Centerra Gold Inc. (“Centerra” or the “Company”) (TSX: CG) (NYSE:

CGAU) is pleased to announce that the Company and its subsidiary,

Thompson Creek Metals Company Inc. (“TCM”), have entered into an

additional agreement with RGLD Gold AG, a subsidiary of Royal Gold,

Inc. (“Royal Gold”), relating to the Mount Milligan Mine (“Mount

Milligan”), which has resulted in a life of mine extension to 2035

and establishes favourable parameters for potential future mine

life extensions. All dollar figures are in United States dollars

unless otherwise stated.

President and CEO, Paul Tomory, commented, “We

are pleased to announce a mutually beneficial additional agreement

with Royal Gold, which has allowed us to immediately unlock

additional reserves beyond the current mine life. Extending Mount

Milligan’s mine life by two years is a key first step in our

strategy to realize the full potential of this cornerstone asset in

a top-tier mining jurisdiction. Our strategy to further increase

mine life at Mount Milligan has three prongs. First, we are

immediately initiating a Preliminary Economic Assessment to study

the incorporation of the significant drilled inventory to the west

of the existing pit, and to evaluate options for capital projects

in the mine and the mill that could lead to further mine life

extensions, and will soon be starting the associated work on

permitting and engagement with our First Nations partners and local

stakeholders. Second, we will continue to invest in exploration

drilling to unlock the large mineral endowment at Mount Milligan.

Finally, we are continuing to advance a site optimization program

at Mount Milligan, which began in the fourth quarter of 2023, with

a focus on enhanced safety performance and cash flow improvement.

We are encouraged by today’s announcement and the prospects for

continued optimization at Mount Milligan, which will benefit our

shareholders, our partner Royal Gold, and Mount Milligan’s First

Nations partners, employees and local stakeholders.”

Highlights of the

Transaction

- Mutually beneficial

additional agreement that unlocks incremental mineral reserves and

resources at Mount Milligan: Immediately extends the mine

life by two years to 2035, subject to normal course permitting, and

grows mineral resources to 510 million tonnes, inclusive of

reserves.

- Potential for future mine

life increases beyond 2035: The additional agreement

enables Centerra to study mine life extensions via the conversion

of existing mineral resources into mineral reserves, most of which

are classified in the measured and indicated categories, coupled

with the potential addition of new mineral resources. It also

establishes a strong platform for Centerra to continue to invest in

further drilling at Mount Milligan.

- Beneficial outcome for all

stakeholders at Mount Milligan: The additional agreement

supports Centerra’s strategy of extending Mount Milligan’s mine

life to, and potentially beyond, 2035 for the benefit of Centerra’s

shareholders, as well as Mount Milligan’s First Nations partners,

employees and local stakeholders.

- Centerra will receive

increased cash payments for Mount Milligan gold and copper

production sold to Royal Gold, starting in approximately

2030: When added to the streaming payments under the

Existing Stream Agreement (as defined below), the additional

agreement will effectively provide aggregate cash payments for gold

and copper sold under the Existing Stream Agreement as follows:

- For gold, up to: (i) the lower of

$850 per ounce and 50% of the gold spot price for the period

between approximately 2030 and approximately 2035(1,2); and (ii)

the lower of $1,050 per ounce and 66% of the gold spot price from

and after approximately 2036(1,3);

- For copper, up to, (i) 50% of the

copper spot price for the period between approximately 2030 and

approximately 2035(1,2); and (ii) 66% of the copper spot price from

and after approximately 2036(1,4).

- As part of the additional

agreement, Centerra and TCM have agreed to make certain payments

and deliveries to Royal Gold:

- Upfront cash payments of $24.5

million;

- A commitment to deliver an

aggregate of 50,000 ounces of gold;

- Commencing in approximately

2030(1,5), payments equal to 5% of Mount Milligan’s annual free

cash flow, which increase by an additional 5% of annual free cash

flow commencing in approximately 2036(1,6) (for a total of 10% per

year after such date).

