Notice of the Annual General Meeting of UPM-Kymmene Corporation

UPM-Kymmene

Corporation Stock

Exchange Release (Notice to general

meeting) 1 February

2024 at 15:00 EET

Notice of the Annual General Meeting of UPM-Kymmene

Corporation

Notice is given to the shareholders of UPM-Kymmene Corporation

(the “Company” or “UPM”) of the Annual General Meeting to be held

on Thursday, 4 April 2024 starting at 13:00 (EEST) at Messukeskus

Helsinki (Siipi entrance, Rautatieläisenkatu 3, Helsinki, Finland).

The reception of attendees who have preregistered for the meeting

and the distribution of voting tickets will commence at 12:00

(EEST).

Shareholders may follow the meeting through a webcast.

Instructions regarding the webcast are available at

www.upm.com/agm2024. Webcast starts on 4 April 2024 starting at

13:00 (EEST). It is not possible to ask questions, make

counterproposals or vote through the webcast. Following the webcast

is not considered as participation in the Annual General Meeting or

exercise of the shareholder rights.

A. Matters on the agenda of the Annual General

Meeting

1. Opening of the meeting

2. Calling the meeting to order

3. Election of a person to scrutinise the minutes and to

supervise the counting of votes

4. Recording the legality of the meeting

5. Recording the attendance at the meeting and adoption

of the list of votes

6. Presentation of the Financial Statements, the Report

of the Board of Directors and the Auditor’s Report for the year

2023- Review by the President and CEO

7. Adoption of the Financial Statements

8. Resolution on the use of the profit shown on the

balance sheet and the payment of dividend

The Board proposes to the Annual General Meeting of UPM-Kymmene

Corporation that an aggregate dividend of EUR 1.50 per share be

paid based on the balance sheet to be adopted for the financial

year ended on 31 December 2023, and that the remaining portion of

the distributable funds be retained in the Company’s non-restricted

shareholders’ equity. The Board proposes that the dividend be paid

in two instalments.

The first dividend instalment, EUR 0.75 per share, is proposed

to be paid to shareholders registered in the Company’s register of

shareholders maintained by Euroclear Finland Oy on the record date

for the first dividend instalment 8 April 2024. The Board proposes

that the payment date for the first dividend instalment would be on

16 April 2024.

The second dividend instalment, EUR 0.75 per share, is proposed

to be paid to shareholders registered in the Company's register of

shareholders maintained by Euroclear Finland Oy on the record date

for the second dividend instalment 31 October 2024. The Board

proposes that the payment date for the second dividend instalment

would be on 7 November 2024.

If the payment of the dividend is prevented due to applicable

law, regulation or unexpected circumstances, the Board will

resolve, as soon as practically possible, on a new record date and

payment date.

On the date of the dividend proposal, 1 February 2024, the

registered number of the Company’s shares is 533,735,699. The

aforementioned number of shares includes 411,653 treasury shares

which are not entitled to dividend. As a result, the proposed

aggregate dividend would total EUR 800 million.

On 31 December 2023, the distributable funds of the parent

company were EUR 3,289,796,583.55. The profit of the parent company

for the period was EUR 1,674,687,361.44.

9. Resolution on the discharge of the members of the

Board of Directors and the President and CEO from

liability

10. Adoption of the Remuneration Report

The Board proposes that the Annual General Meeting adopts the

Remuneration Report for the year 2023.

The Remuneration Report for the year 2023 will be available on

the Company’s website at www.upm.com/agm2024 as of 1 March

2024.

11. Adoption of the Remuneration Policy

The Board proposes that the Annual General Meeting adopts the

amended Remuneration Policy. The Remuneration Policy was last time

presented to the Annual General Meeting on 31 March 2020.

The amended Remuneration Policy to be presented to the Annual

General Meeting will be available on the Company’s website at

www.upm.com/agm2024 as of 1 March 2024.

12. Resolution on the remuneration of the members of the

Board of Directors

The Board’s Nomination and Governance Committee proposes to the

Annual General Meeting of UPM-Kymmene Corporation that the

remuneration of the Chair of the Board be raised, and that the

Chair of the Board be paid an annual base fee of EUR 231,000

(previously EUR 218,000). The Board’s Nomination and Governance

Committee proposes that the remuneration of the Deputy Chair of the

Board and the other members of the Board remains unchanged and that

the Deputy Chair of the Board be paid an annual base fee of EUR

145,000 and other members of the Board EUR 120,000.

