statements or information (collectively,

“FLI”) within the meaning of applicable Canadian

securities legislation. FLI is based on expectations, estimates,

projections, and interpretations as at the date of this

document.

All statements, other than statements of

historical fact, included herein are FLI that involve various

risks, assumptions, estimates and uncertainties. Generally, FLI can

be identified by the use of statements that include, but are not

limited to, words such as “seeks”, “believes”, “anticipates”,

“plans”, “continues”, “budget”, “scheduled”, “estimates”,

“expects”, “forecasts”, “intends”, “projects”, “predicts”,

“proposes”, "potential", “targets” and variations of such words and

phrases, or by statements that certain actions, events or results

“may”, “will”, “could”, “would”, “should” or “might”, “be taken”,

“occur” or “be achieved.”

FLI in this document may include, but is not

limited to: statements regarding the Shelf Prospectus, the

effectiveness and timing thereof and any future offerings; the

Company’s exploration plans; the future prospects of Wallbridge;

statements regarding the results of the Fenelon preliminary

economic assessment; the potential future performance of Archer

common shares; future drill results; the Company’s ability to

convert inferred resources into measured and indicated resources;

parameters and methods used to estimate the MRE’s at the Fenelon

and Martiniere properties (collectively the

“Deposits”); the prospects, if

any, of the Deposits; future drilling at the Deposits; and the

significance of historic exploration activities and results.

FLI is designed to help you understand

management’s current views of its near- and longer-term prospects,

and it may not be appropriate for other purposes. FLI by their

nature are based on assumptions and involve known and unknown

risks, uncertainties and other factors which may cause the actual

results, performance, or achievements of the Company to be

materially different from any future results, performance or

achievements expressed or implied by such FLI. Although the FLI

contained in this document is based upon what management believes,

or believed at the time, to be reasonable assumptions, the Company

cannot assure shareholders and prospective purchasers of securities

of the Company that actual results will be consistent with such

FLI, as there may be other factors that cause results not to be as

anticipated, estimated or intended, and neither the Company nor any

other person assumes responsibility for the accuracy and

completeness of any such FLI. Except as required by law, the

Company does not undertake, and assumes no obligation, to update or

revise any such FLI contained in this document to reflect new

events or circumstances. Unless otherwise noted, this document has

been prepared based on information available as of the date of this

document. Accordingly, you should not place undue reliance on the

FLI, or information contained herein.

Furthermore, should one or more of the risks,

uncertainties or other factors materialize, or should underlying

assumptions prove incorrect, actual results may vary materially

from those described in FLI.

Assumptions upon which FLI is based, without

limitation, include: the results of exploration activities, the

Company’s financial position and general economic conditions; the

ability of exploration activities to accurately predict

mineralization; the accuracy of geological modelling; the ability

of the Company to complete further exploration activities; the

legitimacy of title and property interests in the Deposits; the

accuracy of key assumptions, parameters or methods used to estimate

the MREs and in the PEA; the ability of the Company to obtain

required approvals; geological, mining and exploration technical

problems; and failure of equipment or processes to operate as

anticipated. Risks and uncertainties about Wallbridge's business

are discussed in the disclosure materials filed with the securities

regulatory authorities in Canada, which are available at

www.sedarplus.ca.

Cautionary Notes to United States

Investors

Wallbridge prepares its disclosure in accordance

with NI 43-101 which differs from the requirements of the U.S.

Securities and Exchange Commission (the

"SEC"). Terms relating to mineral properties,

mineralization and estimates of mineral reserves and mineral

resources and economic studies used herein are defined in

accordance with NI 43-101 under the guidelines set out in CIM

Definition Standards on Mineral Resources and Mineral Reserves,

adopted by the Canadian Institute of Mining, Metallurgy and

Petroleum Council on May 19, 2014, as amended. NI 43-101 differs

significantly from the disclosure requirements of the SEC generally

applicable to US companies. As such, the information presented

herein concerning mineral properties, mineralization and estimates

of mineral reserves and mineral resources may not be comparable to

similar information made public by U.S. companies subject to the

reporting and disclosure requirements under the U.S. federal

securities laws and the rules and regulations thereunder.

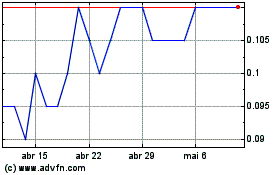

Wallbridge Mining (TSX:WM)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Wallbridge Mining (TSX:WM)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024