(1) Approximate year estimates are based on

production forecasts.(2) The 2030 timeframe relates to the first to

occur of delivering, to Royal Gold, after January 1, 2024, 375,000

ounces of gold or 30,000 tonnes of copper.(3) The 2036 timeframe

relates specifically to the threshold of delivering to Royal Gold

665,000 ounces of gold after January 1, 2024.(4) The 2036 timeframe

relates specifically to the threshold of delivering to Royal Gold

60,000 tonnes of copper after January 1, 2024.(5) January 1st of

the year following the later of delivering to Royal Gold an

aggregate of 375,000 ounces of gold and an aggregate of 30,000

tonnes of copper, in each case from and after January 1, 2024, but

no later than January 1, 2036.(6) January 1st of the year

following the later of delivering to Royal Gold an aggregate of

665,000 ounces of gold and an aggregate of 60,000 tonnes of copper,

in each case from and after January 1, 2024, but not later than

January 1, 2036.

Mount Milligan Life of Mine

Extension

2023 Year-End Mineral Reserves and Mineral

Resources

As of December 31, 2023, Mount Milligan’s proven

and probable gold mineral reserves were an estimated 2.8 million

ounces of contained gold (250 million tonnes at 0.35 grams per

tonne (“g/t”) gold), and its measured and indicated gold resources

was 2.3 million ounces of contained gold (260 million tonnes at

0.27 g/t gold). As of December 31, 2023, the mine’s proven and

probable copper mineral reserves were an estimated 961 million

pounds of contained copper (250 million tonnes at 0.17% copper) and

its measured and indicated mineral resources were an estimated 851

million pounds (260 million tonnes at 0.15% copper).

Further Study, Preliminary Economic Assessment

(“PEA”), Exploration and Optimization

Centerra will be initiating a PEA to evaluate

the substantial mineral resources at Mount Milligan with a goal to

unlock additional value beyond its current 2035 mine life. The

scope of the PEA is expected to include significant drilling

completed to the west of the pit not currently included in the

existing resource, plus inclusion of existing resources, most of

which are classified in the measured and indicated categories. The

PEA will also evaluate several capital projects to support a

further expansion of Mount Milligan’s mine life, including options

for a new tailings storage facility (“TSF”) and potential process

plant upgrades. The Company will also be starting the associated

work on permitting and engagement with its First Nations partners

and local stakeholders. The PEA is expected to be completed in

first half of 2025.

The Company is also continuing its exploration

drilling program aimed at expanding the mineral resource base

significantly at Mount Milligan. In 2023, approximately 80% of the

exploration drilling at Mount Milligan was carried out in the pit

and three brownfield areas within the mining lease. In all these

areas, results received showed mineralization extending west from

the pit margin and below the ultimate pit boundary. Centerra is

encouraged by the significant mineral endowment at Mount Milligan,

setting the stage for potential future resource additions. At

Goldmark and South Boundary, there are possibilities for

near-surface additions. At North Slope, DWBX Extension and Saddle

West, the Company continues to test for depth extensions. Centerra

expects to invest approximately $5 to $7 million in exploration

spending at Mount Milligan in 2024. For additional details and

drill results from the 2023 Mount Milligan exploration program,

please refer to the announcement entitled “Centerra Gold Announces

2023 Year-End Mineral Reserves and Resources and Provides

Exploration Update”, which was issued in conjunction with this news

release on February 14, 2024.

Finally, in the fourth quarter of 2023, Centerra

embarked on a site-wide optimization program at Mount Milligan

focused holistically on assessments of operational health and

safety, productivity, and cost efficiency opportunities, in concert

with mine plan optimization. The comprehensive optimization program

will set up Mount Milligan for long-term success to 2035 and

beyond. The Company is encouraged by the preliminary cash flow

improvement estimates from the first phases of work on the

program.

