Health Catalyst, Inc. ("Health Catalyst," Nasdaq: HCAT), a leading

provider of data and analytics technology and services to

healthcare organizations, today reported financial results for the

quarter and year ended December 31, 2023.

“For the full year 2023, I am pleased to share

that we achieved strong performance across our business, including

total revenue of $295.9 million, with this result beating the

midpoint of our most recent guidance, and Adjusted EBITDA of $11.0

million, with this result in line with the midpoint of our most

recent guidance. Additionally, I am pleased by our meaningful 2023

Adjusted EBITDA margin progress relative to 2022, and I am excited

that we anticipate material year-over-year Adjusted EBITDA growth

again in 2024, at a rate of approximately 125%+,” said Dan Burton,

CEO of Health Catalyst.

“Additionally, in connection with our annual

planning process, we are enacting multiple Leadership level

changes. First, Bryan Hunt will be transitioning from CFO to a

Strategic Advisor role, effective March 1, 2024. I would like to

express my heartfelt gratitude to Bryan for his countless

contributions to Health Catalyst’s growth and success over the last

ten years, including his service as our CFO, helping us navigate

through a global pandemic, record high inflation, and a period of

tremendous financial pressure for our health system clients. Bryan

has been an extraordinary leader and partner to me and to our Board

of Directors, and we are grateful for his dedication,

professionalism and commitment to the company and its mission. I am

also pleased to share that Jason Alger will begin as Health

Catalyst’s CFO, effective March 1, 2024. Jason has been with Health

Catalyst for more than ten years, having contributed significantly

during that time, including most recently as our Chief Accounting

Officer. Prior to joining Health Catalyst, Jason held various roles

at Ernst & Young. My fellow board members and I, along with our

finance organization, have the utmost confidence in and respect for

Jason. Also, effective March 1, 2024, Dan LeSueur will be promoted

to Health Catalyst’s Chief Operating Officer role, with

responsibilities spanning both our Technology and Professional

Services business units. Dan brings a wealth of experience to this

role, having had leadership responsibility across many functions

during his twelve years at Health Catalyst, most recently as the

Senior Vice President and General Manager of our Professional

Services Business Unit. I am thrilled to have someone with Dan’s

breadth and depth of expertise to lead this important strategic

function as Health Catalyst continues on its maturation path,

focusing on operational excellence to enable scalable growth and

profitability.”

Financial Highlights for the Three and

Twelve Months Ended December 31, 2023Key

Financial Measures

| |

Three Months EndedDecember

31, |

|

Year over Year Change |

|

Twelve Months EndedDecember

31, |

|

Year over Year Change |

| |

|

2023 |

|

|

|

2022 |

|

|

|

|

2023 |

|

|

|

2022 |

|

|

| GAAP Financial

Measures: |

(in thousands, except percentages) |

|

(in thousands, except percentages) |

|

|

|

Technology revenue |

$ |

47,100 |

|

|

$ |

44,664 |

|

|

5 |

% |

|

$ |

187,583 |

|

|

$ |

176,288 |

|

|

6 |

% |

| Professional services

revenue |

$ |

27,984 |

|

|

$ |

24,498 |

|

|

14 |

% |

|

$ |

108,355 |

|

|

$ |

99,948 |

|

|

8 |

% |

| Total revenue |

$ |

75,084 |

|

|

$ |

69,162 |

|

|

9 |

% |

|

$ |

295,938 |

|

|

$ |

276,236 |

|

|

7 |

% |

| Loss from operations |

$ |

(32,785 |

) |

|

$ |

(36,745 |

) |

|

11 |

% |

|

$ |

(126,897 |

) |

|

$ |

(140,005 |

) |

|

9 |

% |

| Net loss |

$ |

(30,312 |

) |

|

$ |

(35,782 |

) |

|

15 |

% |

|

$ |

(118,147 |

) |

|

$ |

(137,403 |

) |

|

14 |

% |

| Non-GAAP Financial

Measures:(1) |

|

|

|

|

|

|

|

|

|

|

|

| Adjusted Technology Gross

Profit |

$ |

31,388 |

|

|

$ |

30,725 |

|

|

2 |

% |

|

$ |

127,744 |

|

|

$ |

122,284 |

|

|

4 |

% |

| Adjusted Technology Gross

Margin |

|

67 |

% |

|

|

69 |

% |

|

|

|

|

68 |

% |

|

|

69 |

% |

|

|

| Adjusted Professional Services

Gross Profit |

$ |

3,305 |

|

|

$ |

4,325 |

|

|

(24 |

)% |

|

$ |

16,316 |

|

|

$ |

23,565 |

|

|

(31 |

)% |

| Adjusted Professional Services

Gross Margin |

|

12 |

% |

|

|

18 |

% |

|

|

|

|

15 |

% |

|

|

24 |

% |

|

|

| Total Adjusted Gross

Profit |

$ |

34,693 |

|

|

$ |

35,050 |

|

|

(1 |

)% |

|

$ |

144,060 |

|

|

$ |

145,849 |

|

|

(1 |

)% |

| Total Adjusted Gross

Margin |

|

46 |

% |

|

|

51 |

% |

|

|

|

|

49 |

% |

|

|

53 |

% |

|

|

| Adjusted EBITDA |

$ |

1,352 |

|

|

$ |

(603 |

) |

|

324 |

% |

|

$ |

11,021 |

|

|

$ |

(2,487 |

) |

|

543 |

% |

________________________

(1) These measures are not calculated in

accordance with generally accepted accounting principles in the

United States (GAAP). See the accompanying "Non-GAAP Financial

Measures" section below for more information about these financial

measures, including the limitations of such measures, and for a

reconciliation of each measure to the most directly comparable

measure calculated in accordance with GAAP.