The Nomination and Governance Committee further proposes that

the remuneration of the Audit Committee Chair and members be

raised, remuneration of members of other committees remain

unchanged and that the members of the Board’s committees be paid

annual committee fees as follows:• Audit Committee: Chair EUR

45,000 (previously EUR 35,000) and members EUR 25,000

(previously EUR 15,000)• Remuneration Committee: Chair EUR

27,500 and members EUR 10,000• Nomination and Governance Committee:

Chair EUR 20,000 and members EUR 10,000.

The annual committee fees of the Audit Committee Chair and

members have not been increased since the Annual General Meeting

held in 2017.

The annual base fees are proposed to be paid in Company shares

and cash so that approximately 40 per cent will be payable in the

Company shares to be purchased on the Board members’ behalf, and

the rest in cash. The Company will pay any costs and transfer tax

related to the purchase of the Company shares. Shares thus

purchased may not be transferred within two years from the purchase

date or until the director’s membership of the Board has ended,

whichever occurs first. The annual committee fees are proposed to

be paid in cash. If the term of a member of the Board terminates

before the annual general meeting of 2025, the Board has a right to

resolve upon potential reclaim of the annual fees as it deems

fit.

In addition, the Board’s Nomination and Governance Committee

proposes that travel and lodging expenses incurred from meetings

held elsewhere than in a director’s place of residence will be paid

against invoice.

13. Resolution on the number of members of the Board of

Directors

The Board’s Nomination and Governance Committee proposes that

the number of members of the Board be the current nine (9).

14. Election of members of the Board of

Directors

The Board of Directors’ Nomination and Governance Committee

proposes to the Annual General Meeting of UPM-Kymmene Corporation

that the following incumbent directors be re-elected to the Board:

Pia Aaltonen-Forsell, Henrik Ehrnrooth, Jari Gustafsson, Piia-Noora

Kauppi, Topi Manner, Marjan Oudeman, Martin à Porta and Kim Wahl.

The Nomination and Governance Committee further proposes that

Melanie Maas-Brunner be elected as a new director to the Board. The

directors will be elected for a one-year term and their term of

office will end upon closure of the next Annual General Meeting.

All director nominees have given their consent to the election.

Emma FitzGerald has announced that she is not available for

re-election.

The new director nominee Melanie Maas-Brunner (born 1968) is a

German citizen and holds a Doctoral degree in Chemistry from

University of RWTH Aachen, Germany. Maas-Brunner has been the Chief

Technology Officer and Industrial Relations Director of BASF SE and

member of the Executive Directors Board of BASF from 2021 until

January 2024. Previously she has worked as President of Nutrition

and Health at BASF SE 2017–2020, Senior Vice President of

Performance Materials Europe at BASF SE 2014–2017, Senior Vice

President of Engineering Plastics Europe at BASF SE 2013, Senior

Vice President of Polyurethanes Asia Pacific at BASF East Asia

Headquarters in Hong Kong 2009–2012 and in various Vice President,

Plant Manager and Research Scientist positions at BASF AG

1997–2008.

The Board of Directors has assessed the director nominees’

independence based on the Finnish Corporate Governance Code’s

independence criteria and other factors and circumstances to be

taken into account in the overall evaluation and concluded that all

director nominees are independent of the Company’s significant

shareholders, and that all director nominees are non-executive and

independent of the Company. Kim Wahl and Piia-Noora Kauppi, if

re-elected, would be non-executive directors for more than 10

consecutive years. However, their independence is not compromised

due to their service history, and no other factors or circumstances

have been identified that could impair their independence. Mr Wahl

has been a member of the Company’s Board of Directors since 2012

and Ms Kauppi since 2013.

If the Annual General Meeting resolves to elect the Board

members in accordance with this proposal, the Board is planning to

resolve in its constitutive meeting that Kim Wahl will not continue

as the Chair of the Audit Committee.

The biographical details of all director nominees are available

at www.upm.com/agm2024.

15. Resolution on the remuneration of the auditor for

the financial period 2025

Based on the proposal prepared by the Audit Committee, the Board

proposes that the auditor to be elected for the financial period

2025 be paid against invoices approved by the Board’s Audit

Committee.

