Bilibili Inc. (“Bilibili” or the “Company”) (NASDAQ: BILI and HKEX:

9626), an iconic brand and a leading video community for young

generations in China, today announced that it is notifying holders

of its 1.375% Convertible Senior Notes due 2026 (CUSIP No.

090040AB2) (the “Notes”) that, pursuant to the Indenture dated as

of April 5, 2019 (the “Indenture”) relating to the Notes by and

between the Company and Deutsche Bank Trust Company Americas, as

trustee, each holder has the right, at the option of such holder,

to require the Company to repurchase all of such holder’s Notes or

any portion thereof that is an integral multiple of US$1,000

principal amount for cash on April 1, 2024 (the “Repurchase

Right”). Holders of the Notes may exercise the Repurchase Right

from 12:01 a.m., New York City time, on Thursday, February 29, 2024

until 5:00 p.m., New York City time, on Thursday, March 28, 2024.

As required by rules of the United States

Securities and Exchange Commission (the “SEC”), the Company will

file a Tender Offer Statement on Schedule TO today. In addition,

documents specifying the terms, conditions, and procedures for

exercising the Repurchase Right will be available through the

Depository Trust Company and the paying agent, which is Deutsche

Bank Trust Company Americas. None of the Company, its board of

directors, or its employees has made or is making any

representation or recommendation to any holder as to whether to

exercise or refrain from exercising the Repurchase Right.

The Repurchase Right entitles each holder of the

Notes to require the Company to repurchase all of such holder’s

Notes, or any portion thereof that is an integral multiple of

US$1,000 principal amount. The repurchase price for such Notes will

be an amount in cash equal to 100% of the principal amount of the

Notes to be repurchased, plus accrued and unpaid interest to, but

excluding, April 1, 2024, which is the date specified for

repurchase in the Indenture (the “Repurchase Date”), subject to the

terms and conditions of the Indenture and the Notes. The Repurchase

Date is an interest payment date under the terms of the Indenture

and the Notes. Accordingly, on Monday, April 1, 2024, the interest

payment date, the Company will pay accrued and unpaid interest on

all of the Notes through March 29, 2024 to all holders who were

holders of record as of close of business on Friday, March 15,

2024, regardless of whether the Repurchase Right is exercised with

respect to such Notes. On the Repurchase Date, there will be no

accrued and unpaid interest on the Notes. As of February 20, 2024,

there was US$429,343,000 in aggregate principal amount of the Notes

outstanding. If all outstanding Notes are surrendered for

repurchase through exercise of the Repurchase Right, the aggregate

cash purchase price will be US$429,343,000.

In order to exercise the Repurchase Right, a

holder must follow the transmittal procedures set forth in the

Company’s Repurchase Right Notice to holders (the “Repurchase Right

Notice”), which is available through the Depository Trust Company

and Deutsche Bank Trust Company Americas. Holders may withdraw any

previously tendered Notes pursuant to the terms of the Repurchase

Right at any time prior to 5:00 p.m., New York City time, on

Tuesday, March 28, 2024, which is the second business day

immediately preceding the Repurchase Date. If a holder has tendered

any Notes pursuant to the Repurchase Right, such Notes cannot be

converted unless the holder withdraws the tender in accordance with

the terms of the Indenture.

This press release is for information only and

is not an offer to purchase, a solicitation of an offer to

purchase, or a solicitation of an offer to sell the Notes or any

other securities of the Company. The offer to purchase the Notes

will be only pursuant to, and the Notes may be tendered only in

accordance with, the Company’s Repurchase Right Notice dated

February 20, 2024 and related documents.

Holders of the Notes should refer to the

Indenture for a complete description of repurchase procedures and

direct any questions concerning the mechanics of repurchase to the

Trustee by contacting Deutsche Bank Trust Company Americas. Holders

of Notes may request the Company’s Repurchase Right Notice from the

paying agent, at Deutsche Bank Trust Company Americas, c/o DB

Services Americas Inc., 5022 Gate Parkway Suite 200, MS JCK01-218,

Jacksonville, FL 32256.

HOLDERS OF NOTES AND OTHER INTERESTED PARTIES

ARE URGED TO READ THE COMPANY’S TENDER OFFER STATEMENT ON SCHEDULE

TO, REPURCHASE RIGHT NOTICE, AND OTHER RELEVANT DOCUMENTS FILED

WITH THE SEC WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN

IMPORTANT INFORMATION ABOUT BILIBILI INC. AND THE REPURCHASE

RIGHT.

Materials filed with the SEC will be available

electronically without charge at the SEC’s website,

http://www.sec.gov. Documents filed with the SEC may also be

obtained without charge at the Company’s website,

http://ir.bilibili.com.

About Bilibili Inc.

Bilibili is an iconic brand and a leading video

community with a mission to enrich the everyday lives of young

generations in China. Bilibili offers a wide array of video-based

content with All the Videos You Like as its value proposition.

Bilibili builds its community around aspiring users, high-quality

content, talented content creators and the strong emotional bonds

among them. Bilibili pioneered the “bullet chatting” feature, a

live comment function that has transformed our users’ viewing

experience by displaying the thoughts and feelings of audience

members viewing the same video. The Company has now become the

welcoming home of diverse interests among young generations in

China and the frontier for promoting Chinese culture across the

world.

For more information, please visit:

http://ir.bilibili.com.

For investor and media inquiries, please

contact:

In China:

Bilibili Inc.Juliet YangTel: +86-21-2509-9255 Ext.

8523E-mail: ir@bilibili.com

Piacente Financial CommunicationsHelen WuTel:

+86-10-6508-0677E-mail: bilibili@tpg-ir.com

In the United States:

Piacente Financial CommunicationsBrandi

PiacenteTel: +1-212-481-2050E-mail: bilibili@tpg-ir.com

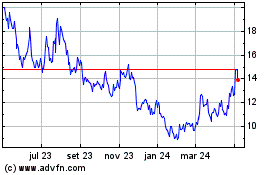

Bilibili (NASDAQ:BILI)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

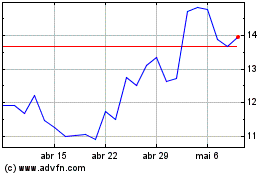

Bilibili (NASDAQ:BILI)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024