Other Key Metrics

| |

As of December 31, |

| |

2023 |

|

2022 |

|

2021 |

|

DOS Subscription

Clients |

109 |

|

|

98 |

|

|

90 |

|

| |

|

|

|

|

|

| |

Year Ended December 31, |

| |

2023 |

|

2022 |

|

2021 |

| Dollar-based Retention

Rate |

100 |

% |

|

100 |

% |

|

112 |

% |

| |

|

|

|

|

|

|

|

|

Financial Outlook

Health Catalyst provides forward-looking guidance on total

revenue, a GAAP measure, and Adjusted EBITDA, a non-GAAP

measure.

For the first quarter of 2024, we expect:

- Total revenue between $72.5 million and $76.5 million, and

- Adjusted EBITDA between $2.0 million

and $4.0 million

For the full year of 2024, we expect:

- Total revenue between $304 million and $312 million, and

- Adjusted EBITDA between $24 million

and $26 million

We have not reconciled guidance for Adjusted

EBITDA to net loss, the most directly comparable GAAP measure, and

have not provided forward-looking guidance for net loss, because

there are items that may impact net loss, including stock-based

compensation, that are not within our control or cannot be

reasonably forecasted.

Quarterly Conference Call Details

The company will host a conference call to

review the results today, Thursday, February 22, 2024 at 5:00

p.m. E.T. The conference call can be accessed by dialing (800)

267-6316 for U.S. participants, or (203) 518-9783 for international

participants, and referencing conference ID “HCAT Q423.” A live

audio webcast will be available online at

https://ir.healthcatalyst.com/. A replay of the call will be

available via webcast for on-demand listening shortly after the

completion of the call, at the same web link, and will remain

available for approximately 90 days.

About Health Catalyst

Health Catalyst is a leading provider of data

and analytics technology and services to healthcare organizations

committed to being the catalyst for massive, measurable,

data-informed healthcare improvement. Its clients leverage the

cloud-based data platform — powered by data from more than 100

million patient records and encompassing trillions of facts — as

well as its analytics software and professional services expertise

to make data-informed decisions and realize measurable clinical,

financial, and operational improvements. Health Catalyst envisions

a future in which all healthcare decisions are data informed.

Available Information

Our investors and others should note that we

announce material information to the public about our company,

products and services, and other matters related to our company

through a variety of means, including our website

(https://www.healthcatalyst.com/), our investor relations website

(https://ir.healthcatalyst.com/), press releases, SEC filings,

public conference calls, and social media, including our and our

CEO's social media accounts, in order to achieve broad,

non-exclusionary distribution of information to the public and to

comply with our disclosure obligations under Regulation FD.

Forward-Looking Statements

This release contains forward-looking statements

within the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended, and the Private Securities Litigation Reform Act of 1995,

as amended. These forward-looking statements include statements

regarding our future growth and our financial outlook for Q1 and

fiscal year 2024. Forward-looking statements are subject to risks

and uncertainties and are based on potentially inaccurate

assumptions that could cause actual results to differ materially

from those expected or implied by the forward-looking statements.

Actual results may differ materially from the results predicted,

and reported results should not be considered as an indication of

future performance.

Important risks and uncertainties that could

cause our actual results and financial condition to differ

materially from those indicated in the forward-looking statements

include, among others, the following: (i) changes in laws and

regulations applicable to our business model; (ii) changes in

market or industry conditions, regulatory environment, and

receptivity to our technology and services; (iii) results of

litigation or a security incident; (iv) the loss of one or more key

clients or partners; (v) macroeconomic challenges (including high

inflationary and/or high interest rate environments, or market

volatility caused by bank failures and measures taken in response

thereto) and any new public health crisis; and (vi) changes to our

abilities to recruit and retain qualified team members. For a

detailed discussion of the risk factors that could affect our

actual results, please refer to the risk factors identified in our

SEC reports, including, but not limited to the Quarterly Report on

Form 10-Q for the fiscal quarter ended September 30, 2023 that was

filed with the SEC on November 6, 2023 and the Annual Report on

Form 10-K for the year ended December 31, 2023 expected to be

filed with the SEC on or about February 22, 2024. All

information provided in this release and in the attachments is as

of the date hereof, and we undertake no duty to update or revise

this information unless required by law.