16. Election of the auditor for the financial period

2025

Based on the proposal prepared by the Audit Committee, the Board

proposes that Ernst & Young Oy, a firm of authorised public

accountants, be re-elected as the Company’s auditor for the

financial period 2025. Since 2023, the Board has proposed to the

Annual General Meeting that the Annual General Meeting elects the

auditor for the financial period commencing next after the

election.

Ernst & Young Oy has informed the Company that Authorised

Public Accountant (KHT) Heikki Ilkka would continue as the lead

audit partner. He has held this position since the financial period

2024.

The Company shall also prepare its first statutory

sustainability report for the financial period 2024. In accordance

with the transitional provisions of the amended Finnish Companies

Act (1252/2023) the Board of Directors has resolved that Ernst

& Young Oy shall provide the assurance for the statutory

sustainability report in 2024.

17. Authorising the Board of Directors to resolve on the

issuance of shares and special rights entitling to

shares

The Board proposes that the Board be authorised to resolve on

the issuance of new shares, transfer of treasury shares and

issuance of special rights entitling to shares as follows:

The aggregate maximum number of new shares that may be issued

and treasury shares that may be transferred is 25,000,000 including

also the number of shares that can be received on the basis of the

special rights referred to in Chapter 10, Section 1 of the Finnish

Limited Liability Companies Act. The proposed maximum number of

shares corresponds to approximately 4.7 per cent of the Company’s

registered number of shares at the time of the proposal.

The new shares and the special rights entitling to shares may be

issued and the treasury shares transferred to the Company's

shareholders in proportion to their existing shareholdings in the

Company, or in a directed share issue, deviating from the

shareholder's pre-emptive subscription right, if there is a weighty

financial reason for doing so from the Company’s point of view,

such as using the shares as a consideration in potential mergers or

acquisitions, to finance investments or other business-related

transactions, to develop the Company’s capital structure, or as a

part of the Company’s incentive plans.

The Board may also resolve on a share issue without payment to

the Company itself. In addition, the Board may resolve to issue

special rights referred to in Chapter 10, Section 1 of the Finnish

Limited Liability Companies Act, which carry the right to receive,

against payment, new shares in the Company or treasury shares in

such a manner that the subscription price of the shares is paid in

cash or by using the subscriber's receivable to offset the

subscription price.

The new shares may be issued and the treasury shares transferred

either against payment or without payment. The directed share issue

may be without payment only if there is an especially weighty

financial reason for doing so from the Company’s point of view and

taking the interests of the Company’s shareholders into

consideration.

The subscription price of the new shares and the amount payable

for the treasury shares shall be recorded in the reserve for

invested non-restricted equity.

The Board shall resolve on all other matters related to the

issuances and transfers of shares and special rights entitling to

shares. The authorisation will be valid for 18 months from the date

of the resolution of the Annual General Meeting. If this

authorisation is granted, it will revoke the authorisation to

resolve on the issuance of shares and special rights entitling to

shares which was granted to the Board by the Annual General Meeting

on 12 April 2023.

18. Authorising the Board of Directors to resolve on the

repurchase of the Company’s own shares

The Board proposes that the Board be authorised to resolve on

the repurchase of the Company’s own shares as follows:

By virtue of the authorisation, the Board may resolve to

repurchase a maximum of 50,000,000 of the Company’s own shares. The

proposed maximum number of shares corresponds to approximately 9.4

per cent of the Company’s registered number of shares at the time

of the proposal. The authorisation includes also the right to

accept the Company’s own shares as a pledge.

The Company’s own shares will be repurchased in public trading

otherwise than in proportion to the existing shareholdings of the

Company’s shareholders, at the market price quoted at the time of

purchase, on the trading places where the Company’s shares or

certificates entitling to its shares are traded, using the

Company’s non-restricted shareholders’ equity. The purchase price

for the shares will be paid according to the applicable rules of

the trading places where the shares have been repurchased.

The shares will be repurchased to be used as a consideration in

potential mergers or acquisitions, to finance investments or other

business-related transactions, to develop the Company’s capital

structure, or as a part of the Company’s incentive plans, or to be

retained by the Company as treasury shares, transferred or

cancelled.