Highlights of the Additional Royal Gold

Agreement

The additional agreement entered into with Royal

Gold (the “Additional Royal Gold Agreement”), which is effective

immediately, provides supplementary payments to Mount Milligan that

has enabled the reserve increase and corresponding extension of the

mine life described above. The existing Amended and Restated

Purchase and Sale Agreement with Royal Gold dated as of December

14, 2011, as amended (the “Existing Stream Agreement”), is not

affected by the Additional Royal Gold Agreement. The Additional

Royal Gold Agreement, taken together with the Existing Stream

Agreement, will have the effect of increasing payments for Mount

Milligan gold and copper production sold to Royal Gold under the

Existing Stream Agreement, among other things. The percentage of

gold and copper production streamed to Royal Gold remains unchanged

at 35% gold and 18.75% copper.

Gold Stream

|

Gold Delivery Threshold(after January 1,

2024) |

Approximate Year(1) |

Gold Payments Received from Royal

Gold |

|

Additional Royal Gold Agreement plus Existing Stream

Agreement |

Existing Stream Agreement |

|

Until either 375,000 ounces of gold or 30,000 tonnes of copper have

been delivered to Royal Gold (the “First Threshold”) |

2024 - 2029 |

$435/oz |

$435/oz |

|

After the First Threshold until 665,000 ounces of gold have been

delivered to Royal Gold (the “Second Gold Threshold”) |

2030 - 2035 |

Lower of $850/oz and 50% of spot gold price |

$435/oz |

|

After 665,000 ounces of gold have been delivered to Royal Gold |

2036+ |

Lower of $1,050/oz and 66% of spot gold price |

$435/oz |

(1) Approximate year estimates are based on

production forecasts.

Copper Stream

|

Copper Delivery Threshold(after January 1,

2024) |

Approximate Year(1) |

Copper Payments Receivedfrom Royal

Gold |

|

Additional Royal Gold Agreement plus Existing Stream

Agreement |

Existing Stream Agreement |

|

Until either 375,000 ounces of gold or 30,000 tonnes of copper have

been delivered to Royal Gold (the “First Threshold”) |

2024 - 2029 |

15% of spot copper price |

15% of spot copper price |

|

After the First Threshold until 60,000 tonnes of copper have been

delivered to Royal Gold (the “Second Copper Threshold”) |

2030 - 2035 |

50% of spot copper price |

15% of spot copper price |

|

After 60,000 tonnes of copper have been delivered to Royal

Gold |

2036+ |

66% of spot copper price |

15% of spot copper price |

(1) Approximate year estimates are based on

production forecasts.

Optional Pre-Threshold Payments

The Additional Royal Gold Agreement also

provides TCM an option to elect to receive additional payments

(“Optional Pre-Threshold Payments”) from Royal Gold prior to the

First Threshold (“Pre-Threshold Period”), in a low commodity price

environment. If both the gold spot price falls below $1,600 per

ounce and the copper spot price falls below $3.50 per pound, then

Centerra may elect to receive up to:

- For gold, the lesser of: (i) $415

per ounce, for an aggregate cash payment per ounce equal to $850

per ounce when including any cash payment under the Existing Stream

Agreement; and (ii) an amount per ounce equal to the difference of

66% of the gold spot price, less any cash payment under the

Existing Stream Agreement for such gold; and

- For copper, 35% of the copper spot

price, for an aggregate cash payment per metric tonne equal to 50%

of the copper spot price when including any cash payment under the

Existing Stream Agreement for such copper.

After the Pre-Threshold Period, any Optional

Pre-Threshold Payments previously received by TCM will be repayable

if the prices of gold and copper each increase above $1,600 per

ounce and $3.50 per pound, respectively, at the time of any gold or

copper delivery under the Existing Stream Agreement.

Centerra Payments

As part of the Additional Royal Gold Agreement,

Centerra and TCM have agreed to make certain payments and

deliveries to Royal Gold as outlined below.