Condensed Consolidated Balance

Sheets(in thousands, except share and per share data,

unaudited)

| |

As of December 31, |

|

|

|

2023 |

|

|

|

2022 |

|

| Assets |

|

|

|

| Current assets: |

|

|

|

|

Cash and cash equivalents |

$ |

106,276 |

|

|

$ |

116,312 |

|

|

Short-term investments |

|

211,452 |

|

|

|

247,178 |

|

|

Accounts receivable, net |

|

60,290 |

|

|

|

47,970 |

|

|

Prepaid expenses and other assets |

|

15,379 |

|

|

|

16,335 |

|

| Total current assets |

|

393,397 |

|

|

|

427,795 |

|

| Property and equipment,

net |

|

25,712 |

|

|

|

25,928 |

|

| Operating lease right-of-use

assets |

|

13,927 |

|

|

|

16,658 |

|

| Intangible assets, net |

|

73,384 |

|

|

|

92,189 |

|

| Goodwill |

|

190,652 |

|

|

|

185,982 |

|

| Other assets |

|

4,742 |

|

|

|

3,734 |

|

| Total assets |

$ |

701,814 |

|

|

$ |

752,286 |

|

| Liabilities and

stockholders’ equity |

|

|

|

| Current liabilities: |

|

|

|

|

Accounts payable |

$ |

6,641 |

|

|

$ |

4,424 |

|

|

Accrued liabilities |

|

23,282 |

|

|

|

19,691 |

|

|

Deferred revenue |

|

55,753 |

|

|

|

54,961 |

|

|

Operating lease liabilities |

|

3,358 |

|

|

|

3,434 |

|

| Total current liabilities |

|

89,034 |

|

|

|

82,510 |

|

| Convertible senior notes |

|

228,034 |

|

|

|

226,523 |

|

| Deferred revenue, net of

current portion |

|

77 |

|

|

|

105 |

|

| Operating lease liabilities,

net of current portion |

|

17,676 |

|

|

|

18,017 |

|

| Other liabilities |

|

74 |

|

|

|

121 |

|

| Total liabilities |

|

334,895 |

|

|

|

327,276 |

|

| Commitments and

contingencies |

|

|

|

| Stockholders’ equity: |

|

|

|

|

Preferred stock, $0.001 par value per share and additional paid-in

capital; 25,000,000 shares authorized and no shares issued and

outstanding as of December 31, 2023 and 2022

|

|

— |

|

|

|

— |

|

|

Common stock, $0.001 par value per share, and additional paid-in

capital; 500,000,000 shares authorized as of December 31, 2023

and 2022; 58,295,491 and 55,261,922 shares issued and outstanding

as of December 31, 2023 and 2022,

respectively |

|

1,484,056 |

|

|

|

1,424,681 |

|

| Accumulated

deficit |

|

(1,117,170 |

) |

|

|

(999,023 |

) |

| Accumulated other

comprehensive income

(loss) |

|

33 |

|

|

|

(648 |

) |

| Total stockholders’ equity

|

|

366,919 |

|

|

|

425,010 |

|

| Total liabilities and

stockholders’

equity |

$ |

701,814 |

|

|

$ |

752,286 |

|

| |

|

|

|

|

|

|

|

Condensed Consolidated Statements of

Operations(in thousands, except per share data,

unaudited)

| |

Three Months EndedDecember

31, |

|

Twelve Months EndedDecember

31, |

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

| Revenue: |

|

|

|

|

|

|

Technology |

$ |

47,100 |

|

|

$ |

44,664 |

|

|

$ |

187,583 |

|

|

$ |

176,288 |

|

|

Professional services |

|

27,984 |

|

|

|

24,498 |

|

|

|

108,355 |

|

|

|

99,948 |

|

| Total revenue |

|

75,084 |

|

|

|

69,162 |

|

|

|

295,938 |

|

|

|

276,236 |

|

|

Cost of revenue, excluding depreciation and amortization: |

|

|

|

|

|

|

|

|

Technology(1)(2)(3) |

|

16,719 |

|

|

|

14,747 |

|

|

|

62,474 |

|

|

|

56,642 |

|

|

Professional services(1)(2)(3) |

|

27,857 |

|

|

|

23,359 |

|

|

|

101,631 |

|

|

|

86,407 |

|

|

Total cost of revenue, excluding depreciation and amortization |

|

44,576 |

|

|

|

38,106 |

|

|

|

164,105 |

|

|

|

143,049 |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

Sales and marketing(1)(2)(3) |

|

17,271 |

|

|

|

20,373 |

|

|

|

67,321 |

|

|

|

87,514 |

|

|

Research and development(1)(2)(3) |

|

20,288 |

|

|

|

19,614 |

|

|

|

72,627 |

|

|

|

75,680 |

|

|

General and administrative(1)(2)(3)(4)(5) |

|

15,430 |

|

|

|

16,150 |

|

|

|

76,559 |

|

|

|

61,701 |

|

|

Depreciation and amortization |

|

10,304 |

|

|

|

11,664 |

|

|

|

42,223 |

|

|

|

48,297 |

|

| Total operating expenses |

|

63,293 |

|

|

|

67,801 |

|

|

|

258,730 |

|

|

|

273,192 |

|

| Loss from operations |

|

(32,785 |

) |

|

|

(36,745 |

) |

|

|

(126,897 |

) |

|

|

(140,005 |

) |

| Loss on extinguishment of

debt |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Interest and other expense,