The Board shall resolve on all other matters related to the

repurchase of the Company’s own shares. The authorisation will be

valid for 18 months from the date of the resolution of the Annual

General Meeting. If this authorisation is granted, it will revoke

the repurchase authorisation granted to the Board by the Annual

General Meeting on 12 April 2023.

19. Authorising the Board of Directors to resolve on

charitable contributions

The Board proposes that the Board be authorised to resolve on

contributions not exceeding a total of EUR 1,000,000 for charitable

or corresponding purposes and that the Board be authorised to

resolve on the recipients, purposes and other terms and conditions

of the contributions. Contributions would be primarily granted

under the Company’s Biofore Share and Care programme whose focus

areas are reading and learning, engaging with communities and

Beyond Fossils initiatives.

The authorisation is proposed to be valid until the next Annual

General Meeting.

20. Closing of the meeting

B. Documents of the Annual General Meeting

The proposals for the resolutions on the matters on the agenda

of the Annual General Meeting as well as this notice, are available

on UPM-Kymmene Corporation’s website at www.upm.com/agm2024. The

Annual Report of UPM-Kymmene Corporation, including the Company’s

Financial Statements, the Report of the Board of Directors and the

Auditor’s Report, as well as the Remuneration Policy and the

Remuneration Report for the year 2023 will be available on the

above-mentioned website as of 1 March 2024. The proposals for

the resolutions and the Financial Statements are also available at

the venue of the Annual General Meeting. The minutes of the Annual

General Meeting will be available on the above-mentioned website as

of 18 April 2024 at the latest.

C. Instructions for the participants of the Annual

General Meeting

1. Shareholders registered in the shareholders’

register

Each shareholder, who is registered on 21 March 2024 in the

shareholders’ register of the Company maintained by Euroclear

Finland Oy, has the right to participate in the Annual General

Meeting. A shareholder, whose shares are registered on her/his

personal Finnish book-entry account, is registered in the

shareholders’ register of the Company.

Preregistration for the Annual General Meeting commences on 1

February 2024. A shareholder, who is registered in the

shareholders' register of the Company and who wishes to participate

in the Annual General Meeting, shall preregister for the meeting no

later than 26 March 2024 by 16:00 (EET) by giving a prior notice of

attendance, which shall be received by the Company no later than on

the above-mentioned date and time. Such notice can be given:

a) on the Company’s website at www.upm.com/agm2024.

For shareholders that are private persons, the preregistration

requires either the number of the shareholder’s Finnish book-entry

account or a strong electronic authentication. When shareholders

who are private persons log into the service through the Company's

website, they are directed to the electronic authentication. Strong

electronic authentication can be conducted with the Finnish online

banking codes or a mobile certificate.

For shareholders that are legal persons, no strong electronic

authentication is required. However, shareholders that are legal

persons must notify their book-entry account number and other

required information. If a shareholder that is a legal person uses

the electronic suomi.fi authorisation, registration requires strong

electronic authentication from the authorised representative, which

can be conducted with the Finnish online banking codes or a mobile

certificate.

b) by regular mail to UPM-Kymmene Corporation, Legal Function,

PO Box 380 (Alvar Aallon katu 1), FI-00101 Helsinki, Finland or

c) by e-mail to agm@upm.com.

In connection with the prior notice of attendance, a shareholder

shall notify her/his name, personal identification number/date of

birth or business identity code, address, telephone number, the

name of a possible assistant and the name and personal

identification number or date of birth of a possible proxy

representative. The personal data is used only in connection with

the Annual General Meeting and processing of related

registrations.

2. Holders of nominee registered shares

A holder of nominee registered shares has the right to

participate in the Annual General Meeting by virtue of such shares,

based on which she/he on the record date of the Annual General

Meeting, i.e., on 21 March 2024, would be entitled to be registered

in the shareholders’ register of the Company held by Euroclear

Finland Oy. The right to participate in the Annual General Meeting

requires, in addition, that the shareholder on the basis of such

shares has been temporarily preregistered in the shareholders’

register held by Euroclear Finland Oy by 10:00 (EET) on 28 March

2024 at the latest. As regards nominee registered shares, this

constitutes a due registration for the Annual General Meeting.