- Upfront

consideration: Cash payment of $24.5 million;

- Deferred gold

consideration: Deliver an aggregate of 50,000 ounces of

gold. The first 33,333 ounces are expected to be delivered in

tranches of 11,111 ounces after an equivalent number of gold ounces

are received by Centerra in relation to the sale of Centerra’s 50%

interest in the Greenstone Gold Mines Partnership. Any remaining

ounces are to be delivered to Royal Gold in quarterly installments

equally over a 5-year period, with the first delivery to occur by

June 30, 2030(1); and

- Free Cash Flow

payments: Payments equal to 5% of Mount Milligan’s

cumulative free cash flow commencing approximately 2030(2), payable

annually. Commencing in approximately 2036(3) the annual payments

will double (for a total of 10% of free cash flow per year after

such date). No payments will be made for a calendar year in which

free cash flow is negative, and Centerra is allowed to recoup any

negative free cash flow (i.e., such that cumulative free cash flow

from the commencement of the payments in 2030 is positive) before

any such payments to Royal Gold resume. For the purposes of

calculating these payments, free cash flow is defined as gross

revenue received by TCM from the sale of minerals, less treatment

and refining costs, operating costs, exploration costs, interest

costs, taxes (excluding federal and provincial income taxes), lease

payments, capital costs, reclamation costs, net stream costs,

intercompany costs, and changes in working capital (all in respect

of Mount Milligan).

(1) First to occur of: the achievement of the

First Threshold, and Q2 2030.(2) January 1st of the year following

the later to occur of delivering to Royal Gold an aggregate of

375,000 of gold and an aggregate of 30,000 tonnes of copper, in

each case from and after January 1, 2024, but no later than January

1, 2036.(3) January 1st of the year following the later of the

Second Gold Threshold and the Second Copper Threshold, but not

later than January 1, 2036.

Conference Call to Discuss the Mount

Milligan Mine Life Extension and Additional Royal Gold

Agreement

Centerra will host a conference call and webcast

to discuss the Mount Milligan mine life extension and Additional

Royal Gold Agreement on Wednesday February 14, 2024 at 8:00 am

Eastern Time. Details for the conference call and webcast are

included below.

Webcast

- Participants can access the webcast

at the following

link:https://services.choruscall.ca/links/centerragold202402.html

- An archive of the webcast will be

available for until end of day May 14, 2024.

Conference Call

- Participants can register for the

conference call at the following registration link. Upon

registering, you will receive the dial-in details and a unique PIN

to access the call. This process will by-pass the live operator and

avoid the queue. Registration will remain open until the end of the

live conference call.

- Participants who prefer to dial-in

and speak with a live operator, can access the call by dialing

1-800-319-4610 or 604-638-5340. It is recommended that you call 10

minutes before the scheduled start time.

- After the call, an audio recording

will be made available via telephone for one month, until end of

day March 14, 2024. The recording can be accessed by dialing

412-317-0088 or 1-855-669-9658 and using the passcode 0700. In

addition, the webcast will be archived on Centerra’s website at:

www.centerragold.com/investor/events-presentations.

Advisors and Counsel

National Bank Financial acted as financial

advisor, and Stikeman Elliott LLP acted as legal advisor to

Centerra.

About Centerra Gold

Centerra Gold Inc. is a Canadian-based gold

mining company focused on operating, developing, exploring and

acquiring gold and copper properties in North America, Türkiye, and

other markets worldwide. Centerra operates two mines: the Mount

Milligan Mine in British Columbia, Canada, and the Öksüt Mine in

Türkiye. The Company also owns the Goldfield District Project in

Nevada, United States, the Kemess Project in British Columbia,

Canada, and owns and operates the Molybdenum Business Unit in the

United States and Canada. Centerra’s shares trade on the Toronto

Stock Exchange (“TSX”) under the symbol CG and on the New York

Stock Exchange (“NYSE”) under the symbol CGAU. The Company is based

in Toronto, Ontario, Canada.

For more information:

Lisa WilkinsonVice President, Investor Relations & Corporate

Communications(416) 204-3780lisa.wilkinson@centerragold.com

Lana PisarenkoSenior Manager, Investor Relations

lana.pisarenko@centerragold.com

Additional information on Centerra is available on the

Company’s website at www.centerragold.com and at

SEDAR+ at www.sedarplus.ca and EDGAR at www.sec.gov/edgar.