net |

|

2,616 |

|

|

|

1,022 |

|

|

|

9,106 |

|

|

|

(1,678 |

) |

| Loss before income taxes |

|

(30,169 |

) |

|

|

(35,723 |

) |

|

|

(117,791 |

) |

|

|

(141,683 |

) |

| Income tax provision

(benefit)(2) |

|

143 |

|

|

|

59 |

|

|

|

356 |

|

|

|

(4,280 |

) |

| Net loss |

$ |

(30,312 |

) |

|

$ |

(35,782 |

) |

|

$ |

(118,147 |

) |

|

$ |

(137,403 |

) |

|

Net loss per share, basic |

$ |

(0.53 |

) |

|

$ |

(0.66 |

) |

|

$ |

(2.09 |

) |

|

$ |

(2.56 |

) |

|

Net loss per share, diluted |

$ |

(0.53 |

) |

|

$ |

(0.66 |

) |

|

$ |

(2.09 |

) |

|

$ |

(2.63 |

) |

|

Weighted-average shares outstanding used in calculating net loss

per share, basic |

|

57,476 |

|

|

|

54,496 |

|

|

|

56,418 |

|

|

|

53,722 |

|

|

Weighted-average shares outstanding used in calculating net loss

per share, diluted |

|

57,476 |

|

|

|

54,496 |

|

|

|

56,418 |

|

|

|

54,080 |

|

_______________(1) Includes stock-based

compensation expense as follows:

| |

Three Months Ended December 31, |

|

Twelve Months Ended December 31, |

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

| Stock-Based

Compensation Expense: |

(in thousands) |

|

(in thousands) |

| Cost of revenue, excluding

depreciation and amortization: |

|

|

|

|

|

|

|

|

Technology |

$ |

458 |

|

$ |

495 |

|

$ |

1,866 |

|

$ |

2,058 |

|

Professional

services |

|

1,687 |

|

|

2,148 |

|

|

7,369 |

|

|

8,230 |

| Sales and

marketing |

|

4,933 |

|

|

7,157 |

|

|

20,982 |

|

|

28,082 |

| Research and

development |

|

2,536 |

|

|

3,295 |

|

|

11,213 |

|

|

12,938 |

| General and

administrative |

|

3,397 |

|

|

5,653 |

|

|

14,326 |

|

|

20,796 |

|

Total |

$ |

13,011 |

|

$ |

18,748 |

|

$ |

55,756 |

|

$ |

72,104 |

(2) Includes acquisition-related costs, net as follows:

| |

Three Months Ended December 31, |

|

Twelve Months Ended December 31, |

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

| Acquisition-related

costs, net: |

(in thousands) |

|

(in thousands) |

| Cost of revenue, excluding

depreciation and amortization: |

|

|

|

|

|

|

|

|

Technology |

$ |

65 |

|

$ |

84 |

|

$ |

273 |

|

$ |

351 |

|

|

Professional

services |

|

93 |

|

|

146 |

|

|

391 |

|

|

655 |

|

| Sales and

marketing |

|

393 |

|

|

337 |

|

|

697 |

|

|

1,894 |

|

| Research and

development |

|

200 |

|

|

687 |

|

|

787 |

|

|

3,045 |

|

| General and

administrative |

|

1,904 |

|

|

452 |

|

|

3,609 |

|

|

(1,051 |

) |

| Income tax

benefit |

|

— |

|

|

— |

|

|

— |

|

|

(4,533 |

) |

|

Total |

$ |

2,655 |

|

$ |

1,706 |

|

$ |

5,757 |

|

$ |

361 |

|

| |

|

|

|

|

|

|

|

(3) Includes restructuring costs, as follows:

| |

Three Months Ended December 31, |

|

Twelve Months Ended December 31, |

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

| Restructuring

costs: |

(in thousands) |

|

(in thousands) |

| Cost of revenue, excluding

depreciation and amortization: |

|

|

|

|

|

|

|

|

Technology |

$ |

484 |

|

$ |

229 |

|

$ |

496 |

|

$ |

229 |

|

Professional

services |

|

1,398 |

|

|

892 |

|

|

1,832 |

|

|

1,139 |

| Sales and

marketing |

|

1,210 |

|

|

1,464 |

|

|

2,415 |

|

|

3,023 |

| Research and

development |

|

3,051 |

|

|

1,153 |

|

|

3,337 |

|

|

3,410 |

| General and

administrative |

|

624 |

|

|

188 |

|

|

742 |

|

|

624 |

|

Total |

$ |

6,767 |

|

$ |

3,926 |

|

$ |

8,822 |

|

$ |

8,425 |

(4) Includes litigation costs, as follows:

| |

Three Months Ended December 31, |

|

Twelve Months Ended December 31, |

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

| Litigation

costs: |

(in thousands) |

|

(in thousands) |

| General and

administrative |

$ |

— |

|

$ |

— |

|

$ |

21,279 |

|

$ |

— |

(5) Includes non-recurring lease-related charges, as

follows:

| |

Three Months Ended December 31, |

|

Twelve Months Ended December 31, |

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

| Non-recurring

lease-related charges: |

(in thousands) |

|

(in thousands) |

| General and

administrative |

$ |

1,400 |

|

$ |

98 |

|

$ |

4,081 |

|

$ |

3,798 |

| |

|

|

|

|

|

|

|

|

|

|

|

Condensed Consolidated Statements of Cash

Flows(in thousands, unaudited)