Holders of nominee registered shares are advised to request

without delay necessary instructions from their custodian bank

regarding the temporary registration in the shareholders’ register

of the Company, the issuing of proxy documents and preregistration

for the Annual General Meeting. The account management organisation

of the custodian bank has to register a holder of nominee

registered shares, who wishes to participate in the Annual General

Meeting, temporarily in the shareholders’ register of the Company

by the time stated above at the latest.

Further information on these matters can also be found on the

Company’s website at www.upm.com/agm2024.

3. Proxy representatives and powers of

attorney

A shareholder may participate in the Annual General Meeting

through a proxy representative.

Proxy representatives shall produce a dated proxy document or

otherwise in a reliable manner demonstrate their right to represent

the shareholder at the Annual General Meeting. A proxy template is

available on the Company’s website at www.upm.com/agm2024.

If a shareholder participates in the Annual General Meeting by

means of several proxy representatives representing the shareholder

with shares in different securities accounts, the shares in respect

of which each proxy representative represents the shareholder shall

be identified in connection with the registration for the Annual

General Meeting.

The signed proxy documents should be submitted to UPM-Kymmene

Corporation, Legal Function, PO Box 380 (Alvar Aallon katu 1),

FI-00101 Helsinki, Finland or agm@upm.com, prior to the end of the

registration period. The original proxy document shall be presented

to the Company upon request. In addition to submitting proxy

documents, a shareholder or her/his proxy representative shall

ensure that she/he has registered for the Annual General Meeting in

the manner described above in this notice.

Shareholders that are legal persons can also use the electronic

suomi.fi authorisation service instead of a traditional proxy

document. In this case, the legal person shall authorise the

authorised representative nominated by the legal person in the

suomi.fi service at www.suomi.fi/e-authorisations by using the

mandate theme “Representation at the General Meeting”. In the

General Meeting service of Euroclear Finland Oy, the authorised

representative shall in connection with registration use strong

electronic authentication and thereafter the electronic

authorisation is verified automatically. Strong electronic

authentication can be conducted with the Finnish online banking

codes or a mobile certificate. Further information is available at

www.suomi.fi/e-authorisations and on the Company’s website at

www.upm.com/agm2024.

4. Other information

The meeting language is Finnish but some presentations such as

the Review by the President and CEO will be held in English. There

is simultaneous interpretation available both into Finnish and

English at the meeting venue.

Pursuant to Chapter 5, Section 25 of the Finnish Limited

Liability Companies Act, a shareholder who is present at the Annual

General Meeting has the right to ask questions with respect to the

matters to be considered at the meeting.

Changes in the number of shares held after the record date of

the Annual General Meeting shall not have an effect on the right to

participate the meeting nor on the number of votes held by a

shareholder in the meeting.

On the date of this notice of the Annual General Meeting, the

Company has 533,735,699 shares representing the same number of

votes.

Helsinki, 1 February 2024

UPM-KYMMENE CORPORATION

BOARD OF DIRECTORS

UPM-Kymmene CorporationPirkko HarrelaExecutive Vice President,

Stakeholder Relations

UPM, Media RelationsMon-Fri 9:00–16:00 EETtel.

+358 40 588 3284media@upm.com

UPMWe deliver renewable and responsible

solutions and innovate for a future beyond fossils across six

business areas: UPM Fibres, UPM Energy, UPM Raflatac, UPM Specialty

Papers, UPM Communication Papers and UPM Plywood. As the industry

leader in responsibility, we are committed to the UN Business

Ambition for 1.5°C and the science-based targets to mitigate

climate change. We employ 16,500 people worldwide and our annual

sales are approximately EUR 10.5 billion. Our shares are listed on

Nasdaq Helsinki Ltd. UPM Biofore – Beyond

fossils. www.upm.com

Follow UPM

on X | LinkedIn | Facebook | YouTube | Instagram |

#UPM #biofore #beyondfossils

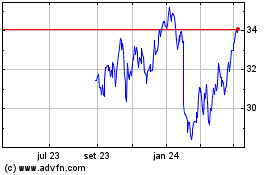

UPM Kymmene Oyj (TG:RPL)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

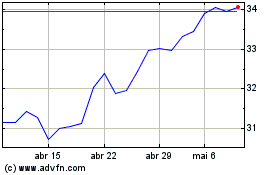

UPM Kymmene Oyj (TG:RPL)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024