Qualified Persons

Jean-Francois St-Onge, Professional Engineer,

member of the Professional Engineer of Ontario (PEO) and Centerra’s

Senior Director, Technical Services, has reviewed and approved the

scientific and technical information in this news release related

to mining. Mr. St-Onge is a Qualified Person within the meaning of

NI 43-101.

Lars Weiershäuser, PhD, P.Geo, and Centerra’s

Director, Geology, has reviewed and approved the scientific and

technical information included in this news release related to

geology and mineral resources. Dr. Weiershäuser is a Qualified

Person within the meaning of NI 43-101.

All other scientific and technical information

presented in this document was reviewed and approved by Centerra’s

geological and mining staff under the supervision of W. Paul

Chawrun, Professional Engineer, member of the Professional

Engineers of Ontario (PEO) and Centerra’s Executive Vice President

and Chief Operating Officer. Mr. Chawrun is a Qualified Person

within the meaning of NI 43-101.

Caution Regarding Forward-Looking

Information:

Information contained in this document which is

not a statement of historical fact, and the documents incorporated

by reference herein, may be “forward-looking information” for the

purposes of Canadian securities laws and within the meaning of the

United States Private Securities Litigation Reform Act of 1995.

Such forward-looking information involves risks, uncertainties and

other factors that could cause actual results, performance,

prospects and opportunities to differ materially from those

expressed or implied by such forward-looking information. The words

"achieve", “assume”, “anticipate”, “approach”, “believe”, “budget”,

“contemplate”, “contingent”, “continue”, “could”, “deliver”,

“de-risk”, “develop”, “enhance”, “estimate”, “evaluate”, “expand”,

“expect”, “explore”, “focus”, “forecast”, “future”, “generate”,

“growth”, “in line”, “improve”, “intend”, “may”, “maximize”,

“modify”, “obtain”, “offset”, “on track”, “optimize”, “path”,

“plan”, "potential", “re-evaluate”, “realize”, “remaining”,

“restart”, “result”, “schedule”, “sees”, “seek”, “strategy”,

“subject to”, “target”, “test”, “understand”, “update”, “will”, and

similar expressions identify forward-looking information. These

forward-looking statements relate to, among other things: the

benefits expected to be realized from the Additional Royal Gold

Agreement, including expectations regarding future mine life

extensions and optimizations, benefits expected to be realized by

the Company’s shareholders and local stakeholders; the timing of

receiving the increased cash payments for Mount Milligan gold and

copper production sold to Royal Gold and the timing of the free

cash flow payments to Royal Gold under the Additional Royal Gold

Agreement; expectations regarding converting existing mineral

resources into reserves and investments in further drilling at

Mount Milligan; the completion of the PEA, including the timing,

scope and expected results of the PEA; the exploration drilling and

site-wide optimization programs at Mount Milligan and the benefits

expected to be realized from them.

Forward-looking information is necessarily based

upon a number of estimates and assumptions that, while considered

reasonable by Centerra, are inherently subject to significant

technical, political, business, economic and competitive

uncertainties and contingencies. Known and unknown factors could

cause actual results to differ materially from those projected in

the forward- looking information. Factors and assumptions that

could cause actual results or events to differ materially from

current expectations include, among other things: (A) strategic,

legal, planning and other risks, including: political risks

associated with the Company’s Mount Milligan operations; the impact

of changes in, or to the more aggressive enforcement of, laws,

regulations and government practices, including unjustified civil

or criminal action against the Company, its affiliates, or its

current or former employees; risks that community activism may

result in increased contributory demands or business interruptions;

the risks related to outstanding litigation affecting the Company;

risks relating to future disagreements or disputes with Royal Gold,

including in respect of the Existing Stream Agreement and/or the

Additional Royal Gold Agreement; potential defects of title in the

Mount Milligan properties that are not known as of the date hereof;

the inability of the Company and its subsidiaries to enforce their

legal rights in certain circumstances; Centerra not being able to

replace mineral reserves; Indigenous claims and consultative issues

relating to the Mount Milligan properties; (B) risks relating to

financial matters, including: sensitivity of the Mount Milligan

Mine to the volatility of gold, copper and other mineral prices;