| |

Year Ended December 31, |

|

|

|

2023 |

|

|

|

2022 |

|

| Cash flows from

operating activities |

|

|

|

| Net loss |

$ |

(118,147 |

) |

|

$ |

(137,403 |

) |

| Adjustments to reconcile net

loss to net cash used in operating activities: |

|

|

|

|

Stock-based compensation expense |

|

55,756 |

|

|

|

72,104 |

|

|

Depreciation and amortization |

|

42,223 |

|

|

|

48,297 |

|

|

Investment (discount accretion) and premium amortization |

|

(9,720 |

) |

|

|

(2,236 |

) |

|

Impairment of long-lived assets |

|

4,081 |

|

|

|

5,023 |

|

|

Non-cash operating lease expense |

|

2,990 |

|

|

|

3,231 |

|

|

Provision for expected credit losses |

|

1,821 |

|

|

|

691 |

|

|

Amortization of debt discount and issuance costs |

|

1,511 |

|

|

|

1,500 |

|

|

Deferred tax provision (benefit) |

|

8 |

|

|

|

(4,523 |

) |

|

Change in fair value of contingent consideration liabilities |

|

— |

|

|

|

(4,668 |

) |

|

Payment of acquisition-related contingent consideration |

|

— |

|

|

|

(3,234 |

) |

|

Other |

|

67 |

|

|

|

(145 |

) |

|

Change in operating assets and liabilities: |

|

|

|

|

Accounts receivable |

|

(13,663 |

) |

|

|

788 |

|

|

Prepaid expenses and other assets |

|

164 |

|

|

|

(478 |

) |

|

Accounts payable, accrued liabilities, and other liabilities |

|

4,868 |

|

|

|

(4,702 |

) |

|

Deferred revenue |

|

(1,487 |

) |

|

|

(5,997 |

) |

|

Operating lease liabilities |

|

(3,552 |

) |

|

|

(3,518 |

) |

| Net cash used in operating

activities |

|

(33,080 |

) |

|

|

(35,270 |

) |

| Cash flows from

investing activities |

|

|

|

| Proceeds from the sale and

maturity of short-term investments |

|

336,801 |

|

|

|

315,171 |

|

| Purchase of short-term

investments |

|

(290,836 |

) |

|

|

(308,961 |

) |

| Capitalization of internal use

software |

|

(11,957 |

) |

|

|

(12,987 |

) |

| Acquisition of businesses, net

of cash acquired |

|

(11,392 |

) |

|

|

(27,846 |

) |

| Purchases of property and

equipment |

|

(1,236 |

) |

|

|

(2,167 |

) |

| Purchase of intangible

assets |

|

(1,118 |

) |

|

|

(2,260 |

) |

| Proceeds from the sale of

property and equipment |

|

31 |

|

|

|

29 |

|

| Net cash provided by (used in)

investing activities |

|

20,293 |

|

|

|

(39,021 |

) |

| Cash flows from

financing activities |

|

|

|

| Proceeds from employee stock

purchase plan |

|

3,588 |

|

|

|

3,153 |

|

| Repurchase of common

stock |

|

(1,808 |

) |

|

|

(8,393 |

) |

| Proceeds from exercise of

stock options |

|

950 |

|

|

|

3,969 |

|

| Payments of

acquisition-related consideration |

|

— |

|

|

|

(1,342 |

) |

| Net cash provided by (used in)

financing activities |

|

2,730 |

|

|

|

(2,613 |

) |

| Effect of exchange rate

changes on cash and cash equivalents |

|

21 |

|

|

|

(11 |

) |

| Net decrease in cash and cash

equivalents |

|

(10,036 |

) |

|

|

(76,915 |

) |

| |

|

|

|

| Cash and cash equivalents at

beginning of period |

|

116,312 |

|

|

|

193,227 |

|

| Cash and cash equivalents at

end of period |

$ |

106,276 |

|

|

$ |

116,312 |

|

| |

|

|

|

|

|

|

|

Non-GAAP Financial Measures

To supplement our financial information

presented in accordance with GAAP, we believe certain non-GAAP

financial measures, including Adjusted Gross Profit, Adjusted Gross

Margin, Adjusted EBITDA, Adjusted Net Income (Loss), and Adjusted

Net Income (Loss) per share, basic and diluted, are useful in

evaluating our operating performance. For example, we exclude

stock-based compensation expense because it is non-cash in nature

and excluding this expense provides meaningful supplemental

information regarding our operational performance and allows

investors the ability to make more meaningful comparisons between

our operating results and those of other companies. We use this

non-GAAP financial information to evaluate our ongoing operations,

as a component in determining employee bonus compensation, and for

internal planning and forecasting purposes.

We believe that non-GAAP financial information,

when taken collectively, may be helpful to investors because it

provides consistency and comparability with past financial

performance. However, non-GAAP financial information is presented

for supplemental informational purposes only, has limitations as an

analytical tool and should not be considered in isolation or as a

substitute for financial information presented in accordance with

GAAP. In addition, other companies, including companies in our

industry, may calculate similarly-titled non-GAAP financial

measures differently or may use other measures to evaluate their

performance. A reconciliation is provided below for each non-GAAP

financial measure to the most directly comparable financial measure

stated in accordance with GAAP. Investors are encouraged to review

the related GAAP financial measures and the reconciliation of these

non-GAAP financial measures to their most directly comparable GAAP

financial measures, and not to rely on any single financial measure

to evaluate our business.

