Conifex Timber Inc. (

"Conifex") (TSX: CFF)

announced today that it has completed a first amendment to credit

agreement and accommodation agreement (the

"Amendment") with Wells Fargo Capital Finance

Corporation Canada (

"Wells Fargo"), pursuant to

which Wells Fargo agreed, subject to certain terms and conditions,

to amend Conifex's existing lumber business credit facility (the

"Facility") and provide certain accommodations

thereunder. Following the Amendment, the Facility is secured

by substantially all Conifex's lumber business assets.

Benchmark SPF lumber prices declined 50% in

20231 which resulted in negative earnings before finance costs,

taxes, depreciation and amortization

("EBITDA") in 2023 versus positive EBITDA of

$46.7 million in 2022. As we progressed through 2023, our

liquidity diminished, and accumulating losses made it increasingly

difficult to comply with our fixed charge coverage ratio

requirements under the Facility. On May 4, 2023, the Chief

Forester in British Columbia permitted licensees in the Mackenzie

Timber Supply Area to transition to a “green” log diet which

enabled us to benefit from increased sawmill productivity, improved

lumber grade outturns, and higher mill net sales price

realizations. These benefits have significantly contributed to

reduced Q4, 2023 EBITDA losses compared to Q3, 2023. Q1, 2024

benchmark prices are currently 10% higher than in the preceding

quarter.2 If these prices hold, and assuming quarter-to-date

productivity levels are maintained at our sawmill complex and green

power generation facility, we expect further improvement in EBITDA

in the first quarter of 2024.

Pursuant to the Amendment, Wells Fargo agreed to

provide additional short-term liquidity, continue funding revolving

loans and refrain from exercising certain of its rights under the

Facility until May 31, 2024, subject to certain terms and

conditions. The Amendment follows Conifex's non-maintenance of the

minimum excess availability and fixed charge coverage ratio

required by the terms of the Facility. Among other

conditions, Conifex shall commence a process to secure replacement

funding in an amount sufficient to repay in full the

Facility. Conifex has engaged Raymond James Ltd. to assist in

the process.

Concurrent with the Amendment, Conifex's wholly

owned subsidiary Conifex Power Limited Partnership amended its

outstanding power business credit facility to, among other things,

release certain restricted cash thereunder, the proceeds of which

were applied to paydown the Facility. Following this amendment, the

power term loan bears interest at a stepped up interest rate per

annum commencing at 7.35%. As part of the Amendment, Conifex is

reviewing the long-term financing of its power business, which may

include new or replacement lenders, and may be impacted by, among

other things, potential business initiatives the company is

pursuing. Conifex expects the foregoing to be completed by or about

the second quarter of next year.

Conifex is working collaboratively with its

lenders and is pleased to have their continued support as it works

to implement an acceptable refinancing process. However,

there can be no assurance that it will result in or be able to

provide an acceptable plan as required by the Amendment or at

all.

____________________________

1 Random Lengths. 2 Random Lengths.

For further information, please contact:

Kenneth A. ShieldsChairman and Chief

Executive Officer(604) 216-2949 or media@conifex.com

About Conifex Timber Inc.

Conifex and its subsidiaries' primary business

currently includes timber harvesting, reforestation, forest

management, sawmilling logs into lumber and wood chips, and value

added lumber finishing and distribution. Conifex's lumber products

are sold in the United States, Canadian and Japanese markets.

Conifex also produces bioenergy at its power generation facility at

Mackenzie, BC.

Forward-Looking Statements

Certain statements in this news release may

constitute “forward-looking statements”. Forward-looking statements

are statements that address or discuss activities, events or

developments that Conifex expects or anticipates may occur in the

future. When used in this news release, words such as “estimates”,

“expects”, “plans”, “anticipates”, “projects”, “will”, “believes”,

“intends” “should”, “could”, “may” and other similar terminology

are intended to identify such forward-looking statements.

Forward-looking statements reflect the current expectations and

beliefs of Conifex’s management. Because forward-looking statements

involve known and unknown risks, uncertainties and other factors,

actual results, performance or achievements of Conifex or the

industry may be materially different from those implied by such

forward-looking statements. Examples of such forward-looking

information that may be contained in this news release include, but

are not limited to, our expectations regarding our results of

operations and performance; our success in providing an acceptable

plan as required by the Amendment or at all; securing replacement

funding in an amount sufficient to repay in full the Facility;

whether Wells Fargo will continue to refrain from exercising its

rights and remedies on expiry of the Amendment and what the terms

or timing of such transaction or such continued restraint might be;

the outcome of Conifex's review of its long-term financing of its

power business and the expected completion date thereof.

Forward-looking statements involve significant uncertainties,

should not be read as a guarantee of future performance or results,

and will not necessarily be an accurate indication of whether or

not such results will be achieved. A number of factors could cause

actual results to differ materially from the results discussed in

the forward-looking statements, including, risk factors described

in Conifex’s annual information from for the year ended December

31, 2022 which is available on SEDAR+ at www.sedarplus.ca. These

risks, as well as others, could cause actual results and events to

vary significantly. Accordingly, readers should exercise caution in

relying upon forward-looking statements and Conifex undertakes no

obligation to publicly revise them to reflect subsequent events or

circumstances, except as required by law.

Note Regarding Financial Information

We disclose EBITDA and expected EBITDA in this

news release as it is a measure used in the Facility to calculate

financial covenants and ratios and to provide clarity relating to

the Amendment. EBITDA is not a substitute for net earnings, or cash

flows, as determined in accordance with IFRS, and therefore readers

should consider those measures in evaluating our financial

performance, which shall be disclosed upon completion and filing of

our audited consolidated financial statements for the year ended

December 31, 2023 later this month. Expectations around EBITDA for

the first quarter of 2024 involve known and unknown risks and

uncertainties, including those beyond the assumptions disclosed

herein, that may cause actual results to differ materially. While

we believe there is a reasonable basis for this forecast, such

forecast may not be met.

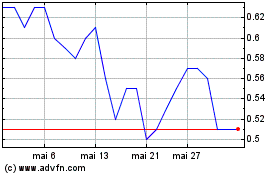

Conifex Timber (TSX:CFF)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Conifex Timber (TSX:CFF)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024