the use of provisionally-priced sales contracts for production at

the Mount Milligan Mine; reliance on a few key customers for the

gold-copper concentrate at the Mount Milligan Mine; use of

commodity derivatives; the imprecision of the Company’s mineral

reserves and resources estimates and the assumptions they rely on,

including assumptions relating to the Additional Royal Gold

Agreement; the accuracy of the Company’s production and cost

estimates; the accounting treatment of the Additional Royal Gold

Agreement; changes to tax regimes; the Company’s ability to obtain

future financing; the impact of global financial conditions; the

impact of currency fluctuations; the effect of market conditions on

the Company’s short-term investments; the Company’s ability to make

payments, including any payments of principal and interest on the

Company’s debt facilities, which depends on the cash flow of its

subsidiaries; risks relating to the complexity of calculating free

cash flow in respect of the Mount Milligan Mine and the free cash

flow payments to be made to Royal Gold based thereon; and (C) risks

related to operational matters and geotechnical issues and the

Company’s continued ability to successfully manage such matters,

including: the stability of the pit walls at the Company’s

operations; the integrity of tailings storage facilities and the

management thereof, including as to stability, compliance with

laws, regulations, licenses and permits, controlling seepages and

storage of water, where applicable; the risk of having sufficient

water to continue operations at the Mount Milligan Mine and achieve

expected mill throughput; changes to, or delays in the Company’s

supply chain and transportation routes, including cessation or

disruption in rail and shipping networks, whether caused by

decisions of third-party providers or force majeure events

(including, but not limited to: labour action, flooding, wildfires,

earthquakes, COVID-19, or other global events such as wars); the

success of the Company’s future exploration and development

activities, including the financial and political risks inherent in

carrying out exploration activities; inherent risks associated with

the use of sodium cyanide in the mining operations; the adequacy of

the Company’s insurance to mitigate operational and corporate

risks; mechanical breakdowns; the occurrence of any labour unrest

or disturbance and the ability of the Company to successfully

renegotiate collective agreement when required; the risk that

Centerra’s workforce and operations may be exposed to widespread

epidemic or pandemic; seismic activity, including earthquakes;

wildfires; long lead-times required for equipment and supplies

given the remote location of some of the Company’s operating

properties and disruptions caused by global events; reliance on a

limited number of suppliers for certain consumables, equipment and

components; the ability of the Company to address physical and

transition risks from climate change and sufficiently manage

stakeholder expectations on climate-related issues; the Company’s

ability to accurately predict decommissioning and reclamation costs

and the assumptions they rely upon; the Company’s ability to

attract and retain qualified personnel; competition for mineral

acquisition opportunities; risks associated with the conduct of

joint ventures/partnerships; and, the Company’s ability to manage

its projects effectively and to mitigate the potential lack of

availability of contractors, budget and timing overruns, and

project resources. For additional risk factors, please see section

titled “Risks Factors” in the Company’s most recently filed Annual

Information Form (“AIF”) available on SEDAR at www.sedar.com and

EDGAR at www.sec.gov/edgar.

There can be no assurances that forward-looking

information and statements will prove to be accurate, as many

factors and future events, both known and unknown could cause

actual results, performance or achievements to vary or differ

materially from the results, performance or achievements that are

or may be expressed or implied by such forward-looking statements

contained herein or incorporated by reference. Accordingly, all

such factors should be considered carefully when making decisions

with respect to Centerra, and prospective investors should not

place undue reliance on forward-looking information.

Forward-looking information is as of February 14, 2024. Centerra

assumes no obligation to update or revise forward-looking

information to reflect changes in assumptions, changes in

circumstances or any other events affecting such forward-looking

information, except as required by applicable law.

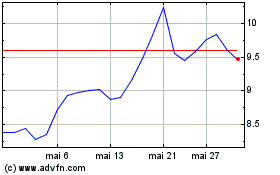

Centerra Gold (TSX:CG)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Centerra Gold (TSX:CG)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024