Adjusted Gross Profit

and Adjusted Gross Margin

Adjusted Gross Profit is

a non-GAAP financial measure that we define as revenue

less cost of revenue, excluding depreciation and amortization,

adding back stock-based compensation, acquisition-related costs,

net, and restructuring costs as applicable. We

define Adjusted Gross Margin as

our Adjusted Gross Profit divided by our revenue. We

believe Adjusted Gross Profit

and Adjusted Gross Margin are useful to investors as they

eliminate the impact of certain non-cash expenses and

certain other non-recurring operating expenses, and allow a direct

comparison of these measures between periods without the impact

of non-cash expenses and certain other non-recurring

operating expenses. The following is a reconciliation of revenue,

the most directly comparable GAAP financial measure, to Adjusted

Gross Profit, for the three and twelve months ended December 31,

2023 and 2022:

| |

Three Months Ended December 31, 2023 |

| |

(in thousands, except percentages) |

| |

Technology |

|

Professional Services |

|

Total |

|

Revenue |

$ |

47,100 |

|

|

$ |

27,984 |

|

|

$ |

75,084 |

|

| Cost of revenue, excluding

depreciation and amortization |

|

(16,719 |

) |

|

|

(27,857 |

) |

|

|

(44,576 |

) |

| Gross profit, excluding

depreciation and amortization |

|

30,381 |

|

|

|

127 |

|

|

|

30,508 |

|

| Add: |

|

|

|

|

|

|

Stock-based compensation |

|

458 |

|

|

|

1,687 |

|

|

|

2,145 |

|

|

Acquisition-related costs, net(1) |

|

65 |

|

|

|

93 |

|

|

|

158 |

|

|

Restructuring costs(2) |

|

484 |

|

|

|

1,398 |

|

|

|

1,882 |

|

| Adjusted Gross Profit |

$ |

31,388 |

|

|

$ |

3,305 |

|

|

$ |

34,693 |

|

| Gross margin, excluding

depreciation and amortization |

|

65 |

% |

|

|

— |

% |

|

|

41 |

% |

| Adjusted Gross Margin |

|

67 |

% |

|

|

12 |

% |

|

|

46 |

% |

___________________

(1) Acquisition-related costs, net include deferred retention

expenses following the ARMUS and KPI Ninja acquisitions.(2)

Restructuring costs include severance and other team member costs

from workforce reductions.

| |

Three Months Ended December 31, 2022 |

| |

(in thousands, except percentages) |

| |

Technology |

|

Professional Services |

|

Total |

|

Revenue |

$ |

44,664 |

|

|

$ |

24,498 |

|

|

$ |

69,162 |

|

| Cost of revenue, excluding

depreciation and amortization |

|

(14,747 |

) |

|

|

(23,359 |

) |

|

|

(38,106 |

) |

| Gross profit, excluding

depreciation and amortization |

|

29,917 |

|

|

|

1,139 |

|

|

|

31,056 |

|

| Add: |

|

|

|

|

|

|

Stock-based compensation |

|

495 |

|

|

|

2,148 |

|

|

|

2,643 |

|

|

Acquisition-related costs, net(1) |

|

84 |

|

|

|

146 |

|

|

|

230 |

|

|

Restructuring costs(2) |

|

229 |

|

|

|

892 |

|

|

|

1,121 |

|

| Adjusted Gross Profit |

$ |

30,725 |

|

|

$ |

4,325 |

|

|

$ |

35,050 |

|

| Gross margin, excluding

depreciation and amortization |

|

67 |

% |

|

|

5 |

% |

|

|

45 |

% |

| Adjusted Gross Margin |

|

69 |

% |

|

|

18 |

% |

|

|

51 |

% |

___________________(1) Acquisition-related

costs, net include deferred retention expenses following the ARMUS,

KPI Ninja, and Twistle acquisitions.(2) Restructuring costs include

severance and other team member costs from workforce

reductions.

| |

Twelve Months Ended December 31, 2023 |

| |

(in thousands, except percentages) |

| |

Technology |

|

Professional Services |

|

Total |

|

Revenue |

$ |

187,583 |

|

|

$ |

108,355 |

|

|

$ |

295,938 |

|

| Cost of revenue, excluding

depreciation and amortization |

|

(62,474 |

) |

|

|

(101,631 |

) |

|

|

(164,105 |

) |

| Gross profit, excluding

depreciation and amortization |

|

125,109 |

|

|

|

6,724 |

|

|

|

131,833 |

|

| Add: |

|

|

|

|

|

|

Stock-based compensation |

|

1,866 |

|

|

|

7,369 |

|

|

|

9,235 |

|

|

Acquisition-related costs, net(1) |

|

273 |

|

|

|

391 |

|

|

|

664 |

|

|

Restructuring costs(2) |

|

496 |

|

|

|

1,832 |

|

|

|

2,328 |

|

| Adjusted Gross Profit |

$ |

127,744 |

|

|

$ |

16,316 |

|

|

$ |

144,060 |

|

| Gross margin, excluding

depreciation and amortization |

|

67 |

% |

|

|

6 |

% |

|

|

45 |

% |

| Adjusted Gross Margin |

|

68 |

% |

|

|

15 |

% |

|

|

49 |

% |

___________________(1) Acquisition-related

costs, net include deferred retention expenses following the ARMUS,

KPI Ninja, and Twistle acquisitions.(2) Restructuring costs include

severance and other team member costs from workforce

reductions.

| |

Twelve Months Ended December 31, 2022 |

| |

(in thousands, except percentages) |

| |

Technology |

|

ProfessionalServices |

|

Total |

|

Revenue |

$ |

176,288 |

|

|

$ |

99,948 |

|

|

$ |

276,236 |

|

| Cost of revenue, excluding

depreciation and amortization |

|

(56,642 |

) |

|

|

(86,407 |

) |

|

|

(143,049 |

) |

| Gross profit, excluding

depreciation and amortization |

|

119,646 |

|

|

|

13,541 |

|

|

|

133,187 |

|

| Add: |

|

|

|

|

|

|

Stock-based compensation |

|

2,058 |

|

|

|

8,230 |

|

|

|

10,288 |

|

|

Acquisition-related costs, net(1) |

|

351 |

|

|

|

655 |

|

|

|

1,006 |

|

|

Restructuring costs(2) |

|

229 |

|

|

|

1,139 |

|

|

|

1,368 |

|

| Adjusted Gross Profit |

$ |

122,284 |

|

|

$ |

23,565 |

|

|

$ |

145,849 |

|

| Gross margin, excluding

depreciation and amortization |

|

68 |

% |

|

|

14 |

% |

|

|

48 |

% |

| Adjusted Gross Margin |

|

69 |

% |

|

|

24 |

% |

|

|

53 |

% |

__________________ (1) Acquisition-related

costs, net include deferred retention expenses following the ARMUS,

KPI Ninja, and Twistle acquisitions.(2) Restructuring costs include

severance and other team member costs from workforce

reductions.

Adjusted EBITDA

Adjusted EBITDA is a non-GAAP financial measure

that we define as net loss adjusted for (i) interest and other

(income) expense, net, (ii) income tax provision (benefit), (iii)

depreciation and amortization, (iv) stock-based compensation, (v)

acquisition-related costs, net, including the fair change in value

of contingent consideration liabilities for potential earn-out

payments, (vi) litigation costs, (vii) restructuring costs, and

(viii) non-recurring lease-related charges. We view

acquisition-related expenses when applicable, such as transaction

costs and changes in the fair value of contingent consideration

liabilities that are directly related to business combinations, as

costs that are unpredictable, dependent upon factors outside of our

control, and are not necessarily reflective of operational

performance during a period. We believe that excluding

restructuring costs, litigation costs, and non-recurring

lease-related charges allows for more meaningful comparisons

between operating results from period to period as this is separate

from the core activities that arise in the ordinary course of our

business and are not part of our ongoing operations. We believe

Adjusted EBITDA provides investors with useful information on

period-to-period performance as evaluated by management and a

comparison with our past financial performance and is useful in

evaluating our operating performance compared to that of other

companies in our industry, as this metric generally eliminates the

effects of certain items that may vary from company to company for

reasons unrelated to overall operating performance. The following

is a reconciliation of our net loss, the most directly comparable

GAAP financial measure, to Adjusted EBITDA, for the three and

twelve months ended December 31, 2023 and 2022:

| |

Three Months Ended December 31, |

|

Twelve Months Ended December 31, |

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

| |

(in thousands) |

|

(in thousands) |

| Net loss |

$ |

(30,312 |

) |

|

$ |

(35,782 |

) |

|

$ |

(118,147 |

) |

|

$ |

(137,403 |

) |

| Add: |

|

|

|

|

|

|

|

|

Interest and other (income) expense, net |

|

(2,616 |

) |

|

|

(1,022 |

) |

|

|

(9,106 |

) |

|

|

1,678 |

|

|

Income tax provision (benefit) |

|

143 |

|

|

|

59 |

|

|

|

356 |

|

|

|

(4,280 |

) |

|

Depreciation and amortization |

|

10,304 |

|

|

|

11,664 |

|

|

|

42,223 |

|

|

|

48,297 |

|

|

Stock-based compensation |

|

13,011 |

|

|

|

18,748 |

|

|

|

55,756 |

|

|

|

72,104 |

|

|

Acquisition-related costs, net(1) |

|

2,655 |

|

|

|

1,706 |

|

|

|

5,757 |

|

|

|

4,894 |

|

|

Litigation costs(2) |

|

— |

|

|

|

— |

|

|

|

21,279 |

|

|

|

— |

|

|

Restructuring costs(3) |

|

6,767 |

|

|

|

3,926 |

|

|

|

8,822 |

|

|

|

8,425 |

|

|

Non-recurring lease-related charges(4) |

|

1,400 |

|

|

|

98 |

|

|

|

4,081 |

|

|

|

3,798 |

|

| Adjusted EBITDA |

$ |

1,352 |

|

|

$ |

(603 |

) |

|

$ |

11,021 |

|

|

$ |

(2,487 |

) |

__________________(1) Acquisition-related costs,

net includes third-party fees associated with due diligence,

deferred retention expenses, post-acquisition restructuring costs

incurred as part of business combinations, and changes in fair

value of contingent consideration liabilities for potential

earn-out payments. For additional details refer to Notes 1, 2, and

7 in our consolidated financial statements.(2) Litigation costs

include costs related to litigation that are outside the ordinary

course of our business. For additional details, refer to Note 16 in

our consolidated financial statements.(3) Restructuring costs

include severance and other team member costs from workforce

reductions, impairment of discontinued capitalized software

projects, and other miscellaneous charges. For additional details,

refer to Note 11 in our consolidated financial statements.(4)

Non-recurring lease-related charges includes lease-related

impairment charges for the subleased portion of our corporate

headquarters. For additional details refer to Note 9 in our

consolidated financial statements.Adjusted Net Income

(Loss) and Adjusted Net Income (Loss) Per Share

Adjusted Net Income (Loss) is a non-GAAP

financial measure that we define as net loss adjusted for (i)

stock-based compensation, (ii) amortization of acquired

intangibles, (iii) acquisition-related costs, net, including the

deferred tax valuation allowance release from acquisitions, (iv)

litigation costs, (v) restructuring costs, (vi) non-recurring

lease-related charges, and (vii) non-cash interest expense related

to our convertible senior notes. We believe Adjusted Net Income

(Loss) provides investors with useful information on

period-to-period performance as evaluated by management and

comparison with our past financial performance and is useful in

evaluating our operating performance compared to that of other

companies in our industry, as this metric generally eliminates the

effects of certain items that may vary from company to company for

reasons unrelated to overall operating performance. The following

is a reconciliation of our net loss, the most directly comparable

GAAP financial measure, to Adjusted Net Income (Loss), for the

three and twelve months ended December 31, 2023 and 2022:

| |

Three Months Ended December 31, |

|

Twelve Months Ended December 31, |

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

| Numerator: |

(in thousands, except share and per share

amounts) |

|

Net loss |

$ |

(30,312 |

) |

|

$ |

(35,782 |

) |

|

$ |

(118,147 |

) |

|

$ |

(137,403 |

) |

|

Add: |

|

|

|

|

|

|

|

|

Stock-based compensation |

|

13,011 |

|

|

|

18,748 |

|

|

|

55,756 |

|

|

|

72,104 |

|

|

Amortization of acquired intangibles |

|

7,243 |

|

|

|

8,464 |

|

|

|

29,636 |

|

|

|

37,188 |

|

|

Acquisition-related costs, net(1) |

|

2,655 |

|

|

|

1,706 |

|

|

|

5,757 |

|

|

|

361 |

|

|

Litigation costs(2) |

|

— |

|

|

|

— |

|

|

|

21,279 |

|

|

|

— |

|

|

Restructuring costs(3) |

|

6,767 |

|

|

|

3,926 |

|

|

|

8,822 |

|

|

|

8,425 |

|

|

Non-recurring lease-related charges(4) |

|

1,400 |

|

|

|

98 |

|

|

|

4,081 |

|

|

|

3,798 |

|

|

Non-cash interest expense related to convertible senior notes |

|

379 |

|

|

|

376 |

|

|

|

1,511 |

|

|

|

1,500 |

|

|

Adjusted Net Income (Loss) |

$ |

1,143 |

|

|

$ |

(2,464 |

) |

|

$ |

8,695 |

|

|

$ |

(14,027 |

) |

| Denominator: |

|

|

|

|

|

|

|

|

Weighted-average number of shares used in calculating net loss per

share, basic |

|

57,476,187 |

|

|

|

54,496,128 |

|

|

|

56,418,397 |

|

|

|

53,721,702 |

|

|

Non-GAAP weighted-average effect of dilutive securities |

|

283,805 |

|

|

|

— |

|

|

|

666,488 |

|

|

|

— |

|

|

Non-GAAP weighted-average number of shares used in calculating

Adjusted Net Income (Loss) per share, diluted |

|

57,759,992 |

|

|

|

54,496,128 |

|

|

|

57,084,885 |

|

|

|

53,721,702 |

|

|

|

|

|

|

|

|

|

|

|

Adjusted Net Income (Loss) per share, basic |

$ |

0.02 |

|

|

$ |

(0.05 |

) |

|

$ |

0.15 |

|

|

$ |

(0.26 |

) |

|

Adjusted Net Income (Loss) per share, diluted |

$ |

0.02 |

|

|

$ |

(0.05 |

) |

|

$ |

0.15 |

|

|

$ |

(0.26 |

) |

______________(1) Acquisition-related costs, net

includes third-party fees associated with due diligence, deferred

retention expenses, post-acquisition restructuring costs incurred

as part of business combinations, changes in fair value of

contingent consideration liabilities for potential earn-out

payments, and the deferred tax valuation allowance release from

acquisitions. For additional details refer to Notes 1, 2, 7, and 15

in our consolidated financial statements.(2) Litigation costs

include costs related to litigation that are outside the ordinary

course of our business. For additional details, refer to Note 16 in

our consolidated financial statements.(3) Restructuring costs

include severance and other team member costs from workforce

reductions, impairment of discontinued capitalized software

projects, and other miscellaneous charges. For additional details,

refer to Note 11 in our consolidated financial statements.(4)

Includes the lease-related impairment charge for the subleased

portion of our corporate headquarters. For additional details refer

to Note 9 in our consolidated financial statements.Health

Catalyst Investor Relations Contact:Adam BrownSenior Vice

President, Investor Relations and FP&A+1 (855)

309-6800ir@healthcatalyst.com

Health Catalyst Media Contact:Tarah Neujahr

BryanChief Marketing Officermedia@healthcatalyst.com

To view this slide as a PDF, please click

here: http://ml.globenewswire.com/Resource/Download/540180be-a9a0-4e69-b6ac-e247b84e663a

To view this slide as a PDF, please click

here: http://ml.globenewswire.com/Resource/Download/c3e0a805-d056-4e53-a25e-e983f7edcd6f

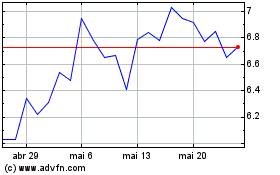

Health Catalyst (NASDAQ:HCAT)

Gráfico Histórico do Ativo

De Abr 2024 até Mai 2024

Health Catalyst (NASDAQ:HCAT)

Gráfico Histórico do Ativo

De Mai 2023 até Mai 2024